How Much Does Entresto Cost With Medicare

In 2022, the manufacturer of Entresto states that around 80% of individuals with Medicare Part D prescription drug plans pay less than $50 per month in out-of-pocket costs for Entresto, and over 50% of people with Medicare Part D pay $10 or less for their Entresto prescription each month. Thats a significant saving compared to uninsured individuals who pay the full list price of $623.69 for Entresto, as stated on the manufacturers website.

The amount an individual pays for Entresto with prescription insurance coverage depends on various factors such as:

- the type of Medicare coverage

- the formulary tier

- whether the individual has reached their annual deductible amount

- coinsurance or copayments

Cataract Surgery Cost And Coverage With Medicare

Medicare covers both types of cataract surgery equally. Your eye doctor will help you determine which is better for you during an eye exam.

The different plans of Medicare come into play at various points of your cataract surgery journey and provide coverage for different expenses, while working together to help you walk away from your procedure with the lowest cost possible.

Medicare Costs Went Up In 2022

The reductions come after more significant increases in costs for 2022, compared to 2021. Then. the premium went up 14.5%, or $21.60. The annual Part B deductible increased $30 in 2022, compared to 2021.

CMS said the 2022 increases were attributed to rising health care costs and expected spending on the newly approved Alzheimers drug, Aduhelm. Aduhelms price tag was then put at $56,000 per person each year. However, drug maker Biogen later cut the annual price to $28,200. And Medicare decided to cover the drug only for people with diagnoses of mild cognitive impairment due to Alzheimer’s who are participating in clinical trials.

According to CMS, lower-than-planned spending on both Aduhelm and other Part B items and services resulted in much larger reserves in the Part B account of the Supplementary Medical Insurance Trust Fund, which can be used to limit future Part B premium increases.

CMS also announced that starting next year, certain Medicare enrollees who are 36 months post kidney transplant, and therefore are no longer eligible for full Medicare coverage, can elect to continue Part B coverage of immunosuppressive drugs by paying a premium. The premium in 2023 will be $97.10.

You May Like: How Do I Find A Medicare Advocate

Medicare Part B : Out

Part B is your doctor’s office insurance under Original Medicare. It covers necessary medical treatments and preventive healthcare services. You pay a monthly premium for this coverage, which can be automatically taken out of your Social Security benefits.

Most people pay a standard monthly premium, which is set each year. In 2023, the standard monthly Part B premium amount is $164.90 . If you earn over $97,000 a year, you will pay a higher premium. If the premium is deducted from your Social Security benefits, you will pay a lower premium.

Your total annual costs for Medicare Part B premium can be up to $6,726.00.

How To Enroll In A Medicare Advantage Plan

To join a Medicare part C plan, you need to qualify for original Medicare. Original Medicare is usually available to those over the age of 65. But it is also available to younger disabled persons.

You must also be enrolled in Medicare A and B. Plus, you need not have end-stage renal disease.

Finally, you must live in the service area covered by the plan. Thankfully, the Medicare advantage plan is available to all USA residents.

You May Like: How To Pay For Medicare Without Social Security

What Is The Difference Between Medicare Part A And Part B

The primary difference between Part A and Part B is what each part covers. Part A helps pay for care and services you need related to inpatient hospitalizations and subsequent care you need in a facility or at home, for a limited time. Part B is for healthcare that is typically received when you are not admitted to a hospital, except for doctors visits that occur when you are inpatient. Part B helps pay for healthcare that you receive as an outpatient, such as, urgent care visits, visits to your doctor, durable medical equipment , and preventive care.

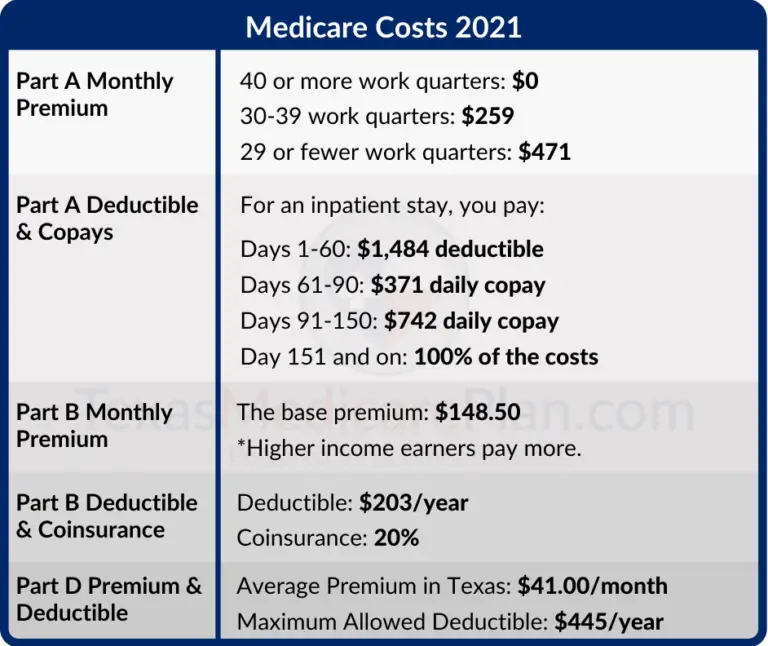

Another difference between Part A and B is the out-of-pocket costs associated with each. Most people receive premium-free Part A, but must pay a deductible, and potentially daily coinsurance, if benefits are accessed. Part B always charges a monthly premium even if you have a Medicare Advantage Plan. There is also an annual deductible , in addition to coinsurance of 20% for most Part B services.

Something that Part A and Part B have in common is that care, services, and supplies must be deemed medically necessary, ordered by a healthcare professional, and received from a Medicare-approved provider in order to be paid for by Medicare.

How Much Does Shingrix Cost With Medicare Part D

According to GoodRx, the average retail price per dose of Shingrix is about $211. You can pay as little as $155 per dose by using GoodRx. If you have Medicare Part D coverage, the standard deductible is $480 in 2022, so, if you haven’t reached your deductible, you may have to pay the entire cost of the vaccine.

Read Also: Do I Have To Re Enroll In Medicare Every Year

Medicare Part A : Out

Most people don’t need to pay monthly premiums for Part A. You won’t pay a premium if you or your spouse paid Medicare taxes for at least 10 years while working.

However, you will need to help cover the cost of some fees when you receive care. These expenses come in the form of deductibles and copayments.

If you are admitted to the hospital, you should expect to pay the following:

A deductible is the amount you pay before your insurance pays.

For Part A , the deductible is $1,600 per benefit period.1

Entresto Assistance For Medicare Patients

If you have Medicare and need help paying for your Entresto prescription medication, there are a few options that might be able to help you save money.

- With the Entresto Co-Pay Card, you may be eligible to pay as little as $10 for a 30, 60, or 90 day supply of Entresto. You can bring your co-pay card along with your prescription to a participating pharmacy. The offer from the manufacturer is not valid under Medicare, Medicaid, or any other federal or state program. To see if you qualify for this program, visit the manufacturers website or speak with your doctor.

- Enrollment in Patient Assistance Programs is also an option to help you pay for Entresto.

- You may also be eligible for Extra Help. Extra Help is a program from the Social Security Administration that helps people with limited incomes and resources pay for their Medicare prescription drug costs. To see if you qualify for Extra Help, visit the Social Security Administrations website or call 1-800-772-1213.

- If you cannot afford your medication, your doctor may be able to provide you with samples of Entresto from the manufacturer.

Don’t Miss: How To Get Dental With Medicare

Are You Looking For Free Insurance Quotes

Secured with SHA-256 Encryption

|

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsburys 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from Seve |

You May Like: Can You Only Have Medicare Part B

Will Medicare Part D Cover Vaccines

Medicare Part D works with Part A and Part B to cover vaccines. Remember that Part D is a voluntary insurance plan that costs extra each month. However, the popular coverages savings usually offset that additional cost.

Part D covers the vaccines that Part B wont. All prescription drug plans cover the Herpes Zoster vaccine. Each policy will have a compiled list, including a covered drug formulary and a list of covered inoculations.

You May Like: What Is The Difference Between Medicare And Managed Medicare

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

After you and your plan combine to spend at least $4,660 on covered drugs in 2023, you enter the Part D coverage gap.

In 2023, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit, which is $7,400, on covered drugs.

Once you enter the catastrophic coverage phase, you pay only a limited copay for covered drugs for the rest of the year.

An Overview Of The Medicare Part D Prescription Drug Benefit

Medicare Part D is a voluntary outpatient prescription drug benefit for people with Medicare provided through private plans that contract with the federal government. Beneficiaries can choose to enroll in either a stand-alone prescription drug plan to supplement traditional Medicare or a Medicare Advantage plan, mainly HMOs and PPOs, that provides all Medicare-covered benefits, including prescription drugs . In 2022, 49 million of the 65 million people covered by Medicare are enrolled in Part D plans. This fact sheet provides an overview of the Medicare Part D program, plan availability, enrollment, and spending and financing, based on data from the Centers for Medicare & Medicaid Services , the Congressional Budget Office , and other sources. It also provides an overview of upcoming changes to the Part D benefit based on provisions in the Inflation Reduction Act.

Also Check: When Do My Medicare Benefits Start

Medicare Part D Coverage For Cataract Surgery

Medicare Part D prescription drug coverage can help you pay for the prescription drugs you will need following cataract surgery.

Types of Drugs Typically Prescribed Before or After Cataract Surgery

- Antibiotics

- Antibiotics are often prescribed to prevent endophthalmitis, a rare but serious complication that can follow cataract surgery along with other bacterial infections. They are prescribed for a few days before surgery until a week or two after.

- Corticosteroids

- These steroids can reduce inflammation caused by the trauma of surgery and the release of lens proteins that can result in a painful, red eye. You usually take these medications for a few weeks following surgery.

- Nonsteroidal Anti-Inflammatory Drugs

- These are anti-inflammatory drugs that work differently and can be used in conjunction with corticosteroids. Many are over-the-counter medications such as aspirin, Advil and Aleve. Other drugs in the class, such as Celebrex, may require a prescription.

If you have Original Medicare, youll have to purchase a separate Part D prescription drug plan, but these plans are often included in a Medicare Advantage plan. You should check if a Part D plan is included before purchasing a Medicare Advantage plan.

Some medications related to your immediate surgery may be covered by Medicare Part B, but only if Medicare considers them to be medical, rather than prescription drug, expenses.

How Much Does Medicare Cost

The monthly cost of Medicare will depend on what parts and plans you select for your coverage.

| Medicare plan |

|---|

- Monthly cost: Usually free

- Annual deductible in 2023: $1,600

About 99% of enrollees get Medicare Part A for free, according to the Medicare program. Those who do not qualify will pay between $278 and $506 per month in 2023, with the exact amount based on how much they or their spouse have paid in Medicare taxes.

Medicare Part A costs nothing for most enrollees due to their previous participation in the workforce. If you have worked for more than 10 years or 40 quarters, then you are eligible to pay $0 for Medicare Part A. This is because during your working years, you contributed to Social Security and Medicare payroll taxes.

A large cost for Medicare Part A is the deductible, which is the amount you have to pay for medical care out of pocket before the plan’s benefits begin.

For 2023, the Medicare Part A deductible is $1,600. That’s $44 more than last year. However, this cost is usually covered if you enroll in a Medigap policy, and those who are enrolled in Medicare Advantage will pay their plan’s deductible instead of the Part A deductible.

Don’t Miss: How Do I Apply For Medicare When I Turn 65

What Are Medicare Costs

It’s not just about premiums. Many Americans find that qualifying for Medicare eases some financial stress, as its possible to pay less and get more. However, there are still expenses you should be aware of.

Take a moment to familiarize yourself with the out-of-pocket costs associated with Medicare Parts A, B, C, and D, so that you can select a plan that is best suited for the type of retirement youre planning on. All costs listed here apply for 2023.

What Are The 2023 Income Adjustments For Medicare Part D

If you receive Medicare Part D for prescription drug coverage — which received a massive boost this year from the passage of the Inflation Reduction Act — and earn more than a certain amount, you’ll need to pay extra monthly. The adjustment amounts for each income tier haven’t changed much at all from 2022, but the income brackets themselves all rose about 6%.

Recommended Reading: Is Medicare Automatically Deducted From Social Security

Can I Find Out How Much Medicare Will Cover Before I Choose To Have Surgery

Yes. The Centers for Medicare & Medicaid Services offer a searchable database on outpatient procedure costs. That data tool can tell you the national average cost of cataract surgery and the amounts Medicare will pay. Keep in mind, though, that these prices are for people who:

-

Have original Medicare

-

Have already met their Part B deductible

-

Do not have Medigap policies

After you reach your deductible, Part B pays 80% of the Medicare-approved amount. Your coinsurance share is 20%.

To be covered, your cataract condition must meet Medicares rules of medical necessity. CMS considers these factors in making its decision:

-

How severe is your condition? For example, a foggy lens without other symptoms may not qualify.

-

Do you also have other eye diseases?

-

How much is the cataract limiting your activity?

-

Does your documented medical history confirm the necessity?

What If I Can’t Afford Part B

If youre at least 65 and cant afford your Medicare Part B premium or deductible, there may be help. Medicare Savings ProgramsMedicare Savings Programs help those with low incomes pay premiums and sometimes coinsurance for Medicare expenses. are designed for low-income individuals who have trouble affording healthcare. To help you get started, here are the four types of MSPs, and their most-recent eligibility requirements from 2021:

- Qualified Medicare Beneficiary Program : helps pay premiums, copays, deductibles and coinsurance for Parts A and B.

- Whos eligible: individuals with income up to $1,094 per month couples making up to $1,472

If you need help finding an affordable Medicare plan, contact GoHealth. Our licensed insurance agents can help you navigate the different options and see what makes the most sense for you.

Recommended Reading: Are Podiatrists Covered By Medicare

What Does Medicare Cataract Surgery Coverage Include

Original Medicare covers an intraocular lens replacement, facility and doctor services during the surgery, and one pair of prosthetic eyeglasses or contact lenses. It also covers postoperative complications that are addressed in the office.

A basic cataract procedure involves the surgeon using a blade to remove the lens. The surgeon then replaces it with a monofocal lens that replaces the cloudy lens but doesnt enhance your vision. Subsequently, you might still require contacts or glasses after cataract surgery.

However, it is possible to upgrade your surgery by paying the additional costs out of your pocket. For instance, you can get bladeless surgery and multifocal lenses, so you dont require glasses or contacts. You will pay the remaining balance after Medicare pays for the standard procedure. Before moving forward, talk to the provider to find out exactly how much the out-of-pocket costs will be.

Medicare Part A Deductible

If you’re getting Medicare Part A for free, you’ll still pay other out-of-pocket costs, including your Part A deductible. The deductible is the amount you pay out of pocket for covered services before your health plan begins to pay. For 2023, the Medicare Part A deductible is $1,600.

Unlike most health insurance deductibles, the Part A deductible goes by benefit period rather than by calendar year. A benefit period begins the day you’re admitted and ends 60 days after you leave the hospital. You pay the inpatient hospital deductible for each benefit period, but there’s no limit to the number of benefit periods. If you’re admitted to a hospital or SNF within 60 days, the timer resets and you won’t pay another deductible.

For example, say you had an inpatient hospital stay and paid the full $1,600 deductible. You were discharged on Mar. 1 and admitted again on Apr. 15. Because your new hospital stay began within 60 days of the prior visit, you would not be charged another Part A deductible. However, if you were readmitted in June, you would pay a new Part A deductible.

Don’t Miss: How Do 0 Premium Medicare Plans Work