Signing Up For Medicare Online Step

Signing up for Medicare online through the Social Security Administration is the fastest way to apply.

Enrollment takes less than 10 minutes online, according to the Social Security Administration.

How to Apply for Medicare Online

You will be asked to provide your current health insurance information or, if you receive Medicaid benefits, your Medicaid number.

You may be required to provide additional documentation if you are:

- Not a U.S. citizen

- Applying under your spouseâs work record

- Over age 65 and transitioning from your employerâs health coverage

After youâre enrolled, CMS will send you a welcome packet in the mail along with your Medicare card.

If you sign up for Medicare on your own, the packet should arrive about two weeks after you sign up.

You will also receive a âMedicare & Youâ handbook, which includes important information about your coverage.

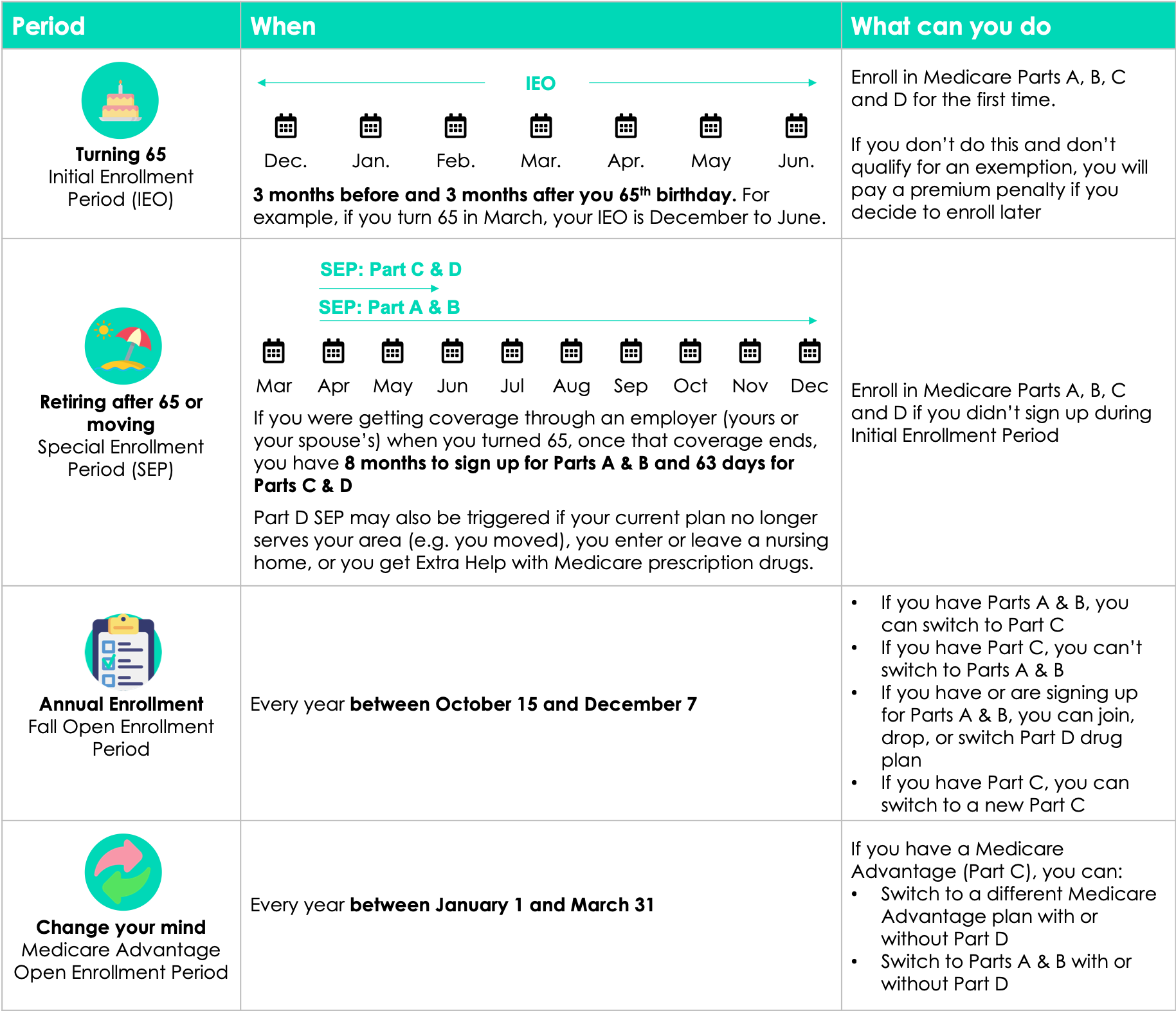

Special Enrollment Period For Parts A And B

Some people with health care coverage through their job or union, or through their spouse’s job or union, wait to sign up for Medicare Part A and/or Part B . If you or your spouse are actively working for an employer with more than 20 employees when you turn 65, you can get a Special Enrollment Period to sign up for Parts A and/or B:

- Any time you’re still covered by the employer or union group health plan through you or your spouses current employment or

- During the eight months following the month the employer or union group health plan coverage ends, or when the employment ends .

If you delay enrolling even longer, you may have to wait for coverage and you may pay a lifetime late enrollment penalty surcharge on your Medicare premiums.

If you’re under age 65, and eligible for Medicare because you’re disabled and working , the SEP rules also apply to you as long as the employer has more than 100 employees.

Signing Up For Medicare Online

Some people are automatically enrolled in Medicare and do not have to worry about manually enrolling the program. You will automatically be enrolled in Medicare Part A and Part B and receive your Medicare card in the mail three months before your 65th birthday or on your 25th month of disability if:

- You already receive retirement benefits from Social Security or the Railroad Retirement Board

- You are under 65, have a disability and have been receiving Social Security or RRB benefits for 24 months

- You live in Puerto Rico and get Social Security or RRB benefits

Also Check: Does Aarp Medicare Complete Cover Cataract Surgery

Why Might I Want To Consider Medicare Easy Pay

There are several reasons some beneficiaries may consider using Medicare Easy Pay, such as the following:

- Time savingsOnce you set it up initially, youre done. You dont need to spend time each month paying the bill manually online or going to the post office to physically mail payments.

- No missed paymentsYou wont need to remember deadlines because your Medicare premium bill will be paid on time every time.

- No lapses in coverageOn-time payments mean seamless health care coverage when and where you need it most.

Medicare Advantage: New Bill May Speed Up Your Access To Care

If you have a Medicare Advantage plan, you along with roughly 28 million others who rely on this type of coverage may soon have an easier time obtaining necessary medical care.

Currently, patients with Medicare Advantage plans often must seek prior authorization for many medical services. They, and their physicians, can face a laborious series of steps in getting approved, which can result in a delay in critical care, or worse yet, denial of care. In fact, in a 2021 survey, the American Medical Association found that more than 90 percent of physician respondents reported that prior authorization processes always, often, or sometimes delayed being able to secure necessary care for their patients.

Through legislation known as the Improving Seniors Timely Access to Care Act, officials are seeking to modernize the approval process. In addition to requiring Medicare Advantage plans to create electronic prior authorization processes, the bill also underlines the need to reduce time-consuming paperwork for routine medical procedures as well as requiring these plans to be more transparent in their reporting not only about the rate at which they approve and deny care, but also their average response times.

This September, the U.S. House of Representatives passed the legislation unanimously. The bill, which has bipartisan support in the Senate, could go to a vote by the end of 2022.

Learn more about what to look for when choosing a Medicare Advantage plan.

Read Also: Does Quest Diagnostics Accept Medicare

How To Enroll In The Various Medicare Plans

There are three types of Medicare plans that all have different ways of signing up. Each of these plans also has different enrollment periods. If youâre new to Medicare, delaying your enrollment could result in various penalties and fees. Itâs helpful to set reminders for these important dates, especially when signing up for Medicare for the first time.

| Plan | |||

|---|---|---|---|

| Original Medicare |

|

Automatic or three months before the month you turn 65 and extends three months after. | 10 percent of the monthly premium |

| Medicare Advantage Plans |

|

None | |

|

|

Six months after the month youâre 65 and enrolled in Medicare Part B. | None | |

|

|

It depends on how long you went without Part D |

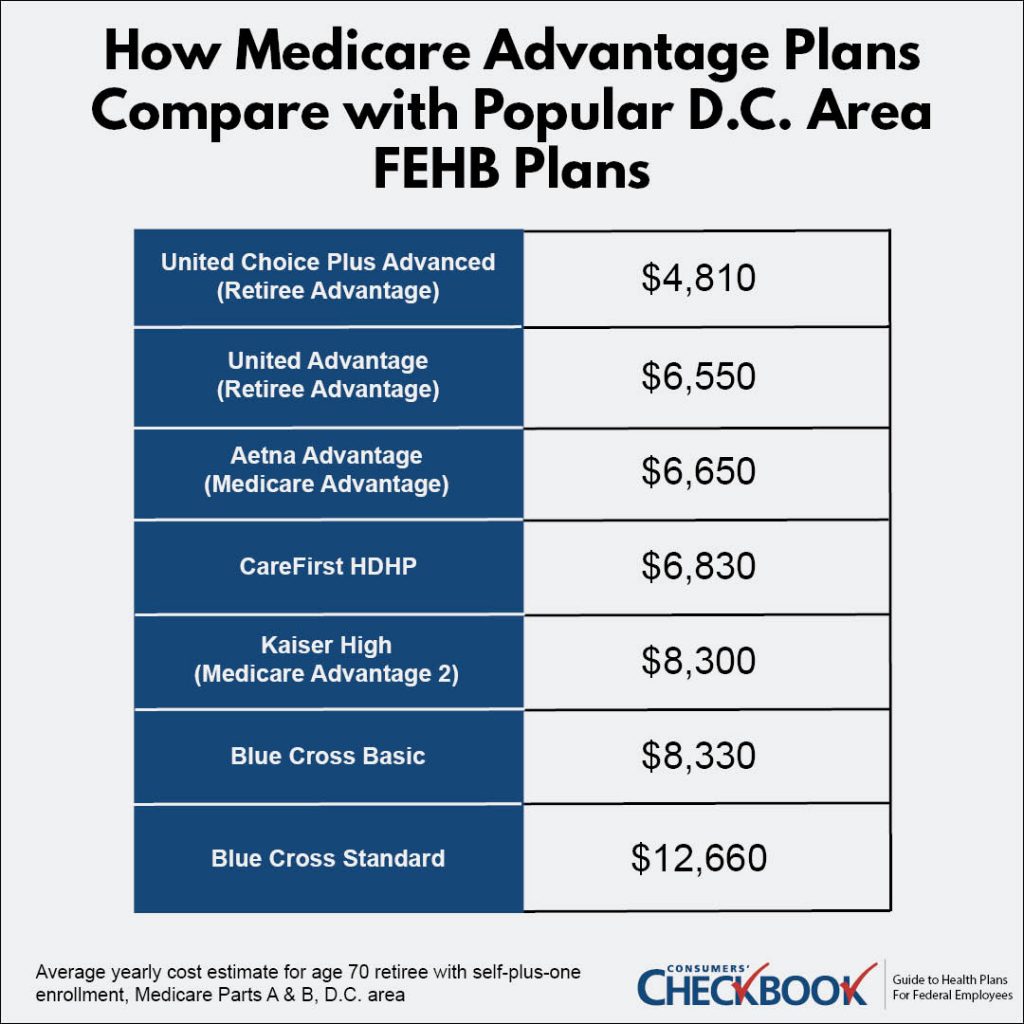

Pitfalls Of Medicare Advantage Plans

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

A Medicare Advantage Plan, also called a Part C or an MA Plan, may sound enticing. It combines Medicare Part A , Medicare Part B , and usually Medicare Part D into one plan. These plans cover all Medicare services, and some offer extra coverage for vision, hearing, and dental. They are offered by private companies approved by Medicare.

Still, while many offer low premiumssometimes as low as $0 per monththe devil is in the details. You will find that many plans unexpectedly won’t cover certain expenses when you get sickresulting in unforeseen out-of-pocket costs for youand what they pay can differ depending upon your overall health. Here’s a look at some of the disadvantages of Medicare Advantage Plans.

Read Also: Are You Eligible For Medicare If You Never Worked

Medicare Advantage Enrollment Online

The quickest and easiest way to compare Medicare Advantage plans is online, using The Official U.S. Government Site for Medicare. The best part of applying online is that you’ll have all of the information you need at your fingertips. You can then see each planâs benefits, premium, co-pays, and out-of-pocket maximum. After you’ve compared plans and selected the one you want, you’ll use your Medicare Number in order to enroll.

When You First Get Medicare

- I’m newly eligible for Medicare because I turned 65.

-

What can I do?

Sign up for a Medicare Advantage Plan and/or a Medicare drug plan.

When?

During the 7-month period that:

- Starts 3 months before the month you turn 65

- Includes the month you turn 65

- Ends 3 months after the month you turn 65

If you join

Don’t Miss: Can I Get Medicare If I Have Cancer

When To Enroll In Medicare Advantage

Medicare Advantage providers group their customers into risk pools to help spread out the costs of providing medical care. As a result, companies encourage all participants to join up and pay their monthly premiums in a set time block to help create uniformity and predictability in the risk pool. Buying into a Medicare Advantage plan is possible outside of the enrollment periods given, but it often comes at a penalty in higher prices or limited coverage for many seniors who sign up late. This makes it extra important to know when you can enroll in your chosen plan without penalties.

The Initial Coverage Election Period

Most of the people who buy into a Medicare Advantage plan do so during the initial coverage election period . This is the period that begins three months before your birth month and ends three months after it. While there is no cost penalty for signing up at any time during this period, it is highly desirable to sign up as early in the period as possible. This is because any plan with a Part D component takes approximately three months to kick in, which means you could see a temporary gap in your drug coverage if you sign up any time after your birthday. This gap could last as long as three months after the time you lose the coverage you had before switching to Medicare, so its helpful to start your research before the ICEP and get the forms submitted prior to the first day of the month you turn 65.

Medicare Advantage Annual Election Period

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

You May Like: Does Medicare Pay For Foot Care

How To Pay For Medicare Advantage

After youve signed up for a plan, you may be required to pay a monthly premium to the insurance company although many plans dont charge one. Youll also pay your Part B premiums to Medicare. Medicare beneficiaries with low incomes and sometimes few assets can get financial assistance to help pay for Medicare Part A and B premiums and sometimes deductibles, coinsurance and copayments for Parts A and B and Medicare Advantage plans.

Mark your calendar for Medicares open enrollment period and the Medicare Advantage open enrollment period each year. Even if youre satisfied with your coverage, its a good idea to go to Medicare’s Plan Finder to compare what’s available in your area. Plans can change their coverage, costs and provider networks every year.

Images: Medicare.gov

Kimberly Lankford is a contributing writer who covers personal finance and Medicare. She previously wrote for Kiplinger’s Personal Finance magazine, and her articles have also appeared in U.S. News & World Report, The Washington Post and the Boston Globe. She received the personal finance Best in Business award from the Society of American Business Editors and Writers.

If You Have Other Coverage

Talk to your employer, union, or other benefits administrator about their rules before you join a Medicare Advantage Plan. In some cases, joining a Medicare Advantage Plan might cause you to lose employer or union coverage. If you lose coverage for yourself, you may also lose coverage for your spouse and dependents.

In other cases, you may still be able to use your employer or union coverage along with the Medicare Advantage plan you join. Remember, if you drop your employer or union coverage, you may not be able to get it back.

You May Like: Does Medicare Pay For Dexcom

Why Should I Choose Medicare Advantage

A Medicare Advantage plan covers some of the gaps of Original Medicare and usually offers a $0 premium through a private company. It can be an affordable option for patients who are not currently sick or in need of intense medical care. If a patient’s situation worsens, it might be difficult or expensive to switch plans.

Medicare Advantage Where You Live

Medicare Advantage plans can be administered on state and local levels.

- Some types of plans may be available in certain regions of a state but not in others.

- Some plans may come with certain premiums and other costs in one part of a state while the same plan features different costs in another county.

- Some health insurance companies and Medicare Advantage plan providers may offer plans in one part of a state but not in others.

Learn more about Medicare Advantage plan costs and availability in your state.

Read Also: Can You Sign Up For Medicare Part A Only

Disadvantages Of Medicare Advantage Plans

In general, Medicare Advantage Plans do not offer the same level of choice as a Medicare plus Medigap combination. Most plans require you to go to their network of doctors and health providers. Since Medicare Advantage Plans cant pick their customers , they discourage people who are sick by the way they structure their copays and deductibles.

Although Mom saw her MA premiums increase significantly over the years, she didnt have any real motivation to disenroll until after she broke her hip and required skilled care in a nursing facility. After a few days, the nursing home administrator told her that if she stayed there, she would have to pay for everything out of her own pocket. Why? Because a utilization review nurse at her MA plan, who had never seen or examined her, decided that the care she was receiving was no longer medically necessary.

Because there are no commonly used criteria as to what constitutes medical necessity, insurers have wide discretion in determining what they will pay for and when they will stop paying for services like skilled nursing care by decreeing it custodial.

Don’t Give Personal Information To Plan Callers

Medicare plans aren’t allowed to call you to enroll you in a plan, unless you specifically ask to be called. Also, plans should never ask you for financial information, including credit card or bank account numbers, over the phone.

No one should call you without your permission, or come to your home uninvited to sell Medicare products. Call 1-800-MEDICARE to report a plan that does this. Learn more about how to prevent Medicare fraud and abuse.

You May Like: What Does Medicare Part B Cover

S To Sign Up For A Part D Plan

1. Compare the Part D options in your area by using the Plan Finder tool at Medicare.gov.

You can log in to your Medicare account to get information about the plans in your area. You also can use the tool without logging in.

2. If you select Continue without logging in, youll be able to choose the type of coverage you want, such as a Part D drug plan. Enter your zip code and select your county.

3. Now indicate whether you get help with your medical expenses. If youre not sure, you can find out by logging in to your Medicare account.

4. If you dont receive any help, youll be asked if you want to see your drug costs when you compare plans. Click Yes so you can get a sense of how much you would spend with each plan.

5. Enter the names of your medications. Be sure to include ones you take regularly so that youll get a good estimate of ongoing costs. Youll also need to select the dosage and quantity and indicate how frequently you need to refill your prescriptions. To add another medication, click Add Another Drug. When youre finished, click Done Adding Drugs.

6. Choose up to five pharmacies where you want to fill your prescriptions. Many plans charge lower copayments for preferred pharmacies. You can see how plans work with the pharmacies and what your copayments would be for each one. Enter the names of pharmacies you use or search by your address or zip code.

For help signing up for a Part D plan, contact your State Health Insurance Assistance Program .

Are There Any Drawbacks To Medicare Easy Pay

Not really. However, as with any automatic bill pay, you need to make sure you have enough money to cover each withdrawal to avoid potential overdraft fees. Also, starting, stopping, or changing Medicare Easy Pay can take up to eight weeks.

In addition, you cannot use Medicare Easy Pay to pay monthly premiums for Medicare products offered by private insurance companies, nor can you use it to pay for Medicare Part D premiums, so you still need to keep track of these deadlines and payments separately.

Read Also: What Is The Best Medicare Advantage Plan In Texas

Costs For Medicare Advantage Plans

What you pay in a Medicare Advantage Plan depends on several factors. In most cases, youll need to use health care providers who participate in the plans network. Some plans wont cover services from providers outside the plans network and service area.

Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for all Part A and Part B services. Once you reach this limit, youll pay nothing for services Part A and Part B cover.