What Is Medicare Health Insurance

Funded and sponsored by the United States government, Medicare health insurance is designed for individuals who are age 65 or higher, or younger than 65, but with certain disabilities. Medicare is also available for anyone who has been diagnosed with kidney failure that requires daily dialysis.

Even if you are eligible for Medicare, you can still compare health insurance rates online. Just enter your zip code in the box above to get started.

Medicare health insurance has four different options, each of them with their own unique options and coverage. These different plans are known as:

- Medicare Part A

How Is Medicare Financed

Funding for Medicare, which totaled $888 billion in 2021, comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries . Other sources include taxes on Social Security benefits, payments from states, and interest. The different parts of Medicare are funded in varying ways, and revenue sources dedicated to one part of the program cannot be used to pay for another part.

- Part A, which covers inpatient hospital stays, skilled nursing facility stays, some home health visits, and hospice care, is financed primarily through a 2.9% tax on earnings paid by employers and employees . Higher-income taxpayers pay a higher payroll tax on earnings . Payroll taxes accounted for 90% of Part A revenue in 2021.

- Part B, which covers physician visits, outpatient services, preventive services, and some home health visits, is financed primarily through a combination of general revenues and beneficiary premiums . Beneficiaries with annual incomes over $85,000 per individual or $170,000 per couple pay a higher, income-related Part B premium reflecting a larger share of total Part B spending, ranging from 35% to 85%.

- Part D, which covers outpatient prescription drugs, is financed primarily by general revenues and beneficiary premiums , with an additional 11% of revenues coming from state payments for beneficiaries enrolled in both Medicare and Medicaid. Higher-income enrollees pay a larger share of the cost of Part D coverage, as they do for Part B.

What Does Medicare Part A Cost

When you work, your employer takes out money for Medicare taxes. As long as you or your spouse works for 10 years paying Medicare taxes, you get Medicare Part A without a premium when youre 65 years old.

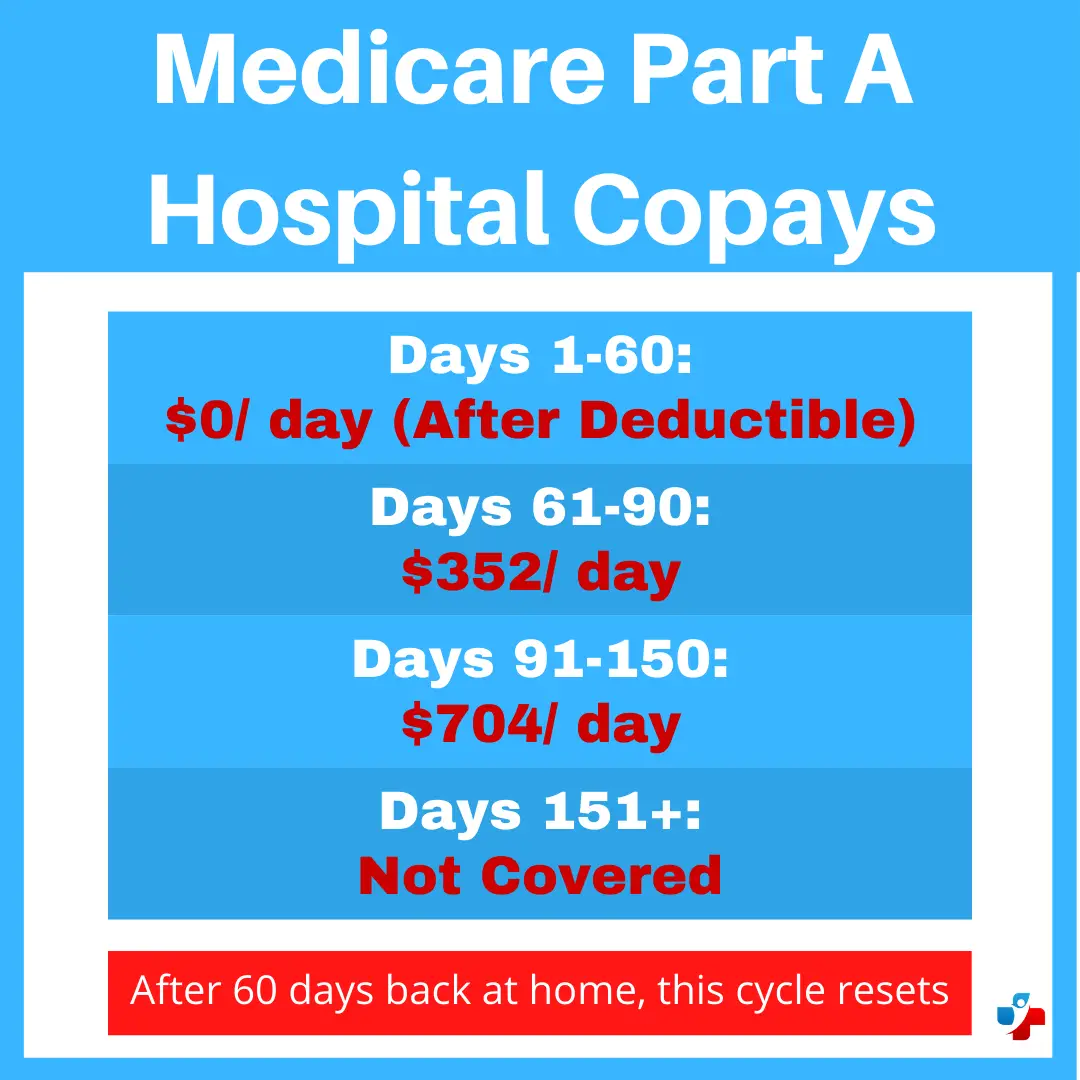

Thats not to say that you or a loved one can walk into a hospital and receive free care. Medical Part A requires you pay a deductible toward your inpatient care. For 2022, this is $1,556 for each benefit period.

If you dont automatically qualify for free Part A, you can still buy Part A. For 2022, the monthly premium for Part A is $499 if youve worked less than 30 quarters. If you paid Medicare taxes for 30 to 39 quarters, you would pay $274.

Don’t Miss: How Many Days Does Medicare Pay For Nursing Home

How Do I Apply For Medicare

If youre 65 and getting Social Security or Railroad Retirement Board benefits, you will be automatically enrolled in Original Medicare . You can expect your card in the mail three months prior to your 65th birthday.

Ready to shop for life insurance?

If youre 65 and not getting Social Security or Railroad Retirement Board benefits, youll need to enroll. You can start signing up when you are 64 years and 9 months old, the start of your seven-month initial enrollment period. It ends three months after your 65th birthday. For example, if your birthday is May 1, then your initial enrollment period is January 1 to July 31. After that, you may need to wait until the next Medicare Open Enrollment period. Medicare Open Enrollment started October 15, 2021.

Coverage starts on July 1 of the year you enroll. You can apply for Medicare via online application, by visiting your local Social Security office, or calling Medicare at 1-800-772-1213.

You dont need to reapply for Medicare each year. You can review and change coverage each Open Enrollment period. . If you made any changes to your Medicare coverage during this time, those changes take effect on January 1.

Here is a step-by-step guide on how to apply for Medicare.

What Is Medicare Part A Hospital Insurance

Medicare Part A covers the following services:

- Inpatient hospital care: This is care received after you are formally admitted into a hospital by a physician. You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility care: Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage. To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services.

- Home health care: Medicare covers services in your home if you are homebound and need skilled care. You are covered for up to 100 days of daily care or an unlimited amount of intermittent care. To qualify for Part A coverage, you must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care.

- Hospice care: This is care you may elect to receive if a provider determines you are terminally ill. You are covered for as long as your provider certifies you need care.

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

You May Like: How To Find Someone’s Medicare Number

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

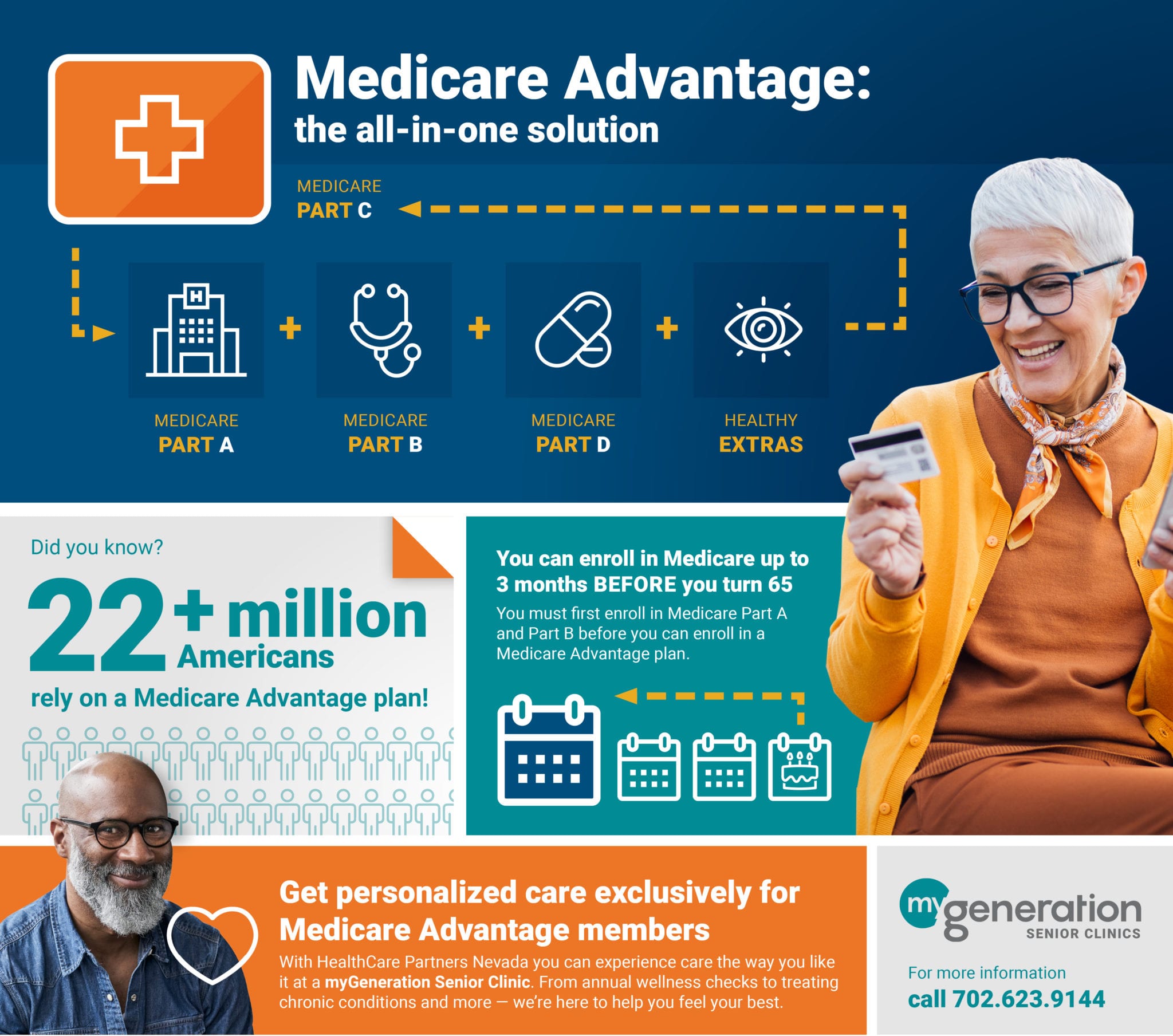

What Is Medicare Advantage Also Known As Medicare Part C

Medicare Advantage is a type of health insurance provided by private insurance companies to U.S. adults ages 65 and up, as well as younger individuals with certain disabilities and health conditions. The federal government pays a flat fee per enrollee to the insurance companies, which then provide the core benefits of Original Medicare, payment to care providers and oftentimes additional benefits.

Recommended Reading: Will Medicare Cover A Mobility Scooter

Am I Eligible For Medicare Part A

If youre currently receiving Social Security benefits and are under age 65, youll be automatically enrolled in Medicare parts A and B when you turn 65 years old. However, if youre not currently getting Social Security, youll have to actively enroll in Medicare.

The section below on initial enrollment explains when you can begin the enrollment process based on your age.

- Go online to SocialSecurity.gov and click on Medicare Enrollment.

- Apply in person at your local Social Security Office. to find your local office by ZIP code.

Medicare History And Background

Medicare was created in 1965 to help elderly Americans pay for health care. At that time, U.S. residents relied almost solely on employers for coverage. These days the majority of Americans still get health coverage through employer-sponsored insurance, but there are alternatives to getting care.

The Medicare program is administered by the Centers for Medicare and Medicaid Services and funded by two trusts held by the U.S. treasury the Hospital Insurance Trust Fund and Supplementary Medical Insurance Trust Fund. These trusts are maintained by taxpayer dollars and premiums paid by Medicare beneficiaries.

Learn more about how Medicare is funded.

Don’t Miss: How Much Is Taken Out For Medicare

The Cares Act Of 2020

On March 27, 2020, former President Trump signed into law a $2 trillion coronavirus emergency stimulus package called the Coronavirus Aid, Relief, and Economic Security Act. It expanded Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increases flexibility for Medicare to cover telehealth services.

- Increases Medicare payments for COVID 19related hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarifies that non-expansion states can use the Medicaid program to cover COVID 19related services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Medicare Covers The Elderly In 1965

I am one of your old retired teachers that has been forgotten. I am 80 years old and for 10 years I have been living on a bare nothing, two meals a day, one egg, a soup, because I want to be independent. I am of Scotch ancestry, my father fought in the Civil War to the end of the war, therefore, I have it in my blood to be independent and my dignity would not let me go down and be on welfare. And I worked so hard that I have pernicious anemia, $9.95 for a little bottle of liquid for shots, wholesale, I couldn’t pay for it.

Hearings of the Subcommittee on Problems of the Aged and Aging of the Committee of Labor and Public Welfare, 1959

When Medicare was enacted in 1965, America was in many ways a different place than it is today.

Recommended Reading: What Is A Good Medicare Plan

Help With Medicare Costs

Depending on your income, you may qualify for help paying your Medicare premiums. The Medicare Shared Savings Program is part of your states Medicaid programs. It can help you pay for Part B premiums, as well as Part A premiums if you pay them. To find out if you qualify, contact your states Medicaid program.

There’s also a program to help you pay for Medicare Part D programs, called Extra Help. You can apply through your local Social Security office or state Medicaid program.

To get individual help understanding your Medicare benefits, contact your local State Health Insurance Assistance Program . Trained SHIP counselors will give you free, unbiased, and one-on-one advice and answer your Medicare questions.

WebMD Feature

How Does Medicare Part B Work And What Is The Available Coverage

Medicare Part B covers the majority of your medically necessary services such as:

- Doctors visits

- Outpatient services such as lab work and diagnostic imaging

- Home health care if you need it

Medicare Part B also covers the cost of any supplies and care relating to the use of those supplies. For example, if you are diabetic, Medicare Part B will cover the costs associated with the treatment of your condition, as well as the cost of any health care professional that helps care for you.

Medicare Part B is different from Part A in that you must pay a premium each month to be covered by Part B. In addition, Part B covers preventative care such as flu vaccines.

Also Check: Does Medicare Pay For Anesthesia

Access To Care For Minorities

Before a hospital could be certified for Medicare, it had to do more than have a plan to end discrimination: It had to demonstrate nondiscrimination.

Segregation denied minorities access to the same health care as white persons. With the passage of the Civil Rights Act in 1964 and Medicare in 1965, minorities were able to receive health care in the same hospitals and clinics used by white persons. More than 1,000 Medicare and Public Health Service staff worked with hospitals to make sure they understood they would have to serve all Americans when they signed up for the federally funded Medicare program.

Black hospitalization rates were about 70 percent of white hospitalization rates in the program’s first few years. Over the next several years, hospitalization rates rose to comparable levels. In 1963, minorities age 75 or over averaged 4.8 visits to the doctor by 1971, their visits grew to 7.3, comparable with white utilization rates .

While Medicare and Medicaid have contributed to considerable progress in the health of minorities, there is still room for improvement as disparities in health status, utilization, and outcomes persist today .

When Should You Enroll In Original Medicare

Retirees can first enroll in original Medicare during a seven-month window that begins three months before the month they turn 65. Sign up at the beginning of this period if you want coverage to begin the month you reach age 65. Its recommended to also sign up for Part D from the start, which helps with prescription drug coverage, even if you dont take prescription drugs. If you sign up for Part D later, youll be required to pay a late enrollment penalty for each year you are enrolled.

“If you miss the initial enrollment period you can sign up between January 1 and March 31 for coverage that will begin July 1, but you will be charged late enrollment penalties for as long as you have Medicare. These penalties from Medicare can be long-term,” says Anna Maria Chávez, former executive vice president and chief growth officer at the National Council on Aging and current Board Chair for The SCAN Foundation. “You don’t want to have to worry about higher costs just because you didn’t act when you became eligible at 65.

If you delay original Medicare enrollment because you or your spouse is still working at a job with group health insurance, sign up within eight months of leaving the employer or health plan to avoid the penalty.

Don’t Miss: Does Medicare Cover Depends For Incontinence

What Is Medicare Part A What Does Part A Cover

As hospital insurance, Medicare Part A generally covers

- Inpatient hospital stays

- Prescription drugs administered to you as part of your inpatient treatment

- Skilled nursing facility stays

- Limited, temporary home health care

This is not a complete list. Please note that a deductible or coinsurance payment may apply to some services/items. Most services are covered only for a certain length of time.

Special Considerations For Medicare Part A

Although Medicare Part A covers many hospital-related services, it doesnt cover everything. Providers must ask patients to sign a notice before receiving treatment when a service may not be covered. This procedure allows the patient to choose whether to accept the service and pay for it out of pocket or to refuse the service.

To be proactive about keeping your medical bills down, its a good idea to find out before using a Part A service if Medicare will cover all, part, or none of the cost. If Medicare wont cover enough of the expense, find out why. There may be an alternative that is covered that would still help you, or you can file an appeal to try to get the coverage decision changed in your favor.

The three reasons why Medicare Part A might not cover something are:

- General federal and state laws

- Specific federal laws about what Medicare covers

- Local Medicare claims processors assessment of whether a service is medically necessary

One example of a service Medicare does not usually cover is custodial care in a skilled nursing facilityhelp with basic activities of daily living, such as getting dressed, bathing, and eatingif its the only care you need. You must have more serious medical needs for Medicare to cover your stay at a nursing home.

You May Like: Does United Healthcare Medicare Supplement Cover Eye Exams

Is Medicare Part A Expensive

It depends. For most Americans, Part A has no monthly premium because they, or their spouse, paid Medicare taxes throughout their career. If this is not the case, an individual will have a premium of up to $499 per month in 2022 . Regardless of premium costs, all individuals with Medicare will be responsible for additional costs like copays, coinsurance, and deductibles.

How Does Medicare Advantage Differ From Medicare Supplement Also Known As Medigap

Medicare Advantage plans serve as a substitute for Original Medicare, providing that same coverage plus additional benefits like prescription drugs coverage . Meanwhile, Medicare Supplement plans are sold by private insurance companies to people enrolled in Original Medicare to help fill the gaps of that coverage. There are 10 types of Medigap planswith letter names ranging from A to Nthat provide standardized coverage and help pay for expenses like deductibles, coinsurance and copays. Another important difference to note: Medigap policies dont cover prescription drugs. A person enrolled in Original Medicare who wants prescription drug coverage must purchase a separate Medicare Part D plan in addition to any Medicare Supplement plan.

Recommended Reading: Is Palliative Care Covered By Medicare