What Counts As An Emergency

Your health insurance plan may cover emergencies. But each insurer has its own idea of what is an emergency. A lot of people end up paying for expenses when the insurer decides the case was not an emergency. Ask for the exact definition. It will help you decide if you need to buy supplemental coverage, like health or medical travel insurance.

Is Kaiser An Hmo Plan

Your Traditional HMO Employee Plan with Kaiser Permanente is not just health coverage its a partnership in health. You receive preventive care services at little or no cost to you, and online features let you manage most of your care around the clock. Your benefits include: a personal doctor for routine medical care.

Medicare Doesn’t Cover Long

One of the largest potential expenses in retirement is the cost of long-term care. The median cost of a private room in a nursing home was roughly $105,800 in 2020, according to the Genworth Cost of Care Study a room in an assisted-living facility cost $51,600, and 44 hours per week of care from a home health aide cost $54,900.

Medicare provides coverage for some skilled nursing services but not for custodial care, such as help with bathing, dressing and other activities of daily living. But you can buy long-term-care insurance or a combination long-term-care and life insurance policy to cover these costs.

Don’t Miss: Are Continuous Glucose Monitors Covered By Medicare

Does Kaiser Cover Out Of State College Students

Kaiser Permanente now covers routine, continuing and follow-up care for out-of-area students,1 who are legal dependents. Therefore, out-of-area students will now be covered for non-urgent medical needs, in addition to urgent and emergency care. The school must be located outside any Kaiser Permanente service area.

Costs And Funding Challenges

Over the long-term, Medicare faces significant financial challenges because of rising overall health care costs, increasing enrollment as the population ages, and a decreasing ratio of workers to enrollees. Total Medicare spending is projected to increase from $523 billion in 2010 to around $900 billion by 2020. From 2010 to 2030, Medicare enrollment is projected to increase dramatically, from 47 million to 79 million, and the ratio of workers to enrollees is expected to decrease from 3.7 to 2.4. However, the ratio of workers to retirees has declined steadily for decades, and social insurance systems have remained sustainable due to rising worker productivity. There is some evidence that productivity gains will continue to offset demographic trends in the near future.

The Congressional Budget Office wrote in 2008 that “future growth in spending per beneficiary for Medicare and Medicaidthe federal government’s major health care programswill be the most important determinant of long-term trends in federal spending. Changing those programs in ways that reduce the growth of costswhich will be difficult, in part because of the complexity of health policy choicesis ultimately the nation’s central long-term challenge in setting federal fiscal policy.”

Read Also: Will Medicare Cover Cataract Surgery

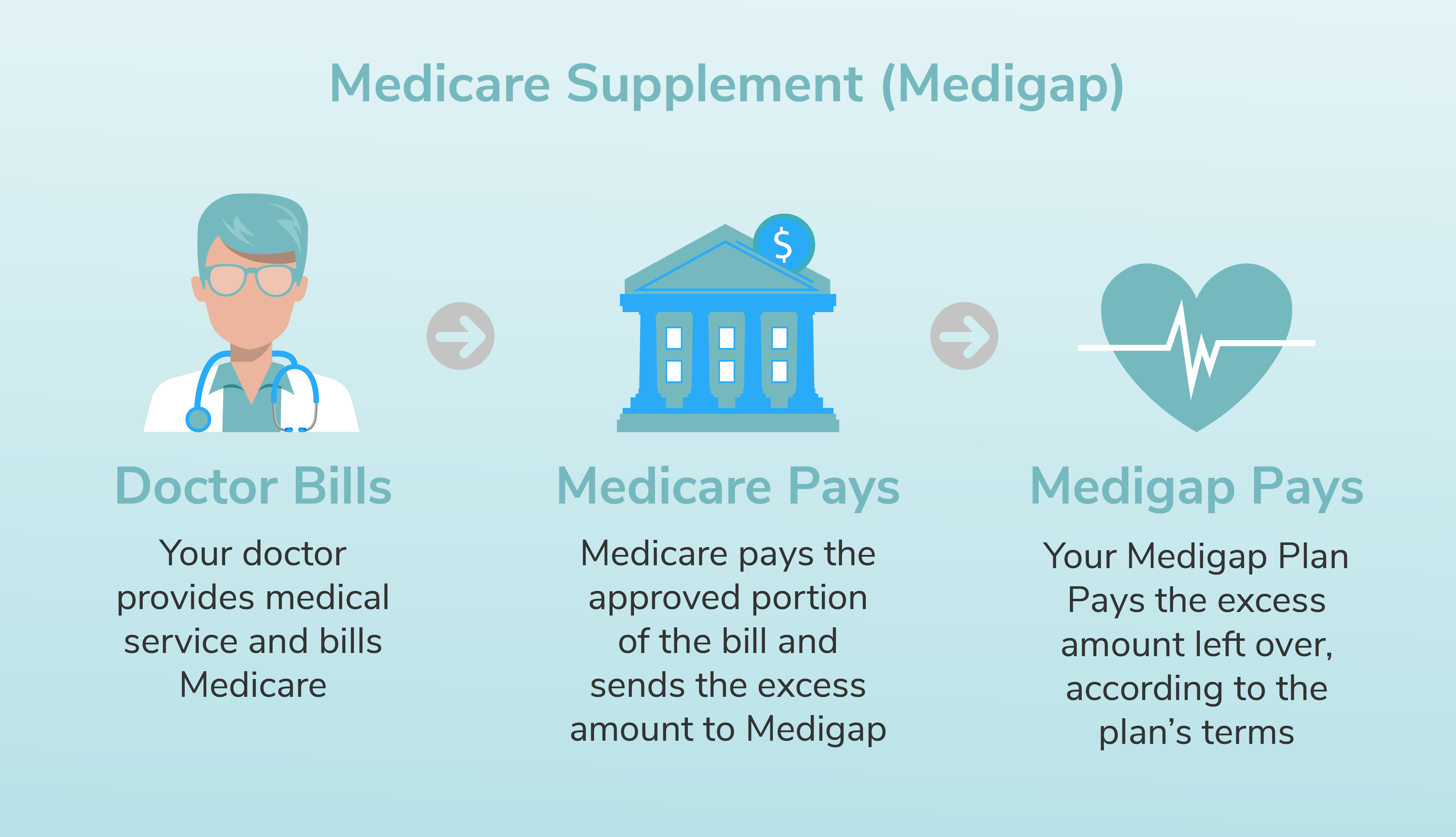

Which Medicare Supplement Plan Is The Best

Medicare Supplement Insurance, or Medigap, is a group of different policies meant to work with your Original Medicare policy to help cover your out-of-pocket costs. While some Medigap plans cover more than others, finding the right fit comes down to your personal needs and budget. Keep in mind that all Medigap plans must offer at least a portion of the following benefits:

- Part A coinsurance and hospital costs

- Part B coinsurance and copays

- Part A coinsurance and copays for hospice care

- The first three pints of blood

Medigap in Delaware consists of 10 plans, starting with A and ending with N.All Medigap plans must be the same from one insurance company to another. In other words, a Plan A from one company in Delaware must be the same as another companys Plan A.

What Are The Parts Of Medicare And What Do They Cover

Here are some basic facts to get you started learning about Medicare and what it covers.

When I first started my career in the Medicare world, I realized there was a lot of new information I had to learn. I found that breaking it down into bite-sized pieces made it easier to understand. I started by focusing on all the different parts of Medicare. Here are some tips that helped me understand the parts of Medicare and what they cover.

Don’t Miss: Is Root Canal Covered By Medicare

What If Im Moving Out Of State

As opposed to traveling to or through another state, if youre planing to move to another state, you need to give Medicare your new address.

The fastest way to update your contact information for Medicare is to use the My Profile tab on the Social Security website. You do not have to be receiving Social Security benefits to use this site.

However, to access this site, you must first register. You can only create an account for your own use, and you must be able to verify information about yourself, including your:

- Social Security number

- U.S. mailing address

- valid email address

You can also update your Medicare contact information by calling the Social Security Administration at 800-772-1213. If youd prefer to update in person, you can go to your local Social Security field office, which you can find here.

Does Your Plan Cover Medical Expenses Out Of State

In many cases, health insurance restricts you to a network of health care providers. Learning the terms of your health insurance policy will tell you if your plan includes providers out of state or not. Figuring this out on your own could be tricky. You do not want to end up getting denied for a health insurance claim. So, the first step is to call your insurer and ask them.

Don’t Miss: Do Medicare Advantage Plans Have Dental Coverage

Does Kaiser Have Dental

The adult/family plan includes dental coverage for those over age 19 and those under age 19. This plan is available for adults and families who purchase their medical plan direct from Kaiser Permanente. These plans are available only if you purchase your medical plan direct from Kaiser Permanente.

Can I Keep My Medigap Coverage If I Move To A New State

Original Medicare has participating providers across the country. If you have Original Medicare plus a Medigap plan, your Medigap insurer must allow you keep your coverage. What you pay for your Medigap plan may change though, because states differ in their rules for determining Medigap premiums.

You cant keep your current coverage if youre moving to Massachusetts, Minnesota, or Wisconsin, where Medigap plans operate differently. If this is the case, youll have an opportunity to apply for new coverage. Contact your state insurance department for more information.

Don’t Miss: What Are The Advantages And Disadvantages Of Medicare Advantage

Am I Eligible For Medicare

To receive Medicare, you must be eligible for Social Security benefits.

Part A Eligibility

Most people age 65 or older are eligible for Medicare Part A based on their own employment, or their spouse’s employment. Most people have enough Social Security credits to get Part A for free. Others must purchase it.

You are eligible for Medicare Part A if you meet one of the following criteria:

- You are eligible for Social Security or Railroad Retirement benefits, even if you do not receive those benefits.

- You are entitled to Social Security benefits based on a spouse’s, or divorced spouse’s work record, and that spouse is at least 62 years old.

- You have worked long enough in a federal, state, or local government job to be eligible for Medicare.

If you are under 65, you are eligible for Medicare Part A if you meet one of the following criteria:

- You have received Social Security disability benefits for 24 months.

- You have received Social Security benefits as a disabled widow, divorced disabled widow, or a disabled child for 24 months.

- You have worked long enough in a federal, state, or local government job and meet the requirements of the Social Security disability program.

- You have permanent kidney failure that requires maintenance dialysis or a kidney transplant.

- You are diagnosed with ALS or Lou Gehrig’s disease.

Part B Eligibility

If you are eligible for Part A, you can enroll in Medicare Part B which has a monthly premium.

Will I Need To Prove My Age?

Automatic Enrollment

How To Transfer Medicare Coverage To Another State Or County

If you have Original Medicare Medicare Part A and Part B you should notify the Social Security Administration and Medicare before you move. Its important to update your address and other information so you dont miss or delay benefits.

If you have a Medicare Advantage plan, Medicare Part D prescription drug plan, or a Medigap plan, you should notify your plans administrator before you move to another state or to any area outside your plans service area.

Your Options to Change Medicare Advantage & Part D Plans When Moving

- Moving outside your plans service area

- You can switch to a new plan in the new service area. Or you can leave your Medicare Advantage plan and enroll in Original Medicare.

- Moving to a new place in your plans service area

- If you have new plan options in your new area, you can switch to a new Medicare Advantage plan or Medicare prescription drug plan during your special enrollment period.

- Moving back to the U.S. after living abroad

- You can join a Medicare Advantage plan or a Medicare Part D prescription drug plan within two months after you move back to the U.S.

When you move, you will be eligible for a special enrollment period during which you will be able to enroll in a new plan for your new area. This generally begins one month before the month you move and lasts two months after the move.

Read Also: What Is The Cost Of Medicare Supplement Plan F

Am I Still Covered By Medicare When I Travel Out Of State

Editors Note: Journalist Philip Moeller, who writes widely on health and retirement, is here to provide the Medicare answers you need in Ask Phil, the Medicare Maven. Send your questions to Phil.

Medicare rules and private insurance plans can affect people differently depending on where they live. To make sure the answers here are as accurate as possible, Phil is working with the State Health Insurance Assistance Program and the Medicare Rights Center .

Judy Fla.: We currently have a Medicare Advantage policy. Michigan is our primary residence. While in Florida last winter I had shingles. I was covered by insurance for visits to urgent care clinics but was informed I really needed to see a physician for ongoing treatment due to the severity of the shingles. I also receive light treatments for psoriasis while in Michigan. My policy has no participating physicians in Florida to cover either of these situations. Can I use only Medicare to cover these situations, and if so, how do I accomplish that? I understand I can buy a policy that covers me outside my policy area, but Medicare is a national program. Is there a way to use just basic Medicare since I pay for that coverage each month?

Phil Moeller: HSAs can be a great health and retirement tool. You can save and invest the balances tax-free and not be taxed when theyre spent, either, so long as its on eligible health care items.

CORRECTION

Exploring The United States

Medicare can provide excellent health coverage during your travels in the United States. Original Medicare, which is what many people call the combination of Medicare Parts A and B, is widely accepted by health care providers across the country. You just need to confirm that the provider you see accepts Medicare before you receive your care.

Medicare Advantage plans can be an excellent option for travelers who want coverage while on the road. But members should check with their plans regarding the level of coverage they have while away from home.

Medicare Advantage plans can also be a good way to get health coverage while on a trip. MA differs from Original Medicare in a few important ways. MA plans are sold by private companies, and many offer benefits not included in Original Medicare, like dental, vision and hearing coverage. MA plans also include a network of providers. In Health Maintenance Organization plans you generally need to use one of the health care providers in network to get coverage for a service. Members of Preferred Provider Organization plans have coverage when they see providers who are out of their plans network, although they usually pay more.

|

Yes when medical records are requested by the plan member |

However, to be completely certain of the level of coverage you will receive while on the road, its important to check with your plan regarding the coverage you have before beginning your travels.

You May Like: What Information Do I Need To Sign Up For Medicare

Can I Use My Medicare In Any State

- Medicare Part A and B and Medicare Supplement plans can be used in any state, but you may face regional restrictions in where you can use Medicare Advantage or Medicare Part D drug plans. Use our guide to see how Medicare can and cant be used in other states.

Youve signed up for Medicare insurance and are all set to receive health care coverage under the program. But youre traveling to another state next month and are wondering if you can use your Medicare in another state.

Depending on the type of Medicare insurance you have, the answer may be yes. Below is a breakdown of each type of Medicare coverage and the rules about using it on the go.

How To Change Your Address With Medicare

If you are a Medicare beneficiary and move to another state, you can change your address that’s on file with Medicare by contacting the Social Security Administration .

Here are some ways you can contact the SSA:

- Visit the SSA website and submit an address change notice through the website.

- Visit your local SSA office in person.

Recommended Reading: Does Medicare Cover Depends For Incontinence

When You Need To Change Your Medicare Supplement Insurance Plan

In some situations, you may not be able to keep your current coverage if youre moving. Medicare SELECT plans are a type of Medicare Supplement insurance plan that requires you to use providers in the plans network to be covered. If you have a Medicare SELECT plan and move out of the plans service area, you have a guaranteed-issue right to buy any Medicare Supplement insurance Plan A, B, C, F, K, or L that is offered by an insurance company in your new state.

If this applies to you, youll need to contact your Medicare SELECT insurance company to drop your current plan and enroll in a different Medigap plan. You can do so as early as 60 days before your coverage ends, or no later than 63 days after your coverage ends. Make sure to contact your Medicare SELECT company before you move to avoid a lapse in coverage.

If you have any questions about how moving may affect your current Medicare Supplement insurance coverage, an eHealth licensed insurance agent can help you figure out your options. Contact eHealth today at the phone number listed below to learn more.

**Medicare Supplement Plans C and F wont be sold to beneficiaries who are new to Medicare as of January 1, 2020. You wont be able to buy either plan if you qualify for Medicare on that date or later. You can keep Plan C or Plan F if you already have one. Also, if you qualify for Medicare before January 1, 2020, you can still apply for one of these plans.

New To Medicare?

A Home Away From Home

Does travel means spending an extended amount of time in your second home or with family or in a long-term vacation rental? During these longer stays, you may need to take an even closer look at your MA coverage.

Medicare Advantage is a national program, but MA plans are offered to individuals based on their ZIP codes. That means you are only eligible to remain in a particular MA plan if you are in a ZIP code where that plan is offered. In fact, the Centers for Medicare & Medicaid Services require that members be disenrolled from their MA plan if they live outside their plans service area for more than six months.

However, there are MA plans designed to allow you to stay on your plan even if you spend significant time outside the plans service area. Aetna offers MA plans with a visitor travel program. This program allows you to remain in your plan for an extra six months on top of what CMS rules allow when you live outside your plans service area.

How to make sure your Medicare Advantage HMO plan travels with you

Monique C. has a Medicare Advantage HMO plan from Aetna that includes the Travel Advantage feature. Travel Advantage allows Monique to remain in her plan for an extra six months when out of her plans service area. It also offers a multistate provider network. She lives in Florida but is planning to spend three months in New York to visit her grandchildren. Here are some steps she should take to enjoy her coverage away from home.

Recommended Reading: What Insulin Pumps Does Medicare Cover

Is Medicaid Part Of Medicare

Medicare and Medicaid are different programs. Medicaid is not part of Medicare. Heres how Medicaid works for people who are age 65 and older: Its a federal and state program that helps pay for health care for people with limited income and assets. A basic difference is that Medicaid covers some benefits or services that Medicare doesnt like nursing home care or transportation to medical appointments .

Visit your states Medicaid/Medical Assistance website or medicare.gov for more information. Learn more in the article Can I get help paying my Medicare costs?

WANT TO KEEP LEARNING HOW MEDICARE WORKS?

Using Medicare Advantage Or Medicare Part D In Another State

Medicare Advantage and Medicare Part D prescription drug plans are both sold by private insurance companies.

Medicare Advantage plans can come in a few different forms that can determine how the plan may be used in another state.

Two popular types of Medicare Advantage plans include:

- Health Maintenance Organization plansHealth Maintenance Organization plans feature a network of providers who participate in the plan. These networks can be local or regional, so they can span multiple states in some cases. In order to use the plans benefits, you must visit one of these participating providers. Be sure to check with your plan to ensure you can use your Medicare Advantage HMO plan in another state.

- Preferred Provider Organization plansPreferred Provider Organization plans also feature a network of participating providers, but they typically have fewer restrictions than HMO plans on which providers you may see. You may pay more to receive care outside of your Medicare Advantage PPO network.Also be sure to check with your plan provider to ensure you can use your Medicare plan in another state.

Many Medicare Part D plans may feature a network of pharmacies. Some plans include regional or national networks, while other plans may have more localized networks.

Don’t Miss: How Can I Sign Up For Medicare