Beware This Medicare Gotcha When You File For Social Security

Editors Note: Journalist Philip Moeller, who writes widely on health and retirement, is here to provide the Medicare answers you need in Ask Phil, the Medicare Maven. Send your questions to Phil.

Moeller is a research fellow at the Center on Aging & Work at Boston College and co-author of How to Live to 100. He wrote his latest book, How to Get Whats Yours: The Secrets to Maxing Out Your Social Security, with Making Sen$es Paul Solman and Larry Kotlikoff. Follow him on Twitter or email him at .

Stay On Top Of Your Health

If youre living with, or at risk for, diabetesyoure not alone. Get help managing your condition with resources tailored to your health needsall in one convenient place.

- Get connected with benefits you may qualify for, such as diabetic shoes or blood glucose test equipment

- Access a 12-month view of your lab values for A1c, blood pressure, urinary protein and cholesterol

- Order in-home test kits for A1c or urine protein screenings

- Get timely reminders when youre due for screenings or medication refills

- Locate foot care resources if you are at risk for diabetes-related foot issues

- Find educational resources on healthy living and tips for better understanding your health

Eight Requirements Satisfy Medicare Blood Test Screening Benefit

- The screening must be for the purpose of early detection of cardiovascular disease, according to the Guide to Medicare Preventive Services for Physicians, Providers, Suppliers, and Other Healthcare Professionals . CMS recommends all eligible beneficiaries to take advantage of the coverage.

- The patient must be asymptomatic. The beneficiary must have no apparent signs or symptoms of cardiovascular disease, the Guide to Medicare Preventive Services for Physicians, Providers, Suppliers, and Other Healthcare Professionals explains.

Although the patient must have no apparent signs or symptoms of cardiovascular disease to qualify for the screening, he or she may exhibit one or more risk factors for cardiovascular disease, such as:

- Diabetes

- Smoking

- Stress

- The screening may take place no more often than once every five years . To stress this point, the Guide to Medicare Preventive Services for Physicians, Providers, Suppliers, and Other Healthcare Professionals offers two examples of when Medicare may deny coverage of cardiovascular screening blood tests:

- The beneficiary received a covered Lipid Panel during the past 5 years.

- The beneficiary received the same individual cardiovascular screening blood test during the past five years.

Cardiovascular screening blood tests covered under the benefit include:

Read Also: Does Shrimp Cause High Cholesterol

You May Like: What Is Blue Cross Blue Shield Medicare Advantage

Receiving Your Medicare Premium Bill

If you only have Medicare Part B and dont get your Part B premiums deducted from your benefits, youll receive a premium bill every three months.

If you have to buy Part A or owe Part D income-related monthly adjustment amounts , youll get a monthly premium bill. Your bill should arrive by mail around the 10th of the month. Youll have your payment due on the 25th of the month, so pay early to allow processing time.

Whether you prefer making individual payments or enjoy the convenience of automated payment options, Medicare’s online portal has you covered. Sign up for the free MyMedicare.gov service to familiarize yourself with all it offers.

Is Lipid Panel Covered By Insurance

4.1/5lipidcoveredlipidabout it here

Cholesterol testing at a local pharmacy can cost $5 to $25. An at-home test can cost anywhere from $15 to $25, while tests that need to be shipped to a lab can average $75 to $200. There are very few risks associated with having your blood drawn for a cholesterol test.

Also, what ICD 10 code will cover lipid panel? Z13.220

Also Know, are cholesterol tests covered by insurance?

Medicare Part B generally covers a cholesterol test once every five years. You typically donât have to pay for this test. However, you might pay a deductible or coinsurance for the doctor visit itself, or other medical services related to your health condition.

How often does Medicare cover a lipid panel?

Medicare generally covers routine high cholesterol screening blood tests once every five years at no cost to you if your provider accepts Medicare.

Recommended Reading: Does Kaiser Medicare Cover Dental

What Is Deducted From Social Security Retirement Benefits

Social Security benefits are a solid means of support for millions of retirees. When economic weakness and low interest rates sap the income-producing power of some of your assets, Social Security payments are a financial resource upon which you can rely during difficult times. Also, Social Security benefits, like stocks and bonds or a well-stocked bank account, can help you realize your retirement dreams. Be aware, however, that your benefits may be reduced for a number of reasons:

What Are Diabetic Test Strips

A diabetic test strip is a chemically treated piece of laminate that works with a blood glucose meter to check glucose levels in the blood. These disposable strips are inserted into the electronic meter after an individual pricks their finger just enough to get a droplet of blood to place on the strip.

The reaction between the blood and the strip creates a measurement of blood glucose, which can indicate ranges for those with diabetes. The use of these strips can help to diagnose diabetes. They are also pertinent in the efficacy of diabetes management, which is why those with diabetes are strongly encouraged to check their levels daily.

You May Like: Can I Enroll In Medicare Online

Also Check: Will Medicare Pay For Eye Exams

How Does Medicare Advantage Cover Diabetes

If you have Medicare Advantage, your plan must give you at least the same coverage as Parts A, B and D but there may be different rules. You may have different rights, protections and choices for where to get your care. You may even get extra benefits. For more information on coverage, read your plan materials or contact your plan for information.

There are also Medicare Special Needs plans ,6 which are a type of Medicare Advantage plan that limits membership to people with a specific disease, such as diabetes. Medicare SNPs design their benefits, provider choices, and drug formularies to meet the needs of the group they serve.

What If I Need More Test Strips Than My Reimbursement Limit

The established reimbursement limits for test strips are set at a higher level than the minimum levels suggested by the Canadian Diabetes Association. Additional information is available from the Canadian Diabetes Association Self-Monitoring Blood Glucose tool.

It is understood that there may be exceptional clinical circumstances where you require more frequent testing. Your physician may prescribe you an additional 100 test strips at a time if it has been determined that you need more test strips for exceptional circumstances.

Also Check: Is Dental Care Included In Medicare

How Often Do You Need The Test

Your doctor probably will have you take the A1c test as soon as youâre diagnosed with diabetes. Youâll also have the test if your doctor thinks you may get diabetes. The test will set a baseline level so you can see how well youâre controlling your blood sugar.

How often youâll need the test after that depends on several things, like:

- The type of diabetes you have

- Your blood sugar control

- Your treatment plan

Youâll probably get tested once a year if you have prediabetes, which means you have a strong chance of developing diabetes.

You may get tested twice each year if you have type 2 diabetes, you donât use insulin, and your blood sugar level is usually in your target range.

You could get it three or four times each year if you have type 1 diabetes.

You may also need the test more often if your diabetes plan changes or if you start a new medicine.

Itâs not a fasting test. You can take it any time of day, before or after eating.

People with diseases affecting hemoglobin, such as anemia, may get misleading results with this test. Other things that can affect the results of the hemoglobin A1c include supplements, such as vitamins C and E, and high cholesterol levels. Kidney disease and liver disease may also affect the test.

How To Sign Up For Easy Pay

If a person wishes to sign up for Medicare Easy Pay, they can print and fill out the .

Individuals who do not have access to either a printer or the internet can instead call 800-MEDICARE to request a form through the mail.

Filling out the form requires a Medicare card and bank details. The easiest way to get access to bank details is to have a blank check handy. A void check is necessary if a person intends to use their checking account for the program.

The table below shows some of the boxes on the form and suggests the information that may be required:

| Box to complete |

Recommended Reading: Is Medicare Part B Based On Income

Prepare A Conditional Claim

Once it has been determine that a conditional claim will be submitted, prepare the conditional claim using the following guidelines:

CAGC:

If using FISS DDE to enter an MSP claim:

How Is High Cholesterol Diagnosed

Your doctor diagnoses high cholesterol using a simple blood test called a lipid panel. You will be asked to fast the night before your test. Your lipid panel shows the level of LDL and HDL in your blood, as well as your triglycerides, which are a type of fat stored in the cells for energy. Your total cholesterol score is the sum of your LDL and HDL, plus 20% of your triglycerides, according to the American Heart Association .

A total cholesterol score below 200 is within the healthy range, while a total score of 240 or more is considered high cholesterol and may increase your risk of health complications.

Donât Miss: Is Shrimp High In Cholesterol Mayo Clinic

Don’t Miss: Can People On Medicare Use Good Rx

Which Parts Of Medicare Can You Pay Online

Youll need to be enrolled in both parts of original Medicare to get any additional parts of Medicare. No matter what other Medicare parts you use, you always pay for original Medicare.

You might be able to pay these parts online, but itll depend on the company and your specific plans. Some companies might not offer online payments. However, you should still be able to use online bill pay from your bank.

- Medicare Part A. Most people get Part A without a premium. However, if you or your spouse didnt work for at least 40 quarters , you may owe a monthly premium.

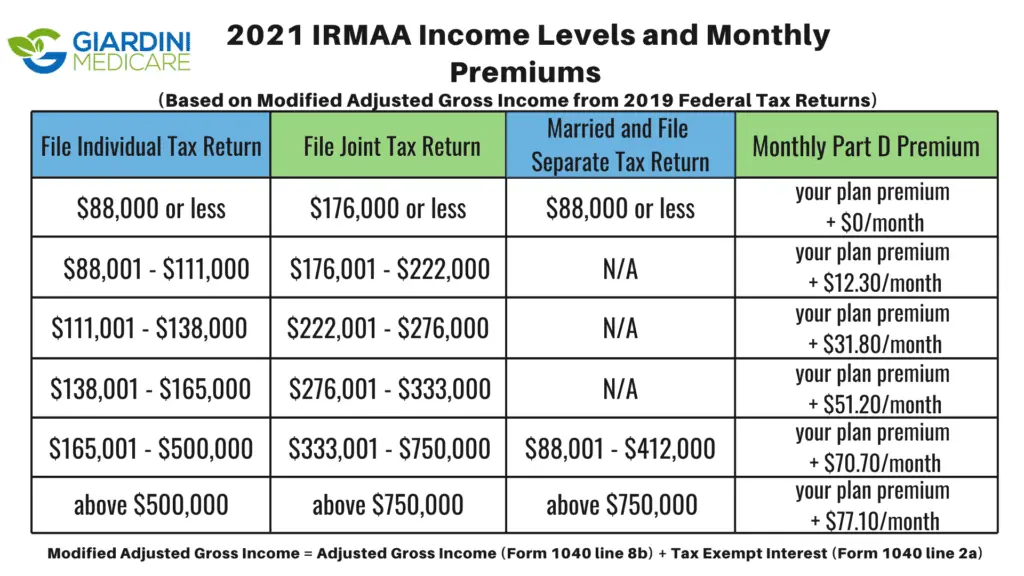

- Medicare Part B. Part B has a standard premium of $170.10 in 2022. People with a higher income typically pay whats known as an income-related monthly adjustment amount , which is added onto your premium.

- Medicare Part C . Part C is a private plan and youll need to check with your insurance provider about whether they offer online payment options or not.

- Medicare Part D .Part D is also a private plan and payment options will be specific to your insurance provider. Part D is also subject to IRMAA fees if you make a certain level of income.

If you receive an IRMAA for parts B or D, you can pay that using your MyMedicare account. Your owed IRMAA amount will be listed on your Medicare premium bill or electronic Medicare summary notice.

You have two different ways to pay your Medicare premiums online either through your MyMedicare account or your banks bill pay service.

Downsides To The Medicare Giveback Benefit

While the giveback benefit can help save you money, there are a few things to be aware of when considering enrolling in an MA plan that offers it.

- It may not be available in your service area.

- Possible reduction in benefits. MA plans cover everything Original Medicare does and more, typically including coverage for things like routine dental, vision, and hearing. However, some plans that offer a premium reduction benefit eliminate those other benefits to make up for the lower premium. You should weigh the loss of these benefits with the premium savings you’d get.

- May not save you money in the long run. Plans that offer a premium reduction may have a higher annual deductible, co-pays, or co-insurance. They may also have a smaller network of providers, and you’d have to pay more to see someone out-of-network.

- Givebacks vary. While you could get a premium reduction of the full $170.10, it could also be as low as $1. That may not be worth it depending on the other costs and benefits offered or not offered by the plan.

- Giveback amounts could change. MA plans are offered by private insurance companies that set their own fees and costs, and they can change them each year. This means the premium reduction could also change from year to year.

There are so many factors in choosing the right Medicare Advantage plan for your unique needs. That’s the true value of using a Medicare agent.

Recommended Reading: Is Everyone Eligible For Medicare

Is There Anything I Can Do To Make Dealing With The Social Security Administration Easier

You shouldnt expect as many problems dealing with the Social Security Administration while receiving benefits as you had trying to get benefits in the first place. Sometimes, though, some people have problems. Here are some things you can do to try to minimize the hassle:

- Keep all decisions, letters, and notices you receive from SSA in a safe place.

- Read everything you get from the Social Security Administration. The booklets that come with award letters and notices are well written and informative.

- When reading the booklets you receive from the Social Security Administration, pay special attention to the kind of information you are required to report to the Social Security Administration. Report promptly and in writing and keep a copy with your Social Security papers.

- Dont necessarily believe everything they tell you at the Social Security Administration 800 number. If you have an important issue to take up with the Social Security Administration, sometimes it is better to go to your local Social Security Office.

How Do I Pay My Medicare Premium Online Through My Bank

Don’t Miss: What Does Medicare Part C Cost

Is There Anything That I Can Do Now To Help Ensure That My Benefits Will Continue

The very best thing you can do is to continue seeing your doctor. A lot of people with long-term chronic medical problems stop seeing their doctors because no treatment seems to help. This is a mistake for two reasons. First, it means that when the Social Security Administration conducts a review, no medical evidence will exist to show that your condition is the same as it was when you were first found disabled. Second, and perhaps even more importantly, doctors recommend that even healthy people after a certain age periodically have a thorough physical examination. This is even more important for people who already have chronic medical problems.

What Is A Blood Test

By taking and testing a small sample of a persons blood, doctors can check for many kinds of diseases and conditions. Blood tests help doctors check how the bodys organs are working and see if medical treatments are helpful.

To help your child get ready for a blood test, find out if they need to fast or should stop taking medicines before the test. Explain what to expect during the test. If your child is anxious about it, work together on ways to stay calm.

Also Check: Do You Have Dental With Medicare

Read Also: How Much Does Medicare Pay For Physical Therapy In 2020

Ways To Pay Your Medicare Part B Premium

If youre like most people, you dont pay a monthly premium for your Medicare Part A. However, if you have Medicare Part B and you are receiving Social Security or Railroad Retirement Board benefits, your Medicare Part B premium is usually deducted from your monthly benefit payment.

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a Notice of Medicare Premium Payment Due . You will need to make arrangements to pay this bill every month.

If you are required to pay a Part D income-related monthly adjustment amount , you will also need a way to make your payment.