Ask Rusty I Have Va Coverage Should I Get Medicare Part B

Dear Rusty:I am a 74 year old veteran enrolled with the VA. I have never had Medicare Part B. Should I? My only source of income is Social Security.Signed: Retired Veteran

Dear Retired Veteran: First, thank you for your service to our country. Like you, I use the VA for certain healthcare needs but, unlike you, I am also enrolled in Medicare Part B. The decision on whether to have both is a personal choice only you can make, but Ill give you some things to consider:

If you are 100% satisfied with your VA coverage, and if that coverage is conveniently available to you, and if the VA provides all the health care you will ever need wherever you happen to be, then enrolling in Medicare Part B may not be needed in your personal situation. For me, the nearest full service VA facility is about 40 miles away, while just about every imaginable private healthcare service is nearby. Thus, for convenience reasons, I am enrolled in Part B so I can use any doctor or medical service provider I want within just a few miles of my home. I also travel a fair amount, and I like the convenience and flexibility of using any healthcare provider I happen to be near, without worrying about finding a VA facility or VA-affiliated private provider. So, for me, it all comes down to convenience and flexibility to use any healthcare provider I want. I use my VA coverage when its convenient for me, but otherwise use non-VA providers. But your needs may be different.

Do I Need A Medicare Supplement If I Have Va Benefits

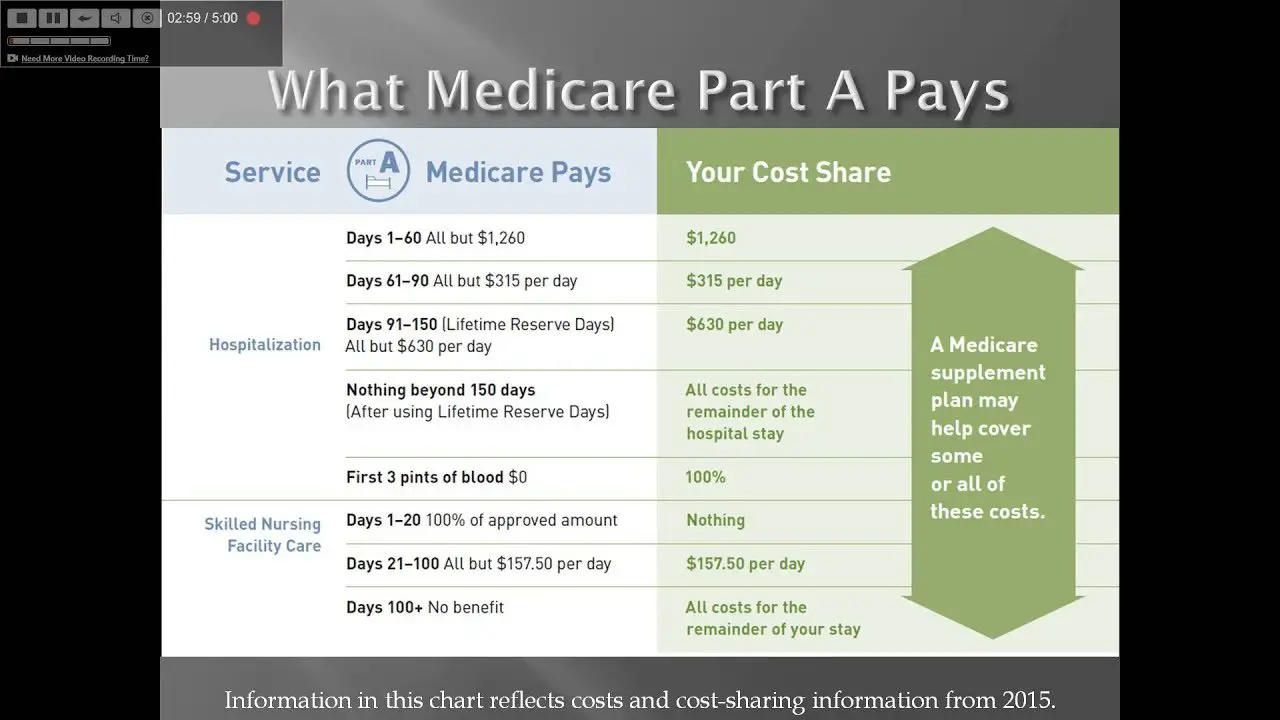

A Medicare Supplement plan can benefit anyone who has Original Medicare, regardless of what other coverage they might have. Part A and Part B dont cover 100% of your care, but when you have a Medigap plan, it pays for the balance youre responsible for after Medicare pays.

When you have this type of policy in addition to your Medicare and VA coverage, your visits to civilian facilities and hospitals that accept Medicare will receive full coverage. Although the VA doesnt bill Medicare, they may bill your Medigap plan for services the plan covers .

What The Part B Late Enrollment Penalty

If you do not have creditable coverage after you first become eligible for Medicare Part B, you incur a penalty that you will pay when you eventually do enroll in Part B.

The late enrollment penalty fee amount is a 10 percent increase in your Part B premium for each 12-month period you could have enrolled in Part B but did not.

- For example, if you did not enroll in Part B when first eligible and delayed your enrollment for 14 months , your standard Part B premium amount including your late enrollment penalty would be $149.05 per month.

- This total includes the standard Part B premium of $135.50 per month, plus your late enrollment penalty of $13.55 per month .

If you qualify for a Medicare Special Enrollment Period, you may not be required to pay the late enrollment penalty.

Also Check: Can Medicare Be Used Out Of State

Retiree Health Plan Part B Reimbursement Options

If you’re retired and have Medicare and retiree group health plan coverage from a former employer, Medicare typically pays first for your medical bills and your retiree plan would pay the remaining amount.

Some of these retiree plans offer a Part B reimbursement to eligible enrollees. Each retiree plan has different eligibility requirements, so check with your plan to understand your options. However, for most plans you must be a retired employee or already enrolled in the health plan and be enrolled in Medicare Part B.

You may be reimbursed the full premium amount, or it may only be a partial amount. In most cases, you must complete a Part B reimbursement program application and include a copy of your Medicare card or Part B premium information.

When To Enroll In Medicare Part B

The actual Medicare application process also parallels that of Part A. However, your decision about signing up for Part B can depend on personal preferences or other health insurance plans. One of the biggest factors for Part B enrollment is private insurance. If you have a private insurance plan, you may not need to sign up for Part B immediately. Contact your agent if you have more questions on this front. Part B can be an important choice if you or a family member/spouse is disabled, still working and have employer-provided coverage. If this is the case, you may have options to delay your enrollment in Part B.

You May Like: Does Medicare Cover Whooping Cough Vaccine

How To Cancel Medicare Part B

The Part B cancellation process begins with downloading and printing Form CMS 1763, but dont fill it out yet. Youll need to complete the form during an interview with a representative of the Social Security Administration by phone or in person.

Due to the COVID-19 pandemic, all Social Security Administration offices are currently closed. The SSA is still answering phone calls, and you can access many services on its website. See the latest COVID-19 updates.

Call a Licensed Agent:

You can schedule an in-person or over-the-phone interview by contacting the SSA. If you prefer an in-person interview, use the Social Security Office Locator to find your nearest location. During your interview, fill out Form CMS 1763 as directed by the representative. If youve already received your Medicare card, youll need to return it during your in-person interview or mail it back after your phone interview.

What happens next depends on why youre canceling your Part B coverage.

Will I Pay Less For Fehb Premiums If I Enroll In Medicare

FEHB premiums are not reduced if you enroll in Medicare, but having Medicare Part A and B can allow you to switch to a less expensive version of your current FEHB plan, because some FEHB insurers waive cost sharing when you have Medicare Parts A and B. Contact your FEHB insurer if youre wondering whether your plan waives cost sharing for people enrolled in Medicare.

The decision whether to enroll in Part B often hinges on whether you have to pay more for it because of your income. You pay more for Part B in 2020 if you earn over $87,000 , according to your tax return from two years ago. These higher premiums can range from $202.40/month to $491.60/month. Youll have to gauge how much you are willing to pay in Part B premiums in exchange for lower cost sharing when you visit the doctor.

Recommended Reading: Does Medicare Cover Dental Root Canals

How To Opt Out Of Medicare Part B

So, if you dont want to be enrolled, you may be able to opt out. Follow the instructions in your Welcome to Medicare packet, which Medicare sends you during the three months before youre eligible, in most cases.

Were always happy to answer your questions. Call one of our eHealth licensed insurance agents at 1-888-296-0117 . Representatives are available from 8 AM to 8 PM Monday through Friday, and from 10 AM to 7 PM Saturdays, Eastern time.

NEW TO MEDICARE?

How To Apply For Medicare Part B

If you’re nearing 65 and you’re not receiving Social Security or Railroad Retirement Board benefits, you’ll want to apply for Part B as soon as you can. Similar to Part A, you can apply doing any of the following:

- Call the Social Security Administration at

- Go to your local Social Security office

- Sign up online at ssa.gov

If you already receive Social Security or RRB benefits, you don’t need to do anything. You’ll receive a Medicare red-white-and-blue card about three months before your 65th birthday. If disabled, you’ll receive your card during your 25th month of disability. Even if you dont want Part B, you can follow the instructions on that same card and return it.

Read Also: Does Medicare Pay For Air Evac

Medicare Part C: Medicare Advantage

Also known as Medicare Advantage, Part C is an alternative to traditional Medicare coverage. Coverage normally includes all of Parts A and B, a prescription drug plan , and, depending on your choice of a Medicare Advantage plan, other possible benefits.

Part C is administered by Medicare-approved private insurance companies that collect your Medicare payment from the federal government.

Depending on the plan, you may or may not need to pay an additional premium for Part C. You still need to pay your Medicare Part B premium. You don’t have to enroll in a Medicare Advantage plan, but for many people, these plans can be a better deal than paying separately for Parts A, B, and D. Beneficiaries will still pay separate premiums if they don’t choose to have the Part “C/D” premium taken out of their Social Security check.

If you’ve been pleased by the coverage of a Health Maintenance Organization , you might find similar services using a Medicare Advantage plan.

Youre Still Employed And Pass On Part B

If youre happy with the coverage your employer offers, you may think you dont need to enroll in Medicare. But individuals who work for a small employer should enroll in Part B because that will be their primary insurance coverage.

Employees of large companies do not have to enroll in Medicare. However, if they choose to sign up for Part A and B, Medicare will act as secondary coverage and pay for care after the GHP pays.

*The threshold for being considered a large employer is 100 employees when an individual qualifies for Medicare based on a disability.

Also Check: Does Medicare Cover Skin Removal

Can My Medicare Part B Enrollment Start The Day My Work Coverage Ends

Yes, you should be able to enroll in your Medicare Part B a few months in advance and select a future Part B start date. That way you can time it that when your work coverage ends, your Medicare Part B all start at the same time. You should not have a gap when your work coverage has ended but your Medicare has yet to begin.

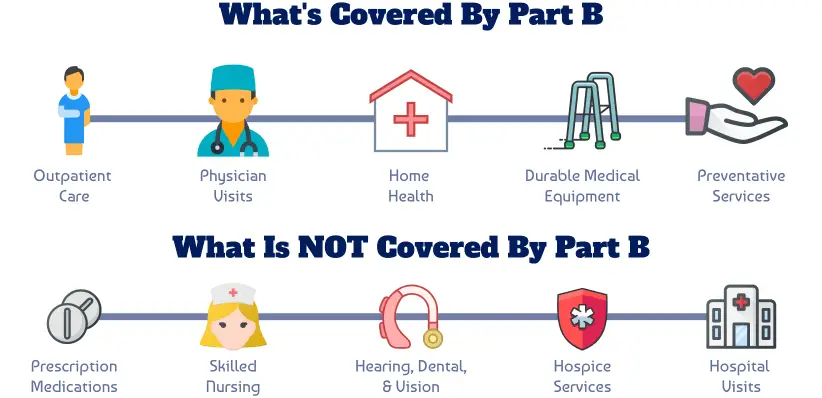

Does Part B Cover Prescription Drugs

Short answer: No, Part B doesnt typically cover prescription drugs.

Longer answer: Part B may cover some drugs in a specific situations, typically only those that are administered by a doctor in their offices or in a clinic.

To get Medicare coverage for most retail prescription drugs, you need a Medicare Part D prescription drug plan or a Medicare Advantage plan that includes prescription drug coverage.

Don’t Miss: Does Medicare Cover Knee Injections

Sign Up: Within 8 Months After The Active Duty Service Member Retires

- Most people dont have to pay a premium for Part A . So, you might want to sign up for Part A when you turn 65, even if the active duty service member is still working.

- Youll pay a monthly premium for Part B , so you might want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Does The General Enrollment Period Impact Medicare Advantage Coverage

Since youre using the General Enrollment Period, you dont currently have Part A, Part B, or both. One of the requirements of a Medicare Advantage plan is you must be enrolled in both Part A and Part B of Medicare.

Since your coverage for these will start July first, youll have an Initial Coverage Election Period for a Medicare Advantage plan. Just like the Part D Special Enrollment Period, it begins on April 1st and continues until June 30th.

Your Medicare Advantage plan would also start on July 1st. An enrollment selection must be made prior to July 1st or youll lose your chance to enroll in a Medicare Advantage plan until the Annual Election Period.

Read Also: What Is Better Original Medicare Or Medicare Advantage

Canceling Part B Because You Cant Afford The Premiums

If you dont have a job with creditable health care coverage but still dont want to pay Part B premiums, use caution. Without health insurance thats as good or better than Medicare, you could start racking up late-enrollment penalties the longer you go without coverage. If you decide to re-enroll in Part B later, these penalties could make your premiums even less affordable.

If you can’t afford your Part B premiums, consider other options before canceling your coverage. You can apply for Medicaid coverage if you’re in a low-income household or have few assets. Medicare also offers several savings programs, which help qualified individuals pay their Medicare expenses.

Do I Need To Pay For Medicare If I Have Va Benefits

For individuals who have worked enough quarters, Part A is premium-free. Therefore, its beneficial to take this hospital insurance through Medicare.

However, like other beneficiaries, veterans with VA benefits will need to pay a standard Part B premium for outpatient coverage through Medicare. The premium is subject to increase the longer you go without Part B coverage after youre eligible, via a lifelong late penalty. The penalty occurs because, unlike group health insurance through a large employer, VA benefits arent for Medicare.

As a result, youll save money long-term when you sign up as soon as youre eligible. If you need financial assistance with your Part B premium, you might qualify for a Medicare Savings Program .

You May Like: Does Medicare Cover While Traveling Abroad

When Can You Sign Up

Like Medicare Part A, typical Medicare Part B enrollment comes with a seven-month Initial Enrollment Period for signup. This includes the three months before and after the month you turn 65, plus the month of your birthday. Hence, if you turn 65 in April, your Initial Enrollment Period stretches from January through July.8

If you arent automatically enrolled, you can sign up for Part B any time during your Initial Enrollment Period. But if you wait until the month you turn 65 , your Part B coverage will be delayed.

If you miss your initial signup and you arent eligible for a Special Enrollment Period , you can enroll in Part B during the General Enrollment Period, between January 1 and March 31 each year. There are a variety of reasons you might get a SEP, including losing employer health coverage or moving back to the U.S. after living in another country.

Sign Up: Within 8 Months After Your Family Member Stopped Working

- Your current coverage might not pay for health services if you dont have both Part A and Part B .

- If you have Medicare due to a disability or ALS , youll already have Part A coverage.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Also Check: Do Most Doctors Accept Medicare

Will Fehb Be My Primary Coverage Or Medicare

If you have FEHB and do enroll in Medicare, then Medicare will be your primary coverage and your FEHB plan will pay after Medicare does. Having Medicare could reduce your out-of-pocket costs, because many FEHB plans waive cost sharing for enrollees who have Medicare. Even if this isnt the case, as long as your provider takes both your FEHB plan and Medicare, the most youd have to pay for care is the difference between what Medicare and your FEHB plan pay and Medicares limiting charge.

. Some states dont allow excess Medicare charges. If you live in one of these states or you see a doctor in any state that accepts Medicares rate as full payment youd only have to pay the difference between what Medicare and your FEHB plan pay and Medicares rate. Part Bs limits on what you can be charged dont apply to some services, and Part A doesnt have these limits.)

If you enroll in Part A but decline Part B, your FEHB coverage will pay after Medicare does for Part A services, but will be your primary insurer for other medical care. Medicare would no longer be your primary insurer if you return to work for the federal government, however, and in that case your FEHB plan would pay first, with Medicare paying at least some of your remaining costs.

What Is My Medicare Part B And Coinsurance Amount

The annual deductible for Medicare Part B is $203 in 2021. You will also be responsible for a 20% coinsurance for many covered services. If your doctor or health care provider accepts assignment for a covered service, you would pay the Part B deductible along with 20% of the Medicare-approved amount for services rendered. Accepting assignment means that your doctor will not charge you more than the Medicare-approved amount for the covered service. You would still be responsible for cost-sharing.

Just by entering your zip code in the form on this page, you can start comparing Medicare plans in your area instantly. But youre also more than welcome to reach out to us .

*Pre-existing conditions are generally health conditions that existed before the start of a policy. They may limit coverage, be excluded from coverage, or even prevent you from being approved for a policy however, the exact definition and relevant limitations or exclusions of coverage will vary with each plan, so check a specific plans official plan documents to understand how that plan handles pre-existing conditions.

This information is not a complete description of benefits. Contact the plan for more information.

Limitations, copayments, and restrictions may apply.

Benefits may change on January 1 of each year.

You May Like: Does Medicare Cover Home Sleep Apnea Test