B Late Enrollment Penalty

If you delay enrollment in Part B and don’t have coverage from a current employer , you’ll be subject to a late penalty when you eventually enroll in Part B. For each 12-month period that you were eligible for Part B but not enrolled, the penalty is an extra 10% added to the Part B premiums. And you’ll pay this penalty for as long as you have Part Bwhich generally means for the rest of your life.

In 2020, most Medicare Part B enrollees pay $144.60/month. So a person who is now enrolled but had delayed their enrollment in Medicare Part B by 40 months would be paying an extra 30% in addition to those premiums . That means they’d be paying roughly an extra $43/month for their Part B coverage, for a total of about $188/month.

Part B premiums generally change each year. Sometimes they stay the same from one year to the next, but the general trend has been upwards over time. So the part B penalty will generally also increase from one year to the next. If you’re paying 10% or 30% or 50% more than the standard rates, the dollar amount of that penalty will increase as the standard premiums increase over time.

A Late Enrollment Penalty

You’d only be subject to a Part A late enrollment penalty if you’re not eligible for premium-free Part A coverage. Most Americans don’t have to worry about this, as they have at least ten years of work history, or are/were married to someone who does. But if you’d have to pay a premium to buy Part A coverage, there’s a penalty if you delay your enrollment.

The penalty is a 10% increase in your monthly premium. In 2020, the Part A premium is $458/month for people with 0-29 quarters of work history, and $252/month for people with 30-39 quarters of work history. So those premium amounts would increase to $504/month and $277/month, respectively, if you’re subject to the late enrollment penalty.

But unlike the penalties for Part B and Part D, the penalty for late enrollment in Part A does not last forever. Instead, you’d pay it for twice as long as the amount of time you delayed your enrollment. So if you were eligible for Medicare for three years before enrolling, you’d have to pay the extra Part A premiums for six years. Keep in mind that the Part A premium changes each year , so the actual amount you’d be paying would vary for each of those six years.

I Want To Sign Up For Only Part A Or Both Part A & Part B

Once youre eligible to sign up for Medicare , you have 2 options:

Once you sign up , youll get a welcome package with your Medicare card.

Also Check: When Do I Receive Medicare

How To Apply For Medicare

The good news is if youre already receiving benefits from Social Security or the Railroad Retirement Board, you dont have to apply for Medicare. Youll automatically be signed up for Medicare parts A and B as you near your 65th birthday.

If youre not automatically enrolled, youll need to apply for original Medicare and any additional coverage you want.

What Happens If You Dont Sign Up For Medicare At 65

![When to sign up for Medicare Benefits [The 3 most common situations] When to sign up for Medicare Benefits [The 3 most common situations]](https://www.medicaretalk.net/wp-content/uploads/when-to-sign-up-for-medicare-benefits-the-3-most-common-situations.jpeg)

When you near your 65th birthday, you will enter what is called your Initial Enrollment Period . This seven-month period begins three months before you turn 65, includes the month of your birthday and continues for three additional months. This is your first opportunity to sign up for Medicare.

If you choose not to sign up for Medicare during your IEP, there are a few scenarios that might play out depending on your situation.

Medicare Advantage plans do not have a late enrollment penalty. You can sign up for a Medicare Advantage plan at any age, as long as you are already enrolled in Medicare Part A and Part B.

Medicare Supplement Insurance does not technically have a late enrollment penalty. However, if you enroll in a Medigap plan during your Medigap Open Enrollment Period, insurance providers arent allowed to use medical underwriting to determine your plan premiums or deny you coverage. Your Medigap Open Enrollment Period lasts for six months and starts as soon as you are 65 and enrolled in Medicare Part B.

There are also some Medicare Special Enrollment Periods that may apply to a someone who is turning 65. For example, if you are living overseas at the time of your 65th birthday and then later return to the U.S., you may qualify for a Special Enrollment Period for which you can sign up for Medicare with no late enrollment penalty.

Don’t Miss: How Many Medicare Credits Do I Have

Or Older And Still Working

If you are 65 or older, currently employed, and get health care coverage through your employer, you can wait to sign up for Medicare until you retire or your coverage with your employer expires. You have an 8-month window to sign up for Medicare in this scenario. This is considered a Special Enrollment Period.

When To Sign Up For Medicare And How To Apply

Home / FAQs / General Medicare / When to Sign Up for Medicare and How to Apply

Its not uncommon for new beneficiaries to have questions when signing up for Medicare. It is important to be confident that you enroll correctly to ensure you have the necessary health coverage. Below, we tell you how to effectively apply for Medicare.

Get A Free Quote

Find the most affordable Medicare Plan in your area

You May Like: Does Medicare Pay For Breast Reconstruction

Can I Avoid Penalties

There are some special circumstances in which you can sign up late for Medicare without paying penalties. After the initial enrollment period, you can sign up for optional programs during special enrollment periods.

If you or your spouse continued working past your 65th birthday and had health insurance through your employer, you wont have to pay a penalty for late enrollment in any of the Medicare programs.

Beginning the month after you end your employment, or when your group health plan insurance from that employment ends, you have an 8-month window to sign up for Medicare parts A and B without penalty.

COBRA and retiree health plans are not considered as coverage under current employment and do not qualify you for a special enrollment period or save you from late enrollment penalties.

You can also qualify for a special enrollment period for Medicare parts A and B and avoid late enrollment penalties if you were volunteering in a foreign country during your initial enrollment period.

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

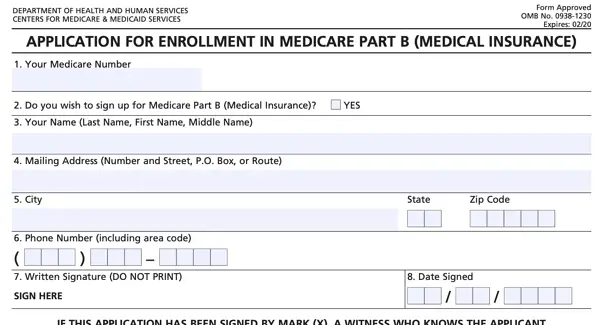

If you are enrolled in Medicare Part A and you want to enroll in Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employers signature and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

Recommended Reading: Is Keystone First Medicaid Or Medicare

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

What If Im Not Automatically Enrolled At 65

If your Medicare enrollment at 65 is not automatic, but you want to enroll, here are some more magic numbers.

3 and 7.

To start taking advantage of Medicare at 65, you need to sign up during the three months before the birthday month you turn 65. Those are the first three months of your seven-month Initial Enrollment Period.

Unless your birthday is on the first day of the month, your Initial Enrollment Period includes the three full months before turning 65, the month you turn 65, and the three months after you turn 65. If you were born on the first day of the month, IEP is the four months before your birth month, along with your birthday month and the two months after.

If you sign up during one of the months before your 65th birthday, your coverage will begin on the first day of the month you turn 65 .

Are you eligible for cost-saving Medicare subsidies?

You May Like: Does Medicare Advantage Pay For Hearing Aids

When To Sign Up For Medicare

If youre not enrolled automatically, you should sign up in the three months before your 65th birthday. That way, coverage will start on the first day of your birthday month .

You technically have seven months around your 65th birthday to enroll: the three months before your birthday month, your birthday month and the three months after. This is called your initial enrollment period. If your birthday is the first of the month, your initial enrollment period includes the four months before your birthday month and two months after.

Your coverage could be delayed if you wait until your birthday month or the three months afterward to apply for Medicare. And if you miss your initial window, you may need to sign up during Medicare’s general enrollment period. However, you may be subject to a permanent penalty unless you have continuous coverage from a large employer group health insurance plan.

Contact Social Security To Sign Up For Medicare

You can either:

Know when to sign up for Part BYou can only sign up for Part B at certain times. If you dont sign up for Part B when you turn 65, you might have to wait to sign up and pay a monthly late enrollment penalty. Find out when you can sign up. How much is the Part B late enrollment penalty?

Recommended Reading: Does Medicare Pay For Ct Scans

Example : You Are Contributing To Your Group Health Insurance Plan

In almost all cases, you can save money by switching to Medicare with a Medigap plan if youâre the one contributing to your group health insurance plan.

Health insurance premiums are sky-high, with some plans costing upwards of $800 per month. Medicareâs monthly premium is nowhere close to that, and you can even add on a Medicare Supplement with no chance of reaching that kind of premium.

In sum, you can have much better coverage for a fraction of the cost if youâre paying for your group health insurance and are over 65.

If youâd like a Medicare specialist to help you one-on-one, schedule a free Medicare planner with one of our licensed agents.

How To Sign Up For Medicare At Age 65

When you turn 65, do you automatically get Medicare? If youre already collecting social security when you turn 65, then yes, you should be automatically signed up and your Medicare card should be sent to you. If you havent received your Medicare card , youll need to apply for Parts A & B before your 65th birthday .

To sign up for Medicare online:

If you do not want to sign up for Medicare online, you can call Social Security or make an appointment at your local social security office and sign up in person.

To Note: Everyone pays a Part B premium, although some may qualify for government assistance with this cost. This Part B premium varies depending on your income, but most will pay the standard monthly premium of $148.50 , which will be billed to you quarterly. If youre receiving Social Security, the Part B monthly premium will be taken out of your Social Security.

For more information on how to sign up for medicare, read this article.

Also Check: Is Tresiba Covered By Medicare

The Bottom Line: Know Your Options Enroll On Time

Dont delay making Medicare decisions and dealing with Medicare enrollment. Learn about the choices you have can you delay, must you enroll and then understand the implications of both as they relate to your overall health and financial well-being.

Late-enrollment penalties for Medicare Part B and Medicare Part D are permanent and can have a meaningful impact on your finances so think carefully about what you do and when.

Not sure where to start? A good first step for anyone approaching Medicare eligibility is to know when your enrollment dates are. You can quickly find your dates for your Initial Enrollment Period using our enrollment date calculator.

Why Are You Forced Into Medicare

If you or your spouse worked for at least 10 years in a job where Medicare taxes were withheld , you’ll become automatically eligible for Medicare once you turn 65.

Recent immigrants are not eligible for Medicare, but once they’ve been legal permanent residents for five years and are at least 65, they have the option to purchase Medicare coverageas opposed to getting Medicare Part A for freewhich is the same option available to long-term U.S. residents who, for one reason or another, don’t have a work history that gives them access to premium-free Medicare Part A . Note that immigrants who go on to work for at least 10 years in the US do then become eligible for premium-free Part A Medicare if they’re 65 or older, just like anyone else who has paid into the Medicare system for at least a decade.

Once you become eligible for premium-free Medicare Part A, you have to enroll in Medicare Part A or you forfeit your Social Security benefits. Most individuals are unwilling to forfeit their Social Security benefits, and thus accept the enrollment into Medicare. Note that you’re only required to accept Medicare Part Awhich is premium-free if you’re receiving Social Security benefitsin order to retain your Social Security benefits. You are allowed to reject Medicare Part Bwhich has a premiumif you choose to do so, although you could be subject to a late enrollment penalty if you choose to enroll in Part B at a later date. .

Don’t Miss: When Is Open Enrollment For Medicare Supplement Plans

Do I Automatically Get Medicare When I Turn 65

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Most people who automatically get Medicare at age 65 do so because they have been receiving Social Security benefits for at least four months before turning 65. Traditionally, Medicare premiums are deducted from your Social Security check. For the longest time, you could retire with full Social Security benefits at 65 and start on Medicare at the same time.

You are still automatically enrolled in Medicare Part A and Part B at 65 if youre drawing Social Security, but not as many people draw Social Security that early these days because of changes to the eligibility age for full Social Security benefits.

In 2000, the Social Security Amendments of 1983 began pushing back the standard age for full Social Security benefits. The progressive changes are nearing their conclusion: Beginning in 2022, the standard age for full benefits will be 67 for anyone born after 1960.

Besides the Medicare eligibility age of 65, what remains unchanged is that you can opt to begin drawing partial Social Security benefits as early as age 62. So, if you opt for accepting partial Social Security benefits before age 65, you are automatically enrolled in Medicare.

A smaller group of people also automatically get Medicare at age 65: people who receive Railroad Board benefits for at least four months before 65.

Questions To Ask Your Employer Benefits Manager Include:

- Will my health insurance change if I enrolled in Medicare? If so, how?

- How much is deducted from my paycheck for my employer health insurance?

- Do I have through my employer?

- How will my covered dependents be impacted if I choose to get Medicare?

This information will help you weigh your choices and decide whats best for you. You may decide to enroll in Medicare Part A, Part B or both. Or you may be able to and want to delay enrolling in Medicare all together until you retire.

Recommended Reading: What Is Gap Coverage For Medicare