What Are The Different Types Of Medicare Advantage Plans

There are several types of Medicare Advantage plans, although the number of plans available depend on the companies offering the plans. For example, according to the KFF, almost a quarter of beneficiaries will have a choice of plans from more than 10 companies.

However, also according to the KFF, the number of available plans varies across the country, from fewer than 16 plans on average in non-metropolitan areas to more than 30 plans in a metropolitan area.

Listed below are five of the most common types of Advantage plans.

How To Pay For Medicare Advantage

After youve signed up for a plan, you may be required to pay a monthly premium to the insurance company although many plans dont charge one. Youll also pay your Part B premiums to Medicare. Medicare beneficiaries with low incomes and sometimes few assets can get financial assistance to help pay for Medicare Part A and B premiums and sometimes deductibles, coinsurance and copayments for Parts A and B and Medicare Advantage plans.

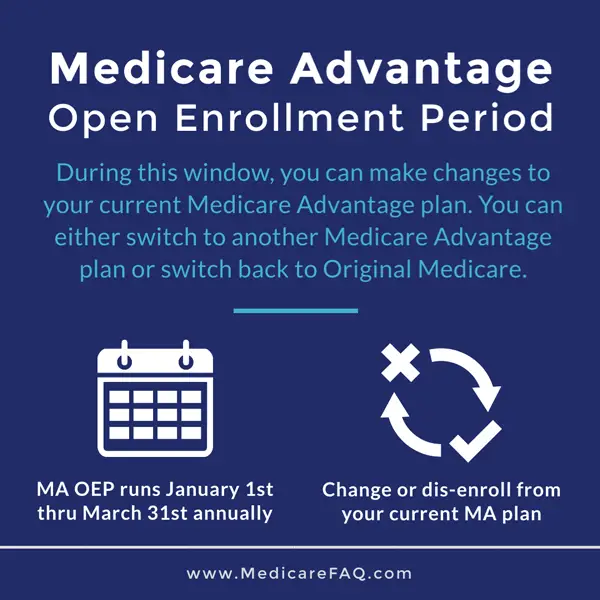

Mark your calendar for Medicares open enrollment period and the Medicare Advantage open enrollment period each year. Even if youre satisfied with your coverage, its a good idea to go to Medicare’s Plan Finder to compare what’s available in your area. Plans can change their coverage, costs and provider networks every year.

Images: Medicare.gov

Kimberly Lankford is a contributing writer who covers personal finance and Medicare. She previously wrote for Kiplinger’s Personal Finance magazine, and her articles have also appeared in U.S. News & World Report, The Washington Post and the Boston Globe. She received the personal finance Best in Business award from the Society of American Business Editors and Writers.

Low Or $0 Monthly Premium Medicare Advantage Plans Can Add Up To Real Savings

With , rather than pay your medical bills directly, the federal government contracts with private insurance companies to administer your plan. You still have all the rights and benefits that come with Original Medicare, but private insurerslike Humanacompete for your business with low premiums and added benefits.

Don’t Miss: Is Imvexxy Covered By Medicare

How Can I Switch Advantage Plans

To switch a Medicare Advantage plan, a person can compare the different plans online and choose one that suits them. A person can also call 800-MEDICARE to find a plan in their area.

A person can then enroll in the new plan during one of the available enrollment periods. When coverage from the new plan begins, a person is automatically disenrolled from their previous plan.

How Has Health Reform Impacted Medicare Advantage

The Patient Protection and Affordable Care Act has restructured payments to Medicare Advantage plans in an effort to reduce budget spending on Medicare, but for the last few years, the payment changes have either been delayed or offset by payment increases. When the law was first passed, many people including the CBO projected that Medicare Advantage enrollment would drop considerably over the coming years as payment reductions forced plans to offer fewer benefits, higher out-of-pocket costs, and narrower networks.

But that has not been the case at all. Medicare Advantage enrollment continues to grow each year. There were nearly 28 million Advantage enrollees in 2021, which accounts for more than 43% of all Medicare beneficiaries Thats up from just 13% in 2004, and 24% in 2010, the year the ACA was enacted.

The number of Medicare Advantage plans available has increased for 2022 to the highest in the last decade, with a total of 3,834 plans available nationwide. The majority of beneficiaries still have at least one zero-premium plan available to them, and the average enrollee can select from among 39 plans in 2022.

Recommended Reading: Is Methadone Covered By Medicare

How Do I Enroll In Medicare

If you are not automatically enrolled in Part A and Part B, contact Social Security or the RRB during the three months before you turn 65. Although Medicare regulates the Medicare health insurance program, you must enroll through the Social Security Administration. According to Medicare, you can:

- Apply online This is the easiest and fastest way to sign up and get any financial help you may need. Youll need to create your secure my Social Security account to sign up for Medicare or apply for Social Security benefits online.

- Contact your local Social Security office. You can speak with a local representative on the phone and may be able to schedule an in- person appointment if your situation is complicated.

- If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

If Social Security enrolls you over the phone, ask for the Medicare number assigned to you, the start dates for both A and B, and when you can expect your card in the mail. If you do not receive the card when promised, follow up on it. When you do receive your card, make sure your name is spelled correctly and verify that the Medicare number is the same. Also confirm the card shows the correct start dates for Parts A and B.

Keep track of your interactions with SSA representatives. Be sure to log the date, time, and the name of the person you talk with, and any pertinent information in the event a mistake is made in the processing of your enrollment.

Is Medicare Open Enrollment Still Open

No, the fall Medicare Open Enrollment Period for Medicare Advantage plans and Medicare prescription drug coverage is closed. The next fall Medicare Open Enrollment Period begins October 15, 2022, during which you may be able to drop, switch or enroll in a Medicare Advantage or Medicare Part D prescription drug plan for the 2023 plan year.

Recommended Reading: What Is Humana Medicare Supplement Plan

What Is An Annual Notice Of Change

Every year in September, you should receive an Annual Notice of Change in the mail from your Medicare Advantage plan or Medicare Prescription Drug plan provider. This letter outlines any upcoming changes to the plan for the following year, such as:

- Service area adjustments

- Provider network changes

Be sure to take the time to review your plan ANOC and make sure that your Medicare plan still fits with your coverage and budget needs for the coming year.

If anything is changing in your plan and you want to see what else is offered in your area, the Medicare AEP is your opportunity to find a Medicare plan option that works better for you.

How Can A Medicare Advantage Plan Have A $0 Monthly Premium

Private insurance companies are able to offer zero-premium Medicare Advantage plans, in part, because:

- To help manage costs, Medicare Advantage plans usually enter into contracts with a network of doctors and hospitals.

- That means you may have to pay more money if you see a doctor outside the plans network

Read Also: Does Medicare Pay For Custom Foot Orthotics

What If I’m Collecting Retirement Benefits

If you are collecting social security retirement benefits when you turn 65, you will automatically be enrolled in Medicare Parts A and B. You do have the option to opt-out of Part B in certain situations.

If you live outside the fifty states or Washington D.C. , you will automatically be enrolled in Medicare Part A, but you must enroll in Part B manually.

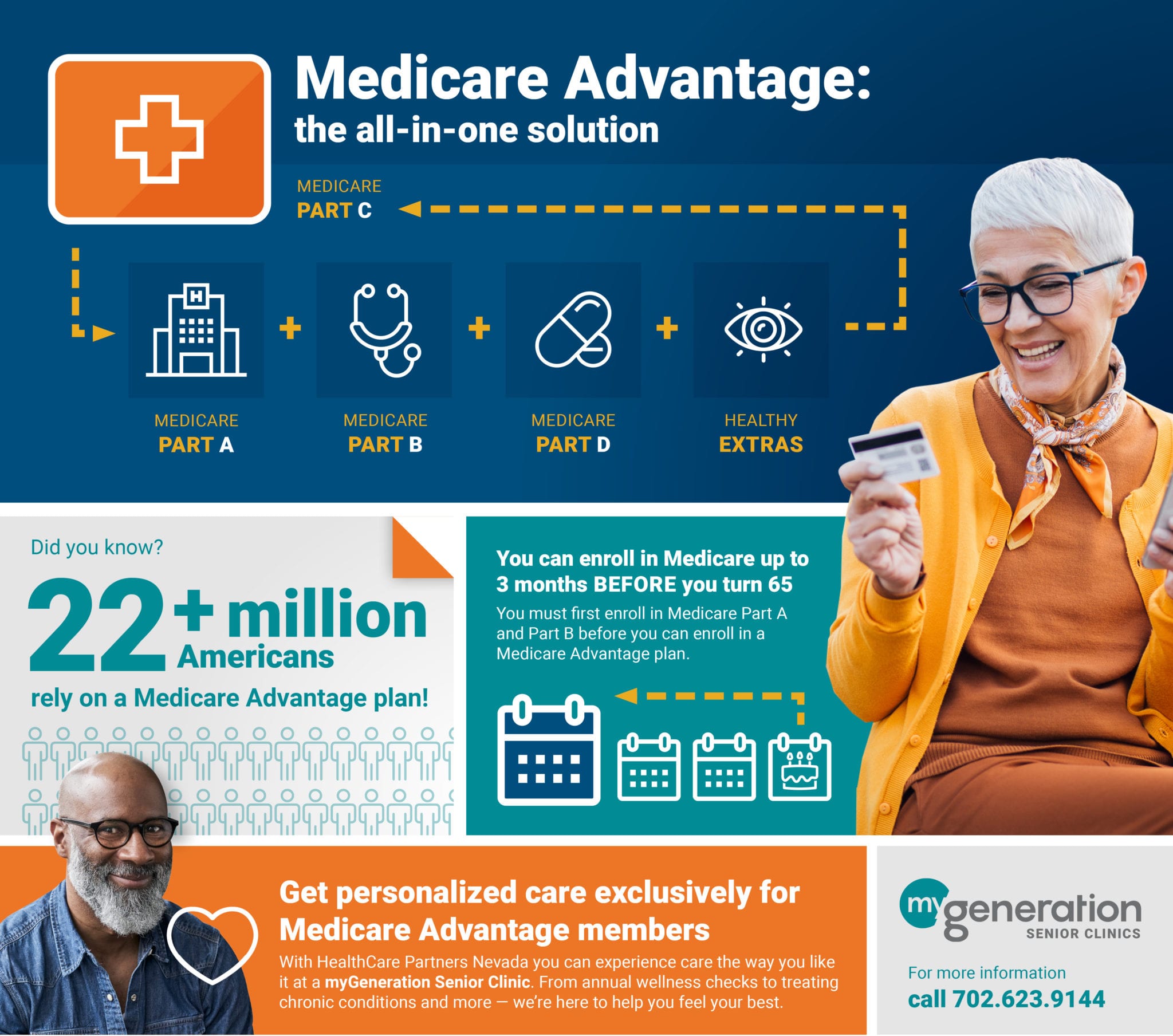

What Is Medicare Advantage

Since 1997, Medicare enrollees have had the option of opting for Medicare Advantage instead of Original Medicare. Medicare Advantage plans often incorporate additional benefits, including Part D coverage and extras such as dental and vision as well as additionals supplemental benefits.

And unlike Original Medicare, the plans do include a cap on out-of-pocket costs that currently cant exceed $7,550. This out-of-pocket limit only applies to services that would otherwise have been covered by Original Medicare, so it does not include prescription drug costs, which Original Medicare does not cover.

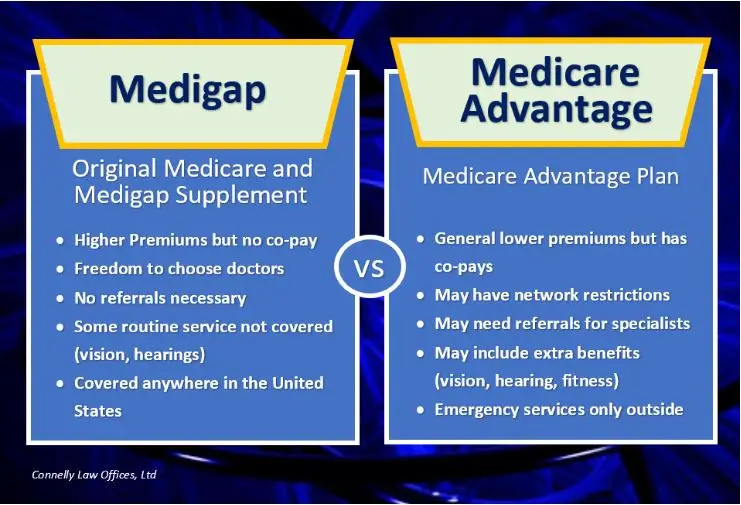

Advantage plans tend to constrain beneficiaries to a limited provider network, and coverage for specific services may not be as robust as it would be with Original Medicare plus supplemental coverage. But Advantage plans, including the cost for Medicare Part B, also tend to be less expensive than Original Medicare plus a Medigap plan plus a Part D plan. This article helps to illustrate the pros and cons of each option.

Also Check: How Does Bernie Sanders Pay For Medicare For All

Medicare Special Enrollment Period

Depending on your circumstances, you may also qualify for a Special Enrollment Period .

Medicare Special Enrollment Periods can happen at any time during the year. You may qualify for a Special Enrollment Period for a number of reasons, which can include:

- You moved to a new area that is outside of your current Medicare Advantage plan’s service area

- You left your employer coverage

- Medicare ended your current Medicare Advantage plan’s contract

A licensed insurance agent can help you find out if you qualify for a Medicare Special Enrollment Period.

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Read Also: How Long Does It Take To Get Medicare After Applying

If You Have Other Coverage

Talk to your employer, union, or other benefits administrator about their rules before you join a Medicare Advantage Plan. In some cases, joining a Medicare Advantage Plan might cause you to lose employer or union coverage. If you lose coverage for yourself, you may also lose coverage for your spouse and dependents.

In other cases, you may still be able to use your employer or union coverage along with the Medicare Advantage plan you join. Remember, if you drop your employer or union coverage, you may not be able to get it back.

Medicare General Enrollment Period

If you don’t sign up during your Initial Enrollment Period and if you aren’t eligible for a Special Enrollment Period, the next time you can enroll in Medicare is during the Medicare General Enrollment Period.

The General Enrollment Period lasts from each year.

You can only sign up for Part A and/or Part B during this period, and your coverage starts on July 1. You may have to pay a late enrollment period for Part A and/or Part B, as detailed below.

|

Part B Late Enrollment Penalty: If you do not enroll in Medicare Part B during your Initial Enrollment Period but decide to enroll later in life, you will have to pay a late enrollment penalty. Your Part B monthly premium could go up 10 percent for each 12-month period that you were eligible for Part B but didn’t sign up. You pay the Part B late enrollment penalty for the rest of your life as long as you remain enrolled in Part B. |

Don’t Miss: Can You Get Medicare At 60

How To Enroll In Medicare Advantage

Medicare Advantage coverage is not automatic, and you have to sign up for any plan you want for your Part C provision. These plans are offered by private insurance carriers, just like any other insurance product, and the enrollment process is similar to buying any health coverage.

Your first option for enrolling in a Medicare Advantage plan is to go straight to the private company that provides it and sign up. This is a direct method that works very well if you already know which company youre interested in and what plan you want to buy into. It can be difficult to compare coverage options this way, however, which is why many seniors look into buying their Medicare Advantage from a third-party marketplace.

Most states offer relatively simple online tools for comparing Medicare Advantage options that are available in the area. Because some plans are limited to certain cities or counties, you may have to enter details about your address to find a plan that can cover your needs. Online tools like this typically ask questions about the specific coverage you need, as well as prescriptions you are on that you want to have coverage for. This information is only gathered for the purpose of helping you find a plan that covers your needs.

Eldercare Financial Assistance Locator

- Discover all of your options

- Search over 400 Programs

When To Sign Up For An Advantage Plan

You can enroll in a Medicare Advantage plan during the seven-month initial enrollment period surrounding your 65th birthday after youve enrolled in Parts A and B.

You can also sign up for a plan during the annual open enrollment period, which runs from Oct. 15 to Dec. 7 each year. To enroll during this time, be sure youve already signed up for Medicare Parts A and B. Your coverage will start Jan. 1.

You may be able to sign up at other times if you qualify for a special enrollment period. You also can switch between Medicare Advantage plans or go back to original Medicare during the annual Medicare Advantage open enrollment period from Jan. 1 to March 31.

Keep in mind that if you decide to return to original Medicare, you may not be able to get a Medigap policy. Insurers may deny coverage or charge a higher premium if you have a preexisting condition.

Don’t Miss: What Is The Annual Deductible For Medicare

Signing Up For Original Medicare

You can sign up for Medicare one of four ways:

For California residents, CA-Do Not Sell My Personal Info, .

1 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

The Share Of Medicare Beneficiaries In Medicare Advantage Plans By State Ranges From 1% To 59%

The share of Medicare beneficiaries in Medicare Advantage plans varies across the country, but in 25 states, at least half of all Medicare beneficiaries are enrolled in Medicare Advantage plans. In contrast, Medicare Advantage enrollment is relatively low in four mostly rural states . Overall, Puerto Rico has the highest Medicare Advantage penetration, with 93 percent of Medicare beneficiaries enrolled in a Medicare Advantage plan. This may be due in part to the high share of beneficiaries in Puerto Rico with low incomes who are dually enrolled in Medicare and Medicaid, as noted above.

Read Also: How Much Does Medicare Pay For Physical Therapy In 2020

Medicare Advantage Where You Live

Medicare Advantage plans can be administered on state and local levels.

- Some types of plans may be available in certain regions of a state but not in others.

- Some plans may come with certain premiums and other costs in one part of a state while the same plan features different costs in another county.

- Some health insurance companies and Medicare Advantage plan providers may offer plans in one part of a state but not in others.

Learn more about Medicare Advantage plan costs and availability in your state.

How Do Medicare Advantage Plans Work

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

These “bundled” plans include

, and usually Medicare drug coverage .

You May Like: What Is Medicare Plan G Supplement