How Do Medicare Advantage Work For Provider Coverage

A frequently asked question about Medicare is: What doctors and facilities will I be able to use? You are comfortable with them, you trust them, and they are convenient for you. Therefore its important to understand that Medicare Advantage has two main plan types which differ in how you can access doctors:

In a Medicare Advantage HMO, you can only use in-network providers. An in-network provider is a doctor who is contracted by an insurance company, usually found within a specified list. In most cases, a referral from your primary care doctor is also required to see a specialist. You are also required to use network hospitals and medical facilities. Not all plan networks include all hospitals.

If you belong to a Medicare Advantage PPO, you can see both in-network and out-of-network doctors without needing a referral from your primary care doctor to see a specialist. Be prepared if you choose to visit an out-of-network doctor, you will usually pay more than you would an in-network doctor.

How Do You Enroll In Medicare Supplement

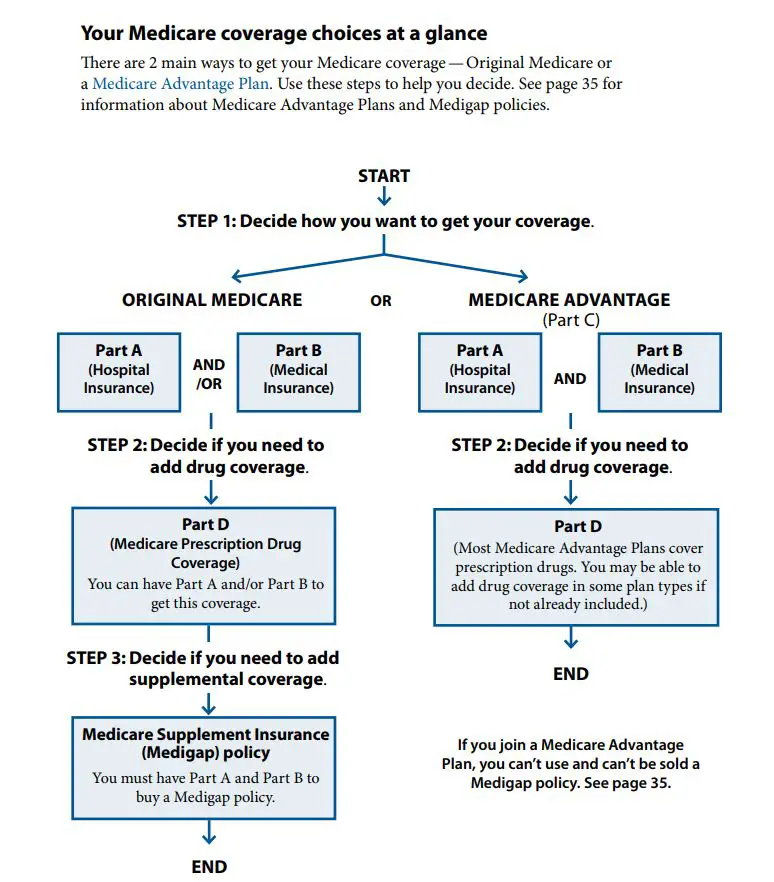

In order to enroll in a Medicare Supplement plan, you must first enroll in Medicare Parts A and B. If you only sign up for Medicare Part A when you turn 65, usually because you or your spouse are still working, then you will need to contact the Social Security Administration to enroll in Part B.

Once you are enrolled in Medicare Parts A and B, you can enroll in a Medicare Supplement plan. Its important to know that in the first six months of Medicare Part B enrollment, you can purchase a Medicare Supplement plan and not have to worry about preexisting conditions or being accepted. This is called the guaranteed issue right period. Any insurance provider must accept your application.

Medicare Supplement Plan Coverage

Every Medigap plan covers some of your costs for Part A, including coinsurance, extended hospital costs, and hospice care coinsurance or copayments.

All Medigap plans also cover some of your Part B costs, like coinsurance or copayments, deductible, and your first 3 pints of blood if you need a transfusion.

Read Also: How Does Medicare Work With Other Insurance

Does Medicare Cover Your Healthcare In Mexico

Mexico offers plenty of amazing destinations for travel, especially when Americans dont want to be too far from home. In fact, Mexico is often cited as one of the top vacation spots for retirees and older Americans who qualify for Medicare. Unfortunately, even the most relaxing vacation is not immune from unforeseen health issues, and many Medicare recipients wonder whether they will be covered by the program when traveling.

Does Medicare Cover Your Healthcare in Mexico?As a general rule, Medicare only provides coverage for recipients within the United States, including its territories. Even though Mexico is right next door, it is a separate country, and therefore, Medicare does not provide coverage for health-related expenses in Mexico. Mexican healthcare providers have their own system of care and social cost sharing, and foreigners are typically not able to access these programs without special circumstances.

With that stated, there may be a few exceptions where Medicare would cover some or all of the cost of healthcare in Mexico. The first would be when a Medicare recipient requires emergency care and the nearest medical facility is in Mexico. Such a situation may arise if you were to get sick at or near the border and a United States facility would be too far away to administer care in a crisis.

Medicare Supplement Coverage for Foreign Travel

Related articles:

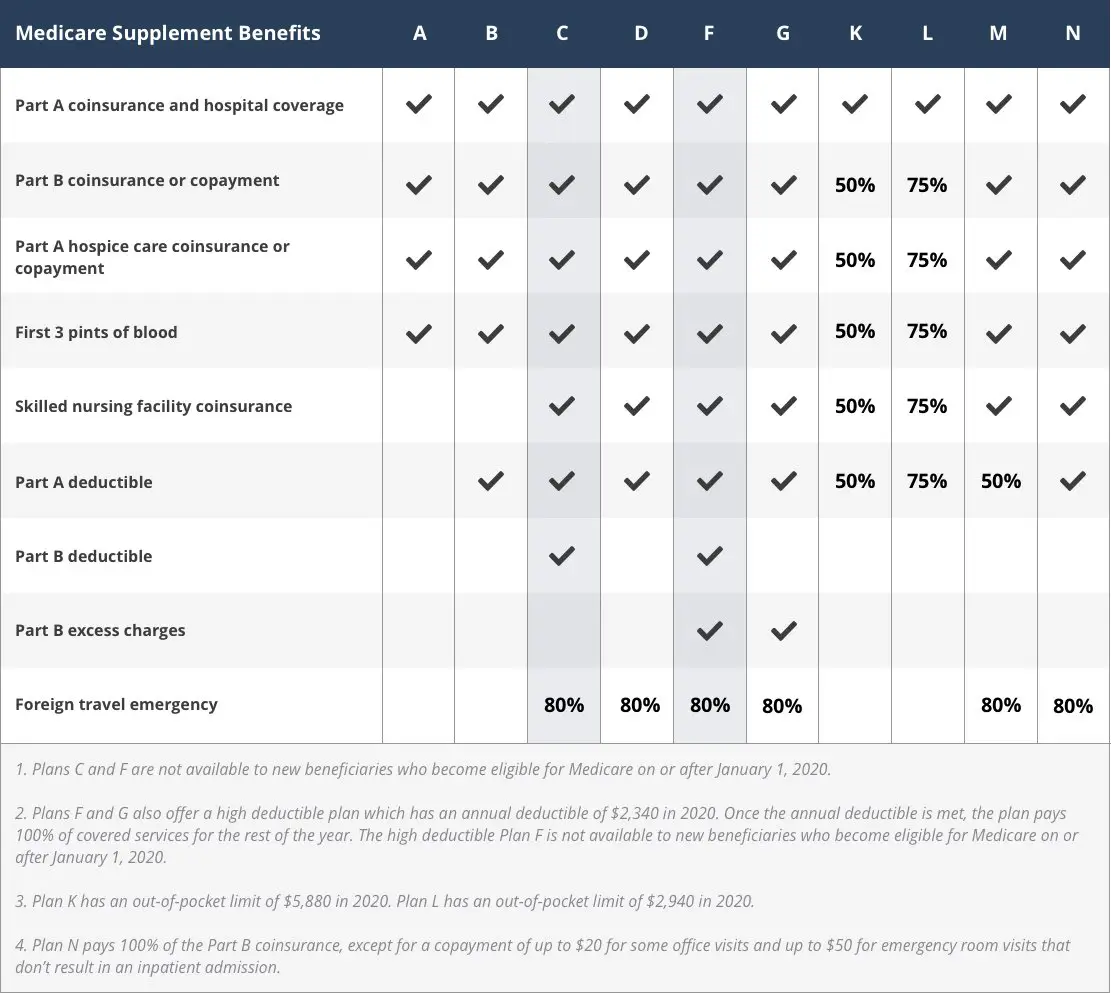

Medicare Supplement Insurance Plan Benefits

There are 10 Medigap insurance plans available in most states, and each plan type is designed by a different letter . Coverage is standardized across each plan letter, which means youll get the same basic benefits for Medicare Supplement coverage within the same letter category, no matter which insurance company you purchase from. However, even if basic benefits are the same across plans of the same letter category, premium costs may vary by insurance company and location. If you live in Massachusetts, Minnesota, or Wisconsin, keep in mind that these three states standardize their Medigap plans differently from the rest of the country.

Medigap plans cover out-of-pocket costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles. Some plans may help pay for other benefits Original Medicare doesnt cover, such as emergency health coverage outside of the country or the first three pints of blood. Medigap plans dont include prescription drug benefits. If you dont already have creditable prescription drug coverage , you should consider buying a separate stand-alone Medicare Part D Prescription Drug Plan to cover the costs of your prescription medications. Also, Medicare Supplement insurance plans generally dont offer extra benefits like routine dental, vision, or hearing coverage beyond whats already covered by Medicare.

You May Like: What Is Blue Cross Blue Shield Medicare Advantage

Plan F And Medicare Advantage

If you have Medicare Advantage, also known as Part C, then you wont be able to purchase a Medigap plan. The reason for this is that Medigap plans only cover out-of-pocket costs associated with Original Medicare.

Although you can have a Part D prescription drug plan along with a Medigap plan, the Medigap plan wont pay anything towards your Part D plan. Medicare Supplement plans only apply to out-of-pocket costs related to Original Medicare.

If you are interested in changing from a Medigap plan to a Medicare Advantage plan contact us at we offer Advantage plans as well.

Is Plan F Still Available?

Yes, Plan F is still available for those who became eligible for Medicare Part A prior to January 1st, 2020. These people can always buy a Plan F.

Can I change from a Medicare Advantage plan to a Medicare supplement plan?

Medicare Advantage plans are private insurance plans that cover the same things as Original Medicare. You cannot have a Medicare Supplement plan while you have Medicare Advantage. If you want a Medicare Supplement plan, you will have to switch to Original Medicare.

Does Medicare supplement Plan F cover prescriptions?

Medicare Supplement Plan F does not cover any prescription drugs. If you have Medicare and want prescription drug coverage, youll need to seek out a Part D prescription drug plan.

Does Medicare supplement Plan F cover skilled nursing facilities?

Choosing Traditional Medicare Plus A Medigap Plan

As noted above, Original Medicare comprises Part A and Part B . You can supplement this coverage with a stand-alone Medicare Part D prescription drug plan and a Medigap supplemental insurance plan. While signing up for Medicare gets you into Parts A and B, you have to take action on your own to buy these supplemental policies.

Recommended Reading: How Do I Know If I Have Part D Medicare

Medicare Supplement Plan F Vs G Which Is Better

Due to their similarities, youll often see Plan F compared to Plan G. Which plan is better depends on what you are looking for, and both are great plans to choose from and offer a lot of coverage.

In general, if you want Plan F but arent eligible to purchase it, then purchasing Plan G instead can be a good choice. Plan G offers the most coverage aside from Plan F. It also may end up being cheaper for you than Plan F.

The only difference between Plan F and Plan G is that Plan F covers the Part B deductible. This comes out to $233 in 2022. If you want to compare the cost of these plans overall, the way to do this is simple. Just take the annual premium amount for Plan G, and add $233. If this is still less than the Plan F annual premium amount, then Plan G will be cheaper for you.

Like Plan F, Plan G also comes in a high-deductible version. In 2022, the deductible can amount to $2,490. Before you pay this amount in out-of-pocket costs, your Medigap plan wont offer any coverage.

How Does Prescription Drug Coverage Work

Original Medicare won’t cover your prescription drugs. So you might want to sign up for Medicare Part D or a Medicare Advantage plan. These are optional benefits offered to everyone who has Medicare. Be sure to do your research because these plans can vary in cost and the drugs that they cover.

Plans that offer prescription drug coverage through Medicare Part D must provide a standard level of coverage set by Medicare. The list of prescription drugs that these plans cover varies, as well as the way they place drugs into tiers . These drugs are placed into different “tiers” on their formularies.

You can compare the prescription drugs you take with the Medicare Part D plans available in your area.

Can You Change Medicare Part D Plans Anytime?

You can, but the best time to sign up or change a Medicare Part D plan is during Medicare Open Enrollment. Otherwise, you might have to pay more for your policy.

Also Check: How Much Does Medicare Cover For Home Health Care

If My Retirement Is Delayed And I Continue Working Beyond Age 65 Must I Take Action With Medicare

Generally, you can postpone Medicare enrollment without penalties as long as you remain employed AND covered under your employers or unions group health plan.

However, here are a few exceptions:

- If your employer has less than 20 employees, you may need to enroll in Medicare. In this scenario, your employers health plan is secondary to Medicare. Contact your employers plan admin to find out more about your plan and how it works with Medicare.Reach out to your employers plan administrator to learn how your plan would work with Medicare.

- Retiree benefits and COBRA arent considered employee coverage. If youre covered through either of these, youll need to apply for Medicare once youre 65 or older.

- Should you retire during your Initial Enrollment Period, you wont be eligible for your Special Enrollment Period until the Initial Enrollment Period terminates. If you dont sign up during your Initial Enrollment Period, then you risk premium penalties and delays in coverage.

How Do Medicare Advantage Plans Work For Hospital Insurance

Medicare Advantage generally covers all the hospital insurance benefits that Medicare Part A covers including:

- Inpatient hospital care

- Skilled nursing facility care

- Home health care in certain circumstances

Your inpatient hospital care may have a coverage limit like 270 days for example. Some Medicare Advantage plans may cover unlimited days for an inpatient hospital stay. You may pay a copayment for a certain number of days and then not have a copayment for another period of days. As you compare Medicare Advantage plans remember that coverage costs and limits may differ from plan to plan.

Read Also: Is Stem Cell Treatment Covered By Medicare

D: Prescription Drug Plans

Medicare Part D went into effect on January 1, 2006. Anyone with Part A or B is eligible for Part D, which covers mostly self-administered drugs. It was made possible by the passage of the Medicare Modernization Act of 2003. To receive this benefit, a person with Medicare must enroll in a stand-alone Prescription Drug Plan or public Part C health plan with integrated prescription drug coverage . These plans are approved and regulated by the Medicare program, but are actually designed and administered by various sponsors including charities, integrated health delivery systems, unions and health insurance companies almost all these sponsors in turn use pharmacy benefit managers in the same way as they are used by sponsors of health insurance for those not on Medicare. Unlike Original Medicare , Part D coverage is not standardized . Plans choose which drugs they wish to cover . The plans can also specify with CMS approval at what level they wish to cover it, and are encouraged to use step therapy. Some drugs are excluded from coverage altogether and Part D plans that cover excluded drugs are not allowed to pass those costs on to Medicare, and plans are required to repay CMS if they are found to have billed Medicare in these cases.

How Much Medicare Supplement Insurance Coverage Will I Need

You can choose between higher-benefit plans , or you can opt for lower premiums with minimal benefits.

Plans with higher benefits offer the greatest amount of supplement coverage and may pay up to 100% of your out-of-pocket expenses for a wide variety of services.

Should you choose a lower-benefit plan, you can expect to pay a lower premium month to month but will pay more out-of-pocket for covered services

Also Check: Does Medicare Have Long Term Care Insurance

What Will Happen If I Dont Sign Up For Medicare During The Initial Enrollment Period When I Reach The Age Of 65

Youll still get a chance to apply during the Medicare General Enrollment Period, which occurs each year from January 1st to March 31st. Upon enrolling in coverage during this period, it will then take effect July 1st of that year. You can sign up for Medicare Part A, Medicare Part B if you didnt sign up initially during the General Enrollment Period. In certain situations, you will have to pay a penalty for late enrollment, however.

What Are Medicare Advantage Plans

Medicare.gov, the government Medicare website explains that Medicare Advantage Plans are sometimes called Part C or MA Plans, are an all in one alternative to Original Medicare. They are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, you still have Medicare. These bundled plans include Medicare Part A and Medicare Part B , and usually Medicare drug coverage .

Recommended Reading: Does Medicare Cover Accu Chek Test Strips

When Would You Need A Supplemental Medicare Policy

Medicare Supplement plans cover the costs that Original Medicare doesn’t. A Medicare Supplement plan fills the “gaps” that exist in Original Medicare.

Unless your employer or a union pays the healthcare costs that Original Medicare doesn’t pay, you may want to purchase a Medigap policy.

Private insurance companies sell Medicare Supplement insurance plans. They help pay for things like copayments, coinsurance, and deductibles. This makes sense if you’re on a budget, and you don’t want to be surprised by medical bills that you can’t afford.

The best time to sign up for a Medicare Supplement plan is during the Medicare Open Enrollment Period, which is October 15 through December 7 each year. Otherwise, you might have to pay more for your policy.

Jackie Trovato is a healthcare and legal writer with nearly 40 years of experience.

The Best Time To Switch Medigap Plans

The best time to switch your Medicare Supplement plan is during the Medigap Open Enrollment Period.

Your Medigap Open Enrollment Period starts when you enroll in Medicare Part B and lasts for six months. During this time you have guaranteed issue rights, which means you can enroll in any Medigap policy available in your state without medical underwriting. You can also switch to another plan without an insurance company factoring your health into the policy issuance.

You May Like: What Are The Four Different Parts Of Medicare

What Does Medicare Plan F Cover

Youll need to investigate the different Medigap plans to determine the right one for you. The comparison chart below will help.

Medicare Plan F provides the same healthcare coverage from state to state. In general, you can use it to cover the copayment for all medical costs and even the Medicare Part B deductible.

Another benefit covered by Plan F is Medicare Part B Excess ChargesA Medicare Part B excess charge is the difference between a health care providers actual charge and Medicares approved amount for payment….. These occur when your doctor or specialist does not accept the standard Medicare payment for a service. Medicare allows healthcare providers that do not accept Medicare assignmentAn agreement by your doctor to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance…. to charge up to 15 percent more. Without Plan F, you will pay these costs out-of-pocket.

Plan F also covers your big costs if you are admitted as an inpatient in the hospital or a skilled nursing facility. Your Medicare benefits cover these costs under Part A, but most people are taken by surprise when they see the per-benefit-period deductible. Plan F is one of these insurance plans that protect enrollees from these high out-of-pocket expenses.

Heres a side-by-side Medigap comparison chart:

When Can I Enroll In Medicare

Upon reaching the age of 65 and if you are getting Social Security or Railroad Retirement Board benefits, in many cases, you should automatically enroll in Medicare Parts A and B. If you do not happen to meet these criteria, you will then have to sign up for coverage. You are able to do this 3 months prior to your 65th birthday .

You May Like: Can I Get Glasses With Medicare

Are There Any Penalties If I Dont Enroll In Medicare During The Initial Enrollment Period

Yes, there could be premium penalties for Medicare Parts A and B should you happen to miss the initial enrollment dates, so we do recommend that you sign up when you are initially eligible.

The penalty for not enrolling in Medicare Part A entails 10% of the Part A premium. Youll pay the premium penalty for 2x the amount of years that enrollment is delayed. The 10% premium penalty applies regardless of how long the Medicare Part A enrollment is delayed. E.g. Should you be eligible for Medicare Part A for 1 year, but you did not enroll, then you will be charged higher premiums for 2 years.

Should you opt not to sign up for Medicare Part B when initially eligible, then you might need to pay a penalty to acquire it down the road. This penalty entails 10% of the Part B premium for every 12 months that enrollment was delayed, and youll need to pay the penalty for each month for the entirety of your Medicare Part B enrollment.

E.g. If your Initial Enrollment Period ended November 30, 2012, and you delayed enrollment for Medicare B until February 2015 during the General Enrollment Period, the Part B premium penalty is 20%. Although you waited 26 months to enroll, the penalty only includes the two full 12 month periods, BUT youll be paying the penalty for the entire duration that you have Medicare Part B.

You can delay enrollment in Medicare Parts A and B without penalty should you qualify for a Special Enrollment Period.