How Much Does Medicare Advantage Cost

Some Medicare Advantage plans may have lower out-of-pocket costs than Original Medicare, and some have a $0 monthly premium. Here are a few questions to consider before purchasing a plan.

- Does the plan have a monthly premium?

- Most have a $0 premium.

- Some pay your Part B premium.

- If you choose a plan with a premium, it will be paid separately from your Part B premium.

Once youre enrolled in a Medicare Advantage plan, it becomes your primary insurance. The provider handles paying all your claims, and the cost of your plan is likely to change every year. The plan provider sets the amounts charged for premiums, deductibles and services. An Annual Notice of Change is mailed to you each September, which goes into effect the following January 1.

Factors like location play a major role in determining the cost of a Medicare Advantage plan. Costs are typically lower when you use providers in your plans network and service area. To find the specific cost of a Medicare Advantage plan in your zip code, visit Medicare.gov.

What Should I Do Next

When youre ready to shop for a Medicare plan, heres what you can do next:

- To sign up for Medicare parts A and B, contact the Social Security Administration. You can call 800-772-1213, visit your local Social Security office, or use Social Securitys online Medicare application.

- If youre interested in Medicare Advantage plans in Illinois, you can compare plans at Medicare.gov. If you see a plan you like, you can enroll online.

Best For Size Of Network: Unitedhealthcare

Average Medicare star rating: 4.2 out of 5.

Service area: Available in 50 states and Washington, D.C.

Standout feature: UnitedHealthcare offers the largest Medicare Advantage network of all companies, with more than 1 million network care providers.

UnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties. UnitedHealthcare also partners with AARP, insuring the Medicare products that carry the AARP name. Many of UHCs members are in highly rated plans, although member satisfaction ratings are lower than those of several other providers.

Pros:

-

Nearly all of UnitedHealthcare Medicare Advantage members who are in contracts with Medicare star ratings are in contracts rated 4 stars or higher.

-

UnitedHealthcare offers $0-copay telehealth visits, as well as annual home health visits.

-

UHC offers members the chance to work with expert advocates if they have care questions, as well as care coordinators for complex health issues.

Cons:

-

Despite being a big player in the industry, UnitedHealthcares scores in J.D. Power’s 2021 Medicare Advantage Study, which measured member satisfaction, were lower than the industry average. UHC tied for sixth out of nine providers measured.

Don’t Miss: How Old To Collect Medicare

Original Medicare + Medigap Vs Medicare Advantage

If you are worried that an HMO or PPO plan will try to limit your care, or that the pros and cons of Cook County Medicare Advantage plans is simply too confusing, Medicare Advantage is not the only way to get full coverage. For a little more each month you can have the best care available and lower your out-of-pocket expenses. Savvy seniors hold on to their Original Medicare and get the additional coverage they need with a Illinois Part D Plan and a Cook County supplemental insurance policy .

If you are not aware of the benefits of Medicare supplement insuranceMedicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare health insurance coverage., and how it pays the big medical bills from an extended illness or hospital stay, check out our Medigap page and compare Medicare supplement plans in your area. All Medicare supplements are standardized and regulated. That means you can go with the lowest cost policy and get all of the same benefits.

What Are The Best Medicare Supplement Plans In Illinois For 2022

Medicare Supplement plans cover the gaps between what Original Medicare pays and what it leaves for the beneficiary to pay out-of-pocket. These policies pay secondary to Original Medicare to offset your financial responsibility.

When you enroll in Medigap, you keep all the same benefits of Original Medicare. You can see any doctor who accepts Original Medicare meaning almost all practitioners in the United States.

The Best Medicare Supplement Plans in Illinois are:

- Medicare Supplement Plan F

- Medicare Supplement Plan G

- Medicare Supplement Plan N

Medicare Supplement Plan F was once the King of Medicare Supplement plans because it covers every cost after Original Medicare pays. However, many Medicare beneficiaries are no longer eligible to enroll in this coverage. Specifically, those initially eligible for Original Medicare after January 1, 2020, cannot enroll in Medigap Plan F.

Additionally, Medicare Supplement Plan F has declined in popularity, even among those eligible to enroll. This decrease in enrollment is due to high premium increases on Medigap Plan F, which negates the annual savings that come with the plans coverage of the Medicare Part B deductible. Thus, it is more cost-effective for most to enroll in Medicare Supplement Plan G.

With Medicare Supplement Plan N, you are responsible for covering the Medicare Part B deductible and $20-$50 copayments when visiting the doctor or emergency room. Additionally, you may be subject to excess charges.

Recommended Reading: Does Medicare Pay For Calquence

We Simplify Your Access To Better Healthcare Insurance Choices

Medicare is one of the most popular federal healthcare insurance program available to people 65 years and older in Illinois. However, there are several healthcare costs that are not covered by original Medicare.

These include medical and hospital costs incurred overseas, hearing aids and other equipment costs, home nursing costs, dental examination and treatment costs and more. As a result, even those who are eligible for basic Medicare health insurance may choose a Medicare Supplemental Plan or a Medicare Advantage HMO or PPO plan to get the right coverage.

As one of the state of Illinois and Chicagoland most online reputable Medicare Advantage and Supplement Insurance Plan brokers, we have in-depth knowledge of the various plan options available, as well as factors that may influence the total cost of a plan.

Using this knowledge and years of experience, we help you select a policy that will provide comprehensive healthcare coverage and peace of mind that your needs will be taken care of in the case of an urgent medical condition.

How To Find The Best Medicare Advantage Plan In Illinois

Between the many insurance companies that serve Illinois residents, there are hundreds of Medicare Advantage plans to choose from. With so many options, theres sure to be one thats an excellent fit for your healthcare needs and budget. But how do you find the right one?

The best way to narrow down your options is to evaluate your current health needs. Is prescription drug coverage essential for health maintenance? Are you the type who rarely goes to a doctor except for your annual physical? Do you travel frequently and need to see a doctor whether youre in Rockford, Rock Island, or Rockville?

Once you identify the features that are most important to your needs, you can narrow down the options. Finding the best Medicare Advantage plan for you is easy with Insurify. It takes just a couple of minutes to search for plans. Type in your ZIP code, and youll instantly be matched with plans that you can compare with a few clicks of your mouse.

Don’t Miss: Who Is Entitled To Medicare Benefits

What Is Medicare Advantage In Illinois

Every Medicare Advantage plan must provide the same benefits that you get with Original Medicare, which includes:

- Medicare Part A covers inpatient services such as you’d receive in a hospital or skilled nursing facility

- Medicare Part B covers outpatient services, including doctor visits, lab work, outpatient procedures performed in a hospital, durable medical equipment , and more

Prescription drug coverage is not included with Original Medicare. If you do not have creditable drug coverage elsewhere, you need a Medicare Part D plan.

Medicare Advantage plans are not limited to the benefits provide by Parts A and B. In fact, over 90 percent of them offer additional coverage. The most common items are:

- Prescription drug coverage

- Routine vision and dental care

- Fitness programs like SilverSneakers

Please note that joining a Medicare Advantage plan in Illinois does not exempt you from the Medicare Part B premium.

Cook County Il Medicare Information

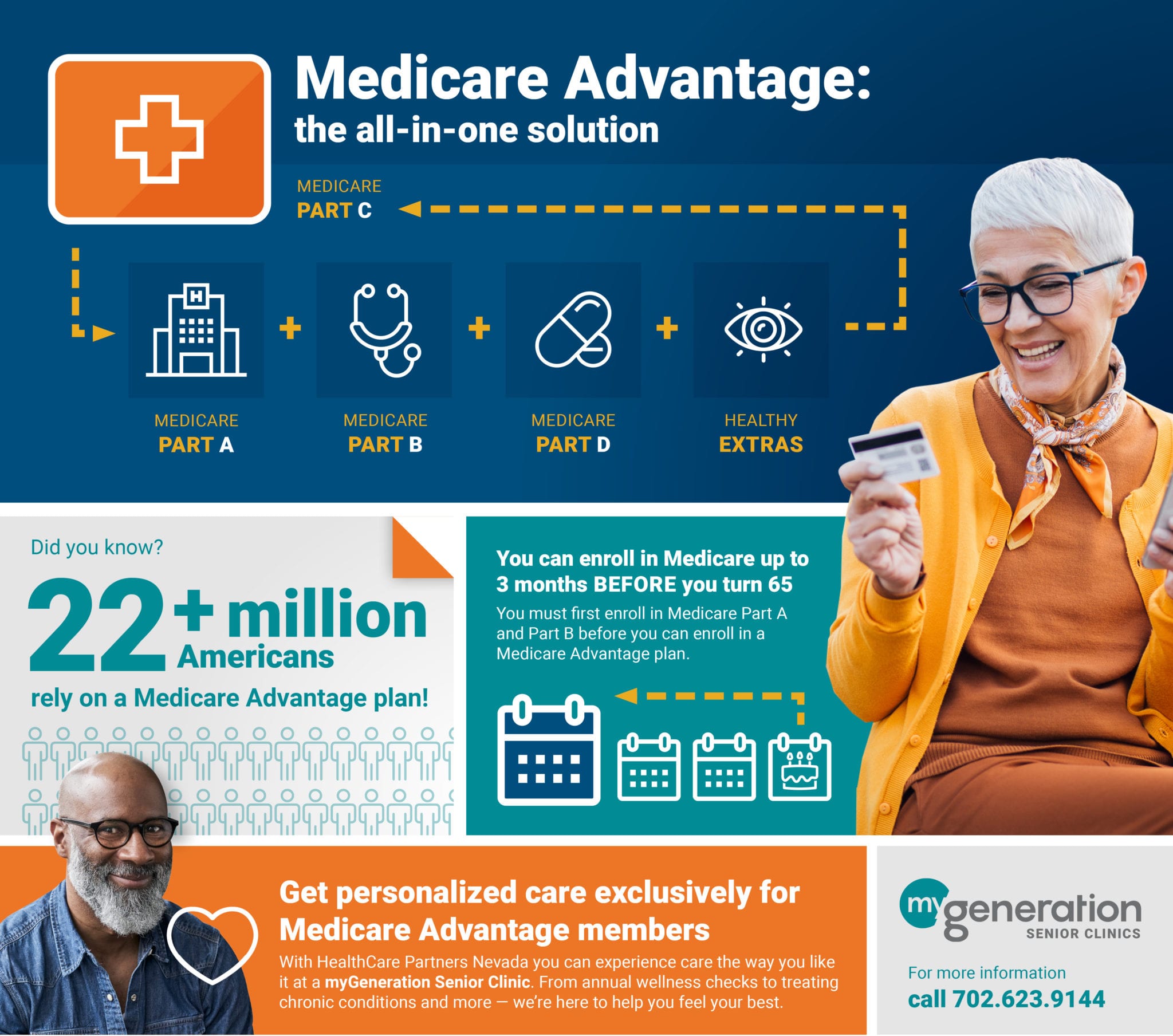

For Cook Countys Medicare beneficiaries, Medicare Advantage plans offer an alternative to Original Medicare. Currently, 53 MA plans are available in Cook County, and coverage is provided through Medicare-approved private companies, following rules set by Medicare. MA plans, which are also referred to as Medicare Part C, may offer additional benefits that aren’t available through Original Medicare.

For Cook Countys Medicare beneficiaries, Medicare Advantage plans offer an alternative to Original Medicare. Currently, 53 MA plans are available in Cook County, and coverage is provided through Medicare-approved private companies, following rules set by Medicare. MA plans, which are also referred to as Medicare Part C, may offer additional benefits that aren’t available through Original Medicare.

Some Medicare Part C plans include coverage for prescription medications. Known as Medicare Advantage Prescription Drug plans, or MAPDs, these plans offer comprehensive coverage for seniors who want to minimize their out-of-pocket costs.

Learn more about Medicare Advantage plans in Cook County, Illinois, including average costs, out-of-pocket expenses and whats involved in obtaining prescription drug coverage.

Read Also: What Are The Qualifications To Get Medicare

What Is Every Medicare Advantage Plan Required To Include

Every Medicare Advantage plan must include the benefits provided by Original Medicare Part A and Part B. Original Medicare Part A covers 80% of hospital stays, skilled nursing, home health care and hospice care. Original Medicare Part B covers 80% of doctors visits, preventative care, mental health services, physical therapy, occupational therapy, lab services and other outpatient services.

Medicare Part D Trends In Illinois:

- There are 23 stand-alone Medicare prescription drug plans available in 2022.

- 100 percent of people with a stand-alone Medicare prescription drug plan have access to a plan with a lower premium than what they paid in 2021.

- There are 7 stand-alone prescription drug plans and 69 Medicare Advantage plans with prescription drug coverage that will offer lower out-of-pocket insulin costs through the Part D Senior Savings Model.

- 26 percent of people with a stand-alone Medicare prescription drug plan get Extra Help.

- The lowest monthly premium for a stand-alone Medicare prescription drug plan is $6.90 in Illinois.

Read Also: Does Medicare Pay For Electric Recliners

What Is The Best Way To Compare Medicare Advantage Plans

Answer: The Plan Finder tool at Medicare.gov is the best way to compare all of the Medicare Advantage plans in your area. These plans provide medical and drug coverage from a private insurer, and are an alternative to signing up for traditional Medicare along with a medigap and a Part D prescription-drug policy.

How To Find The Best Medicare Advantage Plan

Find a knowledgeable insurance agent, says Joe Valenzuela, co-owner of Vista Mutual Insurance Services in the San Francisco Bay area. Having an agent doesnt cost the member anything. Medicare insurance agents are subject matter expertsmany have spent years learning the ins and outs of each plan they represent. There are also many nuanced differences between Medicare Advantage plans. An agent can narrow down the search to only those plans that most closely align with the clients needs.

Valenzuela recommends asking what is most important to you when choosing a Medicare Advantage plan and keeping that priority top of mind. He also suggests paying attention to the fine print in the plan you select.

Once you narrow your search down to one or two plans, look through the plans benefits line by lineyou dont want any surprises, he says. For example, a plan may have a low premium and copayments but might cost you much more each month in prescription copays.

A couple of important benefits to look at are the plans annual out-of-pocket maximum and your prescription drug costs, adds Valenzuela. Check all your medications on the plans formulary so youre aware of the prescription copayments, deductibles and any restrictions.

Compare Top Medicare Plans From Humana, a Forbes Health 5-Star Rated Carrier

Read Also: Does Medicare Pay For Urgent Care

Best Medicare Advantage Plans In 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medicare Advantage is a bundled alternative to Original Medicare that includes all the benefits of Original Medicare and often a few extras, such as cost help with dental and vision care. Medicare Advantage plans are offered by private insurers, and plan availability depends on location.

Medicare Advantage plans are a popular option for people who are eligible for Medicare: Nearly half of Medicare-eligible people are in a Medicare Advantage plan. But each plan has different strengths and weaknesses. Heres a rundown of the top Medicare Advantage plans in 2022.

-

Best of the Blues:Highmark Medicare Advantage.

Medicare Enrollment In Illinois

If youre eligible for Medicare, you can sign up at certain times throughout the year. These times include:

- Initial enrollment period. This 7-month period is available for people who become eligible for Medicare when they turn age 65. It starts 3 months before the month you turn 65 years old and ends 3 months after your birthday month.

- Annual open enrollment period. The annual open enrollment period runs from October 15 to December 7. If you sign up for a Medicare Advantage plan during this period, your new coverage will start on January 1.

- Medicare Advantage open enrollment period. From January 1 to March 31 every year, you can switch to a different Medicare Advantage plan. If you make changes, your new coverage starts on the first day of the month after the insurer gets your request.

- Special enrollment period. If you experience certain life events, youre allowed to sign up for Medicare outside of the annual enrollment periods. You could have a special enrollment period if you lose your employer health coverage, for example.

In some circumstances, you may be signed up for Medicare automatically. If youre eligible for Medicare due to a disability, youll be enrolled after you receive SSDI checks for 24 months. If you get Railroad Retirement benefits or Social Security retirement benefits, youll be enrolled when you turn 65 years old.

Don’t Miss: When Must The Medicare Supplement Buyer’s Guide Be Presented

How Much Are Medicare Advantage Plans

In Illinois in 2021: Medicare Advantage: The average monthly Medicare Advantage premium changed from $16.96 in 2020 to $14.76 in 2021. This represents a -13 percent change in average premium. 147 Medicare Advantage plans are available in 2021, compared to 126 plans in 2020. This represents a 16.67 percent change in plan options.

Best Medicare Part D Plans For 2023

Medicare Part D plans in 2023 will be changing slightly as they always do, as will the premiums, cost, and benefits of each plan.

Many people will be enrolling in one of the best Medicare Part D plans for 2023 due to their low monthly premiums and co-pays.

Its always best to allow us to help you review your Medicare Part D drug plan once per year. Because of these changes its very common to change plans and companies so your plan fits your needs as well as the medications youre currently taking.

There are several Medicare Part D drug plans available in your area.

Also Check: Does Medicare Part B Pay For Prescription Drugs

Does A Medicare Advantage Plan Replace Original Medicare

In Illinois, 2,284,894 individuals are enrolled in Medicare. In Illinois in 2022: Medicare Advantage: The average monthly Medicare Advantage premium changed from $14.05 in 2021 to $12.83 in 2022. This represents a -8.68 percent change in average premium. 166 Medicare Advantage plans are available in 2022, compared to 145 plans in 2021.

Great For Nationwide Coverage: Humana

-

Ranked 2nd by J.D. Power for customer satisfaction

-

Benefits for over-the-counter drugs

-

Wide range of plan types available

-

Few plans offer additional drug coverage in the gap

Humana is the second-largest provider of Medicare Advantage plans nationwide, with 18% of the market in 2022. It also stands out as the second-best company for customer satisfaction, according to J.D. Powerâs 2022 U.S. Medicare Advantage Study . HMO, PPO, and PFFS plans are available, depending on where you live, and Humana offers perks like an over-the-counter drug benefit.

The reason Humana doesnât score higher is that few of its Medicare Advantage plans with drug coverage offer any additional coverage in the coverage gap. Fewer than one third, in fact. If you rely on prescription drugs and they cost more than $4,660 in 2023, you could be on the hook for 25% of their cost in the coverage gap.

Plans are available in all states except for Alaska, Rhode Island, and Wyoming.

Read more in our Humana Medicare review.

Don’t Miss: Is Medicare Issuing New Plastic Cards

Preferred Provider Organization Ppo Plans

PPO plans allow you to visit any doctor you wish, as long as they are Medicare-approved and abide by and agree to the terms of the plan. You may get coverage outside the network but it typically costs more than in-network.

With PPOs

- Visit any doctor or hospital that is Medicare-approved and accepts the plans terms

- Do not need a referral to see a specialist

- Often include prescription drug coverage