Secondary Travel Medical Coverage

When emergency medical coverage is secondary, the provider will reimburse you after any other collectible benefits, such as your primary health insurance. If your plan benefit is secondary and benefits from primary sources have been exhausted, or your primary health care provider will not cover you in your destination, the secondary benefit on your plan will act as a primary benefit. Secondary coverage on a plan is most common.

Dont assume that because you have a primary health coverage here in the United States that you are limited to only secondary emergency medical coverage on your travel insurance. You can use primary coverage, and it may be better for your circumstance.

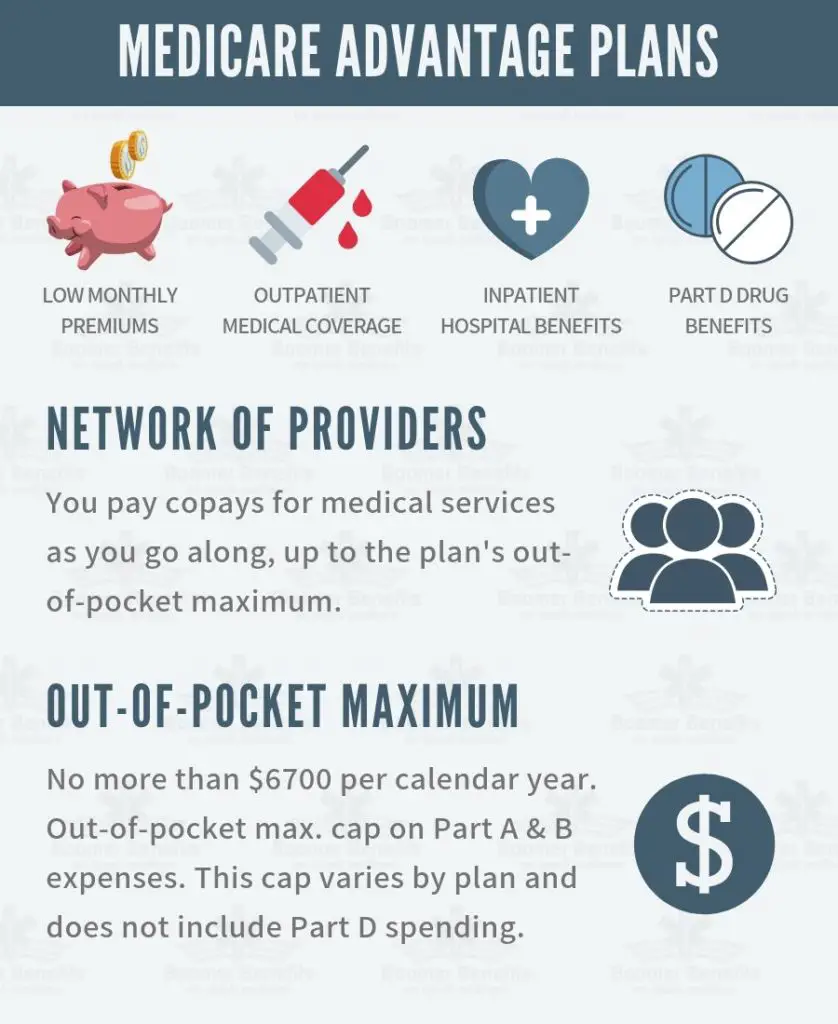

Medicare Consists Of 4 Parts:

- Part A covers inpatient hospitalization hospice home health

- Part B covers outpatient care, services from doctors and other medical providers, durable medical equipment many preventive services

- Part C plans that cover all benefits and services under Parts A and B and usually covers prescription drug benefits. Plans may also include extra benefits and services not covered by Medicare such as basic vision and hearing.

- Part D covers prescription drug costs

Reasons You May Need A Secondary Payer

A secondary payer can help you get even more coverage than offered by Medicare. If you have a health plan from your employer, you might have benefits not offered by Medicare. This can include dental visits, eye exams, fitness programs, and more.

Secondary payer plans often come with their own monthly premium. Youll pay this amount in addition to the standard Part B premium. In 2021, the standard premium is $148.50.

However, even with this added cost, many people find their overall costs are lower, since their out-of-pocket costs are covered by the secondary payer.

Secondary payers are also useful if you have a long hospital or nursing facility stay. Medicare Part A will be your primary payer in this case. If your stay is longer than 60 days, though, there is a $371 coinsurance cost per day. A secondary payer could help cover this cost.

Additionally, most secondary payer insurance offers coverage for prescriptions. This means you wouldnt need a separate Medicare Part D plan. Depending on what plans are available in your area, this could lower your healthcare costs.

Read Also: Is Blue Cross Blue Shield A Medicare Advantage Plan

Information Regarding Coordination Of Benefits With Medicare

When you or your dependents have coverage under more than one health care benefit plan, policy or arrangement , an affiliate of UnitedHealthcare Services, Inc. * will determine the amount of benefits to which you are entitled under the Benefit Plan administered by United using a procedure called Coordination of Benefits or COB. This article does not provide an exhaustive explanation of how COB applies to all Benefit Plans. The Benefit Plan to which you are a member may vary from the practices contained in this article.

The terms of the Employer Plan and applicable law will always govern in determining any entitlement to benefits. For example, some states mandate COB practices that may differ from the practices reflected in this article, and United will follow the laws or regulations that apply in those states. If you require information regarding your Employer Plan or to learn exactly how a particular claim was processed, you should consult your Employer Plan documents or contact Uniteds customer service department at the phone number listed on the back side of your insurance card.

Set forth below is a general overview of how United determines the order in which two different Benefit Plans are responsible for claims payment and how United determines the Allowable Expense when United performs COB. We will then discuss how United performs COB with Medicare, when you receive health care services from an out-of-network provider or a provider who does not accept Medicare.

Is Medicare Considered A Primary Or Secondary Payer

When you only have Original Medicare, you can be sure that Medicare is the primary payer. In insurance, a primary payer is a company or policy that pays first. A secondary payer pays after the primary payer has paid.

When other insurance types come into play, Medicare can step back and become a secondary payer. Next, well review the coordination of benefits to different kinds of insurance with Medicare.

Also Check: How To Sign Up For Medicare At Age 65

You Work At A Large Employer

Medicare is secondary to your group health insurance if the company has 20 or more employees. If the group insurance is affordable, you may choose to delay your enrollment in Part B. ALWAYS speak with a licensed insurance agent who specializes in Medicare before making this decision.

Its critical that you understand your coverage. Late enrollment into Medicare Part B can cause you to pay a penalty if certain conditions are not met. Learn more about Medicare Part B costs here.

Sometimes we find that staying your employer coverage actually costs more than if you left that coverage and let Medicare become primary. Evaluating this ahead of time will help you to evaluate which coverage is most cost-effective.

Medicare Cob When Medicare Does Not Pay The Provider

In some circumstances, Medicare does not make an actual payment to the members provider, either because a Medicare-eligible member is not enrolled in Medicare or the member visited a provider who does not accept, has opted-out of or for some other reason is not covered by the Medicare program. When a provider does not accept, has opted-out of or is not covered by the Medicare program, that means that the provider is not allowed to bill Medicare for the providers services and that the member may be responsible for paying the providers billed charge as agreed in a contract with the doctor that the member signs.

For example, if a providers billed charge is $200, the Medicare coverage percentage is 80%, and the Employer Plans coverage percentage is 100%, Uniteds methodology would result in a secondary benefit payment of $40 . By contrast, if the Medicare fee schedule were used to determine the Allowable Expense and it was $100 for that same procedure, then the Employer Plans secondary benefit payment would be $20 .4

Footnotes

*Includes Oxford. Oxford insurance products are underwritten by Oxford Health Insurance, Inc. Oxford HMO products are underwritten by Oxford Health Plans , Inc. and Oxford Health Plans , Inc.

Don’t Miss: Who Pays For Medicare Part B Premiums

Example: Primary And Secondary Payer Coordination

You visit your doctor for a normal checkup. Your doctors office bills both Medicare and the group insurance you have through your employer for the visit. Your group insurance is the primary payer because youre over 65 and your employer has more than 20 employees, so your group health plan pays whatever their standard rate for a doctors office visit is. Medicare is the secondary payer, so they pay whatever charges are left over. If there happens to be any amount left after both Medicare and your group insurance pay what they will cover, you may have to pay the remainder to your doctors office.

Medicare offers a helpful guide on Medicare.gov that covers different situations and how Medicare works with your other insurance. You can also call the Medicare Benefits Coordination & Recovery Center Monday through Friday, from 8:00 a.m. to 8:00 p.m., Eastern Time, except holidays, at toll-free lines: 1-855-798-2627 if you have questions about who pays first.

To learn more about Medicare, visit Medicare.gov, check the Medical Mutual website, or like our to see the latest updates in this series. You can also for more details.

Responsibilities Of Beneficiaries Under Msp

As a beneficiary, we advise you to:

- Respond to MSP claims development letters in a timely manner to ensure correct payment of your Medicare claims

- Be aware that changes in employment, including retirement and changes in health insurance companies may affect your claims payment

- When you receive health care services, tell your doctor, other providers, and the Benefits Coordination & Recovery Center about any changes in your health insurance due to you, your spouse, or a family member’s current employment or coverage changes

- Contact the BCRC if you, or an attorney on your behalf, takes legal action for a medical claim

- Contact the BCRC if you are involved in an automobile accident and

- Contact the BCRC if you are involved in a workers’ compensation case.

Please select Beneficiary Services in the Related Links section below for more information.

Also Check: Does Medicare Cover Total Knee Replacement

Does Secondary Insurance Cover The Primary Deductible

Typically not. If you have a deductible on one or both plans, you will need to pay those deductibles before your insurance reimburses you for care.

Depending on the type of plan you have, there is not necessarily a pass-through or a honoring of a deductible from one plan design to the next, Mordo says.

Chris Kissell is a Denver-based writer and editor with work featured on U.S. News & World Report, MSN Money, Fox Business, Forbes, Yahoo Finance, Money Talks News and more.

What Is Secondary Health Insurance

Secondary health insurance is coverage you can buy separately from a medical plan. It helps cover you for care and services that your primary medical plan may not. This secondary insurance could be a vision plan, dental plan, or an accidental injury plan, to name a few. These are also called voluntary or supplemental insurance plans.

Some secondary insurance plans may pay you cash. These plans can help pay out-of-pocket health care costs if you get seriously injured or sick.

You May Like: Does Medicare Cover Overseas Expenses

How Medicare Works With Current Employer Coverage

Those with small employer coverage will keep Medicare as the primary insurance. You must complete enrollment in Medicare Part B, or the employer may not pay their portion.

However, Medicare is secondary if you have large employer group health insurance .

Some Medicare beneficiaries will find that group coverage is cheaper. For others, Medicare can save them money.

In these cases, you may be able to delay Part B in this case. However, in most cases, Original Medicare costs less and provides better primary coverage.

Those under age 65, on disability Medicare, and with large employer coverage will have Medicare as secondary insurance.

Suppose you were recently diagnosed with End-Stage Renal Disease and meet the following conditions. In that case, Medicare will be the secondary payer.

- Have employer group coverage

- Medicare-eligible for less than 30 months

Also, suppose you have a successful kidney transplant. In that case, your eligibility for Medicare ends after 36 months unless youre eligible due to age or disability status.

What Is A Secondary Payer

When you have two types of health insurance â for example, a Medicare Advantage plan and an employer plan â generally one will be the primary payer and the other will be the secondary payer. Health insurance companies and Medicare use âcoordination of benefitsâ rules to determine which company pays first, according to the Center for Medicare & Medicaid Services.

The primary payer generally pays for covered services up to its limits. Then the secondary payer may cover the remaining costs, if there are any. Sometimes the secondary payer doesnât cover all remaining costs.

Sometimes Medicare is the primary payer, and sometimes the secondary payer.

You May Like: What Age Can You Get Medicare And Medicaid

You Are On Ssdi Under Age 65 At A Medium

Some people qualify for Medicare early due to a disability. In this situation, if you have group coverage through an employer with less than 100 employees, Medicare is primary.

When you reach your 24th month of SSDI benefits, Medicare will automatically enroll you in Parts A and B. Be sure to notify your employer of your Medicare coverage.

Can I Have Medicare And Employer Health Insurance Together

Yes, you can have both Medicare and employer health insurance together. When you have Medicare and other health insurance or coverage, you have more than one payer. In these instances, coordination of benefits rules will decide which payer pays first.

Medicare is the primary payer for Medicare beneficiaries who are on employer plans if there are less than 20 employees. However, if the beneficiary is on an employer plan with 20 or more employees, that plan will serve as the primary payer,

If you have specific questions about your companys health insurance, contact your benefits administrator, insurer, or plan provider. If you have any questions on which of your health insurance plans is primary, call the Benefits Coordination & Recovery Center at 1-855-798-2627.

Find a local Medicare plan that fits your needs

Don’t Miss: How To Find Medicare Number

Medicare Expects You To Know Who Is Primary

In our example above, Patricia didnt realize that since her employer has less than 20 employees, Medicare would be her primary coverage. By failing to enroll in Medicare, she was now responsible for paying for the cost of that MRI.

Had she properly enrolled in Medicare last year, Medicare would have paid 80% after her small Part B deductible. Then her group insurance would pay secondary. Instead, Patricia found herself stuck with the whole bill.

Telling Medicare she didnt know the rules didnt help her either. In their eyes, they send you a handbook at age 65 and they expect you to do your research from there on out.

Patricia had also now missed her initial election window and will owe a Part B penalty when she finally enrolls. She has to wait until the next General Enrollment Period in January to do so. Thats for another post though. For this post, lets dive into how Medicare coordinates with other coverage so that you wont end up in a similar dilemma as Patricia.

Group Coverage Through Larger Employer

Whether you have group insurance through the company you work for or your spouses employer, Medicare is your secondary coverage when the employer has more than 20 employees. Some Medicare beneficiaries will choose to delay their Part B enrollment if their group coverage is cheaper. However, most of the time after evaluating their coverage they find that Medicare will cost them less and provide better coverage if they let Medicare be their primary coverage.

Recommended Reading: How Often Will Medicare Pay For A Walker

Determining Which Plan Is Primary

If you or your dependents are covered by more than one Benefit Plan, United will apply theterms of your Employer Plan and applicable law to determine that one of those Benefit Plans will be the Primary Plan. The Primary Plan is the Benefit Plan that must pay first on a claim for payment of covered expenses. The Primary Plan is the plan that must determine its benefit amount as if no other Benefit Plan exists. Other Benefit Plans that cover you or your dependent are Secondary Plans. Any Secondary Plan may pay certain benefits in addition to those paid by the Primary Plan. For example, if your spouse covers you under her Employer Plan and you are also covered under a different Employer Plan, your Employer Plan is the Primary Plan for you, and your spouses Employer Plan is the Secondary Plan for you.

COB also applies when you or your dependents have health coverage under Medicare, workers compensation or motor vehicle or homeowners insurance. Your Employer Plan will often have a specific section entitled Order of Benefit Determination Rules which sets forth how your Employer Plan identifies the Primary Plan.

When Is Medicare A Primary Payer

Knowing the difference between Medicare being a primary or secondary payer matters when you are covered by at least one other insurance plan other than Medicare. So if Medicare is the only insurer you have, theyll be the primary payer on all of your claims, and then you will have to pay the remainder of the bill. In many cases, though, youll find that even if you are insured by another source, Medicare is still the primary payer.

Medicare takes on the brunt of the costs with an elderly persons health concerns, then the GHP associated with the small employer will pay the remaining costs.

According to the CMS, these situations include when:

- You are covered by a group health plan through employment or a spouses employment, AND the employer has less than 20 employees.

- You have a retirement benefit plan.

- You are covered by COBRA, a 1985 law that gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances like job loss, death of a close family member, a reduction in work hours, or other situationsand are also covered by Medicare.

- You are disabled and receive Medicare benefits, and are also covered by COBRA.

Recommended Reading: Does Medicare Pay For Revitive

Retiree Plans Often Have Better Drug Coverage

Retiree group health plans generally have built in drug coverage. This coverage may provide all of your medications to you at minimal copays. Be sure to get a copy of the plans drug formulary, and look up your medications to see how much you might spend on your copays.

Part D drug plans, on the other hand, often have deductibles. Medicare drug plans also have the coverage gap, or donut hole, in the middle. This is a phase that kicks in if your drug spending goes beyond a certain limit each year. In 2018, that limit is $3750.

People on Medicare Part D begin to pay 35% of the cost of their brand name drugs when they reach the gap. They pay 44% of the cost of generics. If you are someone taking several brand name medications, you may find that this puts you into the gap sometime during that calendar year.

People who have heavy expenses during the coverage gap will often find that the drug coverage under the retiree plan is more attractive. That coverage doesnt have the same kind of gap that Part D does.

You can easily estimate what your annual drug expenses will be on Part D by using Medicares Plan Finder Tool. Compare this annual cost to what you would spend annually on your drug copays under the employer plan. This comparison may help you begin to lean toward one route or the other.