B Doctor And Outpatient Services

This part of Medicare covers doctor visits, lab tests, diagnostic screenings, medical equipment, ambulance transportation and other outpatient services.

Unlike Part A, Part B involves more costs, and you may want to defer signing up for it if you are still working and have insurance through your job or are covered by your spouses health plan. But if you dont have other insurance and dont sign up for Part B when you first enroll in Medicare, youll likely have to pay a higher monthly premium for as long as youre in the program.

The federal government sets the Part B monthly premium, which is $148.50 for 2021. It may be higher if your income is more than $88,000.

Youll also be subject to an annual deductible, set at $203 for 2021. And youll have to pay 20 percent of the bills for doctor visits and other outpatient services. If you are collecting Social Security, the monthly premium will be deducted from your monthly benefit.

Comparison With Private Insurance

Medicare differs from private insurance available to working Americans in that it is a social insurance program. Social insurance programs provide statutorily guaranteed benefits to the entire population . These benefits are financed in significant part through universal taxes. In effect, Medicare is a mechanism by which the state takes a portion of its citizens’ resources to provide health and financial security to its citizens in old age or in case of disability, helping them cope with the enormous, unpredictable cost of health care. In its universality, Medicare differs substantially from private insurers, which must decide whom to cover and what benefits to offer to manage their risk pools and ensure that their costs do not exceed premiums.

Medicare also has an important role in driving changes in the entire health care system. Because Medicare pays for a huge share of health care in every region of the country, it has a great deal of power to set delivery and payment policies. For example, Medicare promoted the adaptation of prospective payments based on DRG’s, which prevents unscrupulous providers from setting their own exorbitant prices. Meanwhile, the Patient Protection and Affordable Care Act has given Medicare the mandate to promote cost-containment throughout the health care system, for example, by promoting the creation of accountable care organizations or by replacing fee-for-service payments with bundled payments.

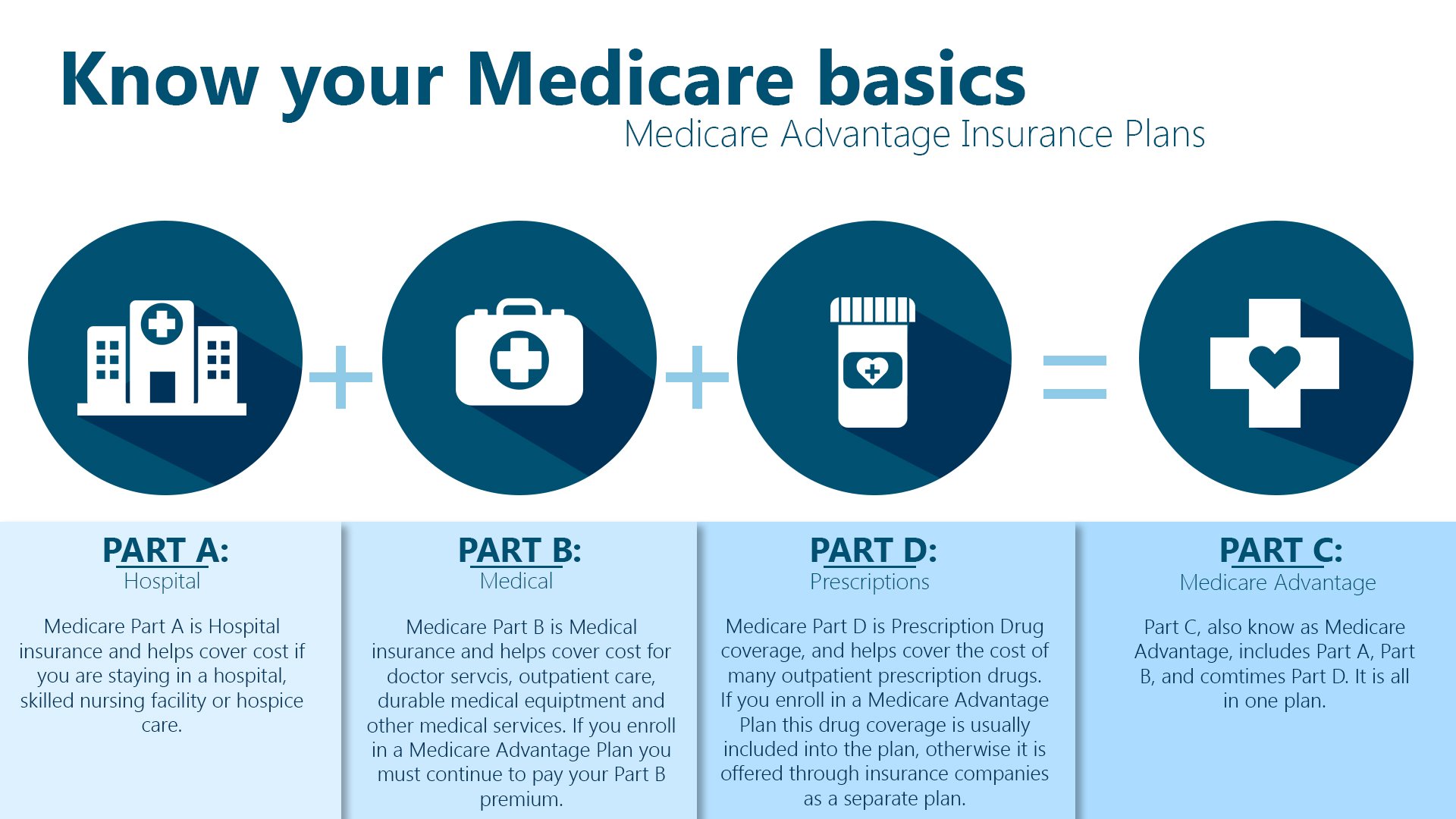

Medicare Part A + Medicare Part B = Original Medicare

Part B complements your Part A coverage to provide coverage both in and out of the hospital. In fact, Part A and Part B were the first parts of Medicare created by the government. This is why the two parts together are often referred to as Original Medicare. Additionally, most people who do not have additional coverage through a group plan generally sign up for Parts A and B at the same time.

Recommended Reading: What Age Can I Apply For Medicare

How Do I Enroll In Each Part Of Medicare

Timing is crucial when enrolling in Medicares different parts. When enrolling in Parts A and B, you will want to take advantage of your Initial Enrollment Period to avoid penalties. If you missed this opportunity, you could enroll in Parts A and B during the General Enrollment Period.

If you plan to enroll in Part C, also known as a Medicare Advantage Plan, it is best to do so during your Initial Coverage Enrollment Period. You can also enroll during the Annual Enrollment Period or the Medicare Advantage Open Enrollment Period.

You can enroll in Part D prescription drug coverage during your Initial Enrollment Period or the Annual Enrollment Period.

You might also be eligible for a Special Enrollment Period. Several qualifying life events permit you to change your Medicare coverage at a time other than during the standard enrollment periods.

What Medicare Parts Do I Need

When it comes to what coverage you need, its entirely personal and varies from person to person. There is no one-plan-fits-all, and there are pros and cons to each part.

One thing to note, however, is Medicare enrollment eligibility for the various parts and plans changes depending on your age, what you are currently enrolled in, and whether you have moved or had a life change. There are only certain times during the year when you can change/add plans or switch from Original Medicare to Medicare Advantage.

Don’t Miss: Is Dexcom G6 Cgm Covered By Medicare

Medicare Part D Prescription Drug Coverage

What it covers:

- Medicare Part D covers prescriptions drugs.

- Plan premiums, the drugs that are covered, deductibles, coinsurance and copays will vary by plan, so you should check and compare plans each year based on your needs, the prescription drugs you take, etc.

What it costs:

- Like Medicare Advantage , prescription drug plans are offered by private insurance companies contracted by the federal government.

- Plans vary in cost, coverage, deductibles and copays.

This material is provided for informational use only and should not be construed as medical advice or used in place of consulting a licensed medical professional. You should consult your doctor to determine what is right for you.

Some links on this page may take you to Humana non-Medicare product or service pages or to a different website.

Y0040_GNHKHNSEN

Who Must Sign Up

Remember that not everyone who is eligible for original Medicare will be automatically enrolled. Some will need to sign up through the SSA office:

- Those who are turning 65 years old and are not currently getting retirement benefits from the SSA or RRB can sign up beginning 3 months before they turn age 65.

- People with ESRD can sign up at any time when your coverage will begin may vary.

Read Also: How Much Is Medicare B Deductible

What Are The Parts Of Medicare And What Do They Cover

Here are some basic facts to get you started learning about Medicare and what it covers.

When I first started my career in the Medicare world, I realized there was a lot of new information I had to learn. I found that breaking it down into bite-sized pieces made it easier to understand. I started by focusing on all the different parts of Medicare. Here are some tips that helped me understand the parts of Medicare and what they cover.

Medigap Plans Work Alongside Original Medicare

Medicare Supplement Insurance plans help cover certain Medicare out-of-pocket costs, such as deductibles, coinsurance, copays and other fees.

There are 10 standardized Medigap plans in most states, and each provides its own level of coverage. A licensed insurance agent can help you find Medigap plans in your area and get you enrolled in one that works for you.

Read Also: Do Medicare Advantage Plans Cover Chemotherapy

What Are The Parts Of Medicare

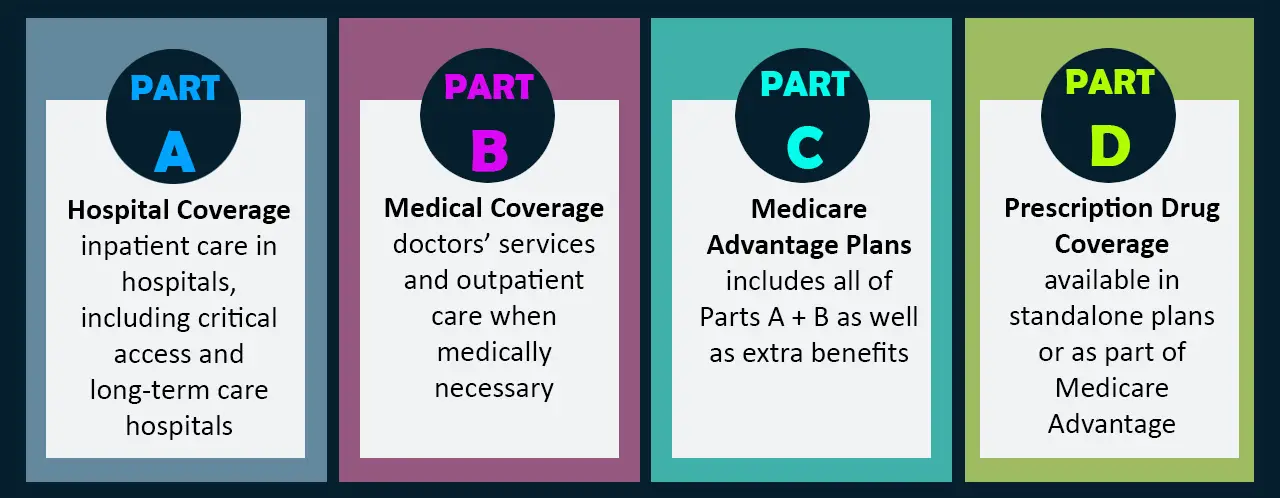

The different parts of Medicare help cover specific services:

- Medicare Part A Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Medicare Part B Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services.

- Medicare Part D Helps cover the cost of prescription drugs .

B Deductible For 2022

Right now, your annual Medicare Part B deductible is $203 for outpatient care. You only have to pay this once per year, and youll only be responsible for 20% of your Medicare-approved expenses for the rest of the year thereafter. In 2022, that price will increase to $233. Thats a $30 annual increase.

Also Check: Can Permanent Residents Get Medicare

The Solvency Of The Medicare Hi Trust Fund

This measure involves only Part A. The trust fund is considered insolvent when available revenue plus any existing balances will not cover 100 percent of annual projected costs. According to the latest estimate by the Medicare trustees , the trust fund is expected to become insolvent in 8 years , at which time available revenue will cover around 85 percent of annual projected costs for Part A services. Since Medicare began, this solvency projection has ranged from two to 28 years, with an average of 11.3 years. This and other projections in Medicare Trustees reports are based on what its actuaries call intermediate scenario but the reports also include worst-case and best-case projections that are quite different .

What Parts A And B Don’t Cover

The largest and most important item that traditional Medicare doesn’t cover is long-term care if the only care you need is custodial. If you are diagnosed with a chronic condition that requires ongoing long-term personal care assistance, the kind that requires an assisted-living facility, Medicare will cover none of the cost. However, Medicare will cover the costs for acute-care hospital services, for patients who are transferred from an intensive care or critical care unit. Services covered could include head trauma treatment or respiratory therapy.

Also Check: What Month Does Medicare Coverage Begin

Medicare Part B Medical Coverage

What it helps cover:

What it costs:

- Most 2021 Medicare members must pay a monthly premium of $148.50.

- If you don’t enroll in Medicare Part B as soon as you are eligible, you could be assessed a late enrollment penalty when you do enroll.

- The penalty could be as high as a 10% increase in your premium for each 12-month period that you were eligible but not enrolled.

Other Part B costs:

- There is a $203 annual deductible for Medicare Part B in 2021. After the deductible, youll pay a 20% copay for most doctor services while hospitalized, as well as for DME and outpatient therapy.

- There is a 20% copay of the Medicare-approved amount for doctor visits to diagnose a mental health condition after the deductible.

- If you receive these services at a hospital outpatient department or clinic, additional copays or coinsurance amounts may apply.

What Is Medicare Part F

Medicare Part F actually doesnt exist. When people begin talking about Part F or Part G, they have likely confused Medigap Plans with the parts of the Medicare program itself. This is simply due to similar wording, with Medicare supplement insurance policies offering Plan A, B, C, D, F, G, K, L, M and N.

Recommended Reading: How Do I Find My Medicare Card Number Online

Why Do I Need Medicare Part A

If you have not needed hospital or inpatient coverage in the past, you might wonder why you need Part A. Without proper coverage, hospital stays can be costly. The cost of services and amenities quickly adds up.

Should you need hospital and inpatient services in the future, Part A will provide coverage. Under Part A, your hospital meals, some hospital rooms, lab tests, x-rays, and more are covered, as well as the initial 60 days of your stay. It is important to enroll in both Part A and Part B, as described below.

Medicare Part D: Prescription Drug Coverage

Original Medicare alone does not cover the cost of most prescription drugs. For that, beneficiaries can purchase a Medicare Part D Prescription Drug Plan.

Similar to Medicare Advantage, these plans are sold by private insurance companies for a .

Other costs associated with Medicare Part D may include:

-

A yearly deductible

-

Costs in the coverage gap

-

A late penalty if you miss your enrollment deadline

Many Medicare Advantage plans include drug coverage. If your Medicare Advantage plan has creditable drug coverage, you are not eligible to purchase a Medicare Part D Prescription Drug Plan.

You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

Don’t Miss: Will Medicare Cover Walk In Tubs

Signing Up For Original Medicare

Some people qualify for automatic enrollment, and others have to enroll.

- If youre already receiving Social Security or railroad retirement benefits youll be enrolled in Part A and Part B automatically on your 65th birthday. If youre under 65, its the 25th month you receive disability benefits.

- ALS patients are automatically enrolled in Medicare coverage when their Social Security disability benefits begin, regardless of age. If you have end-stage renal disease , you must manually enroll.

If youre eligible for Medicare but dont qualify for automatic enrollment, you can apply online, over the phone or in person at your local Social Security office.

If you worked for a railroad, youll need to contact the Railroad Retirement Board for information on enrollment.

Medicare Advantage Plans Have An Out

When you enroll in a Medicare Advantage plan, you can ask about your specific policys out-of-pocket spending limit.

Original Medicare does not include an out-of-pocket spending limit. While its not common, you could potentially be responsible for thousands of dollars in out-of-pocket costs if you only have Original Medicare coverage and require extensive medical care throughout the year.

Read Also: What Is Medicare Part G

Speak With A Licensed Agent Today

To learn more about your Medicare options Part A, B, C or D and to learn more about the benefits that might be available in Medicare Advantage plans in your area, call today to speak with a licensed insurance agent.

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

1 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

How Much Does Medicare Advantage Cost Per Month

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month.1

Depending on your location, $0 premium plans may be available in your area.

Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies. Medicare Advantage offer the same benefits that are covered by Original Medicare, and most Medicare Advantage plans include additional benefits that Original Medicare doesnt cover.

Because Medicare Advantage plans are sold by private insurance companies, plan costs can vary based on location, carrier, benefits offered and more.

Find out the average cost of Medicare Advantage plans in your state.

Read Also: Do Medicare Advantage Plans Have Dental Coverage

What Do Medicare Parts A B C And D Mean

Who is this for?

If you’re new to Medicare, this information will help you understand the different parts and what they do.

There are four parts of Medicare. Each one helps pay for different health care costs.

Part A helps pay for hospital and facility costs. This includes things like a shared hospital room, meals and nurse care. It can also help cover the cost of hospice, home health care and skilled nursing facilities.

Part B helps pay for medical costs. This is care that happens outside of a hospital. It includes things like doctor visits and outpatient procedures. It also covers some preventive care, like flu shots.

Parts A and B together are called Original Medicare. These two parts are run by the federal government. Find out more about what Original Medicare covers in our Help Center.

Part C helps pay for hospital and medical costs, plus more. Part C plans are only available through private health insurance companies. Theyre called Medicare Advantage plans. They cover everything Parts A and B cover, plus more. They usually cover more of the costs youd have to pay for out of pocket with Medicare Parts A and B. Part C plans put a limit on what you pay out of pocket in a given year, too. Some of these plans cover preventive dental, vision and hearing costs. Original Medicare doesnt.

You can see a list of the Medicare Advantage plans we offer and what they cover.

Medicare Advantage Or Part C

Medicare Advantage , often referred to as Part C, encompasses Medicare-approved plans provided by private companies. The plans facilitate delivery of Medicare Parts A and B benefits, often include prescription drug coverage, and may have extra benefits such as vision, dental, and hearing services. Youre required to have both Medicare Parts A and B to get a Medicare Advantage plan.

Premium: Some MA plans have premiums you must pay in addition to your Part A and Part B premium. Others charge no premium and may help cover all or part of your Part B premiums.

Deductible: Deductibles vary between plans.

Enrollment period:

- Initial enrollment: This is the seven-month period that starts three months before your 65th birthday month and ends three months after it.

- Special enrollment: If an event happens that leaves you without coverage, such as if you lose other coverage, you may qualify to enroll in a Medicare Advantage plan.

- Open enrollment: If you already have Original Medicare and would like to enroll in a Medicare Advantage plan, you can do so between Oct. 15 and Dec. 7 each year.

- General enrollment: You can enroll during general enrollment from Jan. 1 to Mar. 31 if you have Part A and get Part B for the first time during this period.

Recommended Reading: Does Medicare Pay Anything On Dental