Sign Up: Within 8 Months After You Or Your Spouse Stop Working

- Most people dont have to pay a premium for Part A . So, you may want to sign up for Part A when you turn 65, even if you or your spouse are still working.

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Can I Get Medicare Early If I Retire Early

If you retire earlier than age 65, you will not be eligible for Medicare. Although Medicare is often thought of as insurance for retired people, the Medicare age requirement is still 65. Some people continue to work past age 65 and have insurance coverage through their employer. Many people retire before they turn 65 and must purchase health insurance or are covered on their spouses insurance plan. Although you may be eligible for social security retirement benefits if you retire early, it does not change your age requirement for Medicare health insurance coverage.

How Do I Get Full Medicare Benefits

Youâre entitled to full Medicare Part A and Part B benefits as soon as youâre eligible for Medicare. Part A and Part B make up Original Medicare.

So how do you sign up for Medicare? In many cases, youâre automatically enrolled in Medicare Part A and Part B, as described above.

What happens when youâre eligible for Medicare and youâre not yet receiving Social Security benefits? In that case, youâll need to sign up for Medicare yourself â it generally wonât happen automatically. You can typically apply for Medicare through the Social Security Administration . If you worked for a railroad, you can sign up through the Railroad Retirement Board .

If youâre interested in benefits beyond Original Medicare coverage, you might want to check out:

- Medicare Advantage . Medicare Advantage gives you another way to get your Medicare Part A and Part B coverage, but plans often include extra benefits, like prescription drug coverage.

- Medicare Supplement insurance. This is available from private insurance companies. It works alongside your Medicare Part A and Part B coverage.

- Stand-alone Medicare Part D prescription drug plans. These plans may help cover your prescription drugs.

You can learn more about your Medicare coverage choices by entering your zip code on this page, or by calling eHealth to speak to a licensed insurance agent.

Also Check: How Does Medicare D Work

Who Is Eligible To Receive Medicare Benefits

Two groups of people are eligible for Medicare benefits: adults aged 65 and older, and people under age 65 with certain disabilities. The program was created in the 1960s to provide health insurance for senior citizens. Older Americans had trouble finding affordable coverage, which spurred the government to create a program specifically for this portion of the population. Its an entitlement program in that the federal government finances it to some degree, but its also supported and financed directly by the very people who use it. Youre eligible for Medicare because you pay for it, in one way or another.

To receive Medicare benefits, you must first:

- Be a U.S. citizen or legal resident of at least five continuous years, and

- Be entitled to receive Social Security benefits.

That means that every U.S. citizen can enroll in Medicare starting at age 65 . When we say Medicare, were referring to original Medicare. This comprises Parts A and B. Part A covers hospital care while Part B covers medical care. There are four parts to the program Part C is a private portion known as Medicare Advantage, and Part D is drug coverage. Please note that throughout this article, we use Medicare as shorthand to refer to Parts A and B specifically.

To qualify for Medicare based on ESRD, you first need to meet the following qualifications:

Medicare Eligibility Age Chart

Most older adults are familiar with Medicare and its eligibility age of 65. You can qualify for Medicare Part A and Medicare Part B by:

- Being age 65 or older

- Living with a qualifying disability

- Living with certain health conditions, like end-stage renal disease or amyotrophic lateral sclerosis

Individuals under 65 and already receiving Social Security or Railroad Retirement Board benefits for 24 months are eligible for Medicare. Still, most beneficiaries enroll at 65 when they become eligible for Medicare.

Recommended Reading: What Is Original Medicare Plan

Full Retirement Age By Year

Full retirement age is the age you begin to receive full Social Security benefits. If you start to draw your Social Security benefits before reaching your full retirement age, the payment you receive will be less.

An easy way to think about full benefits and retirement age is this,

- Social Security will reduce your payments if you choose to receive your benefit before full retirement age. The percentage of reduced amount is highest at age 62 and decreases until you reach full retirement age.

- If you choose to receive Social Security payments when you reach full retirement, you will get the total amount.

- Suppose you choose not to receive Social Security payments when you reach full retirement and delay your benefit. In that case, you can increase the amount of your payment by earning delayed retirement credits.

If youre not sure when you reach full retirement age, our table provides the years and months you need to know for full retirement.

Eligibility For People With Als

People with ALS, or Lou Gehrigs disease, can qualify for Medicare when they are under 65 years of age.

ALS is a progressive, neurodegenerative disorder that disrupts a persons ability to speak, move, eat, and ultimately breathe. The condition has no cure and is eventually fatal.

According to the ALS Association, an estimated 16,000 people in the United States have the disorder. A doctor usually diagnoses ALS between the ages of 4070 years.

Unlike ESRD, those with ALS can receive Medicare Part A benefits in their first month of receiving Social Security or RRB benefits.

The SSA automatically enrolls a person with ALS in a Medicare plan when they start paying Social Security benefits.

According to a 2017 review in Amyotrophic Lateral Sclerosis and Frontotemporal Degeneration, a persons monthly costs with ALS under Medicare can total $10,398 during the month of their diagnosis.

ALS often progresses rapidly and leads to high healthcare costs. This is why a persons Medicare benefits will usually begin as soon as possible.

Read Also: What Is A Hmo Medicare Plan

When Should I Sign Up For Medicare

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application. However, because you must pay a premium for Part B coverage, you have the option of turning it down. You will receive a Medicare card about two months before age 65. If you would like to file for Medicare only, you can apply by calling 1-800-772-1213. Our representatives there can make an appointment for you at any convenient Social Security office and advise you what to bring with you. When you apply for Medicare, we often also take an application for monthly benefits. You can apply for retirement benefits online.

If you didnt sign up when you were first eligible for Medicare, you can sign up during the General Enrollment Period between January 1 and March 31 each year, unless you are eligible for a Special Enrollment Period.

How Do I Sign Up For Medicare

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Youll be automatically enrolled in Medicare at age 65 if youre already receiving Social Security. If you arent receiving those benefits, you can enroll in one of three ways:

-

Apply for Medicare online at Social Securitys website.

-

Contact your local Social Security office.

The online application typically takes less than 10 minutes. The Social Security Administration has suspended face-to-face service in local offices due to the COVID-19 pandemic, so no in-person visits are possible at this time. It’s planning to reopen some offices later in 2022, but most Medicare enrollment is quick and easy online.

Also Check: Should I Sign Up For Medicare Part A

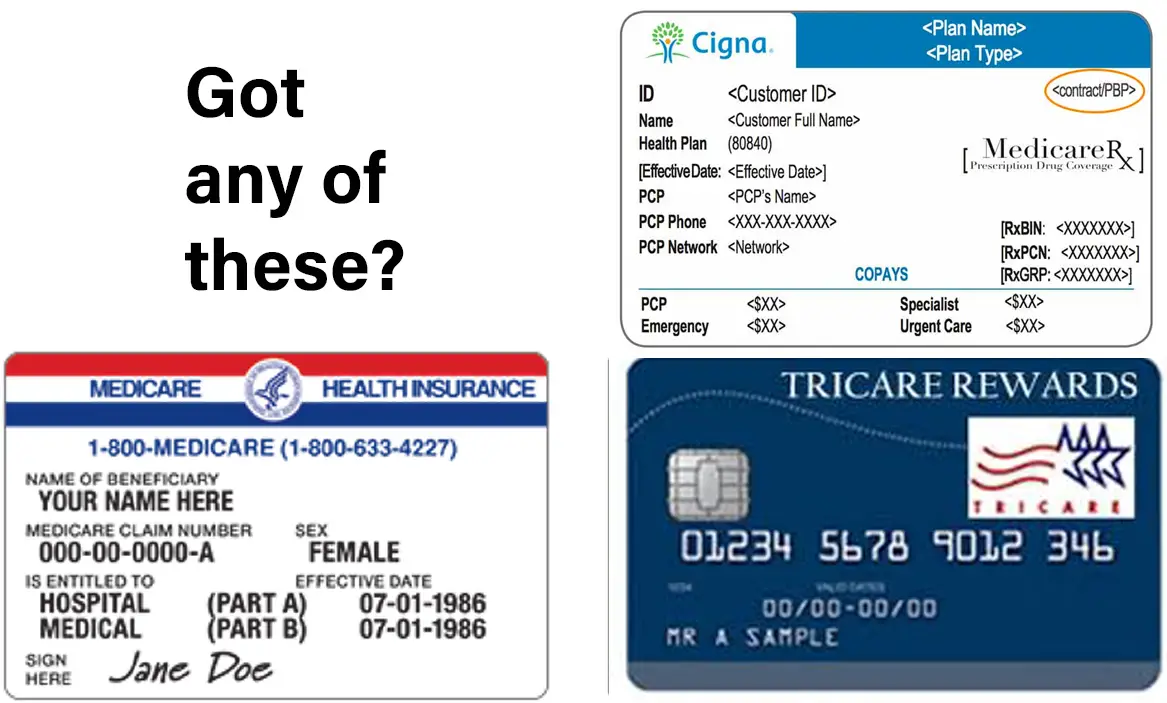

Medicare Other Insurance And How We Can Help

Did you know you can enroll in Medicare even if you have other kinds of insurance such as Medicaid, VA benefits, and employer-sponsored health insurance? That said, some of these types of insurance work better with Medicare than others. In some cases, they may affect your ability to enroll in Medicare.

To find out how to choose the right Medicare coverage and understand how it will interact with health insurance you may already have, call the number below. A licensed Medicare expert can answer your Medicare eligibility questionsand help you enroll.

What If You Still Work

You can work and receive Medicare disability benefits for a transition period under Social Security’s work incentives and Ticket to Work programs.

There are three timeframes to understand. The first, the trial work period, is a nine-month period during which you can test your ability to work and still receive full benefits. The nine months don’t have to be consecutive. The trial period continues until you have worked for nine months within a 60-month period.

Once those nine months are used up, you move into the next time framethe extended period of eligibility. For the next 36 months, you can still receive benefits in any month you aren’t earning “substantial gainful activity.”

Finally, you can still receive free Medicare Part A benefits and pay the premium for Part B for at least 93 months after the nine-month trial periodif you still qualify as disabled. If you want to continue receiving Part B benefits, you have to request them in writing.

If you’re disabled, you may incur extra expenses that those without disabilities do not. Expenses such as paid transportation to work, mental health counseling, prescription drugs, and other qualified expenses might be deducted from your monthly income before the determination of benefits, which mayallow you to earn more and still qualify for benefits.

Recommended Reading: Does Medicare Part B Cover Hearing Aids

Have You Or Your Spouse Worked For At Least 10 Years At Jobs Where You Paid Medicare Taxes

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Avoid the penalty If you dont sign up when youre first eligible, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Do You Have To Sign Up For Medicare At Age 65

- Are you required to sign up for Medicare when you turn 65? The answer is more than just a simple yes or no. Be sure to find out when you should sign up so that you dont face a late enrollment penalty or a lapse in coverage.

When you turn 65, you may have the opportunity to enroll in Medicare. But is it mandatory to sign up?

Technically, it is not mandatory to sign up for Medicare at 65 or at any age, for that matter. But its important to consider the situations in which you might decide not to enroll in Medicare at 65 so that you can make sure not to have any lapse in health insurance coverage or face a Medicate late enrollment penalty.

Don’t Miss: Does Medicare Cover Gastric Bypass Revision

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to enroll in Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employers signature and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

Delaying Medicare Parts A & B

If you qualify to delay both Medicare Parts A & B, you can do so without penalty as long as you enroll within eight months of either losing your employer coverage or ceasing to work, whichever comes first. You will enroll during a Special Enrollment Period and will need to also provide written proof of creditable drug coverage to avoid Part D penalties.

Don’t Miss: Does Medicare Pay For Liver Transplants

What Else Do I Need To Know

- Medicare can help cover your costs for health care, like hospital visits and doctors services.

- Most people dont pay a premium for Part A, but you do pay a monthly premium for Part B.

- If you cant afford the monthly premium, there are programs to help lower your costs. Get details about cost saving programs.

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

Another type of Medicaid program is Early and Periodic Screening, Diagnostic, and Treatment . This program is available to individuals under the age of 21 who live in households that meet certain financial criteria. This type of Medicaid also has an age restriction and could therefore also be considered age-based.

ABD and EPSDT are required by federal law to be included in all state Medicaid programs. But as long as certain federal requirements are met, state Medicaid programs are free to offer their own Medicaid benefits and eligibility guidelines to people who might not otherwise be eligible for these two programs. Age may or may not play a role, depending on where you live.

For example, Medicaid in North Carolina is only available to those age 65 and over or 21 and under unless you are pregnant, are responsible for a child age 18 and under, disabled or require long-term care.

But in North Dakota, Medicaid is available to all low-income adults, regardless of age.

It could be said that Medicaid is age-based in some states and for some programs, but it is not universally age-based.

Also Check: Does Medicare Pay For Varicose Veins

Can You Qualify For Medicare If You Are Under 65

You can qualify for Medicare benefits if you are younger than 65 and one of these situations applies to you. In any case, you are eligible for premium-free Part A hospital insurance:

- You have a disability as defined by Social Security. You will become eligible for Medicare coverage after receiving your monthly social security or the U.S. Railroad Retirement Board for 24 months. If you are disabled but dont receive disability benefits under United States Social Security or qualify for RRB benefits because you are a government employee, the 24 months is extended to 29 months.

- You have ALS. Coverage starts when you are entitled to receive Social Security or RRB disability benefits. There is no waiting period.

- You have kidney disease requiring dialysis or transplant. You must have completed a Medicare application. You or your spouse must have worked long enough under Social Security, the RRB, or as a government employee to be eligible for retirement benefits. Your Medicare coverage start dates work differently if you have end-stage kidney disease. Click here for more details.

B Late Enrollment Penalty

If you delay enrollment in Part B and don’t have coverage from a current employer , you’ll be subject to a late penalty when you eventually enroll in Part B. For each 12-month period that you were eligible for Part B but not enrolled, the penalty is an extra 10% added to the Part B premiums. And you’ll pay this penalty for as long as you have Part Bwhich generally means for the rest of your life.

In 2020, most Medicare Part B enrollees pay $144.60/month. So a person who is now enrolled but had delayed their enrollment in Medicare Part B by 40 months would be paying an extra 30% in addition to those premiums . That means they’d be paying roughly an extra $43/month for their Part B coverage, for a total of about $188/month.

Part B premiums generally change each year. Sometimes they stay the same from one year to the next, but the general trend has been upwards over time. So the part B penalty will generally also increase from one year to the next. If you’re paying 10% or 30% or 50% more than the standard rates, the dollar amount of that penalty will increase as the standard premiums increase over time.

Don’t Miss: Is Shingles Vaccine Covered By Medicare