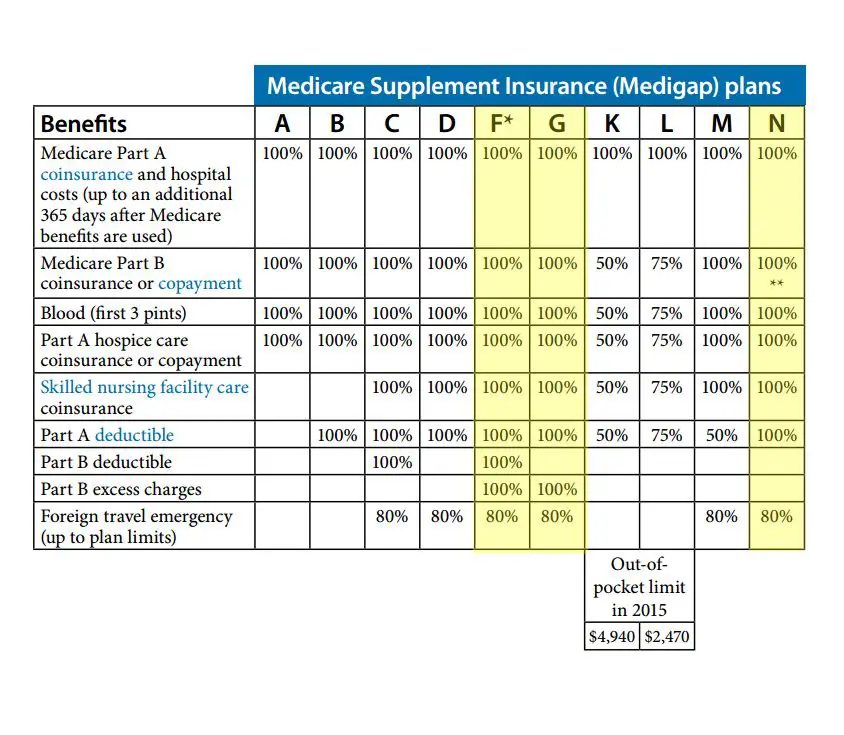

How Does Medicare Supplement Plan N Compare To Other Medigap Plans

Medicare Supplement Plan N provides more coverage than Plans K and L. For example, it covers 100% of the Medicare Part B coinsurance and copayments, whereas K and L only pay 50% and 75%, respectively.1 The same is true with the Medicare Part A deductible.

Additionally, the only out-of-pocket expenses beyond the monthly premium are a $20 copay for office visits and a $50 copay for a trip to the ER.

The chart below will help you make comparisons.

What Is Medicare Plan N

Medicare Plan N is the second most popular Medigap plan. With lower premiums and lower rate increases than Plan G, Medicare Plan N is becoming a favorite amount people on Medicare.

Plan N has just one low deductible to pay before both Medicare and the plan pay 100% of your medical bills. In exchange for lower premiums than Plan G, Plan N has some additional out of pocket expenses that might come up.

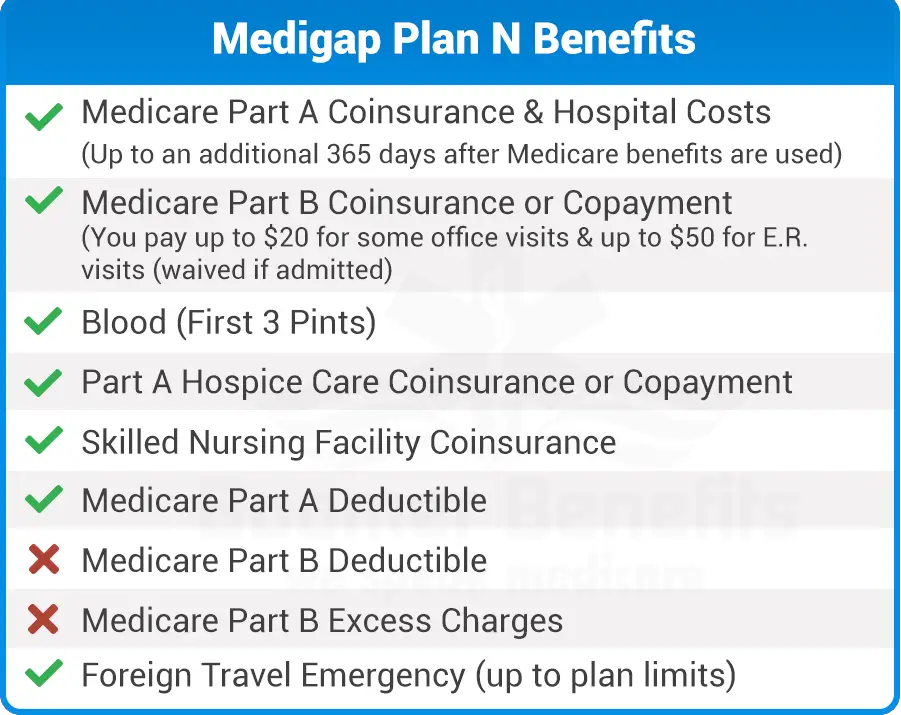

Heres the overage you can expect:

How Does Medicare Part N Work

Plan N covers basic Medicare benefits including:

- Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end

- Medical Expenses: pays Part B coinsurance excluding $20 copay for office visits and $50 copay for ERgenerally 20% of Medicare-approved expensesor copayments for hospital outpatient services

- Blood: pays for the first 3 pints of blood each year

- Hospice care: pays Part A coinsurance

In addition to the basic benefits, Plan N also provides coverage for:

- Skilled nursing facility care

- Medicare Part A deductible for hospitalization

- Travel-abroad medical emergency help

Don’t Miss: Can I Use Medicare For Dental

Medicare Supplement Plan G Vs N Comparison Chart

| Medicare Supplement Benefits | Plan G | Plan N |

|---|---|---|

| Medicare Part Acoinsurance& hospital costs (up to additional 365 days after medicare benefits are used | Yes | |

| Medicare Part B coinsurance or copayment | Yes | |

| Blood 3 | Yes | |

| Part A hospice care coinsurance or copayment | Yes | |

| Skilled nursing facility care coinsurance | Yes | |

| Foreign travel emergency | Yes | Yes |

How Do Medicare Supplement Insurance Plans Work With Original Medicare

Medicare Supplement plans work alongside your Original Medicare coverage to help cover some of the costs you would otherwise have to pay on your own. These plans, also known as “Medigap”, are standardized plans. Each plan has a letter assigned to it, and offers the same basic benefits. The basic benefit structure for each plan is the same, no matter which insurance company is selling it to you. Note: The letters assigned to Medicare Supplement plans are not the same things as the parts of Medicare. For example, Medicare Supplement Plan A is not the same as Medicare Part A .

You May Like: How To Qualify For Medicare And Medicaid

What Medigap Plans Can And Cannot Cover

A Medicare Supplement Insurance policy, sold by private companies, may help pay some of the health care costs that Original Medicare doesnt cover:

- Your Medicare deductibles.

- Hospital costs after you run out of Medicare-covered days.

- Skilled nursing facility costs after you run out of Medicare-covered days.

- Some Medigap policies also offer coverage for services that Original Medicare doesnt cover, like medical care when you travel outside the U.S.

A Medigap policy can only cover one person. Medigap policies sold after January 1, 2006 do not include prescription drug coverage. You can join a Medicare Prescription Drug Plan separately. Medigap policies generally dont cover long-term care, vision or dental care, hearing aids, eyeglasses, or private-duty nursing.

Medicare Supplement Plan N: Is It Right For You

Sorting through Medigap plans can be a challenge if you shop on your own. There are many choices available, but how do you know which one is right for your needs? Medicare Supplement Plan N can be a good choice for those looking for near-comprehensive coverage. Below, we discuss Medicare Supplement Plan Ns main features and benefits.

Recommended Reading: What Age Can You Start To Collect Medicare

How To Enroll In Medicare Plan N

In nearly every case, you cannot simply try to search the internet to get rates on Plan N from all the top companies in just one spot. In fact, were one of the only companies that actually allows you to see any rates at all for any of the Medigap plans.

This is because we want to gain your trust and provide you with the necessary information to help you make an informed decision. And thats why our clients love our FREE service each year.

Well shop all the top companies now for you, as well as every year, to always make sure youre paying the least amount possible for your Medigap coverage.

The easiest way to enroll is to just give us a call now at 1-888-891-0229.

I promise youll be glad you called!

Introducing A New Plan G Option: Plan G Plus

Beginning February 1st, 2021 all three Blue Medicare Supplement Plan Gs have Plus options. Plan G Plus plans have the same medical coverage as their regular versions as well as additional benefits and programs included so members can get more out of their Blue Medicare Supplement insurance plans. Additional benefits and programs include dental, vision, hearing, and fitness. Read this chart for more details:

| Benefit |

|---|

The out-of-pocket annual limit will increase each year for inflation.

Rates as of 04/01/2020. Rates are illustrative only. Actual rates are based on your age, where you live, and your choice of coverage. Please do not send money, you cannot obtain coverage under the above plans until an application is completed and approved. Benefit exclusions and limitations might apply.

Important Information About Quotes for Medicare Supplement Insurance Plans

Quoted prices are based on the criteria specified during your search. This illustration is subject to Blue Cross and Blue Shield of Illinois’s rating or underwriting and approval, as appropriate, and does not guarantee rates, coverage or effective date. Furthermore, rates are subject to change if any of the information you have provided changes when and if a policy is approved. In addition, Blue Cross and Blue Shield of Illinois reserves the right to change rates from time to time.

Also Check: Does Medicare Offer Gym Memberships

The Best Medicare Plan For You: Plan N +rx

The recommended plan is the best fit based on a few questions. There are other personal circumstances that may change this recommendation, including receiving employer sponsored retiree benefits or having specific medical circumstances to consider. Please note that CMS will impose a penalty if you do not have prescription drug coverage . We strongly encourage you review all options with an agent before applying.

Can You Switch Yes But Theres A Catch

Its logical to consider enjoying the cost savings of a Medicare Advantage plan while youre relatively healthy, and then switching back to regular Medicare if you develop a condition you want to be treated at an out-of-town facility. In fact, switching between the two forms of Medicare is an option for everyone during the open enrollment period in the fall. This Annual Election Period runs from October 15 to December 7 each year.

Heres the catch. If you switch back to regular Medicare , you may not be able to sign up for a Medigap insurance policy. When you first sign up for Medicare Part A and Part B, Medigap insurance companies are generally obligated to sell you a policy, regardless of your medical condition. But in subsequent years they may have the right to charge you extra due to your age and preexisting conditions, or not to sell you a policy at all if you have serious medical problems.

Some states have enacted laws to address this. In New York and Connecticut, for example, Medigap insurance plans are guaranteed-issue year-round, while California, Massachusetts, Maine, Missouri, and Oregon have all set aside annual periods in which switching is allowed. If you live in a state that doesn’t have this protection, planning to switch between the systems depending on your health condition is a risky business.

Don’t Miss: Are Chemotherapy Drugs Covered By Medicare

Finding Your Maryland Medicare Supplement Plan

Now that you understand signing up for Medicare, it is time to find the best Maryland Medicare Supplement Plan for you. While rates for Medicare Supplement Plans Maryland are very important, you need to also look at the company and the rate increase history. What might be the absolute cheapest monthly premium now, could end up very costly down the road.

Medicare Supplement Companies tend to come into an area with a very low introduction price in essence they are buying new business. After they start building the book of business they will raise the rates significantly to cover the losses. This is just one of the reasons we at Medicare Solutions Team carry over twenty Medicare Supplement Plans Maryland providers.

EASILY COMPARE PLANS AND RATES

EASILY COMPARE PLANS AND RATES

Medicare Supplement Plans, sometimes called Medigap Plans are set and standardized by CMS . They offer 10 plans but the three most popular are Plan F, Plan G and Plan N.

Medicare Part B Excess Charges On Plan N

Now, one other possible out-of-pocket expense you could see on Plan N though very rare is called Part B Excess Charges.

Theyre extremely rare. Ive never had a client in 11 years ever seen an excess charge, at least that they told me about, or had to pay.

And my clients are pretty good at telling me things like that!

So with Part B Excess Charge, heres how that works

If doctors accept the assigned rates for Medicare, which is estimated that over 97% of them do in this country, then youll never see a Part B Excess Charge because they dont charge them.

Those are good odds. Thats most doctors in this country.

If a doctor does in fact choose to not accept the assignment of Medicares rates, they can charge up to 15% extra of the assigned rates.

Again these almost never happen, and you would have to pay a small percentage or a percentage of that percentage, which would equal a small amount!

Now, I dont want to say it could never happen, but its incredibly rare.

And dont forget, even if you do get a Part B Excess Charge, you have to pay a portion of it, youve saved all that money on your Plan N premiums over Plan G. So it could be minimal.

Plan N is fantastic coverage and we should absolutely consider it when we speak!

Recommended Reading: Is Obamacare Medicaid Or Medicare

How Does Plan N Work

Like other supplemental policies, Plan N fills coverage gaps in traditional Medicare, thus making it easier for beneficiaries to meet their overall health care expenses. Because only about 80% of medical costs are covered by Medicare Part A and Medicare Part B , supplemental plans can help pay for the remaining 20% of costs.

Among other benefits, Plan N covers the entire coinsurance costs for Medicare Part A, Medicare Part B, hospice care and skilled nursing facility. This means that instead of an enrollee being charged 20% of the bill as would happen with Original Medicare, the supplemental plan would pay that 20% of the bill.

One of the most important features of Medigap Plan N is its copays you pay a $20 copay for each physician visit and a $50 copay for each emergency room visit that does not result in hospitalization. Even though the supplemental plan pays the coinsurance charged by Original Medicare, the supplemental policy has its own copayments for these services. Most Medigap Plan N policies do not charge for visits to urgent care centers, though.

Beneficiaries buy supplemental Medigap plans through private insurance companies such as Aetna, Cigna and UnitedHealthcare, among others. Each supplemental plan category bears a distinct letter, denoting differences in coverage, monthly premiums and out-of-pocket expenses.

How supplemental policies work

What Does Plan N Cost

Your costs under Plan N include:

Monthly premium

This monthly premium varies by insurer, and its different from the standard monthly Part B premium that Medicare collects.

Part B deductible

You are required to pay the annual Part B deductible before Plan N starts to cover your coinsurance costs. In 2022, the deductible is $233.3

Copayments

You pay up to $20 for doctors office visits and up to $50 for ER visits.

Excess charges

Some healthcare providers are allowed to charge a bit above the amount that Medicare covers for services. Providers who do not accept Medicares approved amount as full payment are allowed to charge this additional amount known as excess charge. Plan N does not cover excess charges, and youll be responsible for them yourself.

Also Check: Is Estring Covered By Medicare

What Is Medicare Supplementmedicare Supplements Are Additional Insurance Policies That Medicare Beneficiaries Can Purchase To Cover The Gaps In Their Original Medicare Health Insurance Coverage Plan N

Medicare Supplement Plan N is one of the ten standardized Medigap plans. Although it is one of the newest plans available, Medicare Plan N is quickly becoming a favorite with people aging into their Medicare benefits. This is particularly true of people accustomed to sharing healthcare costs with their employers group health planA group health plan is a health plan offered by an employer or employee organization that provides health coverage to employees, their families, and retirees…..

A Brief Review Of Medicare Supplement Plans

When you turn 65, youre eligible to enroll in Medicare, a federally facilitated health insurance program. Original Medicare will cover some, but not all, of your medical expenses. The portion not covered is often referred to as a gap. Medicare Supplement plans, also called Medigap plans, are policies sold by private insurance companies to help pay for the expenses Medicare does not cover.

You May Like: What Is Better Original Medicare Or Medicare Advantage

Medicare Supplement Plan N Rate Increase History

Among the factors that affect your monthly premium rates is the pricing method that your carrier uses. In the last five years, premium rates for Plan N have increased between 2% and 4%. These increases are lower when compared to Plan F and comparable when compared to Plan G.

As Plan N benefits are the same from carrier to carrier, its important to discuss with your agent rate history increase for the company you are considering enrolling with. Additionally, research carrier reviews for Plan N.

What Is Medigap Or Medicare Supplement Plans A

Medicare Supplemental plans, or Medigap, cover the costs youre responsible for with Original Medicare. There are 10 Medicare Supplement plan options available A, B, C, D, F, G, K, L, M, and N. Each plan has different, yet standardized, benefits and coverage that must follow federal and state laws, and must be clearly identified as Medicare Supplement Insurance. This means that no matter which insurer you buy from, the basic benefits of each plan type of the same letter will be the same. In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way.

Also Check: How Often Does Medicare Pay For A1c Blood Test

Which Medigap Plan Is The Best Choice For You

The best policy is the one that is going to meet your coverage, lifestyle and budget goals. Your situation is unique.

Purchasing G may be the best choice if you dont want to deal with copayments because you go to your doctor frequently. Your premium may be a little higher, but avoiding the hassle of copays may be worth it to you. However, N might be the right choice if youre in good health and looking to save money with a lower premium.

Choosing the right policy that meets your coverage goals may be a simple decision or more complicated than you thought it would be. It often depends on your current health profile as well as what your health will look like in the next few years and beyond.

The Ultimate Guide To Medicare Supplement Plans In Texas

Many seniors find Medicares out-of-pocket costs overwhelming. Luckily, this is where Medicare Supplement Insurance Plans come in.

In this article, we will cover the benefits of Medicare Supplement Plans in Texas, which ones are most popular, when the best time is to apply and how much you can expect to pay.

Here’s What We’re Going to Cover:

Read Also: What Are All The Medicare Parts

Why Choose A Medigap Plan

Medigap can help pay out-of-pocket expenses that Original Medicare doesnt cover. An Original Medicare plan paired with a Medigap policy can offer comprehensive coverage, which will likely result in lower out-of-pocket expenses. Medigap policies can vary, but the most comprehensive coverage is offered through Medigap Plan F. Compared to Medicare Advantage, you will keep the same larger network of doctors under Original Medicare. Many Medicare Advantage plans require you to go through their network of doctors and other health providers, while Original Medicare paired with Medigap Plan F will often have a larger network of doctors.

If you are eligible to switch Medigap policies because youre within your six-month Medigap open enrollment period or eligible due to a specific circumstance or guaranteed issue rights, then Medigap offers a free look period. This means you have 30 days to decide if you want to keep the new Medigap policy. You wont cancel your first Medigap policy until youve decided to keep the second Medigap policy, and you will need to pay both premiums for one month.

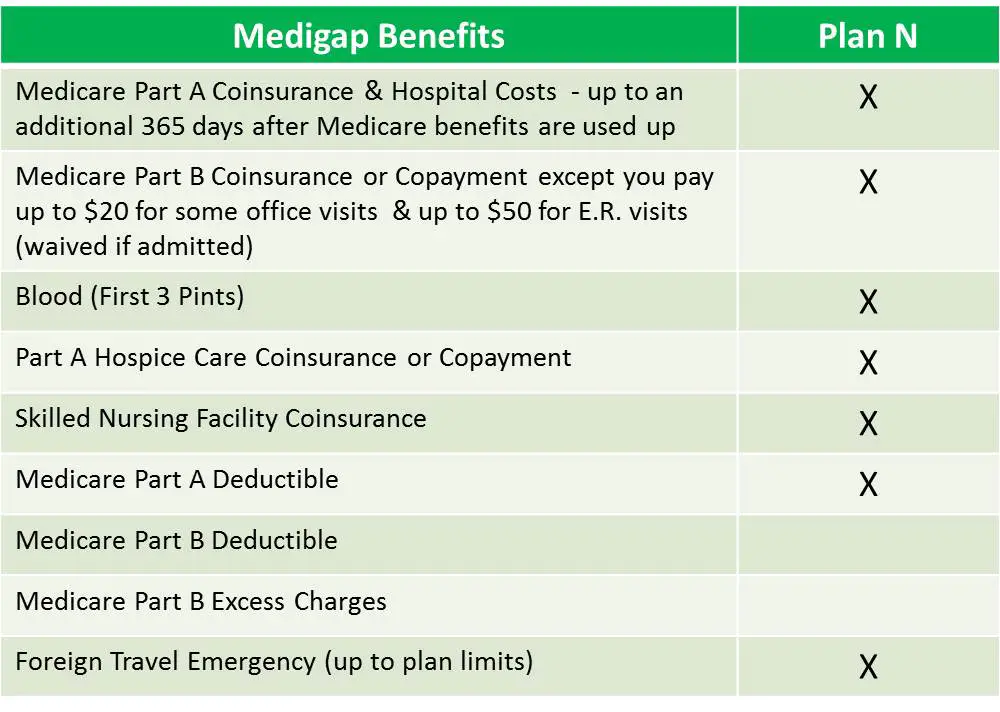

What Does Plan N Cover

Plan N covers the Medicare Part A deductible of $1,556, coinsurance for Parts A and B, three pints of blood and covers 80% of medical costs incurred during foreign travel.

Plan N does not provide coverage for the Medicare Part B deductible . Moreover, its copays do not count towards meeting the Part B deductible. Most Plan N policies do not carry a separate deductible aside from the Part B deductible.

Plan N also does not cover Medicare Part B excess charges the amount providers can charge over and above Medicare costs if they do not accept Medicare-approved rates. And there are no out-of-pocket limits for Plan N.

| Category |

|---|

| Usually up to 80% of costs |

Don’t Miss: Does Medicare Pay For Blood Pressure Cuffs