What Medicare Does And Does Not Cover

by Christian Worstell | Published April 22, 2021 | Reviewed by John Krahnert

Medicare Part A and Part B will cover a lot of your health care costs, but it won’t cover everything. Typically, you will be responsible for paying for most services that arent considered necessary for your health.

If the service you need is covered by Medicare, its likely you will still have to pay something for it in the form of a deductible, coinsurance or copayment.

You can consider applying for a Medicare Supplement plan that can help cover these out-of-pocket Medicare costs, which can add up quickly.

Medicare Doesn’t Cover Prescription Drugs

Medicare doesnt provide coverage for outpatient prescription drugs, but you can buy a separate Part D prescription-drug policy that does, or a Medicare Advantage plan that covers both medical and drug costs. You can sign up for Part D or Medicare Advantage coverage when you enroll in Medicare or when you lose other drug coverage. And you can change policies during open enrollment season each fall. Compare costs and coverage for your specific medications under either a Part D or Medicare Advantage plan by using the Medicare Plan Finder.

How Do You Enroll In Original Medicare

To enroll in Original Medicare , you must be 65 and dont necessarily have to be retired. Initial enrollment period packages are sent to people 3 months before they turn 65 or during their 25th month of disability benefits.

If youve received Social Security disability benefits for 24 months, you are automatically enrolled in Part A and Part B.

Don’t Miss: Does Medicare Pay For Assistance At Home

Does Medicare Cover Laser Cataract Surgery

The short answer to this question is yes.

Medicare will cover your cataract surgery, regardless of the method used. So, whether the surgery is performed using a laser or a more traditional technique, the only thing that matters regarding your coverage is which procedures are performed. This means that if youre going to undergo a laser cataract surgery, you will still receive the same coverage.

Undergoing Cataract Surgery With Part B

Part B covers your outpatient care and is most likely what you will use to cover your cataract surgery. Under Part B, only 80% of the cost of your cataract surgery will be covered. You will be responsible for the remaining 20%. Part B will cover your lens implant, removal, and the prescription glasses or contact lenses covered for the procedure. The Part B deductible is quite low at $198.

Also Check: Does Humana Medicare Cover Incontinence Supplies

Medicare Part D: Prescription Drugs

Prescription drug coverage, known as Part D, is also administered by private insurance companies. Part D is optional and is normally included in any Medicare Advantage plan. Depending on your plan, you may have to meet a yearly deductible before your plan begins covering your eligible drug costs. Some Part D plans have a co-pay.

Medicare prescription drug plans have a coverage gapa temporary limit on what the drug plan will cover. The coverage gap is often called the “doughnut hole,” and this gap kicks in after you and your plan have spent a certain amount in combined costs. For example, in 2020 the donut hole occurs once you and your insurer combined have spent $4,020 on prescriptions.

Once you have paid $6,350 in out-of-pocket costs for covered drugs , you have reached the level of “catastrophic coverage,” for 2020 in out-of-pocket costs for covered drugs. This means you are out of the prescription drug “doughnut hole” and your prescription drug coverage begins paying for most of your drug expenses again.

Many states have insurance options that will close the coverage gap, but these may require paying an additional premium.

What Does Part B Cost

With Medicare Part B, you pay a standard monthly premium thats based on your income. In some cases, your monthly premium may be higher if you didnt sign up for Part B when you became eligible.

You may also need to meet an annual deductible before Medicare kicks in and starts paying. Once youve met your deductible, you will pay a 20 percent copay for approved Medicare Part B services.

You can always buy a Medicare Supplement Plan that pays your Part B deductible, as well as other out-of-pocket costs such as copays and coinsurance.

Recommended Reading: How Much Does Medicare Pay For Physical Therapy In 2020

Does Medicare Cover Hearing Aids

by Ethan Bynon, December 6, 2021 fact checkedA qualified researcher has reviewed the content on this page to ensure it is factually accurate, meets current industry standards, and helps readers achieve a better understanding of Medicare health insurance and Medicare coverage topics…. by Andrew Bynon

If youre someone who is hard of hearing and in need of a hearing aid, you might be wondering if its covered by Medicare. After all, hearing aids can be expensive. Youll need the device, costly batteries, proper fitment, and an initial hearing test. So it would help to have them covered.

In this article, well get into Medicares coverage of hearing aids, so keep on reading!

What Medicare Benefits Are Most Utilized

Part A and Part B services make up most benefits. Inpatient services make up about 21%. Part D services make up roughly 14% of the benefits used.

Doctors payments make up 10%. Outpatient services through a hospital facility equate to about 7%.

Skilled nursing facilities are at about 4%. Home health care services comprise 3%, and other miscellaneous services make up about 11%.

The information above comes from the Kaiser Family Foundation.

- Was this article helpful ?

Read Also: Does Medicare Pay For Revitive

What Does Medicare Part B Cost

Some of your Part B cost is a monthly premium of $148.50 however, your premium could be less or more or less depending on your income.

Some services are covered under Medicare Part B at no additional cost to you if you see a doctor that accepts Medicare. If you need a service outside of what is covered by Medicare, you will have to pay for that service yourself.

What Else Do I Need To Know About Original Medicare

- You generally pay a set amount for your health care before Medicare pays its share. Then, Medicare pays its share, and you pay your share for covered services and supplies. There’s no yearly limit for what you pay out-of-pocket.

- You usually pay a monthly premium for Part B.

- You generally don’t need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

Read Also: What Is A Medicare Physical Exam

Medicare Part D Coverage

Part D refers to the prescription drug coverage portion of Medicare and each plan has its own set of covered drugs. Additionally, each drug is placed in a designated tier within that plan, which ultimately determines the copayment and/or coinsurance cost of the drug.

To find out the specific medications your plan covers, check with your Medicare provider or read through your individual plan.

Alternatively, if youre taking a particular drug and want to find a Medicare plan offering the best benefits possible for that specific medication, Medicare.gov has a Medicare Plan Finder on its website that helps you locate options to consider.

Part D refers to the prescription drug coverage portion of Medicare and each plan has its own set of covered drugs.

How Does Medicare Cover Hearing Aids

Most people find it challenging to hear clearly as they age, especially in a noisy environment. Unfortunately, Medicare has made it very clear on its website that it does not cover hearing aids under Part AMedicare Part A is hospital coverage for Medicare beneficiaries. It covers inpatient care in hospitals and skilled nursing facilities. It also covers limited home healthcare services and hospice care…. and Part BMedicare Part B is medical coverage for people with Original Medicare benefits. It covers doctor visits, preventative care, tests, durable medical equipment, and supplies. Medicare Part B pays 80 percent of most medically necessary healthcare… . It also does not cover routine hearing exams. Under Original Medicare, you will be paying for your hearing-related services completely out-of-pocket.Medicare.gov, Hearing aids, Accessed November 17, 2021

Read Also: How Much Does Social Security And Medicare Take Out

What Is The Cost Of Cataract Surgery With Medicare

According to Medicare.gov, having cataract surgery at an ambulatory surgical center costs about $1,789 . Medicare pays $1,431 of that total, which means the patient pays $357.

On the other hand, having cataract surgery in a hospital outpatient department costs $2,829 . Medicare pays $2,263 of that total, so the patient pays $565. These estimates vary based on where you live and the complexity of your cataracts.

The cost of cataract surgery with Medicare Advantage varies widely based on your specific plan. Contact a customer service representative with your provider to discuss what you can expect to pay before undergoing the procedure.

Medigap Plans Can Help Cover Your Medicare Costs

Keeping up with exactly how much Original Medicare will cover and not cover can be stressful, especially if youre worrying about keeping medical costs down.

Medigap plans can help fill in the coverage gaps left behind by Original Medicare and help you pay less out of pocket for medical costs.

Some Medigap plans even offer coverage for services not covered by Original Medicare at all, such as emergency health care while traveling abroad.

There are 10 standardized Medigap plans available in most states. You can use the 2019 Medigap plans comparison chart below to compare the benefits of each type of plan.

Read Also: When Is Medicare Supplement Open Enrollment

Services Paid For By Someone Else

Medicare interacts with other payers when beneficiaries have other sources that are legally liable for supporting the medical costs. Examples include private insurance, Medicare, workers compensation, and compensation received from a personal injury lawsuit. Nonetheless, theres a limit on what Medicare will pay for. For instance, it doesnt reimburse community mental health centers, although similar clinics are reimbursed.

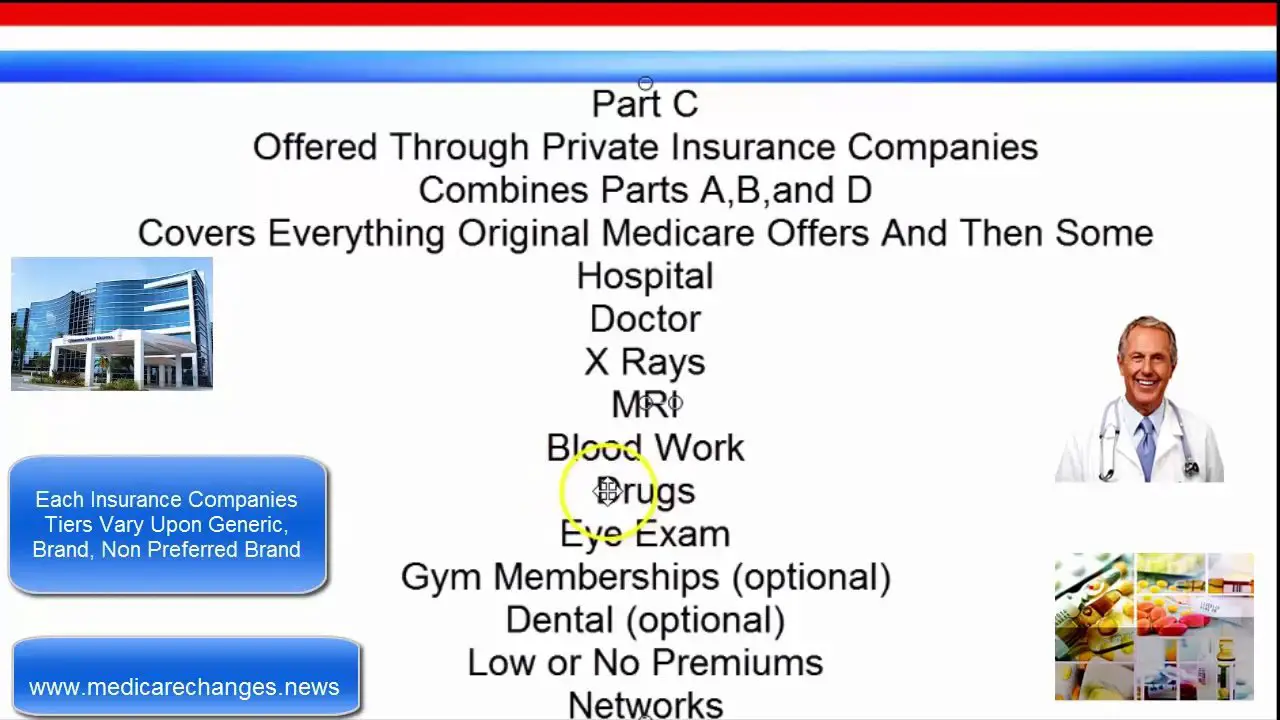

How To Get Coverage For Extra Services

If you need coverage for items or services that Original Medicare doesnt cover, you have a workaround: You can enroll in a Medicare Advantage plan.

Medicare Advantage plans, also known as Medicare Part C, are plans offered by private insurance companies and approved by Medicare. Medicare Advantage plans combine your Part A and Part B benefits into one plan, and most plans also include prescription drug coverage, too.

They may cover additional services and items that arent covered by Original Medicare. For example, Medicare Advantage plans often cover vision, hearing, and dental care, and some will even pay for wellness programs.

In addition to your Medicare Part B premium, some Medicare Advantage plans have a monthly premium. According to the Kaiser Family Foundation, the average monthly premium for a Medicare Advantage plan was $25 in 2020, making it an affordable alternative to Original Medicare if you need extra coverage.

To find a plan that works for you, use the Medicare Plan Finder. You can view available plans, see coverage options, and compare prices. By using the tool, you can ensure you choose the right Medicare plan for you that covers all of the services you use.

Don’t Miss: Is Blood Pressure Monitor Covered By Medicare

What Does Part A Cost

With Medicare Part A, you may have to pay copays and deductibles for hospital stays, but may not have to pay a monthly premium. Copays and deductibles apply to hospital benefit periods, which start when you enter a hospital or skilled nursing facility, and end 60 days after youve left the facility . Its important to note that:

- For each hospital benefit period, you pay a deductible.

- You pay a copay if youve stayed in a hospital for more than 60 days.

- Theres no deductible or copayment for home health care or hospice care.

For many people, Part A comes without a monthly premium. You may have no monthly premium if you paid a certain amount toward Medicare taxes while working. In this case, you are often automatically enrolled in premium-free Part A.

If you dont automatically get premium-free Part A, you may be able to buy it if you :

- Are age 65 or older and allowed to Part B to meet the citizenship and residency requirements.

- Are under age 65 and are disabled but no longer get premium-free Part A because you returned to work.

Whats The Difference Between Medicare Part A And Medicare Part B

Part A is the hospital services part of Medicare. This benefit covers inpatient care, hospital stays, skilled nursing facility care, hospice care, and medically needed home health care services.

Part B is the medical services part of Medicare. It covers many of the medically necessary services not covered in Part A, such as outpatient and preventive services. This involves things like x-rays, bloodwork, doctors visits, and outpatient care. It will also cover other medical items such as diabetic test strips, nebulizers, and wheelchairs.

Recommended Reading: How Much Is The Cost Of Medicare Part B

Medicare Dental Coverage Under Medicare Advantage

If youd like to get more comprehensive dental coverage under Medicare, you might want to consider a Medicare Advantage plan, available under the Medicare Part C program. Offered through Medicare-contracted private insurance companies, these plans are required to offer at least the same coverage as Original Medicare in other words, a Medicare Advantage plan would cover dental care under the same situations as Original Medicare. In addition, many Medicare Advantage plans offer additional benefits such as routine dental or vision care, wellness programs, and prescription drug coverage.

While Medicare dental benefits may vary by plan, some of the services you may be covered under a Medicare Advantage plan may include routine dental exams, cleanings, X-rays, fillings, crowns, root canals, and more. Some Medicare Advantage plans may require you to use dentists in provider networks when receiving care, or you may have the option to use non-network dentists but at a higher cost-sharing level you can check with the specific plan youre considering for more details.

Keep in mind that there may be certain costs related to your dental coverage, including deductibles, copayments, and or/coinsurance. In addition, youll need to keep paying your Part B premium if you enroll in a Medicare Advantage plan, along with any monthly premium required for your plan.

What Is Medicare Advantage

Medicare Advantage, also known as Medicare Part C, is a type of health plan offered by private insurance companies that provides the benefits of Parts A and Part B and often Part D as well. These bundled plans may have additional coverage, such as vision, hearing and dental care.

Unlike Original Medicare, Medicare Advantage plans have an annual limit on out-of-pocket costs. Medicare Advantage plans are typically HMOs or PPOs and are available only in certain areas.

Read Also: Does Medicare Pay For Maintenance Chiropractic Care

Medicare Part B Premiums

| Above $85,000 | $428.60 |

Basic Medicare does not cover prescription drugs, although you have the option of getting coverage when you first sign up for Medicare. If you choose not to and change your mind later, you’ll pay a life-lasting penalty unless you meet certain exclusions .

You can get this coverage either through a standalone prescription drug plan or through a Part C plan, which is also called a Medicare Advantage Plan.

If you go with the latter, which often includes some extra benefits above basic Medicare, your Part A and Part B coverage also will be delivered via the insurance company offering the plan.

How Much Does Original Medicare Cost

People usually dont pay a monthly premium for Medicare Part A coverage if they or their spouse paid Medicare taxes while working. For Medicare Part B, most people pay a standard monthly premium. Some people may pay a higher Medicare Part B premium based on their income. Additional information about Part B premiums can be found on our Medicare Part B page.

Recommended Reading: Where Do You Apply For Medicare

Learn More About Medicare Dental Coverage

If youre interested in Medicare dental coverage, I can find Medicare Advantage plan options that may offer routine dental benefits. To learn more about me, see my photo below and click the View profile link read more about my background. You can schedule a one-on-one phone call or request an email from me with more plan information find both of those links below as well. If you want to compare plan options now, click the Compare Plans button on this page.

This website and its contents are for informational purposes only. Nothing on this website should ever be used as a substitute for professional medical advice. You should always consult with your medical provider regarding diagnosis or treatment for a health condition, including decisions about the correct medication for your condition, as well as prior to undertaking any specific exercise or dietary routine.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

What Does Medicare Part A Cost

Depending on your income, you may have to pay a premium for Part A coverage. If you have worked and paid FICA taxes for 10 years, you pay no premium for Part A. However, You may have to pay copayments or a deductible for any services under Medicare Part A. You can apply for assistance or help if you cant pay.

According to Medicare, in addition to a $1,484 deductible, your 2021 Part A costs include:

- $0 coinsurance for hospitalization days 160

- $371 coinsurance per day for hospitalization days 6190

- $742 coinsurance per day for hospitalization day 91 and beyond for each lifetime reserve day

- all costs for each hospitalization day over your lifetime reserve days

- no charge for the first 20 days of approved skilled nursing facility care

- $185.50 per day for 21100 days of approved skilled nursing facility care

- all costs after 101 days of approved skilled nursing facility care

- no charge for hospice care

For hospital services to be covered by Medicare, you must be approved and receive care in a Medicare-approved facility.

- diabetes supplies

Also Check: Will Medicare Pay For An Inversion Table