Reaching Age 62 Can Affect Your Spouses Medicare Premiums

Although reaching age 62 does not qualify you for Medicare, it can carry some significance for your spouse if they receive Medicare benefits.

When one spouse in a couple turns 62 years old, the other spouse who is at least 65 years old may now qualify for premium-free Medicare Part A if they havent yet qualified based on their own work history.

- For example, Gerald is 65 years old, but he doesnt qualify for premium-free Part A because he did not work the minimum number of years required for eligibility. He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

- Lets say Geralds wife, Jessica, reaches age 62 and has worked for the required number of years to qualify for premium-free Part A once she turns 65. Because Jessica is now 62 years old and has met the working requirement, Gerald may now receive premium-free Part A.

In the above example, Jessica has not become eligible for Medicare by turning 62. Her husband Gerald, however, is now eligible to receive his Medicare Part A benefits without paying a monthly premium any longer.

How Old Do You Have To Be To Get Medicare Part C Or Medicare Supplement

To get Medicare Part C or Medicare Supplement plans, you must be enrolled in Original Medicare. This means, you must be at least 65 years old or meet the Medicare criteria for enrolling under age 65. If you do not meet these criteria, you can get Medicare at age 65.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Medicare Part C and Medicare Supplement plans both act as a supplemental coverage to Original Medicare. However, you cannot have both plans. You are only able to enroll in Medigap OR Part C. If you enroll in Medicare Part C, the plan becomes your primary coverage over Original Medicare. If you enroll in a Medicare Supplement plan, it will pay secondary to Original Medicare. Because they require you to have Original Medicare, you cannot enroll in a plan without Medicare Part A and Part B.

Do You Have To Sign Up For Medicare At 65 If Your Working Spouse Is Younger

If your younger spouse is working and has insurance available to them through their job, you can sign up for their plan. Check with their employer to see what steps need to be taken to make the process as smooth as possible.

You should weigh your options strongly when doing this to ensure that youre getting the best coverage for you at the most competitive rate possible. Usually, this is under your spouses work plan because the employer pays a significant portion of the costs.

Also Check: How To Check My Medicare Coverage

Qualifying For Medicare Under 65

If you are under 65 and have received benefits from Social Security Disability Insurance for 24 months, you will become eligible to enroll in Medicare at 62. You can apply during the 22nd month of receiving disability benefits from Social Security. Your coverage will kick in on the 25th month.

You can also qualify for Medicare at age 62 if you receive Social Security Disability Insurance because you have Amyotrophic Lateral Sclerosis , also commonly known as Lou Gherigs disease. This disease impacts the nerve cells that are in the spine and brain. If you have ALS, then the requirement of waiting 24 months to be eligible to enroll in Medicare is completely disregarded.

Last but not least, if you have End-Stage Renal Disease, you will also qualify for Medicare. End-Stage Renal Disease is a chronic kidney disease where your kidneys cannot properly function. You will typically need dialysis or a transplant once diagnosed.

Who Would Be Eligible For Medicare At 60

When someone with U.S. citizenship of at least five years reaches age 65, they become eligible for Medicare. Currently, it seems as though the age would be lowered to 60 without any additional requirements.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Therefore, millions more Americans could obtain Medicare coverage. Additionally, it is unclear if the penalties people must pay for delaying enrollment would become effective when they turn 60 rather than 65.

Now, those who lack creditable coverage and do not enroll when they age in at 65 pay late penalties through increased premiums. With this potential change, the penalties may start at 60 or remain for those who wait until after 65 to enroll.

Also Check: Which Medicare Plans Offer Silver Sneakers

What Are Your Non Working Spouses Health Insurance Options If You Continue Working

If you continue to work and turn 65, you are not required to sign up for Medicare unless your employer requires you to do so. Instead, you can continue to carry your familys health insurance as normal.

You also dont lose your Medicare eligibility because you would qualify for a Special Enrollment Period after you drop your work insurance from retirement.

Some Retiree Health Plans Terminate At Age 65

If youre not yet 65 but are retired and receiving retiree health benefits from your former employer, make sure youre aware of the employers rules regarding Medicare. Some employers dont continue to offer retiree health coverage for former employees once they turn 65, opting instead for retirees to transition to being covered solely by Medicare. Without coverage from your company, youll need Medicare to ensure that you are covered for potential health issues that arise as you age.

Read Also: What Is The Medicare G Plan

You Must Have A Valid Social Security Number And Meet Other Qualifying Requirements

If you are over the age of 65 and want to qualify for Medicare benefits, you must have a valid Social Security number and meet other qualifying requirements. You may also need to provide proof of income, such as a recent tax return or bank statement. You can find more information about qualifying for Medicare benefits on the Medicare website.

Can I Get Medicare At Age 62

Retirement and Medicare typically go hand in hand. So, if you retire at age 62 are you eligible to enroll in Medicare? Unfortunately, you would not be eligible for Medicare if you retire at age 62. You can typically get Medicare at age 65.

If you retire before age 65, you may be eligible for Social Security benefits at age 62, but that will not allow you to enroll in Medicare coverage. You will need to wait until your Initial Enrollment Period begins three months before your 65th birthday to begin the Medicare enrollment process.

You May Like: What Is Step Therapy In Medicare

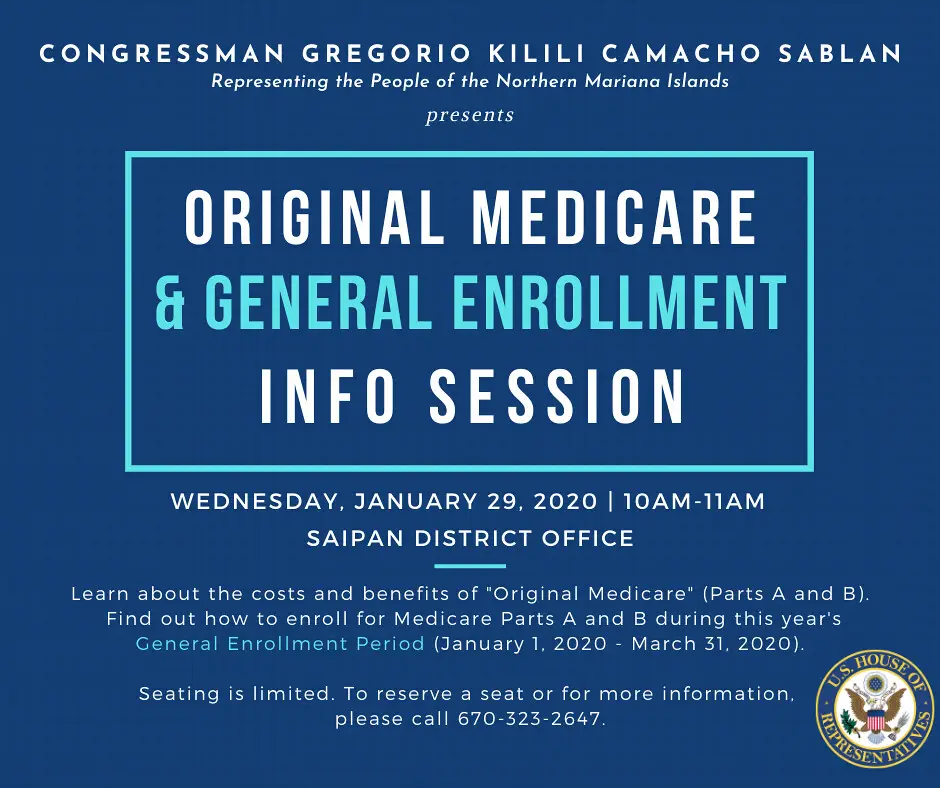

How To Apply For Medicare Part A And Part B Before Age 65

Some people are automatically enrolled in Original Medicare. If youve been receiving disability benefits from Social Security or the Railroad Retirement Board for 24 months in a row, you will be automatically enrolled in Original Medicare, Part A and Part B, when you reach the 25th month.

If you have ALS or Lou Gehrigs disease, youre automatically enrolled in Medicare the month you begin receiving your Social Security disability benefits.

Some people will need to sign up for Medicare themselves. If you have end-stage renal disease , and you would like to enroll in Medicare Part A and Part B, you will need to sign up by visiting your local Social Security Office or calling Social Security at 1-800-772-1213 . If you worked for a railroad, please contact the RRB to enroll by calling 1-877-772-5772 , Monday through Friday, 9 AM to 3:30 PM, to speak to an RRB representative.

How Medicare Works If Your Age 62 Spouse Is Still Working And Youre On Medicare

Traditional Medicare includes Part A and Part B . To qualify for Medicare, your spouse must be age 65 or older. If your spouse is age 62 , he or she could only qualify for Medicare by disability.

Hereâs an example of when a younger spouse whoâs not yet on Medicare might help you save money.

- Suppose you reach age 65 and qualify for Medicare, but you havenât worked long enough to qualify for premium-free Medicare Part A.

- And suppose your younger spouse has worked at least 10 years while paying Medicare taxes. When your spouse turns 62, youâll qualify for premium-free Part A. Your spouse wonât qualify for Medicare until they turn 65, but their work record will help you save money by getting Part A with no monthly premium.

Also Check: How To Determine Medicare Part B Premium

Can I Get Medicare Early If I Retire Early

If you retire earlier than age 65, you will not be eligible for Medicare. Although Medicare is often thought of as insurance for retired people, the Medicare age requirement is still 65. Some people continue to work past age 65 and have insurance coverage through their employer. Many people retire before they turn 65 and must purchase health insurance or are covered on their spouses insurance plan. Although you may be eligible for social security retirement benefits if you retire early, it does not change your age requirement for Medicare health insurance coverage.

How Old Do You Have To Be To Get Medicare Part D

To enroll in Medicare Part D, you must be enrolled in Medicare Part A. Thus, the age requirement for Medicare Part A will inherently become the age requirement for Medicare Part D.

This means, you will need to be at least age 65 or qualify for Medicare Part A based on disability status to enroll in Medicare Part D.

You May Like: What Is The Best Supplemental Insurance To Medicare

Weigh In: What Do You Think Of Proposals To Lower Medicares Age Requirement To 62 Or Less

So now Id like to hear from you. Do you think lowering the initial age of Medicare eligibility is a good idea? Would you be more apt to support Medicare at 62 so it would line up with Social Securitys eligibility age? Id like to hear your thoughts in the comments below.

Dont leave without downloading my Social Security cheat sheet. Its completely free and packed with information that Ive distilled from thousands of government website pages.

Also, if you havent already, you should join the other 330,000 subscribers on my YouTube channel. If youre subscribed with notifications turned on, youll know as soon as I release a new video. See you there!

Medicare Doesnt Kick In Until 65

Medicare benefits dont start until you turn 65. If you retire at 62, youll need to make sure you can afford health insurance until age 65 when your Medicare benefits begin.

With the Affordable Care Act, you are guaranteed to get coverage even if you have a pre-existing condition. You also cant be charged more than someone who is healthier. But health insurance pricing can vary by location. Many retirees whose employers paid for their insurance get caught off guard by how expensive it can be.

Also, keep in mind that Medicare does not cover all healthcare costs. Many people purchase additional health coverage to supplement their Medicare benefits. Get quotes on your health insurance costs. Build that expense into your retirement budget.

You May Like: Does Medicare Provide Dental Care

Medicare Eligibility For People Under 62

There are a few exceptions for Medicare age limits that can allow people younger than 65 and under age 62 to enroll in Medicare.

- If you have ALS , you are immediately eligible for Medicare regardless of your age as soon as your Social Security or Railroad Retirement Board disability benefits begin.

- You may also qualify for Medicare if you have kidney failure that requires dialysis or a kidney transplant, which is known as end-stage renal disease .

- You may also qualify for Medicare at age 62 or any age before 65 if you receive disability benefits from either Social Security or the Railroad Retirement Board for at least 24 months.

If you qualify for Medicare under the age of 65 because of a disability, you might also qualify for a Medicare Advantage Special Needs Plan.

Who Qualifies For Medicare Part C

Medicare Part C is an alternative way to get your Medicare Part A and Part B benefits. Medicare Advantage plans are available through Medicare-approved private insurers. To be eligible for Medicare Part C, you must already be enrolled in Medicare Part A and Part B, and you must reside within the service area of the Medicare Advantage plan you want. You can get more information about and enroll in a Medicare Advantage plan by contacting a licensed insurance agent or broker, such as eHealth.

The Medicare Advantage plan Initial Coverage Election Period is generally the same as the Initial Enrollment Period for Medicare Part A and Part B . Or, you can sign up during the Annual Election Period from October 15 to December 7 for coverage effective January 1 of the following year. You can also enroll during a Special Election Period , if you qualify.

Please note: If you have end-stage renal disease , hereâs a change you may want to know about. Starting in 2021, you may qualify for a Medicare Advantage plan if you have end-stage renal disease and meet the usual requirements listed below.

Medicare Part C is optional, and there is no penalty for not signing up. But you must have Medicare Part A and Part B to get Part C, and live in the service area of a Medicare Advantage plan.

Read Also: Will Medicare Pay For Dental

Also Check: How Much Does Medicare Pay For Hospice

Medicare At Age 65 If Your Younger Spouse Is Still Working

Do you have employer-based health insurance through your spouse? If so, you might want to delay enrollment in Medicare Part B when youâre age 65.

You generally pay a monthly premium for Medicare Part B. Most people donât pay a Part A premium. So, if youâre covered under your working spouseâs plan at age 65, you might want to save money by delaying Part B enrollment.

Check with your spouseâs health plan to make sure it will cover you, and ask how it works with Medicare.

When you qualify for Medicare at age 65, youâd be wise to learn about Medicare so you can have the best possible coverage for you. Then, you can use that wisdom to help guide Medicare planning for your spouse. Read this article on planning and budgeting for Medicare.

You might already know that your Medicare at age 65 doesnât have to stop at Medicare Part A and Part B coverage. You have other Medicare coverage choices and you can compare plans. Type your zip code in the box on this page to start looking at plans in your area.

You and your spouse have to enroll in Medicare coverage separately.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

You May Like: Is Shingles Shot Covered By Medicare Part D

How Much Does Medicare Cost At Age 65

The standard premium for Part B modestly increases year over year. Part A costs also can increase, including the annual deductible and other coinsurance. Known as hospital insurance, Part A doesnt require a monthly premium as long as you have paid Medicare taxes through employment for at least 10 years.

Part B, known as medical insurance, typically pays 80% of the covered cost while you pay the deductible and then 20%.

Recommended Reading: Does Medicare Pay For Varicose Veins

How To Get Health Insurance Before Age 65

If youre retiring at 62 and losing your employers health insurance, youll need to find other coverage until Medicare begins. You have several options. Most of these options also can help if you need coverage for other reasons, such as losing your job or facing the two-year waiting period for Medicare if you receive SSDI.

If I Retire At Age 62 Will I Be Eligible For Medicare At That Time

Medicare is federal health insurance for people 65 or older, some younger people with disabilities, and people with end-stage kidney disease. Most commonly, you are eligible for Medicare when you turn 65, but there are other health insurance options if you are younger and do not have coverage through you or your spouses employer.

What you should know

| 1. The typical age requirement for Medicare is 65, unless you qualify because you have a disability. | 2. If you retire before 65, you may be eligible for Social Security benefits starting at age 62, but you are not eligible for Medicare. |

| 3. You have options for health insurance if you are too young for Medicare. You may obtain it through your employer, or you can purchase from private-sector insurance companies through the health insurance exchange. You may be eligible for Medicaid, which is based on income. | 4. If you retire before you are 65, you may be eligible for employer-provided group health insurance under the Consolidated Omnibus Budget Reconciliation Act . |

Medicare was established in 1965 in order to provide health coverage for seniors who would otherwise not be covered by employer-sponsored health insurance plans. If you retire at the age of 62, you may be eligible for retirement benefits through social security, but early retirement will not make you eligible for Medicare.

Recommended Reading: What Is The Advantage Of Medicare Advantage