Wait Medicare Costs Money

Its something thats happened time and time again an individual turns 65 years old and, much to their dismay, are surprised to learn that unfortunately, this is not the case. Its easy to assume that the Medicare taxes you have paid over the course of your working life mean that coverage will be free once you are eligible, however, Medicare coverage is not entirely cost-free.

However, like anything else, exactly how much you will pay for Medicare coverage depends on several factors. At MedicareInsurance.com, our goal is to inform you about Medicare costs as simply and directly as possible, and help you answer any questions you may have about coverage costs and the options that may be available to you.

How Medicaid Is Funded

Medicaid is funded by the federal government and each state. The federal government pays states for a share of program expenditures, called the Federal Medical Assistance Percentage . Each state has its own FMAP based on per capita income and other criteria. The average state FMAP is 57%, but FMAPs can range from 50% in wealthier states up to 75% for states with lower per capita incomes. FMAPs are adjusted for each state on a three-year cycle to account for fluctuations in the economy. The FMAP is published annually in the Federal Register.

As mentioned above, the CARES Act will provide additional funds to states for costs related to COVID-19.

What Is Part D Coinsurance

There are four payment stages or Part D policyholders.

- Your annual deductible: For 2022, it can be up to $480 per year. You pay this entirely out of pocket.

- Initial coverage, where youll pay your share of copay or coinsurance until the total amount spent on drugs reaches $4,430.

- The coverage gap , where you pay 25% of all costs until youve paid $7,050 out of pocket.

- Catastrophic coverage: For the rest of the year, youll owe 5% coinsurance or $3.95 for generic drugs and $9.85 for brand drugs, whichever is greater.

Recommended Reading: Will Medicare Pay For A Power Lift Chair

What Is Medicare Easy Pay

Medicare Easy Pay automatically deducts your Medicare premium from a designated checking or savings account. Youll still get a Medicare Premium Bill in the mail, but it will say, This is not a bill. It will serve as a statement letting you know that your premium has automatically been deducted from your bank account.

If you prefer to not have your Medicare premiums automatically deducted, there are a few other ways you can pay:

- You can sign onto MyMedicare.gov and pay your premiums online with your credit card or debit card.

- If you receive Social Security benefits, you can have your Medicare premiums deducted from your benefits.

- If you prefer to pay by check or credit card, you can return your Medicare bill with a check or credit card number by mail.

Using Medicare Easy Pay will save you time and prevent you from accidentally forgetting to pay your premiums.

Who’s Eligible For Medigap

If youre enrolled in both Medicare Part A and Part B, and dont have Medicare Advantage or Medicaid benefits, then youre eligible to apply for a Medigap policy. These plans are standardized, and are designed to cover some or all of the out-of-pocket costs that are incurred when you have a Medicare-covered claim .

You have a federal right to buy a Medigap plan during the six months beginning when youre at least 65 years old and have enrolled in Part B. This is known as your Medigap open enrollment period. After this time runs out, you will have only limited chances to purchase one down the road.

Some states allow people of any age or health status to purchase Medigap coverage at any time without medical underwriting, but most dont. In many states, Medigap plans may not be available for people who have Medicare before age 65. There are 33 states that require Medigap plans to be guaranteed issue in at least some circumstances when an applicant is under age 65, but the rules vary from one state to another you can click on a state on this map to see details about state-based Medigap rules.

If youre enrolling in Medicare due to your age, the primary factor that will affect your ability to purchase a Medigap policy regardless of your health will be whether you enroll during your Medigap Open Enrollment Period.

Read Also: Does Medicare Cover In Home Help

Medicare Part C Advantage Plans

The Part C monthly premiums vary based on your reported income for two years, the benefit options, and the plan itself.

The amount you pay for Part C deductibles, copayments, and coinsurance varies by plan.

Like traditional Medicare, Advantage Plans make you pay part of the cost for covered medical services. Your share of the bill typically ranges from 20 percent to 40 percent or more, depending on the care you receive.

All Advantage Plans have a yearly limit on your out-of-pocket costs for medical services. The average out-of-pocket limit typically ranges from $3,400 to $7,550. In 2022, the maximum out-of-pocket limit is $10,000.

With most plans, once you reach this limit, youll pay nothing for covered services. Any monthly premium you pay for Medicare Advantage coverage does not count towards your plans out-of-pocket maximum.

Any costs paid for outpatient prescription drug coverage do not apply to your out-of-pocket maximum.

How Much Does Medicare Advantage Cost

Medicare Advantage plans are private, Medicare-approved health insurance plans that provide Part A and Part B coverage, and may also include other types of coverage, such as vision or dental. The costs of these plans varies, depending on the benefits provided. Each plan offers different coverage and associated premiums, deductibles, and copay. Participants must also pay their Part B premium, along with the adjustment for high earners, if applicable.

Average premiums for 2022 are expected to drop to $19 a month.9

You May Like: How Do I Replace A Lost Medicare Card

Medicare Part B Costs In 2021 And 2022

Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium of $148.50 in 2021 and $170.10 in 2022. A small percentage of people will pay more than this amount if they report income greater than $91,000 as single filers, or more than $182,000 as married joint filers.

Part B also comes with a deductible of $203 per year in 2021 and $233 in 2022. Unlike Part A, your deductible isnt tied to a benefit period or other complicated formulas. Medicare pays 80% of the Medicare-approved amount once you pay your $203 or $233, which is likely to happen after your first or second doctor visit or procedure of the year. That leaves you on the hook for only 20%.

Am I Eligible For Medicare Part B

When you receive notification that youre eligible for Medicare Part A, youll also be notified that youre eligible for Part B coverage, which is optional and has a premium for all enrollees.

Part B costs $170.10/month for most enrollees in 2022, although Part B costs more if your income is more than $91,000 .

Its important to enroll in both Part A and Part B. You have an enrollment window that runs for seven months . And while you can enroll in the three months following your 65th birthday, its best to enroll in Part B early, or you could have gaps in health coverage. If you wait too long, you could end up locked out of Part B and have to wait until the next general Medicare enrollment period.

If you dont enroll during your initial window, you wont lose eligibility for Part B, but you will be penalized with an increased premium when you eventually enroll, which climbs 10% for each year that youre eligible but dont enroll in Part B . The General Enrollment Period for Medicare A and B runs from January 1 to March 31 each year, for coverage effective July 1 with an increased premium if the late enrollment penalty applies.

Don’t Miss: What Is Part D For Medicare

Why Pay For Part C Or Part D Coverage

With just Part A and Part B coverage, you may still have to spend a large amount of money on your health services and prescriptions, especially if your medical needs are significant .

Part C and D plans cover a lot of costs not included under Parts A and B. They can actually save you money, even though your monthly premiums are usually a little bit higher when you choose Part C and Part D plans.

If youre looking for a solution to keep your expenses as low as possible, its a good idea to consider a Medicare Advantage or Medigap health plan.

For more information, download our Welcome to Medicare Guide, which will help you understand your choices even better, and can answer a lot of questions you might still have.

Independence Blue Cross is a subsidiary of Independence Health Group, Inc. independent licensees of the Blue Cross and Blue Shield Association, serving the health insurance needs of Bucks, Chester, Delaware, Montgomery, and Philadelphia counties of Pennsylvania.

Sitemap | Legal | Privacy & other policies

Independence complies with applicable Federal civil rights laws and does not discriminate on the basis of race, color, national origin, age, disability, or sex. Independence does not exclude people or treat them differently because of race, color, national origin, age, disability, or sex. View our documentation for more information and to request language assistance services.

Every year, Medicare evaluates plans based on a 5-Star rating system.

So How Are The Medicare Premiums You Pay For Calculated

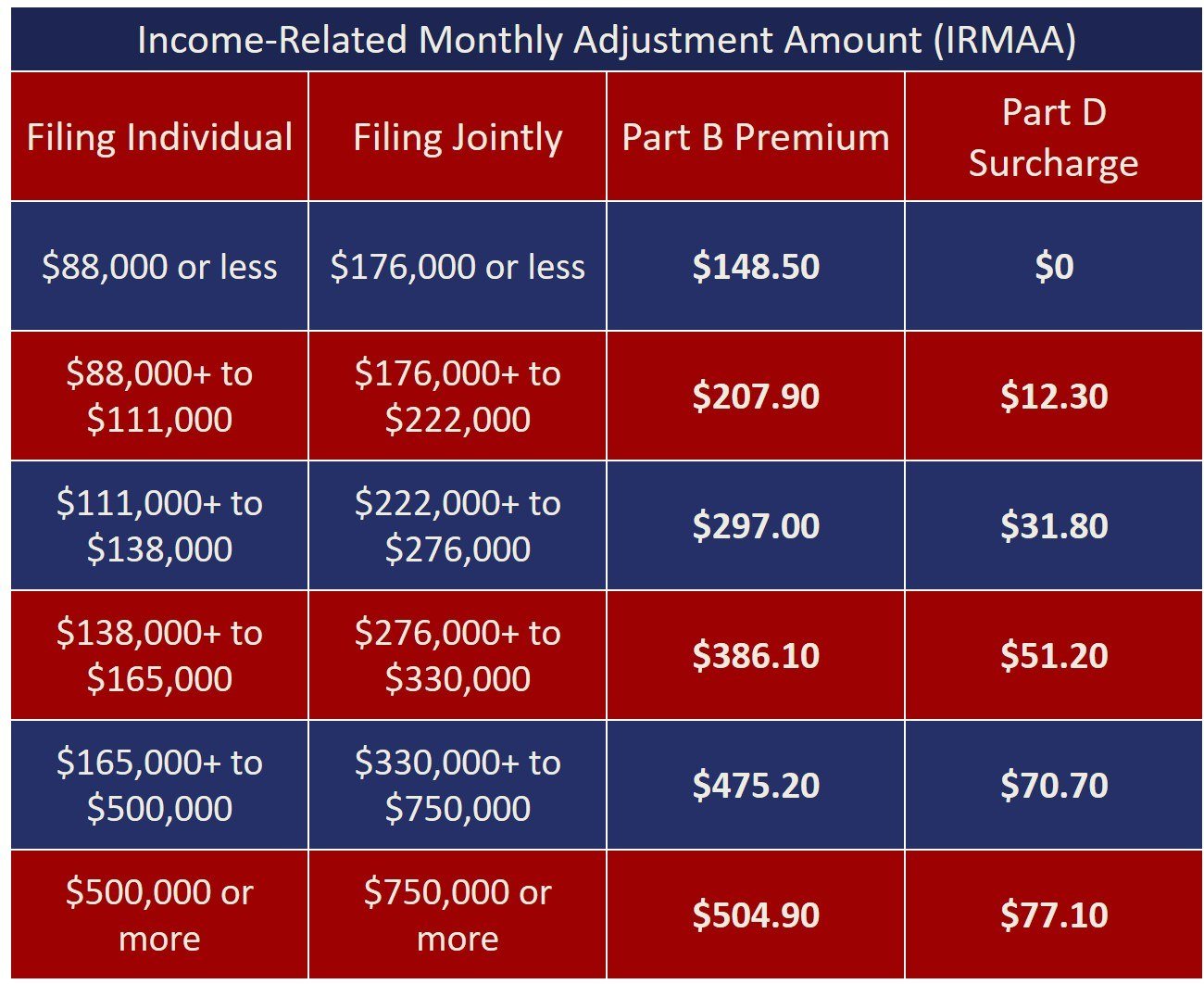

These additional Medicare premiums are all calculated through something called IRMAA, which stands for Income-Related Monthly Adjustment Amount. It is an additional amount that you may have to pay along with your Medicare premium if your modified adjusted gross income is higher than a certain threshold.

Your MAGI is calculated by taking your adjusted gross income plus any of the following that apply to you: untaxed foreign income, non-taxable Social Security benefits, tax-exempt interest, and income from within the US territories that was not already included in AGI. For most people, your MAGI will be the same as your AGI but read this report by the Congressional Research Service here for further details.

In 2022, the IRMAA surcharges only apply if your MAGI is more than $91,000 for an individual or more than $182,000 for a couple. Most people have income below these levels, so the majority of enrollees will pay the standard premium, $170.10 per month.

Recommended Reading: How Much Does Medicare Pay For A Doctors Office Visit

How Much Will I Pay For Premiums In 2022

Most people will pay the standard amount for their Medicare Part B premium. However, youll owe an IRMAA if you make more than $91,000 in a given year.

For Part D, youll pay the premium for the plan you select. Depending on your income, youll also pay an additional amount to Medicare.

The following table shows the income brackets and IRMAA amount youll pay for Part B and Part D in 2022:

| Yearly income in 2020: single | Yearly income in 2020: married, joint filing | 2022 Medicare Part B monthly premium | 2022 Medicare Part D monthly premium |

|---|---|---|---|

| $91,000 | |||

| $578.30 | your plans premium + $77.90 |

There are different brackets for married couples who file taxes separately. If this is your filing situation, youll pay the following amounts for Part B:

- $170.10 per month if you make $91,000 or less

- $544.30 per month if you make more than $91,000 and less than $409,000

- $578.30 per month if you make $409,000 or more

Your Part B premium costs will be deducted directly from your Social Security or Railroad Retirement Board benefits. If you dont receive either benefit, youll get a bill from Medicare every 3 months.

Just like with Part B, there are different brackets for married couples who file separately. In this case, youll pay the following premiums for Part D:

- only the plan premium if you make $91,000 or less

- your plan premium plus $71.30 if you make more than $91,000 and less than $409,000

- your plan premium plus $77.90 if you make $409,000 or more

You can request an appeal if:

Medicare Part C Costs In 2021 And 2022

Parts A and B are called “Original Medicare.” You receive Original Medicare at very little cost to you as part of what you paid into Medicare throughout your working years.

Part C is where you begin to have options. Also called “Medicare Advantage,” it includes plans that are available for purchase from the private insurance market that extend Medicares coverage.

Part C or Medicare Advantage average premiums are expected to drop to $19 a month in 2022, down from $21.22 in 2021. Coinsurance, copayments, premiums, and deductibles may still vary, depending on your plan of choice.

Recommended Reading: Is My Spouse Covered Under My Medicare

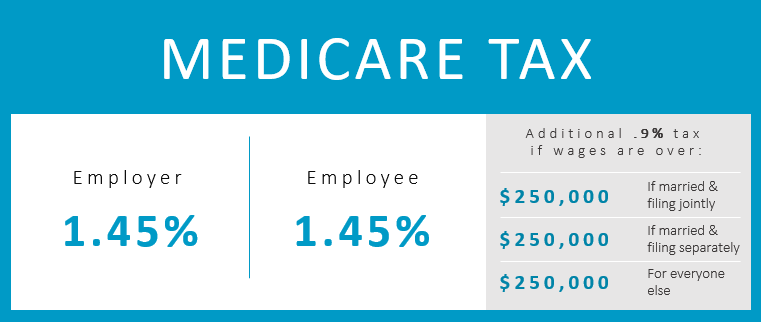

Do I Have To Pay For Medicare

We get this question a lot, and we understand why you may be confused or upset. If you were employed for any extended period of time in your life, youre probably thinking, I already paid for Medicare through taxes! Its true that most people paid Medicare taxes during their working careers, but there are still some costs involved in Medicare for most people.

Those Medicare taxes that you paid all those years certainly helped fund the Medicare program, but its not enough. Healthcare is expensive!

Medicare parts A and B are different. If you worked for at least 39 quarters, you may not have to pay a premium for Part A at all. However, anyone who does not qualify for financial assistance will owe a premium for Part B. The Part B premium can change based on income, but the standard in 2020 is $144.60/month.

- If you worked over 39 quarters , your Part A premium will be $0

- If you worked 30-39 quarters, your Part A premium will be $252 in 2020

- IF you worked for less than 30 quarters, your Part A premium will be $458 in 2020.

Who Doesn’t Have To Pay A Premium For Medicare Part A

A: Most Medicare-eligible people do not have to pay premiums for Medicare Part A. If you are 65 and you or your spouse has paid Medicare taxes for at least 10 years, you dont pay a premium for Part A.

You may also not have to pay the premium:

- If you havent reached age 65, but youre disabled and youve been receiving Social Security benefits or Railroad Retirement Board disability benefits for two years.

- You have end-stage renal disease and are receiving dialysis, and either you or your spouse or parent worked and paid Medicare taxes for at least 10 years. Coverage typically begins the first day of your fourth month of dialysis, but it can begin in your first month of dialysis if you use in-home dialysis treatment.

- You have amyotrophic lateral sclerosis and are eligible for Social Security Disability Insurance . Medicare coverage begins as soon as your SSDI begins, and Medicare Part A has no premiums as long as you or your spouse worked and paid Medicare taxes for at least 10 years.

Read Also: Does Medicare Cover Refraction Test

Medicare Part D Premiums

Medicare Part D is prescription drug coverage. Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2022 is $33.37, but costs vary.

Your Part D Premium will depend on the plan you choose. Just like with your Part B coverage, youll pay an increased cost if you make more than the preset income level.

In 2022, if your income is more than $91,000 per year, youll pay an IRMAA of $12.40 each month on top of the cost of your Part D premium. IRMAA amounts go up from there at higher levels of income.

This means that if you make $95,000 per year, and you select a Part D plan with a monthly premium of $36, your total monthly cost will actually be $48.40.

How Social Security Determines You Have A Higher Premium

Social Security uses the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

If you file your taxes as married, filing jointly and your MAGI is greater than $176,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $88,000, youll pay higher premiums , for an idea of what you can expect to pay).

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, and you already are paying an income-related monthly adjustment amount, well apply an adjustment automatically to the other program when you enroll. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

Read Also: What Age Can You Start To Collect Medicare