How Much Will Medicare Supplement Insurance Cost In My State

Because Medicare Supplement Insurance plans are sold by private insurance companies, plan rates will vary from one market to the next.

In 2018, the average monthly premium rate of Medigap Plan G in New York was $304 per month. In the same year, the average monthly cost of Medigap Plan G in Iowa was only $102.1

The difference in Medigap rates from one state to another can vary widely, similar to how the cost of a gallon of gas can differ greatly from one state to another.

Learn more about Medicare Supplement Insurance rates in your state.

Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

For specific cost information (like whether you’ve met your

, how much you’ll pay for an item or service you got, or the status of a

| 2022 costs at a glance | |

|---|---|

| Part A premium | Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274. |

| Part A hospital inpatient deductible and coinsurance | You pay:

|

| Part B premium | The standard Part B premium amount is $170.10 . |

| Part B deductible and coinsurance | $233. After your deductible is met, you typically pay 20% of theMedicare-Approved Amountfor most doctor services , outpatient therapy, anddurable medical equipment |

| Part C premium |

varies by plan. Compare costs for specific Part C plans. |

| Part D premium | The Part D monthlypremiumvaries by plan . Compare costs for specific Part D plans. |

What Else Do I Need To Know About Drgs

DRGs are updated annually, and the pre-determined amounts associated with each DRG may change from year to year. In 2021, hospitals use Medicare DRG version 39.1.

Finally, your hospitals billing department should be able to answer any questions you have about specific DRGs that were assigned for your hospital stay.

You May Like: How Long Does It Take To Get Credentialed With Medicare

So How Are The Medicare Premiums You Pay For Calculated

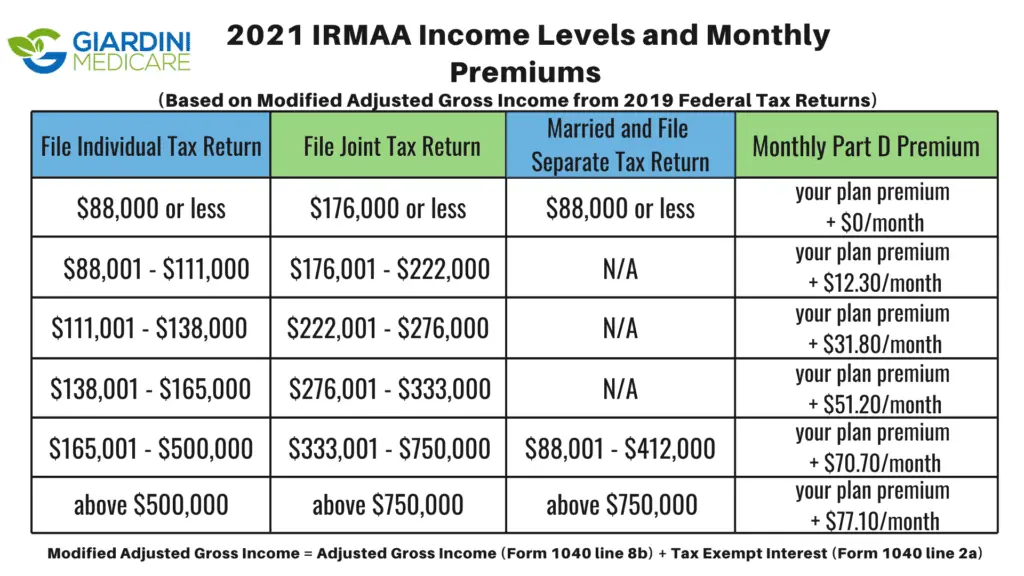

These additional Medicare premiums are all calculated through something called IRMAA, which stands for Income-Related Monthly Adjustment Amount. It is an additional amount that you may have to pay along with your Medicare premium if your modified adjusted gross income is higher than a certain threshold.

Your MAGI is calculated by taking your adjusted gross income plus any of the following that apply to you: untaxed foreign income, non-taxable Social Security benefits, tax-exempt interest, and income from within the US territories that was not already included in AGI. For most people, your MAGI will be the same as your AGI but read this report by the Congressional Research Service here for further details.

In 2022, the IRMAA surcharges only apply if your MAGI is more than $91,000 for an individual or more than $182,000 for a couple. Most people have income below these levels, so the majority of enrollees will pay the standard premium, $170.10 per month.

Why Were Drgs Created

The DRG system was created to standardize hospital reimbursement for Medicare patients while also taking regional factors into account.

Another goal was to incentivize hospitals to become more efficient. If your hospital spends less money taking care of you than the DRG payment it receives, it makes a profit. If it spends more than the DRG payment, it loses money.

You May Like: How Much Does Medicare Cost Annually

How Are Va Mortgage Rates Determined

- A VA mortgage could provide better loan terms if you’re an active service member or military veteran. Learn how VA mortgage rates are determined today.

If you’re in the market for a new home, chances are you’ve researched your current mortgage options. Although external considerations, such as your credit score and income, will affect the loan terms you’re offered, there can be a vast difference in the costs and interests of mortgages you qualify for. If you’re an active military member or armed forces veteran, a VA loan is one excellent mortgage option you should look into. A VA loan is a non-conforming mortgage guaranteed by the Department of Veterans Affairs. They’re designed to help individuals who have served in the military purchase homes at better rates. Although the government backs the loans, they’re issued by private lenders, such as credit unions or local banks, in the same way as traditional mortgages.

Medicare Premiums And The Government Who Pays For What

A quick background on what Medicare premiums are may be helpful. Medicare is broken into two parts. Essentially:

- Medicare Part B Standard healthcare services

There are also options for supplemental coverage, notably:

- Medicare Supplement Highly-regulated add-ons that pay your out-of-pocket Medicare costs

- Medicare Advantage Private plans that replace your Parts A, B, and in most cases, D. Also known as Part C.

- Medicare Part D Prescription drug coverage plans, introduced in 2006.

Generally, if youre on Medicare, you arent charged a premium for Part A. However, you are charged monthly premiums for Part B and Part D, and can also be charged for Part C, depending on the plan you select. These premiums are tax-deductible but very few people itemize their tax returns so only a minority of seniors use this deduction. In fact, even if you do itemize, you can only deduct medical expenses, including Medicare premiums, that exceed 10% of your adjust gross income . This further limits the number of people who can deduct their premiums.

Most ofMedicare Part B about 7% is funded through U.S. income tax revenue. But the remaining 25% of Medicare Part B expenses are paid through your premium, which is determined by your income level. Medicare prices are quoted under the assumption you have an average income. If your income level exceeds a certain threshold, you will have to pay more.

Don’t Miss: Does Medicare Cover Dexcom 6

How Medicare Can Be Coordinated With A Health Reimbursement Arrangement Or A Health Stipend

If youre an employee approaching age 65 and you have a health reimbursement arrangement through your employer, youre in luck. To participate in a stand-alone HRA, employees must have an HRA-eligible health insurance plan. Medicare is an eligible insurance plan, in addition to most major medical plans.

Integration between Medicare and HRAs can be tricky, but it’s very doable depending on what type of HRA you have. Out of the HRAs that are available, the qualified small employer HRA and individual coverage HRA can coordinate with Medicare.

HRA funds can help you pay your Medicare premiums and other qualified medical expenses not covered by your insurance. Integrated HRAs unfortunately cant be integrated with Medicare because they can only be used in conjunction with group health insurance plans.

If your employer offers you an employee stipend, you have even more flexibility. Health stipends provide employees with a fixed amount of money to use on healthcare. Since they are much less regulated than other health benefit options, stipends can be used to pay for Medicare premiums, health services, and out-of-pocket expenses, if your employer allows it.

With WorkPerks through PeopleKeep, employees can easily submit their premium and medical expenses to be reimbursed up to a set monthly allowance amount. The user-friendly dashboard makes it simple for employees of all ages to get their expenses reimbursed quickly and easily.

What If Your Financial Situation Has Significantly Changed Since Filing Your Tax Return From Two Years Ago

As mentioned earlier, most people pay the standard rate for 2022 Part B or Part D premiums. Few pay IRMAA surcharges. But if you are one of the seniors that have had a life-altering event that drastically affects your income level since you first enrolled, such as the death of a spouse or retirement, you can go to Social Securitys website to fill out the Medicare income-related monthly adjustment amount life-changing event form. You dont have to pay an amount that no longer makes sense.

Recommended Reading: Does Medicare Pay For Urolift

How Much Are Medicare Premiums In 2021

There are six income tiers for Medicare premiums in 2022. As stated earlier, the standard Part B premium amount that most people are expected to pay is $170.10 month. But, if your MAGI exceeds an income bracket even by just $1 you are moved to the next tier and will have to pay the higher premium.

Heres a table with the 2022 numbers.

| Individual Taxable Income | Joint Taxable Income | 2021 Monthly Part B IRMAA Premium |

| $91,000 or less | ||

|

$578.30 |

Hold Harmless Provision

What is the hold harmless rule? It ensures that if youre receiving Social Security retirement benefits, the amount of your check wont decline from one year to the next.

Medicare Part B premiums are deducted from Social Security checks, and Social Security benefit amounts are adjusted annually by the cost-of-living adjustment . As long as the COLA is enough to cover the full amount of the Part B premium increase for that year, the full amount of the premium increase can be applied the beneficiarys net Social Security benefit amount wont decrease.

But if the Part B premium increase would be more than the beneficiarys COLA amount, the full amount of the Part B premium increase cant be applied, because that would result in a year-over-year decrease in their Social Security check. The hold harmless provision doesnt apply to people who have to pay the IRMAA surcharge, however, even if theyre receiving Social Security benefits.

How Medicare Surcharges Are Determined

According to the Social Security Administration , your modified adjusted gross income from two years ago is what counts. This means that benefits for the current period are based on calculations from the income you earned two years earlier. Most people’s MAGIs and adjusted gross incomes will be the same, but your MAGI may be different if you’re paying student loan interest, alimony payments, moving expenses, or some other types of payments.

The SSA will look at your 2020 tax return to determine whether you owe surcharges in 2022. It’s done this way because the levels are normally set the year before, while the Social Security Administration only has access to returns from the prior tax year.

Read Also: Does Medicare Part A Cover Doctors In Hospital

Medicares Role In Determining Prices Throughout The Health Care System

Payments for Medicare benefits substantially influence the prices paid by private-sector insurers. Many private insurers simply adopt Medicares levels of reimbursement to providers, and those that do not still are affected when Medicare changes its rates. Although analysts disagree about whether the link leads to lower or higher private payments, Medicares administrative pricing system clearly cannot replicate a well-functioning competitive market. What can be done to move Medicare closer to the optimal prices corresponding to those produced by a competitive market?

A new study published by the Mercatus Center at George Mason University assesses the numerous problems with Medicares price calculations and looks at how they affect prices in commercial insurance policies. The study proposes an arrangement of competitive bidding on bundles of services as a promising alternative to Medicares price-fixing regime.

Below is a brief overview of the analysis. To read the entire study and learn more about its authors, Roger Feldman and Bryan Dowd of the University of Minnesota and Robert Coulam of Simmons College, please see Medicares Role in Determining Prices throughout the Health Care System.

KEY FINDINGS

THE RELATIONSHIP BETWEEN MEDICARE PRICES AND PRIVATE PRICES

A review of a large set of studies generally supports the predictions of the standard economic model:

WHAT ARE THE OPTIMAL PRICES FOR PUBLIC AND PRIVATE HEALTH PLANS?

How Much Does Part B Cost For Most Enrollees

Most people new to Medicare will pay $170.10 a month for Part B premiums in 2022. This is the standard premium that most people pay based on income. Social Security will deduct your Part B premium from your Social Security check monthly. If you have not enrolled in Social Security income benefits yet, theyll bill you quarterly.

Since some people pay more based on income, use the tables below to determine your personal Medicare cost for Part B. It shows the amount that you will pay in 2022 for Part B, per the preview notice released by the Department of Health and Human Services in November.

The Medicare Part B deductible for 2022 is $233.

You May Like: How Much Do Medicare Plans Cost

Recommended Reading: Does Aarp Medicare Complete Cover Cataract Surgery

How To Avoid Paying Medicare Surcharges

You might be able to avoid paying some Medicare surcharges by enrolling in a Medicare Advantage plan or a Medigap policy. Most people are better off having one of these policies to close the Medicare coverage gaps. Work with a professional to create a cost-effective plan if you only enroll in original Medicare.

These surcharges are based on your tax return, so it’s possible to do some tax planning to avoid paying Medicare surcharges altogether, or at least to keep from moving up a tier. You might look at harvesting investment losses to counteract the income if your income will be higher this year due to a one-time gain that disqualifies benefits by putting you over the income limit. You may pay this year but not next year because surcharges are determined yearly.

Work with a tax professional for help on finding ways to bring your MAGI lower to avoid paying more surcharges.

Medicare Part A Premiums

Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as youre eligible for Social Security or Railroad Retirement Board benefits.

You can also get premium-free Part A coverage even if youre not ready to receive Social Security retirement benefits yet. So, if youre 65 years old and not ready to retire, you can still take advantage of Medicare coverage.

Part A does have a yearly deductible. In 2022, the deductible is $1,556. Youll need to spend this amount before your Part A coverage takes over.

Also Check: How Much Is Medicare B Cost

Monthly Medicare Premiums For 2022

The standard Part B premium for 2022 is $170.10. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $91,000 Married couples with a MAGI of $182,000 or less | 2022 standard premium = $170.10 |

| Your plan premium + $77.90 |

Detailed Medicare Cost Information For 2022

- Monthly premium:Learn more about Part A costs.

Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274.

- Late enrollment penalty:

- If you don’t buy it when you’re first eligible, your monthly premium may go up 10%.

Part A costs if you have Original Medicare

Recommended Reading: How Do I Call Medicare

Multiple Procedure Payment Reductions

Under the MPPR policy, Medicare reduces payment for the second and subsequent therapy, surgical, nuclear medicine, and advanced imaging procedures furnished to the same patient on the same day. Currently, no audiology procedures are affected by MPPR.

Therapy Services

MPPR is a per-day policy that applies across disciplines and across settings. For example, if an SLP and a physical therapist both provide treatment to the same patient on the same day, the MPPR applies to all codes billed that day, regardless of discipline. Under MPPR, full payment is made for the therapy service or unit with the highest practice expense value and payment reductions will apply for any other therapy performed on the same day. For the additional procedures provided on the same day, the practice expense of each fee will be reduced by 50% for Part B services in all settings. The professional work and malpractice expense components of the payment will not be affected. ASHA has developed three MPPR scenariosto illustrate how reductions are calculated.

MPPR primarily affects physical therapists and occupational therapists because they are professions that commonly bill multiple procedures or a timed procedure billed more than once per visit.

Speech-Language Pathology Codes Subject to MPPR

What Is The Medicare Part B Premium

The Medicare Part B premium is a monthly fee that Medicare beneficiaries pay if they choose to enroll in it to supplement the services available to most seniors for free with Medicare Part A.

- Medicare Part A is hospital insurance. It is available primarily to U.S. citizens and permanent residents age 65 and older. Most pay no premium for it.

- Medicare Part B covers other medically necessary services and preventative care like doctorâs services, lab tests, and outpatient care. Most pay a flat monthly premium for it, which is adjusted annually.

There is also a Medicare Part D, which covers prescription costs. It is available from insurance companies that are approved to offer it.

Don’t Miss: Does Medicare A Or B Cover Prescriptions