How Are Medicare Part D Premiums Calculated

Medicare Part D prescription drug plans are also sold by private insurance companies, so premiums will vary from one plan to the next.

As with Medicare Part B premiums, Part D plans also calculate premiums based on your income from two years prior and may charge an IRMAA.

The table below illustrates how much you can expect to pay for a Part D plan in 2021.

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $412,000 |

$77.10 + your plan premium |

If you are subject to a Part D IRMAA, you may be able to save money by enrolling in a Medicare Advantage plan that includes prescription drug coverage.

Medicare Part B Part D Irmaa Premium Brackets

September 14, 2021Keywords: AGI, health insurance, Medicare

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors services and Medicare Part D that covers prescription drugs. The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with the government, they must pay a higher share of the program costs.

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount.

I havent seen any numbers that show how much collecting IRMAA really helps the government in the grand scheme. Im guessing very little. One report said 7% of all Medicare beneficiaries pay IRMAA. Suppose the 7% pay double the standard premium, it changes the overall split between the beneficiaries and the government from 25:75 to 27:73. Big deal?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2020 income determines your IRMAA in 2022. Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits arent included in the income for determining IRMAA.

* The last bracket on the far right isnt displayed in the chart.

What Income Is Used To Determine Medicare Premiums

Did you know that not everyone pays the same amount for Medicare premiums? As you are planning for retirement or if you are already in retirement, it is important to understand the effects that your financial decisions can have on your Medicare premiums. It could be the difference of hundreds of dollars a month.

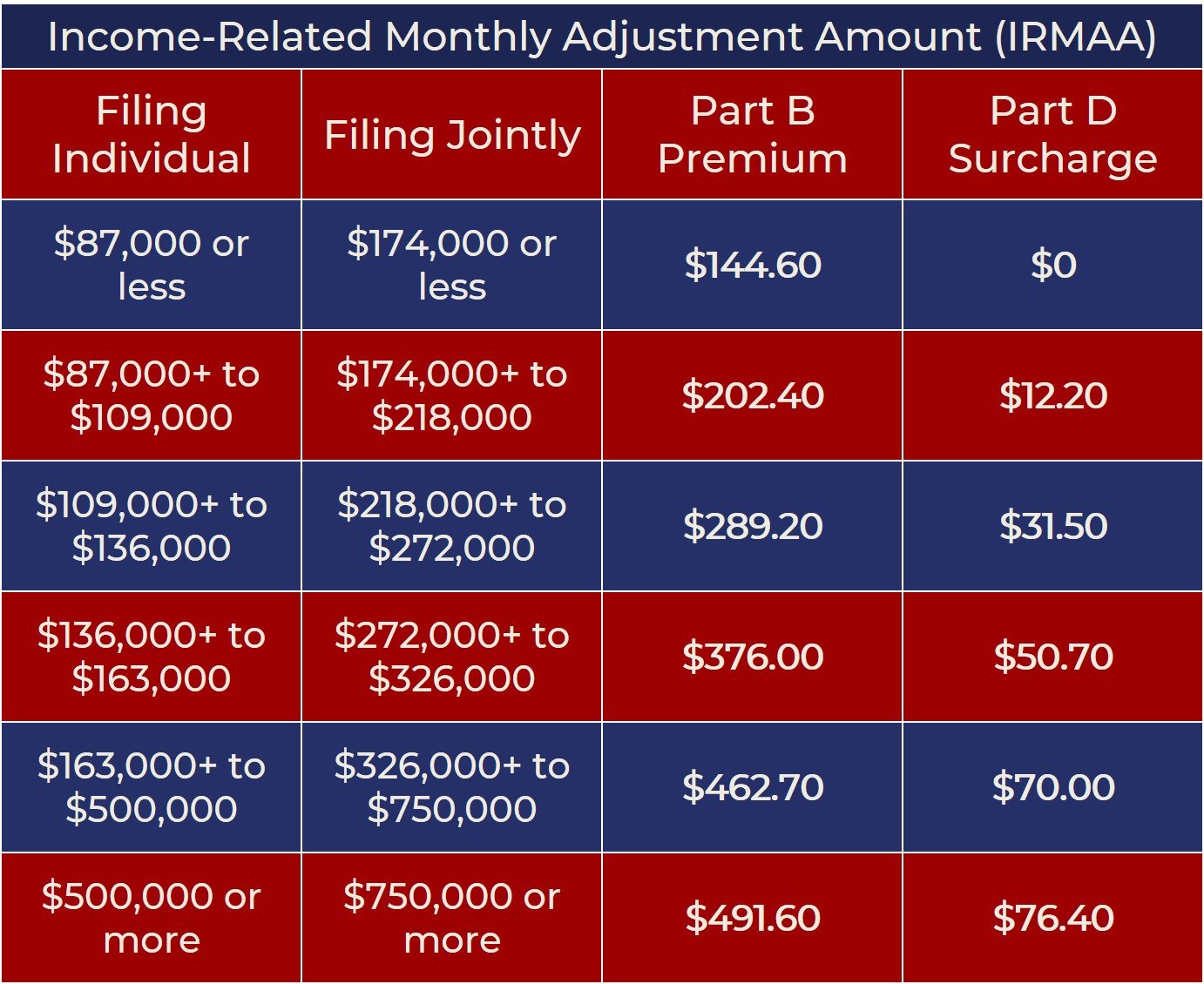

The cost of Medicare B and D premiums are based on your modified adjusted gross income . If your MAGI is above $87,000 , then your premiums will be subject to the income-related monthly adjustment amount . Below are two charts from the Centers for Medicare and Medicaid Services showing how IRMAA can affect premiums at different MAGI levels.

Also Check: Can You Get Medicare Insurance At 62

Medicare Part B Premium Appeals

OMHA handles appeals of the Medicare programs determination of a beneficiarys Income Related Monthly Adjustment Amount , which determines a Medicare beneficiarys total monthly Part B insurance premium.

The Social Security Administration notifies a beneficiary of his or her Part B insurance premium and any IRMAA with the beneficiarys annual notice of Social Security benefits . SSA is responsible for issuing all initial and reconsideration determinations. It is important to remember that IRMAAs apply for only one year. A beneficiary will be notified by SSA near the end of the current year if he or she has to pay an IRMAA for the upcoming year.

How Record Social Security Cost

News that inflation rose to a historic high in November probably comes as no surprise to retirees.

But they may be in for another shock when they receive their monthly Social Security checks in January.

The Social Security Administration announced in October that beneficiaries will get a 5.9% boost to their checks in 2022 the biggest annual cost-of-living adjustment in four decades.

Yet since then, another key measurement for inflation the Consumer Price Index has also reached historic highs.

In November, that measurement for a basket of consumer goods and services climbed to a 6.8% year-over-year increase the highest since 1982.

More from Personal Finance:You need at least $1 million saved to retire in these cities

At first it was more, Wow, look at how great this is,’ said Kelly LaVigne, vice president of consumer insights at Allianz Life Insurance Company of North America, of reactions to the Social Security COLA for 2022.

Now its a recognition after they see this latest CPI news, Oh, thats why they did it,’ LaVigne said.

For retirees who have been living on a fixed income for a long period of time, higher prices can cut into their ability to pay for rent, food and prescriptions.

They havent even received this larger check yet, LaVigne said. So theyre experiencing these higher prices without even getting more money, which will start in January.

More than 64 million Social Security beneficiaries are due for increases to their monthly checks.

Read Also: Can I Enroll In Medicare Online

How Does Medicare Part B Work

Before getting into the weeds of Medicare Part B premiums, lets do a quick review of Medicare Part B and its role in federal retirement health insurance.

Once you turn 65, you become eligible to enroll in Medicare, with its maddening mix of different programs, including Part A, Part B, Part C and Part D. Some of these programs charge you premiums, and some dont.

First the good news: Most Medicare enrollees arent required to pay a premium for Medicare Part A, which covers costs for inpatient hospital care, home nursing care and hospice care. That said, there are typically deductibles and copays for some Medicare Part A expenses.

Medicare Part B covers doctor appointments, outpatient tests and exams as well as medical equipment. Unless your income is very low, youll be charged a monthly premium for Medicare Part B, regardless of whether you are enrolled in Original Medicare or Medicare Advantage, the two options for receiving your Medicare benefits.

If you opt for Original Medicare, the government will cover 80% of your Part B expenses after you meet your deductible. You can purchase a separate supplemental Medigap policy from a private insurer to cover the additional 20% youre on the hook for.

How To Calculate Medicare Premiums

By: Mathew J. Ryan, MBA, CFP®, EA

As you hit the retirement milestone, one of the items you’ll likely need to address is enrolling in Medicare. Medicare has many complexities and the calculation of premiums that you will pay is one of them. The questions and confusion can be endless.

Just a quick, high-level review. Medicare is available for those attaining age 65. Although, you can postpone enrolling if you choose to continue to work and have qualified employer coverage.

Medicare Part A is typically free to all beneficiaries. In contrast, Part B and Part D require premium payments. Thus, collectively speaking, the government covers approximately 75% of the program’s overall costs while the premium payments from enrollees account for the remaining 25%. So, how much will you pay?

Read Also: Do You Have To Get Medicare When You Turn 65

Medicare Premiums According To Your Income Level

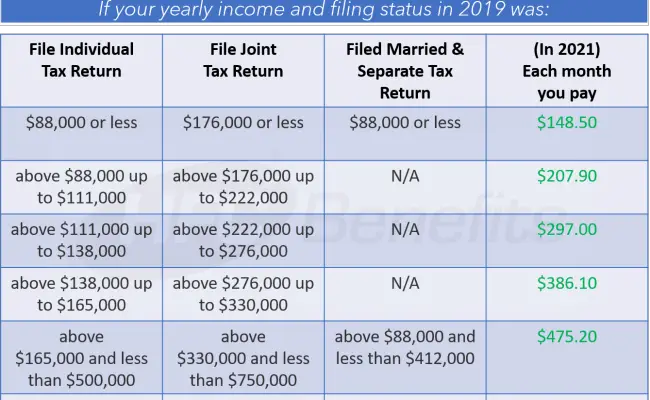

Medicare Part B and Part D require higher income earners to pay higher premiums for their plan. If you have Part B and/or Part D benefits , your premiums will be based in part on your reported income level from two years prior.

This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

In this guide, we break down the costs of Medicare by income level, including costs for Medicare Part A, Part B, Part C, Part D and Medicare Supplement Insurance plans.

Medicare Premiums And The Government Who Pays For What

A quick background on what Medicare premiums are may be helpful. Medicare is broken into two parts. Essentially:

- Medicare Part B Standard healthcare services

There are also options for supplemental coverage, notably:

- Medicare Supplement Highly-regulated add-ons that pay your out-of-pocket Medicare costs

- Medicare Advantage Private plans that replace your Parts A, B, and in most cases, D. Also known as Part C.

- Medicare Part D Prescription drug coverage plans, introduced in 2006.

Generally, if youre on Medicare, you arent charged a premium for Part A. However, you are charged monthly premiums for Part B and Part D, and can also be charged for Part C, depending on the plan you select. These premiums are tax-deductible but very few people itemize their tax returns so only a minority of seniors use this deduction. In fact, even if you do itemize, you can only deduct medical expenses, including Medicare premiums, that exceed 10% of your adjust gross income . This further limits the number of people who can deduct their premiums.

Most ofMedicare Part B about 7% is funded through U.S. income tax revenue. But the remaining 25% of Medicare Part B expenses are paid through your premium, which is determined by your income level. Medicare prices are quoted under the assumption you have an average income. If your income level exceeds a certain threshold, you will have to pay more.

Also Check: Does Medicare Cover Long Term Health Care

Medicare Part D Costs By Income Level

Like Medicare Part B, Medicare Part D prescription drug plans use the IRMAA to determine plan premium costs by income level.

2021 Medicare Part D plan premiums, based on income level from 2019, are as follows:

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $412,000 |

$77.10 + your plan premium |

There are some assistance programs that can help qualified lower-income beneficiaries afford their Medicare Part D prescription drug coverage.

Part D plans are sold by private insurance companies, so additional costs such as copayment amounts and deductibles can vary from plan to plan.

Are you looking for Medicare prescription drug coverage?

You can compare Medicare drug plans available where you live and if you’re eligible enroll in a Medicare prescription drug plan online.

Find Medicare drug plans in your area

Or call 1-800-557-6059TTY Users: 711 24/7 to speak with a licensed insurance agent.

Medicare Premiums And Surcharges

There is no premium or surcharge for Part A. Each year, the Centers for Medicare & Medicaid Services sets the following year’s Part B premium. As noted previously, the 2019 base Part B premium is $135.50 per month per beneficiary. Most people pay that amount. A small number of people pay a premium that is lower than the base premium because they are protected by the “hold harmless” rule. The hold-harmless provision protects people from having their previous year’s Social Security benefit level reduced by an increase in the Part B premium.

Part D coverage is provided via the individual private plan selected by the beneficiary, and base premiums depend upon the plan chosen. Wealthier taxpayers may also pay Medicare surcharges on Parts B and D in addition to the base premium for traditional Medicare or a Medicare Advantage plan. Higher-income individuals paying surcharges are not shielded by the hold-harmless provision. The table “Medicare Parts B and D Premiums for 2019” shows the amounts charged for Part B and Part D at the various income thresholds for individuals and joint filers based upon MAGI from two years prior. In other words, the premiums for 2019 are based upon the reported income tax data from 2017.

Medicare Parts B and D premiums for 2019

Recommended Reading: Are Resident Aliens Eligible For Medicare

Why Do Some People Pay Less For Their Medicare Part B Premium

Some people who get Social Security benefits will still pay less than $148.50 in 2021. This affects around 2 million Medicare beneficiaries. Legislation prevents the cost of Medicare Part B from increasing more than the Social Security annual cost-of-living increase.

In recent years, we have had low COLA increases, so these individuals have only been paying less than the standard base Part B premium. Though the Social Security COLA increases for the last couple of years have been somewhat larger, there is still a small group of beneficiaries being protected by the hold harmless provision.

Though this all very confusing, remember that you do not have to calculate this yourself. Again, Social Security will determine your Part B premium for 2021 and notify you by mail if you exceed the Medicare income limits and must pay a higher adjusted amount.

Most Medicare beneficiaries qualify for premium-free Part A. However, the Medicare Part B premium is deducted from your Social Security check if you are receiving Social Security benefits. In 2021, the Part B premium is $148.50.

You can also request your Part D premium be deducted from your Social Security check.

Most People Pay the Standard Part B Premium

Youll pay the standard Medicare Part B premium amount if:

Understanding Modified Adjusted Gross Income

MAGI can be defined as your household’s adjusted gross income after any tax-exempt interest income, and certain deductions are factored in.

The Internal Revenue Service uses MAGI to establish whether you qualify for certain tax benefits. Most notably, MAGI determines:

- Whether your income does not exceed the level that qualifies you to contribute to a Roth IRA

- Whether you can deduct your traditional individual retirement account contributions if you and/or your spouse have retirement plans, such as a 401 at work

- Whether you’re eligible for the premium tax credit which lowers your health insurance costs if you buy a plan through a state or federal Health Insurance Marketplace

For example, you can contribute to a traditional IRA no matter how much money you earn. Typically, you can deduct the IRA contribution amount, reducing your taxable income for that tax year. However, you can’t deduct those contributions when you file your tax return if your MAGI exceeds limits set by the IRS and you and/or your spouse have a retirement plan at work.

Recommended Reading: Why Is Medicare Advantage Free

Now Modify Your Adjusted Gross Income To Calculate Magi

Now that we have your adjusted gross income, we have to add back some items to call it modified. This is how you calculate MAGI! Add back to your AGI.

You add back tax-exempt interest .

The taxable portion of your social security is already in your AGI, what about the non-taxable portion of your social security?

For IRMAA purposes, you dont include the non-taxable portion of social security for IRMAA.

Specifically for Premium ACA tax Credits, however, you add back the non-taxable portion of social security! This means you probably dont want to claim social security between 62-65 if you want to get Premium ACA tax Credits.

Table 1

Above, find the differences for IRMAA and ACA Premium Tax Credits.

Note that you add back tax-exempt interest and interest from US savings bonds for higher education to both.

In addition, foreign earned income is also added to both. Please note this is income from wages, not investment income. You can still deduct your Foreign Income Credit from your international investments.

The non-taxable portion of social security is added back for ACA Premium Tax Credits but not for IRMAA.

What Purpose Does Magi Serve

The IRS uses MAGI to determine whether you qualify for certain tax programs and benefits. For instance, it helps determine the size of your Roth IRA contributions. Knowing your MAGI can also help you avoid facing tax penalties because over-contributing to these programs and others like them can trigger interest payments and fines. Your MAGI can also determine eligibility for certain government programs, such as the subsidized insurance plans available on the Health Insurance Marketplace.

Don’t Miss: What Is The Window To Sign Up For Medicare

And 2022 Irmaa Brackets

The IRMAA income brackets started adjusting for inflation in 2020. Here are the IRMAA income brackets for 2021 coverage and 2022 coverage. Before the government publishes the official numbers, Im able to calculate based on the inflation numbers and the formula set by law. Remember the income on your 2020 tax return determines the IRMAA you pay in 2022. The income on your 2021 tax return determines the IRMAA you pay in 2023.

| Part B Premium |

|---|

| Single: > $500,000Married Filing Jointly: > $750,000 |

The standard Medicare Part B premium is $148.50/month in 2021. A 40% surcharge on the Medicare Part B premium is about $700/year per person or about $1,400/year for a married couple both on Medicare. In the grand scheme, when a couple on Medicare has over $176k in income, they are probably already paying a large amount in taxes. Does making them pay another $1,400/year make that much difference? Nickel-and-diming just annoys people. People caught by surprise when their income crosses over to a higher bracket by just a small amount get mad at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income and dont accidentally cross a line for IRMAA.

Summary Of Strategies To Decrease Magi

In summary, delay social security and pensions until you are 65. To avoid IRMAA, you may have to avoid these until later, especially if you plan to do partial Roth Conversions during your Tax Planning Window. Dont forget that pensions are also fully taxable! Remember that income from municipal bonds is added back as well.

Minimize IRA and 401k distributions and Roth conversions.

In addition, become familiar with your sources of income on schedule 1 to see if they can be decreased. Avoid harvesting capital gains .

What am I Supposed to Live On?

If you want help with your health care insurance costs, you have to decrease your income. The government does not care about your assets or net worth, only income.

How can you control your income regardless of your net worth?

Essentially, you have to live off cash and the basis of your brokerage account. Or tax-free income.

What else can you do? Contribute to an HSA or traditional IRA. If you have any self-employment income, use a SEP IRA or SOLO 401k to shelter the income from taxes and remove it from MAGI calculations.

Consider having international index funds in your brokerage account, as you are able to exclude the foreign income

Watch out for alimony from divorces prior to 2019.

What about my Standard or Itemized Deduction?

Pay special attention: The Standard Deduction is not used in calculation of MAGI! You dont get the $12,200 or $24,400 deduction as this is a below the line deduction.

Read Also: Does Everyone Go On Medicare At 65