Medicare Part D Prescription Drug Coverage

Those who enroll in Medicare Part D must pay a monthly insurance premium, an annual deductible and coinsurance costs. Individuals who are enrolled in Medicaid and Medicare are automatically enrolled into a Medicare prescription drug plan and receive the majority of their prescriptions through this plan.

Some low-income Medicare beneficiaries qualify for extra help from the federal government covering their premiums, deductible and coinsurance costs, or a portion thereof. Individuals who qualify for extra help are, however, responsible for prescription copayments.

For more information about Medicare Part D, visit www.medicare.gov.

Helpful Phone Numbers

- Ohio Senior Health Insurance Information Program :

How Do I Avoid The Medicare Part D Coverage Gap

Now that you know about the coverage gap , here is some good news:

Many Medicare beneficiaries wont have to pay the increased prices during the coverage gap because their prescription drug costs wont reach the initial coverage limit of $4,020 in 2020.

People who qualify for Extra Help will avoid the coverage gap. Extra Help is a federal program that helps eligible individuals with limited income pay for Medicare Part D costs such as premiums, deductibles, and copayments/coinsurance. If you qualify for this assistance, you wont enter the coverage gap. You can apply for the program through your states Medicaid department or the Social Security Administration.

Although most Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans have a coverage gap, some plans offer additional coverage during this phase. Costs for this additional coverage will vary by plan.

Managing your out-of-pocket prescription drug costs is a big part of avoiding the coverage gap. Here are some tips for how you can lower the amount you spend on medications:

Many expensive prescription drugs have a generic or lower-cost alternative. Switching to lower-cost drugs may help you avoid entering the coverage gap. Talk to your doctor or prescriber about whether there are lower-cost prescription drugs available that may be just as effective for your condition.

New To Medicare?

Medicare Part D Prescription Drug Benefit

Medicare is a federal health insurance program for people aged 65 or older, people under age 65 with certain disabilities, and people of all ages with End-Stage Renal Disease or Amyotrophic Lateral Sclerosis. People who are eligible for Medicare have their prescription benefits covered under Medicare Part D. With Medicare part D, almost all of your drug costs are paid for by Medicare not Medicaid. You will pay a small Medicare copayment for each prescription.

If you are eligible for both Medicare and Medicaid, also known as dual eligible, you will automatically be assigned to a Medicare Prescription Drug Plan . If you are dually eligible, Medicaid will still cover select prescription vitamins and certain non-prescription drugs. See the below website:

You May Like: Does Medicare Pay For Eyeglasses For Diabetics

D Does Not Cover Over

Medicare Part D does not pay for nonprescription drugs like antacids and cold medicines that you find at a pharmacy. Nor does it cover drugs for erectile dysfunction, hair loss or weight control, even if a doctor prescribes them.

You can use money from a health savings account tax free to pay for over-the-counter medications. You cant contribute to an HSA after you enroll in Medicare, but you can withdraw money for eligible expenses at any time without paying taxes.

What To Do If Your Drug Isnt Covered

If you have trouble getting the medication that you want covered, you may be able to appeal. You and your doctor can submit a formal request for an exception to a drug coverage rule. For example, you could send a request to get coverage for a drug thats not in your formulary. You could also send a request to waive a step therapy requirement to use a lower-tier drug.

Recommended Reading: How Much Is Medicare Copay For A Doctor’s Visit

How Much Does Part D Cost

Most people only pay their Part D premium. If you don’t sign up for Part D when you’re first eligible, you may have to pay a Part D late enrollment penalty.

If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit , youll pay an extra amount in addition to your plan premium . Youll also have to pay this extra amount if youre in a Medicare Advantage Plan that includes drug coverage. This doesnt affect everyone, so most people wont have to pay an extra amount. The chart below lists the extra amount costs by income.

Social Security will contact you if you have to pay Part D IRMAA, based on your income. The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree , use this form to contact Social Security . If you have questions about your Medicare drug coverage, contact your plan.

| Note |

|---|

|

The extra amount you have to pay isnt part of your plan premium. You dont pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check. If the amount isnt taken from your check, youll get a bill from Medicare or the Railroad Retirement Board. You must pay this amount to keep your Part D coverage. Youll also have to pay this extra amount if youre in a Medicare Advantage Plan that includes drug coverage. |

In 2019 Around 1 In 10 Low

Figure 10: Weighted Average Monthly Premiums for Low-Income Subsidy Enrollees, 2006-2019

In 2019, 1.0 million LIS beneficiaries pay a premium for Part D coverage, even though they may be able to obtain coverage without paying a premium by enrolling in a benchmark PDP. This total includes 0.7 million PDP enrollees who are not enrolled in benchmark PDPs, and more than 0.3 million enrollees in MA-PDs that charge a premium. MA-PDs are not designated as benchmark plans by CMS, although most of the LIS enrollees in MA-PDs are currently enrolled in zero-premium plans. On average, the 1.0 million LIS beneficiaries paying Part D premiums in 2019 pay nearly $24 per month, or nearly $300 per year. This amount is down 7 percent from 2018, but is 2.6 times the amount in 2006.

| Data and Methods

This analysis uses data from the Centers for Medicare & Medicaid services Part D Enrollment, Benefit, Landscape, and Low Income Subsidy files for the respective year, with enrollment data from March of each year. The analysis excludes plans with small enrollment counts in estimates that are plan-enrollment weighted. For analysis of cost sharing for formulary tiers in PDPs and MA-PDs, we did not analyze which drugs are on what tier under each type of plan and whether this has changed over time, factors which would also influence enrollees out-of-pocket costs. |

You May Like: When Is Someone Medicare Eligible

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

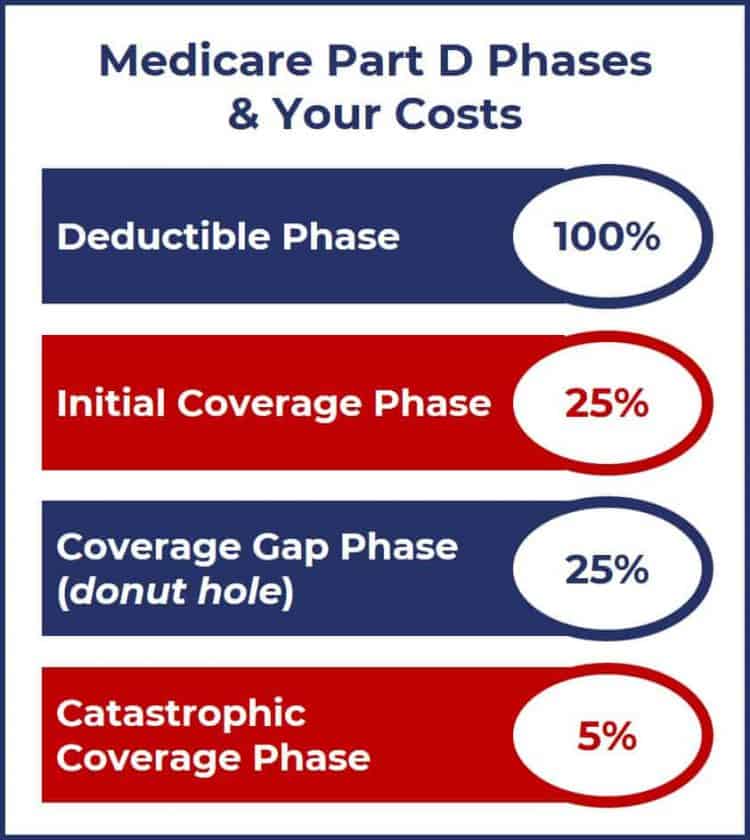

What Is The Coverage Gap Or Donut Hole

Until your total drug costs hit $4,430, you pay the cost sharing designated in your policy in 2022.

- When you reach the initial coverage limit of $4,430 , you enter the coverage gap, also known as the donut hole.

- You then pay 25% of costs for the costs of brand and generic drugs until your total out-of-pocket Part D spending reaches $7,050

- At that point, the catastrophic limit kicks in and beneficiaries pay the greater of 5% or $3.95 for generic medications and $9.85 for brand-name drugs for the rest of the year.12

Read Also: Does Medicare Pay For Liver Transplants

Medicare Part C = Medicare Advantage Plans

- Once you have Parts A and B, you can enroll in a Medicare Advantage plan

- When Medicare Advantage plans include Part D prescription drug coverage, theyre called MAPD plans

- MAPD plans are usually the lowest cost way to get Parts A, B and D together

- Youll continue to pay your Part B premium to the federal government

- Usually, youll pay an additional monthly premium to your private insurance company, too

- Medicare Advantage plans may also include extras like dental and vision coverage

- You wont be denied due to a pre-existing condition

What Should I Know About A Plan’s Drug List

Medicare Part D and Medicare Advantage plans have a drug list that tells you what drugs are covered by a plan. Medicare sets standards for the types of drugs Part D plans must cover, but each plan chooses the specific brand name and generic drugs to include on its formulary. Here are some important things to know:

- A plan’s drug list can change from year to year.

- Plans can choose to add or remove drugs from their drug list each year. The list can also change for other reasons. For example, if a drug is taken off the market. Your plan will let you know if there’s a coverage change to a drug you’re taking.

- Many Part D plans have a tiered formulary.

Recommended Reading: Where Can I Sign Up For Medicare

How Do I Sign Up For Part A

In most cases, youll be automatically enrolled in Medicare Part A. Youre automatically enrolled in original Medicare which is made up of parts A and B starting on the first day of the month you turn 65 years old.

If youre under age 65 and receiving Social Security or RRB disability benefits, youll automatically be enrolled in Medicare Part A when youve been receiving the disability benefits for 24 months.

If youre not automatically enrolled, you can through the Social Security Administration.

Where Should Claim Related Inquiries Be Sent Oct 1 Forward

Providers are encouraged to utilize the Sunshine Health Secure Provider Portal. If providers are not in agreement with the determination of a previously disputed claim issue, inquiries should be directed to . Projects prior to Integration on Oct. 1, 2021, will continue to be reviewed until completion of the project.

Read Also: What Age Can I Apply For Medicare

How Do I Get Medicare Prescription Drug Coverage

There are two ways to get prescription drug coverage.

- You can enroll in a stand-alone Medicare Part D plan. This coverage will be in addition to Original Medicare and/or a Medicare Supplement plan.

- You can enroll in a Medicare Advantage plan that includes prescription drug coverage. This coverage will combine your medical and prescription drug coverage.

Tip: If you dont enroll in prescription drug coverage when you’re first eligible to enroll in Medicare, you may face penalties. Find out how to avoid penalties.

How To Get A Shingrix Discount Without Medicare

There are a few different ways to receive a discount on the Shingrix vaccine. SingleCares prescription discount card provides instant savings on many prescription drugs, including Shingrix. Medicare recipients cannot use SingleCare and Medicare coverage together, but they can choose to use whichever offers a better deal for them. For those who dont have a Medicare plan that covers Shingrix, SingleCare can provide a discount.

GSK, the manufacturer of Shingrix, offers apatient assistance program for those who dont have insurance coverage. However, there are income guidelines and other eligibility requirements in order to qualify. Those who are enrolled in a Medicare Part D prescription drug plan may still be eligible for the program if their income falls below a certain threshold and theyve spent at least $600 on prescription medications through their plan during the current calendar year.

Lastly, you may qualify for financial assistance through a Medicare program called Extra Help. Extra Help can help Part D consumers lower their Medicare-related costs.

Recommended Reading: Can A Person Get Shingles Twice

You May Like: How Old Do You Have To Be For Medicare

Are There Special Rules I Need To Consider

Some prescription drugs require that you adhere to special rules before your insurer will cover them. For example:

- Step therapy: If this is the first time youre taking a drug, you may be required to start with a more cost-efficient version before you can move onto a more expensive medication.

- Prior authorization: Your doctor will need to get approval before the plan will pay for a drug.

- Quantity limits: Certain drugs, such as opioids, will have limits on the number of doses and/or refills that your insurer will cover.

Your plan’s drug list will tell you which drugs require step therapy, prior authorization and quantity limits. If your medication falls into any of these categories, you may need to take action before the plan will cover the drug. Check with your doctor about your options.

Understanding The Donut Hole Coverage Gap

For most Medicare prescription plans, there is a temporary limit on what the plan covers. This is called the coverage gap, or the donut hole. In 2022, this coverage gap will be triggered once you and your plan spend a combined $4,430 on covered medications. Once youre in the coverage gap, you will pay a maximum of 25% of the cost for brand-name drugs in your plan. Although you pay only a fraction of the cost of your prescriptions, almost the full price of the drugs count toward your out-of-pocket costs.

You May Like: How Much Do You Pay For Medicare Part A

Medication Therapy Management Programs For Complex Health Needs

Plans with Medicare drug coverage must offer free Medication Therapy Management services if you meet certain requirements or are in a program to help members use their opioids safely. This program helps you and your doctor make sure that your medications are working to improve your health.

Through the MTM you’ll get:

- A comprehensive review of your medications and the reasons why you take them.

- A written summary of your medication review with your doctor or pharmacist.

- An action plan to help you make the best use of your medications

A pharmacist or other health professional will talk with you about:

- Whether your medications have side effects

- If there might be interactions between the drugs you’re taking

- Whether your costs can be lowered

- How to safely dispose of unused medications

Its a good idea to schedule your medication review before your yearly wellness visit, so you can talk to your doctor about your action plan and medication list. Bring your action plan and medication list with you to your visit or anytime you talk with your doctors, pharmacists, and other health care providers. Also, take your medication list with you if you go to the hospital or emergency room.

If you take many medications for more than one chronic health condition, contact your drug plan to see if you’re eligible for a Medication Therapy Management program.

First Of All What Is Medicare Part D

All across the nation, many Medicare beneficiaries rely on prescription medications to maintain their quality of life. This includes those over the age of 65 and those who have been diagnosed with certain diseases or disabilities.

Medicare Part D is primarily focused on Medicare drug coverage, and is responsible for helping you pay for the costs associated with prescription medications. Like Medicare Advantage, Medicare Part D plans are offered by private insurance providers.

As a result, the exact pricing, benefits, and drugs you are eligible to receive coverage for can vary from plan to plan , but most common outpatient drugs can be covered by Medicare Part D. Medicare Part D coverage can usually be bundled into a Medicare Part C plan, but Part D can also be had as a standalone plan as well.

Don’t Miss: Is Medicare Good Or Bad

Introduction To Medicare Part D

This section constitutes an introduction to Part D. For more detailed information on any of the topics in this section, please click on the links within the topics. There, you will also find relevant legislative, statutory and CFR citation.

Prior to 2006, Medicare paid for some drugs administered during a hospital admission , or a doctors office . Medicare did not cover outpatient prescription drugs until January 1, 2006, when it implemented the Medicare Part D prescription drug benefit, authorized by Congress under the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. This Act is generally known as the MMA.

The Part D drug benefit helps Medicare beneficiaries to pay for outpatient prescription drugs purchased at retail, mail order, home infusion, and long-term care pharmacies.

Unlike Parts A and B, which are administered by Medicare itself, Part D is privatized. That is, Medicare contracts with private companies that are authorized to sell Part D insurance coverage. These companies are both regulated and subsidized by Medicare, pursuant to one-year, annually renewable contracts. In order to have Part D coverage, beneficiaries must purchase a policy offered by one of these companies.

The costs associated with Medicare Part D include a monthly premium, an annual deductible , co-payments and co-insurance for specific drugs, a gap in coverage called the Donut Hole, and catastrophic coverage once a threshold amount has been met.

Skilled Nursing And Hospice Care

Medicare Part A covers the full cost of hospice care, but there are specific coinsurance costs for skilled nursing care services.

In 2022, these costs are:

- $0 coinsurance for days 1 through 20 for each benefit period

- $194.50 daily coinsurance for days 21 through 100 for each benefit period

- all costs for days 101 and beyond in each benefit period

Again, a benefit period resets after youve been discharged for 60 days or you begin inpatient care for a new diagnosis or condition.

Don’t Miss: Will Medicare Pay For Handicap Bathroom