Cons Of Medicare Advantage Plans

The following are some disadvantages of Medicare Advantage plans:

- If you select an HMO Medicare Advantage plan, you may have a small selection of providers to choose from. If you see a provider out-of-network, it can cost you more. However, other plan options will offer a wider provider network.

- With certain plans, you may see additional costs for things like drug deductibles and specialist visit copays.

- If you travel a lot, your plan may not cover services outside your service area.

Selecting A Medigap Plan: Recent Changes Limit Choices

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov. They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states. Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurers prices for each letter plan and simply choose the better deal.

As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren’t allowed to cover the Part B deductible.

Before 2020, most people who bought Medigap policies chose Plan F, which gave the most comprehensive coverage, including paying for the Medicare Part B deductible . However, in an effort to trim Medicare expenses, Congress suspended Plans C, F, and High Deductible F for people who become Medicare-eligible in 2020 and beyond.

Plan D and Plan G have similar benefits to Plan C and Plan F, except for not covering the Part B deductible. People who signed up or became eligible for Medicare before 2020 can purchase or continue Plans C or F, though prices may rise and it may be a better deal to switch to a plan that doesnt cover the deductible.

Medigap Plans = Supplemental Insurance

- These plans cover costs that Original Medicare doesn’t cover

- There are 10 standard Medigap plans , but not all companies offer all of them

- Plan A covers the least, Plan F covers the most

- You’ll pay a monthly premium for a Medigap plan

- Medigap plans don’t cover prescriptions

- You can’t enroll in a Medigap plan if you have a Medicare Advantage plan

- During your guaranteed issue period you won’t be denied due to a pre-existing condition

You May Like: Does Medicare Cover Depends For Incontinence

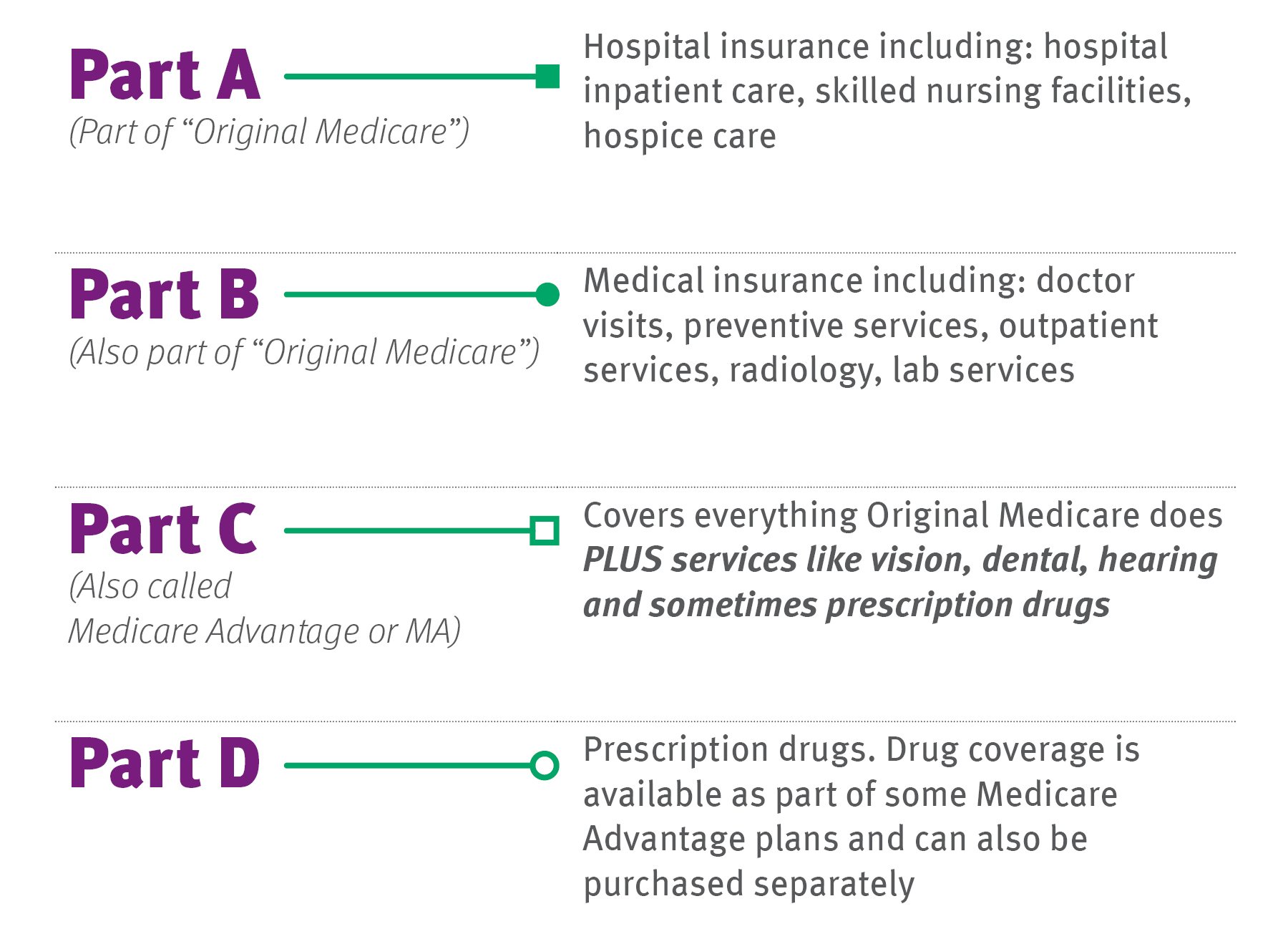

What Is Medicare Advantage Part C

The Medicare Advantage Plan Part C, also known as MAPD Medicare, is one kind of Medicare health plan available through private insurance companies contracted with Medicare to provide you all Part A and Part B benefits. Should you be enrolled in MAPD healthcare plans, Medicare services are exclusively covered via private companies, as opposed to Original Medicare.

Medicare Advantage is comprised of several private health plans . Each plan must cover the same benefits covered under traditional Medicare. Medicare Advantage plans can charge different co-payments, co-insurance, deductibles and max out-of-pockets, depending upon the plan/carrier. Because these plans function as HMOs and PPOs, there are hospital and doctor networks. Often times, insurance companies providing these plans charge monthly premiums on top of the Part B premium however, Medicare Advantage plan premiums are often more affordable compared to Medicare Supplement plans.

Should you desire to avoid going through networks or dealing with referrals, you can also choose Medicare Supplement policies, which allow you to choose any doctor or hospital working with Medicare with no referrals required to visit specialists. Plans like these can be more expensive, but the benefits are typically more ideal.

Enrolling In Medicare Part C

There are different times of the year when you can enroll in a Medicare Part C plan. The first time is during your Initial Enrollment Period . This is the period when you first become eligible for Medicare. This enrollment period begins three months before the month you turn 65. It includes your birthday month and the three months following. For those seven months, you can enroll in a Medicare Part C plan or a Prescription Drug plan.

You May Like: Do You Have Dental With Medicare

Medicare Can Be Confusing Let’s Cover Some Of The Basics

In the United States, Medicare is a health-insurance program for anyone over 65. Medicare may be available to those under the age of 65 who have disabilities or have irreversible renal failure.

Although the program helps with healthcare expenditures, it does not cover all medical bills or most long-term care expenses. You may get Medicare coverage in a few different ways. If you choose to have Original Medicare coverage, you can purchase a Medicare Supplement Insurance policy from a commercial insurance carrier.

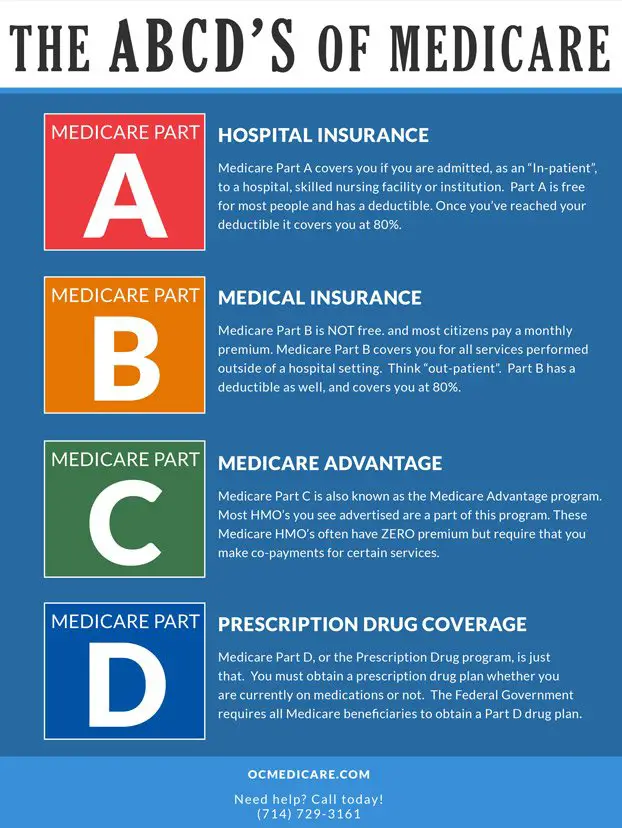

What are the parts of Medicare?

The various elements of Medicare assist in the coverage of certain services:

- Medicare Part A

- Inpatient hospital stays, skilled nursing facility care, hospice care, and certain home health care are all covered in Medicare Part A.

- Medicare Part B

- Part B covers certain doctors services, outpatient care, medical supplies, and preventive services.

- Medicare Part D

- Assist in covering the cost of prescription medications .

What is Medicare Part A? Hospital Insurance.

Medicare Part A covers the following services:

Keep in mind that Medicare does not always cover the whole cost of your treatment, and you will almost certainly be liable for some cost-sharing for Medicare-covered services.

We’re here to help you find an affordable

Insurance Plan

What is Medicare Part B? Medical Insurance.

The Part-B premium for 2022 is $170.10 per month .

What Is The Difference Between Medigap Plan C And Plan F

Medigap Plan F is the most comprehensive Medicare Supplement plan on the market today. It covers everything that Plan C includes, plus one more benefit: Part B excess charges. If you have Original Medicare, and the amount a health care provider is legally allowed to charge is greater than the Medicare-approved amount, the difference is called an excess charge. With Plan F, excess charges will be taken care of, while with Plan C they become the beneficiarys responsibility.

Learn more about upcoming changes to Medigap Plan C and F.

Don’t Miss: Does Medicare Cover Breast Prosthesis

What Other Comprehensive Plans Are Available

There are a variety of Medigap plans available, including Plan C and Plan F. If you cant enroll in either of those because you werent Medicare-eligible before 2020, you have a couple of options for similar coverage.

Popular choices include Plans D, G, and N. They all offer similar coverage to Plans C and F, with a few key differences:

- Plan D. This plan offers all of the coverage of Plan C except for the Part B deductible.

- Plan G. All costs except the Part B deductible are also covered under this plan.

- Plan N. Under Plan N, all of your costs are covered with a few exceptions. The Part B deductible isnt covered, and youll be responsible for some copayments. Under Plan N, youll pay up to $20 for some office visits and up to $50 for emergency room visits that dont result in hospital admission.

The following chart compares the details of each of these plans more closely:

| Plan C |

|---|

| $110$1,036 | $86$722 |

Depending on your state, you might have more than one Plan G option. Some states offer high-deductible Plan G options. Your premium costs will be lower with a high-deductible plan, but your deductible could be as high as a few thousand dollars before your Medigap coverage kicks in.

C Offers Great Medical Benefits

If you enroll in a Medicare Advantage plan, then you can enjoy powerful coverage that keeps you from paying a lot from your own pockets. You just pay for the monthly insurance premiums and should have little else to pay for in regards to your medical care. Thats how powerful these health insurance plans are.

The basic Advantage plan will cover you for all of your emergency care, including ambulance transportation and ER care. It also covers you for any urgently needed care, which can include anything from medical tests to surgery to medications. The basic Advantage plan will include coverage for Medicare Part A and for all of Medicare Part B. This covers most of your inpatient and outpatient expenses, covering costs related to hospital stays, doctors office visits, medical testing, blood usage, nursing care and more.

Medicare Part C could also cover you for some routine checkup expenses. The cost of visiting your dentist, hearing specialist, general practitioner or your optometrist can all be covered by a Medicare Part C plan. Some of these plans will cover you for multiple visits, and they can cover hearing aids and prescription eyeglasses as well. Its not just the visit that is covered, though. In many cases, your dental cleanings, x-rays, medical tests and more will be covered along with the basic checkup costs.

Recommended Reading: Is Aarp Medicare Part D

What Are The Benefits To Medicare Advantage

Medicare Advantage covers more than Medicare , allowing patients more options and flexibility. Patients can customize their Medicare Advantage to cover specific needs like wheelchair ramps, adult day care, and respite care. Additionally, the 2020 CARES Act expanded Medicare’s network to cover more telehealth services.

Medical Savings Account Plans

MSAs are a bit different from the types of plans above. An MSA works very similarly to a high-deductible health plan paired with a health savings account . With an MSA plan, Medicare will deposit money into an account that you can then use to pay for your health care services. Your insurance will not start to pay for your medical expenses until you spend enough to hit your deductible.

Deductibles vary by plan, but can be thousands of dollars. If you spend all of the money in your MSA before reaching your deductible, you will need to pay expenses out of pocket until you hit your deductible. Make sure to take the high deductible into account before getting an MSA.

Also Check: Does Medicare Cover Dental Root Canals

How Much Does Part C Cost

The average Medicare Advantage plan cost is about $23 a month. Of course, your location is the determining factor in the plans available to you.

When you live somewhere that has little to now quality plan options, consider the benefits of Medigap.

What happens if you find yourself disenrolled from your Medicare Advantage plan?

Single Grace Period If one or more payments have gone unpaid during your grace period, the plan can discontinue coverage.

Rollover Grace Period If you owe more than one premium but manage to pay for a minimum of one premium during your grace period, the period will end, and your plan will notify you of a new grace period.

Notifications continue until you catch up on premiums. But, if you fail to make a premium payment during this time, you face dis-enrollment.

Cost Of Medicare Part C Plans

There may be different costs with your Medicare Advantage plan. Some plans charge a monthly premium that you pay each month to be enrolled in the plan. They can also have an annual deductible, which is an amount you pay out of pocket before your coverage starts. Some Medicare Advantage plans have $0 premiums and $0 deductibles.

Plan participants might also be responsible for a copayment or coinsurance when they seek medical services. A copayment is a set amount you pay each time you visit your doctor. Coinsurance is a percentage of the total bill that you are responsible for paying.

Since costs and coverage can be different from plan to plan, it is important to compare plans in your service area carefully. This step will ensure you get all the coverage you need at a cost that fits with your monthly budget.

Don’t Miss: Can I Get Glasses With Medicare

What If I Already Have A Medigap Plan C Or Want To Sign Up For One

You can keep your Plan C if you already have it. As long as you were enrolled before December 31, 2019, you can keep using your plan.

Unless the company you have decides to no longer offer your plan, you can hang onto it for as long as it makes sense for you. Additionally, if you became eligible for Medicare on or before December 31, 2019, you can also still enroll in Plan C.

The same rules apply to Plan F. If you already had it, or were already enrolled in Medicare before 2020, Plan F will be available to you.

What Are The Different Medicare Part C Plans

The number of Medicare Advantage plans available to you will depend in part on where you live and how many companies offer coverage in your area.

There are 5 major types of Medicare Advantage plans:

Read Also: What Is The Difference Between Medicare Supplemental And Advantage Plans

What Does Medicare Part C Cost

Medicare Part C plans generally have lower premiums than Medigap plans. This is because you are agreeing to treat in the plans network and pay copays as you go. The network may be an HMO network, where youll need to choose a primary care physician and get referrals.

There are also Medicare PPO and Medicare PFFS options, which have some out of network benefits. Besides your monthly premium, your spending might include deductibles, copays and coinsurance up to the plans out of pocket maximum.

Some Medicare Part C plans have premiums as low as $0. This does not mean that Medicare Part C is free. When you enroll in a Medicare Part C Advantage plan, Medicare pays a fixed monthly sum to the insurance carrier to provide your care. The MA company will offer you a monthly premium as low as possible to attract you to their plan.

The premiums, copays, benefits, and drug formulary can and do change from year to year. This is because the Medicare Part C plan must renew its contract with Medicare annually.

Covered Services In Medicare Advantage Plans

Most Medicare Advantage Plans offer coverage for things Original Medicare doesnt cover, like fitness programs and some vision, hearing, and dental services. Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like transportation to doctor visits, over-the-counter drugs, and services that promote your health and wellness. Plans can also tailor their benefit packages to offer these benefits to certain chronically-ill enrollees. These packages will provide benefits customized to treat specific conditions. Check with the plan before you enroll to see what benefits it offers, if you might qualify, and if there are any limitations. Learn more about what Medicare Advantage Plans cover.

You May Like: How To Apply For Medicare By Phone

Do I Need Medicare Part C

A Medicare Advantage plan allows you to bundle your Medicare Part A and Part B benefits into a single plan.

If want coverage for prescription drugs, dental benefits, routine vision care and other benefits that aren’t covered by Original Medicare, you may want to consider a Medicare Advantage plan that offers those benefits.

Medicare Advantage plans also include an annual out-of-pocket spending limit, which Original Medicare doesn’t cover. Out-of-pocket Medicare costs can add up quickly, and an out-of-pocket spending limit could potentially help you save money.

Speak with a licensed insurance agent to learn more about whether a Medicare Advantage plan may be right for you.

1 Freed M. et al. . Medicare Advantage 2022 Spotlight: First Look. Kaiser Family Foundation. Retrieved from www.kff.org/issue-brief/medicare-advantage-2022-spotlight-first-look.

2 Medicare evaluates plans based on a 5- star rating system.

Find a $0 premium Medicare Advantage plan today.

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.