Unitedhealthcare Connected For Mycare Ohio

UnitedHealthcare Connected® for MyCare Ohio is a health plan that contracts with both Medicare and Ohio Medicaid to provide benefits of both programs to enrollees. If you have any problem reading or understanding this or any other UnitedHealthcare Connected® for MyCare Ohio information, please contact our Member Services at from 7 a.m. to 8 p.m. Monday through Friday for help at no cost to you.

Si tiene problemas para leer o comprender esta o cualquier otra documentación de UnitedHealthcare Connected® de MyCare Ohio , comuníquese con nuestro Departamento de Servicio al Cliente para obtener información adicional sin costo para usted al de lunes a viernes de 7 a.m. a 8 p.m. .

This is not a complete list. The benefit information is a brief summary, not a complete description of benefits. For more information contact the plan or read the Member Handbook. Limitations, copays, and restrictions may apply. For more information, call UnitedHealthcare Connected Member Services or read the UnitedHealthcare Connected Member Handbook. Benefits, List of Covered Drugs, pharmacy and provider networks and/or copayments may change from time to time throughout the year and on January 1 of each year.

Additional Benefits And Health Care Services

There is a large collection of benefits included in Medicare Advantage plans from AARP/UnitedHealthcare. Because Erickson and Rocky Mountain Health Plans offer a different collection of benefits, this section only focuses on what’s included with the AARP and UnitedHealthcare branded plans. These Medicare Advantage plans include:

Understanding Part D Costs

Even though most plans include Part D prescription drug coverage, there is usually a separate deductible for Part D. The maximum is set by CMS , but AARPs deductibles are typically lower.

Medications in lower formulary tiers are usually exempt from the deductible.

AARP plans typically use a five-tiered formulary:

- Tier 1: Preferred generic drugs

- Tier 2: Nonpreferred generic drugs

- Tier 3: Preferred brand-name drugs

- Tier 4: Nonpreferred brand-name drugs

- Tier 5: Specialty prescription drugs

In a typical plan, there is no deductible for medications in tiers 1, 2, and 3, and a deductible of $50 to $100 for tiers 4 and 5.

Read Also: Does Medicare Cover Palliative Care For Dementia

Unitedhealthcare Connected General Benefit Disclaimer

This is not a complete list. The benefit information is a brief summary, not a complete description of benefits. For more information contact the plan or read the Member Handbook. Limitations, copays and restrictions may apply. For more information, call UnitedHealthcare Connected® Member Services or read the UnitedHealthcare Connected® Member Handbook. Benefits, List of Covered Drugs, pharmacy and provider networks and/or copayments may change from time to time throughout the year and on January 1 of each year.

You can get this document for free in other formats, such as large print, braille, or audio. Call Member Services, 8 a.m. – 8 p.m., local time, Monday – Friday . The call is free.

You can call Member Services and ask us to make a note in our system that you would like materials in Spanish, large print, braille, or audio now and in the future.

Language Line is available for all in-network providers.

Puede obtener este documento de forma gratuita en otros formatos, como letra de imprenta grande, braille o audio. Llame al Servicios para los miembros, de 08:00 a. m. a 08:00 p. m., hora local, de lunes a viernes correo de voz disponible las 24 horas del día,/los 7 días de la semana). La llamada es gratuita.

Puede llamar a Servicios para Miembros y pedirnos que registremos en nuestro sistema que le gustaría recibir documentos en español, en letra de imprenta grande, braille o audio, ahora y en el futuro.

Aarp Unitedhealthcare And Expanded Medicare Advantage Benefits

In 2018, the Centers for Medicare and Medicaid Services approved a list of new supplemental benefits for Medicare Advantage plans. These benefits are designed to help people age safely at home.

UnitedHealthcare was one of the first insurers to add some of these new benefits to their Medicare Advantage plans. Many AARP Medicare Advantage plans include one or more of these optional supplemental benefits at no additional cost:

- Nonmedical transportation

- Allowance for over-the-counter medications and devices

- Personal emergency response system

In addition, most AARP UnitedHealthcare Medicare Advantage plans include the new insulin savings program which caps copays for insulin at $35 in all four stages of prescription drug coverage.

Read Also: Does Medicare Cover Glucose Monitors

Medicare Supplement Insurance Plans

Medicare Supplement plans, also known as Medigap, cover some of the costs that Original Medicare doesnt cover, like copayments, coinsurance, and deductibles. You must have Medicare Parts A and B, and you cant have Medicare Advantage to get a Medigap plan. There are 10 standardized plans that cover different costs not all are available in every state.

UnitedHealthcare Medigap plans are the only ones working as a partner with AARP. UnitedHealthcare offers several Medigap options:

- UnitedHealthcare offers Medigap Plans with the AARP: A, B, D, G, K, L, N

All Medigap plan benefits are the same no matter the insurer, but costs and any additional benefits can vary.

Aarp Medicare Advantage Hmo

This is one of the most popular plan types because it gives members low HMO costs within the plans service area as well as the flexibility to use any UnitedHealthcare network provider nationwide. HMO-POS plan benefits usually include:

- Part D prescription drug coverage

- Dental, vision, and hearing coverage

- 24/7 nurse hotline and virtual doctor visits

- Fitness membership

You May Like: Will Medicare Pay For An Upwalker

Sample Costs For Aarp Medicare Advantage Plans

|

$0 primary care, $35 specialist care |

$0 primary care in-network, $20 out-of-network $35 specialist care in network, $55 out-of-network |

|

|

Hospital Visits |

$90 for emergency room visit $325 per inpatient days 15, $0 every day after that |

$90 for emergency room in or out-of-network $345 per inpatient days 15, $0 after that, 40 percent of the cost for out-of-network inpatient stays |

Aarp Unitedhealthcare Medicare Advantage Review

AARP UnitedHealthcare offers a number of Medicare Advantage plans to enrollees. Find out the pros and cons of these plans and what you can expect from coverage.

Everyday Health may earn a portion of revenue from purchases of featured products.

If youre shopping for Medicare Advantage plans, youve probably noticed that AARP and UnitedHealthcare offer quite a few. Thats because UnitedHealthcare is the largest Medicare Advantage provider in the country.

More than 1 in 4 Medicare Advantage members are enrolled in a UnitedHealthcare plan.

All AARP Medicare Advantage plans are underwritten by UnitedHealthcare. When you buy an AARP plan, you become a member of the UnitedHealthcare network. To give you a more complete picture of the pros and cons of AARP Medicare Advantage plans, this review covers AARP plans specifically as well as the overall UnitedHealthcare member experience.

Also Check: Is Unitedhealthcare Dual Complete A Medicare Plan

What Are My Costs With A Unitedhealthcare Medicare Part D Prescription Drug Plan

Most Medicare Advantage plans include prescription drug coverage. If you donât have a Medicare Advantage plan, or if your plan doesnât include Part D coverage, you can get a stand-alone Part D prescription drug plan. Your costs with a stand-alone UnitedHealthcare Part D plan include some or all of the following:

- Monthly premium. If you get your Part D coverage for prescription drugs with your Medicare Advantage plan, you donât pay a separate monthly premium for Part D. If you buy a stand-alone Part D plan to work with Original Medicare, you pay a monthly premium to UnitedHealthcare.

- Annual deductible. Medicare limits the deductible for Part D plans to $435 per year in 2020. Some UnitedHealthcare Part D plans set the deductible much lower you may find a $0 deductible or one that applies only to certain tiers on plans in your area.

- Copayments. You pay a flat fee when you fill your prescription. Most plans use a tiered copayment system. Medications in the lower tiers have a smaller copayment. The copayment is higher for more expensive medications in the upper tiers. Some plans may have no copayment for generic medications.

Pros And Cons Of Aarp Unitedhealthcare Medicare Advantage

|

Pros |

|

|

There is a good selection of plans in most areas, including a flexible HMO-POS plan. |

In some areas, customer service gets below average marks. |

|

There is a large national provider network. |

Although there are many 4 and 4.5 star plans, the average Medicare star rating is 3.9. |

|

The $0 premium and $0 deductible plans are available in most areas. |

PPO plan premiums are slightly higher than average in some areas. |

|

Most plans include Part D plus generous extra benefits, including dental, vision, nurse hotline, and fitness membership. |

Don’t Miss: Does Medicare Cover Plastic Surgery

Competition: Unitedhealthcare Vs Kaiser Permanente

UnitedHealthcare has the largest share of the Medicare Advantage market , offers the largest provider network nationally, and offers plans in 66% of U.S. counties.

Kaiser Permanente also beat UnitedHealthcare on the J.D. Power 2021 Medicare Advantage Study, ranking second overall with a score of 846 out of 1,000 compared to UnitedHealthcares 795. They also only offer HMO plans, which can feel restrictive for members who want to see healthcare providers outside of the HMO network.

For quality, Kaiser Permanente is a clear winner if you live in the states they serve. For breadth of choice and products that offer more flexibility, UnitedHealthcare has the edge.

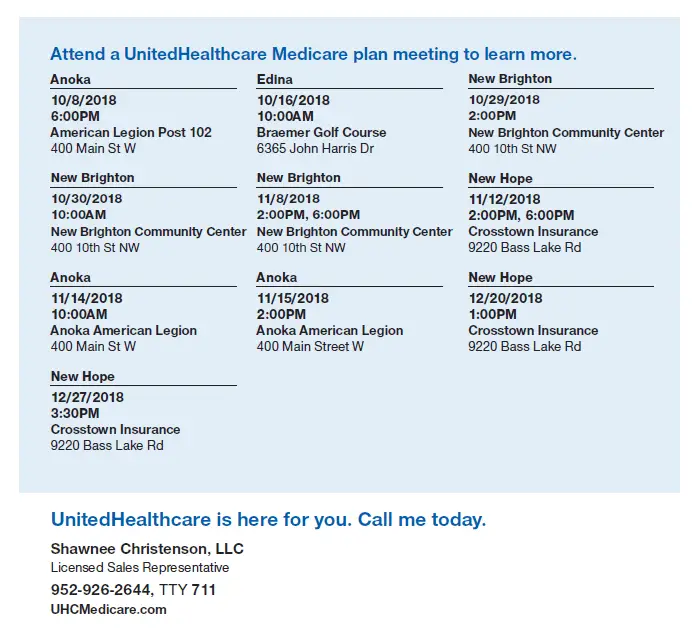

When It Comes To Medicare Unitedhealthcare Offers You Choices Learn More About Your Medicare Plan Options

UnitedHealthcare is here to help. Take this opportunity to ask questions and get answers from a local licensed sales agent. When you are ready, well help you choose the UnitedHealthcare plan or combination of plans that may be right for you. Search for an agent in your area

Video transcript

Upbeat music plays. Text appears beside an illustrated document and folder labeled Medicare. A male narrator speaks in voiceover.

ONSCREEN TEXT: How to Choose the Right Medicare Plan

NARRATOR: How to choose the right Medicare plan for you.

Four illustrated hands raise in the air.

ONSCREEN TEXT: Medicare coverage should fit your unique health and lifestyle needs

NARRATOR: Medicare coverage should fit your unique health and lifestyle needs.The answers to a few important questions can help you determine which Medicare coverage option is right for you.Lets get started.

A bottle of pills appears.

ONSCREEN TEXT: Do you take prescription drugs?

NARRATOR: Do you take prescription drugs?

The word Yes appears beside an icon of a pill bottle labeled Part D and an icon of a bed and stethoscope labeled Medicare Advantage.

NARRATOR: If you answered yes, you will want to consider a Part D prescription drug plan, or Medicare Advantage plan with built in prescription drug coverage.

Text appears beside a graphic of a coin rising out of a wallet.

ONSCREEN TEXT: No Watch out for Part D late enrollment penalty

ONSCREEN TEXT: Do you want coverage for dental, vision, or hearing care?

Also Check: How Much Does Medicare Pay For Ambulance

What Types Of Medicare Advantage Plans Are There

Coordinated Care Plans

Most Medicare Advantage plans are coordinated care plans. Coordinated care plans have a network of doctors and providers. If you use the plan’s network doctors and providers, you generally pay less out-of-pocket for care.

Health Maintenance Organization plans

HMO plans use a network primary care provider to help coordinate care. HMO plans usually only pay for doctors and providers in the plan network.

Point of Service plans

POS plans have the benefits of an HMO, but with more flexible doctor/provider choice. Costs are generally lower for using in-network doctors/providers.

Preferred Provider Organization plans

PPO plans cover doctors and providers both in and out of network. These plans pay a portion of the cost for using an out-of-network doctor or provider.

Special Needs Plans

Special Needs Plans have benefits that cover special health care or financial needs. All SNPs include prescription drug coverage.

- Dual-Eligible Special Needs Plans for people who have both Medicare and Medicaid

- Chronic Special Needs Plans for people living with severe or disabling chronic conditions

- Institutional Special Needs Plans for people who live in a skilled nursing facility

- Institutional-Equivalent Special Needs Plans for people who live in a contracted assisted living facility and need the same kind of care as those who live in a skilled nursing facility

Emergency And Urgent Care

If you require emergency or urgent care, seek care at the nearest medical facility.

You can also receive emergency or urgently needed services from a provider outside the United States. If you receive emergency or urgently-needed services outside of the United States, the provider may require that you pay for the cost of the services in full. Ask for a written, detailed bill or receipt showing the specific services provided to you. Send a copy of the itemized bill or an itemized receipt to us to pay you back. You should be prepared to assist us in obtaining all of the information necessary to properly process your request for reimbursement, including medical records.

You May Like: What’s The Best Medicare Supplemental Plan

What Are My Costs With Unitedhealthcare Medicare Advantage Plans

When you choose a UnitedHealthcare Medicare Advantage plan, you get all the same benefits as Original Medicare . Most plans include coverage for prescription drugs plus additional benefits not covered by Original Medicare, such as dental, vision, hearing, wellness programs and fitness memberships among other extra benefits and features. Your costs are based on the plan you choose. Most plans include some or all of the following expenses:

- Monthly premiums. No matter which Medicare Advantage plan you enroll in, you continue to pay your regular Part B premium to Medicare every month. Some plans have an additional monthly premium you pay UnitedHealthcare, although there may be $0 premium plans available in your area.

- Annual deductible. Some UnitedHealthcare Medicare Advantage plans have annual deductibles for certain services which you might pay each year. With Original Medicare, you have separate deductibles for Part A and Part B.

- Copayments. Many Medicare Advantage plans charge a copayment each time you see the doctor or get other health care services. A copayment is generally a flat fee. As an example, you might pay $10 to see your primary care doctor and $30 if you see a specialist.

- Coinsurance. Coinsurance is a percentage of the actual charge for the service. If you choose a PPO plan, for example, you might pay 30% coinsurance if you receive care outside your planâs network.

Questions We’re Ready To Help

Call UnitedHealthcare at:FED TFN

8 a.m. – 8 p.m., 7 days a week.

Already a member? Call the number on the back of your member ID card.

MO10050ST

7 a.m. – 11 p.m. ET, Monday – Friday 9 a.m. – 5 p.m. ET, Saturday.

Already a member? Call the number on the back of your member ID card.

MO10050ST

Get plan information, forms and documents you may need now or in the future.

Don’t Miss: Is Shingles Shot Covered By Medicare Part D

How Do Aarp/unitedhealthcare Medicare Advantage Plans Work

Medicare Advantage, also called Medicare Part C, is a bundled insurance plan that’s administered by a private insurance company, in this case UnitedHealthcare.

Plans cover medical care, hospitalization services and usually prescription drugs.

You can sign up for Medicare Advantage when you first become eligible for Medicare, and then you can update your plan annually during Medicare open enrollment in the fall.

When comparing Medicare Advantage plans, we recommend you choose a plan based on the medical care you expect to need. If you’re in good health, a low-cost plan could be the most cost effective, even if you have to pay a little more for your medical care. However, if you have chronic health issues, it may be cost effective to sign up for a more expensive plan with better benefits. For example, paying $25 more per month is worth it if the more expensive plan will save you more than $300 per year in medical care.

Does Unitedhealthcare Offer Medicare

Yes, UnitedHealthcare is the most popular provider of Medicare Advantage plans which bundles coverage together as a single plan. It also offers Medicare Part D plans for standalone prescription drug coverage and Medicare Supplement plans to reduce medical costs for those who are enrolled in the government-administered Medicare plan.

Recommended Reading: What Is The Coinsurance For Medicare Part B

What Are My Costs With A Unitedhealthcare Medicare Supplement Insurance Plan

Medicare Supplement insurance plans can cover some of your out-of-pocket costs with Original Medicare. Some plans have more complete coverage: They may pay 100% of your Part A and Part B deductibles, coinsurance, and Part B excess charges. Others pay only some of your out-of-pocket costs.

You pay a monthly premium to UnitedHealthcare for your Medicare Supplement insurance plan, and the plan pays your share of your covered medical expenses directly to the doctor or hospital. Plans that cover more of your Medicare costs may have higher premiums than ones that protect against catastrophic health expenses.

You canât use a Medicare Supplement insurance plan with a Medicare Advantage plan or for costs of your stand-alone Part D prescription drug coverage. It only covers charges under Original Medicare.

Keep in mind that UnitedHealthcare can change its premiums, deductibles, and copayments each year. Be sure to watch for your Annual Notice of Change each year so you know what to expect.

To find a Medicare plan in your area, enter your zip code on this page.

Medicare beneficiaries may also enroll in a UnitedHealthcare Medicare plan through the CMS Medicare Online Enrollment Center located at http://www.medicare.gov.

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract. Enrollment in the plan depends on the planâs contract renewal with Medicare.

Y0066_160913_112515_Accepted

Customer Reviews And Complaints

Overall ratings of AARP/UnitedHealthcare Medicare Advantage plans are good, and the company has an average of 4.2 out of five stars.

That’s slightly ahead of other national providers including Blue Cross Blue Shield, Humana and Aetna, which average between 4.1 and 3.9 stars.

UnitedHealthcare also has a low rate of official customer complaints. In this category, it had a near-perfect score of 4.9 stars. However, member experience is middle of the road. Current policyholders gave their Medicare Advantage plans an average of 3.6 to 3.7 stars for the plan’s overall performance. While this is not a red flag, these lackluster customer reviews are not as strong as a top-rated company like Kaiser Permanente or other regional brands like Baylor Scott & White in Texas.

Customer reviews of UnitedHealthcare Medicare Advantage:

- Rating of health plan: 3.6 stars

- Getting appointments and care quickly: 3.6 stars

- Getting needed care: 3.6 stars

- Rating of health care quality: 3.7 stars

- Customer service: 3.7 stars

These moderate ratings line up with what other researchers have found. In J.D. Power’s survey on Medicare Advantage customer satisfaction, UnitedHealthcare ranks in the bottom third of providers.

Plus, while both AARP and UnitedHealthcare have A+ ratings on the Better Business Bureau , customers commonly complain about poor customer service, aggressive marketing and excessive junk mail.

Recommended Reading: Does Humana Medicare Cover Incontinence Supplies