The Basics Of Original Medicare

Medicare is a government-run and government-sponsored program designed to cover most of your medical expenses during your retirement years. Doctors and medical care facilities across the country almost universally accept Medicare.

But not all doctors and facilities accept Medicare assignment. If you are unsure whether the places you are going for your care accept Medicare assignment, be sure to call ahead and ask so that you dont receive charges for out-of-pocket expenses.

There are two mandatory parts to Original Medicare which you must enroll in if you do not have creditable coverage from an employer. The first one is Medicare Part A. Medicare Part A covers the majority of your hospital expenses should you need inpatient treatment at a local hospital facility.

Part A also includes things like hospice care, skilled nursing facility care, and your first three pints of blood transfusions.

Next, theres Medicare Part B. Medicare Part B covers most of the medical care you receive outside of a hospital, hospice care, or a skilled nursing facility. This includes things like preventative care, durable medical equipment, outpatient care such as minimally invasive surgeries or physical rehabilitation, and more.

You will have to pay a monthly premium for Medicare Part B as well as a 20% coinsurance cost associated with the care you receive.

How To Change Your Coverage

The good news is you arent locked into your Medicare plan for the rest of your life. If you choose Original Medicare and decide its not working for you, you can switch to Medicare Advantage during the next Annual Election Period .

Similarly, you can switch between Medicare Advantage plans twice a year, or drop Medicare Advantage and return to Original Medicare. Medicare Advantage members can make changes during the fall Annual Election Period and the Medicare Advantage Open Enrollment Period each year.

With so much flexibility available, you can choose the coverage that best suits your unique budget and lifestyle, even if your situation changes from year to year. For example, if youre enrolled in Medicare Advantage but plan to spend part of the year in a different state, you might want to switch to Original Medicare for a year so you arent locked into a provider network while you travel.

Its a good idea to use the Medicare Plan Finder to compare available plans in your area each year before the Annual Election Period. You may find a less expensive plan, or discover one with benefits that better meet your needs. To evaluate your options and make a well-informed choice, you can call and speak to a licensed Medicare professional.

How Do You Enroll In Original Medicare

To enroll in Original Medicare , you must be 65 and dont necessarily have to be retired. Initial enrollment period packages are sent to people 3 months before they turn 65 or during their 25th month of disability benefits.

If youve received Social Security disability benefits for 24 months, you are automatically enrolled in Part A and Part B.

Recommended Reading: Does Medicare Cover Iovera Treatment

What Is Not Covered By Original Medicare

Original Medicare, Part A and Part B, doesnt cover everything. For example, it doesnt cover cosmetic surgery, health care you get while traveling outside of the United States , hearing aids, most hearing exams, long-term care , most eyeglasses, most dental care and dentures, and more. Generally, Original Medicare, Parts A and B does not cover prescription drugs, although it does cover some drugs in limited cases such as immunosuppressive drugs and oral anti-cancer drugs. Some of the services that are not available through Original Medicare may be covered by a Medicare Advantage plan.

Medicare Part B Medical Insurance

While Part A basically covers inpatient services, Medicare Part B is also referred to as medical insurance because it covers medically necessary services including physician and nursing fees, x-rays, diagnostic tests, blood transfusions, chemotherapy, renal dialysis, and some vaccinations and also preventive services.Although most medically necessary services are covered by either Part A or Part B, most outpatient prescription drugs are not . Dental care is also not covered under Original Medicare, and neither is routine vision care.

Enrollees pay a monthly Part B premium . Learn more about how to enroll in Part B.

Recommended Reading: Can We Apply For Medicare Online

Why Choose Medicare Advantage

Medicare Advantage plans must offer benefits comparable to original Medicare. The government regulates these plans, ensuring that they meet certain basic care requirements. The costs and copays for various services, however, may be different. For some people, Medicare Advantage is a better choice. You might choose Medicare advantage because:

- There are more options. In 2018, the average Medicare beneficiary could choose from 21 plans, though some regions offered even more choices.

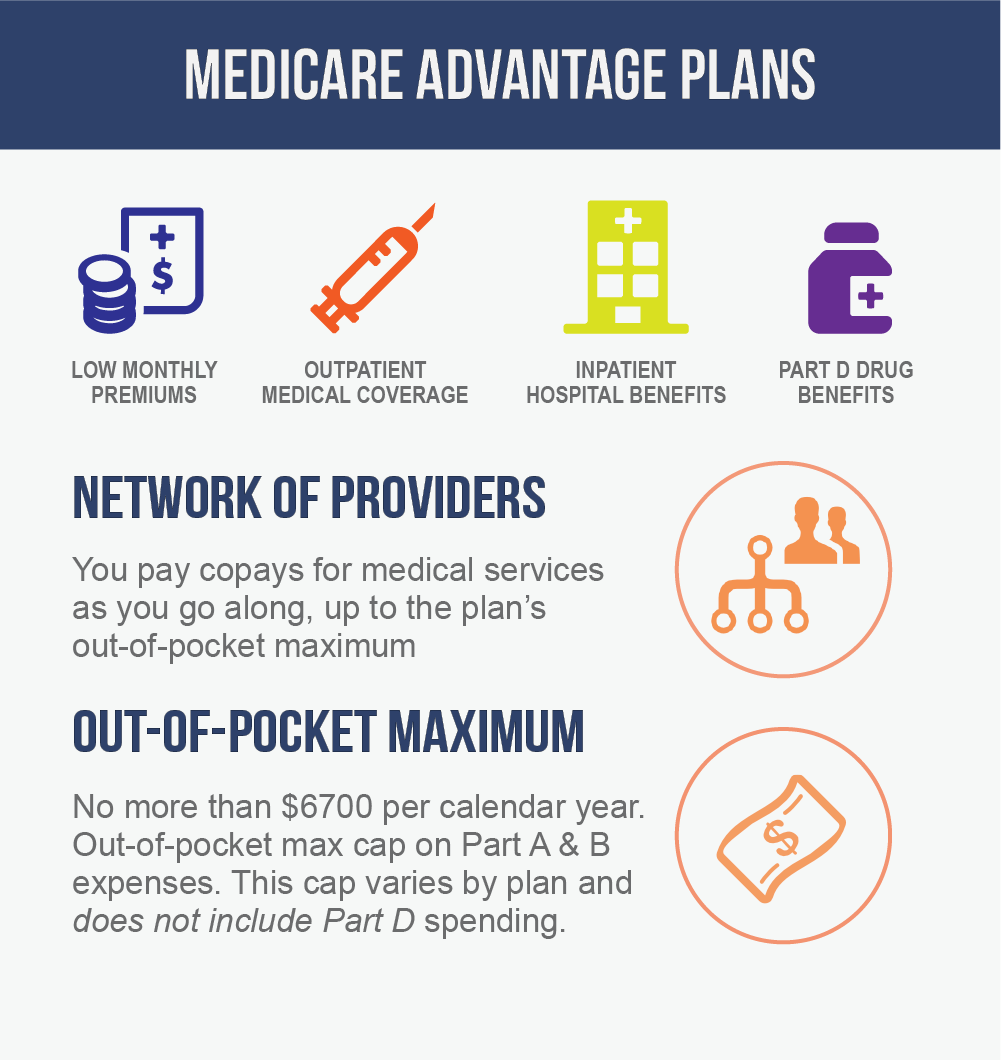

- Premiums may be lower on some plans. Some even offer $0 premiums, though this usually means you’ll pay higher copays.

- There is usually prescription drug coverage. Original Medicare does not cover prescription drugs unless you enroll in Part D. In 2019, 90% of Medicare Advantage policies offered prescription drug coverage.

- You may pay less for expensive services. Medicare Advantage plans are legally required to limit your out-of-pocket maximum costs. With original Medicare, you keep paying costs no matter how much you spend. In 2020, the out-of-pocket maximum for most Medicare Advantage costs was $6,700.

- There is often coverage for services original Medicare will not fund. Each plan is different, so it is important to compare and review plan documents. However, many Medicare Advantage plans offer dental or vision coverage. Original Medicare, by contrast, covers only medical and hospital care.

What Does Part B Cost

With Medicare Part B, you pay a standard monthly premium thats based on your income. In some cases, your monthly premium may be higher if you didnt sign up for Part B when you became eligible.

You may also need to meet an annual deductible before Medicare kicks in and starts paying. Once youve met your deductible, you will pay a 20 percent copay for approved Medicare Part B services.

You can always buy a Medicare Supplement Plan that pays your Part B deductible, as well as other out-of-pocket costs such as copays and coinsurance.

Don’t Miss: Does Medicare Cover Parkinson’s Disease

What Is The Difference Between Original Medicare And Medicare Advantage

Definitions:

- Premium: The monthly fee you pay to have Medicare or your health plan.

- Deductible: What you must pay before Medicare or your health plan starts paying for your care.

- Copayment/coinsurance: Your share of the cost you pay for each service.

- Part A: Medicare hospital insurance for inpatient care.

- Part B: Medicare medical insurance for outpatient care.

- Part D: Medicare drug coverage.

- Medigap: Supplemental insurance that helps pay your out-of-pocket cost in Original Medicare.

Original Medicare And Medicare Advantages

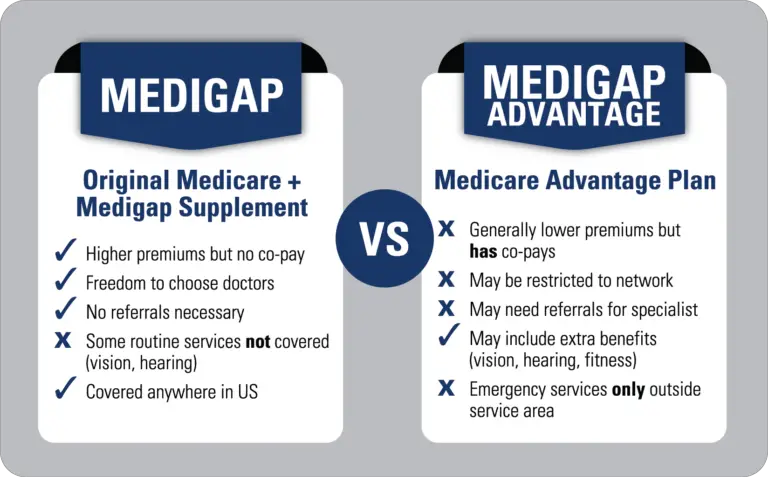

Original Medicare has the advantage of providing a nationwide network of providers, but it may not cover all the services you need. If you want prescription drug coverage, you also need to enroll in a Medicare Part D plan. For Part A, youll pay a monthly premium in a Medicare-taxed job, youll get this premium for free) and 10% of each hospital benefit period deductible.

For Part B, you will pay 20% of the cost of all services plus the monthly premium, except for preventive screening tests . To help reduce out-of-pocket costs, you can enroll in the Medicare Supplement plan, which helps you pay back your Part A and Part B deductibles, copays, and coinsurance. Medigap plans can also help pay for emergency insurance in other countries.

Medicare Advantage, on the other hand, has a narrow network of providers, but it can offer supplemental benefits that Original Medicare doesnt. These plans can also include Part D coverage. On the cost side, youll still pay your Part B premium, but youll also be responsible for any premiums, deductibles, copays, or coinsurance your plan requires. Any care you get from your plans network will cost more and, in some cases, may not be covered. The allure of Medicare Advantage plans is that any care you receive in the network has an annual out-of-pocket limit.

You May Like: Is Humana Gold Plus Hmo A Medicare Advantage Plan

Medicare Prescription Drug Coverage

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage .

Learn more about how to get Medicare drug coverage.

Each plan can vary in cost and specific drugs covered, but must give at least a standard level of coverage set by Medicare. Medicare drug coverage includes generic and brand-name drugs. Plans can vary the list of prescription drugs they cover and how they place drugs into different “tiers” on their formularies.

The Cares Act Of 2020

On March 27, 2020, President Trump signed a $2 trillion coronavirus emergency stimulus package, called the CARES Act, into law. It expanded Medicare’s ability to cover treatment and services for those affected by COVID-19. The CARES Act also:

- Increased flexibility for Medicare to cover telehealth services.

- Increased Medicare payments for COVID-19-related hospital stays and durable medical equipment.

For Medicaid, the CARES Act clarified that non-expansion states can use the Medicaid program to cover COVID-19-related services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Do not pay a Medicare broker directly for their assistance. They are paid by the insurance company to sell their insurance. If you suspect Medicare Advantage fraud, please call the Medicare Drug Integrity Contractor at 1-877-772-3379.

Also Check: Is The Urolift Procedure Covered By Medicare

What Is The Medicare Part B Penalty

If you dont have group health insurance from a large employer and fail to sign up for Medicare Part B at 65, then later decide you need it, youll likely pay a penalty of 10% of the standard premium for each 12-month period that you delayed. You will pay this penalty for life.

You can avoid the penalty if you had health insurance through your job or your spouses or partner’s job when you first became eligible. You must sign up within eight months of when that coverage ends and show proof of group insurance after you turned 65.

You Can’t Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in our advertiser disclosure. We may receive commissions on purchases made from our chosen links.

Anyone who’s ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

You May Like: How Much Does Medicare B Cost

What Isnt Covered By Original Medicare

Original Medicare doesnt cover everything you might need for your healthcare. First, Original Medicare does not include Part D, which is coverage for prescription drugs. If you enroll in Original Medicare and choose a Medigap plan instead of an Advantage plan, you will need to enroll in a stand-alone Part D plan and pay its associated monthly premiums separately.

Additionally, Original Medicare will not cover the following health-related needs:

How Do I Choose The Right Coverage For Me

Determining your current and anticipated medical needs can help you create a roadmap to help you choose coverage. Consider the following issues as you decide:

- Prescription drugs. Even though Medicare Part D is voluntary, it is important to consider your prescription medication needs. Signing up for Part D, or for an Advantage plan that includes medications, may save you money in the long run.

- Vision and dental needs. Because these arent covered by original Medicare, it may make sense for you to buy a plan that provides this coverage.

- Budget. Plan out your anticipated monthly and annual budget after retirement. Some plans have low monthly premiums, which make them attractive. However, these plans often have higher copays. If you have a lot of doctor appointments during an average month, add up what your copays will be with a $0 premium plan before you buy.

- Chronic conditions. Keep in mind any known chronic condition or one that runs in your family, as well as upcoming procedures you know will be needed. If you are comfortable using in-network doctors, going with a Medicare Advantage plan might make the most sense for you.

- Travel. If you travel extensively, opting for original Medicare plus Medigap may be a good option. Many Medigap plans pay for a large portion of emergency medical services you may need when traveling outside the United States.

Read Also: What Is Medicare Advantage Part C

How Original Medicare And Medicare Advantage Differ

Since the 1990s, Medicare recipients have been able to choose private health plans as an alternative to original Medicare. These health plans, once called Medicare Part C, are now known as Medicare Advantage.

Most Medicare recipients still choose the original program, but in 2019, 34% of Medicare beneficiaries opted to enroll in Medicare advantage. In 2016, 29% of new Medicare beneficiaries chose an Advantage plan during the first year of enrollment. The two programs offer similar benefits, but there are some important distinctions.

How Original Medicare Works

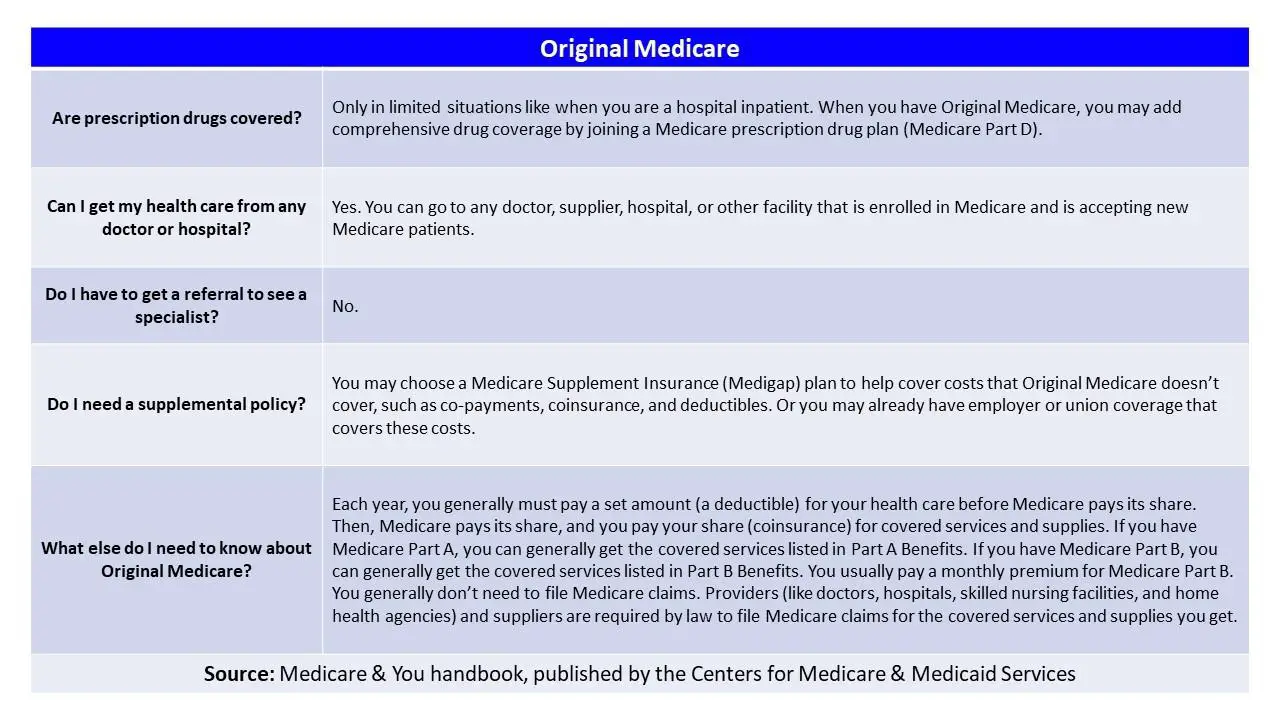

| Are prescription drugs covered? | Only in limited situations like when you are a hospital inpatient. When you have Original Medicare, you may add comprehensive drug coverage by joining a Medicare prescription drug plan . |

| Can I get my health care from any doctor or hospital? | Yes. You can go to any doctor, supplier, hospital, or other facility that is enrolled in Medicare and is accepting new Medicare patients. |

| Do I have to get a referral to see a specialist? | No. |

| Do I need a supplemental policy? | You may choose a Medicare Supplement Insurance plan to help cover costs that Original Medicare doesnt cover, such as copayments, coinsurance, and deductibles. Or you may already have employer or union coverage that covers these costs. |

| What else do I need to know about Original Medicare? | Each year, you generally must pay a set amount for your health care before Medicare pays its share. Then, Medicare pays its share, and you pay your share for covered services and supplies. If you have Medicare Part A, you can generally get the covered services listed in Part A Benefits. If you have Medicare Part B, you can generally get the covered services listed in Part B Benefits. You usually pay a monthly premium for Medicare Part B. You generally dont need to file Medicare claims. Providers and suppliers are required by law to file Medicare claims for the covered services and supplies you get. |

Read Also: How To Choose The Best Medicare Plan

How Much Does Original Medicare Cost

People usually dont pay a monthly premium for Medicare Part A coverage if they or their spouse paid Medicare taxes while working. For Medicare Part B, most people pay a standard monthly premium. Some people may pay a higher Medicare Part B premium based on their income. Additional information about Part B premiums can be found on our Medicare Part B page.

The Basics Of Medicare Supplement Insurance

Before we dive into the details of Plan N, well review the basics of Medigap coverage. Medicare Supplement plans work as secondary coverage. Original Medicare, Parts A, and B are primary they will cover the majority of your medical expenses. Your Supplement plan will pay as secondary coverage. There are ten standardized Medigap plans and each one of them will cover a different level of the expenses youre expected to pay. Some are very or even totally comprehensive, and others are less so. No matter which standardized plan you use, your Medigap plan helps pay the costs that youd normally have to pay out of pocket.

Read Also: When Can You Join Medicare

What Is The Difference Between Medicaid And Medicare

Medicare and Medicaid are different programs. Medicaid is not part of Medicare.

Heres how Medicaid works for people who are age 65 and older:

Its a federal and state program that helps pay for health care for people with limited income and assets. A basic difference is that Medicaid covers some benefits or services that Medicare doesnt like nursing home care or transportation to medical appointments .

Visit your states Medicaid/Medical Assistance website or medicare.gov for more information. Learn more in the article, Can I get help paying my Medicare costs?

What Is The Medicare Premium Plan

Medicare fee plans are a mix of Medicare Advantage and Original Medicare. It offers a narrow provider network, like a Medicare Advantage plan, that may also be able to give you more benefits. It also gives you the freedom to use Original Medicare when you need to plan out-of-network care. This helps reduce your out-of-network costs.

Medicare fee plans offer the most flexibility of any plan. This is especially true for people who like to travel, especially within the United States. Traveling while you are in a Medicare Advantage plan may put you at risk of needing out-of-network coverage. Whether its an emergency or someone is a snowbird , they will face higher out-of-pocket costs if they enroll in a Medicare Advantage plan.

To be eligible for the Medicare Premium Plan, you must be enrolled in Part B.This is slightly different than a Medicare Advantage plan that requires you to be in both Part A and Part B. You can register anytime the program accepts applications. Depending on your needs, you can choose a plan with prescription drug coverage or otherwise enroll in a stand-alone Part D plan. You can leave the plan and change to Original Medicare at any time without waiting for the Medicare open enrollment period.

On the cost side, you pay premiums, deductibles, copays, and coinsurance for your Medicare cost plan. You dont have to pay a Part B deductible or coinsurance unless you actually use Original Medicare.

Read Also: Does Medicare Pay For Insulin