How Medicare Advantage Plans Work

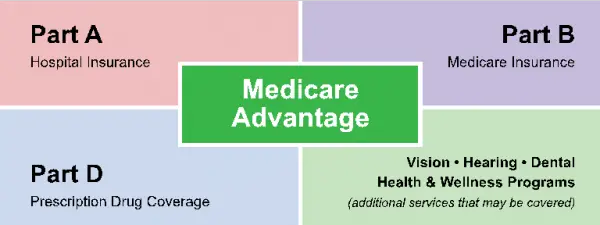

Medicare Advantage, or Part C, is an all-in-one alternative to Original Medicare . These plans are offered by government-approved private insurance companies Medicare later reimburses.

Instead of juggling coverage from multiple plans, Medicare Advantage offers all benefits within a single plan.

Medicare Advantage plans may also include Part D drug coverage, vision, dental and hearing benefits.

No matter what Medicare Advantage plan you select, youre guaranteed emergency and urgently needed care.

Types of Medicare Advantage Plans Get a Free Medicare Advantage Guide

How Much Does Medicare Part C Cost Per Month

You may be surprised how affordable Plan C coverage can be.

Medicare Advantage plans, often called Medicare Part C, are an alternative option to Original Medicare. Instead of having to get separate Part A , Part B , and prescription drug coverage, Medicare Advantage plans allow you to bundle your coverage together into one simple insurance plan.

However, Medicare Part C isnt run by the government, so youll have to pay for Medicare Advantage plans. How much does Medicare Part C cost per month? While your actual cost is dependent on several factors, you may be surprised by how affordable Medicare Advantage Plans can be. According to the Kaiser Family Foundation, the average monthly premium for enrollees of Medicare Part C plans was $25 for 2020.

With Medicare Advantage plans, Medicare pays a fixed amount toward your care each month to the private companies providing Medicare Part C plans.

While the average cost for Medicare Part C is $25 per month, its possible to get a Medicare Advantage plan with a $0 monthly premium. In fact, according to Kaiser Family Foundation, 60 percent of Medicare Advantage plan enrollees pay no premium for their plan, other than their Medicare Part B premium.

However, prices for Medicare Advantage plans can range widely. According to the National Council on Aging, plans can range from $0 to $270 per month. How much youll pay is dependent on your MA plan type.

In general, the lower your deductible, the higher your premium will be.

Medicare Advantage Plans Include Out

A Medicare Advantage plan out-of-pocket spending limit represents an annual cap on your out-of-pocket spending for covered Part A and Part B health care costs.

Once you have reached this amount, your Part C plan will pay for 100 percent of the cost of all covered services and items for the remainder of the year.

The out-of-pocket limit can help protect you from Medicare out-of-pocket costs that can add up quickly as a result from a serious injury or illness that requires lengthy inpatient hospital stays.

Original Medicare does not feature an out-of-pocket limit, which can be one factor many beneficiaries may consider in joining a Medicare Advantage plan.

You May Like: Does Medicare Cover Hiv Medication

Types Of Medicare Part C Plans

Medicare Part C comes in several types, much like non-Medicare health insurance, with different requirements for finding care providers. In a health maintenance organization, or HMO plan, for instance, you need to see in-network health care providers unless its an emergency, and you need a referral to see a specialist. In a preferred provider organization, or PPO plan, you can see both in-network and out-of-network health care providers, although you typically pay more to go out of network.

Types of Medicare Advantage plans include:

-

HMO plans.

Medicare Advantage Plans Must Spend At Least 85% Of Premiums On Medical Costs

The ACA added new medical loss ratio requirements for commercial insurers offering plans in the individual, small group, and large group markets. It also added similar requirements for Medicare Advantage plans, although they took effect three years later, in January 2014.

Medicare Advantage plans must have MLRs of at least 85%, which is the same as the requirement for plans issued to employers in the large group market. That means 85% of their revenue must be used for patient care and quality improvements, and their administrative costs, including profits and salaries, cant exceed 15% of their revenue . The specifics of the calculations are laid out in this HHS regulation from 2013, with the calculation details starting on page 31288.

In the individual, small-group, and large-group health insurance markets, insurers that fail to meet the MLR requirements must send rebates to policyholders . But for Medicare Advantage plans, the rebates must be sent to the Centers for Medicare and Medicaid Services instead.

If a Medicare Advantage plan fails to meet the MLR requirement for three consecutive years, CMS will not allow that plan to continue to enroll new members. And if a plan fails to meet the MLR requirements for five consecutive years, the Medicare Advantage contract will be terminated altogether.

The federal government has ordered several plans to suspend enrollment in 2022 coverage due to a failure to meet the MRL requirements.

Recommended Reading: Is Shingles Vaccine Covered By Medicare

Eligibility For Part C

You must have Both Part A and Part B to be eligible for Part C. The one health question that can disqualify you for a Medicare Advantage plan is, do you have End-Stage Renal Disease? Unless you develop End-Stage Renal Disease when youre already on a Medicare Advantage plan, you wont be able to select this coverage.

If you already have Medicare Advantage when you develop ESRD, you might be able to select a different plan with the same company. Also, if the plan leaves the area, youll have a one-time right to choose another policy.

Further, if an ESRD Special Needs Plan is available in your area, you may join. Also, if you have a successful kidney transplant and no longer have ESRD, youll qualify for Medicare Advantage coverage.

CMSnewsroom claims ESRD patients will have access to Medicare Advantage plans by 2021 or 2022.

Compare Medicare Part C Plan Costs In Your Area

Plan pricing is not always made readily available on an insurance companys website. But a licensed insurance agent can help you gather up the costs for the various Medicare Part C plans available in your area and help you better understand the terms and conditions of each. You can also compare plan costs online from multiple different insurance companies.

Also Check: How Much Does Medicare Part A And B Cover

S For Using The Plan Finder Tool

To check which plans are in your area, you can use the Medicare Health Plan Finder. If you wish, you can create an account, log in, and return to saved plan searches later if youre not able to make your selection in one day.

Step 1: Select Search PreferencesTo begin your search for a plan, either create an account or click log in as a guest. Next, select Medicare Advantage from the menu provided, enter your zip code in the box that pops up, and click continue. Now youll be asked if you get help with your costs from one of several programs select not sure if necessary. Youll then be given the option to see the costs of specific drugs on different plans. This will be useful to you if you have regular prescriptions. The drug costs question is the final prompt youll receive before youll be shown a list of local Medicare Advantage plans.

Step 2: Examine Coverage DetailsWhen you first look at the plans, you may just want to scroll through them all to see the range of costs and types in your area. Once you have a sense of whats available, begin looking at the coverage offered in individual plans by clicking plan details. Here you can evaluate the copays/coinsurance of specific tests, office visits, and hospital stays, including for extra services like drug coverage, dental coverage, and more. Youll also find contact information for the plan in this section.

What Medicare Part C Covers

Medicare Part C plans offer all the benefits of Medicare Part A and Part B, with a few exceptions:

-

Clinical trials .

-

Hospice services .

-

Some new Medicare benefits, which temporarily are covered by Original Medicare.

Most Medicare Advantage plans include Medicare Part D prescription drug coverage. And the majority offer additional benefits that Original Medicare doesnt offer, such as cost help with dental and vision care, fitness benefits, transportation to doctor visits and over-the-counter drug allowances.

Medicare Part C isnt required to cover services that arent deemed medically necessary under Medicare.

You May Like: Is Medicare Advantage Plan Worth It

Eligibility And Enrollment Part B Vs Part C

Original Medicare and Advantage plans vary in their eligibility and enrollment requirements.

Part B

After a person gets Social Security benefits at age 65, Medicare automatically enrolls them in Part A and Part B. If a person meets the age requirement but does not receive Social Security benefits, they will not automatically get Medicare and will need to sign up for it.

If someone does not sign up for Part A and Part B during the Initial Enrollment Period when they first become eligible, they may sign up during the general enrollment period, which is from January 1 to March 31 every year.

An individual may apply for Medicare online here.

Part C

A person who has Medicare Part A and Part B and does not have end stage renal disease is eligible for an Advantage plan. An individual may switch from Part A and Part B to an Advantage plan during the initial enrollment period or the open enrollment period, which is from October 15 to December 7 of every year.

To enroll in an Advantage plan, a person first needs to select a plan in their area. After they decide on a plan, they may request an enrollment form from the insurance company offering it or enroll on the companys website.

Other Costs To Consider

Some parts of Medicare may include certain other out-of-pocket costs. These usually include:

- Deductibles: The amount you must pay before your insurance policy will pay their share of a claim

- Coinsurance: The percentage you must pay for a covered health care service

- Copayment: The fixed amount you must pay for a covered health care service

In 2022, the Medicare Part A deductible is $1,556 per benefit period, and the Part B deductible is $233 for the year.

2022 premiums, deductibles, coinsurance and copays for Medicare Advantage plans and Medicare prescription drug plans may vary, with some plans featuring $0 premiums or $0 deductibles. Learn more by comparing plan costs online for free, with no obligation to enroll, or by calling to speak with a licensed insurance agent.

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Recommended Reading: Are Canes Covered By Medicare

Understanding The Three Premiums Of Medicare Advantage

In order to get and keep a Medicare Advantage plan, you will need to pay anywhere from 0-3 different premiums, depending on the plan. This table breaks down the reasons seniors can owe different premiums.

| Paying Medicare Advantage Premiums | |

|

$0- approximately $450, but frequently less than $100. |

Your health plan chooses to not charge a premium. |

*Note: In some cases, qualifying for Medicaid can make you eligible to get help with premiums.

As the chart above indicates, there are three possible premiums for Medicare Advantage participants. But many seniors will only owe one or two of them, and some seniors will owe no premiums. Medicare Savings Programs, which vary by state, can pay Part B premiums for some low-income seniors. To learn about these and other forms of assistance with Medicare Advantage costs, you can read Paying for Medicare Advantage: Costs and Financial Assistance.

Pros And Cons To Medicare Advantage Part C Plans

Pros:

- These are typically cheaper compared to Medicare Supplement plans.

- These normally include Rx drug coverage.

- They can be switched once per year .

- SOME plans include dental and vision coverage.

Cons:

- Because they are cheaper, the benefits are often lacking compared to Medigap plans.

- One must deal with networks of hospitals and doctors .

- Plan benefits and premiums usually change once per annum . While this isnt inherently a bad thing, we have observed that costs tend to rise and benefits decrease.

There is a lot more information to be covered regarding these plans. In order to make sure that youre choosing the best MAPD healthcare plan for your needs, do not hesitate to give us a call, and our highly trained Medicare agents will be available to assist you. We can answer any questions you may have regarding the MAPD disenrollment period and healthcare.

Get the Cheapest Medicare Advantage Plan Part CRates!

If you’ve been asking, What is Medicare Advantage Part C? Speak to one of our licensed Medicare agents to get the best rates today!

- Medicare Advantage Plan Part C

You May Like: Can Medicare Take Your House

Tips On How To Pay Medicare Premiums

- Make sure to pay both your Part B and Part C premiums on time so you wont lose coverage. Automatic deductions are the best way to avoid missing a payment.

- Make sure both Medicare and your Part C provider have your current mailing address for bill delivery .

- Dont miss more than three months of Medicare Part B payments. Premiums are due the 25th of every month and coverage will end in the fourth month if past due payments are not made.

- Contact your Medicare Part C provider if you think you will miss a payment. Private insurance companies have their own rules on plan cancellation for nonpayment.

Should I Get A Medicare Part C Plan

Enrollment in Medicare Part C plans has been growing, largely because Advantage plans offer more benefits than standard Medicare plans. Medicare Advantage plans usually arenât the best option for low-income recipients because they can often qualify for other Medicare savings programs. Medicare Advantage also isnât generally necessary if youâre still receiving employer-sponsored coverage.

Pros of Medicare Part C

-

Provides coverage for services Original Medicare does not, like vision or dental

-

Usually offers prescription drug coverage

-

Caps out-of-pocket expenses, unlike traditional Medicare

Cons of Medicare Part C

-

Likely have to pay two premiums, one for Medicare Part B and one for your Advantage Plan

-

Many types of individual plans, each with their own rules on the coverage and costs for using out-of-network providers

-

Your network of available health care providers is smaller than with Original Medicare plans

-

Not all in-network providers are necessarily accepting new patients

-

Canât be used in conjunction with employer-sponsored health care benefits that supplement Original Medicare

Recommended Reading: Is Skyrizi Covered By Medicare

How Has Health Reform Impacted Medicare Advantage

The Patient Protection and Affordable Care Act has restructured payments to Medicare Advantage plans in an effort to reduce budget spending on Medicare, but for the last few years, the payment changes have either been delayed or offset by payment increases. When the law was first passed, many people including the CBO projected that Medicare Advantage enrollment would drop considerably over the coming years as payment reductions forced plans to offer fewer benefits, higher out-of-pocket costs, and narrower networks.

But that has not been the case at all. Medicare Advantage enrollment continues to grow each year. There were nearly 28 million Advantage enrollees in 2021, which accounts for more than 43% of all Medicare beneficiaries Thats up from just 13% in 2004, and 24% in 2010, the year the ACA was enacted.

The number of Medicare Advantage plans available has increased for 2022 to the highest in the last decade, with a total of 3,834 plans available nationwide. The majority of beneficiaries still have at least one zero-premium plan available to them, and the average enrollee can select from among 39 plans in 2022.

What You Pay In A Medicare Advantage Plan

Your

depend on:

- Whether the plan charges a monthlypremium. Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium .

- Whether the plan pays any of your monthlyMedicare Part B premium. Some plans will help pay all or part of your Part B premium. This is sometimes called a “Medicare Part B premium reduction.”

- Whether the plan has a yearlydeductible or any additional deductibles.

- How much you pay for each visit or service . For example, the plan may charge a copayment, like $10 or $20 every time you see a doctor. These amounts can be different than those underOriginal Medicare.

- The type of health care services you need and how often you get them.

- Whether you go to a doctor orsupplierwho acceptsassignmentif:

- You’re in a PPO, PFFS, or MSA plan.

- You goout-of-network.

You May Like: Does Medicare Have A Limit

Medicare Part A Premiums

Most Medicare beneficiaries don’t pay a premium for their Part A hospital insurance coverage. This is because most people or their spouses have worked and paid Medicare taxes for at least 40 quarters , which qualifies them for premium-free Part A.

For people who worked and paid Medicare taxes for less than the required amount of time may have to pay a monthly premium for Part A in 2022.

- People who paid Medicare taxes for fewer than 30 quarters: $499 per month Part A premium

- People who paid Medicare taxes for 30-39 quarters: $274 per month Part A premium

What Are Medicare Advantage Plans

A Medicare Advantage Plan is another way to get your Medicare coverage. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, youll still have Medicare but youll get most of your Medicare Part A and Medicare Part B coverage from the Medicare Advantage Plan, not Original Medicare. Most plans include Medicare prescription drug coverage . In most cases, youll need to use health care providers who participate in the plans network. However, many plans offer out-of-network coverage, but sometimes at a higher cost. Remember, you must use the card from your Medicare Advantage Plan to get your Medicare-covered services. Keep your red, white, and blue Medicare card in a safe place because youll need it if you ever switch back to Original Medicare.

Medicare Advantage Plans cover almost all Medicare Part A and Part B benefits

In all types of Medicare Advantage Plans, youre always covered for emergency and urgent care. Medicare Advantage Plans must cover almost all of the medically necessary services that Original Medicare covers. However, if youre in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies.

Plans can offer extra benefits

Medicare Advantage Plans must follow Medicare’s rules

Recommended Reading: How Much Is Medicare Cost For 2020