How Do I Pick A Comprehensive Medicare Supplement Plan

Although at first glance, selecting a Medicare Supplement plan that is right for you may seem daunting. With so many companies and plans to choose from, many seniors feel frustrated trying to find the best plan at affordable prices.

We recommend using this article and the FAQs provided to develop a short list of companies and then call one of our insurance professionals to help you confirm your selection based on your circumstances and budget.

Have Questions?

We can Help!

Talk to one of our licensed Medicare supplement agents about the options available to you in your area.

What Is The Average Cost For Medicare Plan G

The cost for Plan G can vary based on the region where you live. Insurers consider your health and age, cost of living, and the cost of health care in your area when determining premiums.

While there isnt more recent data on the average cost of Plan G, we found a wide range of costs while conducting our research. According to Medicares Plan Finder Website, here are some of the average costs for a 65-year-old man who doesnt smoke:

- New York City: Plan G is $268 to $545 High-deductible Plan G: $69 to $91

- Tampa, Florida: Plan G is $176 to $263 High-deductible Plan G: $52 to $92

- Houston, Texas: Plan G is $128 to $434 High-deductible Plan G: $36 to $86

- Albuquerque, New Mexico: Plan G is $105 to $355 High-deductible Plan G: $30 to $59

- Sacramento, California.: Plan G is $115 to $248 High-deductible Plan G: $38 to $61

These costs can vary by company, your overall health, and if you are in a guaranteed-issue period.

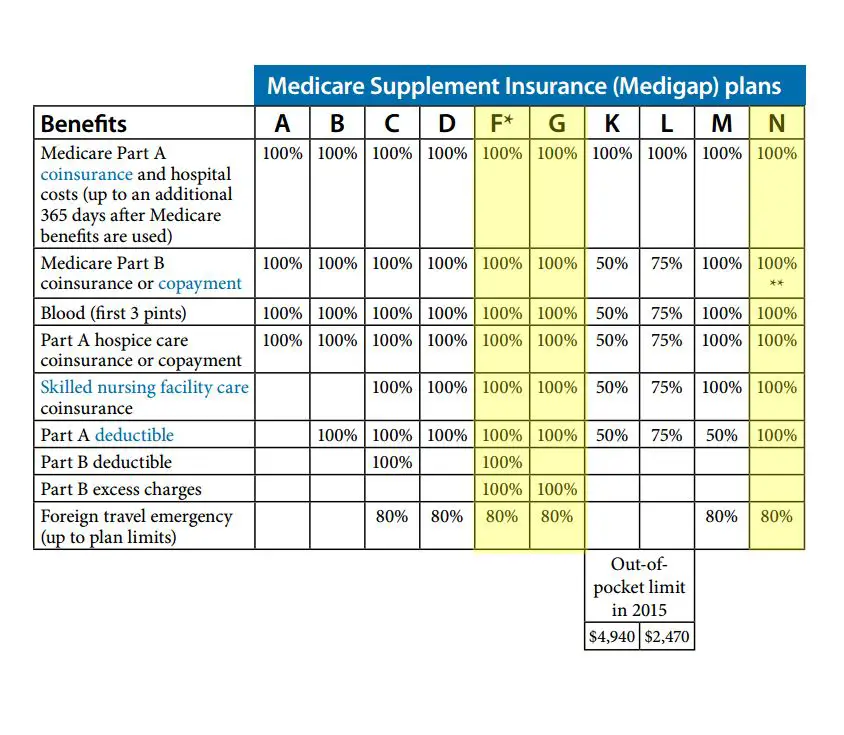

Am I Still Eligible For Medicare Supplement Plan F

Congress passed the Medicare Access and CHIP Reauthorization Act in 2015. One part of the law aimed to reduce access to Medicare Supplement Plans that covered the Part B deductible. Those plans, Plan C and Plan F, are no longer available to new beneficiaries, but you can still sign up for them if you were eligible for Medicare and born before January 1, 2020.

Don’t Miss: Does Medicare Pay For Ambulance Calls

What Is Our Methodology

We selected the health insurance companies with the highest market share and reviewed them by financial strength, customer satisfaction, and other factors, such as what makes these plans so popular.

We also offer information on the companies, including financials, customer satisfaction, complaints, geographic reach, and pricing.

What Are The Basic Benefits Of Medicare Supplemental Insurance Plans

Having supplemental insurance offers a safety net to help keep these expenses from becoming lifelong, major debt.

Standardized, basic benefits that must be covered to an extent include:

- Medicare Part A hospice care copayments or coinsurance

- They allow you to see any doctor or specialist who accepts Medicare without a referral

- Medicare Part B copayments or coinsurance

- Cost of the initial 3 pints of blood utilized for a medical procedure

Don’t Miss: Does Medicare Pay For Blepharoplasty

Our Search For The Best Medicare Supplement Plans

1. We considered a large number of Medicare supplement insurance companies

2. We evaluated Medicare supplement insurance companies based on our expert-guided criteria: price transparency, helpfulness and coverage

3. We brought you the best Medigap plans for consideration

Searching for the right Medicare supplement policy can be difficult, so we narrowed the choices for you. We homed in on the top Medigap insurance companies as follows:

Next, we analyzed these companies based on our expert-guided buyer criteria in three categories: price transparency, helpfulness, and coverage. Companies that obscured their prices, made the process very difficult, or had limited coverage options were cut from the search.

We contacted companies and asked for more information. Policies range in price from less than $100 per month for basic coverage to thousands for maximum protection.

The result of our analysis is the best Medicare supplement insurance companies for you, a friend or family member to consider.

The Best Medicare Advantage Provider For Hmo Plans

Among Medicare Advantage HMOs available in at least 25 states, MoneyGeeks pick for the best carrier overall is UnitedHealthcare based on Medicare Star Ratings and the availability of robust extra benefits.

The best HMO for you depends on where you live, what options are available, and what you care most about. Your budget, as well as your preferences and priorities, may point you to a different option.

If youre not sure if an HMO is right for you, consider the pros and cons. HMOs tend to be less expensive but more restrictive.

If you need to see a specialist, youll likely need to get a referral from your primary care doctor. Youll also probably have to get care from a set network of providers seeing a provider outside that network may be difficult and more expensive.

UnitedHealthcare

UnitedHealthcare HMO plans earned an average of 4.5 stars out of 5.0 in Medicares Star Ratings. Nearly three-quarters of UHCs HMOs have no monthly premiums. All offer vision and hearing benefits and 95% offer dental coverage.

UHC is the nations largest health insurer, with nearly 49.5 million members, including more than six million Medicare Advantage members. UHC has an exclusive relationship with AARP as the only Medicare Advantage carrier AARP promotes.

Read Also: How Soon Before Turning 65 Should You Apply For Medicare

How To Shop & Compare Medicare Plan G Plans

Thanks to online searching and plan comparison tools, you can “shop” for Medicare Plan G coverage in your own home. Here are our steps to help you find the best Plan G for you:

Step 1: See which Medicare Supplement Plan Gs are available in your area.

You can do this by visiting Medicare.gov’s Plan Finder or going to individual insurance companies’ websites and searching for Plan G. Some insurance companies may not offer the high-deductible Plan G, so you’ll have to look at the plan offerings carefully.

If you live in Massachusetts, Minnesota, or Wisconsin, these states standardize their Medigap plans differently. You wont be able to purchase Plan G if you live in these states because they have their own Medigap plan structure.

Step 2: Compare the difference in cost among plans.

Because Plan G coverage is standardized, the true differences are in cost and company. Some companies will offer discounts on their website for varying factors, including if members of your household sign up for a plan or if you pay via automatic bank draft.

Step 3: Consider talking to a broker or consultant.

Its understandable you may still have questions regarding plan selection. For general advice, you can contact your State Health Insurance Assistance Program . This is a free service offered in each state that offers unbiased counseling and assistance.

Step 4: Sign up

Silverscript: Best Medicare Part D Plan For 24/7 Advice

SilverScript is a Medicare Part D plan specialist, and this, together with being part of the CVS family of companies, puts it in good stead to assist potential customers with their initial enquiries.

Although the company only offers two plans , the plans are different enough to appeal to most customers, and is why we have featured it in our best Medicare Part D plans guide.

SilverScript should appeal to those with basic, low-level medical requirements, through to those who take regular multiple medications. The 24/7 customer service and a range of online tools to help with medication organization is also a good benefit to customers.

Recommended Reading: Will Medicare Pay For A Transport Wheelchair

Best Medicare Supplement Plan N In Florida

UnitedHealthcare is the best provider for Medigap Plan N in Florida, offering premiums at an average of $218.32 per month. They also offer a SELECT plan at a more affordable rate averaging $201.89 per month, although these plans typically come with more restrictive provider networks.

MoneyGeeks ranking of the best Plan N providers in Florida only considers companies that offer quotes online. You may find better plans or offers from other regional providers in Florida that need to be contacted directly.

Whats New For Medicare Supplement Insurance In 2020

Medicare supplement plans stopped selling Plan C and Plan F to new policyholders. This rule went into effect in 2020 due to the Medicare Access and CHIP Reauthorization Act. MACRA mandates that new Medigap plans cant cover the Part B deductible.

You can keep the coverage if you enrolled in either plan or the high deductible version of Plan F before January 1, 2020. You may still be able to buy Plan C and Plan F if you were Medicare-eligible before January 1, 2020, but did not enroll.

Read Also: Is Pneumonia Shot Covered By Medicare

Are You Considering A Medicare Supplement Plan

SHIIP’s interactive tool allows you to compare Medicare supplement by entering your age, gender the Medicare supplement plan you want to compare and whether or note you use tobacco products to receive a list of companies offering that plan along with their estimated premiums.

You will not be auto enrolled into a Medicare supplement policy and must make application directly with the insurance company. You will need to contact the insurance company that sells the specific policy that you wish to purchase, or you may contact an agent who sells the specific policy you want. We recommend that you apply at least 30 days before you want the policy to start. If you do not have thirty days, apply as soon as possible. Supplement premiums are paid directly to the insurance company and are not deducted from your Social Security payments.

Decide Between A Regular Plan F And High

Choose the plan that makes the most sense for you financially. Regular Plan F will offer higher monthly premiums but will begin to pay toward out-of-pocket costs right away. High-Deductible Plan F, on the other hand, offers lower monthly premiums but requires you to pay an annual deductible, set at $2,490 for 2022, before it will pay toward out-of-pocket costs.

You May Like: Does Medicare Cover Capsule Endoscopy

What Is The Best Medicare Supplement Plan

To enroll in Medigap, you must be eligible for, and enrolled in, Original Medicare.

The answer to the question What is the best Medigap Plan? can be broken down into two parts:

- Which Standardized Plan best fits your needs and budget?

- Which private insurance company is a good fit for you?

In other words, you want to pick the benefits that best fit your needs first. From there, you should look for a company that offers the plans you desire in your specific state, and that also has a high financial strength rating and an attractive price. When it comes time to deciding which insurance company you should choose, ask yourself:

- Do they offer the Medigap Plan you want in your state?

- Are they financially sound?

- Are their premiums affordable?

- Have they received good reviews?

To give you an idea of how this works in real life, we will review three of the more popular Medicare Supplement insurance companies: Humana, United Healthcare, and Mutual of Omaha. Each of these three insurance companies is trusted by millions of Americans for Medigap coverage.

Humana Medicare Supplement Insurance

Humana offers a host of extra benefits beyond the standardized benefits. Ranging from vision, hearing, and dental to fitness and nursing line options, Humanas Medigap plans give you the most options to add a comprehensive wellness package. Humana is financially sound and also ranks in the top 10 list on caring.com.

More Advice

Medigap Premium Prices Vary Between Insurance Companies

All Medicare Supplement policies are standardized the same. When you choose amongst the companies that offer the plan, you are making a choice regarding service and additional Medicare benefits.

Below, you can find the standard Plan G monthly premium, the Plan G High-Deductible premium, and the Plan N premium for a 65-year-old, non-smoking woman in the 75001 zip code. Plan costs are based on the insurance carrier, age, sex, and tobacco use. Men tend to have higher monthly premiums than women.

Review below to compare monthly premiums amongst the three most popular Medigap plans in Texas.

| Insurance company |

| $93 |

You May Like: Can You Get Medicare If You Work Full Time

How Do You Choose A Medicare Supplement Plan

When you sign up for Medicare, youre making a decision regarding coverage and cost.

Either Original Medicare with a Part D prescription drug plan and with or without a Medicare Supplement plan. Or a Medicare Advantage Plan with Prescription Drug coverage. These two methods are the most common way to get coverage suited to your health and budget needs.

Just because the plans and insurance companies mentioned above are the most popular doesnt mean they are right for you. To choose a Medicare Supplement plan tailored to your needs, you should consider the costs and coverage. Choose a plan that includes the doctors and medications you want and need at a price you can afford.

Need help deciding which Medicare Supplement Plan is right for your health and budget? Speak with a local licensed agent who can guide you through your options. Call or review your Medicare plan options online.

Aarp Medicare Rx: Best Medicare Part D Plan For Seniors

AARP Medicare Rx, with services provided by United Healthcare, is an excellent all-round provider of Medicare Part D plans and is the only range of plans backed by AARP.

This is the best Medicare Part D plan option for seniors as it mixes low co-pays with competitive premiums and has a network of preferred providers. These include Walgreens and Duane Reed, making this widely accessible. The plan is available nationwide and the quote process is very straightforward.

Plans range from the AARP Medicare Rx Saver Plus at $31.30 per month, the AARP Medicare Rx Walgreens at $39.40 and the AARP Medicare Rx Preferred plan as the most comprehensive for $81.80.

Also Check: Is Entyvio Covered By Medicare Part B

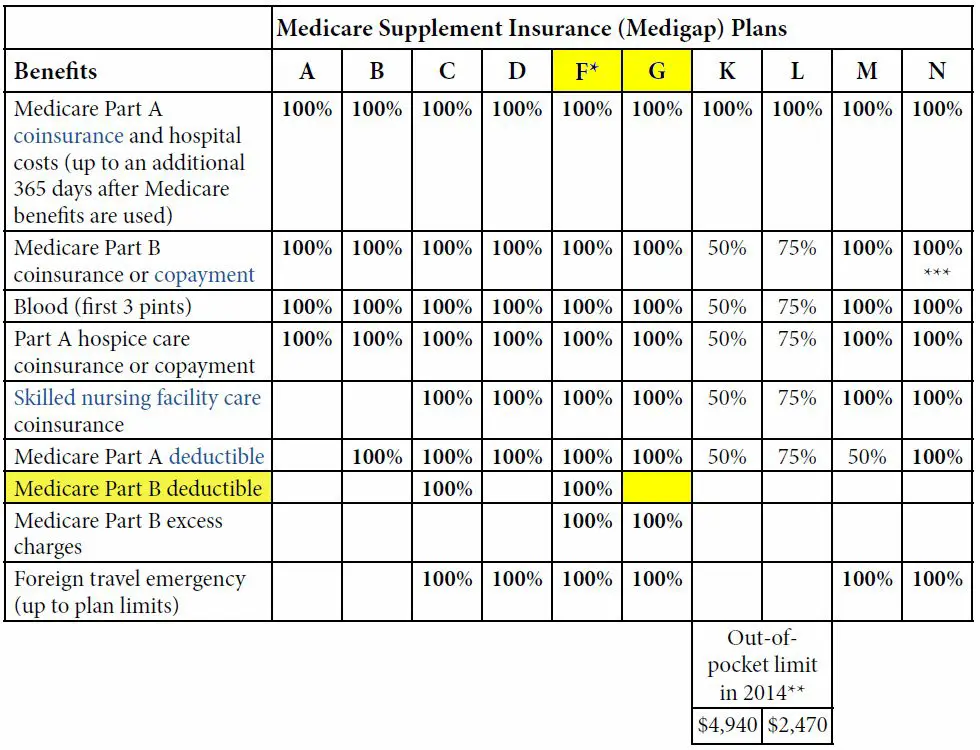

Medicare Supplement Insurance Closes The Gaps

Medicare Supplement insurance closes or reduces these gaps. That is why it is often called Medigap insurance. Medigap policies come with different levels of coverage. Understanding the details of the Medigap plans can help you know how to choose the best Medigap plan for your specific needs.

Now that we know why you should consider Medigap, we will review the various details of eligibility and coverage for these plans.

More Advice

What Medigap Plan N Covers

Heres what Plan N covers, according to Medicare.gov:

-

Part A coinsurance and hospital stays up to an additional 365 days after Medicare benefits are used up.

-

Part A deductible.

-

Part A hospice care coinsurance or copayment.

-

Part B coinsurance .

-

Skilled nursing facility care coinsurance.

-

Blood transfusion .

-

Medically necessary emergency health care service for the first 60 days when traveling outside the U.S. Deductible and limitations apply.

Recommended Reading: What Is Medicare In Simple Terms

Medigap Plan K And Plan L Have Annual Out

Plan K and Plan L each have an annual out-of-pocket spending limit.

Once you reach this limit within a calendar year, the plan will pay 100 percent of the costs for your covered Medicare services for the remainder of the year.

The Plan K out-of-pocket maximum is $6,620 in 2022. The 2022 Plan L out-of-pocket spending limit is $3,310.

What Is Medicare Supplement Insurance

Medicare Supplement Insurance, also known as Medigap insurance, was created to fill in the gaps in costs left behind by Medicare Part A and Part B. Medicare Part A and Part B sometimes require you to pay deductibles, copays, and coinsurances. A Medicare Supplement policy can help you cover these costs.

A Medigap policy only supplements, not replaces, your Medicare Part A and Part B. That means you must enroll in Original Medicare before you can purchase a Medigap policy.

Medigap plans are named after letters, just like Medicare parts. This gives way to some confusion.

Remember, Medicare has Part A, Part B, Part C, and Part D.

Medicare Supplement Insurance has Plan A, Plan B, Plan C, etc., up to Plan N.

Medicare Supplement plans are standardized across almost all states. This means insurance companies cant change the plans to offer more or less benefits. Insurers can, however, decide which plans they will offer, though the government requires them to offer certain plans.

Every insurance company that offers Medicare Supplement insurance has to offer Plan A. If they offer any plan in addition to Plan A, they must also offer either Plan C or Plan F to current Medicare beneficiaries and either Plan D or Plan G to new Medicare beneficiaries.

Like we mentioned earlier, Medigap plans are the same in almost every state, except Massachusetts, Minnesota, and Wisconsin. Well discuss the differences later.

Read Also: Does Medicare Part B Cover Chiropractic Services

Best For Comparison Tools: Unitedhealthcare/aarp

UnitedHealthcare/AARP

-

Does not offer high-deductible Plan G

-

Cannot qualify for enrollment discount past age 75

AARP Medicare Plans through UnitedHealthcare combine two of the best-known names in the insurance and elderly care business. It enrolls 4 million Americans in its Medigap plans. UnitedHealthcare has been in operation since 1977, and its strategic partnership with the AARP began in 1997.

Through this partnership, UnitedHealthcare and the AARP have developed a variety of educational tools, and the website is a blend of education, price quote, and pricing tools. We especially liked the Plan Comparison Guide, which featured easy-to-read graphs and plan comparison features. The guide placed each Medigap plan into a different category to guide decision-making. For example, Plan G falls into its “Higher Benefit Level, Higher Premium” category.

In terms of pricing, the Medicare Plan Finder quoted us a premium range of $107 to $448 for a 70-year-old male who doesn’t use tobacco. Our estimated monthly rate from UnitedHealthcare/AARP was $138.18but we were reminded the premium could be $495 or a “Level 2” rate if we used tobacco.

UnitedHealthcare/AARP also offers an “Enrollment Discount,” which is rated by age. For those age 65 without certain chronic medical conditions or a history of smoking, this discount may be as high as 39%. There’s also a household discount if another member in your household signs up for a Medigap plan as well.