Medicare Supplement Plan N Cost

Lets talk a little bit more about the differences between the two plans, and more specifically what other charges you could incur on Medicare Plan N.

Again, if youre somebody who doesnt go to the doctor very oftenand I have clients who never got to the doctor who loves Plan N because they pay lower premiums all year long.

So they absolutely love it. They know if something happens to them, theyve got outstanding coverage, but their out-of-pocket expenses are going to be minimal, even on a Plan N.

So they love Plan N because they dont go to the doctor very often, but they know they are protected very, very well, God forbid something major happens.

How Much Does The Medicare Plan G With High Deductible Cost

How much you pay for your Medicare Plan G with a high deductible depends on several factors, including your age and which company you buy your policy from. Where you live can also make a significant difference to your monthly premiums. For example, a Plan G policy with a high deductible could cost you between $34 and $157 per month in Des Moines, IA, but a similar policy could set you back between $42 and $710 in Atlanta, GA.

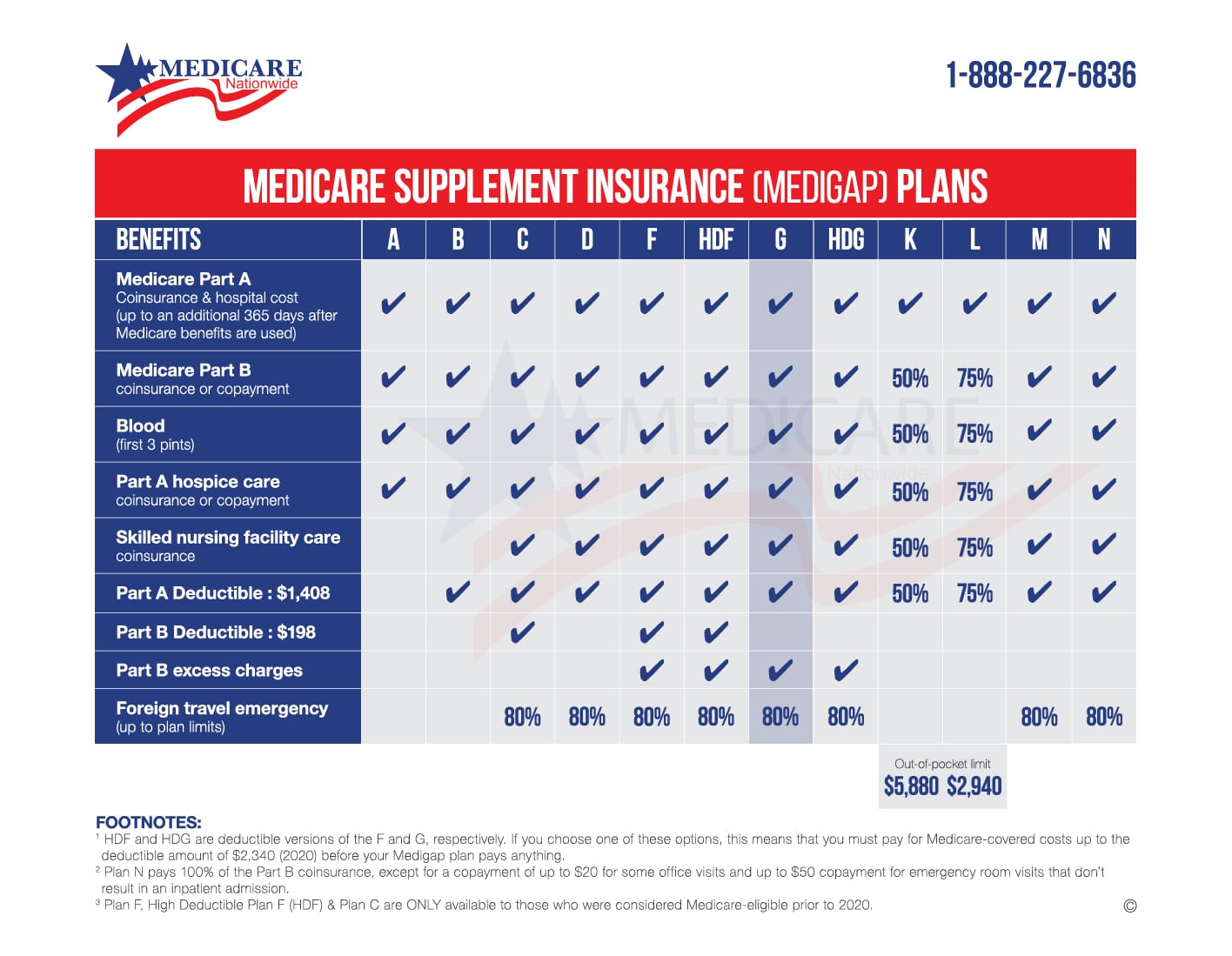

Medicare Supplement Deductibles By Plan

There are 10 standardized Medicare Supplement plans available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses.

Medicare Supplement Insurance plans are sold by private insurance companies. These plans help pay for Original Medicare deductibles and other out-of-pocket Medicare expenses like copayments and coinsurance.

Six types of Medigap plans provide full coverage of the Medicare Part A deductible, and another three plans provide partial coverage of the Part A deductible.

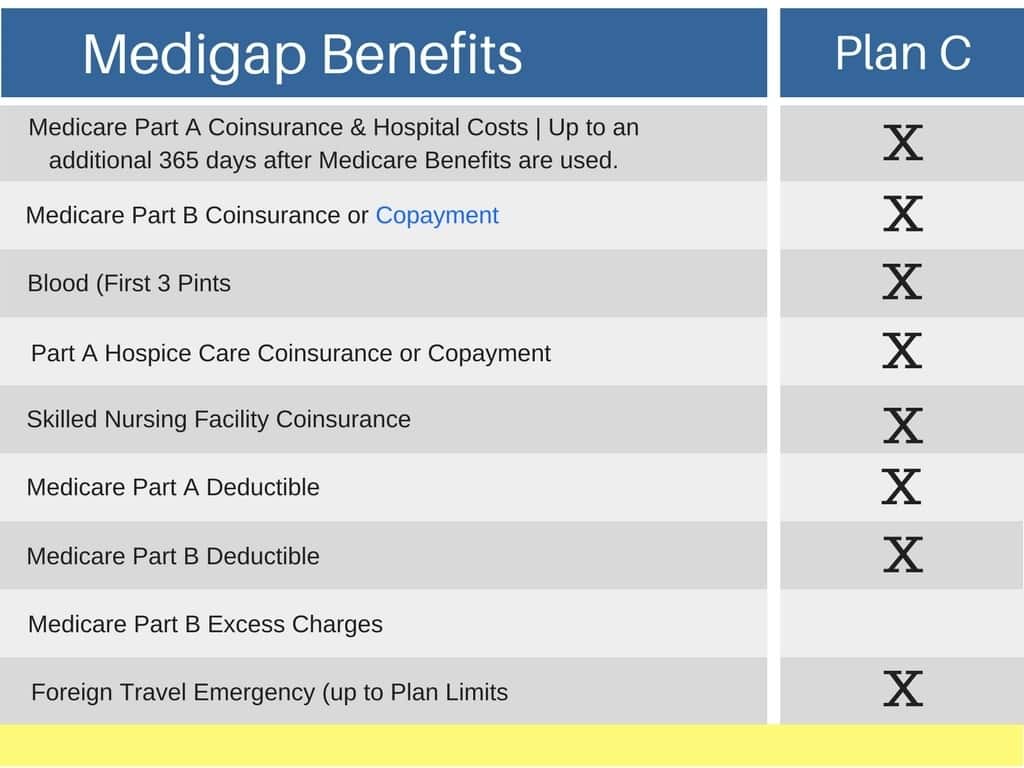

Two plans, Plan F and Plan C, provide full coverage of the Medicare Part B deductible, although these plans are only available to beneficiaries who became eligible for Medicare before Jan. 1, 2020. If you were eligible for Medicare before 2020, you may still be able to apply for Plan F or Plan C if theyre available where you live. If you already have either plan, you can keep your plan as long as you continue to pay your plan premiums.

Also Check: Does Medicare Cover Bladder Control Pads

What Does Medicare Supplement Plan A Cover

Medicare Supplement Plan A is not the same as Medicare Part A, but is one of the Medicare Supplemental insurance plans available to Medicare beneficiaries. It is a basic plan that covers:

- Medicare Part A coinsurance payments up to an additional 365 days after Original Medicare benefits are exhausted

- Medicare Part B copayment or coinsurance expenses

- The first three pints of blood used in a medical procedure

- Part A hospice care coinsurance expense or copayment

Medicare Supplement Plan A has the fewest individual benefits of the ten standardized Medicare Supplement insurance plans available in most states.

Among the Medicare out-of-pocket costs not covered is the Part A deductible for inpatient hospital stays.

In 2021, the Medicare Part A deductible is $1,484. Medicare Part A covers inpatient hospital care, skilled nursing facility care, hospice care, and certain home health-care services. If you expect to use many of these services and want to avoid the deductible, you may want to consider a Medicare Supplement plan that covers the Part A deductible. Out of the 10 standardized Medigap plans, Medicare Supplement Plans B, C*, D, F^, G, and N fully cover the Medicare Part A deductible. Medicare Supplement Plans K, L, and M also provide partial coverage for the deductible.

If a health insurance company wishes to offer Medigap coverage, then it must at least offer the basic Medigap Plan A and its benefits.

Do Guaranteed Issue Rights Apply To High

You may have guaranteed issue rights to purchase specific Medigap policies in certain situations without medical underwriting. This means that a company must offer you a particular type of Medigap policy that covers any preexisting conditions and cannot increase your premiums due to your health status.

There are several situations in which you may have guaranteed issue rights. For example, you might have the right to purchase a Medigap policy if you move outside your existing Medicare Advantage plan’s coverage area or your insurer leaves Medicare. You can only assert your guaranteed issue rights to buy High-Deductible Plan G if you have the right to enroll in Medicare Supplement Plan G.

Don’t Miss: Does Medicare Cover Gastric Bypass

What Does Medicare Plan F Cover

Those who have Medicare Plan F wont pay out-of-pocket costs for Medicare parts A and B. Policyholders would only pay the premiums, which start at $0 for Part A and $135.50 for Part B. Additionally, individuals would not have to pay the deductible, which is $1,364 for Part A and $185 for Part B.

Supplemental Medicare Plan F will cover:

- Medicare Part A coinsurance and hospital costs

- Medicare Part A deductible

- Hearing aids and routine hearing tests

- Cosmetic surgery

- Prescription drugs

The most important to note of these coverage gaps are prescriptions drugs and we would recommend purchasing Medicare Part D if you need this coverage. Medicare Plan F does provide coverage for injectable or infusion drugs given in a clinical setting but does not pay for other prescription drugs. The ideal coverage package would include Medicare parts A and B, along with the Part D prescription drug plan and a supplemental Medigap policy such as Plan F.

Unfortunately, none of the Medicare and Medigap policies cover dental care. If you are looking for dental coverage, then you would need to purchase a stand-alone dental insurance policy.

You May Like: How Do I Do My Taxes

Choosing Traditional Medicare Plus A Medigap Plan

As noted above, Original Medicare comprises Part A and Part B . You can supplement this coverage with a stand-alone Medicare Part D prescription drug plan and a Medigap supplemental insurance plan. While signing up for Medicare gets you into Parts A and B, you have to take action on your own to buy these supplemental policies.

Don’t Miss: How Much Does Medicare Pay For Dialysis Transport

Is There An Alternative To Plan F

As noted above, Plan F will be gradually phased out. But you might be able to buy Medicare Supplement Plan G or high-deductible Plan G. Plan G has the same basic benefits as Plan F except it doesnât cover the Medicare Part B deductible.

As a Medicare beneficiary, you may be able to find other Medigap plans with lower premiums. However, if you see the doctor frequently, require a lot of health-care services, or are facing mounting out-of-pocket expenses, the comprehensive coverage of Plan F generally offers the most help with your Original Medicare costs.

The product and service descriptions, if any, provided on these eHealth web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

Medigap Policy Without Creditable Drug Coverage

You’ll probably have to pay a late enrollment penalty if you have a Medigap policy that doesn’t include creditable prescription drug coverage and you decide to join a Medicare Prescription Drug Plan later. This means you’ll pay a higher monthly premium than if you joined when you were first eligible.

Your penalty amount increases for each month you wait to join a Medicare drug plan. In general, you’ll have to pay this penalty for as long as you have a Medicare drug plan. Learn more about the Part D late enrollment penalty.

Also Check: Does Medicare Cover Retirement Home

Medigap Supplements With Nontraditional Benefits

A recently released analysis from The CommonWealth Fund looks at Medigap plans offering nontraditional benefits like vision, dental and hearing services that arent covered by Original MedicareAli R, Hellow L. Small Share of Medicare Supplement Plans Offer Access to Dental, Vision, and Other Benefits Not Covered by Traditional Medicare. The Commonwealth Fund. Accessed 9/4/2021. . Our research showed a relatively small share of plansonly 7%offering these benefits, said Jacobson. I think most people dont realize there are these plans out there with benefits comparable to Medicare Advantage.

At the federal level, there are tradeoffs in terms of policies encouraging or discouraging these benefits being offered. The American Dental Association, for example, is currently advocating for a distinct program to provide comprehensive dental care for low-income older adultsnot the Medicare Part B program that has been part of past and current proposals.

We need comprehensive oral health coverage in Medicare, as well as hearing and vision, said Amber Christ, directing attorney at Justice in Aging, an advocacy organization protecting the rights of low-income older adults. Nearly half of Medicare enrollees have no dental coverage at allthats 24 million older adults and people with disabilities who have no coverage.

Review Your Personalized Medicare Options With A Dedicated Advisor

Your one stop shop for navigating Medicare and finding the benefits you are looking for.

A Look At Aarp Supplement Plans

Here is a brief look at the AARP supplement plans offered by UnitedHealthcare. Note that exact coverage, coinsurance, copays, and deductibles may vary by state. There are quite a few plans to choose from:

- Plan A

- Plan L

- Plan N

All figures for the plans listed are taken from a zip code in North Carolina, so your deductibles may vary based on where you live. These figures are listed as examples only. If you need specific information, you can enter your zip code on AARP’s website and view the costs for your area.

Don’t Miss: Where Do I Apply For Medicare Card

How Can I Get Additional Medicare Coverage

Beneficiaries enrolled in Original Medicare may choose to enroll in a Medicare Supplement insurance plan to fill in the gaps in coverage and cover some of the costs of care not covered through Original Medicare. Some Medicare Supplement insurance plans cover the out-of-pocket costs associated with Original Medicare, such as deductibles and coinsurance payments. Therefore, some Medicare Supplement insurance plans may pay for your deductible and/or your coinsurance and/or other out-of-pocket costs not covered by Original Medicare. Medicare Supplement insurance plans usually require a monthly premium.

Starting January 1, 2020, Medicare Supplement insurance plans canât cover the Medicare Part B deductible. This eliminates Plan C and Plan F for new beneficiaries. However, if you already have one of these plans, you can keep it. Also, if youâre eligible to enroll in Medicare before January 1, 2020, you may be able to enroll in one of these plans.

Most Medicare Supplement insurance plans cover the Part A deductible at least 50%. All Medicare Supplement plans also cover your Part A coinsurance and hospital costs 100% for an additional 365 days after your Medicare benefits are used up.

Deductibles For Original Medicare

Medicare premiums, deductibles and coinsurance rates for Original Medicare are adjusted each year. Original Medicare includes Medicare Part A hospital insurance and Part B medical insurance. Each has different deductibles.

You can find out if youve met your Medicare Part A or Part B deductible for the year at MyMedicare.gov.

Don’t Miss: What Income Is Used To Calculate Medicare Premiums

How Does Medicare Plan G Work

Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in both Part A and Part B of Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

Plan G is a supplemental policy, meaning it’s not your primary coverage but fills many of the gaps in a Medicare policy. Part A or Part B benefits pay for health services you may need.

Once Medicare pays its share, Plan G pays for most remaining costs.

Plan G also covers some of the expenses related to your Medicare policy. For example, Medicare Part A has a deductible of $1,556 in 2022. If you don’t have Plan G, you pay that deductible out of pocket. But with Plan G coverage, your health insurer pays the entire deductible.

Who Can Sign Up For Plan G

If you qualify for Original Medicare, you may be able to enroll in Plan G. American citizens and legal residents of at least five years can qualify for Medicare. Having worked 10 or more years is a requirement for getting Part A without a premium. If you have not worked 10 years in the US, you may still be eligible for Medicare but you have to pay the Part A premium. And in most cases, you should either be turning 65 or have a disability that qualifies for Social Security disability benefits.

The only exception to getting Medicare without the 2-year wait is amyotrophic lateral sclerosis . Cancer and other diseases e.g. some cases of breast cancer, early-onset Alzheimers disease, may be considered a disability if it meets the SSDI criteria and the 24-month waiting period applies.5

Read Also: Does Medicare Cover Massage Therapy

Paying For Medicare Deductibles

Medicare Supplement Insurance provides full or partial coverage for the Medicare Part A and Part B deductibles. So instead of paying out of pocket to meet a deductible, you can simply pay a premium to belong to an appropriate Medigap plan and the Medigap insurance will cover the cost of that deductible.

Even better, Medigap plans cover more than just the cost of deductibles. Other out-of-pocket expenses such as copayments and coinsurance can also be covered by several Medigap plans.

To learn more about how trading a Medicare deductible for a Medigap premium may benefit you financially, speak with a licensed agent. Compare free quotes for Medicare Supplement Insurance plans online today.

To learn more about Medicare, read through some of the guides below.

Who Is Eligible For Medicare Advantage

Generally, Medicare Advantage is available for:

- Seniors age 65 or older

- Younger people with disabilities

- People with end-stage renal disease

With Medicare Advantage plans, you must also be enrolled in Medicare Part A and Part B and reside in the plans service area.

Enrollment only occurs during certain periods, but you cannot be denied coverage due to a preexisting condition. Specifically, you can join or switch to a Medicare Advantage plan with or without drug coverage during the following three windows:

- Initial Medicare Enrollment Period: Begins three months before you turn 65 and ends three months after you turn 65

- Open Enrollment Period: From Oct. 15 to Dec. 7

- Medicare Advantage Open Enrollment Period: Jan. 1 to March 31 annually

Read Also: Are Doctors Required To Accept Medicare

How Can I Purchase A Medicare Supplement Plan

To purchase a Medicare Supplement plan, you must be enrolled in Original Medicare. The best time to enroll is during your Medigap Open Enrollment Period. This six-month period begins when you enroll in Medicare Part B.

During this period, insurance companies cannot subject you to medical underwriting. This is a process that can be used to raise your premiums or deny you coverage. Outside of this period, you are not guaranteed the ability to enroll in a Medicare Supplement plan. Each plan of the same type must cover the same standard set of benefits. However, your costs can vary from carrier to carrier.

MORE ADVICE Discover more tips for comfortably aging in place

- Plan L

- Plan N

*Plan C and Plan F are available only to applicants who were first eligible for Medicare prior to 2020.

As mentioned before, each plan offers a different set of benefits. Youll want to review each of these options to find the plan that works best for you.

You May Like: Does Kaiser Medicare Cover Dental

Do You Have To Pay A Deductible With Medicare

Youve probably heard the one about death and taxes. If you have Original Medicare, you can add deductibles to that list.

If you have Original Medicare , you will have deductibles that must be paid, either by you or your Medigap plan.

If you prefer not to pay deductibles, considering a Medicare Advantage Part C plan may make sense.

Part C and Part D plans may or may not have annual deductibles. And while you are still responsible for your Part B deductible if you switch to a Part C plan, some Part C plans help pay your Part B deductible.

Check with your plans provider to find out if the plan youre interested in has a deductible of $0 or more. And, if you need our help, just reach out. GoHealth is here for you.

Also Check: Does Medicare Cover Auto Accidents In Michigan

Standard Medicare Supplement Coverage

To make it easier for you to compare one Medicare Supplement policy to another, Indiana allows 8 standard plans to be sold. The plans are labeled with a letter, A through N. Plans H, I, and J are no longer offered, and Plans C and F are only available to people who were eligible for Medicare before January, 2020. There are high deductible versions of Plans F and G..

These 8 plans are standardized, which means that benefits will be the same no matter which company sells the policy to you. Plan A is the basic benefit package. Plan A from one company is the same as Plan A from another company. Since Medicare Supplement policies are standardized, you are free to shop for the company with the best price and customer service. To see what benefits are offered with each plan,.

Generally, Medicare Supplement policies pay most, if not all, Medicare copayment amounts, and policies may pay Medicare deductible amounts except for the Part B deductible. Although the benefits are the same for each standard plan, the premiums may vary greatly. Before purchasing a supplement policy, determine how the company calculates its premiums.

An insurance company can calculate premiums one of three ways.

- Issue Age: If you were 65 when you bought the policy, you will pay the same premium the company charges people who are 65 regardless of your age.

- Attained Age: The premium is based on your current age and will increase as you grow older.

- No Age Rating: Everyone pays the same premium regardless of age.