Medicare Advantage Vs Medicare Supplement

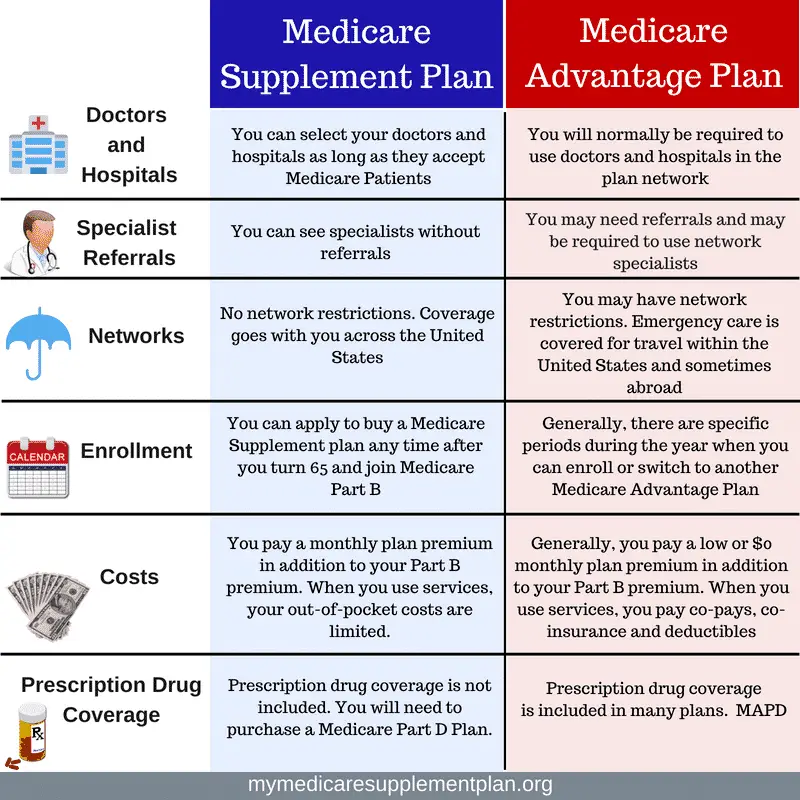

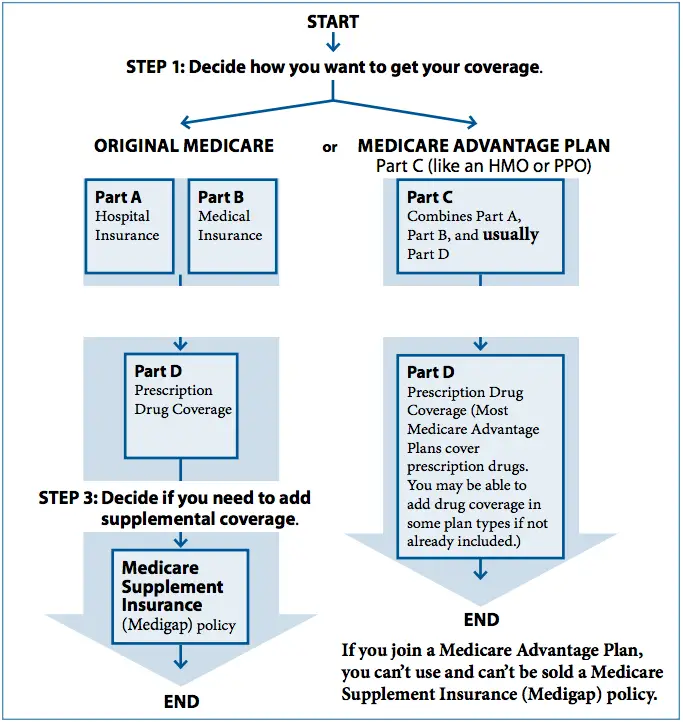

Medicare Advantage plans serve as a substitute for Original Medicare, providing that same coverage plus additional benefits like prescription drugs coverage . Meanwhile, Medicare Supplement plans, or Medigap plans, are sold by private insurance companies to people enrolled in Original Medicare to help fill the gaps of that coverage.

The 10 types of Medigap plans provide standardized coverage to beneficiaries nationwide and help pay for things like deductibles, coinsurance and copays. Because plan coverages are standardized, only monthly premium rates vary from provider to provider. Also, Medigap policies dont typically cover prescription drugs. A person enrolled in Original Medicare who wants prescription drug coverage needs to purchase a separate Medicare Part D plan in addition to any Medicare Supplement plan. Many Medigap plans dont provide dental, vision or hearing coverage, either.

Conversely, Medicare Advantage policies are only standardized in that they must provide the same benefits of Original Medicare. Once this threshold is met, private insurance providers can add any number of benefits and services to a planprescription drugs, dental care, vision care and moreto make them more comprehensive .

Whats The Best Way To Compare Medicare Advantage Plans

Medicare-approved commercial insurance providers provide Medicare Advantage plans, and as a result, each one may have a different price and set of benefits. Each plan may have unique out-of-pocket expenses and requirements, such as when a specialist referral is required.

The Kaiser Family Foundation estimates that there are almost 4,000 Medicare Advantage plans offered in the United States, though not all of them are accessible everywhere. According to the KFF, you can choose from 39 different Medicare Advantage plans on average, which is the most options in more than ten years.

What to consider while contrasting the best Medicare Advantage plans is as follows:

- Monthly premiums: You will pay this amount to your Medicare Advantage plan each month. Although the cost of Medicare Advantage plans might vary, they frequently have the same premium as Medicare Part B. In 2022, the standard base premium for Medicare Part B will be $170.10.

- Annual deductibles: This is the sum that you must spend out-of-pocket for medical expenses or prescription medications before your plan starts to pay. You should feel at ease spending this sum for the package you choose.

- Provider network: If there are any doctors you visit frequently, investigate if your Advantage plans network includes them. Visits to them might not be covered if they arent.

- Star rating*: A star rating of 1 to 5 is provided to each Medicare Advantage plan. This is one technique to assess the quality of each plan.

Medicare Advantage In 202: Enrollment Update And Key Trends

Since 2006, the role of Medicare Advantage, the private plan alternative to traditional Medicare, has steadily grown. In 2022, more than 28 million people are enrolled in a Medicare Advantage plan, accounting for nearly half or 48 percent of the eligible Medicare population, and $427 billion of total federal Medicare spending . The average Medicare beneficiary in 2022 has access to 39 Medicare Advantage plans, the largest number of options available in more than a decade.

To better understand trends in the growth of the program, this brief provides current information about Medicare Advantage enrollment, including the types of plans in which Medicare beneficiaries are enrolled, and how enrollment varies across geographic areas. A second, companion analysis describes Medicare Advantage premiums, out-of-pocket limits, cost sharing, extra benefits offered, prior authorization requirements, and star ratings in 2022.

Don’t Miss: Is Medicare Plus Blue A Medicare Advantage Plan

What To Ask When Comparing Medicare Advantage Plan

Armed with the information from the Medicare website, you may want to ask yourself a few questions:

- What are the costs associated with each plan, including premiums, deductibles, and copays?

- What is the out-of-pocket maximum per year?

- How is this plan rated?

- What kind of coverage options does each plan offer?

- Do I want an HMO, PPO, PFFS, or SNP plan?

- If a plan has a network of preferred providers, are my usual doctors and other health care professionals on that list?

For Insurance Quotes By Phonetty 711 Mon

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MedicareInsurance.com, DBA of Health Insurance Associates LLC, is privately owned and operated. MedicareInsurance.com is a non-government asset for people on Medicare, providing resources in easy to understand format. The government Medicare site is www.medicare.gov.

This website and its contents are for informational purposes only and should not be a substitute for experienced medical advice. We recommend consulting with your medical provider regarding diagnosis or treatment, including choices about changes to medication, treatments, diets, daily routines, or exercise.

This communications purpose is insurance solicitation. A licensed insurance agent/producer or insurance company will contact you. Medicare Supplement insurance plans are not linked with or sanctioned by the U.S. government or the federal Medicare program.

MULTIPLAN_GHHK5LLEN_2023

Also Check: Does Medicare Pay For Ensure

More Than 46 Million Medicare Beneficiaries Are Enrolled In Special Needs Plans In 2022

More than 4.6 million Medicare beneficiaries are enrolled in Special Needs Plans . SNPs restrict enrollment to specific types of beneficiaries with significant or relatively specialized care needs, or who qualify because they are eligible for both Medicare and Medicaid. The majority of SNP enrollees are in plans for beneficiaries dually enrolled in both Medicare and Medicaid . Another 9 percent of SNP enrollees are in plans for people with severe chronic or disabling conditions and 2 percent are in plans for beneficiaries requiring a nursing home or institutional level of care .

While D-SNPs are designed specifically for dually-eligible beneficiaries, 1.9 million Medicare beneficiaries with Medicaid were enrolled in non-SNP Medicare Advantage plans in 2020 .

Enrollment in SNPs increased from 3.8 million beneficiaries in 2021 to 4.6 million beneficiaries in 2022 , and accounts for about 16% of total Medicare Advantage enrollment in 2022, up from 11% in 2011, with some variation across states. In the District of Columbia and Puerto Rico, SNPs comprise about half of all Medicare Advantage enrollees . In 11 states, SNP enrollment accounts for about one-fifth of Medicare Advantage enrollment . More than 95% of C-SNP enrollees are in plans for people with diabetes or cardiovascular conditions in 2022. Enrollment in I-SNPs has been increasing slightly, but is still fewer than 100,000.

Best For Extra Perks: Aetna

Average Medicare star rating: 3.8 out of 5.

Service area: Available in 46 states and Washington, D.C.

Standout feature: In addition to cost help with dental, vision and hearing care, Aetna Medicare members have access to a variety of other benefits, such as in-home health visits and meal delivery after a hospital stay.

Aetna, a CVS Health company, is the fourth-largest provider of Medicare Advantage plans. Most of Aetnas plans provide cost help with dental, vision and hearing care, and many offer other extras. Some valuable Aetna benefits include companionship benefits in eight states, an over-the-counter benefit that lets you pick up things like vitamins and cold medications from drugstores or online at no cost, and concierge services to help members find local resources and activities.

Pros:

-

Aetna estimates that 84% of Medicare-eligible beneficiaries in the U.S. will have access to a $0-premium Aetna Medicare Advantage plan.

-

Aetna offers some of the lowest-premium stand-alone Medicare prescription drug plans nationwide.

-

As a CVS Health company, Aetna offers members the ability to visit one of a network of walk-in clinics or MinuteClinics for the same copay as a regular visit to a primary care physician, or PCP, as long as theyre in plans that dont require a PCP visit. This network includes walk-in locations across 33 states and Washington, D.C.

Cons:

You May Like: Should Retired Federal Employees Take Medicare Part B

What Does A Medicare Advantage Plan Cost

Like Original Medicare, Medicare Advantage plans share the cost of care through deductibles, co-payments and co-insurance. These costs vary by plan. Our HMO plans offer $0 premiums, low out-of-pocket costs, and low prescription drug costs. While our PPO plans cost a bit more for the opportunity to go out-of-network and see specialists without a referral, they still offer low out-of-pocket costs for in-network visits.

Medicare Advantage plans also have an out-of-pocket-maximum. Once you reach the maximum, your Medicare Advantage plan pays 100% toward Medicare covered services and you dont pay anything.

Medicare Advantage Open Enrollment

During the open enrollment period, which runs from October 15 to December 7 each year, you can join, switch or drop a plan for your coverage to begin on January 1 of the following year.

If youre already enrolled in a Medicare Advantage plan, you can switch to a different Medicare Advantage plan or Original Medicare during the Medicare Advantage open enrollment period, which starts on January 1 and ends on March 31 annually. You can only make one switch during that time period.

If youre already enrolled in Original Medicare , you may be eligible to switch to a Medicare Advantage plan . You must be at least 65 years old or have certain disabilities, such as permanent kidney failure or amyotrophic lateral sclerosis . If the Medicare Advantage plan you choose doesnt already have prescription drug coverage, you will have the option to enroll in Part D.

Don’t Miss: Does Medicare Cover Motorcycle Accidents

Plans Can Offer Extra Benefits

Most Medicare Advantage Plans offer coverage for things that arent covered by Original Medicare, like vision, hearing, dental, and wellness programs . Plans can also cover more extra benefits than they have in the past, including services like transportation to doctor visits, over-the-counter drugs, adult day-care services, and other health-related services that promote your health and wellness. Plans can also tailor their benefit packages to offer these new benefits to certain chronically ill enrollees. These packages will provide benefits customized to treat those conditions. Check with the plan to see what benefits are offered and if you qualify.

Florida Blue Medicare Hmo Plans

Looking for a Medicare plan that saves you money? If you prefer having one doctor to coordinate your care with specialists and other healthcare providers, one of our Medicare Advantage HMO plans could be a great choice for you.

-

You choose a trusted primary care physician to coordinate your medical needs.

- With most plans, you must use in-network doctors, specialists or hospitals, with a few exceptions, like medical emergencies.

- You can benefit from our rewards programs.

Our HMO D-SNP plan provides Dual Eligible Special Needs coverage to people who have both Medicare and Medicaid.

Read Also: Can You Only Have Medicare Part B

How To Shop For Medicare Advantage Plans

The right Medicare Advantage plan for you will depend on your health history, prescription medications and where you live, among other things. Here are some strategies for selecting the best plan:

-

Check star ratings. The CMS collects data on Medicare Advantage plans from member surveys, the plans themselves and medical providers, and then assigns a star rating based on the results. The star rating is on a scale of 1 to 5, with 5 being best.

-

Compare out-of-pocket costs. Each plan will have a monthly premium and a maximum out-of-pocket cost, which is the most youll pay in a year for covered health care.

-

Keep your meds in mind. Your medications may seem like an afterthought, but make sure you investigate how each plan will cover your medications or whether theyre covered at all.

-

Look for your doctors. If youve got a list of caregivers and medical facilities you use and prefer, look for plans that include them.

-

Consider the plan type. If you see specialists frequently and you dont want to seek a referral for every office visit, a PPO plan is probably the better fit. If youre a light health care user and see mostly your primary care physician, an HMO might be more affordable.

Medicare Advantage Plan Annual Prices By Location

| LOCATION | |

|---|---|

| 82061 | $0-$0 |

Most Medicare drug plans have a coverage gap called the donut hole, which means theres a temporary limit on what the drug plan will cover. A person gets limited coverage while in the donut hole. whether on a Medicare Advantage plan or a separate Part D plan, says Antinea Martin-Alexander, founder of Advocate Insurance Group in South Carolina. The individual will pay no more than 25% of the cost of the medication in the donut hole until a total out of $6,550 in out of pocket expenses is reached. There are different items that contribute to the out-of-pocket expenses while in the donut hole: any yearly drug deductible you may have, copays for any and all your medications, what the manufacturers discount is on that medication and what the insurance company pays for that medication, she says.

Also Check: Do You Have To Be To Get Medicare

Medicare Advantage Plans Near Any Location

Wherever you live, theres likely several Medicare Advantage plans available in your area. We understand that finding a plan that meets your needs and offers access to high quality care providers in your city is a priority for most seniors. Were happy to help you find Medicare coverage in the following locations and more:

Medicare Advantage Plans in Florida

Medicare Advantage Plans in Maine

How To Select A Medicare Advantage Plan In Your Area

If youre among the 17.8% of the United States population who are covered by Medicare, you may decide to receive your Medicare benefits through a Medicare Advantage plan. Medicare Advantage, also called Medicare Part C, allows you to obtain your Original Medicare benefits and additional benefits through a Medicare-approved private insurance company. Although this is beneficial, how do you select a suitable Medicare Advantage plan in your area from the many options available to you? Heres what you need to know.

Don’t Miss: Is Nursing Home Covered By Medicare

What Other Tests Can Be Run

Naturopathic Doctors also have access to ordering salivary, stool, urine, and blood-drop tests. These are take-home tests that are then sent in to a lab to be processed. There are many tests available, but some of the more common ones I run are:

- Dried Urine Test for Comprehensive Hormones

- Comprehensive Stool Analysis & SIBO Testing

- Salivary Cortisol Testing

- Food Sensitivity Testing

Specialty tests require a follow-up appointment to discuss results and treatment plan. Copies of results are always made available to my patients for them to keep for their personal health records. If you have had blood work run by your family doctor, please bring a copy to your appointment with me in order to complete your file.

Not Sure How To Enroll We’re Here To Help

Whether its your first time enrolling in a Medicare plan or youre looking for better coverage, our licensed agents are available to assist. Youre eligible to enroll in, or switch to, a new Medicare plan if any of the following criteria apply:

- Youre about to turn 65

- Youve just moved

- Its an Annual Enrollment Period

- Its an Open Enrollment Period

- Theres a 5-star Medicare Advantage plan available in your area

There are additional circumstances you might be qualified to increase your coverage or gain additional benefits. Call us at for help determining your eligibility and finding comprehensive health insurance coverage in your area.

Also Check: Can You Be On Medicare And Medicaid

How Much Does Medicare Advantage Cost

Some Medicare Advantage plans may have lower out-of-pocket costs than Original Medicare, and some have a $0 monthly premium. Here are a few questions to consider before purchasing a plan.

- Does the plan have a monthly premium?

- Most have a $0 premium.

- Some pay your Part B premium.

- If you choose a plan with a premium, it will be paid separately from your Part B premium.

Once youre enrolled in a Medicare Advantage plan, it becomes your primary insurance. The provider handles paying all your claims, and the cost of your plan is likely to change every year. The plan provider sets the amounts charged for premiums, deductibles and services. An Annual Notice of Change is mailed to you each September, which goes into effect the following January 1.

Factors like location play a major role in determining the cost of a Medicare Advantage plan. Costs are typically lower when you use providers in your plans network and service area. To find the specific cost of a Medicare Advantage plan in your zip code, visit Medicare.gov.

Consider Medicare Advantage Plan Costs

Of course youll want to consider the costs involved in your Medicare Advantage plan, and how you can get a plan tailored to your specific needs for as little money as possible. There are several types of cost associated with your Medicare Advantage plan, including the following:

One benefit of Medicare Advantage plans is that they have a yearly limit for out-of-pocket costs. If you go over this amount, your plan should pay 100% of the costs of covered health care services or items. This maximum amount will vary from plan to plan, and its something you should find out before you sign up.

Don’t Miss: Should I Sign Up For Medicare Part A

Nearly One In Five Medicare Advantage Enrollees Are In Group Plans Offered To Retirees By Employers And Unions In 2022

Nearly 5.1 million Medicare Advantage enrollees are in a group plan offered to retirees by an employer or union. While this is roughly the same share of enrollment since 2010 , the actual number has increased from 1.8 million in 2010 to 5.1 million in 2022 . With a group plan, an employer or union contracts with an insurer and Medicare pays the insurer a fixed amount per enrollee to provide benefits covered by Medicare. For example, some states, such as Illinois and Pennsylvania, provide health insurance benefits to their Medicare-eligible retirees exclusively through Medicare Advantage plans. As with other Medicare Advantage plans, employer and union group plans often provide additional benefits and/or lower cost sharing than traditional Medicare and are eligible for bonus payments. The employer or union may also pay an additional premium for these supplemental benefits. Group enrollees comprise a disproportionately large share of Medicare Advantage enrollees in six states: Alaska , Michigan , Maryland , West Virginia , New Jersey , and Illinois .