When Does Medicare Part A And B Coverage Start

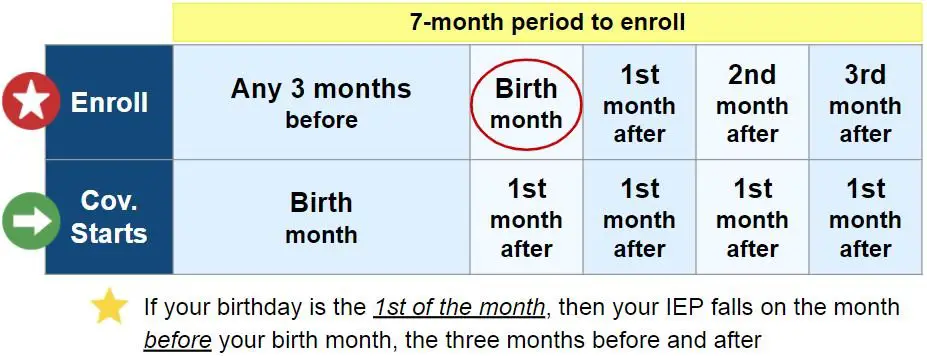

To avoid a gap in coverage, sign up for Medicare Part A and Part B in the three months before your 65th birthday. If you do, your coverage will start in your birthday month.

If you sign up toward the middle or end of your Initial Enrollment Period, your coverage will start from one to six months after your birthday month, depending on when you enroll.

Dental Care Eye Care And Other Services

Dental care is not required to be covered by the government insurance plans. In Quebec, children under the age of 10 receive almost full coverage, and many oral surgeries are covered for everyone. Canadians rely on their employers or individual private insurance, pay cash themselves for dental treatments, or receive no care. In some jurisdictions, public health units have been involved in providing targeted programs to address the need of the young, the elderly or those who are on welfare. The Canadian Association of Public Health Dentistry tracks programs, and has been advocating for extending coverage to those currently unable to receive dental care.

The range of services for vision care coverage also varies widely among the provinces. Generally, “medically required” vision care is covered if provided by physicians . Similarly, the standard vision test may or may not be covered. Some provinces allow a limited number of tests . Others, including Ontario, Alberta, Saskatchewan, and British Columbia, do not, although different provisions may apply to particular sub-groups .

Costs And Funding Challenges

Over the long-term, Medicare faces significant financial challenges because of rising overall health care costs, increasing enrollment as the population ages, and a decreasing ratio of workers to enrollees. Total Medicare spending is projected to increase from $523 billion in 2010 to around $900 billion by 2020. From 2010 to 2030, Medicare enrollment is projected to increase dramatically, from 47 million to 79 million, and the ratio of workers to enrollees is expected to decrease from 3.7 to 2.4. However, the ratio of workers to retirees has declined steadily for decades, and social insurance systems have remained sustainable due to rising worker productivity. There is some evidence that productivity gains will continue to offset demographic trends in the near future.

The Congressional Budget Office wrote in 2008 that “future growth in spending per beneficiary for Medicare and Medicaidthe federal government’s major health care programswill be the most important determinant of long-term trends in federal spending. Changing those programs in ways that reduce the growth of costswhich will be difficult, in part because of the complexity of health policy choicesis ultimately the nation’s central long-term challenge in setting federal fiscal policy.”

Also Check: What Is Blue Cross Blue Shield Medicare Advantage

Signing Up For Premium

You can sign up for Part A any time after you turn 65. Your Part A coverage starts 6 months back from when you sign up or when you apply for benefits from Social Security . Coverage cant start earlier than the month you turned 65.

After your Initial Enrollment Period ends, you can only sign up for Part B and Premium-Part A during one of the other enrollment periods.

Medicare Deadline: 65 Or Older And Have Health Insurance Through Your Spouse

If you have health insurance through your spouses employer, you dont need to sign up for Medicare when you turn 65 or retire. You can sign up for Part A and Part B up to 8 months after your spouses employer coverage ends. This is considered a Special Enrollment Period.

Important reminder: You are not automatically covered by Medicare through your spouse. Unlike health insurance you may have had through your employer, Medicare does not allow you to receive coverage through your spouse. In order to receive Medicare coverage, you must apply for it individually.

Recommended Reading: Are Medicare Advantage Premiums Deducted From Social Security

Medicare Deadline: 65 Or Older And Still Working

If you are 65 or older, currently employed, and get health care coverage through your employer, you can wait to sign up for Medicare until you retire or your coverage with your employer ends. In this scenario, you have an 8-month window to sign up for Medicare . This is considered a Special Enrollment Period.

But First A Quick Intro To Medicare

Medicare is basic health insurance provided by the Federal government for people 65 and older and people under 65 who meet certain criteria. When you sign up for Medicare, you are signing up for Part A and Part B. This is the first step to completing your Medicare coverage.

Medicare consists of 4 separate parts:

- Part A

- Part B

- Part C

- Part D

You May Like: How Do I Cancel Medicare Part A

Medicaid Or Medicare Savings Programs

Medicare beneficiaries with limited income or very high medical costs may be eligible to receive assistance from the Medicaid program. There are also Medicare Savings Programs for other limited-income beneficiaries that may help pay for Medicare premiums, deductibles, and coinsurance. There are specified income and resources limits for both programs. Contact your local county Department of Social Services or SHIIP to apply for one of these programs.

Does It Cover 100% Of All Healthcare Costs

Since its inception, Medicare health insurance covers about 80 percent of all major medical costs. Medicare beneficiaries are responsible for the remaining 20 percent. Both Original Medicare and Medicare Advantage are designed to be this way.

A simple doctor visit might only require a $20 to $40 coinsurance or copay, but more complicated healthcare services can cost beneficiaries hundreds or even thousands of dollars out of pocket. The big difference between Original Medicare and Medicare Advantage is that Medicare Advantage plans have an annual cap called the maximum out-of-pocket limit, whereas Original Medicare has no limits.

Imagine needing cancer treatment, which can cost upwards of $2 million. With Original Medicare and no additional coverage, you would be responsible to cover upwards of $400,000 out of pocket. To insure against these costs, people often buy supplemental insurance called Medigap .

If youre thinking that a Medicare Advantage plan will help you avoid this issue, youre partially right. However, most low-cost Medicare Advantage plans have a high MOOP. Some as high as $7,550 per year. Thats a lot of money to pull out of your pocket, and it does not include the monthly premiums or the cost of your medications. Read Why Medicare Advantage Plans are Bad.

You May Like: What Is The Best Medicare Advantage Plan In Alabama

Medicare Part B Late Enrollment Penalty

If you didn’t get Part B when you’re first eligible, your monthly premium may go up 10% for each 12-month period you could’ve had Part B, but didn’t sign up. In most cases, you’ll have to pay this penalty each time you pay your Part B premiums, for as long as you have Part B.

Usually, you don’t pay a late enrollment penalty if you meet certain conditions that allow you to sign up for Part B during a Special Enrollment Period.

Medicare Part D Late Enrollment Penalty

Medicare calculates the penalty by multiplying 1% of the “national base beneficiary premium” times the number of full, uncovered months you didn’t have Part D or creditable prescription drug coverage. For example, if you go 12 months without coverage, the penalty will be 12% of the “national base beneficiary premium”. The “national base beneficiary premium” is the average monthly premium for Medicare drug plans in the nation, as determined by Medicare. In 2021 this average premium amount is $33.06. The penalty amount is then rounded to the nearest $.10 and added to your monthly Part D premium.

For Example:

12% X 33.06 = $3.96 rounded to $4.00

The national base beneficiary premium may change each year, so your penalty amount may also change each year.

Recommended Reading: Where Can I Get Medicare Information

General Fund Revenue As A Share Of Total Medicare Spending

This measure, established under the Medicare Modernization Act , examines Medicare spending in the context of the federal budget. Each year, MMA requires the Medicare trustees to make a determination about whether general fund revenue is projected to exceed 45 percent of total program spending within a seven-year period. If the Medicare trustees make this determination in two consecutive years, a “funding warning” is issued. In response, the president must submit cost-saving legislation to Congress, which must consider this legislation on an expedited basis. This threshold was reached and a warning issued every year between 2006 and 2013 but it has not been reached since that time and is not expected to be reached in the 20162022 “window”. This is a reflection of the reduced spending growth mandated by the ACA according to the Trustees.

When Does Medicare Start 7 Important Facts You Need To Know

by David Bynon, June 11, 2021

Medicare is the government medical insurance plan for older Americans and people with certain disabilities. As of 2020, more than 62-million Americans rely on Medicare for their primary health insurance needs. By the year 2032, this number will swell to nearly 80-million people. In this MedicareWireMedicareWire is a Medicare insurance consulting agency. We founded MedicareWire after seeing and hearing how confusing and frustrating it is to find, understand, and choose a plan. Our services are free to the consumer…. article, well explain when Medicare starts and important rights you dont want to overlook.

Recommended Reading: Can You Sign Up For Medicare Part A Only

Medicare Part D Prescription Drug Plan Enrollment

When youre eligible to enroll in Original Medicare, you also become eligible to enroll in a Medicare Part D prescription drug plan.

If you want Medicare prescription drug coverage, you typically have two options:

- Enroll in a Medicare Advantage plan that includes prescription drug coverage

- Enroll in a Medicare Part D standalone prescription drug plan

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent.

You can also enroll in a prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.1

I Turn 65 In A Few Months When Should I Sign Up For Medicare

En español | If you already receive Social Security benefits, Social Security will automatically sign you up for Medicare Part A and Part B though you can decline Part B enrollment if you want to. Otherwise, you need to apply for Medicare. The best time to do that depends entirely on your own situation. Broadly, there are two options:

Read Also: Is A Nursing Home Covered By Medicare

Many Cities States And Universities Already Have Vaccine Mandates

Several states, including California and New York, require state employees to be vaccinated. Additionally, several cities, like New York City and San Francisco, require proof of vaccination for inside dining, gyms and other indoor activities. There’s a mandate that applies to all city workers in New York City and comes with a $500 bonus for getting vaccinated.

Los Angeles County requires proof of vaccination to enter indoor bars, nightclubs, breweries and wineries. Los Angeles also approved its strictest COVID-19 vaccination mandate, which requires people age 12 and older to be fully vaccinated before entering public indoor places. Also in California, a judge ordered vaccine mandates for prison guards and staff.

California Gov. Gavin Newsom says all students, elementary through high school, will be required to get the shot. Nine states, as well as the District of Columbia and Puerto Rico, have vaccination requirements for staff in K-12 schools.

More than 400 colleges and universities are also requiring vaccines for students who plan to take in-person classes.

A Pfizer injection at a mass vaccination site in March at the Circuit of the Americas racetrack in Austin, Texas.

When Can You Buy A Medigap Policy

Once youre age 65 and enrolled in Medicare Part B for the first time, you have a six-month Medigap Open Enrollment Period in which you can buy a Medigap policy. During this period, you can buy any Medigap policy sold in your state, even if you have health problems .

If, though, you apply for Medicare Supplement Insurance after your Medigap Open Enrollment Period, you could be turned down for a policy if you have certain health conditions.

Recommended Reading: Does Medicare Medicaid Cover Assisted Living

More Answers: Changing From The Marketplace To Medicare

- Can I get help paying for Medicare?

-

If you need help with your Part A and B costs, you can apply for a Medicare Savings Program.

-

You may also qualify for Extra Help to pay for your Medicare prescription drug coverage if you meet certain income and resource limits.

- What if Im eligible for Medicare, but my spouse isnt and wants to stay covered under our current Marketplace plan?

-

If someone gets Medicare but the rest of the people on the application want to keep their Marketplace coverage, you can end coverage for just some people on the Marketplace plan, like a spouse or dependents.

When Does Medicare Coverage Start If You Sign Up For A Medicare Supplement Insurance Plan

Details of your coverage start date might vary. Call your Medicare Supplement insurance plan for information.

If you would like to learn more about your Medicare coverage options in your area, youre welcome to use the plan finder tool on this page. Just enter your zip code and click the button.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

Don’t Miss: Where Do I File For Medicare

When Does Medicare Advantage Coverage Start

The date your Medicare Advantage plan starts depends on the enrollment period and your eligibility. Those turning 65 and enrolling in Medicare, can select an advantage plan 3-month before the effective date.

When you pre-enroll in your plan, you save yourself from scrambling. Medicare is one thing you dont want to procrastinate on. Many people change plans during the Annual Enrollment Period if you make a change during this period, your policy will begin on January 1st of the following year.

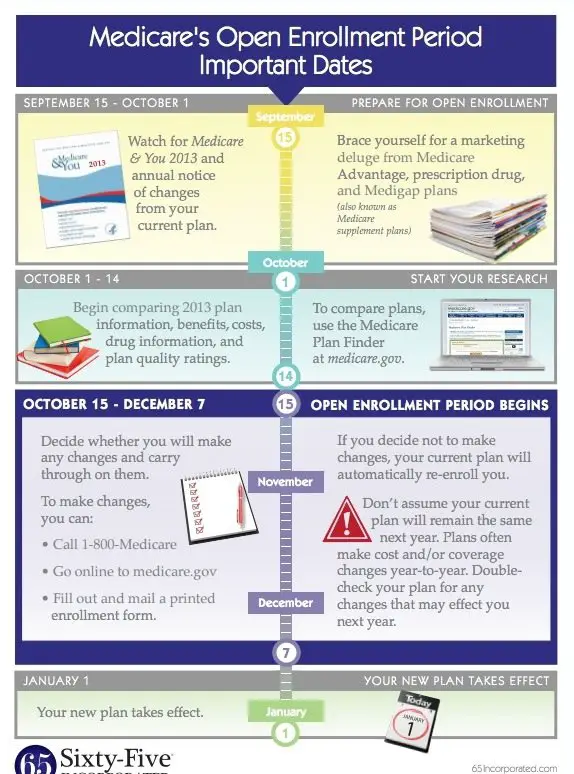

Take Advantage Of Open Enrollment

Medicare holds its open enrollment period from October 15 through December 7 of each calendar year. This period is the ideal time to review current enrollment coverage and consider ways to improve coverage and reduce costs. Beneficiaries can perform many tasks during open enrollment including the below-listed changes.

- Change from Original Medicare to Medicare Advantage

- Switch from Medicare Advantage to Original Medicare

- Switch Medicare Advantage Plans

- Add a Part D Prescription Drug Plan

Recommended Reading: Can You Get Medicare If You Retire At 62

Quality Of Beneficiary Services

A 2001 study by the Government Accountability Office evaluated the quality of responses given by Medicare contractor customer service representatives to provider questions. The evaluators assembled a list of questions, which they asked during a random sampling of calls to Medicare contractors. The rate of complete, accurate information provided by Medicare customer service representatives was 15%. Since then, steps have been taken to improve the quality of customer service given by Medicare contractors, specifically the 1-800-MEDICARE contractor. As a result, 1-800-MEDICARE customer service representatives have seen an increase in training, quality assurance monitoring has significantly increased, and a customer satisfaction survey is offered to random callers.

Can You Opt Out Of Retroactive Medicare Coverage

You may be able to opt out of retroactive Medicare coverage by contacting the Social Security Administration. This is suggested in this article in InvestmentNews.com, but the idea is to 1) begin Social Security but 2) contact the SSI and request not to begin retroactive Medicare coverage. I do not know that this works, but is worth a shot if you wish to continue funding your HSA during this time.

I received the following advice from HSA Reader Steve:

I called the Social Security office today to make my Medicare Part A coverage not retroactive for 6 months. She said it could be changed, but it would take a lot of work and could delay my application by 2 months. Apparently this could have been done when I applied, so that is the time to make this election. Moreover, the retroactive coverage began 6 months prior to my application date, not the start date I requested.

If any readers have more information or have done this successfully, please contact me.

You May Like: Does Medicare Part A Cover Doctors In Hospital

Canadian Health Practitioner Standards

It is generally accepted that physicians arriving in Canada from other countries must meet Canadian Health Practitioner standards. So there is concern that doctors from other countries are not trained or educated to meet Canadian standards. Consequently, doctors who want to practise in Canada must meet the same educational and medical qualifications as Canadian-trained practitioners. Others suggest that the Canadian Medical Association, the Ontario Medical Association, and the regulatory bodies have created too much red tape to allow qualified doctors to practise in Canada. Canada’s health system is ranked 30th in the world, suggesting the logic of the doctor shortage defies the statistics. In fact according to a report by Keith Leslie of the Canadian Press in the Chronicle Journal, Nov 21, 2005, over 10,000 trained doctors are working in the United States, a country ranked 37th in the world. It would suggest money or the perception of better working conditions, or both, are resulting in an exodus of Canadian doctors to the USA.

A CBC report on the health care system reports the following:

How To Change Medicare Plans

Once youre enrolled in Medicare, youll have various opportunities to change certain aspects of your coverage. Heres an overview:

- During the annual open enrollment period , you can make a variety of changes, none of which involve medical underwriting:

- Switch from Medicare Advantage to Original Medicare or vice versa.

- Switch from one Medicare Advantage plan to another.

- Switch from one Part D prescription plan to another. Its highly recommended that all beneficiaries use Medicares plan finder tool each year to compare the available Part D plans, as opposed to simply letting an existing drug plan auto-renew.

- Join a Medicare Part D plan.

- Drop your Part D coverage altogether.

Read Also: What Age Qualifies You For Medicare