What Differs By State

Medicare Advantage plans are offered by both local insurance companies and large national companies. No matter which company you go with, your plan will be specific to where you live.

Many plans are only available in a certain state, region, city, or even a single ZIP code. Even if the plan has the same name and covers the same services, your ZIP code could affect the price you pay.

Both Medicare Part D and Medigap plans work similarly. Like Medicare Advantage plans, theyre offered by private companies. You purchase them in addition to your original Medicare coverage, and the plans that are available to you will depend on where you live.

In general, plans in all states need to follow the same rules. For example, all Medicare Advantage plans must cover all the same services as original Medicare.

An exception to this is Medigap plans. In most states, Medigap plans will have the same letter names across all insurance companies and offer the same coverage. However, thats not the case in Minnesota, Wisconsin, and Massachusetts. All three of these states have their own Medigap regulations and plan types.

Who Runs Medicare And Medicaid

The federal government runs the Medicare program. Each state runs its own Medicaid program. Thats why Medicare is basically the same all over the country, but Medicaid programs differ from state to state.

The Centers for Medicare and Medicaid Services, part of the federal government, runs the Medicare program. It also oversees each states Medicaid program to make sure it meets minimum federal standards.

Although each state designs and runs its own Medicaid program, all Medicaid programs must meet standards set by the federal government in order to get federal funds .

In order to make significant adjustments to their Medicaid programs, states must seek permission from the federal government via a waiver process.

What Services Does Medicaid Cover

Medicaid covers more than 60 percent of all nursing home residents and roughly 50 percent of costs for long-term care services and supports.

Federal rules require state Medicaid programs to cover certain mandatory services, such as hospital and physician care, laboratory and X-ray services, home health services, and nursing facility services for adults. States are also required to provide a more comprehensive set of services, known as the Early and Periodic Screening, Diagnostic, and Treatment benefit, for children under age 21.

States can and all do cover certain additional services as well. All states cover prescription drugs, and most cover other common optional benefits include dental care, vision services, hearing aids, and personal care services for frail seniors and people with disabilities. These services, though considered optional because states are not required to provide them, are critical to meeting the health needs of Medicaid beneficiaries.

About three-quarters of all Medicaid spending on services pays for acute-care services such as hospital care, physician services, and prescription drugs the rest pays for nursing home and other long-term care services and supports. Medicaid covers more than 60 percent of all nursing home residents and roughly 50 percent of costs for long-term care services and supports.

How Much Does Medicaid Cost? How Is It Financed?

Don’t Miss: Does Medicare Cover Acupuncture Services

Medicare Vs Medicaid: The Important Differences To Know

In the United States, there are currently two government-provided health insurance policies that citizens can enroll in: Medicare and Medicaid.

While they both provide general health insurance benefits, there are differences in eligibility and coverage that are crucial to identify and be aware of the largest being that Medicare is available to adults who are over 65 years old whereas Medicaid is only available to low-income families.

Medicaid is usually cheaper than Medicare, providing those who are near or below the poverty line with free or low-cost coverage. In contrast, Medicare is open to all income levels and usually costs a few hundred dollars per month.

Find Cheap Medicare Plans in Your Area

What Does The Delaware Medicare Advantage Plan Consist Of

State officials say the Medicare Advantage plan has been specifically customized to state pensioners. Its called the Highmark BCBS Delaware Freedom Blue PPO Medicare Advantage Plan. Its replacing the Medicfill Medicare Supplemental Plan.

Coverage, officials say, will remain the same for Medicare services and prescription drugs. Pensioners will also have access to the same doctors that accept Medicare. Heres a break down of the benefits, per the state:

- $0 co-pay for visits with your doctor

- $0 deductible for medical services

- $0 cost for skilled nursing facility services

- $0 cost for nationwide in and out-of-network coverage with out-of-network providers receiving the 100% Medicare allowable reimbursement for services provided

- $0 cost for lab and imaging

- $0 cost for emergency room and urgent care services

- Full and immediate coverage for pensioners with pre-existing conditions

The Medicare Advantage plan also includes other benefits like the Silver Sneakers fitness program membership and home meal service after a hospital discharge.

DeMatteis said the main priority when negotiating its plan with Highmark was to make sure that Delaware retirees would be able to keep their current health care providers.

This is not some off-the-shelf Medicare Advantage plan, she said. This Medicare Advantage plan was custom designed for state of Delaware pensioners to get them the same coverage that they previously had under the Medicare supplement plan.

You May Like: How Old Before Medicare Starts

Is Medicare Different In Each State

Home / FAQs / General Medicare / Is Medicare Different in Each State?

Although Medicare is a federal program, states can implement various rules if they meet the basic Medicare regulations. Most states implement rules to ease the requirements for seniors to make changes to their Medigap plans. Below, we will highlight unique Medicare rules and their applicable states.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Tn Ship: Tennesseans’ Medicare Resource

The Tennessee State Health Insurance Assistance Program is a federally funded program that provides free, unbiased counseling and assistance to Tennessee’s Medicare-eligible individuals, their families, and caregivers. We do not promote any insurance agency, and we maintain confidentiality with all of our clients. Whether you are new to Medicare or a seasoned beneficiary, our trained counselors can assist you with all of your Medicare questions.

Contact us at 1-877-801-0044 or email us at [email protected]!

Recommended Reading: When Will I Get Medicare

Who Is Eligible For Medicaid

Medicaid is an entitlement program, which means that anyone who meets eligibility rules has a right to enroll in Medicaid coverage. It also means that states have guaranteed federal financial support for part of the cost of their Medicaid programs.

In order to receive federal funding, states must cover certain mandatory populations:

- children through age 18 in families with income below 138 percent of the federal poverty line

- people who are pregnant and have income below 138 percent of the poverty line

- certain parents or caretakers with very low income and

- most seniors and people with disabilities who receive cash assistance through the Supplemental Security Income program.

States may also receive federal Medicaid funds to cover optional populations. These include: people in the groups listed above whose income exceeds the limits for mandatory coverage seniors and people with disabilities not receiving SSI and with income below the poverty line medically needy people and other people with higher income who need long-term services and supports and thanks to the Affordable Care Act non-disabled adults with income below 138 percent of the poverty line, including those without children. The ACA was intended to extend coverage to all such adults, but a 2012 Supreme Court decision gave states the choice of whether to expand their programs.

Guaranteed Issue Rights And Open Enrollment Periods

Guaranteed issue rights are protections for Medicare enrollees in certain situations. These rights prevent insurance companies from denying enrollment in certain Medigap policies when beneficiaries meet specific criteria.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

To utilize guaranteed issue rights, beneficiaries must abide by MACRA when selecting their plan. At this time, only those who got Medicare Part A before January 1, 2020, can sign up for Medicare Supplement Plan F or Medicare Supplement Plan C.

Like Open Enrollment Periods, guaranteed issue rights, let you enroll in a Medigap plan with no underwriting health questions. Those who receive Medicare after January 1, 2020, must abide by MACRA when in an open enrollment period. Thus, individuals with Medicare since before January 1, 2020, may enroll in any Medigap plan they wish.

You May Like: Is Healthfirst Medicaid Or Medicare

Should I Take Medicare Part B

You should take Medicare Part A when you are eligible. However, some people may not want to apply for Medicare Part B when they become eligible.

You can delay enrollment in Medicare Part B without penalty if you fit one of the following categories.

Employer group health plans may cover items normally not covered by Medicare Part B. If so, and you meet one of the categories above or below, then you may not need to enroll in Medicare Part B and pay the monthly premium.

If you are:

- a spouse of an active worker

- a disabled, active worker

- a disabled spouse of an active worker

and choose coverage under the employer group health plan, you can refuse Medicare Part B during the automatic or initial enrollment period. You wait to sign up for Medicare Part B during the special enrollment period, an eight month period that begins the month the group health coverage ends or the month employment ends, whichever comes first.

You will not be enrolling late, so you will not have any penalty.

If you choose coverage under the employer group health plan and are still working, Medicare will be the “secondary payer,” which means the employer plan pays first.

If the employer group health plan does not pay all the patient’s expenses, Medicare may pay the entire balance, a portion, or nothing. An employer group health plan must be primary or nothing.

Medicaid Facilitates Access To Care

A large body of research shows that Medicaid beneficiaries have far better access to care than the uninsured and are less likely to postpone or go without needed care due to cost. Moreover, rates of access to care and satisfaction with care among Medicaid enrollees are comparable to rates for people with private insurance . Medicaid coverage of low-income pregnant women and children has contributed to dramatic in the U.S. A growing body of research indicates that Medicaid eligibility during childhood is associated with reduced teen mortality, improved long-run educational attainment, reduced disability, and lower rates of hospitalization and emergency department visits in later life. Benefits also include second-order fiscal effects such as increased tax collections due to higher earnings in adulthood. Research findings show that state Medicaid expansions to adults are associated with increased access to care, improved self-reported health, and reduced mortality among adults.

Figure 7: Nationally, Medicaid is comparable to private insurance for access to care the uninsured fare far less well.

Also Check: Is Medicare Advantage Part C

Medicare Supplement Plans For Those Under 65

Often, Medicare Supplement carriers will charge higher premiums to those under 65 on Medicare due to their high-risk disability status. Not every state requires companies to provide Medicare Supplement coverage to disabled individuals under 65, but those that do often have low enrollment for those under 65 due to the high premium costs.

States that require Medicare Supplement plan carriers to provide at least one plan to those under 65 include:

Differences In Medigap Plans Between States

Medicare Supplement insurance also known as Medigap policies help you cover your out-of-pocket expenses if you have Original Medicare. Its the only private Medicare-related insurance for which the federal government does not set a mandatory open enrollment period.

You have six months starting with your 65th birthday and once youre enrolled in Medicare Part B to buy a Medigap policy available in your area.

After that, youre often locked into the Medigap plan you choose. It is difficult or extremely expensive to switch to another Medigap plan in most states.

Medigap plans are standardized across most states, meaning they offer the same benefits. The exceptions are Wisconsin, Minnesota and Massachusetts. Plans in those states may have options that differ from Medigap plans in other states.

Examples of Rare State Rules for Medigap

Medicare does not require states to guarantee access to Medigap plans for people under 65 who qualify for Medicare due to a disability such as End-Stage Renal Disease or ALS . But most states have some type of rule in place giving people with these conditions access.

Also Check: Does Medicare Cover Laser Surgery

Medicaid Is The Nations Public Health Insurance Program For People With Low Income

Medicaid is the nations public health insurance program for people with low income. The Medicaid program covers 1 in 5 Americans, including many with complex and costly needs for care. The program is the principal source of long-term care coverage for Americans. The vast majority of Medicaid enrollees lack access to other affordable health insurance. Medicaid covers a broad array of health services and limits enrollee out-of-pocket costs. Medicaid finances nearly a fifth of all personal health care spending in the U.S., providing significant financing for hospitals, community health centers, physicians, nursing homes, and jobs in the health care sector. Title XIX of the Social Security Act and a large body of federal regulations govern the program, defining federal Medicaid requirements and state options and authorities. The Centers for Medicare and Medicaid Services within the Department of Health and Human Services is responsible for implementing Medicaid .

Figure 1: Medicaid plays a central role in our health care system.

Medicare Part B Premiums

State and California State University retirees and their dependents enrolled in a CalPERS Medicare health plan may be eligible for a reimbursement of all or part of their Medicare Part B premium .

Pursuant to the Public Employees Medical and Hospital Care Act section 22879, the following bargaining units with a first state hired date are not eligible for Part B premium reimbursement:

| Civil Service Bargaining Unit |

|---|

| 9, 10, and related employees |

| 1, 2, 3, 4, 6, 7, 8, 11, 12, 13, 14, 15, 17, 18, 19, 20, 21, related employees and the Judicial Branch |

| 5 and related employees |

If you or your dependents are eligible for Medicare Part B reimbursement, well automatically reimburse the eligible amount of the standard Medicare Part B premium, beginning the date of your enrollment into a CalPERS Medicare Health Plan. Your reimbursement will be listed on your warrant as Medicare Reimbursement.

If you receive SSA benefits, the Part B premium will be deducted from your SSA benefits otherwise, the SSA will bill you quarterly.

Each year, the Centers for Medicare and Medicaid Services announces the Medicare Part B premium amount. CalPERS sets the standard Medicare Part B premium reimbursement amount on January 1 based on the amount determined by the CMS. According to the CMS, most Medicare beneficiaries will pay the standard Medicare Part B premium amount.

Don’t Miss: Does Medicare Cover Dna Testing

Illinois Association Of Area Agencies On Aging

The Illinois Association of Area Agencies on Aging can connect you with one of its regional agencies, all of which provide a comprehensive selection of services for the regions older adults. The agencies have programs designed to help seniors 60 and older maintain their health and independence, including resources to guide you through the Medicare enrollment process, and the counselors will help you understand the available benefits fully.

Contact information: Website | 787-9234

Can I Be Covered By Both Medicare And Medicaid

It is possible to be eligible and covered by both Medicare and Medicaid. Within health care, it is known as being “dual eligible.” Typically, these individuals will be enrolled in Original Medicare but receive subsidized Medicaid benefits through Medicare Savings Programs such as the:

- Qualified Medicare Beneficiary Program

- Specified Low-Income Medicare Beneficiary Program

- Qualified Disabled and Working Individual Program

All of these programs would provide extra help for covering premiums, deductibles and coinsurance for Medicare.

If you don’t qualify for Medicaid when you are enrolled in Medicare, there are still options to help provide financial aid for Part A, B and D deductibles. This would include enrolling in a supplemental Medigap policy such as Medicare Part F, which is offered by private health insurance companies.

Read Also: What Does Medicare Part A And Part B Pay For

Are Medicare Supplement Plans Different In Each State

are the same regardless of the state where you enroll. There are 10 lettered plans and 2 high deductible Medicare Supplement plans that are standardized throughout the U.S. However, many states have state-specific rules in place to help the enrollment process for residents of the state who have Medicare.

Not every state offers state-specific perks and states that do each have their own rules how the rules can be used.

State-specific rules for Medicare Supplement plans include:

- State-Specific Medicare Supplement Plans

- Available plans for those under 65

- Employer coverage termination

Medicare Is A Federal Program With State Cooperation

All-in-all, federal taxes, federal administration, and federal standards govern the largest healthcare system in the country.

Our free comparison tool gives you a convenient way to find the private plans offered through Medicare Advantage, Part D prescription policies, and comprehensive care in Medicare Advantage.

Get started finding your best Medicare Advantage options

Read Also: What Is The Difference Medicare Part A And B

Medicare: The Federal Health Insurance In Parts

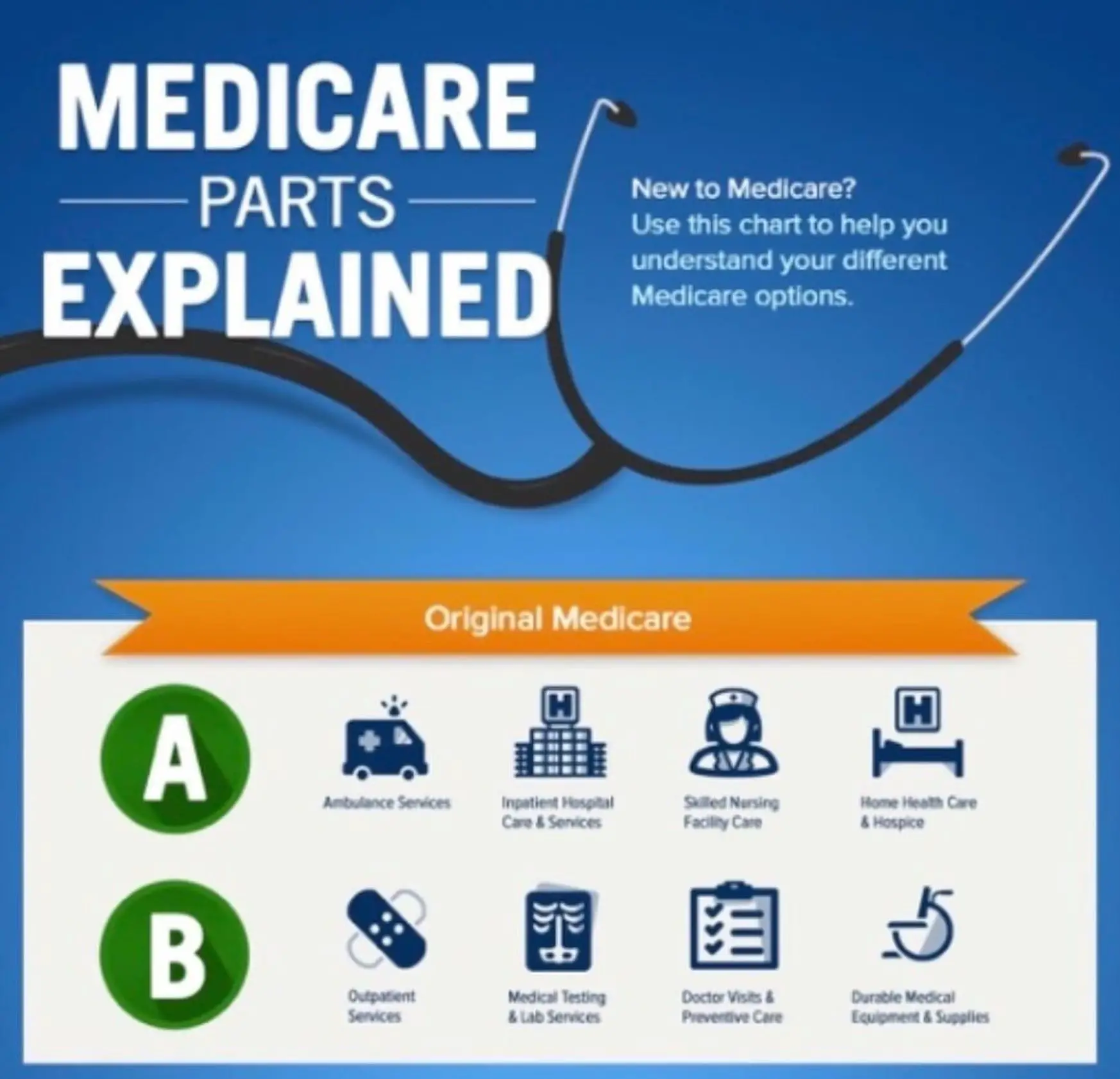

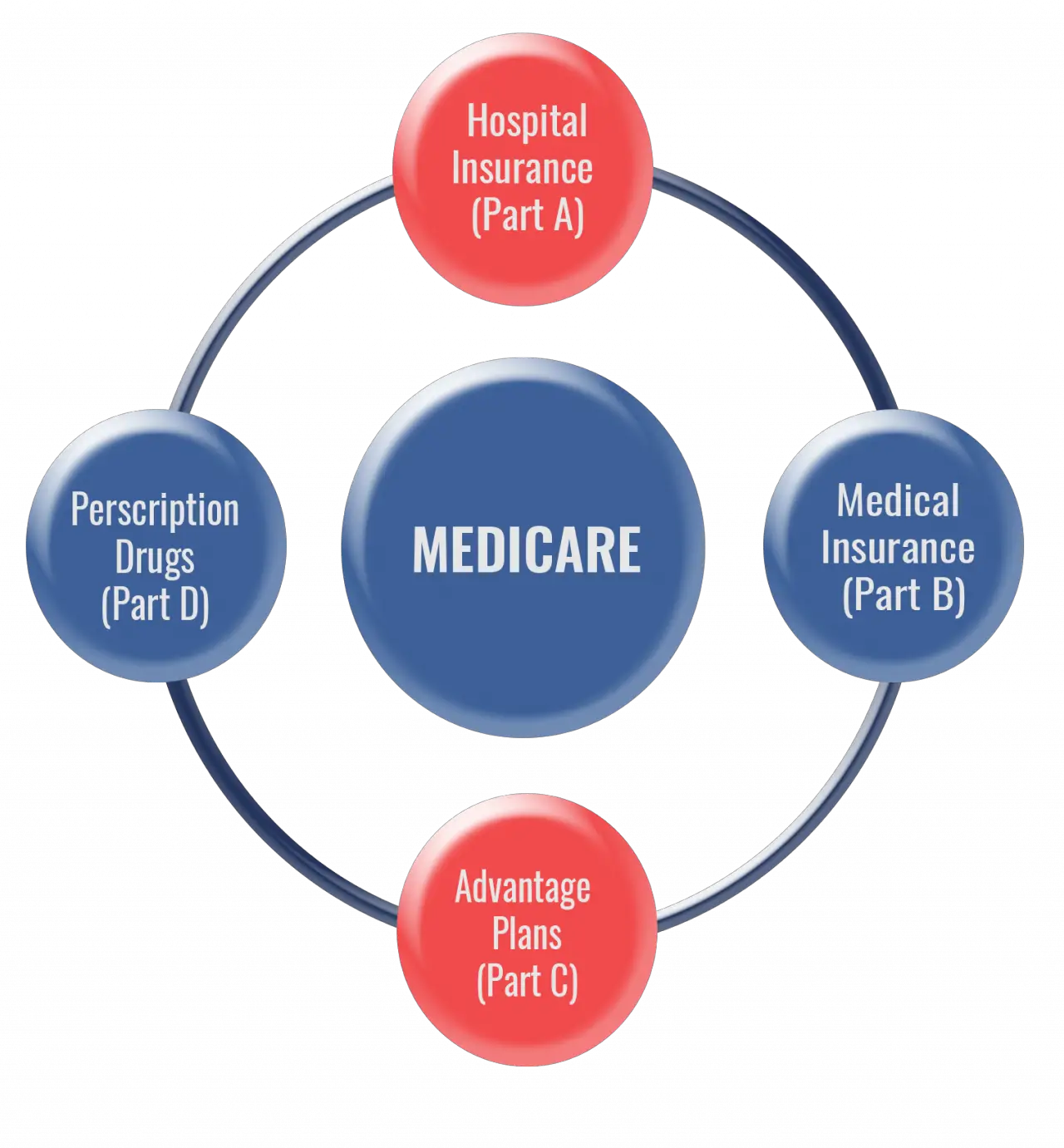

Medicare began as an amendment to the Social Security Act. The Original Medicare program encompassed the Medical Insurance of Part B and the Hospital coverage of Part A.

Listed below are the major parts of Medicare:

- Original Medicare Part A Inpatient Hospital Insurance.

- Original Medicare Part B Medical Insurance.

- Medicare Part C Medicare Advantage that include at least the coverage of Parts A and B, and many include Part D as well.

- Medicare Part D Prescription Drug coverage.

- Medigap supplemental policies Gap insurance which helps pay out-of-pocket costs for Medicare-covered services.