If Your Income Has Gone Down

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

How The Age You Retire Affects Your Benefits

You can apply for Social Security retirement benefits once youve turned 62. However, youll receive more money per month if you wait a few years. People who start collecting retirement benefits at 62 will receive 70 percent of their full benefit amount. You can receive 100 percent of your benefit amount if you dont start collecting until full retirement age.

The full retirement age for people born after 1960 is 67. If you were born before 1960, refer to this chart from Social Security to see when youll reach full retirement age.

You can qualify for additional benefits if you have a limited income. Known as Supplemental Security Income , these benefits are for people with limited income who qualify for Social Security because of age or disability.

You May Like: How Do They Determine Social Security

If You’re Not Sure Why You Received A Payment

If you receive a check or direct deposit payment from the Treasury Department and do not know what its for, contact the regional financial center that issued it.

If you received a check, look for the RFCs city and state at the top center. Then contact that RFC to find out which federal agency authorized the payment. It will be one of these:

If you received payment byelectronic funds transfer , or direct deposit, follow the directions under Find Information About a Payment.

Use the Treasury Check Verification System to verify that the check is legitimate and issued by the government.

Don’t Miss: Does Medicare Cover Dementia Care Facilities

Who Is Eligible For Medicare

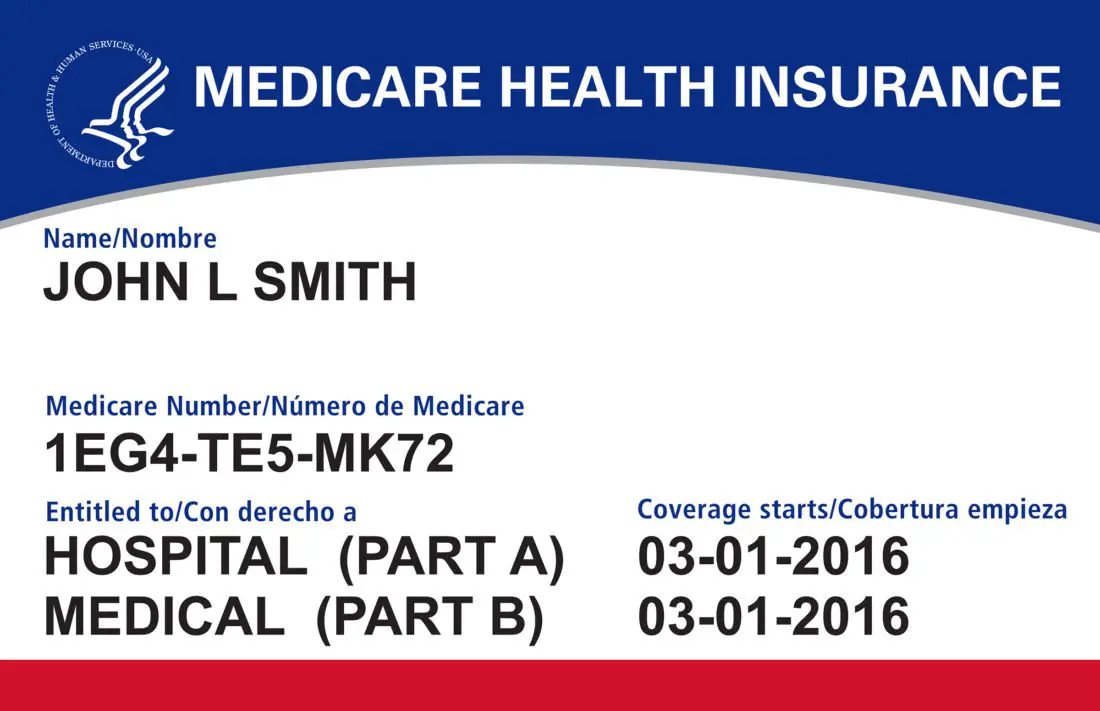

Most people enroll in Medicare when they turn 65. You can enroll as early as three months before your 65th birthday or as late as three months after. Youll need to be a United States citizen or have been a permanent legal resident for at least five years. In order to get full coverage, you or your spouse need to meet a work requirement. Meeting the work requirement verifies that youve paid into the system.

How Fica Tax And Tax Withholding Work In 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

Payroll taxes, including FICA tax or withholding tax, are what your employer deducts from your pay and sends to the IRS, state or other tax authority on your behalf. Here are the key factors, and why your tax withholding is important to monitor.

Don’t Miss: Does Medicare Cover Cancer Treatment Centers Of America

Social Security And Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, , Employers Tax Guide for more information or Publication 51, , Agricultural Employers Tax Guide for agricultural employers. Refer to Notice 2020-65 and Notice 2021-11 for information allowing employers to defer withholding and payment of the employees share of Social Security taxes of certain employees.

How Much Is Deducted From Social Security For Medicare Part B

There is no premium-free version of Medicare Part B. If you are enrolled in Part B and receive Social Security benefits, then your Medicare Part B premiums are deducted automatically. If you are enrolled in Part B but do not receive Social Security benefits, you have to pay your monthly premium online or by check.

The standard monthly premium for Part B is $170.10 in 2022. However, there may be an additional amount you pay each month depending on your income.

This additional fee is called the Income-Related Monthly Adjustment Amount . The amount varies depending on the income that you reported to the IRS on your most recent tax return. In 2022, the highest your monthly premium will be is $578.30. Fewer than 5% of Medicare beneficiaries owe IRMAA.

The table below shows the additional amount you’d owe for IRMAA at each income level.

Recommended Reading: Does Medicare Pay For A Caregiver In The Home

Fact #: Most Elderly Beneficiaries Rely On Social Security For The Majority Of Their Income

Social Security provides the majority of income to most elderly Americans. For about half of seniors, it provides at least 50 percent of their income, and for about 1 in 4 seniors, it provides at least 90 percent of income, across multiple surveys and the study that matches survey and administrative data.

What Should You Do Once You Get Medicare

Although you can rely on Original Medicare alone, 86% of Medicare enrollees also have some type of additional coverage.2 It can be from an employer, a privately-purchased plan or from a government-run program like Medicaid. Original Medicare pays for a great deal of healthcare, but still leaves you with potentially costly gaps in healthcare coverage. Supplementary plans can cover these gaps including deductibles and copayments at a fraction of the out-of-pocket rate.

MedicareGuide.coms plan selector is designed to intelligently bring you the best Medicare Supplement plans. These plans, also known as Medigap policies, fill the gaps in coverage that you would otherwise be charged by Original Medicare.

Recommended Reading: What Is The Annual Deductible For Medicare Part A

How Much Medicare Is Taken Out Of Social Security Check

There are actually two different rate components, broken out as follows:

- The Social Security withholding rate is gross pay times 6.2% up to the maximum pay level for that year. This is the employees portion of the Social Security payment. You as the employer must pay 6.2% with no limit.

- The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you dont have to pay the additional 0.9%

- For a total of 7.65% withheld, based on the employees gross pay.

How To Appeal A Part B Premium Income Adjustment

You may request an appeal if you disagree with a decision regarding your income-related monthly adjustment amount. Complete a Request for Reconsideration or contact your local Social Security office to file an appeal.

You may be able to skip the formal appeal and simply provide documentation if your income changed due to any of the following:

- You married, divorced or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property due to a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy or reorganization.

These methods apply to the Part B premium. Contact the IRS if you disagree with your adjusted gross income amount, which is provided to Medicare by the IRS.

Recommended Reading: How Much Does Medicare Pay For Inpatient Psychiatric Care

The Tax On Combined Types Of Income

An adjustment can be made on Form 8959 beginning at line 10, if youre calculating the AMT on both self-employment income and wages. This adjustment functions to ensure that the Additional Medicare Tax is calculated only once on wages and only once on self-employment income when theyre combined and exceed the threshold amount.

Individuals with wages subject to the FICA tax and self-employment income subject to the self-employment tax can calculate their liabilities for Additional Medicare Tax in three steps:

- Step 1: Calculate the Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld.

- Step 2: Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

- Step 3: Calculate the Additional Medicare Tax on any self-employment income in excess of the reduced threshold.

Net self-employment income cant be less than zero for purposes of calculating the Additional Medicare Tax, so business losses cant reduce the tax owed on wage compensation.

Read Also: How Much Does Medicare Pay For Urgent Care Visit

Spouses And Social Security Retirement Benefits

Your spouse can also claim up to 50 percent of your benefit amount if they dont have enough work credits, or if youre the higher earner. This doesnt take away from your benefit amount. For example, say you have a retirement benefit amount of $1,500 and your spouse has never worked. You can receive your monthly $1,500 and your spouse can receive up to $750. This means your household will get $2,250 each month.

Don’t Miss: What Is The Requirement For Medicare

Get Ssa Benefits While Living Overseas

U.S. citizens can travel to or live in most, but not all, foreign countries and still receive their Social Security benefits. You can find out if you can receive benefits overseas by using the Social Security Administrations payment verification tool. Once you access the tool, pick the country you’re visiting or living in from the drop-down menu options.

How Much Do Part A Premiums Cost

If you paid Medicare taxes for under 30 quarters, the Part A premium is $499 in 2022. Those who paid Medicare taxes for 30 to 39 quarters will pay $274 per month in premiums. Please note that, if you have to pay monthly Medicare premiums, you cannot qualify for Social Security benefits. In that case, you will not have to worry about money being taken out for now.

Read Also: What Age Does Medicare Eligibility Start

How Medicare Supplements Work With Your Part B Premiums

Most people will still need to pay for Part B premiums if they have a Medicare Supplement or Medicare Advantage plan. With Original Medicare, Part A is usually free. If you work for at least 40 quarters and pay into the system then you are also entitled to Part B.

There is a premium associated with Part B, but not everyone has to pay it. Those individuals would get assistance through the Medicare Savings Program or other programs through Medicaid.

Monthly Medicare Premiums For 2021

The standard Part B premium for 2021 is $148.50. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $88,000 Married couples with a MAGI of $176,000 or less | 2021 standard premium = $148.50 |

| Your plan premium + $77.10 |

Don’t Miss: Is Medicare Medicaid The Same

Medicare Part A Deductible

Medicare Part A covers certain hospitalization costs, including inpatient care in a hospital, skilled nursing facility care, hospice and home health care. It does not cover long-term custodial care.

For 2021, the Medicare Part A deductible is $1,484 for each benefit period. If you re-enter the hospital or skilled nursing facility any time after your benefit period ends, you will have to pay the first $1,484 again as a new deductible.

For 2021, your Medicare Part B deductible is $203. Thats up from $198 in 2020.

Unlike Medicare Part A, there is no benefit period tied to Medicare Part B.

After meeting the deductible, youll usually have to pay 20 percent of the Medicare-approved costs for most doctor services, outpatient care and durable medical equipment things such as wheelchairs or walkers your doctor may order for you.

- Alice Grahns, Senior Digital Consumer Reporter

- 14:11 ET, Sep 20 2021

SOCIAL Security claimants expecting a boost to their payments in 2022 may find the raise wiped out by Medicare premiums.

The cost-of-living adjustment of Social Security is expected to rise by 6% or 6.1% next year, which would mark the biggest hike since 1982.

Based on the current average benefit of $1,543, an increase of this size would mean a hike of between $92.58 and $94.123.

Meanwhile, those receiving the maximum payout of $3,895 each month can expect a monthly boost of between $233.70 and $237.595.

B Premium Can Be Limited By Social Security Cola But That Wasnt An Issue For Most Beneficiaries In 2020 Or 2021

In 2021, most enrollees pay $148.50/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2020 and in 2019 . But thats in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium. The standard premium in 2018 was actually $134/month, but the cost of living adjustment for Social Security wasnt quite large enough to cover all of the increase from 2017s premium for most enrollees. Thats why most people paid about $130/month.

The standard Part B premium increased by about $9/month in 2020. But the 1.6% Social Security COLA for 2020 increased the average beneficiarys Social Security benefit . Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees paid the standard premium in 2020. And for 2021, the 1.3% COLA was adequate to cover the increase to the new standard premium for virtually all enrollees.

Read Also: Silverdale Social Security Office

Recommended Reading: How Long Do You Have To Sign Up For Medicare

How Much Is Social Security Taxed At Full Retirement Age

Even if you work past full retirement age, you still have to make applicable Social Security contributions on your income. However, if you work past full retirement age, you can increase the amount of Social Security Benefits you receive.

Once you start receiving Social Security benefits, your income will determine if you pay income tax on part of your Social Security income. For more information, refer to question #2: How Much Social Security Income Is Taxable?

The Five Ways To Pay For Medicare

There are several ways to pay for Medicare premiums. They accommodate the preferences and user situations by offering several modes in addition to online bill pay.

- Automatic deductions from Social Security

- Automatic payment from a bank accounts online bill pay service

- Medicare Easy Pay is a free service from Medicare that deducts the payment from the members bank account on an agreed date of the month.

- Medicare offers the paper mail method for payments. The pre-addressed coupon directs the check to the Medicare Premium Collection Center.

Recommended Reading: Do Doctors Have To Accept Medicare Advantage Plans

What If Youre Still Working At 65

If youre still working at 65 and receiving health insurance through your employer, you may still need to sign up for Medicare. If your company offers health insurance and has fewer than 20 employees, your health insurer will refuse to pay for costs that Medicare would have covered. Signing up for Medicare will ensure that those costs are covered.

If your company has more than 20 employees, its still a good idea to enroll in free Part A coverage right away. Your coverage will be free since you already paid Medicare taxes. However, if you have a Health Savings Account, you wont be able to contribute to it once you enroll in Medicare, even if you only enroll in Part A.

Where Can I Find More Information

To find more information about Maryland programs for seniors, visit www.aging.maryland.gov. You can also call 410-767-1100, 800-243-3425 , or 410-767-1083 . The Centers for Medicare and Medicaid Services offer consumer resources at www.medicare.gov and 1-800-MEDICARE. The Social Security Administration has several helpful publications on its website, visit .

You May Like: Does Medicare Pay For Someone To Sit With Elderly

How To Receive Federal Benefits

To begin receiving your federal benefits, like Social Security or veterans benefits, you must sign up for electronic payments with direct deposit.

If You Have a Bank or Credit Union Account:

- Call the Go Direct Helpline at .

If You Don’t have a Bank or Credit Union Account:

- Direct Express debit card – a pre-paid debit card. Get help by calling the Go Direct Helpline at .

Make Changes to an Existing Direct Deposit Account:

Learn how to make changes to an existing direct deposit account. You also may contact the federal agency that pays your benefit for help with your enrollment.