The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Tell Ors Your Medicare Number And Effective Dates For Parts A And B

When your new 11-digit Medicare card arrives, tell ORS your Medicare number as soon as you receive your card.

- Log in to miAccount and send a secure message on Message Board, using the Submit My Medicare Number category. Include the name, Medicare number, and effective dates for parts A and B in your message for the individual going on Medicare.

- Use miAccount to update your Medicare information and complete a plan change to enroll in the Medicare health and prescription drug plan. Print the confirmation page and mail or fax it to ORS.

- Make a copy of your Medicare card. Write your name, member ID, address, and date of birth on the copy and mail or fax the copy of your card.

- Mail or fax a completed Insurance Enrollment/Change Request form to ORS with your Medicare information.

Do not enroll yourself or your eligible dependents in an individual Part D plan . All prescription drug plans offered by the retirement system for Medicare members are Part D plans, including those offered by our HMO options.

Having Creditable Drug Coverage

Before you officially delay Medicare, make sure you have creditable drug coverage. This means your employer drug coverage is at least as good as the standard Medicare Part D plan coverage. If your employer’s drug coverage isn’t creditable, you will need to enroll in a Part D plan during your Initial Enrollment Period to avoid the Part D late enrollment penalty . Consequently, you’ll also need to get either Part A or Part B in order to get a Part D plan.

You May Like: Does Medicare Pay For Telephone Psychotherapy

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

2 months after you sign up |

|

2 or 3 months after you turn 65 |

3 months after you sign up |

Reaching Age 62 Can Affect Your Spouse’s Medicare Premiums

Although reaching age 62 does not qualify you for Medicare, it can carry some significance for your spouse if they receive Medicare benefits.

When one spouse in a couple turns 62 years old, the other spouse who is at least 65 years old may now qualify for premium-free Medicare Part A if they havent yet qualified based on their own work history.

- For example, Gerald is 65 years old, but he doesnt qualify for premium-free Part A because he did not work the minimum number of years required for eligibility. He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

- Lets say Geralds wife, Jessica, reaches age 62 and has worked for the required number of years to qualify for premium-free Part A once she turns 65. Because Jessica is now 62 years old and has met the working requirement, Gerald may now receive premium-free Part A.

In the above example, Jessica has not become eligible for Medicare by turning 62. Her husband Gerald, however, is now eligible to receive his Medicare Part A benefits without paying a monthly premium any longer.

Don’t Miss: How Much Does Medicare Cost At Age 62

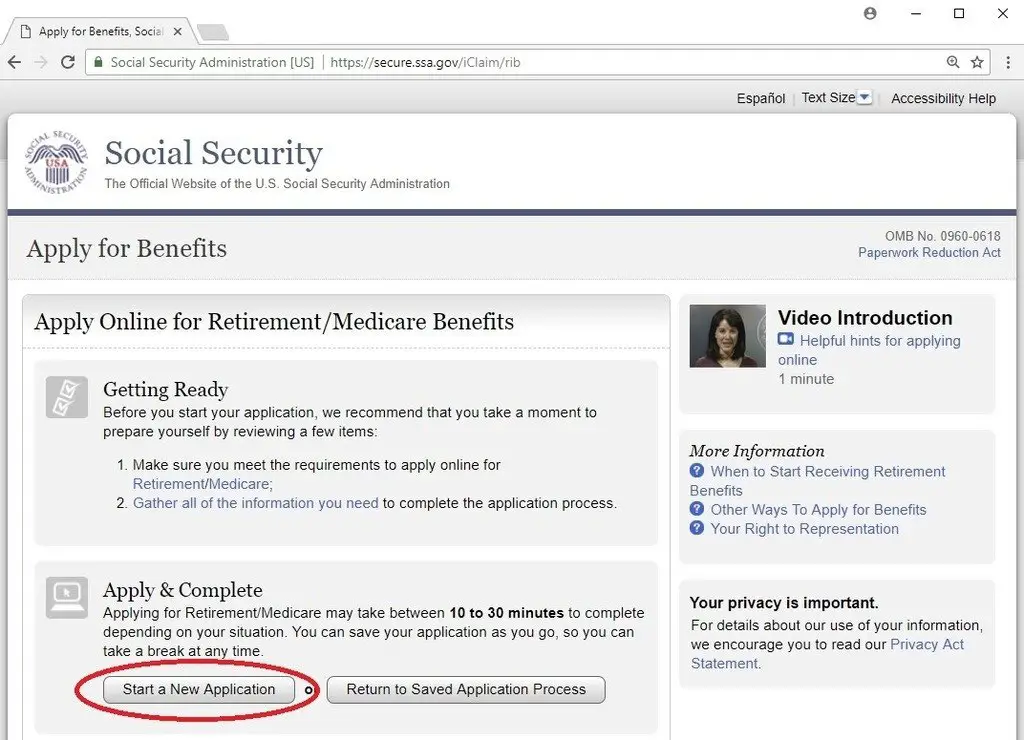

What You Need To Do

If you will be eligible for Medicare when you retire, you should contact Social Security to enroll in both Medicare Parts A and Parts B three months before your retirement effective date. You will get a Medicare number once you are enrolled that you will need to provide to ORS when you enroll in an insurance plan.

When you apply to retire, you’ll have a chance to enroll in a retiree insurance plan in step two of the online application. You will pick a carrier from the list of available options in your area and ORS will enroll you in the respective Medicare Advantage plan. Once you’re enrolled in the Medicare plan of your choice, you can expect ID cards and welcome kits from your selected carrier. If you apply at least three months before your insurance effective date, your cards will usually arrive before your coverage begins. If you need health services before your cards arrive, contact the insurance carrier directly to get your policy number or to verify coverage. For more information, go to your insurance carrier’s website. Waiting to enroll in Medicare could affect your eligibility and coverage.

New Medicare Card

Tell ORS your Medicare number and effective dates for parts A and B

If your new 11-digit Medicare card arrives after you apply to retire, tell ORS your Medicare number as soon as you receive your card.

You can submit your Medicare enrollment information one of the following ways:

Consequences of not enrolling on time or disenrolling

Effects of other coverage

Medicare Eligibility For Medicare Advantage Before 65

After youre enrolled in Original Medicare, you may choose to remain with Original Medicare or consider enrollment in a Medicare Advantage plan offered by a private, Medicare-approved insurance company.

Medicare eligibility for Medicare Part C works a little differently. Youre eligible for Medicare Advantage plans if you have Part A and Part B and live in the service area of a Medicare Advantage plan. If you have End Stage Renal Disease , you usually cant enroll in a Medicare Advantage plan, but there may be some exceptions, such as a Medicare Advantage plan offered by the same insurance company as your employer-based health plan, or a Medicare Special Needs Plan .

When you enroll in a Medicare Advantage plan, youre still in the Medicare program and need to pay your monthly Medicare Part B premium and any premium the plan charges. The Medicare Advantage program offers an alternative way of receiving Original Medicare coverage but may offer additional benefits. For example, Original Medicare doesnt include prescription drug coverage or routine dental/vision care, but a Medicare Advantage plan may include these benefits and more. Benefits, availability and plan costs vary among plans.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

You May Like: How To Apply For Help Paying Medicare Premiums

Medicare Prescription Drug Coverage

Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans. If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

The Basics On Signing Up

Medicare enrollment in Part A and Part B is automatic if you have claimed Social Security benefits before your 65th birthday your Medicare card will arrive in the mail and coverage begins the first day of the month in which you turn 65. There is no premium charged for Part A in most cases, and you may be able to turn down Part B at that point without incurring late-enrollment penalties if you are still working and receive your primary insurance through work.

If you have not yet applied for Social Security, signing up for Medicare requires proactive steps to avoid problems.

Medicare offers an Initial Enrollment Period around your 65th birthday. If you miss that window, you will be subject to a late enrollment surcharge equal to 10 percent of the standard Part B premium for each 12 months of delay a penalty that continues forever. That can really add up. In 2017, 1.3 percent of Part B enrollees paid penalties , according to the Congressional Research Service. On average, their total premiums were 31 percent higher than what they would have been.

Medicares prescription drug program comes with a much less onerous late enrollment penalty, equal to 1 percent of the national base beneficiary premium for each month of delay. In 2019, the base monthly premium is $33.19, so a seven-month delay would tack $2.32 onto your plans premium.

Late enrollment also exposes you to significant gaps while waiting for Medicare coverage.

You May Like: Does Medicare Cover Prolia Injections

Don’t Miss: How To Get Started With Medicare

If Im Still Working At Age 65 When Do I Sign Up For Medicare

En español | If you arent already receiving Social Security benefits at age 65, you wont be signed up automatically. So youll have to make a decision.

Whether you need to enroll in Medicare if you continue to work and have health benefits through your job depends on the size of the employer. The same rules apply if your health insurance is through your spouses job.

Know Your Medicare Plan Options

Everyone has different health care needs. The best Medicare plan for you may look different from what works for others in your life. Having a cancer diagnosis adds an additional layer to consider. Before making any enrollment decisions, its important to do your research and understand how Medicare is structured.

The U.S. governments Medicare websiteoffers helpful information. Or you can call 1-800-MEDICARE. You can also get free guidance through the State Health Insurance Assistance Program . This federally funded counseling service offers objective support to help you understand your options. Call SHIP at 1-877-839-2675 or visit the SHIP National Technical Assistance Center website.

As you do your research, these are some of the Medicare plans you may encounter:

- Part A of original Medicare covers inpatient hospitalization, skilled nursing care, hospice, and some home care services.

- Part B of original Medicare covers outpatient services such as doctors visits, physical and occupational therapy, preventive screenings, and some medical equipment and supplies.

- Part D covers outpatient prescription drugs.

- Part C or Medicare Advantage is an alternative coverage plan offered through federally approved private insurance companies. These plans are required to provide at least the same coverage as Parts A and B and in most cases, Part D. However, they may have different rules, costs, and coverage restrictions.

Dont Miss: Is Silver Sneakers Part Of Medicare

You May Like: How Do I Contact Medicare Cms

Retiring At 67 Understanding Your Medicare Benefits

For anyone born after 1960 or after, the full retirement age is 67. This is the age that you will be able to receive your full retirement benefits. However, if you are planning to retire at the age of 67, you should be aware that you may need to make some decisions about your health insurance prior to retirement. Medicare provides coverage for all adults over the age of 65 or with long-term disabilities, but to take advantage of this care, you must enroll at the appropriate time to receive the best coverage at the best price.

When Should You Apply for Medicare Coverage?

In order to receive Medicare coverage, you will need to apply during the initial enrollment period. This period begins three months prior to your birthday and ends three months after you turn 65. In order to receive Medicare benefits, it is critical that you enroll in coverage during this initial period so that you can ensure you gain coverage that will last you throughout the remainder of your life.

Upon initial enrollment, you can enroll in both Medicare Part A and Part B. Part A enrollment is required, whereas Part B enrollment is optional. However, if you decide to decline Part B enrollment and that you would like to receive this coverage at a later time, you may experience a delay in coverage and be forced to pay a higher premium payment.

What Medicare Coverage Will You Receive?

Related articles:

How Medicare Affects Your Coverage

Medicare is the federal health insurance program for people who are 65 or older, or otherwise receiving Social Security disability benefits.

Medicare is divided into four different parts, which cover specific services. You will only need to focus on these three if you enroll in a state-sponsored retiree insurance plan:

- Part A

- Part D

You May Like: Does Medicare Pay For Drug Rehab

What If Im Not Automatically Enrolled At 65

If your Medicare enrollment at 65 is not automatic, but you want to enroll, here are some more magic numbers.

3 and 7.

To start taking advantage of Medicare at 65, you need to sign up during the three months before the birthday month you turn 65. Those are the first three months of your seven-month Initial Enrollment Period.

Unless your birthday is on the first day of the month, your Initial Enrollment Period includes the three full months before turning 65, the month you turn 65, and the three months after you turn 65. If you were born on the first day of the month, IEP is the four months before your birth month, along with your birthday month and the two months after.

If you sign up during one of the months before your 65th birthday, your coverage will begin on the first day of the month you turn 65 .

Are you eligible for cost-saving Medicare subsidies?

Delaying Medicare Due To Work: Special Enrollment Period

If you didn’t enroll in Medicare because you were still working, and you were covered under a group health plan based on employment, you have a Special Enrollment Period during which you can sign up for Part A and/or Part B. While you or your spouse are still working and you’re still covered under a group health plan, you can sign up anytime.

After your or your spouse’s employment ends, your Special Enrollment Period lasts eight months, starting the month after the employment or group health plan ends . However, you have only two months after the employment or group health plan ends to sign up for a Medicare Advantage plan or Part D prescription drug plan . You can enroll in a Medicare Advantage plan starting three months before your Medicare Part B enrollment is due to take effect up to the day before your Part B coverage startsbut again, enrollment must take place within two months of your employment or group health plan ending.

Example:

Judy’s last day of work is July 1 and her group health plan ends July 31. She has eight months, until April 30, to sign up for Part B without a penalty. But if she wants to join a Medicare Advantage plan, she needs to do so by September 30 . Instead, on June 15, Judy signs up for Part B coverage to begin on August 1, so that she won’t have a gap in coverage. She has only until July 31 to add a Medicare Advantage plan . Her Medicare Advantage plan will start August 1.

Don’t Miss: How Long Can You Stay In The Hospital Under Medicare

Some Retiree Health Plans Terminate At Age 65

If you’re not yet 65 but are retired and receiving retiree health benefits from your former employer, make sure you’re aware of the employer’s rules regarding Medicare. Some employers don’t continue to offer retiree health coverage for former employees once they turn 65, opting instead for retirees to transition to being covered solely by Medicare. Without coverage from your company, you’ll need Medicare to ensure that you are covered for potential health issues that arise as you age.

What Happens If You Dont Sign Up For Medicare At 65

When you near your 65th birthday, you will enter what is called your Initial Enrollment Period . This seven-month period begins three months before you turn 65, includes the month of your birthday and continues for three additional months. This is your first opportunity to sign up for Medicare.

If you choose not to sign up for Medicare during your IEP, there are a few scenarios that might play out depending on your situation.

Medicare Advantage plans do not have a late enrollment penalty. You can sign up for a Medicare Advantage plan at any age, as long as you are already enrolled in Medicare Part A and Part B.

Medicare Supplement Insurance does not technically have a late enrollment penalty. However, if you enroll in a Medigap plan during your Medigap Open Enrollment Period, insurance providers arent allowed to use medical underwriting to determine your plan premiums or deny you coverage. Your Medigap Open Enrollment Period lasts for six months and starts as soon as you are 65 and enrolled in Medicare Part B.

There are also some Medicare Special Enrollment Periods that may apply to a someone who is turning 65. For example, if you are living overseas at the time of your 65th birthday and then later return to the U.S., you may qualify for a Special Enrollment Period for which you can sign up for Medicare with no late enrollment penalty.

Recommended Reading: Does Medicare Cover Laser Therapy