Can You Switch From Medigap To Medicare Advantage

Learn if you can leave Medicare Supplement for an MA plan down the road.

Medigap and Medicare Advantage are the best options for seniors who want to cover some or all of the expenses not covered by Original Medicare. Many people struggle deciding which Medicare plan is right: Medigap or Medicare Advantage? Many of our clients ask, if I first enroll in Medigap, can I then switch to Medicare Advantage down the line? Weve got your answer below.

Can You Disenroll From A Medicare Advantage Plan At Any Time

You can drop out of the plan and return to original Medicare, with the right to buy Medigap supplemental insurance, at any time during those first 12 months if you joined the plan straight away when you enrolled in Medicare at age 65, or if you dropped a Medigap policy to join the Advantage plan and this is the first.

Before You Cancel Keep These Things In Mind

Now that you know how to cancel your Marketplace plan, just friendly reminders of some important things to keep in mind before you do.

- You wont be eligible for premium tax credits or other Marketplace plan savings once your Medicare Part A coverage starts. Youll have to start paying full-price for your Marketplace plan. Keep your Marketplace health plan coverage in effect until the day your Medicare coverage begins or you could risk having a gap in health coverage.

- You can cancel your plan at any time throughout the year, but you need to cancel your Marketplace health plan at least 14 days before you want your coverage to end. Enrolling in Medicare doesnt cancel your Marketplace plan, nor does cancelling through your plan provider. You need to cancel with the Marketplace center.

Read Also: How To Register For Social Security And Medicare

More Answers: Changing From The Marketplace To Medicare

- Can I get help paying for Medicare?

-

If you need help with your Part A and B costs, you can apply for a Medicare Savings Program.

-

You may also qualify for Extra Help to pay for your Medicare prescription drug coverage if you meet certain income and resource limits.

- What if Im eligible for Medicare, but my spouse isnt and wants to stay covered under our current Marketplace plan?

-

If someone gets Medicare but the rest of the people on the application want to keep their Marketplace coverage, you can end coverage for just some people on the Marketplace plan, like a spouse or dependents.

Dont Miss: Is Medicare The Best Insurance

Are You Required To Have Health Insurance

The Affordable Care Act legally requires individuals to have adequate health insurance. In the past, there was a federal tax penalty for those who did not have a suitable health insurance policy however, the ACA reforms of 2018 mean that there is no longer a federal tax penalty for those who are uninsured or underinsured.

Some states have their own health insurance requirements. If you live in one of the following states, it is important that you maintain a valid and adequate health insurance policy:

- Massachusetts

- Washington D.C.

Read Also: Does Medicare Cover Foreign Travel Emergencies

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best. While prices vary by person and location, here are three top insurance providers to consider as you start your search for the best plan for you. Each of them offers coverage nationwide and holds an A.M. Best rating of A- or higher.

Do You Have To Take Medicare When You Turn 65

The answer is no. If you are collecting Social Security retirement benefits or Railroad Retirement Board benefits at least four months before you turn 65, you will be automatically enrolled in Medicare Part A and Part B.

If you choose to delay your Social Security or Railroad Retirement Board retirement benefits, you will not be automatically enrolled in Medicare when you turn 65. In this case, you will have to manually enroll if you want to be covered by Medicare.

Many people who are still working and covered by an employer health insurance policy at age 65 may choose to delay Medicare Part B coverage until they retire and are no longer covered by the employers plan.

As with many questions about Medicare, you may call 1-800-MEDICARE with questions about cancelling Part A or Part B coverage.

You should contact your plan carrier directly if you want to cancel a Medicare Advantage, Part D or Medigap plan.

You May Like: Which One Is Better Medicare Or Medicaid

Adjustment To Medicare Plans Standard Benefit

Each year, the Centers for Medicare & Medicaid Services sets a benchmark for the cost-sharing structure of all Medicare plans. All Part D plans must choose to provide the standard benefit or an enhanced benefit. A standard benefit plan will use Medicares required baseline cost-sharing structure and an enhanced benefit plan will usually charge a higher premium for a wider range of benefits.

Some notable changes to the standard benefit in 2021 are the following:

-

Prescription drug plans are structured into benefit phases that determine what costs an enrollee is responsible for. The deductible is the phase where you are responsible for 100% of costs. After paying the full deductible amount, you are then in the initial coverage phase, where you pay a copayment or coinsurance, and the plan will pay the rest. The standard deductible is increasing $10 and will be $445 in 2021.

-

When the amount that you and your plan have paid reaches a certain threshold, you reach the initial coverage limit and enter into the coverage gap phase of your plan, where you will be responsible for a larger share of the cost of the drug. The initial coverage limit is increasing $110 and will be $4,130 in 2021.

-

The out-of-pocket spending threshold is increasing $200 and will be $6,550 in 2021. This is an important threshold, because once youve spent that amount out of pocket in 2021, you leave the coverage gap and enter into the catastrophic phase, where you only pay a small fraction of drug costs.

How To Cancel Medicare Part C

If you wish to cancel your Medicare Part C plan, here is one option for cancelling your coverage:

- The Fall Annual Enrollment Period lasts from each year. During this time, you may disenroll from your Medicare Advantage plan and enroll in a different plan, or you can cancel your Medicare Advantage plan and revert back to Original Medicare coverage.

-

You can take advantage of the Medicare Advantage Open Enrollment Period, which runs each year from .

During this time, you can change from one Medicare Advantage plan to another, whether or not either plan includes prescription drug coverage.

You can also disenroll from your Medicare Advantage plan and switch back to Original Medicare . If you switch back to Original Medicare during this period, you can join a Medicare Part D prescription drug plan.

If you enroll in a Medicare Advantage plan during your Initial Enrollment Period , you can switch to another Medicare Advantage plan or cancel your Medicare Advantage plan and return to Original Medicare at any time during the first three months you have Medicare.

You may be able to cancel your Medicare Advantage plan if you qualify for a Special Enrollment Period .

Recommended Reading: Do People Pay For Medicare

Can You Change Medicare Supplement Plans Anytime

Suppose you have a Medicare Supplement insurance plan, and you want to switch plans outside the OEP described above. In most cases the insurance company can review your medical records and consider your health condition. They can charge you a higher premium or even refuse to accept you as a member.

Certain situations might give you guaranteed-issue rights to change Medicare Supplement insurance plans. There are several situations when you might have guaranteed-issue rights. Here are a few of them:

- You signed up for a Medicare Advantage plan for the first time, and decided you want to drop the plan and buy a Medicare Supplement insurance plan instead.

- You have a Medicare SELECT plan, and youre moving out of the plans service area. Medicare SELECT plans are generally the only Medicare Supplement insurance plans that have provider networks that you might have to use. You can either change to a standardized Medicare Supplement insurance plan with the same or fewer basic benefits than your current plan, or buy any Medicare Supplement Plan A, B, C*, F*, K, or L.

- Youve had your current Medicare Supplement insurance plan for less than six months. If the insurance company agrees to sell you a new policy with the same basic benefits, it cant add conditions related to pre-existing health problems. However, you might have to wait up to six months before the plan covers your pre-existing condition.

Things To Think About Before You Cancel Your Medicare Supplement Plan

It may be easier to drop your Medicare Supplement plan than to get it back so make a careful decision.

If you have a Medicare Advantage plan, its illegal for someone to sell you a Medicare Supplement policy unless youre switching back to Original Medicare . This law is to protect you from buying useless insurance since a Medicare Supplement plan cant benefit you if you have a Medicare Advantage plan.

If you decide to leave your Medicare Advantage plan, you can typically get Original Medicare back if you are still eligible but you may not be able to get Medicare Supplement again unless you have a trial right or guaranteed issue. A trial right is when you have the opportunity to try a Medicare Advantage plan but still buy a Medicare Supplement policy if you decide against Medicare Advantage. Usually the trial rights must be exercised within a year of signing up for the Medicare Advantage plan.

If you have guaranteed issue rights it means that an insurance company generally must sell you a Medicare Supplement policy, cover all your pre-existing health conditions and not charge you more because of any health problems. You may get guaranteed issue in special circumstances, such as:

Recommended Reading: Is Synvisc Covered By Medicare In Australia

Changing Part D Plans: The Final Steps

After youve found your new Part D plan and figured out the scheduling with enrollment periods, the rest of the process is pretty simple. You can enroll in your new plan either through Medicares online plan finder tool or by contacting the plan directly. Youll need the following information:

- Your Medicare number

- The policy and group numbers of your current plan

- The dates you want changes to take effect

More good news: You dont have to cancel your old Part D plan. The new plan will give your information to Medicare, then Medicare will inform your soon-to-be-canceled plan. That coverage will automatically end when your new coverage begins.

Recommended Reading: Will Medicare Pay For Ymca Membership

How To Cancel Medicare Part D

Disenrolling from a Medicare Part D prescription drug plan also requires waiting for the Annual Enrollment Period mentioned above . During this period, you can switch to a new Part D plan or just drop the coverage entirely.

You may be able to cancel your Medicare Part D plan if you qualify for a Special Enrollment Period .

Recommended Reading: Does Medicare Pay For Physical Therapy After Knee Surgery

Can I Switch Or Cancel My Medicare Supplemental Plan Anytime

There might be times when you want to switch or cancel your Medigap policy, for example because you are not satisfied with the customer service of your plan provider, the benefits of your plan dont match your medical needs anymore, or your policy is too expensive compared to other available options.

You may find yourself in a situation where you need to switch or cancel your plan for reasons other than dissatisfaction, for example if the provider gos out of business, or stops offering the plan in your area.

Is There A Penalty For Canceling Health Insurance

As long as you do not live in a state where ongoing health insurance is a requirement, you should not be penalized for cancelling health insurance.

It is up to individual providers to decide whether someone who has prepaid for health insurance is entitled to a refund, as well as what the final bill and notice period will be on monthly billed plans.

For this reason, its important to speak to your health insurance provider if you decide that your plan is no longer suitable for you or your family. They will tell you what you must do to cancel and explain the process to you.

Instead of canceling, you may find that changing plans makes more sense. Read the terms and conditions of your plan, examine the other plans that are open to you and discuss your options with the insurance provider.

If youre looking for a new health insurance policy, compare quotes here to find the best deals available in your area or contact TrueCoverage to get in touch with one of our insurance Experts today.

Don’t Miss: Does Medicare Cover Dexa Scan

Can You Cancel Your Benefits At Any Time

You can cancel your individual health insurance plan without a qualifying life event at any time. On the other hand, you cannot cancel an employer-sponsored health policy at any time. If you want to cancel an employer plan outside of the company’s open enrollment, it would require a qualifying life event .

Canceling A Marketplace Health Plan When You Get Medicaid

Canceling a Marketplace plan when you get Medicaid or CHIP. Once you get a final determination that you’re eligible for Medicaid or the Childrens Health Insurance Program that counts as qualifying health coverage : You should immediately end Marketplace coverage with premium tax credits or other cost …

Also Check: What Is The Average Cost Of Medicare Supplement Plan F

Cancelling Medicare During A Special Enrollment Period

Certain circumstances may make you eligible for a Medicare Special Enrollment Period.

A Special Enrollment Period may be granted at any time outside of the Annual Enrollment Period to people who move outside of their plans coverage area, lose Medicaid coverage or other experience other specific life events.

If you qualify for a Special Enrollment Period, you may be able to switch or cancel your Medicare Advantage or Part D plan.

What Is A Medicare Supplement Plan

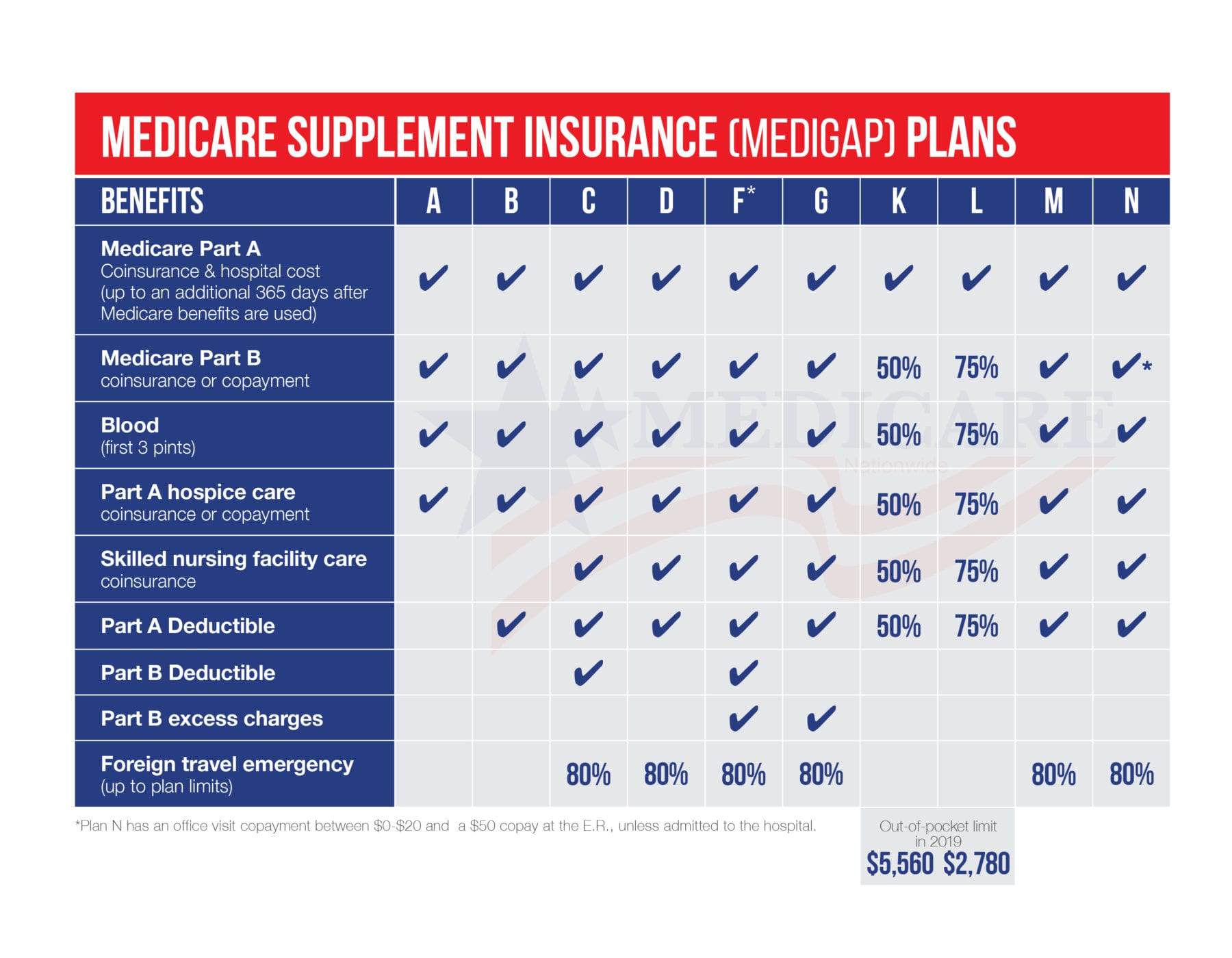

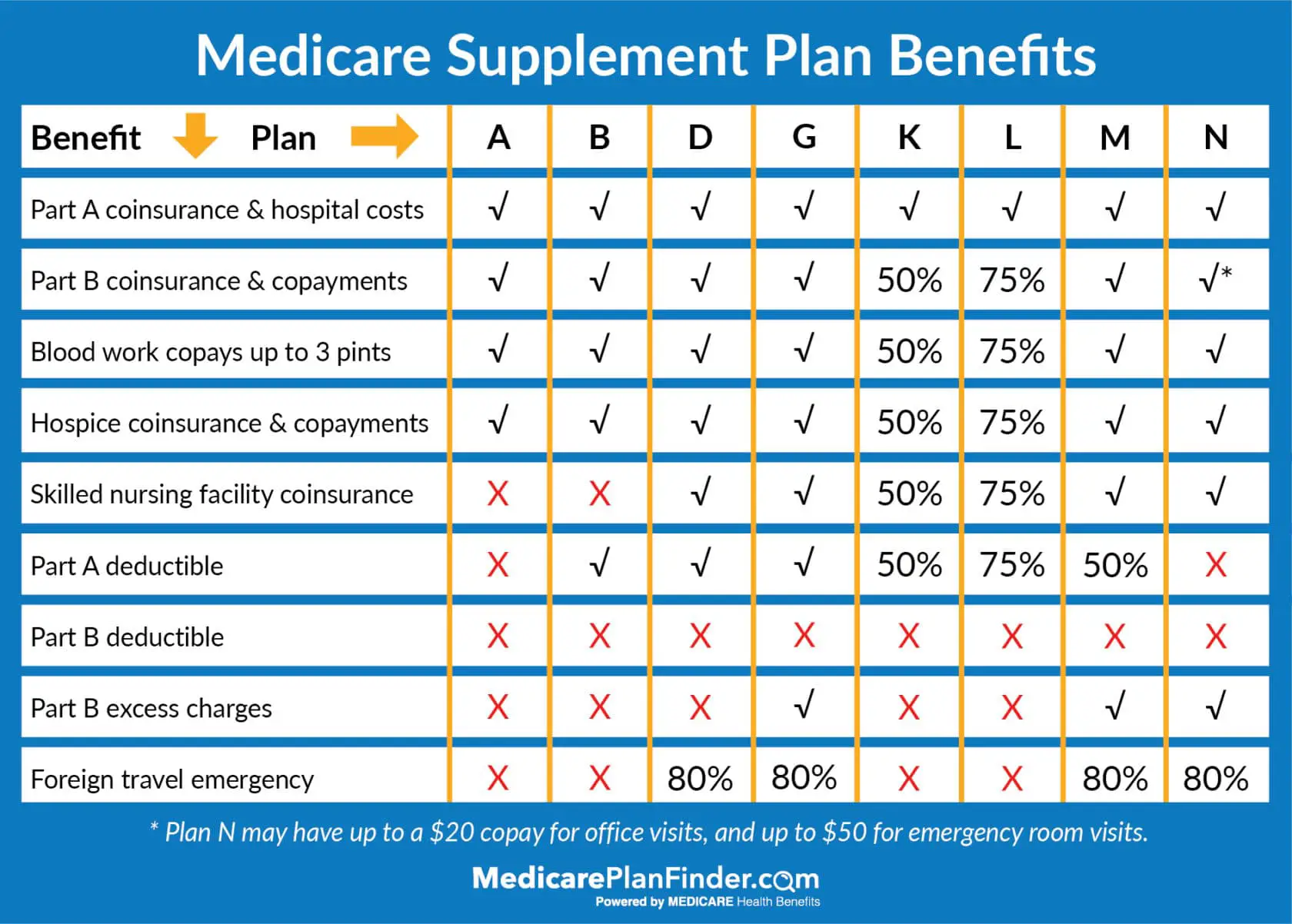

Medicare supplement plans are one health insurance option for people with Original Medicare. There are standardized Medicare supplement insurance plans available that are designed to fill the gaps left by Original Medicare . These are sold by private insurance companies as individual insurance policies and are regulated by the Department of Insurance. After age 65 and for the first six months of eligibility for Medicare Part B, beneficiaries have an Open Enrollment Period and are guaranteed the ability to buy any of these plans from any company that sells them. Companies cannot deny coverage or charge more for current or past health problems. If you fail to apply for a Medicare supplement within your Open Enrollment Period, you may lose the right to purchase a Medicare supplement policy without regard to your health.

Don’t Miss: What Is A Medicare Special Needs Plan

Should You Change Your Medigap Policy

You may want to consider changing your plan or insurance company to increase your benefits or lower your monthly costs.

If you are happy with your current policy, there is no reason to change plans. But you may be interested in changing policies under certain circumstances:

- Better priceEvery September, insurance companies must send out a Medicare Annual Notice of Change letter to Medicare beneficiaries. This letter tells you of any changes to your rates. If your rates go up, you may want to consider looking for a new policy. You can shop around for a similar plan offered by the same company or a different company for a lower premium.

- More coverageIf you decide you need more coverage, you can switch to a different plan letter to get more benefits.

- Less CoverageLikewise, if you dont need or want to keep paying for benefits you dont use, you might consider switching to a more basic plan if it offers a lower premium.

- Different ProviderIf you are unhappy with your insurance company for any reason, you can purchase a plan from a different insurance underwriter.

Can I Drop My Employer Health Insurance For Medicare

Because enrolling in Medicare can mean changes in your existing medical insurance plan, check your company plan before making a decision. Even though you can drop your employer health insurance for Medicare, it may not be your best option. In most cases, older employers do better by keeping their existing company healthcare plans.

Don’t Miss: How To Pay For Medicare Without Social Security

Cancellation Or Termination Of Health Coverage Faqs

If you are a retiree, you may cancel at any time. You must provide written, signed notification of cancellation to ETF. If your health insurance premiums are being deducted on a pre-tax basis, you may cancel coverage only if: You experience a qualifying change or life event and submit an application to cancel coverage within 30 days of the event

What Is A Medicare Prescription Drug Plan

First, lets review some basics about Medicare drug plans.

Medicare is a federally administered health insurance program for those 65 years and older, certain younger people with disabilities, and people with end-stage renal disease. A Medicare prescription drug plan adds prescription drug benefits to your health coverage.

You can either get prescription drug coverage through a Medicare Advantage plan or a stand-alone Medicare plan. Learn more about these two different plans here. And if youre ready to enroll, you can read more here.

Recommended Reading: How To Calculate Medicare Wages