Ct Medicare Education And Advocacy Projects

For decades the Center for Medicare Advocacy has designed and implemented projects to assist Connecticut residents and their families obtain fair access to Medicare and necessary care. Our Connecticut assistance, outreach, and education work has been the foundation for much of the Centers broader systemic advocacy. This work is increasingly important as Connecticuts population is aging, more residents rely on Medicare to access health care, and the state and country continue to deal with the pandemic.

The overall goal of these projects is to help Connecticut residents and stakeholders know what Medicare should cover, help beneficiaries obtain appropriate coverage, reduce cost-shifting to families and Medicaid, and effect systemic change to benefit all who rely on Medicare now and in the future. This work, and the Centers mission, particularly focus on the needs and rights of people with lower incomes and longer-term, debilitating conditions. Our assistance is provided at no cost for residents of Connecticut and is supported by the Connecticut State Unit on Aging.

Aging and Human Services Joint Informational Forum Regarding Medicare in CT Featuring Judith Stein and Kathy Holt

Enrolling In Medicare When Working Past 65

Even if you plan to keep working, you still have a 7-month Initial Enrollment Period when you turn 65. Moreover, if an employer has fewer than 20 employees or your spouse’s employer requires you to get Medicare to remain on their plan as a dependent, you will need to enroll during your IEP to avoid late enrollment penalties.

Signing Up For Medicare Part A And Part B

If you are collecting Social Security benefits, you will automatically enroll in Medicare Part A and Part B upon turning 65. However, if you are not automatically enrolled, the best time to enroll in Medicare Part A is during your Initial Enrollment Period.

If you worked a minimum of ten years while paying Medicare taxes in the United States, you can receive Medicare Part A premium-free. So, regardless of whether you are still working when you become eligible for Medicare, it makes sense to enroll in Medicare Part A as soon as possible. This will help keep your out-of-pocket hospital inpatient costs to a minimum.

With Medicare Part B, you have different enrollment options. Medicare Part B medical insurance requires every beneficiary to pay a monthly premium. Therefore, if you have health coverage at age 65 through an active employer, union, or other creditable source, you may delay Medicare Part B without penalties unless you lose creditable coverage before getting Medicare Part B.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Common reasons beneficiaries delay Medicare Part B include:

- Health insurance through a previous employer

- To remain with spousal coverage, if available, as Medicare Part B premiums are based on income reported two years prior

- Employer coverage

Read Also: How Much Does Medicare Cost A Person

What Is The Next Step Call Us

If you are retired and have a health plan provided by your former employer, then you need to sign up for Medicare Parts A and B. Medicare is usually necessary in this case because it takes precedent over a retiree health plan. If you neglect to enroll, you could be penalized for not signing up for Medicare on time. Youll also want to sign up for Medicare if youre a retiree whose former employer doesnt offer a retirement plan. Signing up for Medicare at age 65 will help you avoid late fees, delays in coverage, and lost social security benefits.

If youre still employed and work for a company with 20 or more employees, there are a few Medicare options available for you. If you work for a large company, you may want to enroll in Medicare Part A and delay Medicare Part B. You can do this because your employee group plan acts as your primary coverage. When you have creditable employer coverage, you are able to delay signing up for Medicare until that coverage is gone. Many people enroll in Part A and delay Parts B and D until they retire.

The clarification youre looking for on Medicare can be found by contacting Health Insurance Associates, LLP. Call us to review your specific circumstances and what steps, if any, you need to take to avoid any future enrollment penalties with Medicare. There is no obligation and we promise your experience with us will be pleasant and most certainly educational.

LOCATED IN:

250 State Street Unit F1

North Haven, CT 06473

How You Could Receive Medicare Benefits

At a minimum, be sure you understand 2 of the most basic ways you can receive Medicare:

- Original Medicare: This includes Medicare Part A and Medicare Part B .

- Medicare Advantage: Also known as Medicare Part C, this is a private alternative to Original Medicare that bundles Parts A and B. It also often includes Part D as well.

Under Original Medicare, youll have to add Part D separately and pay extra for it. There are also supplemental plans that can help you pay for out-of-pocket costs associated with Medicare. And if you have Original Medicare, it likely wont cover things like dental or vision care, so you might want to add supplemental plans for those as well.

As noted above, Medicare Advantage can include Part D, as well as dental, vision, hearing, and other benefits. But there are pros and cons to each type of plan, so youll want to weigh your options carefully.

Don’t Miss: How Much Is Medicare B Cost

Signing Up For Medicare Part D

Signing up for Medicare Part D is simple. Once you enroll in Medicare Part A and Part B, you can enroll in Medicare Part D.

Like other parts of Medicare, unless you have creditable coverage, enrolling during your initial enrollment period is best to avoid future penalties. To enroll, you must apply through Medicare and choose to enroll in any plan in your service area.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

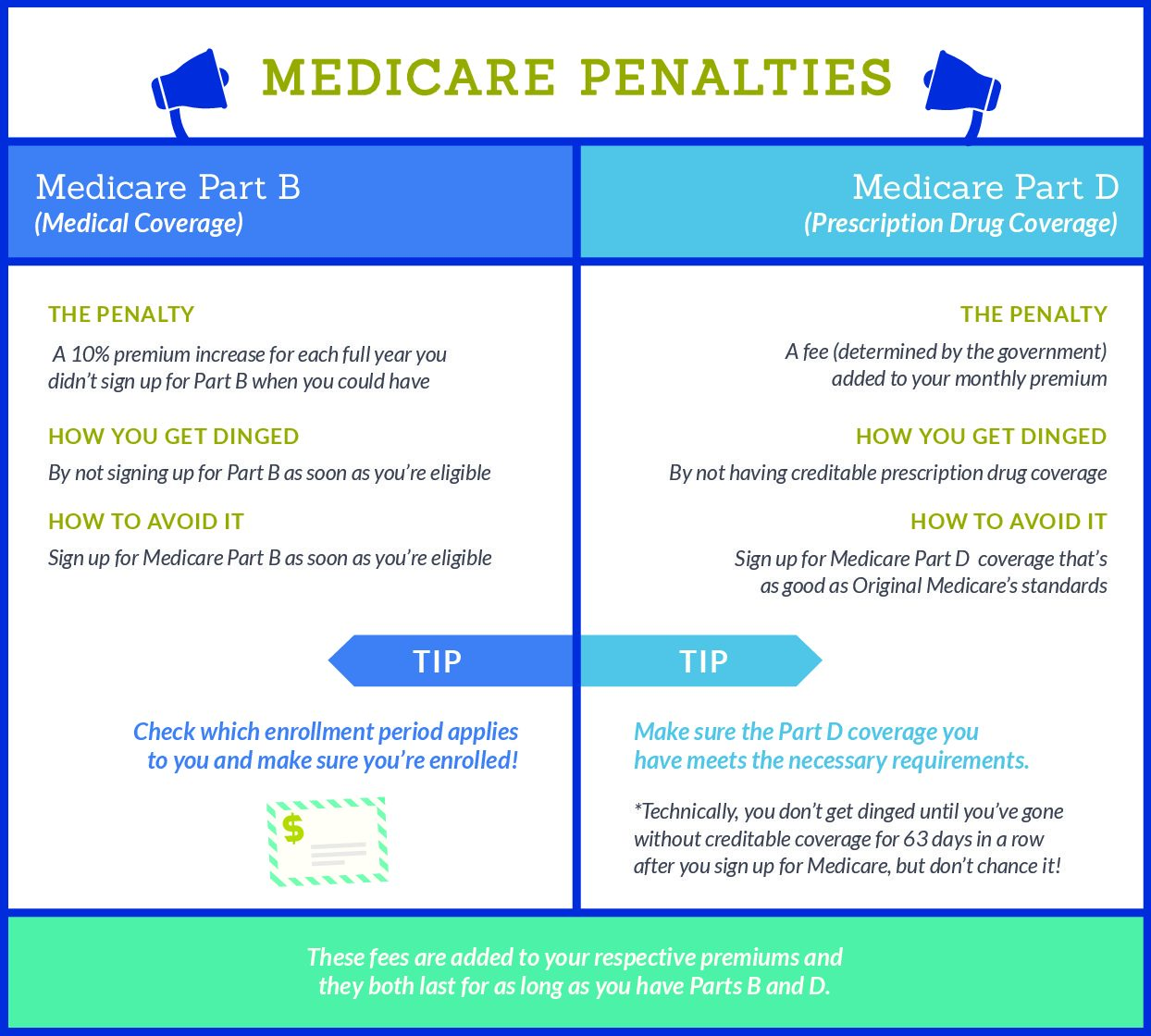

Medicare Part B Late Enrollment Penalty

A 10% late enrollment penalty is applied to your monthly premium for twice the number of years you did not have Part B despite being eligible.

Example:

Your Initial Enrollment Period ended December 2016. You waited to sign up for Part B until March 2019 during the General Enrollment Period. Your coverage starts July 1, 2019. Your Part B premium penalty is 20% of the standard premium, and youll have to pay this penalty for as long as you have Part B.

Also Check: Will Medicare Cover Shingles Vaccine

When To Sign Up And Apply For Medicare

Home / FAQs / General Medicare / When to Sign Up and Apply for Medicare

When you are new to Medicare, you probably have questions regarding when and how to apply for Medicare. Understanding when to sign up for Medicare and knowing the right way to enroll in Medicare coverage is important. Below, we tell you how and when to apply for Medicare.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

What Happens When I Retire

It’s important to understand what your options are once you retire. The first step is to find out if you can keep the coverage you have now when you retire, and whether or not it can be combined with Original Medicare coverage. If you have group retiree health coverage, you’ll need to contact the plan’s benefits administrator to learn about how the coverage works with Medicare and what you need to do.

Recommended Reading: Is Goodrx Better Than Medicare Part D

Applying For Medicare Part A And Part B Online

Applying for Medicare Part A and Part B online is a quick and easy process on the Social Security website, taking approximately ten minutes. After you have applied for Medicare Part A and Part B online, you can check the status of your application and appeal, request a replacement card, and print a benefit verification letter.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

When Can You Expect Your Medicare Card

Youll get your card the fastest if you sign up for Medicare online. Youll get it in the mail. You should receive it in about two weeks after you complete the application.

If you want a Medicare Advantage Plan or a Medicare Supplement plan, make sure your card has an effective date for both Medicare Part A and Medicare Part B. Youll only need Medicare Part A or part B if you want a Part D Prescription Drug Plan.

If you apply by phone or in the local Social Security office, it will come later. Your red, white and blue Medicare card should come about two weeks after your meeting.

Also Check: How Old Before I Can Get Medicare

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

You Automatically Get Medicare

- You should already have Part A and Part B , because you have ALS and youre already getting disability benefits.

- We mailed you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

Also Check: Which Medicare Part Covers Prescriptions

What You Should Know About Medicare Advantage Plans In Connecticut

- In 2023, there are 65 Medicare Advantage plans available in Connecticut, compared to 57 plans in 2022.

- 100% of Medicare beneficiaries have access to a zero premium Medicare Advantage plan in 2023.

- The average Medicare Advantage monthly premium in 2022 is $17.66, a decrease from 2022.

- Through the CMS Innovation Centers Value-Based Insurance Design Model, 18 plans will offer Medicare Advantage enrollees eliminated Part D cost-sharing rewards and incentives programs related to healthy behaviors and customized, innovative benefits that address social determinants of health, such as food insecurity and social isolation, for certain underserved and/or chronically ill enrollees.

Medicare Part A Late Enrollment Penalty

A 10% late enrollment penalty is applied to your monthly premium for twice the number of years you did not have Part A despite being eligible.

Example:

If you were eligible for Part A for 2 years but didn’t sign up, you’ll have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a special enrollment period.

Read Also: Who Pays For Part A Medicare

How Do You Get Another Medicare Card

My card is lost or damaged Log into your secure Medicare account to print or order an official copy of your Medicare card. You can also call 1-800-MEDICARE to order a replacement card to be sent in the mail. TTY users can call 1-877-486-2048.

If you get Railroad Retirement Board benefits, you can call 1-877-772-5772 to get a replacement card. TTY users can call 1-312-751-4701.

My name changed Your Medicare card shows the name you have on file with Social Security. Get details from Social Security if you legally changed your name.

Protect your identity

You May Be Able To Add To Your Original Medicare Coverage

You may have some Medicare plan options in Connecticut beyond Original Medicare. Note that not every Medicare plan option may be available in your county in Connecticut.

If you stay with Original Medicare, you may be able to add more optional coverage in either or both of these ways:

- Sign up for a stand-alone Medicare Part D Prescription Drug Plan to help cover your medication costs. Medicare Prescription Drug Plans are available from private insurance companies approved by Medicare. Although this coverage is optional, if you donât sign up for it when youâre first eligible for Medicare, you could pay a late-enrollment penalty if you decide to get prescription drug coverage later on.

- Buy a Medicare Supplement insurance plan to work alongside your Original Medicare coverage.

Or, you may be able to get your Original Medicare coverage in a different way, through a Medicare Advantage plan. Available from private, Medicare-approved health insurance companies, Medicare Advantage plans provide the same benefits you get from Medicare Part A and Part B . Medicare Advantage plans often have additional benefits, such as vision care, fitness programs, and prescription drug coverage. If you sign up for a Medicare Advantage Prescription Drug plan, you can get all your Medicare benefits in a single plan.

No matter what type of Medicare Advantage plan you may enroll in, you must keep paying your Medicare Part B premium, along with any premium the plan may charge.

You May Like: Is Sleep Apnea Covered By Medicare

How Does Medicaid Provide Financial Assistance To Medicare Beneficiaries In Connecticut

Many Medicare beneficiaries receive financial assistance through Medicaid with the cost of Medicare premiums, prescription drug expenses, and services not covered by Medicare such as long-term care.

Our guide to financial assistance for Medicare enrollees in Connecticut includes overviews of these benefits, including Medicare Savings Programs, long-term care coverage, and eligibility guidelines for assistance.

Medicare Advantage In Connecticut

Connecticuts Medicare Advantage market is particularly robust, with at least 44 plan options available throughout the state for 2023 coverage. The service areas for a particular insurance company or plan vary by county some areas of Connecticut have as many as 58 Advantage plans available for 2023.

Nationwide, 34% of all Medicare beneficiaries were enrolled in Medicare Advantage plans as of 2018, although it varied from a low of 1% in Alaska to a high of 56% in Minnesota. Medicare Advantage enrollment in Connecticut was right on par with the national average, however, with 34% of the states Medicare beneficiaries enrolled in Medicare Advantage plans at that point.

By mid-2022, there were 368,276 Connecticut residents with private Medicare coverage, amounting to nearly 52% of the states Medicare population. A similar trend has been happening nationwide, with increasing Medicare Advantage enrollment every year since 2004, although nationwide, more than half of all Medicare beneficiaries still have Original Medicare. Medicare Advantage growth in Connecticut has been particularly robust, with more than half the states Medicare beneficiaries now covered by Medicare Advantage plans.

You May Like: What Part Of Medicare Covers Diabetic Supplies

Medicare Enrollment Guide For Providers & Suppliers

Use this guide if any of the following apply:

- Youre a health care provider who wants to bill Medicare for your services and also have the ability to order and certify.

- You dont want to bill Medicare for your services, but you do want enroll in Medicare solely to order and certify.

- You wish to provide services to beneficiaries but do not want to bill Medicare for your services.

- You want to enroll as a supplier who does not dispense or furnish durable medical equipment, prosthetics, orthotics and supplies .

Enrollment And Eligibility For Medicare Advantage Plans In Connecticut

Youre eligible for Medicare when you turn 65 or if youre younger and have a qualifying disability. A qualifying disability means at least one of the following applies:

- Youve received Social Security Disability Insurance or Railroad Board Disability Annuity for 24 months

- You have Amyotrophic Lateral Sclerosis , also known as Lou Gehrigs disease

- You have End-Stage Renal Disease

When you become eligible for Medicare, you are also eligible for Medicare Advantage Plans. There are specific times of the year when you can enroll for the first time in a Medicare Advantage Plan: during your Initial Enrollment Period and the Open Enrollment Period.

Medicare Advantage Open Enrollment occurs between January 1 and March 31 of each year. This period is only for beneficiaries already in a Medicare Advantage Plan, and you can change plans or switch to Original Medicare. You cannot switch from Original Medicare to Medicare Advantage during Medicare Advantage Open Enrollment.

There are exceptions to these enrollment periods called Special Enrollment Periods. Certain events or circumstances may make you eligible to change your Medicare Advantage Plan outside of the open enrollment periods, such as if you move outside of your existing plans service area or to a location with new plan options you didnt have before. If you think you may qualify for a Special Enrollment Period, call 1-800-MEDICARE and explain your situation.

You May Like: How To Qualify For Oxygen With Medicare

Who Is Eligible For Medicare In Connecticut

You may be eligible for Medicare in Connecticut if youre a U.S. citizen or a permanent legal resident who has lived in the U.S. for more than five years and one or more of the following applies to you:2

- You are 65 or older.

- You have been on Social Security Disability Insurance for two years.

- You have end-stage renal disease or Lou Gehrigs disease.

If you are 65 or older and receiving benefits from Social Security, you will be automatically enrolled into what is known as Original Medicare.