What Is The Coverage Gap And When Does It Start

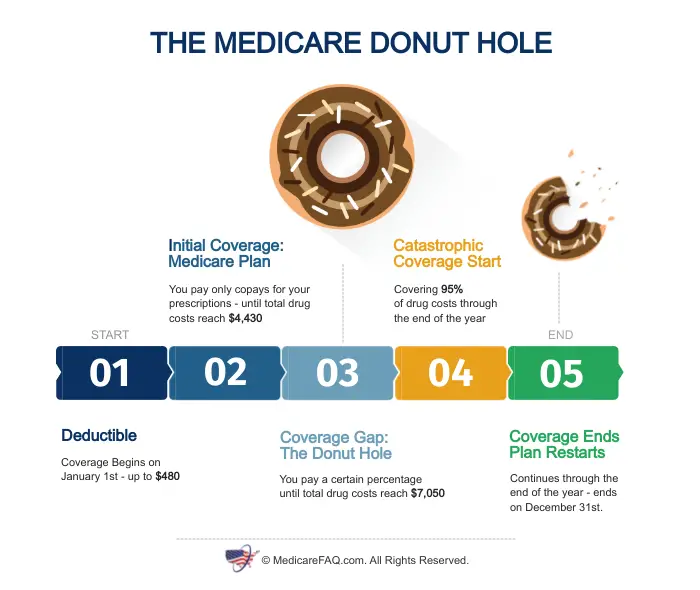

For those who are just finding out about the out-of-pocket threshold , learning about the different Medicare Part D coverage phases is a good place to start. Your costs and what your Medicare plan may pay for prescription drug costs will depend on which coverage phase youre in. Typically, each new coverage phase begins once your spending has reached a certain amount. The coverage gap is one of the coverage phases under Medicare Part D.

Stand-alone Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans can have the following four coverage phases, as applicable:

Deductible phase: For most stand-alone Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans, youll pay 100% for medication costs until you reach the yearly deductible amount . After you reach the deductible, the Medicare plan begins to cover its share of prescription drug costs. The deductible amount may vary by plan, and some plans may not have a deductible. If your Medicare plan doesnt have a deductible, then youll start your coverage in the initial coverage phase .

Out-of-pocket threshold (also known as the coverage gap or donut hole: Not everyone will reach this phase it begins if you and your plan spend a combined $4,020 in 2020 as described above. While in the coverage gap, youll typically pay up to 25% of the plans cost for both covered brand-name drugs and generic drugs in 2020.

What Costs Dont Count Towards Getting Out Of The Coverage Gap

Not all out-of-pocket costs count towards reaching catastrophic coverage. The following costs dont count towards getting you out of the coverage gap:

- The monthly premium for your Medicare Prescription Drug Plan or Medicare Advantage Prescription Drug plan

- The costs you pay for prescription drugs that arent covered by your Medicare plan

How Prescription Coverage Works With Medicare Part D

Medicare Part D Prescription Drug Plans pay different levels of benefits depending on how much youve spent on prescriptions that year. There is more than one plan with differing monthly premiums and coverage rates, but those guidelines are true of most policies under Part D.

- Deductible There is a minimum deductible you must meet before insurance covers any of the cost of prescriptions. You are responsible for paying monthly premiums for insurance plus 100% of the cost of prescriptions until the deductible is met.

- Phase 1 of prescription coverage Once you meet the deductible, you Part D plan will cover the standard percentage of medication for your policy. You may have a 25% coinsurance rate with your plan, meaning your insurance will pay 75% of the cost. This level of coverage continues until you reach a threshold set for your specific plan.

- Donut Hole If you have prescription costs that exceed the plan threshold for the calendar year, there is a coverage gap referred to as the donut hole. While in the gap, you are required to pay a greater percentage of the cost of prescriptions.

- Catastrophic coverage In 2018, the limit for drug costs before catastrophic coverage kicks in is $5,000. If you reach this limit, you are responsible for only a very small percentage of the cost of prescriptions for the remainder of the calendar year about 5%.

Also Check: Does Medicare Pay For Lift Chairs For The Elderly

What Does Catastrophic Coverage Mean

When you reach the amount that is considered the end of normal coverage, you enter what is known as catastrophic coverage. This entitles you to get all of your prescription drugs paid for at that point and takes you out of the donut hole.

The catastrophic coverage category is reserved generally for people who have a catastrophic illness such as severe heart

Most people will not normally reach this status unless they take multiple medications which are very costly at the same time.

Will Everyone Enter The Gap Period

One thing to keep in mind, however, is that not everyone will enter the coverage gap. The coverage gap could be considered upside down deductibles.

This is because you have to spend a certain amount of free coverage for your prescriptions before you will be faced with having to pay for your own at the 45 percent amount.

So, in 2016, for example, once you and your plan have spent around $3,310 on covered medications, you will be in the coverage gap.

Don’t Miss: Does Medicare Cover Miracle Ear

Coverage Can Differ Depending On Your Plan

It’s important to understand that your Part D prescription drug plan may differ from the standard Medicare plan only if the plan offers you a better benefit. For example, your plan can eliminate or lower the amount of the deductible, or can set your costs in the initial coverage level at something less than 25% of the total cost of the drug. But it cannot provide benefits that are less generous than the standard plan design.

Will There Be A Donut Hole In 2022

In 2022, you’ll enter the donut hole when your spending + your plan’s spending reaches $4,430. And you leave the donut hole and enter the catastrophic coverage level when your spending + manufacturer discounts reach $7,050. Both of these amounts are higher than they were in 2021, and generally increase each year.

Also Check: Does Medicare Cover Orthovisc Injections

What Are The Rules About The Medicare Donut Hole For 2022

Originally, being in the donut hole meant that you had to pay OOP until you reached the threshold for more drug coverage. However, since the introduction of the Affordable Care Act, the donut hole has been closing.

There are several changes for 2022 aimed to limit your out-of-pocket costs in the coverage gap. These include:

- You will pay no more than 25 percent of the price for brand-name drugs.

- The nearly full price of the drug will count toward getting you out of the coverage gap.

- You are responsible for a dispensing fee for your medicine. Your plan pays 75 percent while you pay 25 percent.

- The fees that dont count toward your OOP spending include the 5 percent your plan pays plus the 75 percent toward the dispensing fee your plan pays.

Some plans offer even deeper discounts when youre in the coverage gap. Its important to carefully read your plan to see if this is true for you.

Lets see how this works in some examples below.

Medicare Part D Cost Stages

To fully understand the coverage gap, its essential to know the four payment stages of Medicare Part D:

- Annual deductible

- Coverage gap or donut hole

- Catastrophic coverage

After youve reached specific dollar amounts determined by Medicare in each phase, you move to the next payment stage. Keep in mind, some plans dont have a deductible, and you will start with initial coverage. You are responsible for copays or coinsurance for your prescription drug costs in the initial coverage stage.

There are different drug tiers within Part D plans that determine your copay costs, ranging from least expensive to most expensive. After you spend a specific dollar amount from copays, you move into the coverage gap or donut hole. The coverage gap applies until your out-of-pocket costs reach a particular dollar amount.

Heres a more detailed look at the payment stages of Medicare Part D:

Stage 1: Medicare Part D Annual Deductible

- What does it mean? You pay 100% of prescription drug costs until you reach a certain amount set by your plan. The maximum deductible for 2022 is $480. However, some plans dont have a deductible. If thats the case, you will skip the first phase and start in initial coverage.

- Whens the next stage? This phase continues until you reach your deductible. Then, you move into the initial coverage stage.

- Example: Lets say your annual deductible is $400 and your retail medication costs $250. You pay $250. You need to spend $150 more to reach your deductible.

Don’t Miss: Is Viberzi Covered By Medicare

What Happens After I Exit The Donut Hole

After you exit the donut hole, youll receive whats called catastrophic coverage. This means that youll have to pay whatever is greater for the rest of the year: Five percent of a drugs cost or a small copay.

The minimum copay for 2022 has increased a little from 2021:

- Generic drugs: minimum copay is $3.95, which is up from $3.70 in 2021

- Brand-name drugs: minimum copay is $9.85, which is up from $9.20 in 2021

Choosing Medicare prescription drug coverage

Are you planning on enrolling in a Medicare prescription drug plan? Consider the following before choosing a plan:

- Use the Medicare website to search for a plan thats right for you.

- Compare a Medicare Part D with a Medicare Advantage plan. Medicare Advantage plans include health care and drug coverage on one plan and sometimes other benefits like dental and vision.

- Check that the plan covers your medications.

- If you take generic drugs, look for a plan that charges a low copayment.

- If youre concerned about expenses while in the donut hole, find a plan that provides additional coverage during this time.

- Make sure that additional coverage includes medications you take.

When Did The Donut Hole Close

Starting in 2010, the Affordable Care Act gradually reduced the share of costs people had to pay in the donut hole. Discounts from drug manufacturers and government payments helped to cover more costs over several years.

The donut hole finally closed in 2020. It was eliminated in 2019, earlier than initially expected, for brand-name drugs and ended for generic drugs in 2020.

However, after you and your Medicare Part D prescription drug plan have spent a certain amount for your medications each year, you still must pay up to 25 percent of the cost of covered drugs. That is called the coverage gap.

Read Also: How To Get Your Medicare Number

The Good News About The Donut Hole

Despite the fact that you are going to have to pay some serious out-of-pocket expense while you are in the donut hole or Medicare gap, there is good news.

While you only will pay 45 percent of the total cost of your prescription drugs, up to 95 percent of the actual cost of the drug is counted toward your spending record to get you out of the donut hole.

So anytime you purchase or renew your prescriptions, 95 percent of the cost will be counted, even though you are not paying more than 45 percent of the cost of the drugs.

This is like having to pay $1 but getting back 95 cents. The only problem is that you do not get it back. You only get credit for it until you are out of the gap.

What Is The Medicare Donut Hole Coverage Gap Explained

You may have heard of the donut hole in reference to Medicare Part D, Medicares prescription drug coverage.

The donut hole is a gap in prescription drug coverage during which you may pay more for prescription drugs. You enter the donut hole once Medicare has paid a certain amount toward your prescription drugs in one coverage year.

Once you fall into the donut hole, youll pay more out of pocket for the cost of your prescriptions until you reach the yearly limit. Depending on the type of coverage you choose, when you hit this limit, your plan may help pay for your prescriptions again.

Continue reading as we discuss more about the donut hole and how may it affect how much you pay for your prescription drugs this year.

So when exactly does the donut hole begin and end for 2021? The short answer is, that varies depending on the Part D plan you choose and how much you spend on prescription medications. Here are more facts about the Medicare donut hole.

Initial coverage limit

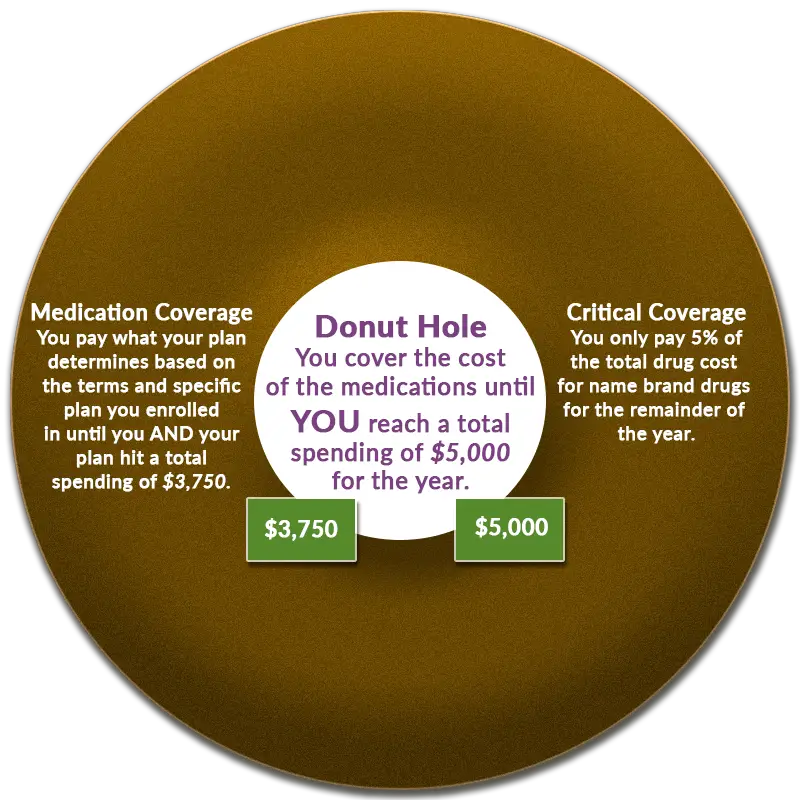

You enter the donut hole after you surpass the initial coverage limit of your Part D plan. The initial coverage limit includes the total cost of drugs what both you and your plan pay for your prescriptions.

After surpassing this limit, youll need to pay a certain percentage yourself until youve reached whats called the OOP threshold.

OOP threshold

This is the amount of OOP money that you have to spend before you exit the donut hole.

Lets see how this works in some examples below.

Generic drugs

Recommended Reading: How Do I Check On My Medicare Application

Stage 2 Initial Coverage Stage

Copayments and coinsurances come into play during this stage. Your share of prescription drug costs are paid by you and your Medicare Part D plan pays the remaining cost for covered medications. You enter the Part D coverage gap once the combined amount that you and your drug plan pay for your prescription drugs reaches a limit of $4,430 in 2022.

Exemptions From The Coverage Gap

Sometimes people ask us if their Medigap plan will cover the coverage gap in their drug plan. The answer is no. Medigap plans help to pay for inpatient and outpatient services only. Drugs fall separately under Part D.

Every year we have clients ask us to help them find a Part D drug plan with no coverage gap. Such a plan does not currently exist in most states. The are no Medicare Part D plans without the donut hole. There is no separate insurance plan that you can buy to cover you in the Medicare donut hole either. Read more on why that is here.

However, certain people with low incomes and limited assets may qualify for the low-income subsidy, called Extra Help for Part D. If you qualify, then Medicare will waive the gap for you. Also, your ordinary copays on your prescriptions will decrease quite a bit. You can apply for the subsidy at your local Social Security office or online at their website.

Recommended Reading: What Is A Medicare Part D Pdp Plan

Brand Name And Generic Drugs

One way that you can save additional money when you are in the gap in coverage is to opt for generic drugs in the place of brand name medications. Most people believe that there is no difference in strength or effects of drugs that are purchased in the generic category but some patients prefer to hold out and purchase brand name drugs.

Brand name medications are always going to be more expensive than generic drugs because they tend to be bought and processed by the biggest pharmaceutical companies.

What Does Closing The Donut Hole Mean

ou might be wondering how the donut hole can be closed when you still have to pay 25% of your prescription drug costs.

Under Part D rules, plan members are responsible for 25% of their drug costs during the initial coverage stage. Before the Affordable Care Act closed the donut hole, members paid 100% during the coverage gap.

Now plan members pay 25% across both stages of coverage. In other words, the cost gap between initial coverage and the donut hole has now disappeared, effectively closing the donut hole.

Beware of drug cost sticker shock

Although you are technically responsible for 25% of drug costs in both stages, most people pay more for medications in the coverage gap. This is because most insurers use set copayments instead of 25% coinsurance during the initial coverage stage.

Heres a hypothetical situation showing how that might look:

Jasper takes medication for high blood pressure and high cholesterol. He pays $5 for his generic blood pressure medicine and $35 for his brand-name cholesterol drug during initial coverage.

The actual cost of his blood pressure medicine is $3.50. The actual cost of his cholesterol drug is $250. When Jasper enters the coverage gap, he now pays just $0.88 for his blood pressure drug, but his coinsurance for the cholesterol drug jumps to $62.50.

Don’t Miss: Does Medicare B Cover Cataract Surgery

How Do I Know If I Will Reach The Medicare Donut Hole

Your Part D company sends out a statement, or explanation of benefits , each month. This statement tells you exactly how much you have already spent on covered medications and how many dollars are left before you reach the coverage gap. Likewise, after you reach the gap, your insurance company will continue to send you notices that track your gap spending. They will calculate how many dollars are left before you reach catastrophic coverage.

What Are The Phases Of A Part D Plan

Your drug coverage will change throughout the year, depending on how much you spend. If you dont spend very much on drugs, or you have drug coverage from another source, you may never reach the donut hole phase.

Bear in mind that Medicare updates the maximum deductible and cost thresholds every year. Heres how Part D coverage breaks down in 2021:

-

Phase 1: Deductible: You start out the year paying full price for your medications until you reach your deductible. Deductibles vary by plan, but the maximum deductible allowed by Medicare in 2021 is $445.

-

Phase 2: Initial coverage: You pay your plans designated copay or coinsurance when filling your prescriptions until total medication expenses including the deductible but not including premiums reach $4,130.

-

Phase 3: Modified coverage : At this stage, you pay no more than 25% of the cost of your prescription drugs. For brand-name drugs, the manufacturers kick in 70% of the cost, and your insurer pays the other 5% . This payment structure lasts until the spending total reaches $6,550. How long it takes you to get there depends on whether youre buying generic or brand-name drugs.

-

Phase 4: Catastrophic coverage: Your copay drops substantially until the end of the year. For each drug, you pay whichever amount is larger:

-

copays of $3.70 for generics and $9.20 for brand-name drugs

When the year ends, you start over at Phase 1.

Recommended Reading: Does Unitedhealthcare Medicare Advantage Cover Hearing Aids

How Does The Medicare Donut Hole Work And When Does It End

So when exactly does the donut hole begin and end for 2022? The short answer is, that varies depending on the Part D plan you choose and how much you spend on prescription medications. Some people pay less for their medications when they enter the donut hole while others pay more.

Here are more facts about the Medicare donut hole.