What Is A Deductible

A deductible is the amount you are required to pay for health care or prescription drugs before your Medicare plan begins to pay its share.

Let’s take Medicare Part A as an example. If you spend three days in the hospital, you pay the first $1,556 in expenses, the amount of your deductible. After this, Medicare will then pick up the rest of your covered Part A expenses for your three-day hospital stay because you have a $0 copay, which is the cost-sharing amount you pay after having met your deductible.

Medicare Part D Deductibles

Medicare Part D is prescription drug coverage. People are often surprised to learn that Part D is not included in Original Medicare. This is understandable since prescription medications are very often integral to health.

Medicare Part D prescription drug plans can be purchased from private insurers, as additional coverage. In addition, many, though not all, Part C plans also include coverage of prescription drugs.

Part D plans have varying deductibles. Each insurer determines what the annual deductible for Part D will be. Your insurer will also determine the plans formulary.

A formulary is a list of the prescription medications that each plan covers. Formularies feature multiple tiers. Each tier includes one or more medication types, such as generics, brand names and specialty drugs. They also include information about costs.

Some Part D plans have a $0 deductible, but others may have deductibles that are quite high. In 2022, no Part D plan is legally allowed to have an annual deductible higher than $480.

Medicare Deductible: Part A

The Medicare Part A deductible 2022 is $1,556 per benefit period. This amount represents an increase of $72 over the 2021 Part A deductible, which was $1,484.

A benefit period begins on the day youre admitted into a hospital or skilled nursing facility and ends when you have been out of the facility for 60 consecutive days. If youre readmitted to the same or a different facility after the 60-day period has passed, another benefit period will begin. This will require you to pay an additional deductible before your services are covered by Medicare. It is possible to have several benefit periods within a calendar year.

Keep in mind that in addition to the Medicare Part A deductible, other costs such as coinsurance will also apply. These include coinsurance and, in some instances, a Part A premium. Most people are eligible for premium-free Part A, based upon theirs or their spouses work history. According to the Centers for Medicare & Medicaid Services , approximately 99% of Medicare beneficiaries receive premium-free Part A.

If you or your spouse have not worked for at least 10 years and paid enough Medicare taxes to make you eligible for premium-free Part A, you will also incur the cost of the Part A premium. The maximum monthly premium cost for Part A is $499 in 2022.

Recommended Reading: How Long Can You Stay In The Hospital Under Medicare

What Is The Difference Between Medicare Part A And Part B

-

At-home Intravenous Immune Globulin

-

Vaccines for flu, pneumococcal pneumonia, Hepatitis B, and more

-

Transplant or immunosuppressive drugs if Medicare helped pay for your organ transplant

Most of the time you can expect to pay 20% of the Medicare-approved amount for Part B-covered drugs you receive in a doctors office or pharmacy. This is after youve paid your Part B deductible.

Part A covers drugs, medical supplies, and medical equipment used during an inpatient hospital stay or at a skilled nursing facility.

Part D covers many drugs you would fill at a pharmacy, including brand-name and generic prescriptions. Check your Part D formulary the list of covered drugs for medications that Part B doesnt cover, unless you have comparable drug coverage from another source.

Also Check: Does Medicare Offer Gym Memberships

Medicare Part C Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage. Medicare Advantage plans are required by law to cover everything found in Medicare Part A and Part B, and many Medicare Advantage plans may typically include benefits not covered by Original Medicare such as dental, vision, hearing, prescription drugs and more.

Medicare Advantage plans are sold by private insurance companies and dont have a standard deductible. There are thousands of different Medicare Advantage plans sold by dozens of insurance companies, and each carrier is free to set their own deductibles for each of their plans.

Medicare Advantage deductibles can range from $0 to several thousand dollars. Medicare Advantage plans that include prescription drug coverage will often have two separate deductibles, one for medical care and another for prescription drug costs.

Also Check: Does Medicare Cover Dexcom G6 Cgm

Medicare Premiums And Deductibles: What Youll Pay In 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

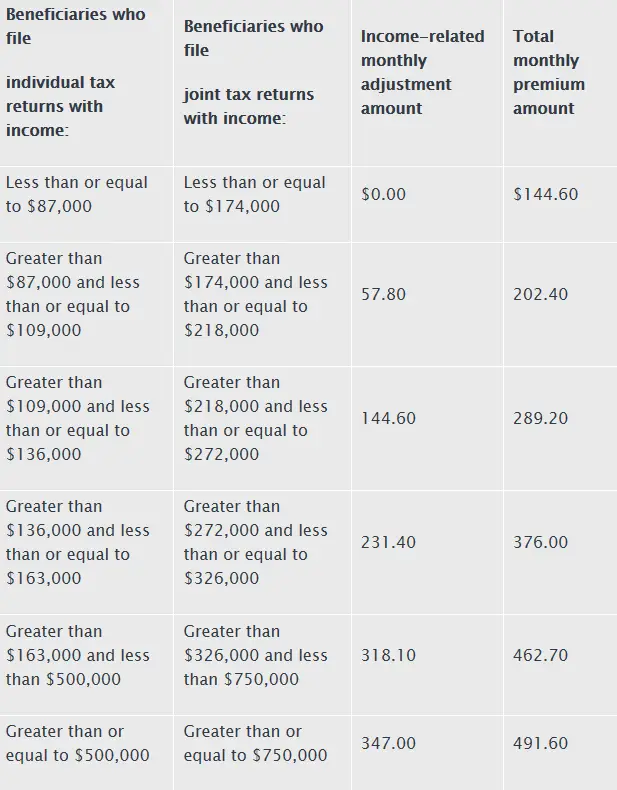

The costs and deductibles associated with the different parts of Medicare may change each year. The Centers for Medicare & Medicaid Services, or CMS, releases the new costs for Medicare Parts A and B and income-related monthly adjustment amounts every fall for the following year.

Medicare is the federal government health insurance program for people age 65 and older and younger people living with certain illnesses or disabilities. Medicare comes in four parts Part A, Part B, Part C and Part D. Theres also Medigap, or Medicare Supplement Insurance, which is an optional add-on to Original Medicare.

Below are Medicares premiums and deductibles for 2022.

Benefits Of Low Deductible Plans

The potential to save on out-of-pocket costs is a major draw of a low deductible health plan. Another benefit may be predictability: being able to budget for and manage your health care expenses. If you have a large family and anticipate regular trips to the doctor or have a busy medical history due to a chronic or pre-existing condition, a low deductible health plan may work best for you.

Read Also: Does Medicare Cover Refraction Test

Medicare Supplement Deductibles By Plan

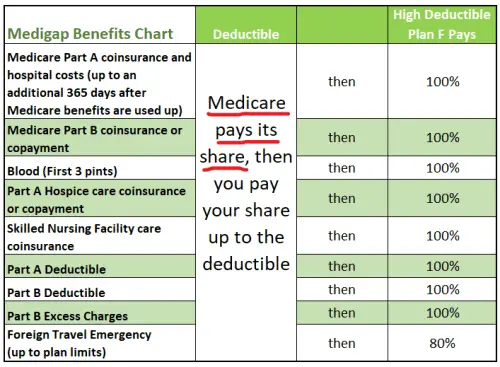

There are 10 standardized Medicare Supplement plans available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses.

Medicare Supplement Insurance plans are sold by private insurance companies. These plans help pay for Original Medicare deductibles and other out-of-pocket Medicare expenses like copayments and coinsurance.

Six types of Medigap plans provide full coverage of the Medicare Part A deductible, and another three plans provide partial coverage of the Part A deductible.

Two plans, Plan F and Plan C, provide full coverage of the Medicare Part B deductible, although these plans are only available to beneficiaries who became eligible for Medicare before Jan. 1, 2020. If you were eligible for Medicare before 2020, you may still be able to apply for Plan F or Plan C if theyre available where you live. If you already have either plan, you can keep your plan as long as you continue to pay your plan premiums.

Christian Worstell is a senior Medicare and health insurance writer with HelpAdivsor.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles hes written, helping Americans better understand their health insurance and Medicare coverage.

Are There Any Special Rules For Medicare Coverage For Skilled Nursing Facility Or Nursing Home Residents Related To Covid

In response to the national emergency declaration related to the coronavirus pandemic, CMS is waiving the requirement for a 3-day prior hospitalization for coverage of a skilled nursing facility for those Medicare beneficiaries who need to be transferred as a result of the effect of a disaster or emergency. For beneficiaries who may have recently exhausted their SNF benefits, the waiver from CMS authorizes renewed SNF coverage without first having to start a new benefit period.

Nursing home residents who have Medicare coverage and who need inpatient hospital care, or other Part A, B, or D covered services related to testing and treatment of coronavirus disease, are entitled to those benefits in the same manner that community residents with Medicare are.

Medicare establishes quality and safety standards for nursing facilities with Medicare beds, and has issuedguidance to facilities to help curb the spread of coronavirus infections. In the early months of the COVID-19 pandemic, the guidance directed nursing homes to restrict visitation by all visitors and non-essential health care personnel , cancel communal dining and other group activities, actively screen residents and staff for symptoms of COVID-19, and use personal protective equipment .

Topics

Read Also: Do You Have To Pay Back Medicare

What Is The Medicare Deductible

Your coverage under Original Medicare is categorized by Medicare Part A and Part B, and they each have their own deductible. Keep in mind that if you only have Original Medicare, youll still have out-of-pocket costs even after you hit the deductibles. Original Medicare typically only covers 80% of the bill, and youre responsible for other costs like the 20% coinsurance and copays.

Is The Medicare Part A Deductible Increasing For 2022

Part A has a deductible that applies to each benefit period . The deductible generally increases each year, and is $1,556 in 2022, up from $1,484 in 2021. The deductible increase applies to all enrollees, although many enrollees have supplemental coverage that pays all or part of the Part A deductible.

Read Also: Does Medicare Cover Mental Health Visits

Don’t Miss: How Much Is Medicare A And B

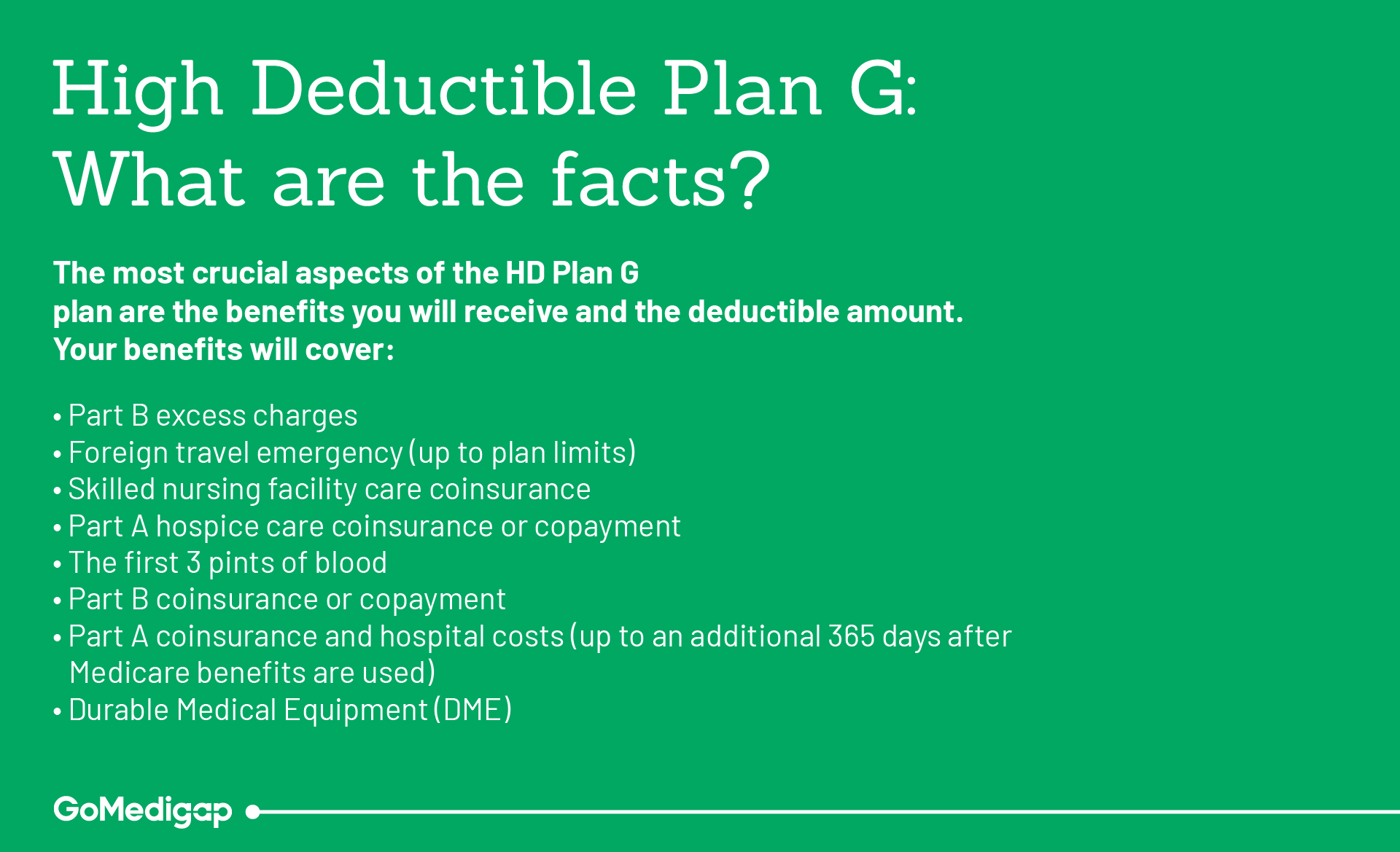

How Does Medicare Plan G Work

Medicare Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

Medicare Plan G is a supplemental policy, meaning itâs not your primary coverage but fills many of the gaps in a Medicare policy. Part A or Part B benefits would pay for health services you need. Once those benefits are exhausted, Plan G pays for any remaining costs.

Plan G also covers some of the expenses related to your Medicare policy. For example, Medicare Part A has a deductible of $1,408. If you donât have Plan G, then youâll pay that deductible out of pocket. But with Plan G coverage, your health insurer would pay for the entire deductible.

What Changes Are Coming To Medigap In 2021

- Supplemental Medicare or Medigap insurance covers a portion of your Medicare premiums. Supplements to Medicare can help pay the cost of premiums and deductibles.

- Companies that sell plans have varying costs.

- Medicare pays a portion of the costs under Plan G, and you pay the remainder until you reach a $2,370 deductible. Plan G will cover the remaining expenses.

Don’t Miss: How To Get Medicare To Pay For Hearing Aids

Who Can Get Pace

You can have either Medicare or Medicaid, or both, to join PACE. PACE is only available in some states that offer PACE under Medicaid. To qualify for PACE, you must:

- Be 55 or older

- Live in theservice areaof a PACE organization

- Need a nursing home-level of care

- Be able to live safely in the community with help from PACE

Whats The Difference Between High And Low Deductible Health Plans

A high deductible health plan is also referred to as HDHP. A low deductible health plan may be referred to as an LDHP. Depending on the type of plan you have, there could be separate deductibles for prescriptions and/or separate deductibles per family member. It could take as little as one visit or over the course of many months to meet your deductible. For some plans, you may not meet your deductible within your plan year.

Recommended Reading: How Can You Get A New Medicare Card

How Does Original Medicare Work

Original Medicare is a federal health care program made up of both Medicare Part A and Part B . Its a fee-for-service plan, which means you can go to any doctor, hospital, or other facility thats enrolled in and accepts Medicare, and is taking new patients.

Medicare was set up to help people 65 and older. In 1972, Medicare became available to people with disabilities and End-Stage Renal Disease/kidney failure.

You May Like: What Age Qualifies You For Medicare

What Does Medicare Part B Not Cover

Medicare Part B only covers specific services performed by medical professionals who accept Original Medicare Coverage.

Medicare Part B does not cover:

- Dental

- Hearing

- Prescription drug coverage

Further, it does not cover anything not considered medically necessary or preventive, nor any medical services provided by non-Medicare-participating providers. Finally, all inpatient services will be covered under Medicare Part A coverage.

You May Like: How Is Medicare Part B Penalty Calculated

Medicare Part D Premiums And Costs

Medicare Part D plans are sold by private insurance companies as an optional addition to Original Medicare. These plans provide their members with coverage for the prescription drugs they need to survive. Each Part D plan has a uniqueformulary, which is the list of drugs it covers.

It is important to ensure that the drugs you are currently taking or expect to take in the future are included in your plans formulary. Otherwise, you could end up paying for those drugs entirely out of pocket.

Medicare Part C Costs In 2021 And 2022

Parts A and B are called Original Medicare. You receive Original Medicare at very little cost to you as part of what you paid into Medicare throughout your working years.

Part C is where you begin to have options. Also called Medicare Advantage, it includes plans that are available for purchase from the private insurance market that extend Medicares coverage.

Part C or Medicare Advantage average premiums are expected to drop to $19 a month in 2022, down from $21.22 in 2021. Coinsurance, copayments, premiums, and deductibles may still vary, depending on your plan of choice.

Recommended Reading: How Do You Get Dental Insurance On Medicare

Read Also: Is Rocklatan Covered By Medicare

Understanding Medicare Premiums And Deductibles For 2022

Summary:

Premiums and deductibles may be some of your Medicare costs and may change every year. If youâre on Medicare, or soon will be eligible for Medicare, you will be happy to know that Medicare covers a lot of medical and preventive care. However, there are some out-of-pocket costs you may have to pay. Medicare Part A, Part B, Part C, and Part D can each have premiums and deductibles, although most people donât have to pay a Part A premium.

Letâs look at the Medicare premiums and deductibles for 2022. Weâll also show you how your income and certain coverage choices may affect your actual monthly Medicare premiums. Keep in mind that Medicare deductibles and premiums can change every year.

Is The Medicare Part A Deductible Increasing For 2021

Part A has a deductible that applies to each benefit period . The deductible generally increases each year. In 2019 it was $1,364, but it increased to $1,408 in 2020. And it has increased to $1,484 for 2021. The deductible increase applies to all enrollees, although many enrollees have supplemental coverage that pays all or part of the Part A deductible.

Also Check: What Is Aetna Medicare Advantage Plan

What Is Covered By Medicare Part B

Medicare Part B offers comprehensive coverage for outpatient services, durable medical equipment, and doctor visits. The two main types of coverage this part of Medicare includes are medically necessary and preventive.

The medically necessary coverage encompasses a variety of tests, procedures, and care options. A medical service or supply must be a requirement for treating or diagnosing a medical condition for Medicare to consider them medically necessary. Each situation is different, so a medical supply or service that is medically necessary for one person may not be for another.

It is easy to keep up with your general health needs through Medicares outpatient insurance by utilizing annual wellness visits.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Medicare Part B covers the following preventive care services:

- Vaccines

- Mental Health Counseling

You can receive many preventive services and more at your annual wellness visit.

Alongside preventive care services, Medicare Part B covers certain outpatient services you receive in the hospital. These include:

- Surgeries

- Chemotherapy

- Dialysis

If you are administered drugs while at the hospital, Medicare Part B will also provide coverage for these services.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Medicare Advantage Premium In 2022

As with stand-alone Medicare Part D prescription drug plans, Medicare Advantage plans set their own premiums. They may vary from one plan to another. Some Medicare Advantage plans have monthly premiums as low as $0.

CMS estimates that the average Medicare Advantage monthly premium in 2022 is $19.

Itâs important to note that you must continue to pay your Medicare Part B premium when you have a Medicare Advantage plan. Of course, you also need to pay the Medicare Advantage premium, if the insurance company charges one.

Note: People with low incomes and limited resources might qualify for state assistance in paying Medicare premiums and/or deductibles, coinsurance, and copayments. For more information, contact your state health insurance assistance program â go to .

Don’t Miss: How To Get Dental And Vision Coverage With Medicare