Premiums Paid By Medicare Advantage Enrollees Have Slowly Declined Since 2015

Figure 7: Average Monthly Medicare Advantage Prescription Drug Plan Premiums, Weighted by Plan Enrollment, 2010-2020

Nationwide, average Medicare Advantage Prescription Drug premiums declined by $4 per month between 2019 and 2020, much of which was due to the relatively sharp decline in premiums for local PPOs this past year. Average premiums for HMOs also declined $3 per month, while premiums for regional PPOs increased $3 per month between 2019 and 2020.

Average MA-PD premiums vary by plan type, ranging from $20 per month for HMOs to $32 per month for local PPOs and $47 per month for regional PPOs. Nearly two-thirds of Medicare Advantage enrollees are in HMOs, 33% are in local PPOs, and 5% are in regional PPOs in 2020.

Inpatient Hospital Health Care Costs

The Medicare program will charge you deductibles and co-insurance for Part A inpatient hospital stays and health care costs, including a $778 co-insurance payment per lifetime reserve day in 2022. The table below outlines the 2022 costs associated with inpatient hospital stays.

| Inpatient hospital stay period |

|---|

Also Check: Are Hearing Aids Covered By Medicare Australia

Costs You May Pay With Medicare

Medicare Part B and most Medicare Part C, Part D and Medigap plans charge monthly premiums. In some cases, you may also have to pay a premium for Part A. A premium is a fixed amount you pay for coverage to either Medicare or a private insurance company, or both.

Youll also pay a share of the cost for your care, while your Medicare or Medigap coverage will pay the rest. There are three methods of cost sharing:

- DeductibleA set amount you pay out of pocket for covered services before Medicare or your plan begins to pay.

- CopayA fixed amount you pay at the time you receive a covered service or benefit. For example, you might pay $20 when you visit the doctor or $12 when you fill a prescription.

- CoinsuranceThe amount you may be required to pay as your share for the cost of a covered service. For example, Medicare Part B pays about 80% of the cost of a covered medical service and you would pay the rest.

Also Check: How Much Medicare Is Taken Out Of Social Security Check

Lifetime Limits On Private Insurance

Before the Affordable Care Act passed in 2010, private insurance companies had the leeway to add lifetime limits to their plans.

Not only did insurers increase the cost of premiums for people who had pre-existing conditions, they stopped paying for care after a certain dollar amount had been spent. Whether there was an annual limit or a lifetime limit set on how much the insurer would pay, beneficiaries would get stuck with all remaining costs after the limit was reached.

Thankfully, the ACA did away not only with pre-existing conditions, but with annual and lifetime limits as well, at least when it comes to essential health benefits. No longer would the sickest people be left without health care when they needed it most.

Can I Get Help Paying For Medicare Advantage

Yes, you can get help paying for your Medicare Advantage plan through Medicare Savings Programs made available by the Centers for Medicare and Medicaid Services . If you meet the requirements for low-income, disability, or certain chronic health conditions, MSPs can help pay for some of your plan costs, which may include premiums.

Also Check: Does Medicare Become Your Primary Insurance

What You Pay In A Medicare Advantage Plan

Your

depend on:

- Whether the plan charges a monthlypremium. Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium .

- Whether the plan pays any of your monthlyMedicare Part B premium. Some plans will help pay all or part of your Part B premium. This is sometimes called a “Medicare Part B premium reduction.”

- Whether the plan has a yearlydeductible or any additional deductibles.

- How much you pay for each visit or service . For example, the plan may charge a copayment, like $10 or $20 every time you see a doctor. These amounts can be different than those underOriginal Medicare.

- The type of health care services you need and how often you get them.

- Whether you go to a doctor orsupplierwho acceptsassignmentif:

- You’re in a PPO, PFFS, or MSA plan.

- You goout-of-network.

How To Appeal A Part B Premium Income Adjustment

You may request an appeal if you disagree with a decision regarding your income-related monthly adjustment amount. Complete a Request for Reconsideration or contact your local Social Security office to file an appeal.

You may be able to skip the formal appeal and simply provide documentation if your income changed due to any of the following:

- You married, divorced or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property due to a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy or reorganization.

These methods apply to the Part B premium. Contact the IRS if you disagree with your adjusted gross income amount, which is provided to Medicare by the IRS.

You May Like: What Is Original Medicare Plan

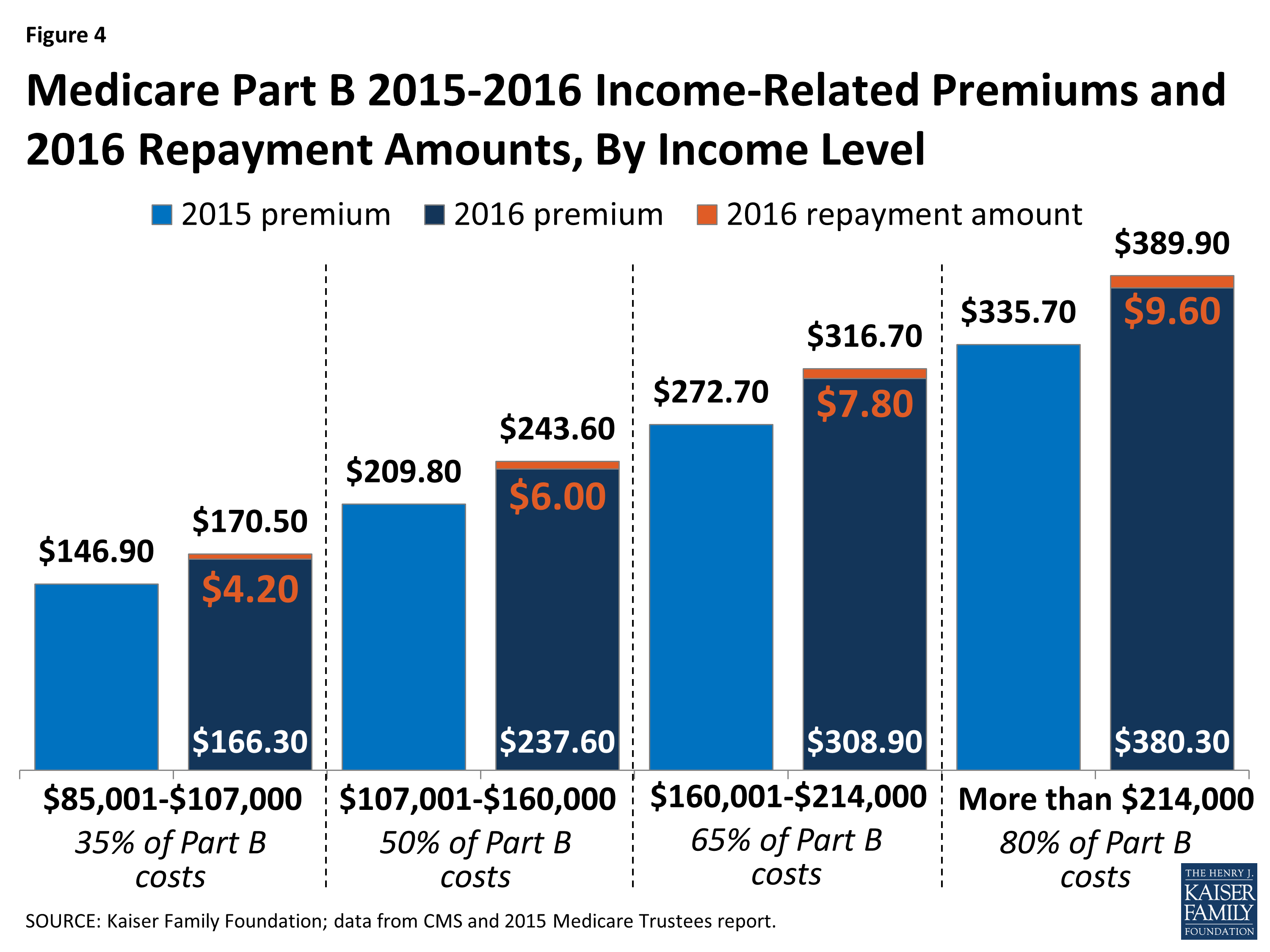

How Does Income Impact Medicare Costs

When you become eligible for Medicare and look at how much to budget for your annual health care costs, youll need to also factor in your tax-reported income. Medicare has set income limits for people filing individual tax returns, joint tax returns and individuals who are married or living with their spouse at any time during the year and file separate tax returns. These limits are then used to determine adjusted costs for Medicare Part B and Part D premiums.

Depending on how much you make, you may have to pay an income-related monthly adjustment amount for Part B and Part D. This amount and the income limits Medicare set can both change every year.

In 2022, people with tax-reported incomes over $91,000 and $182,000 must pay an income-related monthly adjustment amount for Medicare Part B and Part D premiums.

Below are the set income limits and extra monthly costs you could pay for Medicare Part B and Part D based on your tax-reported income.

Watch A Video To Learn More About Medicare Costs

NOTE: Video does not contain audio

Video transcript

An animated white speech bubble appears over an animated character’s yellow and blue head.ON SCREEN TEXT: What are the costs you could pay with Medicare?

The speech bubble and character fall away. Blue text appears surrounded by animated dollar signs on a light blue background.

ON SCREEN TEXT: There are four kinds of costs you may pay with all Medicare plans.

The text and dollar signs fall away. Darker blue text appears surrounded by animated calendars on a light blue background.

ON SCREEN TEXT: 1 Premiums A fixed amount you pay to Medicare, a private insurance company, or both. Premiums are usually charged monthly and can change each year.

ON SCREEN TEXT: January June February April May

The text and calendars fall away. Darker blue text appears above an animated piggybank graphic on a light blue background.

ON SCREEN TEXT: 2 Deductibles A set amount you pay out of pocket for covered health services before your plan begins to pay.

The text and piggybank fall away. Darker blue text appears surrounded by animated green and white circles on a light blue background.

ON SCREEN TEXT: 3 Co-payments A fixed amount you pay when you receive a service covered by Medicare. Your plan pays the remaining amount.

The text and circles fall away. A white and green circle splits in two, the white half falling to the left and the green to the right. Darker blue text emerges in the center of the screen on a light blue background.

Don’t Miss: What Is A Coverage Gap In Medicare

Defer Income To Avoid A Premium Surcharge

The standard premium for Medicare Part B is $148.50 per month in 2021 but that assumes youre not a higher earner. Those with higher income levels are subject to higher premium costs. For 2021 heres what youre looking at:

| 2021 Medicare Part B premium costs by income level | ||

|---|---|---|

| Income level: individual tax filer | Income level: joint tax filer | Total monthly premium |

| $750,000 and above | $504.90 |

If youre able to defer income strategically to future tax years so that you can report a lower total on your tax return, you might save yourself a higher premium charge for at least a year, since those surcharges are based on previous tax returns. For example, your 2019 tax return will determine whether you pay a surcharge in 2021 .

Medicare Part B Premiums For Tricare For Life

When you use TRICARE For Life, you don’t pay any enrollment fees, but you must have Medicare Part A and Medicare Part B.

- Medicare Part A is paid from payroll taxes while you are working.

- Medicare Part B has a monthly premium, which is based on your income.

If you get Social Security or Railroad Retirement Board benefits, your Medicare Part B premium will get deducted from your benefit payment.

You May Like: Does Medicare Cover Inspire Sleep

How Much Does Medicare Part A Cost

The Medicare program is made up of several parts. Medicare Part A together with Medicare Part B make up whats referred to as original Medicare.

Part A is considered hospital insurance. It helps to cover some of your costs at various medical and healthcare facilities when youre admitted as an inpatient. Some people will be automatically enrolled in Part A when they become eligible. Others will have to sign up for it through the Social Security Administration.

Most people who have Part A wont have to pay a premium. However, there are other costs, such as deductibles, copays, and coinsurance you may have to pay if you need hospital care.

Here is what you need to know about the premiums and other costs related to Medicare Part A.

Most people who enroll in Medicare Part A will not pay a monthly premium. This is called premium-free Medicare Part A.

You are eligible for premium-free Part A if you:

- have paid Medicare taxes for 40 or more quarters during your life

- are age 65 or older and eligible for or currently collecting Social Security or Railroad Retirement Board retirement benefits

- are under age 65 and eligible to collect Social Security or RRB disability benefits

Medicare Advantage Msa: A Special Type Of $0 Premium Plan

Another type of Medicare Advantage plan thats available is the Medical Savings Account plan. This plan is different because its designed to not include Medicare Advantage premiums at all. This $0 premium is not because the insurance company is passing on savings to plan members. As with all Medicare Advantage plans, you still pay your Part B premiums when you enroll in a MSA plan.

The trade off with not having a monthly premium is that MSA plans have a high deductible. The deductible is the amount of Medicare-covered services you must pay for out-of-pocket before the plan starts paying for covered services. The money that goes into your MSA can be used to pay your deductible and other healthcare costs.

Recommended Reading: How Can I Sign Up For Medicare Part D

Monthly Medicare Premiums For 2021

The standard Part B premium for 2021 is $148.50. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $88,000 Married couples with a MAGI of $176,000 or less | 2021 standard premium = $148.50 |

| Your plan premium + $77.10 |

How Is A Beneficiarys Premium Determined

The Social Security Administration reviews a beneficiarys most recent federal tax information in order to determine what their premium will be. Based on the image below, the distribution of income among Medicare beneficiaries is represented by 50% with incomes below $23,500. And for those with incomes over $93,900, the beneficiary is required to pay a high premium. This adjustment is based on a sliding scale which is based upon the Modified Adjusted Gross Income and is the beneficiarys total adjusted gross income and tax-exempt interest income.

Chart source – KFF

Recommended Reading: Is Xolair Covered By Medicare Part B

How Can I Reduce My Medicare Premiums And Costs

The best way to save money on Medicare is to enroll in the right plan when you first sign up for an additional coverage option. Prices for similar coverage can vary widely between carriers, and doing your research beforehand can end up saving you a lot of money over the course of the year.

For those seeking additional help paying for Medicare, here are a few resources and programs dedicated to helping those who need financial assistance. If you find yourself in this situation, you might consider one or more of the following options:

How Long Does It Take For Part D Premiums To Be Withheld

Be prepared for it to take up to three months from the time you request your premium be withheld before you start seeing the premiums withheld from your Social Security payment. In the meantime, youll receive a bill from your drug plan, and you will have to pay the premiums by check or electronic funds transfer.

The timing depends on when the plan gets your enrollment request. For example, if you enroll immediately during the Annual Open Enrollment Period, the request may be processed in time where premiums will be withheld from the start of your enrollment in the plan.

In cases where you didnt withhold premiums for one or two months after you enrolled in a Part D plan, or you enroll late in the Annual Open Enrollment period, youll get a bill for the months your drug plans premiums arent withheld and youd have to pay those premiums directly to your drug plan.

Your drug plan will also let you know if there are any issues withholding premiums from your Social Security payment.

Also Check: Should I Apply For Medicare If I Am Still Working

What Youll Pay For Medicare Part D

Medicare Part D is prescription drug coverage, and its sold by private health insurance companies, so premiums vary by policy. In 2022, the average Part D plan premium is $33 per month, but drug plan prices range from $5.50 to $207.20 per month, according to the Kaiser Family Foundation.

Like Part B, youll pay more for your Part D coverage if you have a higher income. The same thresholds apply: If your 2020 income was more than $91,000 or $182,000 , youll pay an additional $12.40 to $77.90 per month, on top of your Part D premium.

Theres also a deductible for some Part D plans, which in 2022 can be no higher than $480.

How Does Medicare Supplement Insurance Affect Part A Costs

Some people choose to reduce out-of-pocket costs associated with Medicare Part A by purchasing Medicare supplement insurance, or Medigap. Private insurers administer Medigap plans.

A person must have Medicare parts A and B to qualify for Medigap. People with Medicare Advantage cannot purchase a Medigap plan. Medicare Advantage is a combination plan, often providing the coverage of parts A, B, and D.

Medicare requires that the various private providers offer consistent Medigap plans. Each plan is assigned a letter, from A to N.

Medigap plans can help offset certain costs of Medicare Part A, including:

- the coinsurance

- hospice care coinsurance or copayments

- the deductible

Recommended Reading: Does Medicare Cover Erectile Dysfunction Pumps

Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

For specific cost information (like whether you’ve met your

, how much you’ll pay for an item or service you got, or the status of a

| 2021 costs at a glance | |

|---|---|

| Part A premium | Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $471 each month in 2021 . If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471 . If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259 . |

| Part A hospital inpatient deductible and coinsurance | You pay:

|

| Part B premium | The standard Part B premium amount is $148.50 . |

| Part B deductible and coinsurance | $203 . After your deductible is met, you typically pay 20% of theMedicare-Approved Amountfor most doctor services , outpatient therapy, anddurable medical equipment |

| Part C premium |

Medicare Premiums Part A Part B Part C And Part D

- Reviewed byJohn Krahnert

The cost of health care may be expensive for Medicare beneficiaries, especially those who require coverage for vision, dental and prescription drugs. Many Medicare Advantage plans provide coverage for these types of services in addition to your Part A and Part B benefits, sometimes for a low or $0 monthly premium.

Read Also: Do You Have To Pay A Premium For Medicare