Size And Growthand Fierce Competition

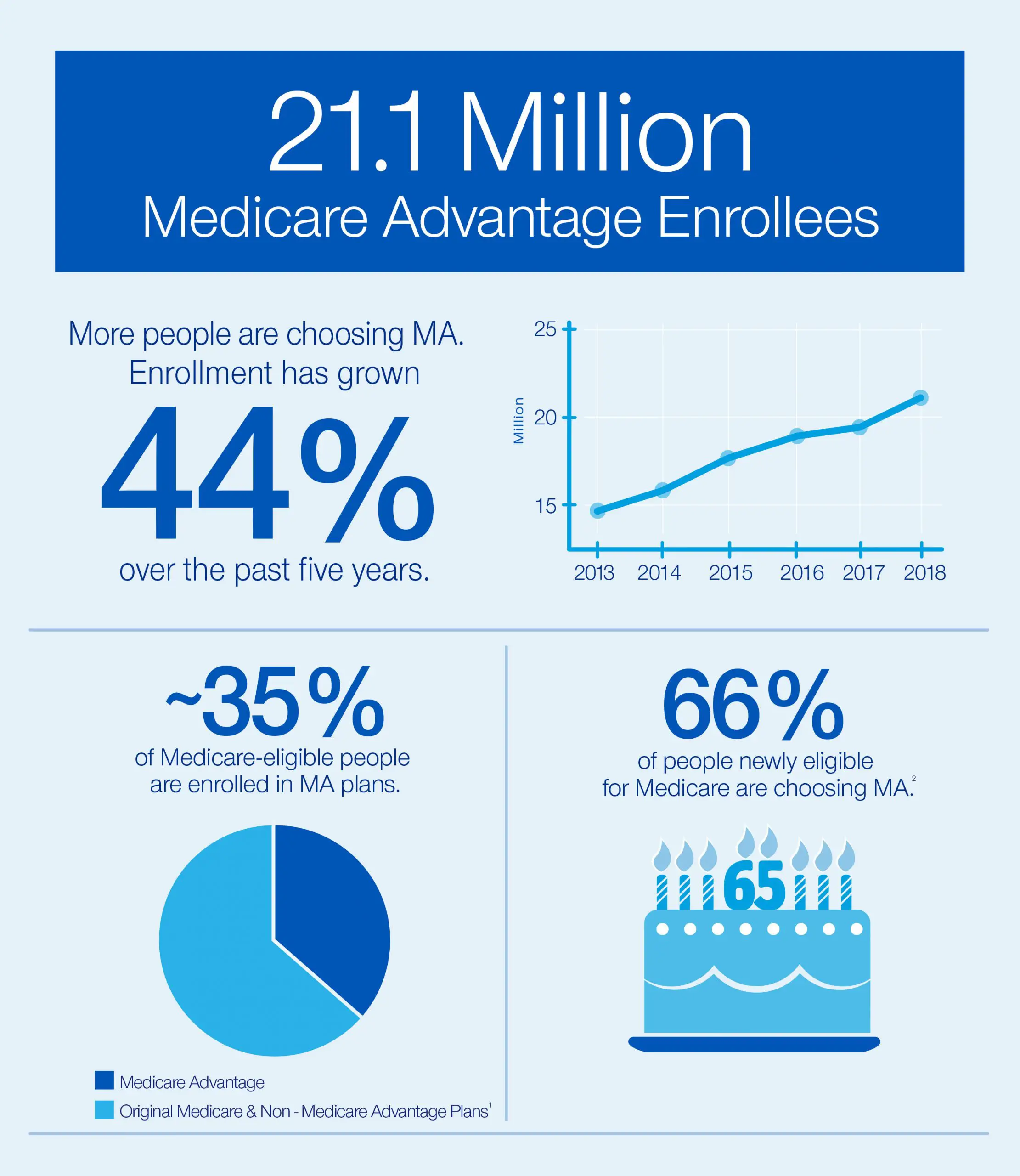

According to our analysis, Medicare Advantage enrollment will increase at an annual rate of 4% to 6% from 2017 to 2023, and revenue will grow at a rate of 7% to 9% annually. By 2023, available annual profit pools will range from $11 billion to $13 billion, making Medicare Advantage the single biggest driver of profit growth for health care payers.

Significant tailwinds are propelling this growth, including an aging population, rising penetration in comparison with fee-for-service plans , and a continued favorable regulatory climate. Current government policiesincluding support for strong rates, considerable latitude for private payers to add benefits beyond core health services, changes in Medicare Part D plans, and initiatives from Centers for Medicare & Medicaid Services for increased transparencywill add fuel to the engine.

Behind the growth, however, lies a fiercely competitive market. The number of plans available per eligible member has increased over the past four years at a rate of 8% per year, from 19 in 2016 to 24 in 2019. According to Deft Research, switching rates have dropped from more than 20% for 2015 to 11% for 2018 and 14% for the 2019 plan year. And in many instances, consumers are simply moving from one plan to another while keeping the same carrier, making the effective switching rate even lower than the reported level. This combination of factors has made it difficult for individual companies to accurately report consistent year-on-year growth.

Insurers Big And Small Jockey For Position In Ma Market As Winners And Losers Emerge

The rapid expansion in MA enrollment in recent years is tied to the plans of major health insurers, regional plans and tech-centric startups, all of which are looking to the program to fuel their own growth. MA plans offer a range of rebates and extra benefits like gym memberships, home health services and healthy meal deliveries that traditional Medicare doesnt, making them appealing to consumers.

Anthem Inc., for one, is leaning into such flexible and personalized benefits to stay competitive. Meanwhile, UnitedHealthcare Inc., the countrys largest MA insurer with nearly 7.9 million beneficiaries, is prioritizing its operational capabilities, such as digital tools, ease of payment and personalized services. And CVS Health Corp., which owns insurer Aetna Inc., drew on its strategic focus on dual-eligible special needs plans to grow enrollment in 2021.

You can see why the plans are into it, said Katherine Hempstead, a senior policy adviser at the Robert Wood Johnson Foundation with expertise in health insurance. But she also warned that the market could hit a saturation point where the number of new offerings exceeds the number of new enrollees, leading to slower growth rates for some of the big players.

Analyzing Data To Prepare For Growing Number Of High

THE ISSUE

Starting in 2020, the United States will experience extraordinary growth in the 75+ population. As the number of older adults on Medicare rapidly increases, it is critical to understand the characteristics and experiences of Medicare beneficiariesin both traditional Medicare and in private Medicare Advantage health plans.

OUR WORK

We partnered with the Better Medicare Alliance to examine how Medicare coverage arrangements affect beneficiaries access to care, utilization of benefits, and out-of-pocket costs. We found that Medicare Advantage plays an important role in protecting vulnerable Medicare beneficiaries from healthcare costs.

Low-income Medicare beneficiaries are more likely to choose Medicare Advantage, and fewer of them report experiencing cost burden associated with out-of-pocket costs compared to low-income Medicare beneficiaries in traditional fee-for-service Medicare.

Chronically ill beneficiaries are choosing Medicare Advantage at rates that mirror traditional FFS and Medicare Advantage enrollees, overall, experience clinical and functional care needs at similar rates to those in the FFS population.

OUR VIEW

As Medicare Advantage enrollment grows, policymakers will need to carefully consider how future Medicare Advantage program changes, such as rate methodologies and quality measures, will equalize access to low cost, high quality plans and foster the kind of service delivery innovation that the growing numbers of very old Americans will need.

Also Check: What Does Medicare Part A

Why Enrollees Are Choosing Medicare Advantage Plans

Nearly a quarter of those 65 and older who chose to enroll in Medicare Advantage plans over traditional Medicare did so because of its additional benefits, according to a survey released Oct. 17 by the Commonwealth Fund.

The survey firm SSRS asked 1,605 adults 65 and older who were enrolled in Medicare as their primary source of coverage why they chose Medicare Advantage or traditional Medicare and what resources they used to choose their coverage, according to the report. SSRS conducted the interview on the Commonwealth Fund’s behalf between March 28 and July 4.

The top five reasons enrollees chose Medicare Advantage plans:

1. More benefits 24 percent

2. Out-of-pocket limit 20 percent

3. Recommended by trusted people 15 percent

4. Offered by former employer 11 percent

5. Maintain same insurer 9 percent

Outlook Remains Competitive As Major Payers Look To Medicare Advantage To Fuel Growth

-

In eight states, at least half of eligible beneficiaries are enrolled in Medicare Advantage plans.

-

UnitedHealthcare is the biggest Medicare Advantage insurer entering 2022, with nearly 7.9 million beneficiaries, followed by Humana and Aetna, with more than 5 million and 3 million enrollees, respectively.

-

Some regional and startup plans have seen MA enrollment growth in the past year, including SCAN Health Plan and Devoted Health.

Medicare Advantage is booming, and industry watchers dont see it slowing anytime soon. Yet they expect it will only get more competitive for major payers, amid pressure on the Medicare programs overall finances, an increasing willingness of beneficiaries to shop around for insurance and growth among smaller players looking to eat at their business.

The Congressional Budget Office projects that by 2030, at least half of eligible beneficiaries will be enrolled in Medicare Advantage, where the federal government pays private insurers a lump sum per patient to keep them healthy, rather than paying for each medical service, with those payments adjusted for various risk factors. Other experts estimate that the country will cross the 50 percent threshold even sooner and a handful of states are already there as of February 2022, a Morning Consult analysis of federal data shows.

Don’t Miss: Are We Getting New Medicare Cards

Failed Attempt At Savings: 19972003

The BBA’s goals with respect to Medicare Advantage can be summarized in the following question: Could Medicare Advantage be reformed so that Medicare could participate in the managed care dividend enjoyed by private employers? In the latter half of the 1990s, Republicans , centrist Democrats, and some policymakers began to look to Medicare as a source for reducing the deficit . Debate centered on the idea of premium support, in which Medicare beneficiaries would be given a lump sumin effect, a voucherthat could be used to pay for a private plan or for the premium for TM, a model used by some private employers as well as the Federal Employees Health Benefit Program . Aaron and Reischauer , among others, argued that such a policy would promote competition and efficiency in Medicare, give beneficiaries a choice, and capture some of the managed care dividend for Medicare.

After an intense debate, Congress passed the BBA, in which Medicare’s at-risk contracting with health plans was formally designated as Part C of Medicare and named Medicare+Choice . The intent was to encourage competition and the growth of managed care in the Medicare program, with the hope that this would save Medicare funds. Most Democrats, however, vehemently opposed the defined-contribution initiative and succeeded in having the topic assigned to a bipartisan commission for study. In the meantime, Medicare remained a defined benefit program.

Why Medicare Advantage Enrollment Will Keep On Growing Whatever The Politics

The feds have a bullish 2019 forecast for Medicare Advantage , which puts private health plans in charge of managing the seniors health insurance program for enrollees who choose it. In September, CMS estimated that the new year will bring a 6% decline in the average monthly premiumto $28 from this years $29.81, with 46% of plan members enjoying a zero premium . The number of MA plans available across the country will increase to 2,734, according to the Kaiser Family Foundation. CMS says that enrollment will shoot up 11.5% from this years 20.2 million to 22.6 million. By CMSs reckoning, that means a record 36% of Medicare beneficiaries will be covered by an MA plan next year.

Experts agree that MA will keep growingnever mind that privately managed Medicare has been a graveyard for prophecies. Long hailed as a potential cost cutter, it has yet to conclusively demonstrate overall net savings in delivering care. In this centurys first years, MAs predecessor, Medicare+Choice, was projected to grow, but shrank instead. When MAs trend lines bounced back, along came the ACAwhich by reducing payments to private health plans, establishing a minimum medical loss ratio, and setting other conditionswas predicted to trigger widespread disenrollment. Wrong again! Boom years ensued.

Beneficiaries will have more supplemental benefits, making it easier for them to lead healthier, more independent lives, said CMS Administrator Seema Verma.

Also Check: Does Medicare Cover Bed Rails

Reason #1 Better For Budget

Plain and simple, pound for pound, Medicare Advantage plans help you save money.

So, if you have a tight budget and need to keep your monthly costs down, you should consider Medicare Advantage plans.

Did you know that the majority of these plans have $0 premiums? This feature means that the Medicare Advantage plan is premium-free. You will only need to pay the Part B premiums.

Although some MA plans do not have $0 premiums, they can still reduce the overall medical costs compared to Medicare Part B. In other cases, MA plans may even help pay for your Part B premium , helping you save further.

Last year, around 60% of enrollees in MA-PD plans did not have to pay for additional premiums other than their Part B premium .

Nearly One In Five Medicare Advantage Enrollees Are In Group Plans Offered To Retirees By Employers And Unions In 2022

Nearly 5.1 million Medicare Advantage enrollees are in a group plan offered to retirees by an employer or union. While this is roughly the same share of enrollment since 2010 , the actual number has increased from 1.8 million in 2010 to 5.1 million in 2022 . With a group plan, an employer or union contracts with an insurer and Medicare pays the insurer a fixed amount per enrollee to provide benefits covered by Medicare. For example, some states, such as Illinois and Pennsylvania, provide health insurance benefits to their Medicare-eligible retirees exclusively through Medicare Advantage plans. As with other Medicare Advantage plans, employer and union group plans often provide additional benefits and/or lower cost sharing than traditional Medicare and are eligible for bonus payments. The employer or union may also pay an additional premium for these supplemental benefits. Group enrollees comprise a disproportionately large share of Medicare Advantage enrollees in six states: Alaska , Michigan , Maryland , West Virginia , New Jersey , and Illinois .

Don’t Miss: What Is Medicare On My Paycheck

Medicare Advantage Enrollment Growth Stems Both From Brand New Enrollees And Enrollees Who Are Switching To Medicare Advantage From Traditional Medicare

August 23, 2022 – Medicare Advantage enrollment has grown in the last decade largely due to an influx of Black, Hispanic, and low-income beneficiaries, a research letter published in the JAMA Health Forum found.

Before 2011, Medicare Advantage health plans absorbed a greater share of Medicare enrollment because traditional Medicare enrollees were transitioning to Medicare Advantage plans. From 2011 to 2019, Medicare Advantage enrollment continued to increase but the source changed.

The researchers used the Master Beneficiary Summary File from 2011 to 2019 to inform their study of the source of Medicare Advantage enrollment during that timeframe. These files provided over 524.4 million person-years.

Dig Deeper

Medicare Advantage still drew enrollees from traditional Medicare from 2012 to 2019, with the share of those who came from Medicare Advantage growing from 65.9 percent to 71.1 percent.

The number of enrollees that were new to Medicare who chose Medicare Advantage coverage also grew. A little over 18 percent of enrollees who did not have Medicare coverage previously transitioned into Medicare Advantage in 2012. But by 2019, that share had swelled to 24.7 percent.

Our study is limited in that it was not designed to examine these mechanisms, the researchers acknowledged. As MA continues to grow, understanding the reasons for switching from TM to MA will become more important.

Medicare Advantage Enrollment Keeps Growing

MHE Publication

Many of the large insurers are responding by expanding into new markets.

Enrollment in Medicare Advantage plans has doubled over the past decade, and today the insurer-run plans cover more than 24 million Americans. Almost one-third of Medicare beneficiaries are now enrolled in MA plans, and that number is expected to grow as the baby boomers age into Medicare coverage.

Insurers see a large and growing line of business in MA. For beneficiaries, the simplicity of having coverage provided by a single plan is appealing. The premiums are low and more than half of the MA plans in the United States have no monthly premium at all. Often additional coverage and other benefits are also thrown in. The trade-off for the enrollees is a narrower network of providers and sometimes some copays and coinsurance.

The growth of MA is not without its critics. They see MAs growing share of the Medicare population as a drift toward the privatization of Medicare or at least the management of the program. Insurers are raking in large profits because of overly generous federal government payment, they say. The rebuttal from the MA plans and their backers: MA brings the value, care coordination and focus on the social determinants of health that is sorely lacking elsewhere in American healthcare.

Financial incentives and responsibilities

Insurers in expansion mode

Karen Appold is a medical writer in the Lehigh Valley region of Pennsylvania.

Don’t Miss: How Old To Collect Medicare

Taking Stock Of Medicare Advantage: Overview

-

Vice President of Health Care and Payor Reform, Arnold Ventures

-

Vice President of Health Care and Payor Reform, Arnold Ventures

-

As enrollment in private Medicare Advantage plans continues to grow, a new blog series explores the challenges and opportunities surrounding this increasingly important program

-

Could payment reforms and changes to risk adjustment make Medicare Advantage plans more efficient, equitable and competitive?

Read About Other Aspects of Medicare Advantage

People on Medicare have the option of receiving benefits through the traditional fee-for-service program or Medicare Advantage, which is administered by private health plans. Private plans vary more than traditional Medicare in their benefit design and cost-sharing structures. They can use network design, care management, and provider incentives to encourage the efficient use of services.

Medicare Advantage plays an increasingly important role in the Medicare program. Enrollment in Medicare Advantage plans has doubled over the past decade and continues to grow. In 2022, approximately 28 million people are enrolled in Medicare Advantage plans by 2025, Medicare Advantage is projected to be the dominant way people receive their Medicare benefits.

Publication Details

Does Ma Save Money

While MA plans dispute this, MedPAC said in a 2021 report that taxpayers have not financially benefited from the program over the past two decades. The Commission estimates that Medicare currently spends 4 percent more per capita for beneficiaries enrolled in MA than it spends for similar enrollees in traditional fee-for-service Medicare, the report states.

Mathews explains how this happens: Each year, MA plans give the government their bids that reflect how much they think it will cost them to deliver care to members. Though the bids say they provide medical care for an average of 87 percent of what it costs fee-for-service Medicare, the formula the government uses to pay nets those plans 104 percent of the fee-for-service costs. Under MedPACs June recommendations, Medicare would pay MA plans closer to parity with original Medicare costs per beneficiary. That would save the program $10 billion over five years.

Medicare Advantage plans say the MedPAC calculations are based on flawed assumptions. Mark Hamelburg, senior vice president at Americas Health Insurance Plans, a trade association for the health insurance industry, says the groups calculations show that not only have MA plans been able to bid to provide care at less than what it cost Medicare for the original program, but the actual dollars out the door have been less.

Also Check: What Is A Medicare Physical Exam

Why Clark Howard Thinks Medicare Advantage Plans Stink

Medicare Advantage plans are growing in popularity. The U.S. Congressional Budget Office projects that the share of all Medicare beneficiaries enrolled in Medicare Advantage plans will rise from 42% to 51% by 2030.

One can certainly understand the allure: Medicare Advantage plans, sometimes called Medicare Part C, are health care plans offered by private companies. They typically offer lower premiums than traditional Medicare and are known for providing coverage for medical services that the government-run program doesnt such as dental and vision.

Nonprofits: Largest 5 Plans Captured Most Of The Growth In This Cohort

While the nonprofit cohort overall saw growth of 4%, the overwhelming majority of growth accrued to few plans. The 5 largest nonprofit health plans captured 71% of 2022 enrollment growth among nonprofits. These 5 plans collectively enrolled 137,000 lives out of the 192,000 added for the cohort as a whole. We continue to see lagging membership growth by provider-sponsored and local/regional nonprofit plans outside of the top 5 leaders. While the cohort as a whole continues to struggle to find growth against for-profits, the smaller nonprofit plans appear to be struggling to find growth the most.

Nonprofit Plan Enrollment and Growth Distribution

Don’t Miss: What Is A Coverage Gap In Medicare