Original Medicare Only Pays 80%

Many people about to retire are shocked to learn that Original MedicareOriginal Medicare is private fee-for-service health insurance for people on Medicare. It has two parts. Part A is hospital coverage. Part B is medical coverage…. only pays about 80% of Medicare-covered costs and that theres no out-of-pocket maximum on the costs that beneficiaries pay . Learning this is when most people become interested in supplemental Medicare insurance.

A Medicare Supplement plan is additional insurance that helps pay some of the deductiblesA deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begins to pay its share…., copaymentsA copayment, also known as a copay, is a set dollar amount you are required to pay for a medical service…., and coinsuranceCoinsurance is a percentage of the total you are required to pay for a medical service. … thats baked into Original Medicare. Some supplements have out-of-pocket limits, meaning they will pay all your covered medical expenses once youve paid a certain amount, but most plans cover one or more of the gaps straight across the board.

With Medicare supplements, the cost is a function of the gaps you want to have covered. The more expansive the coverage, the more the plan will cost. For this reason, its important that you know what costs Medicare expects you to pay, and which ones you are most likely to incur, so you can choose the right amount of coverage.

What Is The Best Supplemental Medicare Plan

Theres no single supplemental health insurance plan for seniors that fits everyone. But there is most likely a plan that will fit your specific needs. HealthMarkets can make finding a plan easy. Get a quote for supplemental health insurance for seniors, at no cost to you. You can also call to speak to a licensed insurance agent.

48203-HM-1221

Medicare Supplement Rate Increases

How much do Medicare Supplement Rates go Up? For most health insurers, once a policy has been issued, any rate changes are generally event-driven.

Medicare Supplement policyholders should not be surprised when their rates go up, in fact, they should expect a rate increase every year. If you just got another Medicare supplement rate increase, enter your information in the quote tool on this page or call to discuss your options. Keep reading to understand how Medicare supplement prices increase.

Easy article Navigation

Also Check: What Is The Requirement For Medicare

B Late Enrollment Penalty

If you dont Part B when youre first eligible, you may be required to pay a late enrollment penalty.

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

For example, if you waited three years after your Initial Enrollment Period to sign up for Medicare Part B, your late enrollment penalty could be 30 percent of the Part B premium.

You will continue to owe this penalty for as long as you remain enrolled in Medicare Part B.

As mentioned above, the 2022 standard premium for Part B is $170.10 per month. If you owe the standard Medicare Part B premium but sign up for Part B a year after you were initially eligible, the late enrollment fee can add another $17.01 per month to your Part B premium.

Comparing The Costs Of Medigap Plans

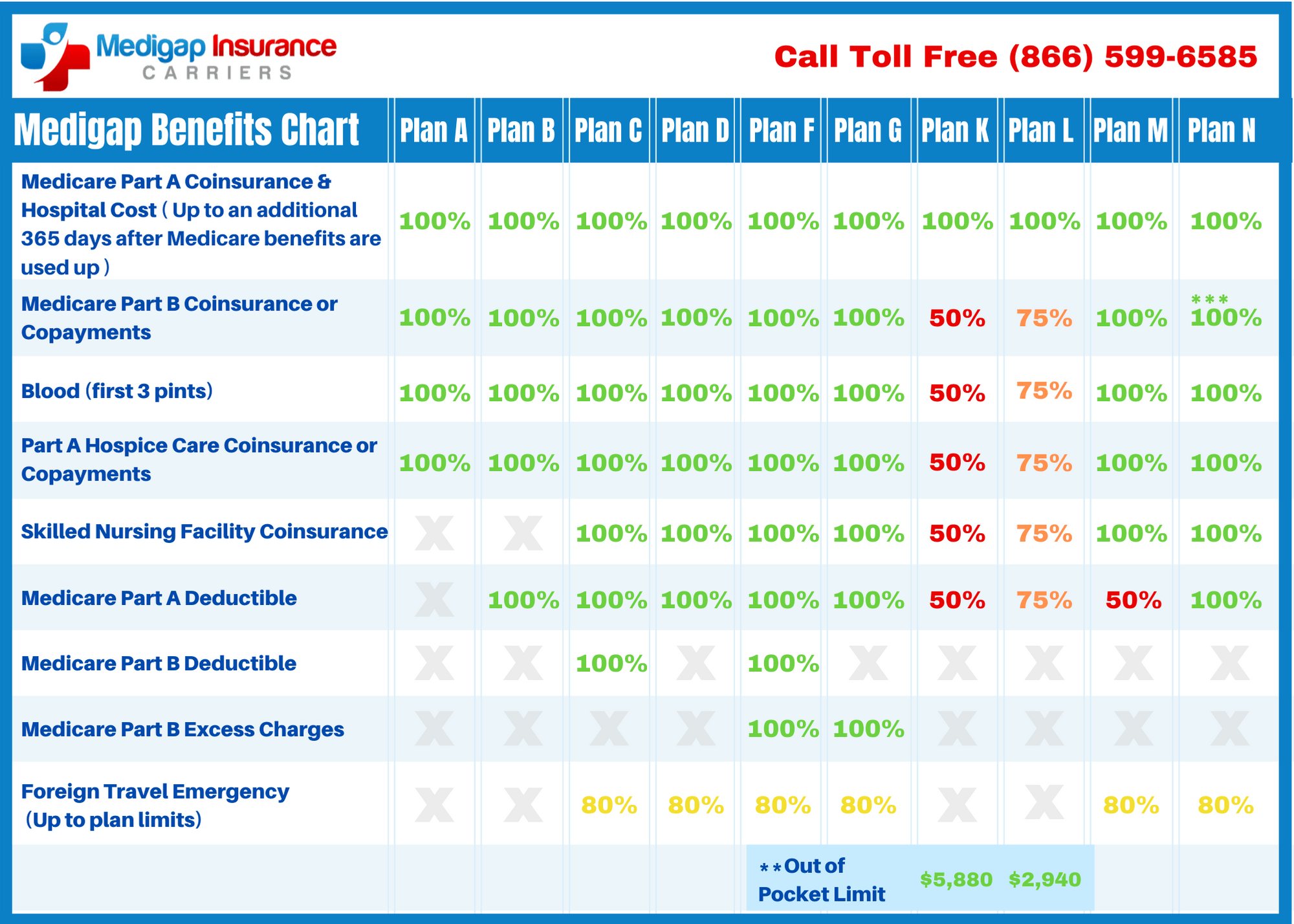

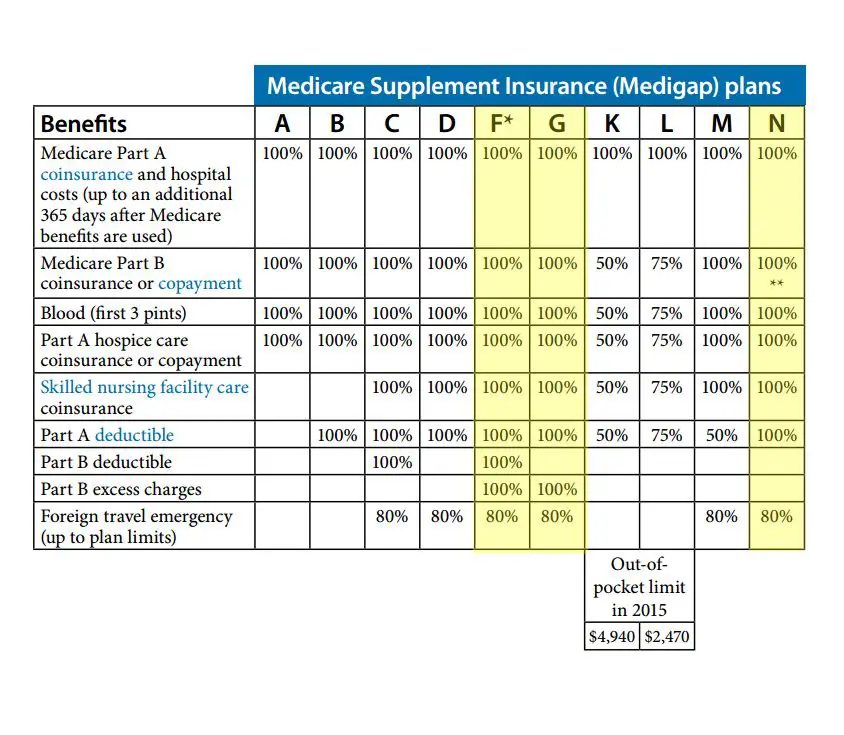

There are 10 Medigap plan types, and each is identified by a letter.

Medicare requires each plan type of the same letter to offer basic, standardized benefits.

While the coverage in Medigap plans is standardized, costs are not.

If you want to save money, its important to shop around, compare coverage, get quotes and ask questions.

However, according to Vice President of Senior Market Sales Brian Hickey, picking the right Medigap plan isnt all about price.

There are other factors that should be considered, including rate increase history, financial stability, customer service experiences and claims history, Hickey told RetireGuide.com. Talking to a professional that has experience across all plans is key in making the right decision.

If you are trying to switch to a better plan and you are in poor health, make sure to ask if the insurer considers your current health status before enrolling.

Also Check: Is Omnipod Covered By Medicare

What Is The Difference Between Medicare Plans F And G

There are two main differences between plans F and G: the premium and the amount of coverage you receive. Here’s a comparison of the coverage differences between the two Medigap plans:

| Benefit |

|---|

| Medicare Part B excess charges |

| Blood |

| Skilled nursing facility coinsurance |

As you can see, Medigap Plan G would not provide coverage for the Medicare Part B deductible. This means if you were to purchase Plan G, you would have to pay the deductible for Part B, which is $185 for 2019, as you receive health services.

Additionally, typical premiums for Medicare Plan F are slightly higher when compared to Plan G â $140 versus $110, respectively â and have a larger rate increase from year to year. The increased premiums are because of the more comprehensive coverage that you receive through Plan F.

Editorial Note: The content of this article is based on the authorâs opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

How Much Does Medicare Part A Cost In 2019

Medicare Part A is hospital insurance. When you are admitted for inpatient care at a hospital, skilled nursing facility and certain other types of inpatient facilities, Medicare Part A helps cover the costs of your qualified care.

Part A includes several different costs, such premiums, a deductible and coinsurance.

Don’t Miss: Is Stem Cell Treatment Covered By Medicare

Whats The Difference Between Medicare And Medigap

Medicare is a federally funded government program that provides health insurance to seniors who are 65 and older.

Medicare also provides coverage for people with specific disabilities.

Meanwhile, Medigap provides coverage where Medicare wont cover. In addition, different plans come with various benefits.

Can I Buy A Medicare Supplement Insurance Plan At Any Time

You can enroll in a Medigap plan or change Medigap plans at any time of the year. However, you may be subject to medical underwriting as part of the application process.The best time to buy a Medigap plan, however, is during your Medigap Open Enrollment period or during another time when you have a Medigap guaranteed issue right. This can help protect you from potentially paying higher Medicare Supplement Insurance costs due to your health.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Read Also: Do Husband And Wife Pay Separate Medicare Premiums

Do I Really Need Supplemental Insurance With Medicare

Lets start our discussion by addressing the elephant in the room. Is a Medicare supplement plan really necessary, and, if so, why?

As you may already be aware, Original Medicare only covers about 80% of your major medical costs. The remaining 20% of all Medicare-approved costs are the beneficiarys responsibility. These costs, which include deductibles, copayments, and coinsurance on the healthcare services you use can be paid in several different ways, including:

These are the most common ways people cover their major medical costs when they have Medicare. If you dont qualify for one of the benefits listed above, then you self-pay out of pocket, or you buy a Medigap plan.

If youre thinking about the self-pay option, think twice. This is a very risky proposition. While you can probably swing the cost of regular doctor visits, the cost of advanced diagnostic or hospitalization due to a critical illness or injury, is enough to send most people to bankruptcy court. Compare how much is Medigap per month vs. self-pay and it wont be difficult to see which costs less.

Think about it. Could you afford to pay 20% of the cost of cancer treatment or a hip replacement? A 2013 cost-effectiveness study reported a total cost of $40,102 for first-line mesothelioma treatment. Thats just the treatment, which does not include your inpatient care. The average cost of a hip replacement in the United States is almost as costly at $32,000.

How Much Does Medicare Part A Cost In 2022

Premiums for Medicare Part A are $0 if youâre getting or are eligible for federal retirement benefits. Itâs also premium-free if youâre under 65 and receiving Social Security disability benefits for 24 months, or are diagnosed with end-stage kidney disease. If youâre eligible for Medicare, but not other federal benefits, youâll pay a Part A premium of $274 or $499 each month, depending on how long youâve paid Medicare taxes.

The deductible for Medicare Part A is $1,556 per benefit period. A benefit period begins the day youâre admitted to a hospital and ends once you havenât received in-hospital care for 60 days.

The Medicare Part A coinsurance amount varies, depending on how long youâre in the hospital. Coinsurance is typically a percentage of the costs, but Medicare designates the coinsurance as a flat fee.

Hereâs how much youâll pay for inpatient hospital care with Medicare Part A:

-

Days 1-60: $0 per day each benefit period, after paying your deductible.

-

Days 61-90: $389 per day each benefit period.

-

Day 91 and beyond: $778 for each “lifetime reserve day” after benefit period. You get a total of 60 lifetime reserve days until you die.

-

After lifetime reserve days: All costs.

The cost of a stay at a skilled nursing facility is different. This is what a skilled nursing facility costs under Medicare Part A:

Hospice care is free.

Read more about how Medicare Part A covers these costs here.

Recommended Reading: How Does Medicare Work With Other Insurance

How Insurance Companies Set Medicare Supplement Insurance Plan Costs & Premiums

Insurance companies can decide the premium costs for the Medicare Supplement insurance plans they offer. They can use any of three ways to set premium costs. Which method insurance companies use to arrive at their premiums can affect your costs in the short term or the long term.

Here is how the rating systems work.

eHealths research team looked at average Medicare Supplement insurance premiums across different age groups . Older beneficiaries had higher average premiums.

Medicare Plan G Coverage

| Medicare Part B excess charges |

| Foreign travel emergency |

Medicare Plan G will not cover your original Medicare Part B deductible, which costs $198 in 2020. You would pay for medical servicessuch as outpatient care, preventive care and ambulance servicesout of pocket until you have reached the deductible amount. Then Medicare would cover your health care costs.

Don’t Miss: When Can You Have Medicare

What Is A Medicare Supplement Deductible

You may know the word deductible from other types of insurance you already have, such as auto insurance. A deductible is an amount you pay before your insurance plan begins to pay. Some Medicare Supplement plans pay the Medicare Part A hospital deductible, but make you pay the Medicare Part B medical deductible. Some plans cover neither the Part A nor the Part B deductible and you will be responsible for those costs out of pocket.

Medicare Supplement high deductible plan F* may charge a lower monthly premium than other plans. However, this low premium may be attached to a high deductible, meaning you must pay a significant amount out of pocket before your Medicare Supplement plan pays anything.

Whats The Average Cost Of Medicare Plan F

Plan F offers the fullest coverage of all the Medigap plans, making it the most popular.

| Plan F Average Monthly Cost in Palm Harbor, FL * |

| Gender: Female, Age: 65 |

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.

Recommended Reading: Does Aetna Medicare Advantage Cover Dental

Medicare Supplement Plans Comparison Chart 2021

*Medigap Plan F is also offered as a high-deductible plan by some insurance companies in some states. If you choose the high-deductible option, it means you must pay for Medicare-covered costs up to the deductible amount of $2,370 in 2021 before your policy will pay anything.

**For Medigap Plans K and L, after you meet your annual out-of-pocket limit and your annual Part B deductible , the Medigap plan pays 100% of covered services for the rest of that calendar year.

***Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that dont result in an inpatient admission. You can find this chart as well as other great info in Medicares Choosing a Medigap booklet as well, which you can find here.

****Medigap Plan G also has a high-deductible option. In 2021, the HDG deductible is $2,370.

What Is The Best Medicare Supplement Plan For 2020

The best Supplement Comparison Chart for 2021 is from our quote tool which gives you an accurate quote for you personally. We can not only give a quote but send you the information you need to further investigate the best plan for you. We not only provide quotes but offer you free no-hassle information, we want to earn your business. Try Woodys Way!

Medicare Supplement Rates

The average cost of Medicare Supplement plans varies because health insurance companies have three ways that

they price these plans:

Average Cost Of Medicare Supplements In Decatur Il

If you live in Decatur and are interested in a Medicare Supplement, the price is probably pretty important to you.

Letâs compare those top 3 plans â Plan F, G, and N.

Now we do have to include a big disclaimer here. Medicare Supplement rates can and do change, so please use these examples as a general guideline. If you want to know what a supplement would cost you down the penny, you need to contact us and ask for a quote.

Also, there are household discounts available, which means if you and your spouse, for example, have a supplement, you can get around 7% off.

Read more:What Is the Medigap Household Discount, and How Do I Get It?

Since the average cost varies based on those four main factors , weâll offer up a few examples. Weâre going to stick with the 62526 zip code, but the rates are generally the same in the surrounding zip codes.

As you can see, rates for Medicare Supplements can range pretty widely. In larger cities, the rates can even go over $300 per month. But in a place like Decatur, youâre looking at a price in the $70-$200 range for a Medicare Supplement depending on those factors we talked about and which plan you choose.

Read Also: Which Is Better Original Medicare Or Medicare Advantage Plan

How Do I Make My Medicare Payments

If youâre on federal retirement benefits, your Medicare Part B premiums get deducted from your Social Security checks. You can elect to get your Medicare Part D premiums deducted from your benefit checks, too. Contact your insurer.

If youâre not on federal retirement benefits, youâll get a Medicare Premium Bill for any parts of Medicare that youâre paying for each month. You can pay this bill via your bankâs online service or by mailing back a credit card, debit card, check or money order payment.

However, Medicare Easy Pay is probably the simplest way to pay your Medicare Premium Bill. It automatically deducts your payment from a linked bank account around the 20th of each month. Deductibles and copays are generally paid directly to health care providers at the time of service.

How Much Does A Medicare Supplement Insurance Plan Cost

Summary: The cost of a Medicare Supplement insurance plan will be dependent on factors such as plan rating systems, if you have guaranteed issue rights, and the type of plans of you choose.

If youre enrolled in Medicare, or will soon be eligible for the program, you may be thinking about buying a Medicare Supplement insurance plan to work alongside your Medicare Part A and Part B coverage. Medicare insurance Supplement insurance plans are offered by private insurance companies and are designed to help pay out-of-pocket costs for services covered under Medicare Part A and Part B, such as deductibles, copayments, and coinsurance. Medicare supplement insurance coverage for these out-of-pocket expenses varies by plan type.

With the exception of Massachusetts, Minnesota and Wisconsin, which have their own standardized plans, insurance companies offer standardized Medicare Supplement insurance plans identified by alphabetic letters . However, the premiums may vary from one company to another. Understanding the factors that affect your premium can help you make cost-conscious choices in your selection of a Medicare Supplement insurance plan.

Several things may affect your out-of-pocket costs when it comes to Medicare Supplement insurance plans here are some of the major factors.

Recommended Reading: Does Medicare Cover Knee Injections