Coverage Gaps In Medicare

Be sure to think about how you’ll pay for the things Medicare doesn’t cover. For instance, it generally doesn’t cover dental work and routine vision or hearing care. Same goes for long-term care, cosmetic procedures and for the jet-setters medical care overseas.

Many people decide to pair original Medicare with a supplemental policy called Medigap to help cover out-of-pocket costs such as deductibles and coinsurance. You cannot, however, pair a Medigap policy with an Advantage Plan.

If you end up choosing an Advantage Plan, there’s a good chance limited coverage for dental and vision will be included.

For long-term care coverage, some people consider purchasing insurance specifically designed to cover those expenses.

Is Medicare Part B Coverage And Pricing Based On Income

The average paid monthly premium in 2021 is $148.50, which is about 25% of the cost of the actual premium â the government foots the rest of that bill. However, because Part B premiums are based on income, your income on your tax return will determine whether or not your premium is higher based on a higher-than-average income.

Medicare Part B COVERAGE is not based on income!

Because Medicare Part B is federally regulated, Part B is Part B â no matter who you are or how much money you make.

You May Like: Can You Receive Medicare Without Social Security

Im Turning 65 Soon But I Like My Current Insurance Do I Have To Enroll In Medicare Will There Be Penalties If I Dont

It depends on how you are receiving your current insurance. If you are receiving employer-sponsored health insurance through either your or your spouses job when you turn 65, you may be able to keep your insurance until you retire. You will need to contact your employers benefits representative to find out whether they will continue your coverage when you turn 65. Since Medicare Part A is premium-free for most beneficiaries, you may want to enroll in Part A as soon as you are eligible , even if you will continue to receive employer-sponsored insurance at that time. If you are covered under an employer plan, you may want to delay signing up for Part B until you retire. However, it is a good idea to check with Social Security or Medicare to confirm you will not face a penalty for late enrollment. Similarly, unless you have drug coverage that is as good as what Medicare drug plans offer, you will need to sign up for a Medicare prescription drug plan when you enroll in Medicare or you may face a late enrollment penalty.

If you decide to drop your Marketplace coverage when you become eligible for Medicare, make sure your Medicare coverage has started before you cancel your Marketplace plan so that you avoid any gaps in coverage. You can start signing up for Medicare three months before your 65th birthday.

Also Check: How To Qualify For Extra Help With Medicare Part D

What If You Have Health Issues

If youre approaching retirement age and youre considering whether or not to enroll in Medicare, its important to know that there are a few things that can affect your decision.

If you have health issues, its important to speak with your doctor about what Medicare might cover. Some health issues that may be covered by Medicare include dental care, hearing aids, and prescription drugs. If you have any questions about what your specific coverage may be, its best to speak with a Medicare specialist.

If youre not sure if you want to enroll in Medicare yet, its important to consider your budget. Enrolling in Medicare can cost money up to the point where it becomes more affordable than paying for private insurance. However, there are also benefits to enrolling in Medicare such as free health care for the elderly and discounts on prescription drugs. Its important to do your research and make the decision that is best for you.

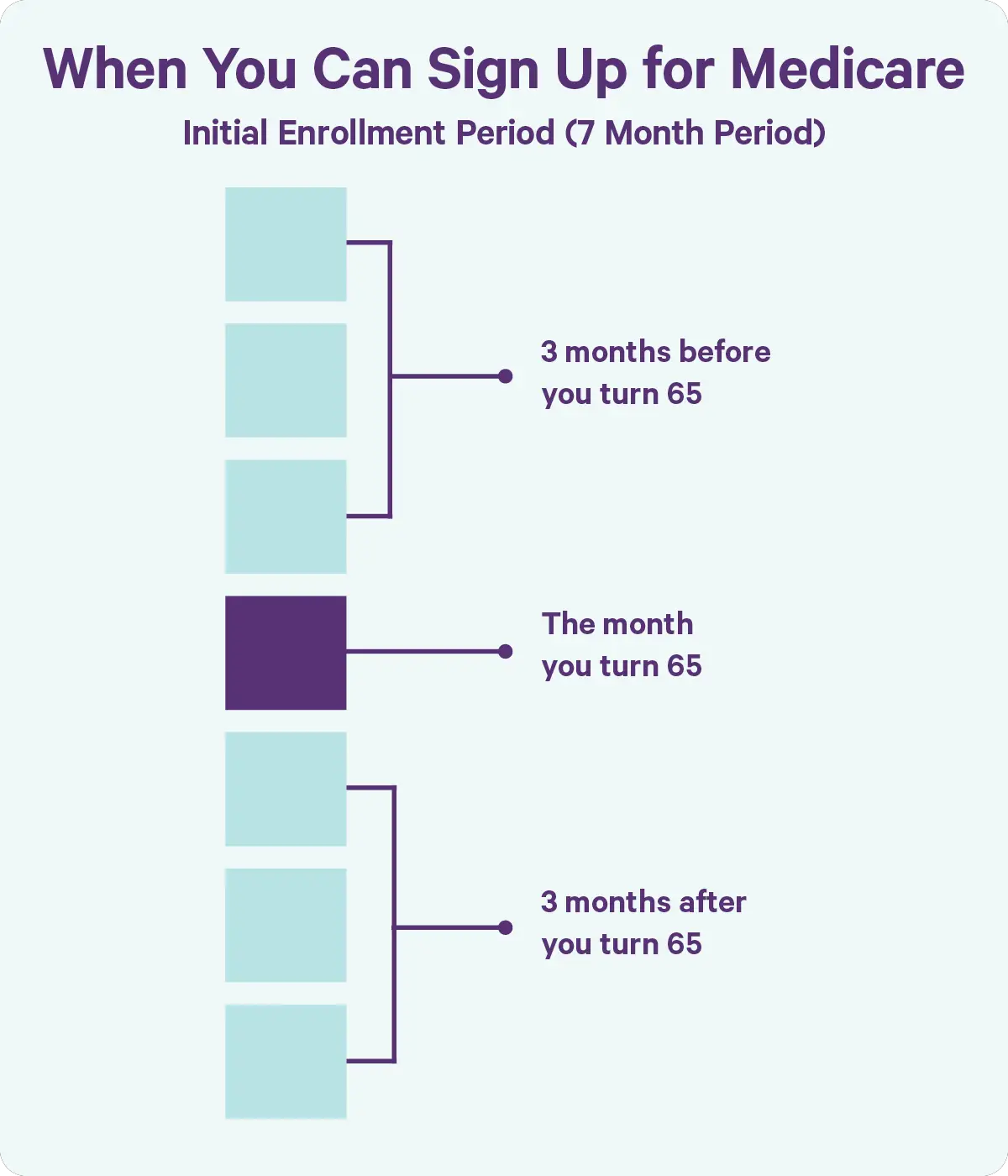

When To Enroll In Medicare

7 months

3 months before you turn 65

You can start enrolling in Medicare 3 months before your 65th birthday. Youll need to be eligible for Part A and Part B before you can get Part C . Youll need Part A, Part B, or both before you can get Part D.

Not sure what services each part covers? Learn the basics of Medicare.

Step 1 Learn about your Medicare benefits

As soon as possible, visit SocialSecurity.gov or call Social Security at , 8 a.m. to 7 p.m., Monday through Friday, to learn about your Part A and Part B benefits. The answers to these questions will help you enroll.

- Will I get Part A at no cost? Typically, you can get Part A at no cost if you or your spouse paid into Medicare for at least 10 years. If not, you can buy it.

- Do I need to enroll in Part A and Part B? Find out if youll be automatically enrolled in Part A and Part B, or if you should sign up.

- How will Social Security bill me for my Medicare premiums? The monthly premium is automatically deducted from your Social Security check each month. If youre not collecting Social Security, youll get a bill from the federal government every 3 months.

- When will I get my Medicare card? The federal government will mail your red, white, and blue Medicare card after youre enrolled. You should get it 3 months before your 65th birthday if you’re automatically enrolled. If you need to enroll in Part A and Part B, it can take up to 2 months to get your Medicare card.

Step 2 Enroll in Part A and Part B

You May Like: How Old Do I Have To Be For Medicare

The Bottom Line: Know Your Options Enroll On Time

Dont delay making Medicare decisions and dealing with Medicare enrollment. Learn about the choices you have can you delay, must you enroll and then understand the implications of both as they relate to your overall health and financial well-being.

Late-enrollment penalties for Medicare Part B and Medicare Part D are permanent and can have a meaningful impact on your finances so think carefully about what you do and when.

Not sure where to start? A good first step for anyone approaching Medicare eligibility is to know when your enrollment dates are. You can quickly find your dates for your Initial Enrollment Period using our enrollment date calculator.

Footnote

Compare Medigap Plan Costs In Your Area

Bear in mind that the premium averages listed above are just that averages. There may be plans available in your area that cost less than the average listed above for your age.

Other factors such as gender, smoking status, health and where you live can also affect Medigap plan rates.

A licensed insurance agent can help you compare Medicare Supplement Insurance plan costs in your area so that you can find a plan that fits your coverage needs as well as your budget.

Compare Medigap plan costs in your area.

Don’t Miss: How Much Is Medicare A & B

Signing Up For Premium

You can sign up for Part A any time after you turn 65. Your Part A coverage starts 6 months back from when you sign up or when you apply for benefits from Social Security . Coverage cant start earlier than the month you turned 65.

After your Initial Enrollment Period ends, you can only sign up for Part B and Premium-Part A during one of the other enrollment periods.

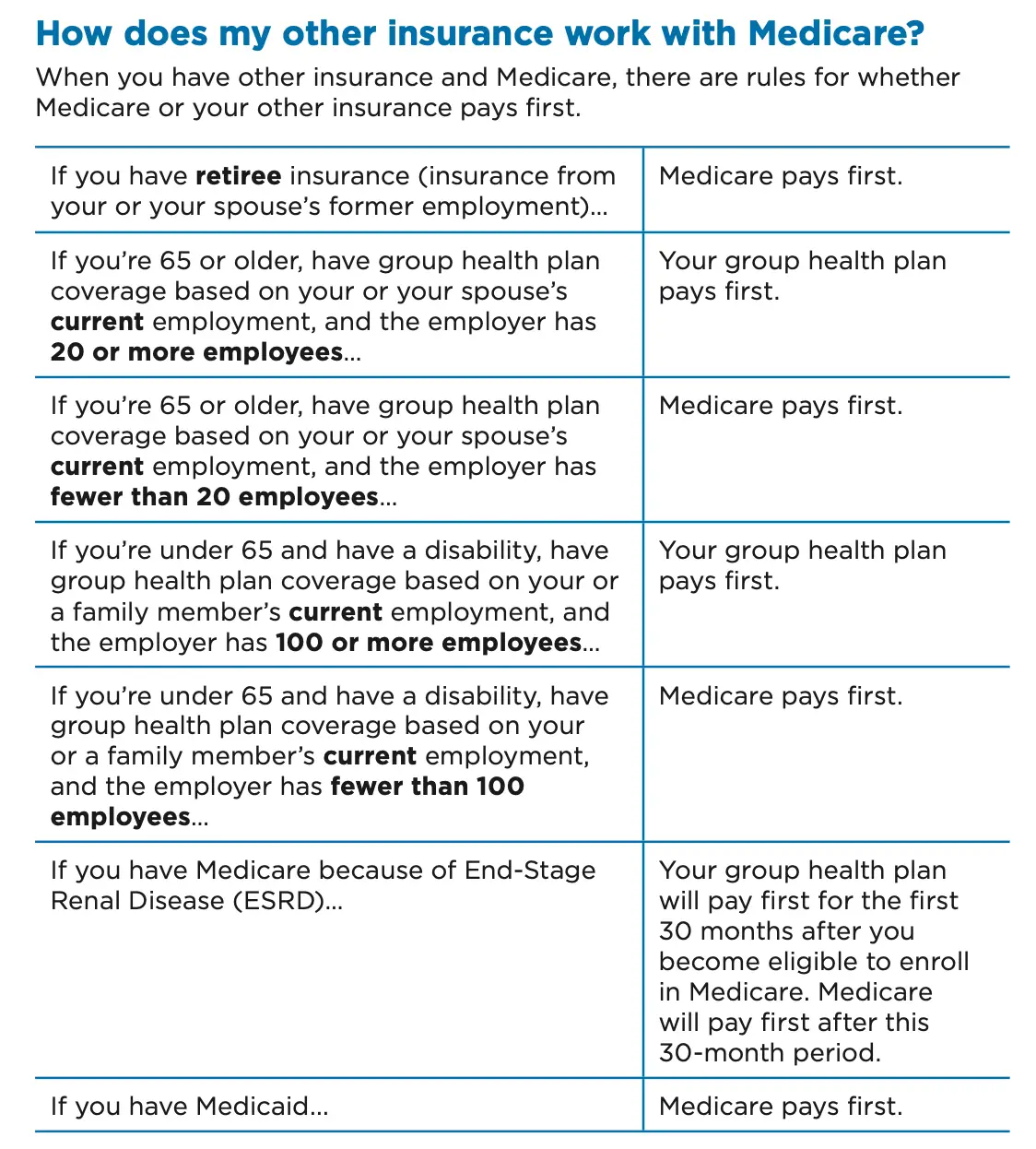

Medicare Part Bit Depends On The Size Of Your Employer

Medicare Part B covers doctors’ services, outpatient care, medical supplies and preventive services. The primary consideration in deciding if you need Part B is how many employees work at your company.

- If your company has 20 or more employees, your company would remain your primary insurer and you can delay enrolling in Part B without worrying about a late-enrollment penalty or lapse of coverage. When you leave your job, you then have eight months to sign up for Part B under a Special Enrollment Period.

- If your company has fewer than 20 employees, Medicare is considered your primary insurer, whether you’ve enrolled in Medicare or not. Your company plan is the secondary, which means that your employer plan won’t pay for anything that’s assumed to be covered by Medicare. If you don’t sign up for Part B as soon as you’re eligible, you may have to pay a penalty, and there could be a delay in coverage.

Recommended Reading: Is It Medicaid Or Medicare

Some Important Considerations Before Making Your Choice

If you work for a large company, compare your employer coverage and costs with Medicare. Be sure to look carefully at premiums for Parts B and D as well as the cost of a Medigap policy that would cover whatever Original Medicare doesn’t . If you’re happy with your current plan, you may well be better off staying with that and delaying Medicare enrollment until you retire.

Another thing to be aware of is that once you enroll in Medicare , you’re no longer eligible to contribute to a health savings account . Therefore, if you want to continue to boost pre-tax savings with an HSA, you may want to postpone. In fact, to avoid an IRS penalty, you must stop contributions to an HSA 6 months prior to enrolling in Medicare Part A or claiming Social Security benefits after age 65.

If you work for a small company, you should probably sign up for Parts A, B, and D as soon as you’re eligible. In this case, you most likely won’t need a Medigap policy under Original Medicare, since your employer coverage will pick up costs not covered by Medicare. Check with your employer to see the impact of enrolling in Medicare Advantage.

Do I Need To Get Medicare Drug Coverage

You can get Medicare drug coverage once you sign up for either Part A or Part B. You can join a Medicare drug plan or Medicare Advantage Plan with drug coverage anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

Even if you have a Special Enrollment Period to join a plan after you first get Medicare, you might have to pay the Part D late enrollment penalty. To avoid the Part D late enrollment penalty, dont go 63 days or more in a row without Medicare drug coverage or other .

If you have other drug coverage: Ask your drug plan if its creditable drug coverage.

Each year, your plan must tell you if your non-Medicare drug coverage is creditable coverage. Keep this information you may need it when youre ready to join a Medicare drug plan.

|

If you: |

|---|

Read Also: What Will Medicare Pay For Home Health Care

Employer Or Military Retiree Coverage

If you or your spouse has an Employer Group Health Plan as retiree health coverage from an employer or the military , you may not need additional insurance. Review the EGHPs costs and benefits and contact your employer benefits representative or SHIIP to learn how your coverage works with Medicare.

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

In 2022: 2 months after you sign up Starting January 1, 2023: the next month |

|

2 or 3 months after you turn 65 |

In 2022: 3 months after you sign up Starting January 1, 2023: the next month |

Recommended Reading: When You Turn 65 Is Medicare Free

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

How Do I Apply For Traditional Medicare

If youre not automatically enrolled in Medicare Part A and Part B, you need to sign up. You should enroll during your IEP, or a Special Enrollment Period if you qualify for one. As mentioned above, one example of a Special Enrollment Period might be if you delayed enrollment in Medicare Part A and/or Part B because you had employer coverage.

You typically sign up for Medicare through the Social Security Administration . You can go to the website at ssa.gov. Or, go in person to a Social Security office. You can reach the SSA at 1-800-772-1213 . Representatives are available Monday through Friday, from 7AM to 7PM, in all U.S. time zones.

Also Check: Do Walk In Clinics Take Medicare

When Does Medicare Not Automatically Start

Medicare will NOT automatically start when you turn 65 if youre not receiving Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday. Youll need to apply for Medicare coverage.

Theres no such thing as a Medicare office enrollment in the program is handled by the Social Security Administration . If you have to enroll in Medicare Part A and/or B on your own, you can visit your local Social Security office.

You can also online by following the instructions at the Social Security Administration Medicare Benefits web page. In most cases, signing up online will take ten minutes.

Total 2022 Monthly Medicare Costs

When we total up all of your monthly Medicare costs, hereâs what you can expect.

If you decide to use Original Medicare with a Medicare Supplement and a drug plan, your monthly costs would be:

- $170.10 for Medicare Part B â

- Get a quoteâ¯for your Medicare Supplement

- An average of $30 for your drug plan

If you decide to use a Medicare Advantage plan that includes a drug plan, your monthly costs would be:

- $170.10 for Medicare Part B

- A very low monthly premium for the MA plan

If you decide to get the Lasso Healthcare MSA and a drug plan, your monthly costs would be:

- $170.10 for Medicare Part B

- $0 premium for the MSA plan

- An average of $30 for your drug plan

For extra help, use the interactive Medicare Cost Worksheet to determine how much you will pay each month for Medicare.

Related Reading

Read Also: Does Medicare Part B Cover Home Health Care Services

How Does Medicare Work With My Job

Keep in mind that:

- Most people qualify to get Part A without paying a monthly premium. If you qualify, you can sign up for Part A coverage starting 3 months before you turn 65 and any time after you turn 65 Part A coverage starts up to 6 months back from when you sign up or apply to get benefits from Social Security .

- If you have a Health Savings Account, you and your employer should stop contributing to it 6 months before you sign up for Part A to avoid a tax penalty.

What If I Get Health Coverage From Cobra Or Another Plan

You still need to sign up for Medicare during your initial enrollment period. You can delay signing up for Medicare only if you have insurance through your own or your spouses current employer.

If you or your spouse is not an active employee, you cant delay Medicare enrollment without penalty after leaving the job, even if you continue coverage on your employers plan through COBRA. The federal Consolidated Omnibus Budget Reconciliation Act of 1985 requires employers with 20 or more employees to let them continue health insurance coverage for up to 18 months, or up to 36 months for certain disabled individuals and family members, after they or their spouse leaves their job.

But Medicare becomes your primary coverage when you turn 65, and the COBRA coverage is secondary. This is another case where you could face big coverage gaps if you dont sign up for Medicare at the proper time.

Retiree health insurance benefits from a former employer function the same way, even if youre working in another job. You or your spouse must be actively working for the employer that now provides your health insurance if you want to delay Medicare enrollment and qualify for a special enrollment period later.

Keep in mind

Recommended Reading: Does Medicare Cover Wheelchair Repairs