What Does Medigap Plan G Offer

Original Medicare, which covers hospital care, doctorâs visits, and related services, does not cover all care, according to the Centers for Medicare and Medicaid Services. Youâll still have a deductible, and may have copays or coinsurance fees.

Original Medicare also excludes coverage for certain servicesâsuch as routine dental care, hearing aids, and some cosmetic procedures. Depending on the cost of your care, you could end up with large copays that eat into your budget, or a deductible that makes it hard for you to cover your care out-of-pocket.

Medigap, also known as Medicare supplemental insurance, covers the cost of Original Medicare deductibles, coinsurance, and copays. It may also cover a range of services excluded from Original Medicare coverage. Medigap Plan G is also available in some states as a high-deductible plan.

What Are Other Options

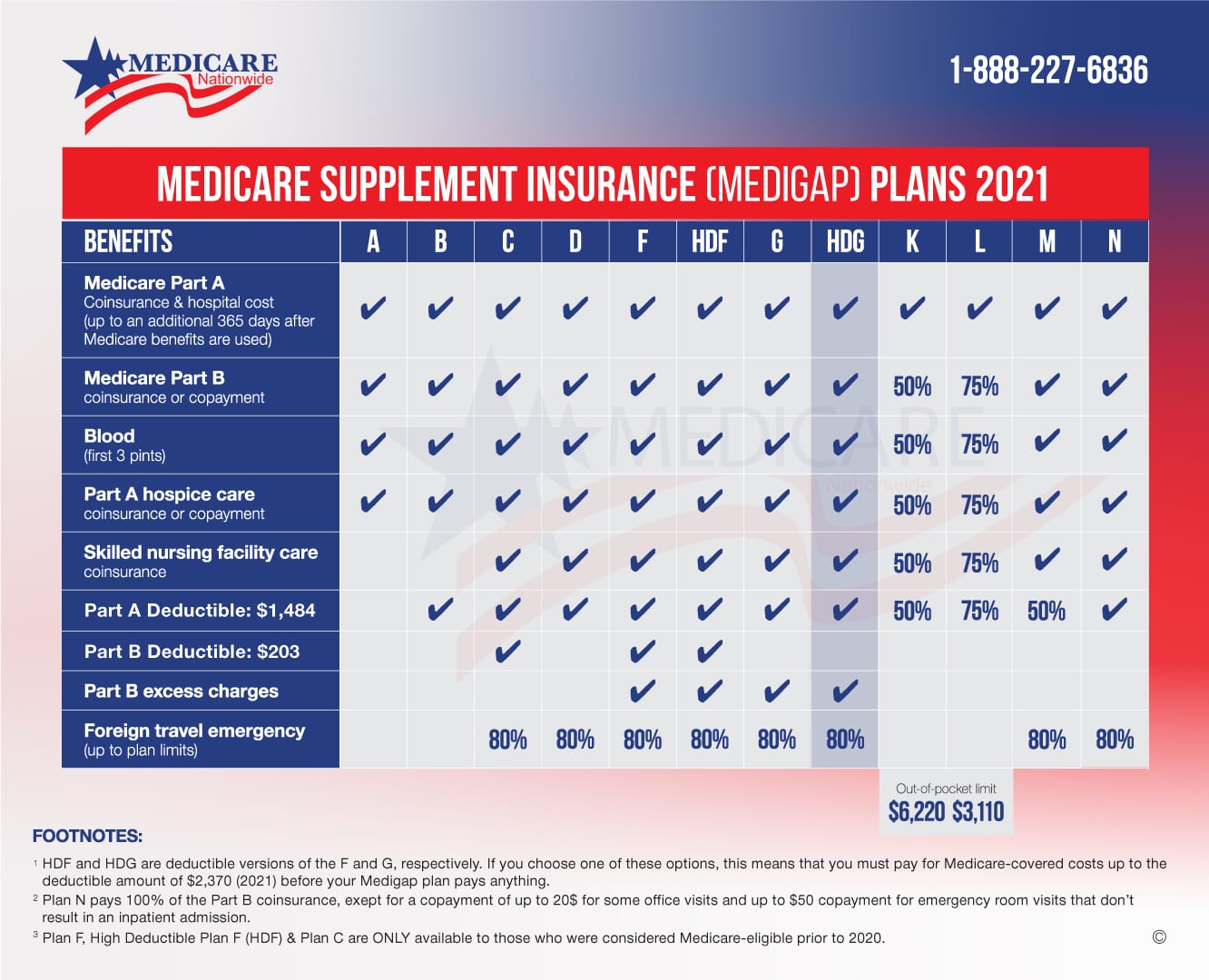

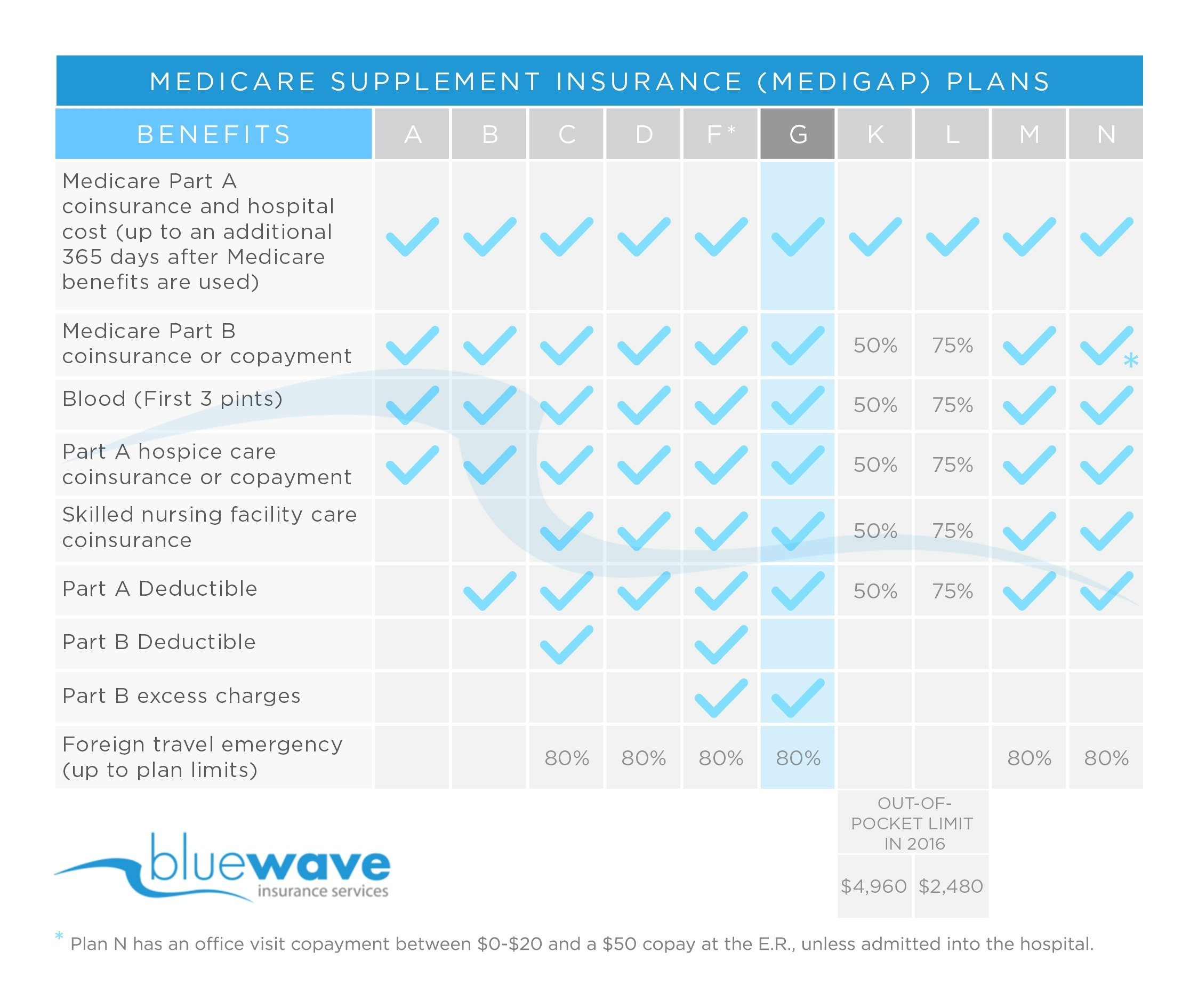

There are nine other plans for beneficiaries to consider, but Plans F, G and N are the most popular.

Plan F has for many years had the highest number of enrollees, covering more than half of policyholders from 2014 to 2017. Plans C, G and N have been popular choices, with G and N gaining popularity for the same time period.8

In 2020, Medigap Plans C and F arent available to those newly eligible for Medicare.9 If youre already a Medicare member, you can still choose Plan F or C.

Plan F and Plan N are often chosen instead of Plan G. Plan F is the most comprehensive Medigap plan since it covers 100% of the gaps in Medicare coverage, so costs more than Plan G or N. This means co-pays for Medicare-covered services and items under Medicare Part A or Part B will be $0 co-pay for those with Plan F. Plan G has nearly the same level of coverage as Plan F. With Plan G, you are responsible for the Part B deductible of $233. Otherwise, coverage is exactly the same as Plan F.

Plan N is the least expensive of these three plans but youll have more out-of-pocket costs with it. With Plan N you are responsible to pay these three items that Plan F covers in full:

- Maximum of $20 for doctor visits and $50 for ER visits

- Part B deductible of $233

If youre more focused on preventive care like doctors visits, and dont expect to have more serious medical needs, then Plan N could save you money.

How To Compare Rates For Medicare Supplement High Deductible Plan G

Well, thats the easy part. Simply give us a call, or fill out the online request form. Well contact and assist you along the way with any additional questions that may come up.

In addition, we can help with a quick and easy analysis to help you decide if this is indeed the correct path for you. Were here to help with any aspect of your Medicare journey.

Recommended Reading: Is Medicare Advantage Better Than Medigap

What Are The Advantages Of Medicare Plan G

Ball tells WebMD Connect to Care that some of the advantages of Medigap Plan G may include:

- It allows you to go to any doctor or hospital that accepts Medicare. There are no networks with a Medigap Plan G.

- The claims are automatically processed through Medicareâs crossover system, so when Medicare approves a claim, the Medigap automatically approves it as well. There are no restrictions like prior authorizations, which are so common in other plans.

- Lastly, the biggest advantage for Medigap Plan G is probably just predictable out of pocket costs. With a Plan G, you know your monthly premium and you can accurately budget for medical expenses.

âWhen someone enrolls in Plan G, they typically have a âset it and forget itâ plan for their inpatient hospital and outpatient medical care,â Malzone says. âThe only plan that’s more comprehensive is Plan F and the only difference in coverage is Plan G doesn’t cover the Part B deductible. However, the cost savings is almost always greater than the cost of that annual deductible.â

How Is Medsup Plan G Different From Other Medsup Plans

Medicare Supplement Plan G and Plan F are very similar. The main difference between them is Plan F covers your Medicare Part B deductible while Plan G doesnt.

Some of the other Medicare Supplement plans available today are only slightly different from F and G while a few are quite different. For example:

- MedSup Plan C is like Plan F but doesnt pay your Medicare Part B excess charges.

- Plan N, on the other hand, doesnt pay your Part B deductible or excess charges.

Other MedSup plans pay just a portion of costs, like your Part A deductible or your Part B copay or coinsurance fees. Some come with yearly out-of-pocket limits, too.

Recommended Reading: Does Medicare Plan F Cover International Travel

What Are The General Medicare Rates

Although Medicare quotes arent available online, we can look at general Medicare rates explained by the U.S. Centers for Medicare and Medicaid Services. Heres a list of rates for Medicare Part A.

Medicare Part A Taxes and Rates Summary

| Medicare Taxes and |

|---|

Most people with Medicare dont pay monthly rates for Part A, which is also called premium-free Part A. If you buy Part A, youll pay up to $458 per month as of 2020. If you paid Medicare taxes for less than 30 quarters , the standard Part A rate is $458. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $252.

Lets look at another factor of Medicare Part A you might want to know about.

Medicare Part A Hospital Inpatient Deductible and Coinsurance Rates

| Hospital Inpatient Deductible and Coinsurance | Estimated Medicare Part A Deductible and Coinsurance Rates |

|---|---|

| Days 1-60: Coinsurance |

**Pay 20 percent of Medicare after the deductible is met

According to the U.S. Centers for Medicare & Medicaid Services, after your deductible is met, you pay 20 percent of the Medicare-approved amount for most medical care and doctor services including inpatient hospital services, outpatient therapy, and durable medical equipment services.

Compare insurance rates in your area by entering your ZIP code in the free comparison tool below.

Medicare Medical Serviceswhat Plan G Pays

Includes expenses in or out of the hospital and outpatient hospital treatment, such as physicians services, inpatient and outpatient medical and surgical services and supplies, physical and speech therapy, diagnostic tests, and durable medical equipment.

A doctor may charge an amount for services that exceeds what Medicare covers. This is called an excess charge. Medicare puts a 15% limit on the extra amount a doctor can charge.

Read Also: What Is The Medicare Discount Card

Medigap Plan G High Deductible Coverage

The most crucial aspects of the HD Plan G plan are the benefits you will receive and the deductible amount. Your benefits will cover:

- Part B excess charges

- Foreign travel emergency

- Skilled nursing facility care coinsurance

- Part A hospice care coinsurance or copayment

- The first 3 pints of blood

- Part B coinsurance or copayment

- Part A coinsurance and hospital costs

- Durable Medical Equipment

Which Medigap Plan Is Better G Or N

Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs. Costs of Medigap policies vary by state and carrier.

Don’t Miss: Does Medicare Help Pay For Dementia Care

Medicare Supplement High Deductible Plan G Is Ideal For Those Who:

- Are comfortable paying a higher deductible in exchange for lower monthly premiums

- Semi-frequently see the doctor or need to visit the hospital

- Live in a state that allows excess charges

- Enjoy traveling outside the U.S.

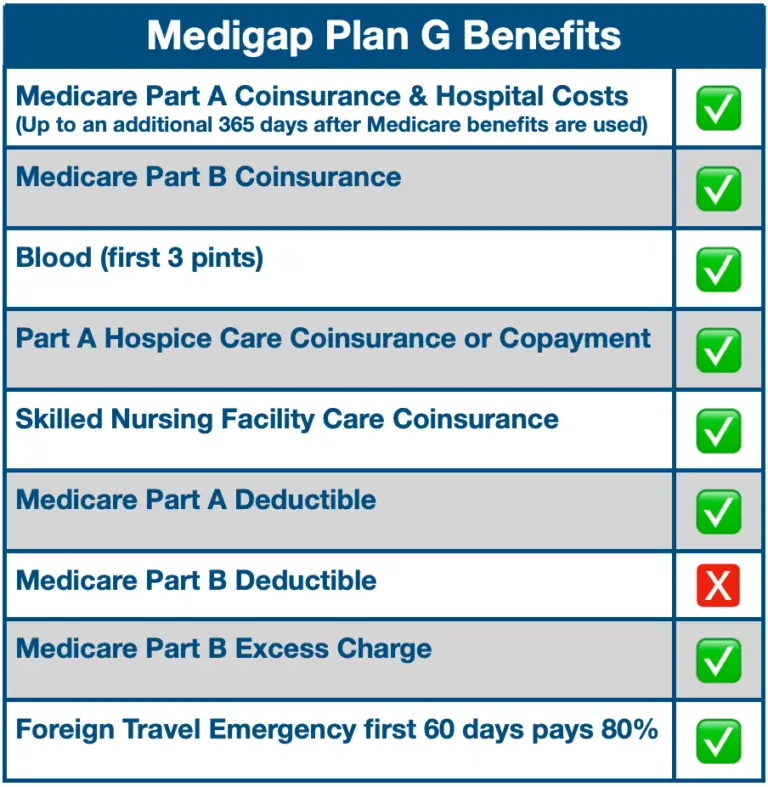

For a full summary of what Medicare Supplement High Deductible Plan G covers in contrast to other plans, see the chart below.

Does Medicare Pay Anything Before The Deductible

Even before you meet the deductibles, preventive health care costs have full Medicare coverage. Also, the Medicare program will continue to cover its portion of your healthcare costs. The Medigap plan will be the policy that doesnt pay until you meet their deductible.

So, even though you sign up for a Medigap plan, you still have your Medicare benefits. The private Medigap health insurance is a separate policy that works alongside your Medicare.

The deductibles and coinsurances you pay Medicare count towards the high deductible policy until you reach your limit. Then, the Medigap policy pays for covered services in full.

Don’t Miss: Does My Doctor Accept Medicare Advantage

What Doesnt Medicare Part G Cover

Although MedSup Plan G helps you pay most of the healthcare costs Original Medicare, or Medicare Part A and Part B, doesnt cover, it doesnt help you pay all of them.

For example, MedSup Plan G doesnt cover the Medicare Part B deductible. Youll pay for all medical services or supplies until your out-of-pocket costs reach that amount if you enroll in Plan G.

For 2020, the Medicare Part B deductible is $198 per year. After your out-of-pocket costs hit that limit, youll pay 20% of the Medicare-approved amount for most of the services Part B covers. That includes care like doctor visits and outpatient therapy.

Also, Plan G usually doesnt cover prescription drugs. Some MedSup policies used to, but thats no longer the case. For that, you need to enroll in Medicare Part D.

Finally, Medicare Supplement Plan G also wont cover any of these costs:

- Private-duty nursing.

Medicare Part N Reviews

Our three best Medicare Supplement companies, Aetna, Cigna, and AARP/UnitedHealthcare, all offer Plan N. By selecting Plan N over Plan G from these providers youll save an average of $31 a month.

Your actual Medicare Supplement plan N prices can change depending on your age, region, and other factors.

Keep in mind that Medicare supplement plan N coverage is uniform so that you will receive the same medical benefits from all providers. However, pricing, customer service, and supplemental benefits vary amongst carriers. Lets check out Medicare plan N reviews.

Medicare Supplement Aetna

The cost of Aetnas Medigap insurance is consistently less than that of its primary rivals, and the companys general commitment to providing its customers with excellent customer service makes it one of our top recommendations.

According to the NAIC customer complaint index, Aetna did poorly, rating a 1.57 for its Medicare Supplement product, much worse than the national average of 1.00.

Cigna Medicare Supplement

Despite being offered by Cigna in 48 states, the business only provides the four Medigap insurance A, F, G, and N in 46 states. Since these are the most widely used Medigap plans, beneficiaries in these states will probably discover a plan they prefer.

Long wait times, other service delays, and problems having claims authorized or reimbursed are some of the customer service issues that Cigna members and providers raise in their complaints.

Recommended Reading: Does Medicare Pay For Tdap

Medigap Plan G: Everything You Need To Know

Original Medicare covers many different services, including hospital stays and doctorâs visits. But the cost of deductibles, coinsurance, and copays can still be high. Medigap policies, also known as Medicare Supplement, help fill in these coverage gapsâand sometimes offer additional services as well. Medigap Plan G offers a wider range of coverage than all Medigap plans except for Medigap Plan F.

How Much Does Medicare Supplement Plan G Cost

Since Medicare Supplement or Medigap plans are sold by private companies, the cost of your Medigap Plan may differ from company to company, according to the Medicare Interactive. Although all the companies offer the same set of benefits under Plan G, differences in the premiums that they charge can vary greatly.Therefore, when you decide to buy a Medigap policy, you should compare the plansâ premium between different companies.The cost of your Medigap Plan depends on which factors your insurance company has chosen to decide the premium of the plan. Factors that may affect the cost of your Medigap Plan are:

- Your marital status

- Your use of tobacco

âFor someone turning 65, a Plan G can be as inexpensive as $80/month or as much as $200/month in other areas,â Ball says. âPrices for Plan G are considerably higher in some states than others. Also, although coverage on a Plan G is the exact same from company to company, the pricing is set by the company and can vary considerably. It is always prudent to check rates from a handful of companies before making a decision.â

Recommended Reading: When Do I Qualify For Medicare Insurance

How Much Will High

Like any Medigap plan, high-deductible Plan G premium costs will depend on the insurance carrier selling the plan, the pricing model used and where you live.

High-deductible Plan G will likely be among the more affordable Medigap plans because it requires you to meet the deductible before any benefits kick in.

In 2022, high-deductible Plan G had an average monthly premium of around $56 per month.1

Medicare Part B Excess Charges

This is potentially one of the most valuable areas of this Medigap plan. Medicare Supplement Plan G covers 100% of the excess charges that Original Medicare Part B leaves to the beneficiary after the yearly deductible has been met. Original Medicare provides for 80% of these expenses leaving the 20% to the beneficiary. In addition to the 20%, copays for appointments are also covered. Ultimately, these costs can add up to a substantial amount of money left to the beneficiary to pay.

Read Also: Are Doctors Required To Accept Medicare

Check Plan Pricing And Coverage

Cost is often a determining factor in many purchases. Medicare supplement insurance providers may have different costs for the same care, while some may go above and beyond the basic level of care required by law.

The federal government mandates all Medicare Supplement Plan G coverage. All plans will cover the same basics: nursing home care, extended hospital care, blood transfusions, etc. Some providers may offer more, but the cost may be higher with those plans.

What Is High Deductible Plan G

This plan is a new option for new Medicare beneficiaries after 2020. HD Plan G has the same deductible as HD Plan F and works in a similar way. For example, once you meet the high deductible for HD Plan G, you will receive all the traditional benefits of a regular Plan G. We can also assume that much like the HD Plan F, the premium for this plan will be much lower than a regular Plan G because of the steep cost of the deductible.

Recommended Reading: When Do My Medicare Benefits Start

Medicare Supplement High Deductible Plan G Annual Deductible

The deductible for the HDG is $2,700. Because of this deductible, many beneficiaries dont meet it annually. Because many dont reach the deductible, the premiums stay low and usually have fewer increases than other plan options.

If you have medical issues and go to the doctor often, the standard Plan G may be a better-suited option for your needs.

Determine If You Would Like A Regular Or A High

As you might have guessed, a high-deductible Plan G comes with a higher out-of-pocket payment than regular Plan G, but with lower monthly premiums. Itâs important to do your homework the trade-off is that with a high-deductible Plan G, there is a potential to have to pay an additional amount before receiving the benefits. Youâll need to determine the best choice for your budget, and if paying a higher monthly premium is worth it to you, to not have to pay out-of-pocket costs throughout the year.

Read Also: What Is Aetna Medicare Advantage Plan

Determine If You Are Eligible To Enroll In Medicare

Medicare enrollment eligibility begins three months before you turn 65 and extends for the three months after unless you’re eligible earlier due to disability. Otherwise, you can enroll during Open Enrollment, which runs from each year. After that, there’s no ability to enroll, only the option to adjust coverage you already are enrolled in. Changes in coverage begin in January. Every provider we look at has an eligibility check when providing you estimates, which will tell you if you’re eligible to enroll or not.

What Is The Difference Between Plan G And Plan G With A High Deductible

The difference between a regular Plan G plan and a High Deductible Plan G plan is the deductible amount and coverage timing. With a standard Supplement Plan G, youâre covered immediately and are responsible only for the $226 Part B deductible, plus your monthly premium. With a high-deductible Plan G, your coverage begins once you pay your $2,700 deductible, which then covers all future out-of-pocket costs.

Determining which one is best for you depends on your situation and if you need the coverage Plan G provides immediately or if it makes more sense to pay the lower premiums until that higher deductible is met.

Also Check: When Do You Register For Medicare

Different Types Of Medicare Supplement Insurance Plans

If you buy a Medicare Supplement insurance plan, in most states, you pick from one of the plan types, labeled A through N. Each Medicare Supplement insurance plan of the same name offers the same basic benefits. For example, Medicare Supplement Plan G will have the same basic benefits no matter which insurance company sells you the plan. Premiums for the same plan may vary. Having standard plans may make it easy for you to compare Medicare Supplement plans.

All Medicare Supplement insurance plans provide certain basic benefits. This means no matter what letter name your Medicare Supplement insurance plan has, it may pay all, or at least part, of your Medicare costs related to:

- The Medicare Part A deductible

- Hospice care copayment/coinsurance

- Up to 365 additional hospital days after your Medicare benefits are used up

- Medicare Part B coinsurance and copayments

- The first 3 pints of blood if you need a transfusion

Some Medicare Supplement insurance plan types, such as the high-deductible plans, provide additional coverage beyond the benefits listed above.