Comparing The Plans: Medicare Advantage Vs Medigap

Both Medicare Part C and Medigap plans will complement your Medicare coverage in different ways.

Medicare Supplement plans are offered by private insurers, but their rules and benefits are set by the government. These plans pay some of the out-of-pocket costs youd otherwise have to pay yourself, but they do not replace your Original Medicare. There are 10 types of Medigap plans, which are standardized so that plans within each level provide the same exact coverage. For example, all Plan L policies regardless of which company offers them must provide the same exact benefits.

Medicare Part C plans operate more like traditional health insurance than Original Medicare. Theyre also run by private companies, and they may create their own premiums, deductibles, copayments, and physician referral systems. At a minimum, Part C plans must cover everything that Medicare Part A & B does. If you choose to enroll in Medicare Part C, it will replace your Part A & B coverage.

What Is The Average Cost Of Medicare Supplement Insurance

The estimated average monthly premium for a Medicare Supplement plan can range from $150 to around $200, depending on the state you live in and your insurer.

Just like Medicare Advantage plans, its good to shop around65-year-olds stand to save an average of $840 a year with Medicare Supplement Plan G or $648 a year with Plan N if they enroll in the lowest-cost option available in their areas, according to a price comparison analysis by eHealth, Inc.

We continue looking at how private plans and Medicare can be more efficient, effective and equitable for people, says Jacobson. The good story here is in the data. Weve seen pretty consistently that inequities are much smaller in Medicare than any other source of coverage.

| Medicare Advantage vs. Medicare Supplement: Which Is Right For You? | |

|---|---|

| Medicare Advantage | |

|

|

Disadvantages Of Medicare Supplement

- There is no prescription drug coverage. Because Medigap plans are not additional insurance, they dont offer prescription drug coverage. While you can choose to purchase a standalone Part D policy, it comes with its own separate premium, deductible, and coverage limits.

- There is limited ability to switch coverage. Medigap coverage is only guaranteed during your 6-month Open Enrollment period after you turn 65 and enroll in Medicare Part B. After this period, you can be denied coverage by insurers. While you can choose to switch away from Medigap to Medicare Advantage, you may be denied coverage or face higher premiums if you decide to apply again and your health circumstances have changed.

- There are multiple plan types to navigate. With 10 differing plan types, it may be challenging to find the combination of premium, deductible, and coverage that works for you.

You May Like: What Is The Monthly Charge For Medicare

Disadvantages Of Medicare Advantage Plans

Medicare Advantage plans may not always be advantageous. Some of the disadvantages of these plans can include:

- You may be limited in your choice of health care providers, as Medicare Advantage plans are generally more restrictive than Original Medicare when it comes to where the plan may be used. Original Medicare doesnt include provider networks, while many Medicare Advantage plans may include some rules about provider networks and the doctors you can visit under the plan.

- Some services may require a referral before you can visit with a specialist, or certain specialist services may require prior authorization from your plan.

- Some Medicare Advantage plans require a monthly premium, which you pay in addition to your monthly Medicare Part B premium. And some plans may have one deductible for your drug coverage and a separate deductible for your medical coverage.

How Does A Medicare Advantage Hmo Plan Work

HMO stands for Health Maintenance Organization. These plans rely heavily on provider networks to care for their members. They do this to control costs while maintaining effective, valuable, quality care for enrollees. Providers and facilities who choose to participate with an HMO plan agree to accept a set payment for each HMO member they see.

HMO members must see a provider who participates in their plan. Care received from a non-contracted provider is not covered by the plan. In that case, the member would be responsible for the entire cost of services. The only exception to this rule is during emergency situations when access to an HMO provider is impossible.

In addition, HMO members must designate a primary care physician . They must go through that PCP for all their care, even if they need to see a specialist. If a member sees a specialist without a referral, they will have no coverage, even if that specialist is a participating provider. Their PCP will coordinate care inside and outside of their office. While this can be seen as a limitation of an HMO plan, the idea is that your PCP will have full knowledge of your health.

All Medicare Advantage plans have a maximum out-of-pocket limit or MOOP. Generally, your MOOP with an HMO plan will be lower than with a PPO plan.

Recommended Reading: Who Must Enroll In Medicare

Medicare Advantage Vs Medigap: Which Is Right For You

What Medicare CoversOriginal Medicare with Medigap BenefitsMedicare Advantage BenefitsEnrolling in MedicareEnrolling in Medicare AdvantageEnrolling in MedigapChoose Between Medigap and Medicare AdvantageCan You Switch?Its Time for Medicare Annual Enrollment: Are You Ready?

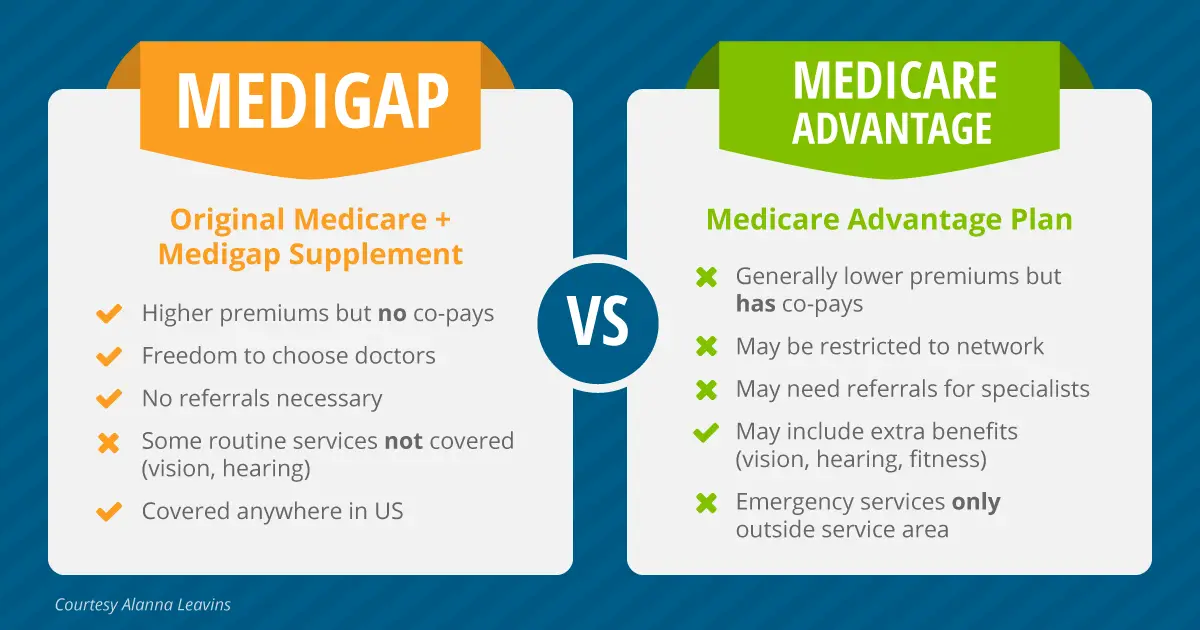

There are many factors to consider when choosing between Medicare Advantage and Medigap. Both options are offered through private carriers to fill the gaps in coverage that come with Original Medicare. They both must cover what Medicare covers, but the primary difference between the two is cost-sharing.

The Pros Of Original Medicare Plus Medigap

Original Medicare, meaning Medicare Part A and Part B, covers expenses related to hospital visits and most other medical services. However, it doesn’t cover all your medical expenses. That’s where Medigap comes in, offering coverage for expenses that original Medicare leaves up to you. The benefits of choosing a Medigap plan include:

-

More physicians to choose from. Most Medicare Advantage plans are network-based, whereas Medigap works for any doctor who accepts Medicare .

-

You don’t need to get a referral to see a specialist. In fact, you don’t even need to choose a primary care physician with Medigap.

-

The options are less confusing. There are just 10 flavors of Medigap plan, and these 10 types of plan are exactly the same all across the country. That makes it a whole lot simpler to figure out which plan is best for you. Given the many other complexities involved in setting up Medicare, anything you can do to simplify the process is a blessing.

-

There is a lot less paperwork involved in using Medigap as opposed to Medicare Advantage plans. With Medigap, the program simply sends a check to the doctor or facility without your involvement. Medicare Advantage typically requires you to make co-pays directly to the provider, adding an extra level of involvement.

-

Medigap coverage typically means lower out-of-pocket expenses than a comparable Medicare Advantage plan.

You May Like: Are Compression Stockings Covered By Medicare

What Is The Difference Between Medicare Advantage And Medicare Supplements

While Medicare Supplement plans pay secondary to Original Medicare, Medicare Advantage plans become your primary source of coverage when you enroll. Medicare pays a set amount to the carrier for the Medicare Advantage plan in which you enroll to take on your coverage needs for the calendar year.

Those new to Medicare may notice a considerable amount of Medicare Advantage plan promotion through advertisements and little to no promotion of Medicare Supplement plans. This is due to the difference in profit margins for carriers between Medicare Advantage and Medicare Supplement plans.

Depending on your lifestyle, budget, and medical coverage needs, one plan type will be more suitable for your needs than the other.

Get A Free Quote

Find the most affordable Medicare Plan in your area

How To Choose Between Medigap And Medicare Advantage

When considering whether to buy a Medigap policy or enroll in a Medicare Advantage plan, the key decision is whether you want to get your coverage from the federal government through original Medicare or a private insurer that provides Medicare Advantage plans.

If you choose original Medicare, you can use any doctor and facility that accepts Medicare. But youll have to buy separate Medigap and Part D drug coverage to fill in the gaps.

If you choose Medicare Advantage, you may have low or no premiums beyond your monthly Part B premiums. But the additional expenses that you pay out of pocket will likely be different, especially as you use more medical services. You usually need to use a provider network. If you go to an out-of-network doctor, the visit might not be covered or you might have a higher copayment.

Most Medicare Advantage plans include prescription drug coverage. Those without are designed for enrollees who have drug coverage from a previous or present employer or another source. You wont have to buy a separate Part D.

Keep in mind

If you enroll in a Medicare Advantage plan, you cannot use a Medigap policy to cover your out-of-pocket expenses. So youll have to pay any deductible, copays or coinsurance yourself. Its illegal for an insurance company to sell you a Medigap policy if youre enrolled in a Medicare Advantage plan.

Read Also: What Is Medicare Advantage Coverage

How Much Does A Medicare Advantage Plan Cost

Many Medicare Advantage plans have a $0 premium, so be sure to explore your options. Baethke explains it like this: If you enroll in a plan that does charge a premium, you must pay this fee every month in addition to your Medicare Part B premium, which is around $149 .

Medicare Part Bs coinsurance and the deductible is $203, according to Medicare.gov, and once they are met, your copay under Medicare Advantage is typically 20% of the Medicare-approved amount for most services and products, such as durable medical equipment like glucometers, walkers, hospital beds and more.

What gets many people into financial trouble is not following the rules of their plan, such as using an out-of-network provider or facility or getting products or services from a supplier not approved by Medicare.

Sometimes, patients urgently need this medical equipment and arent thinking about reading the fine print, says Baethke. This is why its so important to understand Medicares DME requirements from the beginning.

Nebulizers, for instance, are DME commonly used to treat conditions that cause difficulty breathing, such as asthma and COVID-19. If your doctor recommends one, Medicare requires you to get the machine through a Medicare-approved supplier. Not doing so will mean a denied claim from your Medicare Advantage insurerand a sizable surprise bill.

To learn more about your costs in specific Medicare Advantage plans, contact the plan or visit Medicare.gov/plan-compare.

How Do Medicare Advantage Plans Work

Medicare Advantage plans are an alternative to Original Medicare. Sold by private insurers, these plans cover everything covered by Original Medicare but may also offer extra benefits for things that Medicare doesnt. Additional benefits may include prescription drug coverage along with hearing, dental and vision care.

You can purchase a Medicare Advantage plan after enrolling in Medicare Part A hospital insurance and Medicare Part B medical insurance. When you enroll, your Medicare Advantage plan takes the place of your Medicare Part A and Part B coverage.

Don’t Miss: How Long Does It Take To Get Medicare B

Who Qualifies For Medicare Advantage

Generally, Medicare Advantage is available for:

- Seniors age 65 or older

- Younger people with disabilities

- People with end-stage renal disease

With Medicare Advantage plans, you must also be enrolled in Medicare Part A and Part B and reside in the plans service area.

Enrollment only occurs during certain periods, but you cannot be denied coverage due to a preexisting condition. Specifically, you can join or switch to a Medicare Advantage plan with or without drug coverage during the following three windows:

- Initial Medicare Enrollment Period: Begins three months before you turn 65 and ends three months after you turn 65

- Open Enrollment Period: From Oct. 15 to Dec. 7

- Medicare Advantage Open Enrollment Period: Jan. 1 to March 31 annually

How Do Medigap Plans Work

Medigap is intended simply to cover some of the gaps that Original Medicare doesnt pay for coinsurance, copayments and deductibles, for instance.

Original Medicare only pays 80% for Medicare-covered services such as your doctors services and any outpatient medical services and supplies. A Medigap plan can help cover some or all of that 20% gap that you have to pay for out-of-pocket.

Medigap cannot be used to pay for anything that Medicare Part A and Part B does not cover. This means you cant use Medigap to cover prescription drugs or the hearing, vision and dental services that Original Medicare does not cover.

If you have Original Medicare and a Medigap policy, you may also benefit from a Medicare Part D prescription drug plan to help cover prescription drug costs.

Recommended Reading: Can Doctors Limit The Number Of Medicare Patients

What Is Medicare Advantage

Medicare Advantage is private health insurance through Medicare that often also includes prescription drug coverage, or Medicare Part D. The plans usually provide coverage for things like vision, dental, disability services, home health, and other health care needs not covered by original Medicare.

âMedicare Advantage plans offer the convenience of providing all of these services in one plan,â Erin Nance, MD, a New York City-based orthopedic surgeon, tells WebMD Connect to Care. âThe costs and coverage details vary depending on the specific insurance company and what state you live in.â

Medicare Advantage plans can be HMOs, PPOs, Special Needs Plans , private fee-for-service plans, or Medical Savings Account plans.

While Medicare Advantage patients donât need referrals to see a specialist, there are some limits when it comes to providers.

âThere are different types of Medicare Advantage Plans that may limit your ability to see a certain provider,â Nance says. âThe vast majority of doctors accept Original Medicare and the Medigap supplemental insurance.â

How Are Medigap And Medicare Advantage Different

Now that weve summarized each type of policy, lets examine some of the key differences between Medigap and Medicare Advantage. One key difference between the two is that Medigap is used with Original Medicare, while Medicare Advantage is used in place of Original Medicare.

Some other major differences include how these types of Medicare insurance are used, the variety of plans that are available, the types of costs they include and whether or not they cover prescription drugs.

Recommended Reading: Will Medicare Pay For Drug Rehab

Can I Switch Between Medicare Advantage And Medicare Supplement Plans

Switching from a Medicare supplement plan to Medicare Advantage is relatively simple and can be done during the annual open enrollment periods. Switching from Medicare Advantage to Original Medicare with a Medicare supplement plan is possible, but is considerably more challenging and may result in higher out-of-pocket costs.

Start With This Informational Video

Understand that this is a lengthy video, we like to joke around by recommending to grab some popcorn and enjoy at your own pace. When watching this video, write down any additional questions that come along. Then, hop on the phone with one of us to knock em’ out one by one. We have found this to be an extremely effective way to make sure you are educating yourself to make this choice when transitioning to Medicare.

Once you have made the decision that you need to sign up for Medicare part A and Part B, it is time to decide how you fill the financial holes present in original Medicare. It is important to note that this discussion will not include retiree coverage from a former employer, the government, or through military service. If you do not plan on receiving retiree benefits, you will have to turn to the private market to find the best plan to fit your healthcare needs. This Article will help you learn how each product type works, MedigapVs.Medicare Advantage.

There are two main ways to receive additional coverage when you are Medicare eligible. The first is Medigap . The second option is Medicare Advantage .

Medigap plans are offered by private insurance companies as secondary insurance to fill in the gaps that are left by original Medicare . To learn even more details about Medigap plans, watch this video.

Read Also: Can I Add Medicare Part D At Any Time

What Are The Differences Between Medicare Advantage And Medigap

Within Medicare Advantage and Medigap, there are differences in coverage, cost and the provider networks. These vary greatly and thus are important to recognize before you decide on a plan that is right for your health situation. Below is an overview of the main differences between Advantage and Supplement coverage.

| Medicare Advantage | |

|---|---|

| Private health plan that includes Parts A and B | Private supplement coverage that supports Original Medicare Parts A and B |

| Prescriptions | |

| Network of doctors, depending on the plan | Any that participate in Medicare |

Can You Switch Yes But Theres A Catch

Its logical to consider enjoying the cost savings of a Medicare Advantage plan while youre relatively healthy, and then switching back to regular Medicare if you develop a condition you want to be treated at an out-of-town facility. In fact, switching between the two forms of Medicare is an option for everyone during the open enrollment period. This Annual Election Period runs from October 15 to December 7 each year.

Heres the catch. If you switch back to regular Medicare , you may not be able to sign up for a Medigap insurance policy. When you first sign up for Medicare Part A and Part B, Medigap insurance companies are generally obligated to sell you a policy, regardless of your medical condition. But in subsequent years they may have the right to charge you extra due to your age and preexisting conditions, or not to sell you a policy at all if you have serious medical problems.

Some states have enacted laws to address this. In New York and Connecticut, for example, Medigap insurance plans are guaranteed-issue year-round, while California, Massachusetts, Maine, Missouri, and Oregon have all set aside annual periods in which switching is allowed. If you live in a state that doesn’t have this protection, planning to switch between the systems depending on your health condition is a risky business.

Recommended Reading: How Do I Know What Medicare Coverage I Have