What Should You Do Once You Get Medicare

Although you can rely on Original Medicare alone, 86% of Medicare enrollees also have some type of additional coverage.2 It can be from an employer, a privately-purchased plan or from a government-run program like Medicaid. Original Medicare pays for a great deal of healthcare, but still leaves you with potentially costly gaps in healthcare coverage. Supplementary plans can cover these gaps including deductibles and copayments at a fraction of the out-of-pocket rate.

MedicareGuide.coms plan selector is designed to intelligently bring you the best Medicare Supplement plans. These plans, also known as Medigap policies, fill the gaps in coverage that you would otherwise be charged by Original Medicare.

Delaying Medicare Due To Work: Special Enrollment Period

If you didn’t enroll in Medicare because you were still working, and you were covered under a group health plan based on employment, you have a Special Enrollment Period during which you can sign up for Part A and/or Part B. While you or your spouse are still working and you’re still covered under a group health plan, you can sign up anytime.

After your or your spouse’s employment ends, your Special Enrollment Period lasts eight months, starting the month after the employment or group health plan ends . However, you have only two months after the employment or group health plan ends to sign up for a Medicare Advantage plan or Part D prescription drug plan . You can enroll in a Medicare Advantage plan starting three months before your Medicare Part B enrollment is due to take effect up to the day before your Part B coverage startsbut again, enrollment must take place within two months of your employment or group health plan ending.

Example:

Judy’s last day of work is July 1 and her group health plan ends July 31. She has eight months, until April 30, to sign up for Part B without a penalty. But if she wants to join a Medicare Advantage plan, she needs to do so by September 30 . Instead, on June 15, Judy signs up for Part B coverage to begin on August 1, so that she won’t have a gap in coverage. She has only until July 31 to add a Medicare Advantage plan . Her Medicare Advantage plan will start August 1.

How The Age You Retire Affects Your Benefits

You can apply for Social Security retirement benefits once youve turned 62. However, youll receive more money per month if you wait a few years. People who start collecting retirement benefits at 62 will receive 70 percent of their full benefit amount. You can receive 100 percent of your benefit amount if you dont start collecting until full retirement age.

The full retirement age for people born after 1960 is 67. If you were born before 1960, refer to this chart from Social Security to see when youll reach full retirement age.

You can qualify for additional benefits if you have a limited income. Known as Supplemental Security Income , these benefits are for people with limited income who qualify for Social Security because of age or disability.

Also Check: Which Is Better Original Medicare Or Medicare Advantage Plan

How Do Medicare And Social Security Work Together

Youll get Medicare automatically if youre already receiving Social Security retirement or SSDI benefits. For example, if you took retirement benefits starting at age 62, youll be enrolled in Medicare three months before your 65th birthday. Youll also be automatically enrolled once youve been receiving SSDI for 24 months.

Youll need to enroll in Medicare if you turn 65 but havent taken your Social Security benefits yet. The Social Security Administration and Medicare will send you a Welcome to Medicare packet when youre eligible to enroll. The packet will walk you through your Medicare choices and help you enroll.

SSA will also determine the amount you need to pay for Medicare coverage. You wont pay premiums for Part A unless you dont meet the coverage rules discussed above, but most people will pay a premium for Part B.

In 2020, the standard premium amount is $144.60. This amount will be higher if you have a large income. Social Security uses your tax records to determine the rates you need to pay.

If you make more than $87,000 a year, SSA will send you an Income-Related Monthly Adjustment Amount . Your IRMAA notification will tell you the amount above the standard premium you need to pay. Youll also be responsible for an IRMAA if you choose to buy a separate Part D plan and you make over $87,000.

To Qualify For Medicare You Need To Get Disability Benefits From:

- Social Security

- Railroad Retirement Board

Youll automatically get Part A and Part B after you get disability benefits for 24 months. Well mail you a welcome package with your Medicare card.

If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

If you live in Puerto Rico or outside the U.S.

Read Also: Does Medicare Cover Foot Doctors

You Automatically Get Medicare When You Turn 65

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

Who Is Eligible For Medicare

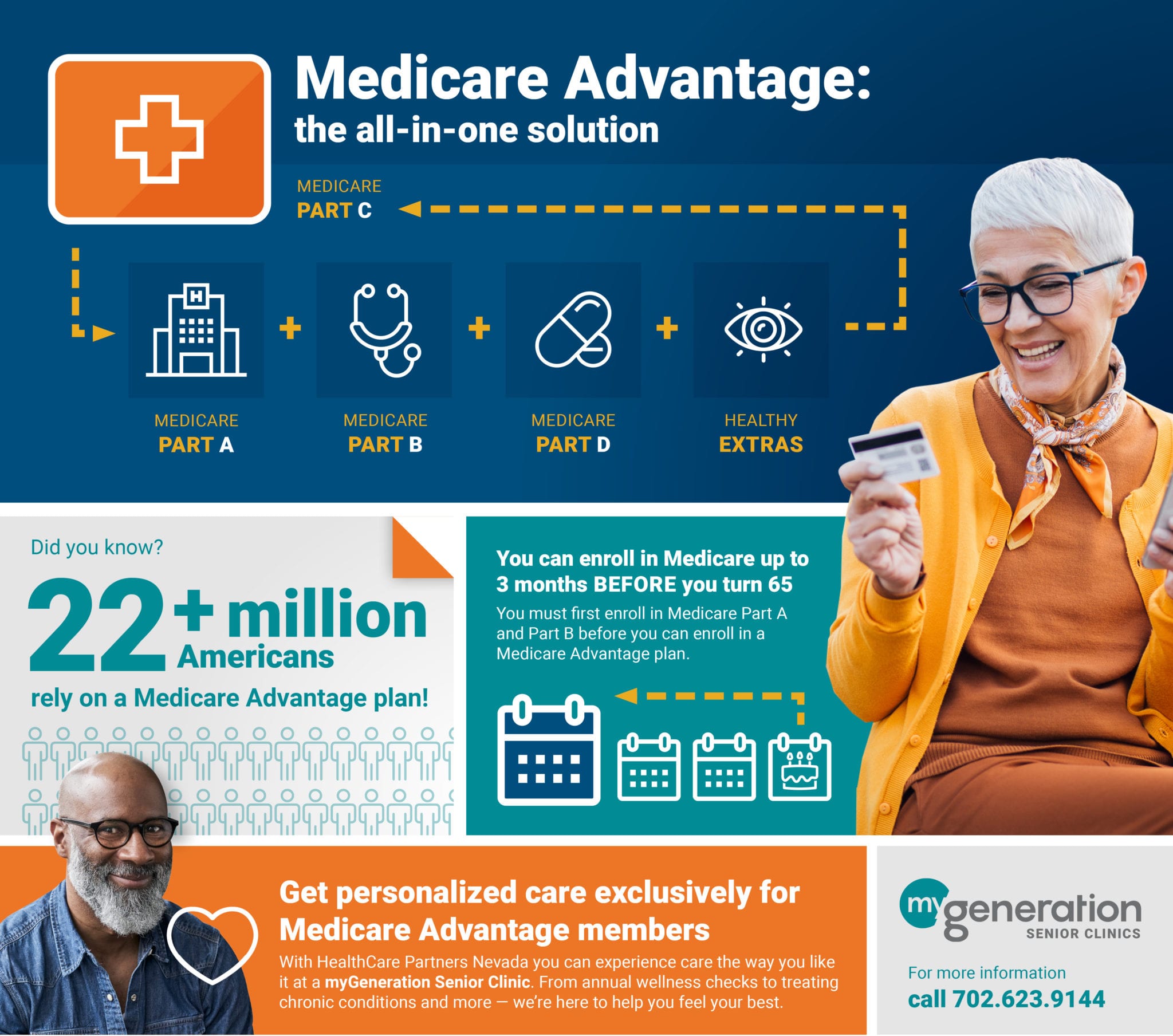

Most people enroll in Medicare when they turn 65. You can enroll as early as three months before your 65th birthday or as late as three months after. Youll need to be a United States citizen or have been a permanent legal resident for at least five years. In order to get full coverage, you or your spouse need to meet a work requirement. Meeting the work requirement verifies that youve paid into the system.

You May Like: How Do I Get A Replacement Medicare Card Online

Effects Of The Patient Protection And Affordable Care Act

The Patient Protection and Affordable Care Act of 2010 made a number of changes to the Medicare program. Several provisions of the law were designed to reduce the cost of Medicare. The most substantial provisions slowed the growth rate of payments to hospitals and skilled nursing facilities under Parts A of Medicare, through a variety of methods .

PPACA also slightly reduced annual increases in payments to physicians and to hospitals that serve a disproportionate share of low-income patients. Along with other minor adjustments, these changes reduced Medicare’s projected cost over the next decade by $455 billion.

Additionally, the PPACA created the Independent Payment Advisory Board , which was empowered to submit legislative proposals to reduce the cost of Medicare if the program’s per-capita spending grows faster than per-capita GDP plus one percent. The IPAB was never formed and was formally repealed by the Balanced Budget Act of 2018.

Meanwhile, Medicare Part B and D premiums were restructured in ways that reduced costs for most people while raising contributions from the wealthiest people with Medicare. The law also expanded coverage of or eliminated co-pays for some preventive services.

Have You Or Your Spouse Worked For At Least 10 Years At Jobs Where You Paid Medicare Taxes

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Avoid the penalty If you dont sign up when youre first eligible, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Recommended Reading: How To Sign Up For Medicare Part B Online

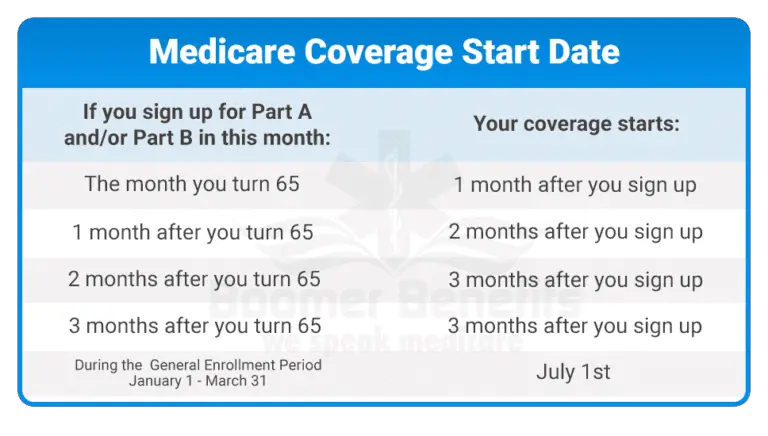

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

2 months after you sign up |

|

2 or 3 months after you turn 65 |

3 months after you sign up |

Proposals For Reforming Medicare

As legislators continue to seek new ways to control the cost of Medicare, a number of new proposals to reform Medicare have been introduced in recent years.

Premium support

Since the mid-1990s, there have been a number of proposals to change Medicare from a publicly run social insurance program with a defined benefit, for which there is no limit to the government’s expenses, into a publicly run health plan program that offers “premium support” for enrollees. The basic concept behind the proposals is that the government would make a defined contribution, that is a premium support, to the health plan of a Medicare enrollee’s choice. Sponsors would compete to provide Medicare benefits and this competition would set the level of fixed contribution. Additionally, enrollees would be able to purchase greater coverage by paying more in addition to the fixed government contribution. Conversely, enrollees could choose lower cost coverage and keep the difference between their coverage costs and the fixed government contribution. The goal of premium Medicare plans is for greater cost-effectiveness if such a proposal worked as planned, the financial incentive would be greatest for Medicare plans that offer the best care at the lowest cost.

Currently, public Part C Medicare health plans avoid this issue with an indexed risk formula that provides lower per capita payments to sponsors for relatively healthy plan members and higher per capita payments for less healthy members.

- Senate

Recommended Reading: How Old To Use Medicare

Who Is Eligible For Ssi

You can qualify for SSI if you:

- are over 65

- are legally blind

- have a disability

As with all Social Security benefits, youll also need to be a United States citizen or legal resident and have limited income and resources. However, to apply for SSI, you dont need work credits.

You can receive SSI in addition to SSDI or retirement benefits, but it can also be a standalone payment. The amount you receive in SSI will depend on your income from other sources.

Social Security Disability Insurance is a type of Social Security benefit for those with disabilities or health conditions that prevent them from working.

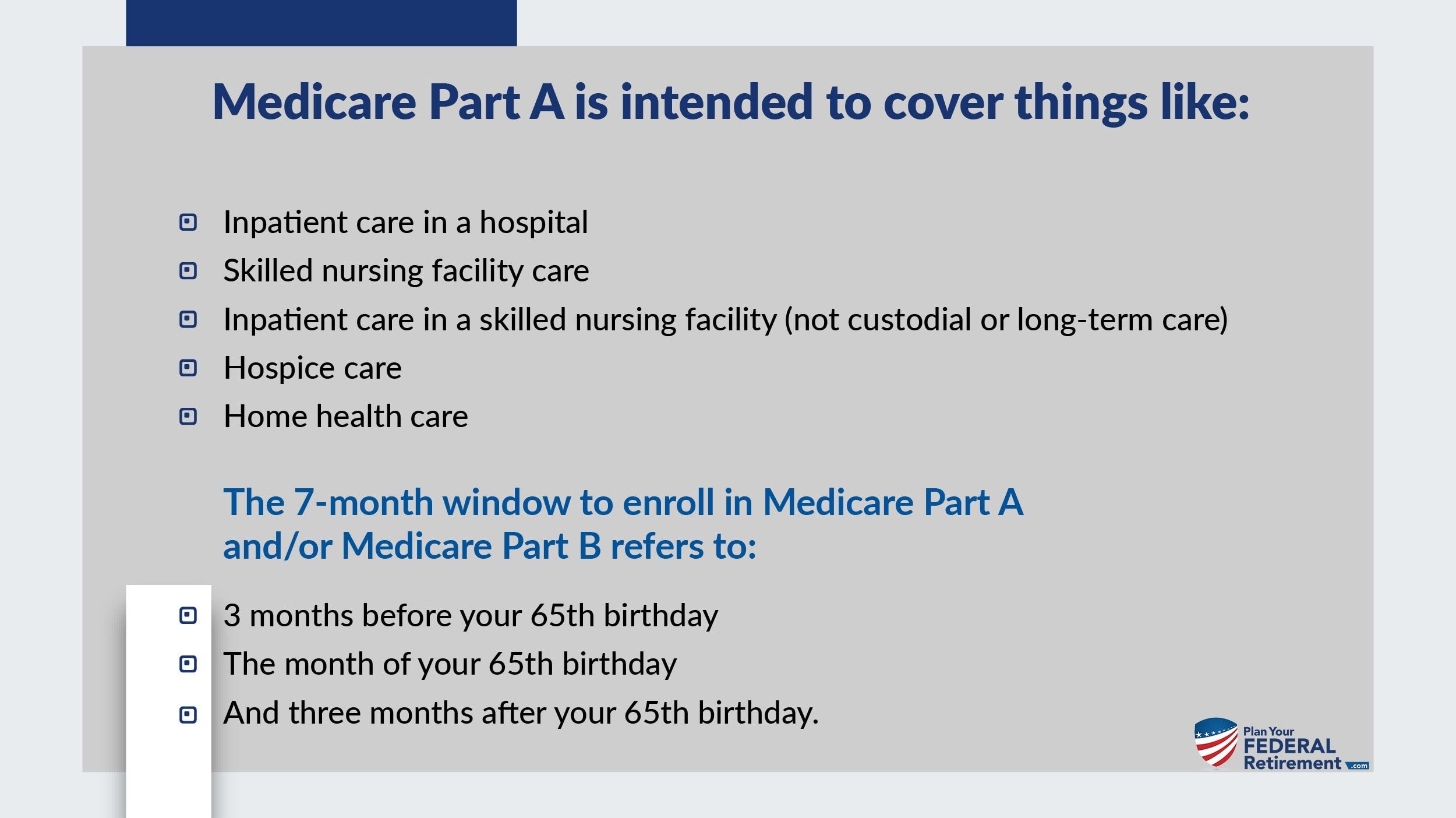

Medicare Part A Hospitalization

For most people, Part A will be provided to you at no charge. If you need to buy Part A, youll pay up to $499 each month.

A deductible amount of $1,556 must be paid for by the insurance policyholder for each benefit period.

Copayments are based on the number of days of hospitalization.

Late enrollment fees can be equal to 10 percent of your premium amount. The fees are payable for twice the number of years you were not enrolled.

Theres no out-of-pocket maximum for the amount you pay.

Recommended Reading: How Much Does Medicare Deduct From Social Security

When Medicare Starts: Special Enrollment Periods

You can qualify for a special enrollment period and avoid penalties in a few circumstances, such as when youre covered by a group health insurance plan from a current employer with 20 or more employees either your own or your spouses. In this case, the clock starts ticking when the employment or the coverage ends, whichever comes first.

Then, you have two months to enroll in Medicare Advantage or Part D and eight months to enroll in Medicare Part B. If you apply using a special enrollment period and your application is approved, your coverage starts either the first day of the month that you applied or the first day of the following month, depending on the situation.

Spouses And Social Security Retirement Benefits

Your spouse can also claim up to 50 percent of your benefit amount if they dont have enough work credits, or if youre the higher earner. This doesnt take away from your benefit amount. For example, say you have a retirement benefit amount of $1,500 and your spouse has never worked. You can receive your monthly $1,500 and your spouse can receive up to $750. This means your household will get $2,250 each month.

Also Check: How To Check My Medicare Coverage

Contact Social Security To Sign Up For Medicare

You can either:

Know when to sign up for Part BYou can only sign up for Part B at certain times. If you dont sign up for Part B when you turn 65, you might have to wait to sign up and pay a monthly late enrollment penalty. Find out when you can sign up. How much is the Part B late enrollment penalty?

Signing Up For Premium

You can sign up for Part A any time after you turn 65. Your Part A coverage starts 6 months back from when you sign up or when you apply for benefits from Social Security . Coverage cant start earlier than the month you turned 65.

After your Initial Enrollment Period ends, you can only sign up for Part B and Premium-Part A during one of the other enrollment periods.

Don’t Miss: Does Medicare B Cover Prescriptions

How Does Part B Enrollment Work

If you already know that you dont want Part B coverage, it can be easier to defer your enrollment from the very beginning. In order to understand whether or not this is a good option for you, lets take a look at how Part B enrollment works.

Most people will automatically enroll in Part B on the month of their 65th birthday. You should expect to receive some materials related to Medicare in the mail a few months before your birthday month. These seven months .

If you are receiving Social Security or Railroad Retirement Board benefits during this time, your enrollment will be automatic and payment will automatically come out of your benefit payments each month. Otherwise, you will have to set up a payment method with Medicare.

Medicare Special Enrollment Period

You may choose not to enroll in Medicare Part B when you are first eligible because you are already covered by group medical insurance through an employer or union. If you lose your group insurance, or if you decide you want to switch from your group coverage to Medicare, you can sign up at any time that you are still covered by the group plan or during a Special Enrollment Period.

Your eight-month special enrollment period begins either the month that your employment ends or when your group health coverage ends, whichever occurs first. If you enroll during an SEP, you generally do not have to pay a late enrollment penalty.

The Special Enrollment Period does not apply if youre eligible for Medicare because you have ESRD. Please also keep in mind that COBRA and retiree health coverage are not considered current employer coverage and would not qualify you for a special enrollment period.

Recommended Reading: How To Work For Medicare

Sign Up: Within 8 Months After Your Family Member Stops Working

- If you have Medicare due to a disability or ALS , youll already have Part A .

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Can I Get Medicare Coverage If I Dont Sign Up For Social Security At 65

Who is this for?

If youre not planning on signing up for Social Security right away, you can still enroll in Medicare. Learn how here.

These days, people are retiring later in life than their parents did. If youre still working, you might not want to start collecting Social Security benefits right when you turn 65.

But you can enroll in Medicare at 65 even if youre not getting Social Security. In some cases, signing up for Medicare as soon as youre eligible is better than waiting.

Heres why:

- Medicare might have better coverage than your health insurance plan through work.

- If you dont have a comparable health insurance plan and you wait to sign up for Medicare, your Medicare premiums will be higher when you do sign up.

Don’t Miss: What Is Retirement Age For Medicare

When To Sign Up For Medicare And How To Apply

Home / FAQs / General Medicare / When to Sign Up for Medicare and How to Apply

Its not uncommon for new beneficiaries to have questions when signing up for Medicare. It is important to be confident that you enroll correctly to ensure you have the necessary health coverage. Below, we tell you how to effectively apply for Medicare.

Get A Free Quote

Find the most affordable Medicare Plan in your area

When Medicare Starts: Turning 65

Medicare coverage can start as early as the first day of the month in which you turn 65, unless you were born on the first of the month. In that case, your coverage can begin on the first day of the previous month.

People who are automatically enrolled will get coverage as soon as its available. Generally, you’re automatically enrolled only if you claimed Social Security benefits early. If you have to enroll yourself, you should sign up in the three months before your birthday. While you have seven months around your birthday to enroll for the first time, that’s not the same as having coverage. The three months before and after your birthday month, plus your birthday month, is whats known as your initial enrollment period. But waiting until your birthday month or the three months afterward to sign up delays the start of your coverage and you’re fully responsible for any health care costs you incur until your Medicare coverage begins.

If your birthday is the first of the month, your enrollment period includes the four months before your birthday month, your birthday month and the two months after.

Don’t Miss: How Much Does Social Security And Medicare Take Out