Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

What Are The Risks Of Enrolling Late In Medicare Part B

Remember that if you do not enroll in Medicare Part B during your Special Enrollment Period, youll have to wait until the next General Enrollment Period, which happens from January 1 to March 31 each year. You may then have to pay a late-enrollment penalty for Medicare Part B because you could have had Part B and did not enroll. If you owe a late-enrollment penalty, youll pay a additional 10% on your premium for every 12-month period that you were eligible for Medicare Part B but didnt sign up for it. You may have to pay this higher premium for as long as youre enrolled in Medicare.

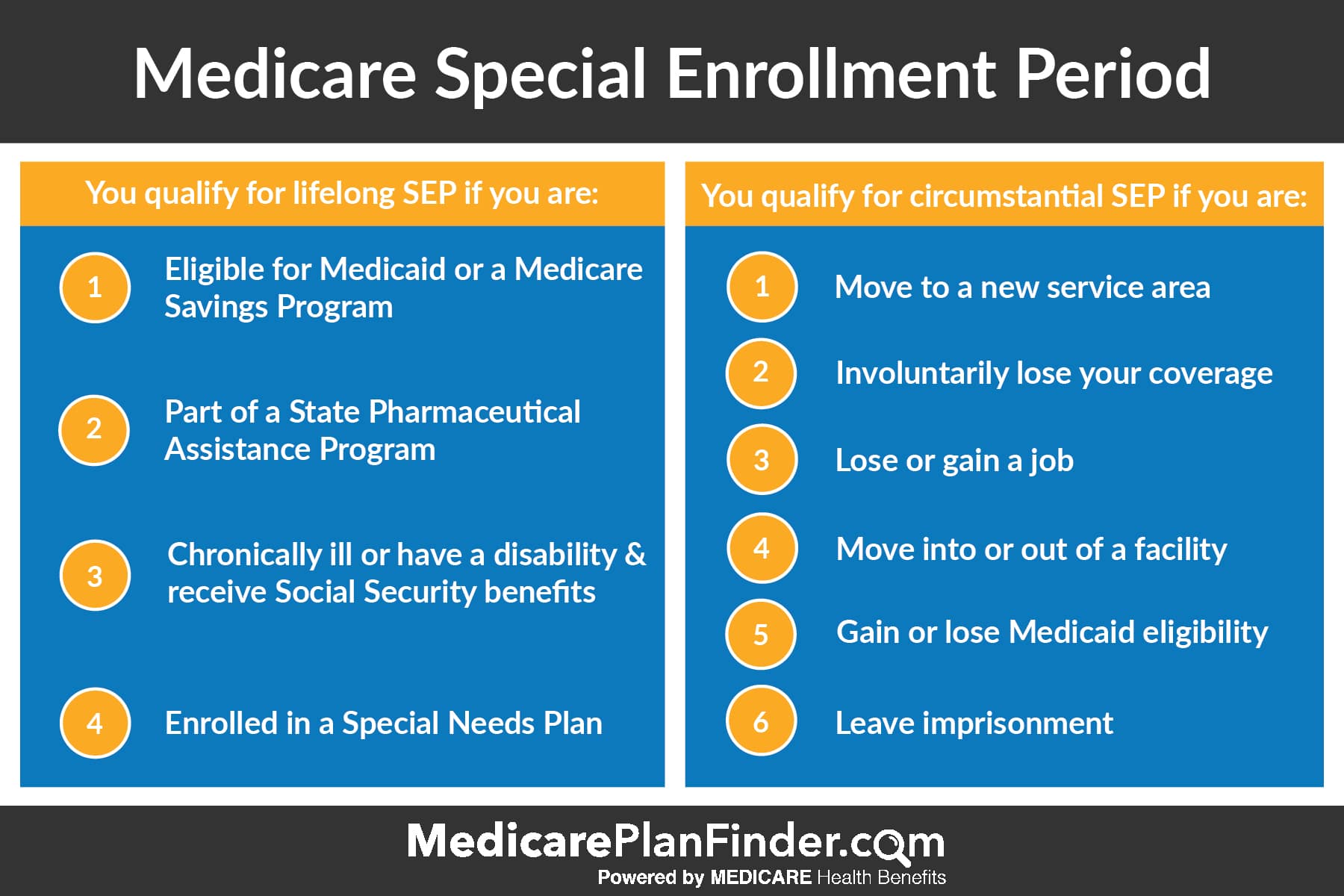

Do I Qualify For The Medicare Part B Special Enrollment Period

You qualify for the Part B SEP if:

- you are eligible for Medicare because of your age or because you collect disability benefits.

- you had Medicare Part B or current employment-based health coverage in the month you qualified for Medicare and

- less than eight months have elapsed since you didnt have either current job-based group health coverage or Medicare Part B.

Some people may need to use the Part B SEP if theyre still working. Youll want to sign up for Part B if your employer has less than 20 employees. This is because your employer plan pays only after Medicare does. If you dont enroll in Part B, your employer plan will pay less for your care or nothing at all when it finds out youre Medicare-eligible. If your employer has more than 20 employees, you dont have to take Part B as long as youre still working, but a small number of people do enroll to lower their out-of-pocket costs.

You have to take Part B once your or your spouses employment ends. Medicare becomes your primary insurer once you stop working, even if youre still covered by the employer-based plan or COBRA. If you dont enroll in Part B, your insurer will claw back the amount it paid for your care when it finds out. At that point, you would need to enroll in Part B, but might no longer qualify for the SEP if you delayed enrolling for more than 8 months.

Read Also: What Is The Difference Between Medigap Insurance And Medicare Advantage

Is There A Special Enrollment Period For Medicare When Losing Coverage

There are several instances in which you may find you lose your current coverage. When a person loses coverage, that is an indication of eligibility for a Medicare Special Enrollment Period.

You lose employer health coverage

When you lose health coverage from an employer or union, you can join a different Medicare plan up to a full two months after.

You lose creditable prescription coverage, or it changes dramatically

Losing drug coverage equal to Medicares means you can switch to another plan with drug coverage or a stand-alone Part D. This Special Enrollment Period continues for two full months after the month you lose your drug coverage, or you get a notification.

You leave a Medicare cost plan

If you have Part D through a cost plan and you end up leaving that plan, you can enroll in a new policy for up to two months after you leave your old plan.

Your PACE coverage drops

Dropping your coverage in your PACE plan means you can enroll in a new plan for two months with a SEP.

If You Want Medicare Part C

If youre considering a Medicare Advantage plan, you should:

- Compare the costs of plans in your area using Medicares plan finder tool. Keep in mind that these costs will be in addition to any Medicare Part A and Part B premiums however, some Advantage plans do cover some or all of the Part B premium.

- Make sure any doctors or other providers you use are part of the plans network.

- If the plan includes Part D coverage, make sure it covers any medications you take.

- Ensure that you can afford any premiums and additional costs.

- Enroll in the plan you choose, then pay your first premium.

Read Also: How To Check Medicare Status Online

Your Plan Changes Its Contract With Medicare

- Medicare takes an official action because of a problem with the plan that affects me.

-

What can I do?

Switch from your Medicare Advantage Plan or Medicare Prescription Drug Plan to another plan.

When?

Your chance to switch is determined by Medicare on a case-by-case basis.

- Medicare ends my plan’s contract.

-

What can I do?

Switch from your Medicare Advantage Plan or Medicare Prescription Drug Plan to another plan.

When?

Your chance to switch starts 2 months before and ends 1 full month after the contract ends.

- My Medicare Advantage Plan, Medicare Prescription Drug Plan, or Medicare Cost Plan’s contract with Medicare isn’t renewed.

-

What can I do?

Join another Medicare Advantage Plan or Medicare Prescription Drug Plan.

When?

Changing Medicare Advantage Plans Or Part D Plans Outside Of Open Enrollment

Many Medicare beneficiaries enroll in a Medicare Advantage plan or a Medicare Part D prescription drug plan during the Medicare Open Enrollment Period for Medicare Advantage and prescription drug plans.

During this period , you can make a number of coverage changes:

- You can change from one Medicare Advantage plan to another, whether or not either plan includes prescription drug coverage.

- You can disenroll from your Medicare Advantage plan and switch back to Original Medicare .

- If you switch back to Original Medicare during this period, you can join a Medicare Part D prescription drug plan.

If you dont enroll in a Medicare plan during this annual period, you may qualify for a Special Enrollment Period.

There are many ways to qualify for a Medicare Advantage Special Enrollment Period or a Medicare Part D Special Enrollment Period.

Some of the situations that may qualify you for one of these types of Special Enrollment Periods include:

The above list does not necessarily include every and all qualifications for a Special Enrollment Period.

Recommended Reading: What Is The Best Supplemental Insurance For Medicare

When Do You Use This Application

Use this form:

- If youre in your Initial Enrollment Period and live in Puerto Rico. You must sign up for Part B using this form.

- If youre in your IEP and refused Part B or did not sign up when you applied for Medicare, but now want Part B.

- If you want to sign up for Part B during the General Enrollment Period from January 1 March 31 each year.

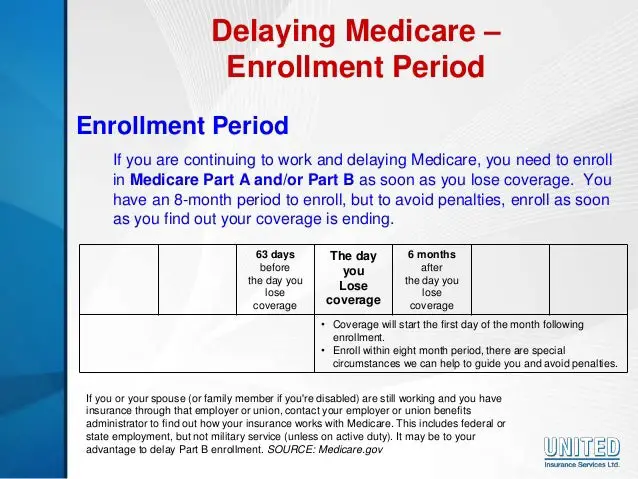

- If you refused Part B during your IEP because you had group health plan coverage through your or your spouses current employment. You may sign up during your 8-month Special Enrollment Period .

- If you have Medicare due to disability and refused Part B during your IEP because you had group health plan coverage through your, your spouse or family memberscurrent employment.

- You may sign up during your 8-month SEP.

NOTE: Your IEP lasts for 7 months. It begins 3 months before your 65th birthday and ends 3 months after you reach 65 .

So Long As You Have Creditable Coverage Elsewhere You Can Disenroll From Medicare Part B Without Incurring Late Penalties

Although Medicare offers very good coverage for most enrollees, there are various reasons why you may want to cancel your coverage. Whether youve found some other insurance that you think works better for you or have some other personal reason why youd rather not keep your enrollment in Medicare, well run through your options for canceling your coverage.

Read Also: Does Medicare Cover Plantar Fasciitis

Medicare Part B Special Enrollment Period: Who Qualifies

If youve worked at least 10 years while paying Medicare taxes, you typically qualify for premium-free Medicare Part A. Since most Medicare beneficiaries pay a monthly Medicare Part B premium, some people choose not to enroll in Part B or to delay enrollment. Generally, you face a lifetime late-enrollment penalty for Part B if you sign up after youre first eligible for Medicare.

However, Medicare has a Special Enrollment Period when you can enroll in Medicare Part B without a penalty. This is how your SEP works:

If all of these apply to you

- you are 65 or older

- you are still working or your spouse is still working

- you are covered by a health plan based on current employment

you may qualify for a SEP to enroll in Medicare Part B at any of these times:

- while you are still covered by an employer or union group health plan

- during the eight months following the month when the employer or union group health plan coverage ends, or when the employment ends, whichever comes first.

If youre working and plan to keep your employers group health coverage, talk to your benefits administrator to help you decide when to enroll in Part B.

If your employer-based group coverage ends and you dont enroll in Medicare Part B during the SEP, you have to wait until the General Enrollment Period to enroll and you may pay a higher Part B premium as a late enrollment penalty.

Find Plans in your area instantly!

How Is The Part B Special Enrollment Period Different

The Part B Special Enrollment Period functions uniquely compared to other enrollment periods. It is usually invoked when you deferred your Original Medicare enrollment because you were already covered through your employer. Assuming your company employs at least 20 people, Medicare will allow you to keep your employer-based coverage and then switch to Medicare later with no penalty.

This is distinct from other uses of the SEP, such as moving out of the coverage area of your Medicare Advantage plan. However, the basic principle of Special Enrollment is the same.

You May Like: What Is Medicare Advantage Coverage

Signing Up For Parts A And B

If youre eligible for premium-free Part A, you can enroll anytime by contacting the Social Security Administration at 800-772-1213. How much you’ll have to pay for Part A depends on how long you’ve worked. You need 40 work credits to avoid paying the Part A premium. If you have accrued fewer than 40 credits and dont have a spouse or an ex-spouse if you were married more than 10 years and havent remarried who has earned 40 credits or more, youll have to pay a premium for Part A and a penalty for signing up after your IEP or any SEP you might qualify for.

AARP Membership $12 for your first year when you sign up for Automatic Renewal

Join today and get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

The SSA has no paper form available for enrollment in Part A during the GEP, so you must call. To sign up for Part B, complete Form CMS-40B and mail it to your local Social Security office or call for assistance.

No option exists now to enroll online if you need to do so during a general enrollment period. Most Social Security offices have been closed during the COVID-19 pandemic. Contact your local office to find out whether you can go in person.

Losing Creditable Drug Coverage Through No Fault Of Your Own

If you had a Medicare Advantage plan with prescription drug coverage which met Medicares standards of creditable coverage and you were to lose that coverage through no fault of your own, you may enroll in a new Medicare Advantage plan with creditable drug coverage beginning the month you received notice of your coverage change and lasting for two months after the loss of coverage .

Additionally, if you wish to disenroll from a Medicare Advantage plan with drug coverage and enroll in another form of creditable coverage such as VA, TRICARE or a state pharmaceutical assistance program, you may do so whenever you become eligible for enrollment in the new coverage.

Read Also: What Are The Medicare Open Enrollment Dates For 2020

Key Things To Remember About Cancelling Part B

If you have decided that canceling your Part B coverage is best for you, then canceling should be a breeze. Although we advise you to look at your options in detail, disenrolling will simply be the best option for some people.

The most important things to remember before you start the process are to remember that the process will take time, so you should start early. And, remember to be mindful of enrollment periods, late penalties, and possible gaps in healthcare coverage that you may face as a result of your disenrolling.

How Do I Know Im Enrolled In Medicare

After you apply for Medicare, Social Security will review and process your application. Theyll contact you if they need more information.

When youre approved for Medicare Part A and/or Part B, Social Security will send you a welcome packet that includes the following:

- Your confirmation letter

- Your red, white and blue Medicare ID card

- A Welcome to Medicare booklet that walks you through decisions you may have to make with your Medicare coverage

- The Medicare & You handbook

If youve applied for a private Medicare plan such as a Medicare Advantage, Medicare Cost, Medigap or Medicare Prescription Drug plan, when your enrollment is accepted youll get a separate confirmation letter and ID card.

Medicare helps pay for your health care costs and covers preventive care including a visit with your doctor each year. So once you get Medicare Part B, schedule your initial Welcome to Medicare visit with your doctor. And each year you get an Annual Wellness Visit with your doctor.

For more helpful tips, review this checklist, how to use Medicare your first year.

Don’t Miss: Does Medicare Cover 24 Hour Care

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to enroll in Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employers signature and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

Domestic Violence Or Spousal Abandonment

Victims of domestic violence or spousal abandonment are eligible to enroll in a plan on their own , separate from the partner who abused and/or abandoned them. This is true regardless of whether the abuse or abandonment happens outside of open enrollment

Under normal circumstances, married enrollees are only eligible for subsidies in the exchange if they file a joint tax return, and their exchange enrollment must include total household income. But theres an exception for victims of domestic violence or spousal abandonment. In those circumstances, the victim can state that he or she is unmarried on the exchange application, and eligibility for premium subsidies and cost-sharing subsidies will be calculated based on the enrollees income alone.

Recommended Reading: How Do I Find Out What My Medicare Number Is

What Happens With Part C Or Part D If I Move

With Part C or Part D, if you move to a new state or region that is outside your plans service area you will be able to change your plan. You can decide if you want a switch back to Original Medicare or enroll in a similar plan.

You may even decide to enroll in a Medigap policy, especially if Medicare Advantage plans are not competitive in your new residence.

Other Ways To Sign Up

If you dont want to enroll online, print the form and mail it, fax it or bring it to your local Social Security office. Alternatively, you can fill out Form CMS-40B and have the employer who provides your health insurance complete Form CMS-L564. If the employer is unable to complete the form, you can submit the documents that show you had health insurance.

Most Social Security offices have been closed during the COVID-19 pandemic. Contact your local office to find out whether you can go in person or must mail your application.

To find your local office, use the Social Security field office locator. If you want to mail your application, use certified mail, which provides confirmation that your document was delivered. Another option is to fax the application to 833-914-2016.

Read Also: Do You Have To Pay Medicare Part B