What Are Medicare Supplement Insurance Plans

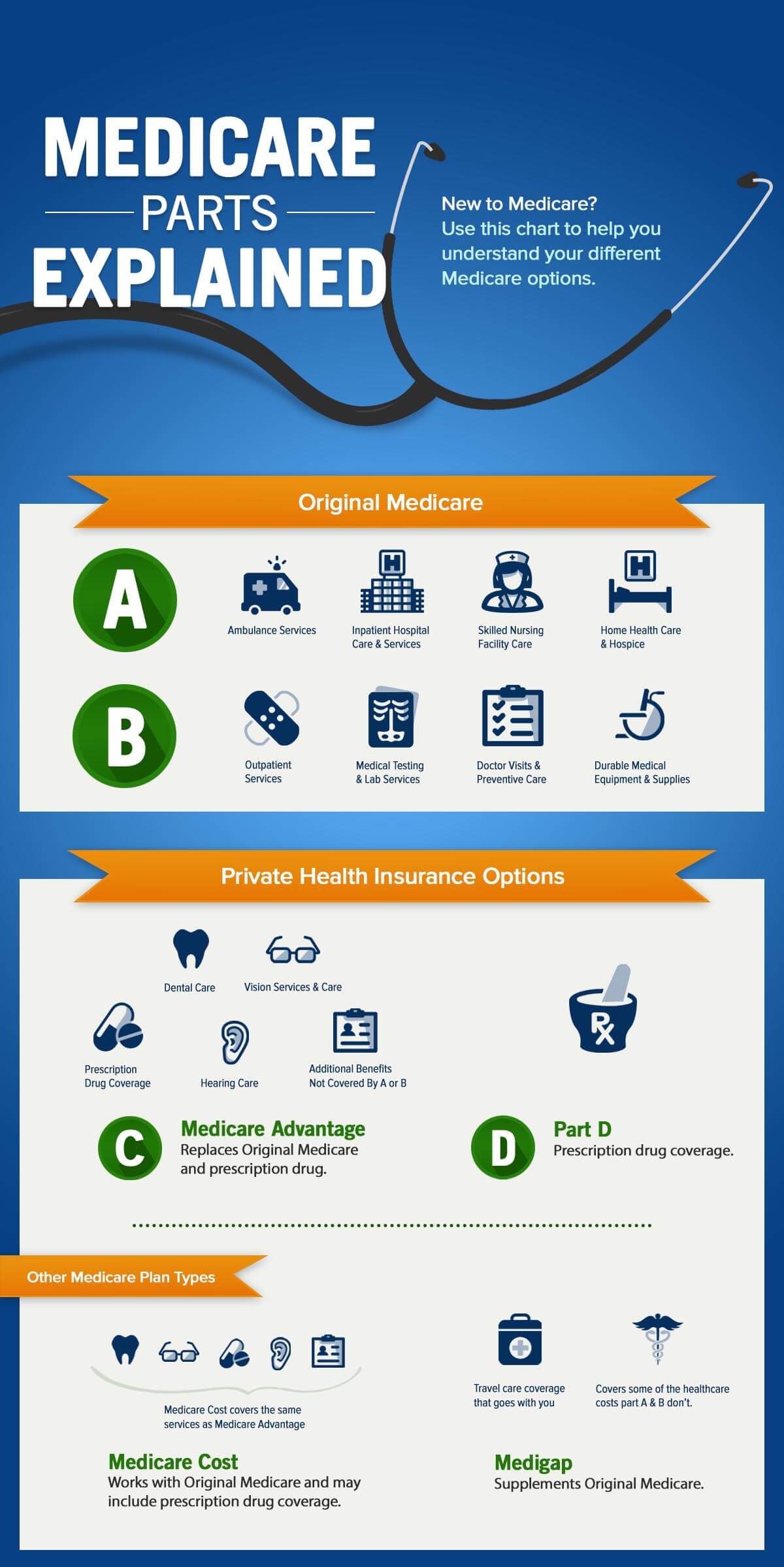

Medicare Supplement insurance, also known as Medigap or MedSup, is also sold through private insurance companies, but it is not comprehensive medical coverage. Instead, Medigap functions as supplemental coverage to Original Medicare. Current Medigap plans dont include prescription drug coverage.

Medigap plans may cover costs like Medicare coinsurance and copayments, deductibles, and emergency medical care while traveling outside of the United States. There are 10 standardized plan types in 47 states, each given a lettered designation . Plans of the same letter offer the same benefits regardless of where you purchase your plan. Massachusetts, Minnesota, and Wisconsin offer their own standardized Medigap plans.

The standardized Medigap plans each cover certain Medicare out-of-pocket costs to at least some degree. Every Medigap plan covers up to one year of Medicare Part A coinsurance and hospital costs after Medicare benefits are used up. But, for example, Medigap Plan G plans dont cover your Medicare Part B deductible, while Medigap Plan C plans do. So, if youd like to enroll in a Medicare Supplement insurance plan, you might want to compare the Medigap policies carefully.

No matter whether you enroll in a Medigap policy or a Medicare Advantage plan, you must continue paying your Part B premium.

NEW TO MEDICARE?

How Can My Medicare Part C Plan Have A $0 Premium

Medicare Advantage plans with $0 premiums are not uncommon. In fact, it was predicted that 93% of Medicare enrollees would have at least one choice for a zero-premium plan in 2020, according to the Kaiser Family Foundation. You may be wondering, how can an insurance company have $0 premiums? Thats a great question. And its easy to explain. This is how the process works:

Its important to remember that, although you may pay $0 in premiums for Medicare Advantage, this does not mean that the plan is free. You still have to pay your Part B premium, annual deductible, copayments, and coinsurance for your Part C plan.

Costs With A Medicare Advantage Plan

If you have a Medicare Advantage plan, your out-of-pocket costs may be different, even lower, than those on Original Medicare. Additionally, many MA plans include Part D coverage, so you could avoid incurring additional prescription costs. Call your plan prior to the surgery to ask about coverage and costs.

Read Also: How To Get Help Paying Your Medicare Premium

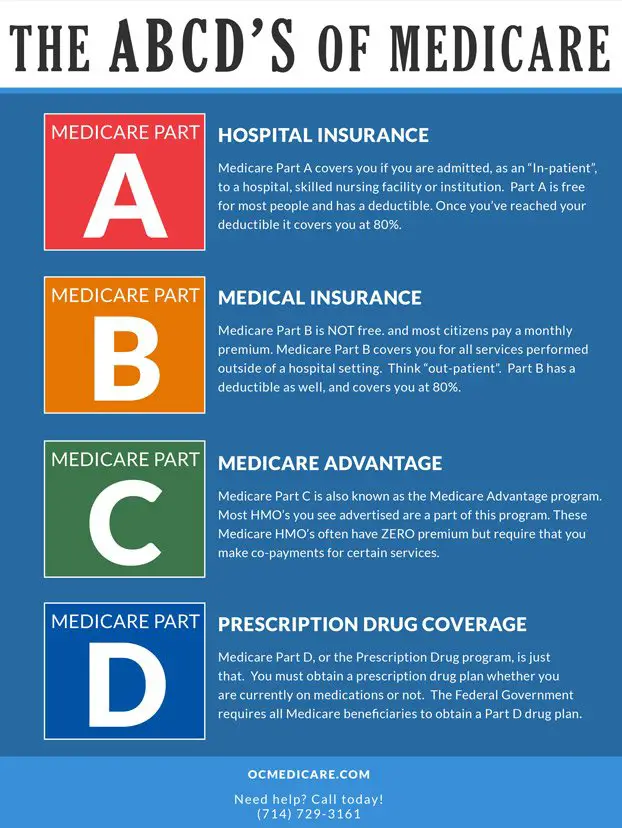

Medicare Part D Your Prescription Drug Plan

Like Medicare Advantage, Part D plans are offered by private insurance companies that are approved by Medicare. Prescription drug benefits are often included as part of Medicare Advantage plans. However, if you choose to enroll in Original Medicare you can add prescription drug coverage to your Original Medicare coverage. You can do this by purchasing a stand-alone Part D plan from a private insurer.

- What Medicare Part D covers: Part D covers prescription drugs. Every Medicare prescription drug plan has a list of drugs also known as a formulary that it agrees to cover. When you research a plan, check your list of medications against the prescription drugs in your plans formulary.

- What Medicare Part D costs: Depending on the Part D plan you choose, you will usually pay a monthly premium and sometimes a deductible, as well as out of pocket costs for your drugs. But keep in mind each plan varies in the cost of premiums, the price of drugs and the list of drugs covered.

To learn more about Medicare Part D plans, go to Unpacking Part D.

Annual Medicare Advantage Open Enrollment Period

For Medicare Advantage enrollees who are no longer in their trial period, theres an annual Medicare Advantage open enrollment period that became available starting in 2019. It runs from each year, and allows Medicare Advantage enrollees to switch to Original Medicare or to a different Medicare Advantage plan.

The ability to switch plans during the January March enrollment period is limited to one plan change per year. This open enrollment period replaced the Medicare Advantage disenrollment period that was used from 2011 to 2018, and provides more flexibility to Medicare Advantage enrollees .

When Medicare Advantage enrollees switch to Original Medicare during the January-March open enrollment period, theyre also eligible to purchase a Part D Prescription Drug Plan. But a person who has Part D coverage with Original Medicare cannot switch to a different Part D plan during the January March open enrollment period, since this window only applies to Medicare Advantage enrollees.

Alternatively, you can switch to a different Medicare Advantage plan during this period, if the one you have is not meeting your needs.

You May Like: How To Qualify For Extra Help With Medicare Part D

What About Urgent Care

Urgent care centers are common for sudden illnesses and conditions that are serious, but not life-threatening. As far as Medicare is concerned, urgent care centers involve outpatient care, so they will be covered by Part B. This means that all of the same conditions will apply as they would for outpatient care in an emergency room: you will have a copayment, pay 20 percent of the Medicare-approved amount, and your deductible will apply.

Changes During Annual Open Enrollment

There are many plan changes that Medicare beneficiaries might want to make from one year to the next.

For most of them, the applicable open enrollment period is October 15 to December 7, with changes effective on January 1. During that timeframe, you can:

- Switch from Original Medicare to Medicare Advantage, or vice versa.

- Switch from one Medicare Advantage plan to another.

- Enroll in a Part D Prescription Drug Plan for the first time

- Switch from one Part D plan to another.

- Drop your Part D coverage altogether .

Read more about the four ways you can upgrade your Medicare coverage during open enrollment. And take a minute to read about Medicare enrollment mistakes that could cost you money.

Read Also: When Can I Apply For Medicare In California

What Is The Difference Medicare Advantage Vs Medigap

There are two options commonly used to replace or supplement Original Medicare. One option, called Medicare Advantage plans, are an alternative way to get Original Medicare. The other option, Medicare Supplement insurance plans work alongside your Original Medicare coverage. These plans have significant differences when it comes to costs, benefits, and how they work. Its important to understand these differences as you review your Medicare coverage options.

Original Medicare, Part A and Part B, is a government health insurance program for those who qualify by age or disability. Part A is hospital insurance, and Part B is medical insurance. There are some out-of-pocket costs associated with Original Medicare, such as copayments, coinsurance, and deductibles. To help with those costs, if youre enrolled in Original Medicare, you can purchase a Medicare Supplement insurance plan.

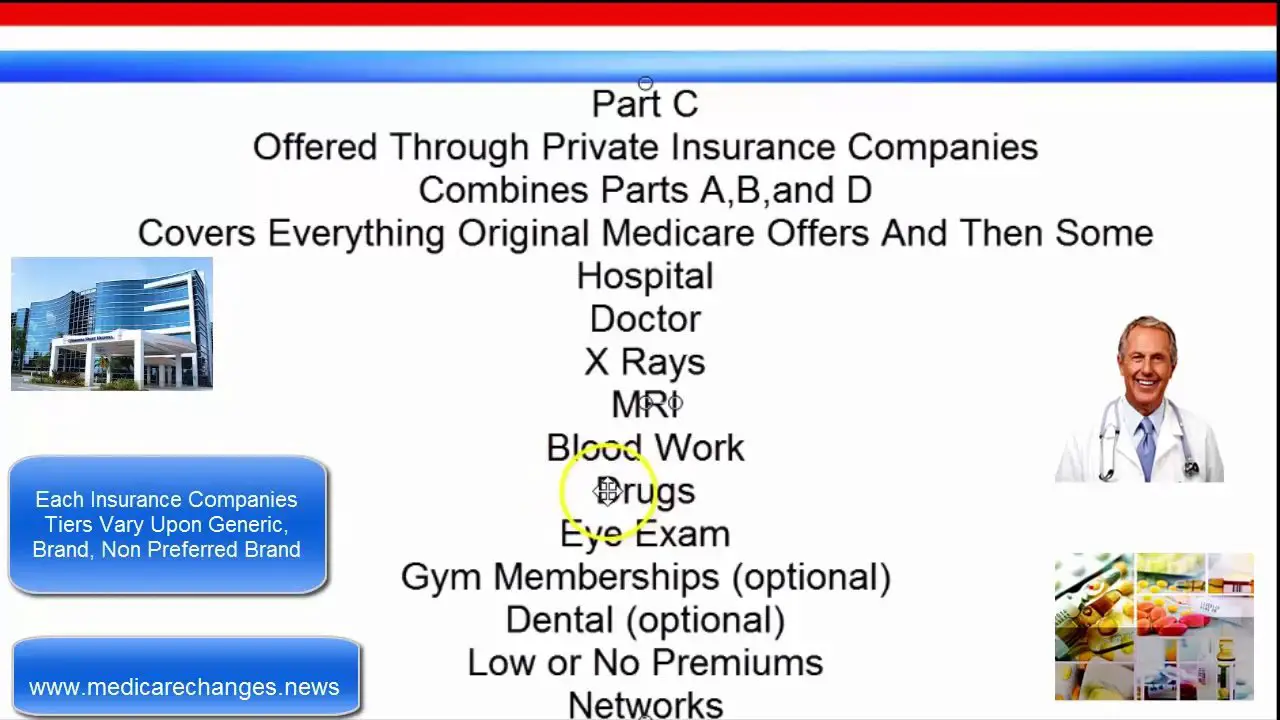

Medicare Advantage plans offer an alternative way to receive your Medicare benefits through a private, Medicare-approved insurance company. They must include all your Medicare Part A and Part B coverage , but may offer additional benefits not included in Original Medicare.

You generally cannot enroll in both a Medicare Advantage plan and a Medigap plan at the same time.

Which Companies Offer Part B Premium Reduction

Humana Medicare Advantage options include the give-back feature on some plans. In some areas, Cigna may also have a Part B premium reduction plan. Even Aetna has a Part B give back in some areas. Further, there are likely more companies offering this type of policy than just the ones weve mentioned. Also, consider the plan ratings before you enroll.

You May Like: Is Healthfirst Medicaid Or Medicare

The Pros And Cons Of Medicare Advantage

Medicare Advantage plans have benefits and drawbacks. While they’re a slam dunk choice for some people, they’re not right for everyone.

Pros:

-

Additional benefits, which may include hearing, dental and vision care.

-

Potentially lower premiums for coverage.

-

Limits on how much you may have to pay out-of-pocket for hospital and medical coverage.

Cons:

-

Less freedom to choose your medical providers.

-

Requirements that you reside and get your nonemergency medical care in the plans geographic service area.

-

Limits on your ability to switch back to Original Medicare with a Medicare Supplement Insurance policy.

Alternatives To Knee Surgery

Depending on your circumstances, Medicare may cover alternatives to knee surgery, including:

- Viscosupplementation. This procedure injects hyaluronic acid into the knee joint to help lubricate the damaged joint, reduce pain, improve movement and slow down osteoarthritis progression.

- Nerve therapy. This involves shifting of pinched nerves in the knee to help alleviate pressure and reduce pain.

- Unloader knee brace. This type of knee brace helps to limit the side-to-side movement of the knee, and puts pressure on the thigh bones to alleviate knee pain.

You May Like: When Does My Medicare Coverage Start

Choosing A Medicare Advantage Plan

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules. Most provide prescription drug coverage. Some require a referral to see a specialist while others do not. Some may pay a portion of out-of-network care, while others will cover only doctors and facilities that are in the HMO or PPO network. There are also other types of Medicare Advantage plans.

Selecting a plan with a low or no annual premium can be important. But it’s also essential to check on copay and coinsurance costs, especially for expensive hospital stays and procedures, to estimate your possible annual expenses. Since care is often limited to in-network physicians and hospitals, the quality and size of a particular plans network should be an important factor in your choice.

The Cost Of Original Medicare

When it became law, Original Medicare provided an unprecedented level of care for Americans 65 and older. But there are costs associated with the coverage. For example, with Part A, you are responsible for paying a $1,340 deductible before your benefits kick in. After that, if you have a problem that requires hospitalization for up to 60 days, Part A covers your needs. If your stay is more than 60 days, youll have to cover part of the price of your stay. And hospital costs can add up quickly, even with Part A chipping in.

Don’t Miss: Can I Get Glasses With Medicare

What Is The Part B Premium Reduction Plan

The Part B premium reduction plan is just like it sounds. You enroll in the policy, and the carrier pays either part or the whole premium for your outpatient coverage. In the summary of benefits or evidence of coverage, youll see a section that says Part B premium buy-down this is where you can see how much of a reduction youll get. Although, your agent or the customer service number on the back of your card can also tell you about the coverage.

Medicare Advantage Vs Medicare Supplement Insurance Plans

Are you trying to decide between Medicare Advantage vs. Medicare Supplement insurance? Heres a rundown of the two types of coverage.

While Original Medicare covers many health-care expenses, it doesnt cover everything. Even with covered health-cares services, beneficiaries are still responsible for a number of copayments and deductibles, which can easily add up. In addition, Medicare Part A and Part B also dont cover certain benefits, such as routine vision and dental, prescription drugs, or overseas emergency health coverage. If all you have is Original Medicare, youll need to pay for these costs out-of-pocket.

As a result, many people with Medicare enroll in two types of plans to cover these gaps in coverage. There are two options commonly used to replace or supplement Original Medicare. One option, called Medicare Advantage plans, are an alternative way to get Original Medicare. The other option, Medicare Supplement insurance plans work alongside your Original Medicare coverage. These plans have significant differences when it comes to costs, benefits, and how they work. Its important to understand these differences as you review your Medicare coverage options.

You May Like: What Information Do I Need To Sign Up For Medicare

What Does Medicare Advantage Cover

Medicare Advantage plans offer both hospital and medical insurance coverage and additional coverage. Depending on the type of plan you choose, you also may be covered for:

- Prescription drug coverage. While this isnt usually offered under original Medicare, almost all Medicare Advantage plans offer prescription drug coverage.

- Dental, vision, and hearing. This includes non-medically necessary coverage, which isnt offered under original Medicare. Most Medicare Advantage plans differ in the amount of coverage for these options.

In addition, some companies offer other health-related perks under their Medicare Advantage plans, such as gym memberships, medical transportation, and meal delivery.

Pros Of Medicare Advantage Plans

With Medicare Advantage plans, you can get personalized, coordinated medical care at a lower cost, depending on your plan. There are many advantages of enrolling in a Medicare Advantage plan. You can get:

- All of your coverage bundled together in 1 convenient plan.

- Costs that may be lower than Original Medicare.

- Extra benefits such as coverage for vision, hearing, dental, wellness programs, and discounts on health-related items.

- Prescription drug coverage .

- All the rights and protections offered through the Medicare program.

- Help paying for premiums , if you qualify.

- All the benefits of Medicare Part A and Part B plans, without buying supplemental insurance.

Also Check: Does Medicare Pay For Drug Rehab

Cons Of Medicare Advantage Plans

The following are some disadvantages of Medicare Advantage plans:

- If you select an HMO Medicare Advantage plan, you may have a small selection of providers to choose from. If you see a provider out-of-network, it can cost you more. However, other plan options will offer a wider provider network.

- With certain plans, you may see additional costs for things like drug deductibles and specialist visit copays.

- If you travel a lot, your plan may not cover services outside your service area.

Does Medicare Cover Total Knee Replacement Surgery

Osteoarthritis is one of the leading causes for people to undergo knee replacement surgery. In fact, nearly 800,000 people undergo knee replacement surgery every year in the U.S.

So a common question many people have is, does Medicare cover total knee replacement surgery? In this article, we answer that question in clear, plain English. You will also find the average costs of total knee replacement surgery and other helpful info.

Also Check: Are Blood Glucose Test Strips Covered By Medicare

How Does The Affordable Care Act Affect Medicare Advantage Costs

The Affordable Care Act made several changes to Medicare Advantage plans. Most of these changes had to do with the health insurance industry in general, including provisions for preventive care. In 2020, the ACA closed the Medicare donut hole however, that doesnt mean prescription drug coverage is free. Beneficiaries are still responsible for various costs.

But one of the major changes specific to Medicare Part C plans is that insurers are not allowed to charge plan members more than what Original Medicare would charge for certain services, such as chemotherapy. This could affect costs, depending on your plan. Only five factors can determine your monthly premium rates: age, location, tobacco use, individual vs. family enrollment, and plan category.

Who Pays The Premium For Medicare Advantage Plans

You continue to pay premiums for your Medicare Part B benefits when you enroll in a Medicare Advantage plan . Medicare decides the Part B premium rate. The standard 2021 Part B premium is $148.50, but it can be higher depending on your income. On average, those who received Social Security benefits will pay a lesser premium rate.

Usually, you pay a separate monthly premium for a Medicare Part C plan. But not all Part C plans have monthly premiums. In addition to covering medically necessary procedures, Part C plans typically provide prescription drug coverage and other types of benefits such as dental and vision. The premium you may pay is used to cover the wider range of services available with Medicare Part C.

The Medicare-approved private insurance companies that offer Medicare Part C coverage decide what services the plans will cover, so monthly premiums vary from plan to plan and state to state. Insurance companies are only allowed to make changes to the premium rate once a year.

You May Like: Is Blood Pressure Monitor Covered By Medicare

Medicare Advantage As Secondary Payer: A Quick Medicare Part C Overview

The Medicare Advantage program is also called Medicare Part C. As you may already know, Medicare Advantage plans contract with Medicare to administer your Original Medicare benefits. Medicare Advantage plans are available from private insurance companies.

Some Medicare Advantage plans offer benefits beyond Part A and Part B. Routine dental, hearing, or vision services are just a few examples. Most Medicare Advantage plans include prescription drug coverage.

When you have a Medicare Advantage plan, youre still in the Medicare program, you still need to keep paying your Medicare Part B premium. Of course, youll also have to pay the Medicare Advantage plan premium, if it charges one.

Does Part D Cover Prescription Drugs In The Emergency Room

Receiving some prescription drugs during your emergency room visit is common. Although Part D plans are usually what covers prescription drugs, you will be covered by your Part A or Part B plan for most drugs administered as part of your emergency room visit.

In general, if you dont administer the drug yourself, it will be considered as part of your inpatient or outpatient care, not as a distinct prescription drug. Many self-administered drugs will also be covered by your Part A or Part B plan if they are part of the medical care you receive during your visit. However, drugs that are prescribed to be taken after you are discharged from the hospital will not be covered by Original Medicare. To cover these drugs, youll need a Part D plan or another health insurance plan that covers drug prescriptions.

Recommended Reading: Which Insulin Pumps Are Covered By Medicare