Signing Up For A Medicare Advantage Plan

If you prefer to get your health coverage through a Medicare Advantage plan, you must first enroll in Original Medicare Part A and Part B and then switch to a separate Medicare Advantage plan.

All Medicare Advantage plans must offer the same Medicare Part A and Part B benefits as Original Medicare, but some plans include other benefits, such as prescription drug coverage, dental and vision.

Medicare Advantage Plans do not all offer the same benefits.

Use the Medicare Plan Finder or call your local SHIP representative to compare plans in your area.

Four Ways to Sign Up for a Medicare Advantage Plan

To join a Medicare Advantage plan, you will need your Medicare number and the date your Part A and Part B coverage began.

Don’t Leave Your Health to Chance

Choosing The Same Plan As A Family Member Or Friend

Standing by your family and friends is a virtue. That does not mean you should always follow their advice.

Loved ones may have had a good experience with a certain Part D plan and make a recommendation to you. This word of mouth is helpful for many reasons:

- It tells you how easy a plan is to use.

- It tells you the coverage is good.

- It tells you customer service is friendly.

However, your health issues may not be the same as your family members. Choosing the same Part D plan might not make the most sense if your medical needs are different. Not only that, you may have different budgets to consider. Feel free to consider their advice but also take the time to investigate other plans that could work well for you.

How To Enroll In Medicare

Enrolling in Medicare is easy once you understand how to do so. It’s important to know that how you enroll in Medicare Part A and Part B is different from how you enroll in Medicare Advantage , Part D or Medicare supplement insurance.

See the table below for a quick overview of how to enroll in a Medicare or Medigap plan and read on for how-to steps for both Original Medicare and the three kinds of Medicare and Medigap plans.

Original Medicare Medicare Advantage plan Medicare Prescription Drug plan Medicare Supplement Insurance plan How to Enroll

Enroll in Original Medicare online at the Social Security website or by calling or visiting your local Social Security office.

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Enroll directly in the plan e.g., on the plans website

Original Medicare

How to Enroll

Enroll in Original Medicare online at the Social Security website or by calling or visiting your local Social Security office.

Medicare Advantage plan

How to Enroll

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Medicare Prescription Drug plan

How to Enroll

Enroll directly in the plan e.g., on the plans website or Medicare.gov .

Medicare Supplement Insurance plan

Enroll directly in the plan e.g., on the plans website

Don’t Miss: Does Quest Diagnostics Accept Medicare

How To Enroll In The Various Medicare Plans

There are three types of Medicare plans that all have different ways of signing up. Each of these plans also has different enrollment periods. Delaying your Medicare Enrollment could result in various penalties and fees. Its helpful to set reminders for these important dates, especially when signing up for Medicare for the first time.

| Plan | |||

|---|---|---|---|

| Original Medicare |

|

Automatic or three months before the month you turn 65 and extends three months after. | 10 percent of the monthly premium |

| Medicare Advantage Plans |

|

None | |

|

|

Six months after the month youre 65 and enrolled in Medicare Part B. | None | |

|

|

It depends on how long you went without Part D |

Can I Get Other Medicare Monthly Premiums Withheld From Social Security

If you are signed up for both Social Security and Medicare Part B , the SSA will automatically deduct the Part B premium from your monthly benefit. You do not have to do anything to enroll in the automatic deduction.

If you are enrolled in Part B but not collecting Social Security, youll be billed quarterly by Medicare and must pay electronically or by mail.

Don’t Miss: When Do You Register For Medicare

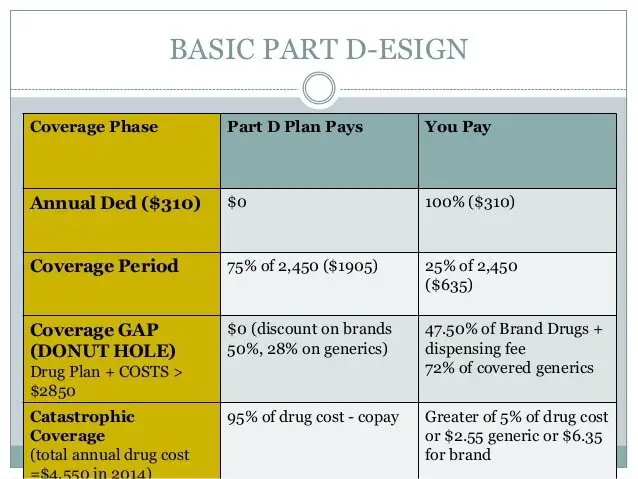

Why Enroll In Medicare Part D

In our last installment, we promised to talk more about prescription drug coverage because its one of the most confusing parts of Medicare. So, what are some of the key things you need to know when helping a loved one, such as a parent or spouse, enroll in Part D? First, unlike Original Medicare , the program is voluntaryindividuals can choose whether or not to participate in the Part D program. However, health insurance counselors recommend against this, as most beneficiaries need prescription drug coverage eventually . Additionally, if your loved one chooses not to enroll in Part D when they first become eligible and then enrolls later , they may have to pay a lifetime penalty for every month that they delayed enrollment. So if your grandmother tells you not to sign her up for Part D because she doesnt want to pay that extra $30 per month for a prescription she doesnt need, just keep in mind that she could be incurring a penalty if she decides to sign up later. Youll also want to check back with her every year during Open Enrollment to see if her health situation has changed and she now needs a Part D plan. In summary, if your Medicare-eligible loved one needs prescription drug coverage and doesnt have it, or will probably need it in the near future, you should strongly consider enrolling them in a Part D plan.

What Is The Late Enrollment Penalty

The Late Enrollment Penalty is a fee that is meant to encourage enrollment in a prescription drug plan at the point of eligibility. If you are enrolled in a Medicare prescription drug plan, you may owe a Late Enrollment Penalty, if for any 63 days or more after the Initial Enrollment Period, you went without 1 of these:

- A Medicare Part D Prescription Plan

- A Medicare Advantage Plan

- Another Medicare health plan that offers Medicare prescription drug coverage

The Late Enrollment Penalty is added to your monthly Part D premium for as long as you have Part D coverage, even if you change your Medicare Part D plan. The Late Enrollment Penalty amount changes each year. You may also have this penalty if you have a Medicare Advantage plan that includes prescription drug coverage . You can avoid the late enrollment penalty by making sure you enroll when you are eligible and keeping your coverage.

If you qualify for Extra Help due to a lack of income or resources, you can enroll late without a penalty. However, if you lose Extra Help, you may be charged a penalty if you have a break in coverage.

Medicare, not the Cigna Part D Plan, will determine the penalty amount. You will receive a letter from the plan notifying you of any penalty. For further questions or concerns about the Late Enrollment Penalty, call Medicare at 1 MEDICARE or visit www.medicare.gov.

Also Check: How Do I Find My Medicare Card Number Online

Signing Up For A Medigap Policy

To purchase a Medigap supplement insurance policy, you must first enroll in Medicare Part A and Part B.

Medigap policies are not required but enrolling in one can help you pay out-of-pocket costs, including deductibles, coinsurance and copayments.

The best time to enroll in a Medigap plan is when you are first eligible.

This is a six-month enrollment period that begins the month youre 65 and enrolled in Medicare Part B.

If you apply for Medigap coverage after this six-month window, private insurance companies may not sell you a policy if youre in poor health.

You can find a Medigap policy by using an online tool on the Medicare website, contacting your local SHIP or calling your State Insurance Department.

How to Sign Up for a Medigap Policy Online

Can I Sign Up For Medicare Plans Online

Enrolling in Medicare coverage options online is generally easy and quick. More and more people are signing up online, according to an eHealth study. During 2018, about 16% of people in the study enrolled in Medicare coverage options online. Thats up from only 10% in 2017. In other words, about 60% more people in the study used eHealths online enrollment tool to sign up in 2018 than in 2017.

Its interesting to note that online enrollment was even higher during Q4. Q4 means the 4th quarter of the year, October through December. Thats when Medicares Fall Open Enrollment happens for Medicare Advantage and Medicare prescription drug plans. Fall Open Enrollment goes from October 15 December 7 every year.

You May Like: When Do Medicare Premiums Start

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

What Should I Do After Medicare’s Enrollment Period Ends

Once the Medicare enrollment period is over, itâs a great time to take a look at your overall financial plan.

- Are you happy with your health insurance?

- Have you rolled over your retirement accounts such as a 401 or IRA?

These are all things we can help you with to give you peace of mind and security that your retirement is going as planned. Plus, the beginning of the year is a great time to meet with us!

The enrollment period in the fall is the busiest time of the year for insurance agents, but the beginning of the year through March is much slower. This gives us extra time to make sure your overall financial and retirement plans are fully taken care of.

If you have any questions about your Medicare Part D drug plan, the enrollment period, or next steps, call us at 833-801-7999. You can also connect with us by filling out a short form. We canât wait to serve you.

Also Check: Does Medicare Coverage Work Overseas

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

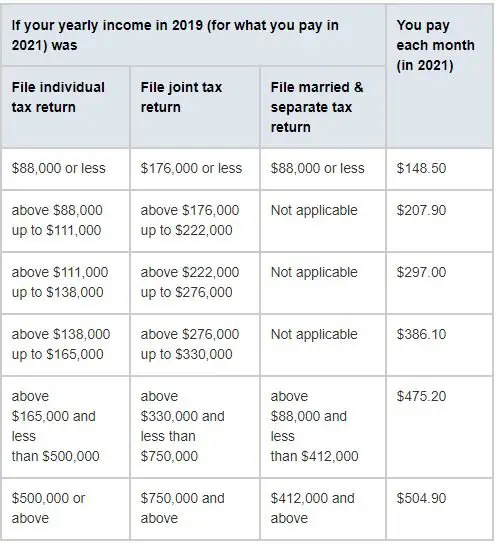

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

How To Sign Up For And Change Medicare Plans

Once youre enrolled in Medicare, youll have various opportunities to change certain aspects of your coverage. Heres an overview:

- During the annual open enrollment period , you can make a variety of changes, none of which involve medical underwriting:

- Switch from Medicare Advantage to Original Medicare or vice versa.

- Switch from one Medicare Advantage plan to another.

- Switch from one Part D prescription plan to another. Its highly recommended that all beneficiaries use Medicares plan finder tool each year to compare the available Part D plans, as opposed to simply letting an existing drug plan auto-renew.

- Join a Medicare Part D plan.

- Drop your Part D coverage altogether.

You May Like: When Can You Collect Medicare Benefits

If Your Existing Prescription Drug Coverage Is Creditable Stick With It

Your current coverage is considered creditable if, on average, it pays out as much as Medicare plans do. Many widely available plans are considered creditable by CMS. These include:

You may have employer-based creditable coverage that comes to an end or that you choose to drop after your initial Medicare Part D enrollment window has closed. If so, you can still avoid the late enrollment penalty. On the date your old coverage ends, you enter a 63-day special enrollment period. If you sign up for a Part D plan during that time, you wont face the late enrollment penalty.

Many insurers contact their customers each year to report whether their coverage is creditable. If you get a letter or other message from your insurer confirming your plan is creditable, hang on to it. Later, when you enroll in a Part D plan, that letter could help you prove you had creditable coverage in the past.

When To Sign Up For Medicare Part B

If youre retiring, the best time to enroll in Part B is during your Initial Enrollment Period. For those still working past 65, check with your health administrators whether your employer coverage is creditable.

If it is, you can enroll in Part B when you retire or leave your group health plan. Youll be eligible for a Special Enrollment Period when you can enroll without any penalties. If your group health plan is not considered creditable coverage, then you should register for Part B during your Initial Enrollment Period.

If you missed your Initial Enrollment Period, the next enrollment window you can enroll in Part A and Part B is the General Enrollment Period.

You May Like: Can You Get Dental On Medicare

Consider All Your Drug Coverage Choices

Before you make a decision, learn how prescription drug coverage works with your other drug coverage. For example, you may have drug coverage from an employer or union, TRICARE, the Department of Veterans Affairs , the Indian Health Service, or a Medicare Supplement Insurance policy. Compare your current coverage to Medicare drug coverage. The drug coverage you already have may change because of Medicare drug coverage, so consider all your coverage options.

If you have other types of drug coverage, read all the materials you get from your insurer or plan provider. Talk to your benefits administrator, insurer, or plan provider before you make any changes to your current coverage.

What Will I Pay For Part D Coverage

CMS has announced that the average Part D plan will cost $33/month in 2022. But the plans are issued by private insurers, and theres significant variation in terms of the benefits, the formularies and the pricing. Among the Part D plans that are available in 2022, premiums range from under $6/month to more than $207/month.

High-income enrollees pay extra for their Part D coverage. For 2022, the additional premiums range from $12.40/month to $77.90/month.

The premium adjustment for high-income enrollees is based on income tax returns from two years prior, since those are the most recent returns on file at the start of the plan year . Theres an appeals process you can use to contest the income-related premium adjustment if youve had a life-change event that has subsequently reduced your income.

In addition to the premiums, youll pay a copay or coinsurance for drugs. The donut hole in Part D plans has closed, thanks to the Affordable Care Act. It was fully closed as of 2020: Enrollees with standard Part D coverage now pay 25% of the cost of generic and brand name drugs while in the donut hole, which is the same percentage they pay before entering the donut hole.

Once you select a PDP, there are four ways to pay the premium:

- deducted from your personal account

- charged to credit or debit card

- billed monthly or

Also Check: How Much Does Medicare Cover For Hospital Stay