Can Spouses Share The Same Medicare Supplement Policy

by Christian Worstell | Published December 16, 2020 | Reviewed by John Krahnert

You cannot be on the same Medicare Supplement insurance policy as your husband or wife you must have separate policies. However, you and your spouse may be able to get a discount if you both buy individual policies from the same insurance company.

B Premium Can Be Limited By Social Security Cola But That Wasnt An Issue For Most Beneficiaries In 2020 Or 2021

In 2021, most enrollees pay $148.50/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2020 and in 2019 . But thats in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium. The standard premium in 2018 was actually $134/month, but the cost of living adjustment for Social Security wasnt quite large enough to cover all of the increase from 2017s premium for most enrollees. Thats why most people paid about $130/month.

The standard Part B premium increased by about $9/month in 2020. But the 1.6% Social Security COLA for 2020 increased the average beneficiarys Social Security benefit . Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees paid the standard premium in 2020. And for 2021, the 1.3% COLA was adequate to cover the increase to the new standard premium for virtually all enrollees.

What If The Working Spouse Is Not Yet 65 Years Old

A non-working spouse can receive premium-free Medicare part A as long as the other partner is at least 62 years old and has satisfied Medicares work requirements.

For example, John is 65 years old and has never worked or paid Medicare taxes. His wife, Cathy, is 62 years old and has worked and paid Medicare taxes for more than 10 years.

In this scenario, John is eligible for premium-free Medicare Part A based on Cathys work history. He may enroll in Medicare Part A and Part B now, at age 65, even though Cathy must wait until she turns 65 to enroll in Medicare herself.

Now lets say Cathy is only 61 years old. In this scenario, John may still enroll in Medicare Part A and Part B, but he wont be entitled to premium-free Part A until Cathy turns 62.

You May Like: Is There A Copay With Medicare Part D

Higher Premiums For Enrollees With High

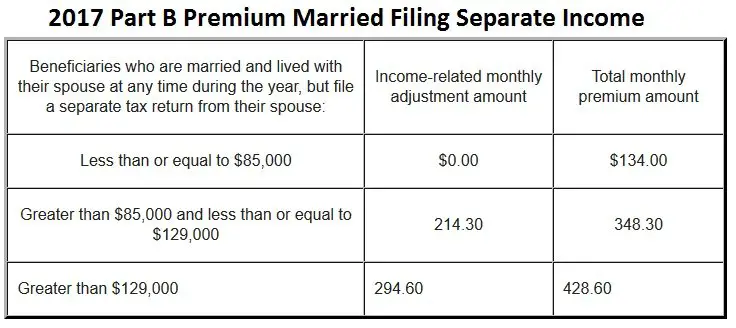

Since 2007, people who earn more than $85,000 have paid higher Part B premiums based on their income.

For the first time, the threshold for what counts as high income was adjusted for inflation as of 2020, increasing it to $87,000 for a single individual and $174,000 for a couple. And it increased again for 2021. Harry Sit, of The Finance Buff, explains how the inflation indexing works here.

Indexing the high-income threshold: The math The indexing is based on the percentage by which the average of the Consumer Price Index for Urban consumers for the 12-month period ending in the most recent August exceeds the average of the 12-month period that preceded that. So for 2021, we look at how the average CPI-U from September 2019-August 2020 exceeded the average CPI-I from September 2018-August 2019.

On this page, you can pull up the data for CPI-U and manually calculate how the average CPI-U has changed. Youll add up all the numbers from September 2019 through August 2020 , and divide by 12 to get the average . Then youll do the same thing for September 2018 through August 2019 . The difference between those two numbers is 3.705, which represents a 1.46% increase from the 254.016 average CPI-U for September 2018 to August 2019.

So as Sit explains here , we increase 87,000 by 1.46% which results in 88,270 and then round to the nearest $1,000. That gives us an income threshold of $88,000, which is the lower bound of high-income as of 2021.

How Much Does Medicare Part B Cost

Q: How much does Medicare Part B cost the insured?A: In 2021, most people earning no more than $88,000 pay $148.50/month for Part B. And in most cases, Part B premiums are just deducted from beneficiaries Social Security checks.

The Part B premium increase from 2020 to 2021 was smaller than initially projected, thanks to a short-term government spending bill that was enacted in the fall of 2020, and that included a provision to cap the increase in the Part B premium for 2021.

You May Like: How Long Does It Take For Medicare To Become Effective

Can My Husbands S Corp Pay His Health Insurance Premiums For Tax Break He Has 100 Shares With Only 1 Employee/himself I Am Listed Only As An Officer With 0 Shares

IRS states a Scorp needs 2 or more employees to purchase insurance on the Healthcare Exchange. I did find this article on the IRS website:

Towards the bottom of the page where it says in RED BOLD: “FEWER THAN TWO PARTICIPANTS WHO ARE CURRENT EMPLOYEES EXCEPTION”

B Deductible Also Increased For 2021

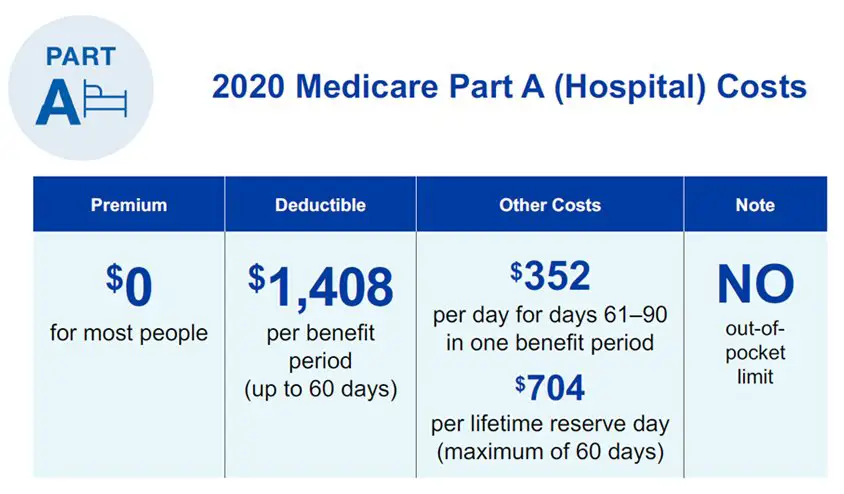

Medicare B also has a deductible, which increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20% of the Medicare-approved cost for Part B services. But supplemental coverage often covers these coinsurance charges.

For people who became eligible for Medicare before the start of 2020, there are Medigap plans available that cover the Part B deductible, in addition to coinsurance charges. But those plans are no longer available for Medicare beneficiaries who became eligible for Medicare after the end of 2019.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Also Check: What Date Does Medicare Coverage Start

If My Wife And I File A Joint Tax Return Will We Both Be Required To Pay Higher Premiums For Medicare

Both my wife and I collect Social Security. I am still working full time and I earn military retirement pay. My wife works 1 day per week and has very low income. I am 67 and already on Medicare. My wife will turn 65 in may 2020. Our AGI on our joint tax return has required me to pay an IRMAA each year, taken directly out of my Social Security payment. I earn about 90% of the income in our AGI on our tax return. I have been unable to find an answer to my very simple question elsewhere: If my wife and I continue to file a joint tax return, will we BOTH be required to pay an IRMAA out of our Social Security, or does just one of us pay an IRMAA? I’m trying to decide if I should investigate the increased costs of filing separately compared to both paying an IRMAA, if that’s how it is applied.

Yes, if you and your wife file a joint tax return and your modified adjusted gross income exceeds $170,000 then both you and your wife would be required to pay the higher IRMAA premium rates . Note, however, that if you file separately the income threshold at which point IRMAA rates kick in is lower .

Best, Jerry

Employers Often Bear Costs

But many employers do pay the lion’s share of the cost to add family members, even though they’re not required to do so. In 2020, the average total premiums for family coverage under employer-sponsored plans was $21,342, and employers paid an average of nearly 74% of that total cost.

But the amount the employers paid varies considerably depending on the size of the organization smaller firms are much less likely to pay a significant portion of the premium to add dependents and spouses to their employees’ coverage.

Also Check: What Does Regular Medicare Cover

Are My Medicare Benefits The Same As My Spouses

Are you trying to figure out how to get your Medicare benefits? Many people are covered under a spouses health insurance plan while theyre working. But Medicare benefits dont usually cover your spouse. Medicare is individual coverage there is no such thing as Medicare family coverage.

Lets examine how Medicare benefits work if you are married.

You And Your Spouse May Choose Different Medicare Coverage Options

There are four parts to the Medicare insurance program, each one providing a certain set of Medicare benefits.

- Medicare Part A provides inpatient hospital coverage.

- Medicare Part B provides medical/outpatient coverage.

- Medicare Part C is the Medicare Advantage program. If you have Medicare Part A and Part B, you may decide to enroll in a Medicare Advantage plan. These plans are offered by private insurance companies that are contracted with Medicare to provide at least the same Medicare benefits as Part A and Part B. Often Medicare Advantage plans provide additional benefits, such as Medicare Part D prescription drug coverage, or routine vision and/or dental coverage. Medicare Advantage plans can set different premiums, deductibles, copayments, and coinsurance. Some have premiums as low as $0.

- Stand-alone Medicare Part D prescription drug plans must cover all the core classes of prescription drugs. However, they can set unique deductibles, coinsurance, and copayment amounts. They can also differ in their formulariesthat is, the prescription drugs that are covered by the plan. This coverage is optional.

For example, you might decide to stay with Original Medicare, and sign up for a stand-alone Medicare Part D prescription drug plan. Your spouse might decide to get her Medicare benefits through a Medicare Advantage prescription drug plan. Your coverage will be independent from one another.

Also Check: When Is The Next Medicare Open Enrollment

How Much Does Medicare Cost For A Married Couple

Medicare has no family plans, meaning that you and your spouse must enroll for Medicare benefits separately. This also means husbands, wives, spouses and partners pay separate Medicare premiums.

You may need to enroll at different times, depending on your age and health. While Medicare considers you individually as beneficiaries, your marital status can influence some of your Medicare costs.

Medicare Part B And Spouses

Medicare Part A is hospital insurance, while Medicare Part B refers to medical insurance. Part A is free for those with the qualifying number of Social Security credits. However, Part B requires a monthly premium.

If one spouse turns 65 years of age and the other still has health insurance coverage through their employer, the individual without Medicare may decide to wait for Medicare Part B enrollment. There is no late enrollment penalty for spouses if they enroll during a SEP.

They can enroll in Part B while still using an employer-sponsored health plan. They also may enroll during the 8-month period that begins the month after the original health plan or employment ends.

Medicare base the special enrollment criteria on whichever event comes first, the end of health plan coverage or employment.

Also Check: How Much Does Medicare Pay For Dental

Is It Better To Have Two Health Insurances

Not exactly, but having two or more health insurance plans does help cover any health insurance expenses better through the coordination of benefits provision. The most common example is when two spouses or domestic partners have health insurance and both of their employers provide a health insurance plan.

Medicare Advantage: What About My Spouse

Medicare Advantage plans dont cover both you and your spouse together under one policy. Just as Medicare Part A and Part B cover each Medicare beneficiary separately, you cant share a Medicare Advantage plan with your spouse.

Certainly, theres nothing to prevent you from signing up for the same Medicare Advantage plan as your spouse, in the sense of enrolling in a plan of the same type from the same insurance company.

For example, suppose your wife qualifies for Medicare before you do. Lets say she enrolls in Medicare Advantage Plan X from XYZ Health Insurance Company. If your wife is happy with this plan, you might be interested in signing up for Plan X when youre eligible for Medicare. But you wont have the same policy. When your wife signs up, for example, her plan cant include you. In this way, its different from the way group health insurance often works.

Recommended Reading: Must I Take Medicare At 65

How Much Does Health Insurance Cost For A Family Of 4

The average premium for a family of 4 in 2018 was $1,168, according to customer data gathered by one health insurance agency. This does not include families who received government subsides. Like individual insurance, your family cost will depend on ages, location, plan category, tobacco use and number of plan members.

If A Nonworking Spouse Is Older Than You And They Meet The 40 Quarters Requirement

If your spouse is older than you, theyll qualify for Medicare benefits at age 65.

You may be able to receive Medicare benefits slightly earlier if youre at least 62 years old, married to someone who is age 65, and also worked for 40 quarters and you paid Medicare taxes.

If you dont meet these requirements, you may be able to qualify for Medicare Part A, but youll have to pay the Part A premium until youre age 62.

If you didnt work or meet the 40 quarters requirement, you may have to wait until age 65 to receive coverage under your spouses benefits.

Recommended Reading: How Long Does It Take To Get Medicare B

Can You Get Medicare If You Have Never Worked

As outlined above, you may still get Medicare even if you have never worked a day in your life. You may even potentially qualify for premium-free Part A, provided that your spouse has paid Medicare taxes for at least 40 quarters and meets all other Medicare eligibility requirements. Those 40 quarters do not need to be consecutive.

Can My Spouse Use My Health Insurance

Some employers will not allow you to cover your spouse on your plan if your spouse can get their own coverage from their employer. Each spouses plan may have a different provider network with different doctors. Make sure you and your family have enough coverage. Get peace of mind by comparing health insurance plans.

You May Like: Does Humana Offer A Medicare Supplement Plan

Rules For Medicare Eligibility Based On Spouses Work History

To qualify for Medicare Part A benefits at age 65 based on your spouses work history, you must meet one of the following requirements:

- You have been married to your spouse who qualifies for Social Security benefits for at least 1 year before applying for Social Security benefits.

- You are divorced, but were married to a spouse for at least 10 years who qualifies for Social Security benefits. You must now be single to apply for Medicare benefits.

- You are widowed, but were married for at least 9 months before your spouse died, and they qualified for Social Security benefits. You must now be single.

If you arent sure you meet a certain requirement, you can contact the Social Security Administration by calling 800-772-1213. You can also visit Medicare.gov and use their eligibility calculator.

Can A Married Couple Have Two Health Insurance

You have the option of putting both spouses on one plan, or selecting two different plans. You can pick separate plans even if youre enrolling in the exchange with premium subsidies. To qualify for subsidies, married enrollees must file a joint tax return, but they dont have to be on the same health insurance plan.

Don’t Miss: How Do I Change Medicare Supplement Plans

Premium Surcharge Is Based On 2019 Tax Return You Can Appeal It If Your Income Has Changed

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. 2019 tax returns were filed in 2020, so those were the most current returns available when income-related premium adjustments were determined for 2021.

But if a life-change event has subsequently reduced your income, theres an appeals process you can use. In the appeal, you can request that the income-related premium adjustment be changed or eliminated without having to wait for it to reflect on a future tax return.

Is It A Good Idea For Couples To Choose The Same Medicare Insurance Plan

Q: Is it a good idea for couples to choose the same Medicare insurance plan?

A: No, you should normally choose Medicare coverage based on your own health care needs. The exception is if both spouses are offered retiree coverage, and in that case you both may end up in a more generous plan than what is available to most Medicare enrollees.

Also Check: Does Medicare Pay For Inogen Oxygen Concentrator

Medicare Eligibility For A Non

- A non-working spouse can qualify for Medicare, depending on their age, disability status or whether they have a qualifying health condition. Depending on their spouses work history, they may even qualify for premium-free Medicare Part A. Learn more about Medicare eligibility rules concerning a spouse who has met Medicare work requirements.

Social Security requires you to have worked a minimum number of years to qualify for benefits. Medicare works differently, however.

Medicare can be available to anyone including a non-working spouse who is at least 65 years old and a U.S. citizen or legal resident of at least five years. You may even qualify for Medicare before 65 if you have a qualifying disability or health condition.

If you havent met the minimum work requirements to receive premium-free Medicare Part A , you may still qualify for Part A coverage, though youll have to pay a monthly premium. Depending on your age and your partners age, you may qualify for premium-free Part A if you havent met the minimum work requirements yourself, as long as your spouse satisfies Medicares work requirements.