What You Need To Know About Medicare Advantage Plans

- You can only join at certain times during the year unless you qualify for a Special Election Period. In most cases, you enroll in a plan for a year.

- The Medicare Advantage Open Enrollment Period allows beneficiaries to switch to another plan. They can even return to Medicare and enroll in a Medicare Supplement plan if theyre unhappy with their current Advantage plan.

- Check with the plan before you get a service to find out if the service is covered and what your costs might be.

- Many times, Medicare Advantage plans require prior authorization.

- Following plan guidelines, like getting a referral when needed, can keep your costs lower. Check with your plan.

- Providers can join and leave a plans provider network at any time during the year. Your policy can change the providers in the network at any time. If either of these things happens, youll need to choose a new provider.

- If your plan decides to stop participating in Medicare, join another Health plan or return to Medicare.

- Once you enroll, youll automatically lose any drug plan you had. You cant have an MA plan and a separate prescription drug plan unless it is a PFFS Medicare Advantage plan.

- You get prescriptions through most Advantage plans. Individuals with a Medigap or Medicare will need a separate drug policy.

Find Cheap Medicare Plans In Your Area

In Texas, the average cost of a Medicare Advantage plan is $34 per month, and the average cost of a Medicare Part D plan is $52 per month.

Among the companies offering plans for 2022, UnitedHealthcare/AARP stands out as one of the best Medicare Advantage providers for most people in Texas. For those looking for stand-alone prescription drug coverage, the best overall Medicare Part D plan in Texas is from Humana.

- 4.2 out of 5 stars on Medicare.gov

- Average cost in Texas: $28 per month

- Good benefits across a variety of plans

- 4.2 out of 5 stars on Medicare.gov

- Average cost in Texas: $40 per month

- Low-cost generic prescriptions

How we chose these Medicare plansOur data-backed research on 2022 Medicare plans in Texas considered Medicare Advantage plans that include prescription drug benefits and providers operating in at least 10 Texas counties. We compared monthly rates, provider quality and plan benefits. When there was a tie, we looked at a plan’s other plan features such as discounts or add-ons.

List Of Medicare Advantage Plans

Medicare Advantage, also known as Medicare Part C, are bundled health plans that provide medical benefits that are at least as good as Original Medicare . In many cases, plans also include coverage for prescription drugs, dental and vision, making them a great way to simplify your insurance.

Here’s how the 2022 Medicare Advantage plans stack up:

| Category |

|---|

| 3.9 |

Average star rating and monthly cost of 2022 plans sourced from Medicare.gov

When choosing a plan, Medicare Advantage star ratings are one of the most important tools to get a snapshot of a plan’s overall performance, customer satisfaction and comprehensiveness of coverage.

However, each insurer will have its pros and cons.

Even our best overall pick isn’t the best for everyone because of its higher costs and limited availability. On the other hand, if you have specialized health care needs, then you could prioritize a plan with a diverse provider network, which may give you better access to specialists. And if you’re looking for cheap coverage, keep in mind that there might be some trade-offs in terms of the plan’s benefits.

Below we compare some of the largest Medicare Advantage plans and providers across several categories. If you want additional options, consider Medicare Advantage plans from regional providers. These smaller companies offer plans in limited regions, but if you live in their service area, they can be a great way to get top-rated coverage.

Read Also: When Do You Get Medicare When On Disability

Enrolling In Medicare Advantage In Texas

To enroll in a Medicare Advantage plan, you must be eligible for Original Medicare.

You are still in the Medicare program if youre enrolled in a Medicare Advantage plan, and you still need to continue paying your Medicare Part B monthly premium.

Medicare Advantage plans in Texas can vary based on your service area.

If you have end-stage renal disease , you might not qualify for most Medicare Advantage plans . You can call a Medicare Advantage plan directly, or call Medicare at the number at the bottom of this page, to discuss your specific situation.

Blue Cross Medicare Advantage Service Areas

Atascosa, Bastrop, Bandera, Bexar, Burnet, Caldwell, Cameron, Chambers, Collin, Colorado, Comal, Cooke, Dallas, Denton, El Paso, Fannin, Fayette, Fort Bend, Galveston, Gonzales, Guadalupe, Hardin, Harris, Hays, Hidalgo, Hill, Hood, Jefferson, Johnson, Kendall, Lamp, Lee, Liberty, Llano, Matagorda, McMullen, Medina, Milam, Montgomery, Navarro, Real, Rockwall, Tarrant, Travis, Wharton, Willacy, Williamson, Wilson and Wise counties.

Also Check: What Is The Cost Of Medicare Supplement Plan F

Frequently Asked Questions About Texas Medicare Advantage Plans

What are the top Medicare Advantage plans in Texas?

Medicare Advantage plans vary from County to County in Texas. This is due to the local nature of healthcare provider networks. If you enter your zipcode into this tool it will show you all of your plan options and 5-star ratings.

Do Texas Medicare Advantage plans include prescription coverage?

Most Medicare Advantage plans available in Texas include a Part D plan, but not all. Before joining a plan, be sure to check that all of your most important medications are covered. You can do that with this tool.

Is Medicare Advantage worse than Original Medicare?

To understand the pros and cons of Medicare Advantage, you need to compare it with Original Medicare and factor in your health and financial situation. This article can help you compare which type of plan is best.

What Coverage Do Medicare Advantage Plans Offer

You must know about the coverage the Advantage plan offers while comparing. Fortunately, all Advantage Plans mandatorily offer or cover your inpatient and outpatient expenses as Medicare Parts B and A does.

However, the Advantage plans are not obligated to offer you coverage for Part B and A as the Original Medicare does.

The Advantage plans can set their unique deductibles, coinsurance, copayments. Also, private insurers can limit the services that are offered to the customers.

For example, some advantage plans require you to take a referral from the primary doctor to see any specialist. But Advantage plans offer amazing additional benefits like routine vision, dental or hearing checkups which arent offered by Original Medicare.

Are Some Advantage Plans Free?

You must have come across those $0 monthly premium Advantage plans. Unfortunately, this never means that they are available for free. The Part B premium actually covers the plans that you see with a $0 premium.

There are some plans which offer extra benefits but arent covered by the premium of Part B. In such situations, the enrollee has to pay an extra monthly premium.

Also Check: How Do I Qualify For Medicare Low Income Subsidy

How To Apply For Medicare In Texas

Whether you’re applying for Medicare for the first time or you’re updating your coverage during the annual open enrollment period, there are important factors to get the best coverage for your needs at the best rate. Keep in mind these five steps when applying for Medicare in Texas:

Medicare Advantage In Texas: The Basics

Medicare Advantage offers an alternative way of receiving your Original Medicare benefits. When you enroll in a Medicare Advantage plan in Texas, a Medicare-approved insurance company provides your Medicare Part A and Part B coverage. The costs and coverage with these plans can vary.

Medicare Advantage plans are required to include the same benefits you get from Original Medicare. The exception is coverage for hospice care, which is still covered by Medicare Part A. Many Medicare Advantage plans in Texas include additional benefits, like routine vision care, dental services, and prescription drug coverage.

You may have a variety of Medicare Advantage plans to choose from, depending on where you live in Texas. Some Medicare Advantage plans include networks of doctors. If you see a doctor outside the network, you might have to pay extra for the services or you might not have coverage at all. It is important to choose a Medicare Advantage plan that includes your doctor in the network to save on your healthcare costs.

Also Check: What Documents Are Needed To Sign Up For Medicare

Finding The Right Medicare Advantage Plan In Texas

There are some important points to keep in mind when comparing Medicare Advantage plans. Specific plans may be different in each county, and not every plan is available in your area. Costs and coverage can also vary from plan to plan. You will need to continue paying your Part B monthly premium.

As you shop for plans, compare the costs of a Medicare Advantage plan to the benefits offered. Many plans charge low premiums, some as low as $0 per month. However, you might pay other costs, such as deductibles, copayments, or coinsurance.

If you take prescription medications, you may be able to find a Medicare Advantage plan that includes prescription drug coverage. Each plan has a formulary or list of covered medications. The formulary may change at any time. You will receive notice from your plan when necessary. Find a plan that includes your medications for the greatest benefit.

If you are ready to compare plans in your area, we can help. Simply enter your zip code to find the Medicare Advantage plans in Texas available to you.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Find Plans in your area instantly!

What You Should Know About Medicare Advantage Plans In Texas

- Open enrollment for Medicare Advantage plans is October 15 to December 31. If you are enrolling in Medicare for the first time, you have three months before your 65th birthday and three months after to get on the plan.

- Look for plans in your county: Medicare Advantage plans in Texas can vary by county. Approved insurance companies offering these plans must fulfill Medicare Part A and Part B and offer other benefits, depending on the plan and insurance company.

- Compare Texas Medicare Advantage Plans: The federal Medicare Plan Finder can help you identify and compare Medicare Advantage plans in Texas. All you have to do is type in your ZIP code to find local plan providers.

- Get help in Texas: The Texas Health Information, Counseling, and Advocacy Program can help you enroll and learn about your Medicare Advantage plan options. Its a partnership between Texas Health and Human Services, Texas Legal Services Center, and the Area Agencies on Aging. Also, the Texas State Health Insurance Assistance Program can help you compare plans and costs if you call 800-252-9240.

Read Also: Does Medicare Pay For Naturopathic Doctors

Types Of Medicare Advantage Plans In Texas

There are four types of plans available in Texass Medicare Advantage program: Health maintenance organization , preferred provider organization , private fee-for-service , and special needs plan . Each offers a different level of flexibility in your network of care providers and varies in price. All Medicare Advantage Plans provide the same coverage as Original Medicare, but additional benefits may come with an increased premium.

How Much Do Medicare Advantage Plans Cost In Texas

When you enroll in a Medicare Advantage plan, youll be responsible for out-of-pocket costs including premiums, health and drug deductibles, and copays. Youll also have to pay for the standard Medicare Part B premium of $148.50 .

Across the United States, the average monthly premium for a Medicare Advantage plan is $21. The good news is that about 60 percent of Medicare Advantage enrollees pay no premium at all. Also, while the premiums on the higher end of the range can seem costly, keep in mind that only 6 percent of Medicare Advantage enrollees pay more than $100 per month for their premium, according to the same Kaiser Family Foundation data.

Costs can vary widely depending on where you live in Texas, so take a look at the data from the eight counties listed below to see where yours stands:

|

County |

Also Check: Does Medicare Part B Cover Mental Health Services

Save Money With The Insulin Savings Program

Our Choice PPO plan includes our new Insulin Savings Program, where members with diabetes will have predictable copays for insulin. Members in the program will pay as low as $25/month for select insulins with no deductible. This will help you save about $446 in out-of-pocket costs for the year.

**For the grocery portion of the benefit, you must qualify. To qualify, members must have certain health condition, such as hypertension, diabetes, congestive heart failure, or chronic kidney disease. A list of qualifying conditions is available at cloverhealth.com/grocery-plus.

Advantages Of Medicare Advantage Plans

Medicare Advantage plans often come with additional benefits not included in Original Medicare, such as:

- Hearing

- Dental

- Vision

Plus, prescription drug coverage is also included in the same plan. This creates a one-stop-shop experience that many beneficiaries will find convenient. It can also keep costs low if the plan is comprehensive and generous.

Comprehensive MA plans can often be less expensive than Original Medicare. Some MA plans may even be less expensive than an Original Medicare plan with prescription drug coverage. Costs are tricky. There are many variables at play when comparing private and public plan options. Always be sure to consider the total cost of plans, not just the monthly premium.

Speaking of total costs, MA plans often include out-of-pocket maximum spending limits. This is very useful, as it can protect you from bankruptcy. Of course, different plans will have different limits. Be sure to keep those limits in mind when comparing Medicare Advantage plans.

Don’t Miss: What Is The Best Medicare Advantage Plan In Washington State

Are Advantage Plans Genuinely An Advantage

As you have read this far, the above question might be disturbing you. Here are the people who can truly benefit from enrolling in Medicare Advantage:

- Individuals who enjoy retiree benefits and use them to pay for copays, deductibles, and premiums

- Individuals who are eligible for Medicare Advantage SNPs.

- Individuals who stay healthy all year long and use healthcare services quite less

- Individuals who cannot register for a supplement plan because of chronic disorders.

If youre falling into any of the above-listed categories, you can genuinely benefit from Advantage Plans.

Humana Honor Plans For Veterans

Open to veterans and non-veterans alike, these plans offer $0 monthly plan premiums, $0 copays for primary care provider visits, and Medicare Part B givebacks up to $145 per month. Plus, with a Medicare Advantage plan from Humana, you can access doctors and hospitals outside the VA system, which may be closer to home.

Don’t Miss: Does Medicare Cover Bed Rails

What Are The Alternatives To Medicare Advantage

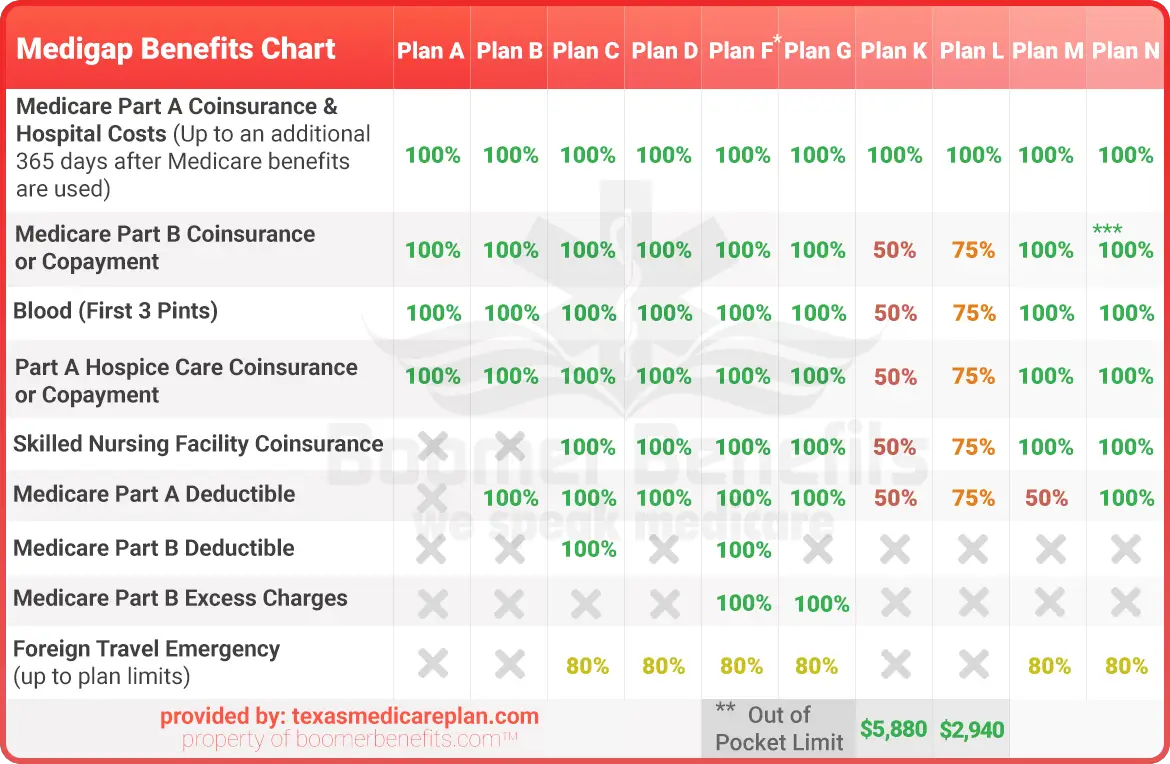

If you dont want to use Medicare Advantage, you should enroll in Original Medicare with Medicare Supplement Insurance, also known as Medigap. Medigap helps you cover coinsurance, co-payments, and deductible costs with Original Medicare. Generally, Medigap plans do not offer additional Medicare benefits. You will need to purchase stand-alone prescription coverage. Youll also need stand-alone dental, hearing, and vision coverage.

What Are My Options For Medicare Advantage Plans In Texas

Reminder Also called Medicare Part C, Medicare Advantage plans are offered by private insurance companies contracted with Medicare. The law requires that they cover everything that Original Medicare covers, but many Advantage plans usually include additional coverage for services that Medicare doesnt.

Depending on where you live, you could have a few options for Medicare Advantage plans, or an overwhelming number of options. Below is a chart offering a closer look at what Medicare Advantage has to offer in eight counties across Texas. With the help of this chart, you can find an option that suits you.

Also Check: What Does Medicare Supplement Plan N Cover

Where Are Medicare Advantage Plans Most Popular In Texas

Medicare Advantage plans help you control costs and have extra benefits. No wonder they are a popular choice for older Americans in Texas and across the United States. As of June 2021, 42% of all U.S. Medicare beneficiaries are enrolled in a Medicare Advantage plan.

In Texas, 45% of Medicare beneficiaries chose to enroll in a Medicare Advantage plan in 2021. The average enrollment in Texas is a bit higher than the national average. Wondering what percentage of older Americans are enrolling in a Medicare Advantage plan in your county?

In 2021, the 10 Texas counties with the highest Medicare Advantage enrollment are El Paso County , Hidalgo County , San Patricio County , Starr County , Nueces County , Cameron County , Willacy County , Kleberg County , Zavala County , and Jim Wells County .

These counties are all well above the national and Texas state averages for Medicare Advantage plan enrollment. The table below shows the counties with the most Medicare beneficiaries, along with the population and percentage of Medicare Advantage enrollment. Scroll down to see if your county is listed.