What If Im Not Automatically Enrolled At 65

If your Medicare enrollment at 65 is not automatic, but you want to enroll, here are some more magic numbers.

3 and 7.

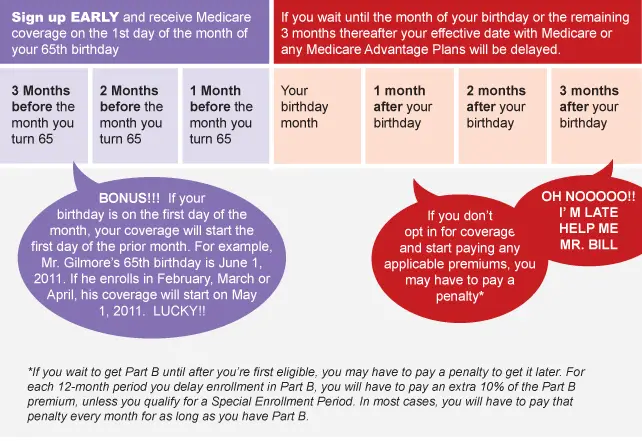

To start taking advantage of Medicare at 65, you need to sign up during the three months before the birthday month you turn 65. Those are the first three months of your seven-month Initial Enrollment Period.

Unless your birthday is on the first day of the month, your Initial Enrollment Period includes the three full months before turning 65, the month you turn 65, and the three months after you turn 65. If you were born on the first day of the month, IEP is the four months before your birth month, along with your birthday month and the two months after.

If you sign up during one of the months before your 65th birthday, your coverage will begin on the first day of the month you turn 65 .

Are you eligible for cost-saving Medicare subsidies?

Must Have: ‘medicare & You’

Before you do a single other thing, download a copy of “Medicare & You,” the consumer handbook that Medicare puts out every year. It includes detailed and crystal-clear instructions for starting Medicarebut, inexplicably, Medicare won’t mail a copy to you until you are already enrolled. Here’s where to find it.

Requalifying For Medicare At 65

If you become eligible for Medicare before you turn 65 due to disability or one of the above diagnoses, youll requalify again when you reach age 65. When you do, youll have another Initial Enrollment Period and all the benefits of a newly eligible Medicare recipient, such as a Medicare Supplement Enrollment Period.

Recommended Reading: How Much Does Medicare Cover For Hospital Stay

Don’t Miss: Can I Switch Medicare Plans

Can A 62 Year Old Get Medicaid

Yes. Medicaid qualification is based on income, not age. While Medicaid eligibility differs from one state to another, it is typically available to people of lower incomes and resources including pregnant women, the disabled, the elderly and children.

Learn more about the difference between Medicare and Medicaid.

Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

Also Check: Is Medicare Advantage Part Of Medicare

Does The Eligibility Age Change For Types Of Medicare Coverage

No. You need to have Medicare Part A and Part B if you want to sign up for a Medicare Advantage plan or a Medicare Supplement insurance plan. If you sign up for a stand-alone Medicare prescription drug plan, you need Part A and/or Part B.

So, itâs not like you can get a Medicare Advantage plan, for example, when youâre younger than 65 unless you qualify by disability.

Can I Get Medicare Early If I Retire Early

If you retire earlier than age 65, you will not be eligible for Medicare. Although Medicare is often thought of as insurance for retired people, the Medicare age requirement is still 65. Some people continue to work past age 65 and have insurance coverage through their employer. Many people retire before they turn 65 and must purchase health insurance or are covered on their spouses insurance plan. Although you may be eligible for social security retirement benefits if you retire early, it does not change your age requirement for Medicare health insurance coverage.

Recommended Reading: What Is A Medicare Special Needs Plan

If I Retire At Age 62 Will I Be Eligible For Medicare At That Time

- IV.

Medicare is federal health insurance for people 65 or older, some younger people with disabilities, and people with end-stage kidney disease. Most commonly, you are eligible for Medicare when you turn 65, but there are other health insurance options if you are younger and do not have coverage through you or your spouses employer.

What you should know

| 1. The typical age requirement for Medicare is 65, unless you qualify because you have a disability. | 2. If you retire before 65, you may be eligible for Social Security benefits starting at age 62, but you are not eligible for Medicare. |

| 3. You have options for health insurance if you are too young for Medicare. You may obtain it through your employer, or you can purchase from private-sector insurance companies through the health insurance exchange. You may be eligible for Medicaid, which is based on income. | 4. If you retire before you are 65, you may be eligible for employer-provided group health insurance under the Consolidated Omnibus Budget Reconciliation Act . |

Medicare was established in 1965 in order to provide health coverage for seniors who would otherwise not be covered by employer-sponsored health insurance plans. If you retire at the age of 62, you may be eligible for retirement benefits through social security, but early retirement will not make you eligible for Medicare.

What Are The Various ‘parts’ Of Medicare

There are three major Parts of Medicare:

- Part A: which covers hospital stays, skilled nursing, and hospice services

- Part B: which covers outpatient services, most doctors visits, and most drugs that need to be administered by medical professionals and

- Part D: which covers most self-administered prescriptions.

Some seniors elect to add additional coverage for things like vision and dental through a Part C or Medicare Advantage plan.

Each year, Medicare members are able to purchase supplemental plans, Parts C and D, which enhance coverage.

Part C includes Medicare Advantage Plans which expand coverage by providing dental, vision, hearing, and other benefits, which are excluded from Parts A and B. Additionally, members looking to bring down the cost of prescription drugs are able to purchase Part D plans.

Don’t Miss: How Do I Add Part D To My Medicare Coverage

Medicaid Or Medicare Savings Programs

Medicare beneficiaries with limited income or very high medical costs may be eligible to receive assistance from the Medicaid program. There are also Medicare Savings Programs for other limited-income beneficiaries that may help pay for Medicare premiums, deductibles, and coinsurance. There are specified income and resources limits for both programs. Contact your local county Department of Social Services or SHIIP to apply for one of these programs.

Medicare Vs Medicaid Compare Benefits

In the context of long term care for the elderly, Medicares benefits are very limited. Medicare does not pay for personal care . Medicare will pay for a very limited number of days of skilled nursing . Medicare will also pay for some home health care, provided it is medical in nature. Starting in 2019, some Medicare Advantage plans started offering long term care benefits. These services and supports are plan specific. But they may include:

- Adult day care

Also Check: How To Find The Best Medicare Prescription Plan

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a ââ .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

How To Get A Medicare Card Online

You can get your own Medicare card using:

You can get your own card online if you meet all of these requirements:

- youre living in Australia and youre an Australian citizen, a New Zealand citizen or you have a permanent resident visa

- youre 15 or older

- youre on one Medicare card only

- your current Medicare card has other people on it

- you want your own Medicare card with just your name on it.

If you cant get your own card online, you can use a form.

Read Also: How Much Does Medicare Pay For Inpatient Psychiatric Care

Heres A Chart On How Medicare Enrollment Works Under Different Scenarios

| If you | Then you | And coverage will start |

| Dont have a disability and wont be receiving Social Security or Railroad Retirement Board benefits for at least four months before you turn 65 | Must sign up for Medicare benefits during your 7-month IEP | On the first day of your birthday month as long as you enroll before your birthday month otherwise, you may face a delay of up to three months |

| Will be receiving retirement benefits from Social Security or the Railroad Retirement Board at least four months before you turn 65 | Will be enrolled automatically into Parts A and B | The first day of your birthday month |

| Are under 65 with a disability | Will be enrolled automatically into Parts A and B | On the 25th month that you receive Social Security disability benefits |

| Have ALS | Will be enrolled automatically into Parts A and B | The same month that you start receiving disability benefits |

| Have end-stage renal disease | Must sign up for Medicare benefits once you meet the qualifications for this condition | On the first day of the fourth month of dialysis treatments but situations can vary, so if you have ESRD, check with Social Security |

What Are The Medicare Eligibility Rules

You can become eligible for Medicare in one of three ways:

-

You are age 65 or older and meet the citizenship and residency requirements.

-

You have a long-term disability.

-

You have permanent kidney failure or ALS.

If you become eligible for Medicare by age, you can 3 months before your 65th birthday, during your birth month, and in the following 3 months. But if you wait until after your birthday to enroll, your coverage may be delayed by 1 to 3 months, depending on how long you wait.

You can estimate when youll be eligible for Medicare by using its eligibility calculator.

If youve paid into Medicare for long enough at least 10 years of payroll tax deductions if you are eligible for Medicare by age you can receive Medicare Part A premium-free. Otherwise, you can pay a premium based on how many quarters you have paid taxes.

If youve received Social Security retirement or disability or Railroad Retirement Board benefits for at least 4 months prior to turning 65, you will be automatically enrolled in Part A and Part B. In that case, you dont have to fill out an application for Medicare.

You also can choose whether to delay Part B enrollment. If you want to put off Part B, you can call the Social Security Administration at or send back your Medicare card when it arrives to avoid being charged premiums.

-

You are eligible for Social Security or RRB.

-

Your spouse is eligible for Social Security or RRB.

-

Your or your spouse paid enough Medicare taxes through a government job.

You May Like: Is Balloon Sinuplasty Covered By Medicare

Medicare Advantage Plan Eligibility For 2022

Heres what you need to know about eligibility for Parts C and D:

| If you | |

| Qualify for Medicare because youre turning 65 | Sign up for Medicare Advantage or Part D during your 7-month initial enrollment period |

| Qualify for Medicare because of a disability but arent 65 | Sign up for Medicare Advantage or Part D during the 7-month period that starts 3 months before your 25th month of disability payments, includes that 25th month, and ends 3 months after the 25th month of disability payments |

| Qualify for Medicare because of a disability and youre 65 | Sign up for Medicare Advantage or Part D during the 7-month period that starts 3 months before the month you turn 65, includes your birthday month, and ends 3 months after your birthday month |

| Dont have Medicare Part A, and you enrolled in Part B during general enrollment | Sign up for Medicare Part D only, from April 1 to June 30 |

| Have Medicare Part A, and you enrolled in Part B during general enrollment | Sign up for Medicare Advantage only, from April 1 to June 30 |

You can also switch to Medicare Advantage or join a Part D drug plan during the Medicare annual open enrollment period, which runs from October 15 through December 7 each year. And if you already have an Advantage plan, you can use the Medicare Advantage Open Enrollment Period to make a one-time change to your coverage.

- A Part D drug plan

- A Medicare Advantage plan with drug coverage

- Another Medicare health plan that covers prescription drugs

- A plan from an employer or union

How To Enroll In Medicare And When You Should Start Your Research Process

Getting older means making more decisions, from planning for your kids futures to mapping out your retirement years. One of the most important decisions that youll make as you prepare to retire or head into your 60s is what to do about health insurance. If youve been working, then you probably have a plan through your employer. Most people do. But once you turn 65, you become eligible for Medicare, a government-backed program designed specifically for seniors. There are also other reasons that you might be eligible for Medicare, which can muddy the waters when youre researching your options for coverage.

Medicare is administered by the Centers for Medicare and Medicaid Services , but technically speaking, youll enroll via Social Security. In this article, well outline eligibility guidelines so that you can sign up with confidence, and as always, if you have any questions about how to sign up, or what plan might be best for your needs, were always available toll free to answer any questions you might have. Well also highlight the importance of enrolling on time to avoid penalties and delays in coverage. Heres what you need to know about eligibility and Medicare.

Recommended Reading: How To Get Medicare To Pay For Wheelchair

Medicare Faqs And Information To Consider

Automatic Enrollment:

If you are already receiving Social Security benefits, Railroad Retirement benefits, or Federal Retiree benefits, your enrollment in Medicare is automatic. Your Medicare card should arrive in the mail shortly before your 65th birthday. Check the card when you receive it to verify that you are entitled to both Medicare Parts A and B.

Initial Enrollment Period:

If you are not eligible for Automatic Enrollment, contact the Social Security Administration at 800-772-1213 or enroll online at www.socialsecurity.gov, or visit the nearest Social Security office to enroll in Medicare Part A and Medicare Part B. You have a seven month window in which to enroll in Medicare without incurring a penalty. If youre not automatically enrolled in premium-free Part A, you can sign up for it once your Initial Enrollment Period starts. Your Part A coverage will start six months back from the date you apply for Medicare, but no earlier than the first month you were eligible for Medicare. However, you can only sign up for Part B during the times listed below.

General Enrollment Period:

- General Enrollment Period for Medicare Parts A & B

If you have coverage through a current employer, you are not required to enroll in Medicare Part A and B. Below are some things to keep in mind about each part of Medicare.

How Do Beneficiaries Out

Out-of-pocket spending

Although total Medicare per capita spending is higher for Medicare beneficiaries under age 65 with disabilities than for older beneficiaries, younger beneficiaries in traditional Medicare spend significantly less out of pocket, on average. This is likely due to the fact that a greater share of younger beneficiaries with disabilities than older beneficiaries have Medicaid coverage , as well as Part D Low-Income Subsidies , that help cover their premiums and cost sharing. Overall, out-of-pocket spending by younger beneficiaries with disabilities is 40% less than that of older beneficiaries . Younger beneficiaries have lower average out-of-pocket spending than older beneficiaries for insurance premiums and for medical and long-term care services combined .

On average, in 2012 beneficiaries in traditional Medicare with disabilities spent the largest share of their total non-premium out-of-pocket costs on medical providers , followed by prescription drugs and long-term care facility costs . These services also were the top three in terms of out-of-pocket costs for older beneficiaries, but in a different order: older beneficiaries spent the largest share of their out-of-pocket costs on facility costs , followed by medical providers and prescription drugs .

Access to care and cost-related problems

Figure 6: Selected Measures of Access to Health Care for Medicare Beneficiaries Under Age 65 Compared to Those Age 65 or Older

You May Like: Do You Have To Sign Up For Medicare