What Is Permission To Contact Guidelines

Permission to contact is consent given by a consumer or plan member to have a plan representative contact the consumer or member regarding Medicare plans. What is permission to contact guidelines for Medicare? Permission to contact is a rule that exists in order to protect existing or new medicare What is permission to contact …

Need More Information We Can Help

You can find complete information about dual plans available your area at UHCCommunityPlan.com Or call , TTY 711 from 8 am 8 pm local time, seven days a week. See if a dual plan is right for you.

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract and a contract with the State Medicaid Program. Enrollment in the plan depends on the plans contract renewal with Medicare and a contract with the State Medicaid Program.

This information is not a complete description of benefits. Call , TTY 711 from 8 am 8 pm local time, seven days a week for more information.

How Much Does Medicare Cost

Original Medicare

Original Medicare is divided into Part A and Part B .

- Part A helps pay for inpatient hospital care, some skilled nursing care, home health care and hospice care.

- Part B helps pay for doctor services, outpatient hospital care, durable medical equipment, home health care not covered by Part A, and other services. Medicare was never intended to pay 100% of medical bills. Its purpose is to help pay a portion of medical expenses. Medicare beneficiaries also pay a portion of their medical expenses, which includes deductibles, copayments, and services not covered by Medicare. The amounts of deductibles and copayments change at the beginning of each year.

Part A – Monthly Premium

If you are eligible, Part A is free because you or your spouse paid Medicare taxes while you were working. You earn Social Security “credits” as you work and pay taxes. For each year that you work, you earn 4 credits.

| $471 | $499 |

You are 65 or older, and you receive or are eligible to receive full benefits fr om Social Security or the Railroad Retirement Board

You are under 65, and you have received Social Security disability benefits for 24 months You are under 65, and you have received Railroad Retirement disability benefits and you meet Social Security disability requirements You or your spouse had Medicare-covered government employment You are under 65 and have End-Stage Renal Disease

Also Check: How To Order Another Medicare Card

Employer Or Military Retiree Coverage

If you or your spouse has an Employer Group Health Plan as retiree health coverage from an employer or the military , you may not need additional insurance. Review the EGHPs costs and benefits and contact your employer benefits representative or SHIIP to learn how your coverage works with Medicare.

Unitedhealthcare Dual Complete Plans

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract and a contract with the State Medicaid Program. Enrollment in the plan depends on the plans contract renewal with Medicare. This plan is available to anyone who has both Medical Assistance from the State and Medicare. This information is not a complete description of benefits. Call TTY 711 for more information. Limitations, co-payments, and restrictions may apply. Benefits, premiums and/or co-payments/co-insurance may change on January 1 of each year.

Also Check: How To Apply For Medicare Card Replacement

Who’s Eligible For Medigap

If youre enrolled in both Medicare Part A and Part B, and dont have Medicare Advantage or Medicaid benefits, then youre eligible to apply for a Medigap policy. These plans are standardized, and are designed to cover some or all of the out-of-pocket costs that are incurred when you have a Medicare-covered claim .

You have a federal right to buy a Medigap plan during the six months beginning when youre at least 65 years old and have enrolled in Part B. This is known as your Medigap open enrollment period. After this time runs out, you will have only limited chances to purchase one down the road.

Some states allow people of any age or health status to purchase Medigap coverage at any time without medical underwriting, but most dont. In many states, Medigap plans may not be available for people who have Medicare before age 65. There are 33 states that require Medigap plans to be guaranteed issue in at least some circumstances when an applicant is under age 65, but the rules vary from one state to another you can click on a state on this map to see details about state-based Medigap rules.

If youre enrolling in Medicare due to your age, the primary factor that will affect your ability to purchase a Medigap policy regardless of your health will be whether you enroll during your Medigap Open Enrollment Period.

What Is Covered Under Medicare Part C

Medicare Part C plans provide all of the same benefits as Original Medicare. Most Medicare Advantage plans also offer prescription drug benefits, which Original Medicare doesn’t cover.

Some Medicare Advantage plans may also offer a number of additional benefits that can include coverage for things like:

Read Also: Does Medicare Cover Wound Care

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

How Does Medicare Part C Work

Medicare Part C plans are sold by private insurance companies as an alternative to Original Medicare. Medicare Part C plans are required by law to offer at least the same benefits as Medicare Part A and Part B.

There are several different types of Medicare Advantage plans, such as HMO plans and PPO plans. Each type of plan may feature its own network of participating providers.

Recommended Reading: Is Root Canal Covered By Medicare

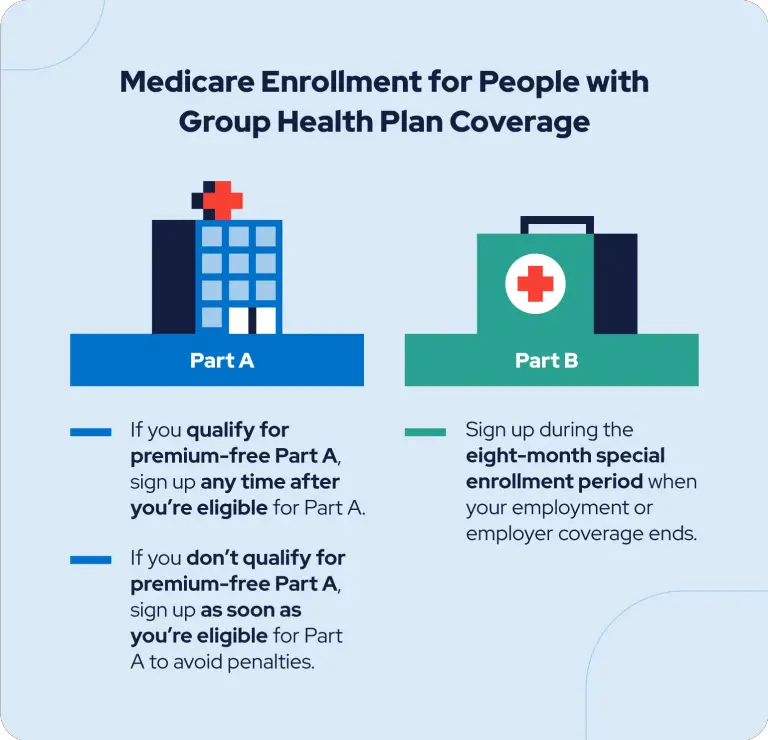

Heres A Chart On How Medicare Enrollment Works Under Different Scenarios

| If you | Then you | And coverage will start |

| Dont have a disability and wont be receiving Social Security or Railroad Retirement Board benefits for at least four months before you turn 65 | Must sign up for Medicare benefits during your 7-month IEP | On the first day of your birthday month as long as you enroll before your birthday month otherwise, you may face a delay of up to three months |

| Will be receiving retirement benefits from Social Security or the Railroad Retirement Board at least four months before you turn 65 | Will be enrolled automatically into Parts A and B | The first day of your birthday month |

| Are under 65 with a disability | Will be enrolled automatically into Parts A and B | On the 25th month that you receive Social Security disability benefits |

| Have ALS | Will be enrolled automatically into Parts A and B | The same month that you start receiving disability benefits |

| Have end-stage renal disease | Must sign up for Medicare benefits once you meet the qualifications for this condition | On the first day of the fourth month of dialysis treatments but situations can vary, so if you have ESRD, check with Social Security |

Medicare Eligibility If You Are Under 65

People younger than 65 may qualify for Medicare if they have certain costly medical conditions or disabilities.

If you are under 65, you can qualify for full Medicare benefits if:

- You have been receiving Social Security disability benefits for at least 24 months. These do not need to be consecutive months.

- You have end-stage renal disease requiring dialysis or a kidney transplant. You qualify if you or your spouse has paid Social Security taxes for a specified period of time, based on your age.

- You have amyotrophic lateral sclerosis, also known as Lou Gehrigs disease. You qualify for Medicare immediately upon diagnosis.

- You receive a disability pension from the Railroad Retirement Board and meet certain other criteria.

You May Like: When Can I Get My Medicare Card

Delaying Part D When Eligible

Medicare may add a Part D Late Enrollment Penalty to your Part D premium each month you have Part D coverage. Unless you enroll in a Part D plan when youre first eligible during your IEP.

As we grow older our chances of needing prescriptions will often increase. If you have no creditable prescription drug coverage, you should enroll when youre first eligible.

For many seniors, taking prescription drugs on a regular basis is not optional. Patients who have regular medication needs should be sure to enroll as soon as Medicare Part D eligibility begins.

Unexpected or not, the cost of medications can be financially exhausting, Part D plans provide you with a much lower cost for the same quality of medications.

What Are The Two Types Of Health Care Services Available In Our System

Primary care focuses on the person as a whole, whereas specialty care centers on diseases or organ systems. Primary care is comprehensive in scope and includes health promotion, disease prevention, health maintenance, counseling, patient education, diagnosis, and treatment of acute and chronic illnesses.

Also Check: Is Medicare Part D Necessary

Am I Eligible For Medicare Part A

Generally, youre eligible for Medicare Part A if youre 65 years old and have been a legal resident of the U.S. for at least five years. In fact, the government will automatically enroll you in Medicare Part A at no cost when you reach 65 as long as youre already collecting Social Security or Railroad Retirement benefits.

If youre already receiving Social Security or Railroad Retirement benefits, all you need to do is check your mail for your Medicare card, which should automatically arrive in the mail about three months prior to your 65th birthday . The card will arrive with the option to opt-out of Part B , but opting out of Part B is only a good idea if youre still working and have employer-sponsored coverage that provides the same or better coverage, or if your spouse is still working and you have coverage under their plan.

If youre not already receiving Social Security or Railroad Retirement benefits, youll need to enroll in Medicare during a seven-month open enrollment window that includes the three months before the month you turn 65, the month you turn 65, and the three following months. If you enroll before the month you turn 65, your benefits will start the month you turn 65 . If you enroll in the three months after you turn 65, your coverage could have a delayed effective date.

In addition to turning 65, people can become eligible for Medicare due to a disability , or due to end-stage renal disease or amyotrophic lateral sclerosis .

Who Qualifies For Medicare Part A Thats Premium

Most people dont have to pay a premium for Medicare Part A if they or their spouse paid Medicare taxes while working for at least 10 years . If youre not eligible for premium-free Part A, you will have to pay a monthly premium of up to $471 in 2021.

In addition, you must also pay the Part B premium each month. The standard premium is $148.50 in 2021.

Also, keep in mind that individuals with a higher income may have to pay more for their Part B premium. Be aware that if you dont sign up for Medicare Part B when you first become eligible, you may have to pay a 10% penalty for each full 12-month period you could have had it but didnt sign up .

Don’t Miss: What Age Does A Person Qualify For Medicare

Scope Of Appointment Faq

family for an unsolicited contact by the agent. If the beneficiary asks the agent to contact their friends and family about Medicare insurance plans, the agent can provide the beneficiary with contact information such as a business card that the individual can give to their friend or family member so that individual can contact the agent directly.

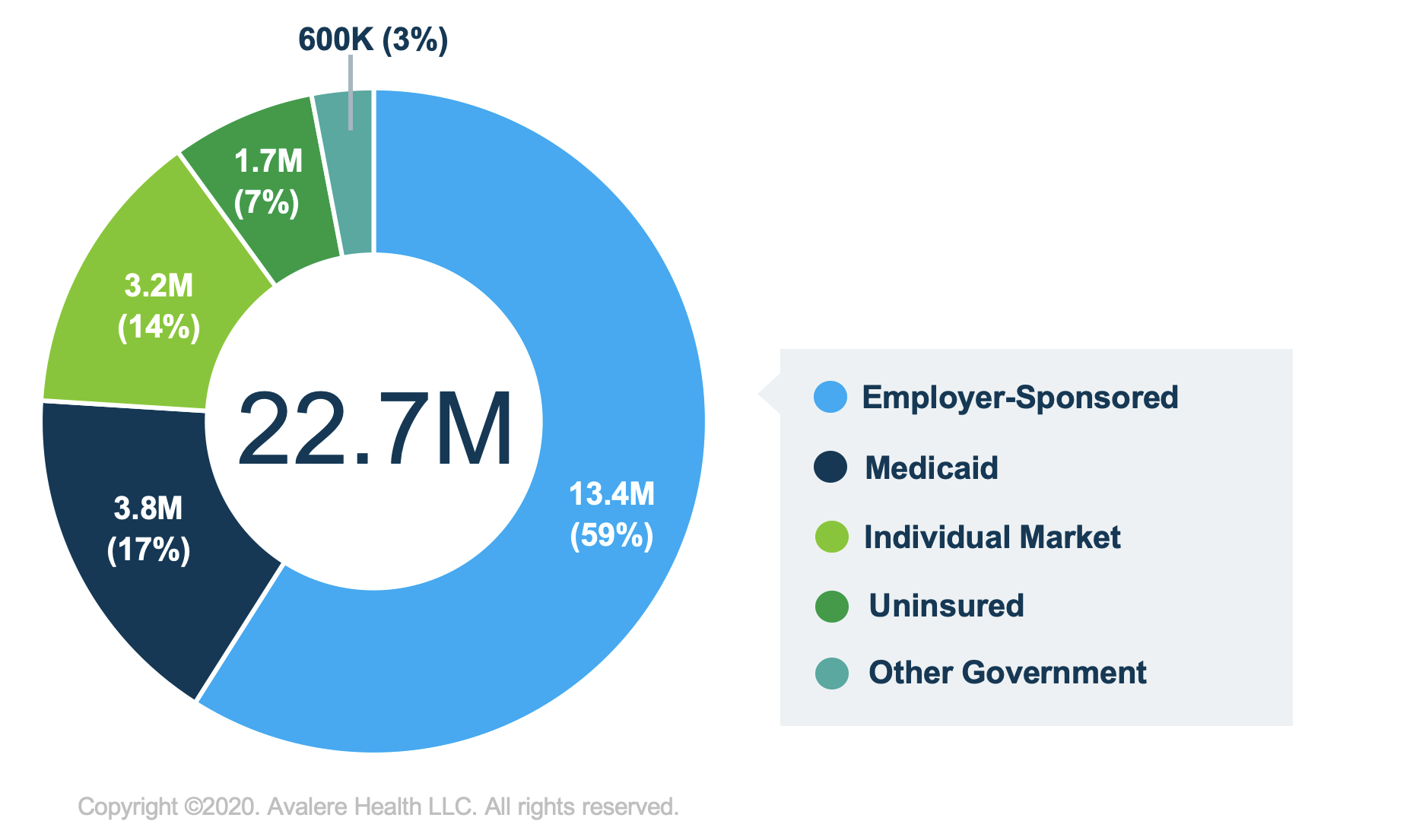

How Do I Become Eligible For Medicare Advantage

If youre eligible for Medicare benefits, you have to choose how to receive them either through the government-run Original Medicare program, or through Medicare Advantage. The majority of all Medicare beneficiaries use Original Medicare, but more than four in ten are enrolled in Medicare Advantage plans, and Advantage enrollment has been steadily climbing at a much faster pace than overall Medicare enrollment.

You need to have both Medicare Part A and Part B in order to enroll in Medicare Advantage, and you can select a plan during your Medicare initial enrollment period the seven months surrounding the month you qualify for Medicare .

Most Medicare Advantage plans also include Part D prescription drug coverage if you have a Medicare Advantage plan, you typically receive your Part D coverage together with the health and hospital benefits, in one single package, although the maximum out-of-pocket limits for Medicare Advantage do not include the cost of prescription drugs.

People with end-stage renal disease are eligible for Medicare, but used to be ineligible for most Medicare Advantage plans. This changed as of 2021, however, under the terms of the 21st Century Cures Act. As of 2021, people with ESRD have the same access to Medicare Advantage plans as other Medicare beneficiaries.

Recommended Reading: Is Entyvio Covered By Medicare Part B

List Of Medicare Supplement Insurance Companies

The Medicare Supplement Insurance information listed below shows the companies that are currently or actively offering Medicare Supplement Insurance policy plans for individuals and/or groups under 65 years of age and over 65, along with the company’s reported explanations and consumer contact information . The company’s name is a hyperlink to the respective company’s website for additional information.

For more Medicare Supplement Insurance information, please select Guide to Medicare Supplement.

Unitedhealthcare Connected For Mycare Ohio

UnitedHealthcare Connected® for MyCare Ohio is a health plan that contracts with both Medicare and Ohio Medicaid to provide benefits of both programs to enrollees. If you have any problem reading or understanding this or any other UnitedHealthcare Connected® for MyCare Ohio information, please contact our Member Services at from 7 a.m. to 8 p.m. Monday through Friday for help at no cost to you.

Si tiene problemas para leer o comprender esta o cualquier otra documentación de UnitedHealthcare Connected® de MyCare Ohio , comuníquese con nuestro Departamento de Servicio al Cliente para obtener información adicional sin costo para usted al de lunes a viernes de 7 a.m. a 8 p.m. .

Also Check: How To Sign Up For Medicare Part A

What Are My Rights As A Medicare Beneficiary

As a Medicare beneficiary, you have certain guaranteed rights. These rights protect you when you get health care, they assure you access to needed health care services, and protect you against unethical practices.

You have these rights whether you are in Original Medicare or another Medicare health plan.

Your rights include, but are not limited to:

The Right to Receive Emergency Care

If you have severe pain, an injury, or a sudden illness that you believe may cause your health serious danger without immediate care, you have the right to receive emergency care. You never need prior approval for emergency care, and you may receive emergency care anywhere in the United States.

The Right to Appeal Decisions About Payments or Services for Medical Care

If you are enrolled in Original Medicare, you have the right to appeal denial of a payment for a service you have been provided. If you are enrolled in another Medicare health plan, you have the right to appeal the plan’s denial for a service to be provided.

The Right to Information About All Treatment Options

You have the right to know about all your health care treatment options from your health care provider. Medicare forbids its health plans from making any rules that would stop a doctor from telling you everything you need to know about your health care. If you think your Medicare health plan may have kept a provider from telling you everything you need to know about your health care options, then you have the right to appeal.

What Does Medicare Cover

Medicare helps pay for certain health care services and durable medical equipment. To have full Medicare coverage, Medicare beneficiaries must have Part A and Part B .

The following is a partial list of Medicare-covered services. The covered services listed below may require payment of deductibles and Co-Payments.

If you have questions about covered services, call Medicare at 1-800-633-4227.

Read Also: Can You Get Medicare If You Retire At 62