Most Popular Medicare Advantage Company

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits.

For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

The plans may not be as highly rated as those from Kaiser Permanente, but they are still rated above-average while also being priced affordably at about $21 per month.

AARP Medicare Advantage plans are administered by UnitedHealthcare , which offers good benefits and a wide network of providers. Theres also the option to get a PPO plan for better access to out-of-network care.

The company stands out for its broad range of add-on programs and discounts including vision, dental, free gym memberships, mental fitness and a credit toward over-the-counter products. These programs can be especially useful for those who want to stay healthy on a budget.

For most people, AARPs prescription drug benefits are middle-of-the-road with a typical drug deductible being about $139. However, for those who need expensive medications, many plans provide benefits during the coverage gap . This is an important benefit that can protect those with high prescription drug costs from paying more for medications at some point in the policy year.

Also Check: How To Know If I Have Medicare

Best Overall Medicare Supplement Plan Pre

If you qualified for Medicare before Jan. 1, 2020, Plan F is the best Medigap plan. Plans will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

Plan F is a good option if you want a comprehensive policy that will give you peace of mind about day-to-day expenses, such as paying a copay for a doctor’s office visit. The monthly premium for Plan F averages $231, which makes this plan even more expensive than Plan G. Unfortunately, Plan F is not available to new Medicare enrollees who become eligible after Jan. 1, 2020. Anyone who currently has Plan F will be able to keep their coverage.

Tips For Comparing Plans

No two Medicare beneficiaries have the same needs. You might hate the plan your neighbor loves. So dont rely on customer reviews or reputation alone. Some questions to ask as you compare plans include:

- Does the Kaiser plan in my area have a good reputation?

- Which doctors does this plan cover? Do these doctors have good reviews?

- How much will I pay for care? What are the copays and what is the deductible?

- Does the plan offer supplemental services?

- Would another plan better serve my needs while offering me more providers to choose from?

- Am I comfortable choosing from a limited pool of providers?

Recommended Reading: What Does Medicare Cost Me

Also Check: What Medicare Premiums Are Deducted From Social Security

Search Out The Plans Available In Your State

Medicare Advantage Company With The Largest Network

When comparing provider networks, keep in mind that its not always an apples-to-apples comparison because each company publicizes its figures slightly differently. However, the overall trends can give you a snapshot of how broad the health care access could be in your area.

- Blue Cross Blue Shield/Anthem: 90% of doctors and hospitals

- Cigna Healthspring: 1.5 million health care providers, clinics and facilities

- UnitedHealthcare/AARP: 1.3 million health care providers

- Aetna/CVS: 1.2 million health care providers

- Humana: 560,000 providers in the ChoiceCare and Behavioral Health networks

- Centene: 238,000 physicians

- Kaiser Permanente: 80,000 physicians and nurses

Blue Cross Blue Shield has one of the largest provider networks, making it a good choice for those who are seeking flexibility about which doctors and medical facilities they use.

Whether Blue Cross Blue Shield is operating in your area as Anthem, Highmark or another subsidiary, the companys massive footprint can give you access to one of the industrys largest provider networks.

This makes BCBS Medicare Advantage plans an especially good choice for those who want the flexibility to get care from a wide range of doctors and medical providers. Not only can this help you see doctors you like, but the wide network is especially useful for those who need specialized health care.

Read Also: When Can You Enroll In Medicare Part D

Also Check: A Medicare Supplement Policy Must Not Contain Benefits Which

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Disadvantages Of Medicare Advantage

- Additional up-front costs. Unlike original Medicare, the additional costs of an Advantage plan include in-network, out-of-network, and prescription drug deductibles, copays, and coinsurance.

- Provider limitations. Most Medicare Advantage plans are either HMO or PPO plans, both of which have some provider limitations. Other plan offers may also come with additional provider limitations.

- State-specific coverage. Medicare Advantage plans cover you within the state you enrolled, typically the state you live in. This means that if you travel, you may not be covered for out-of-state medical expenses.

Don’t Miss: What To Do Before You Turn 65 Medicare

The Average Cost Of A Medicare Advantage Plan

Some Medicare Advantage plans may have lower out-of-pocket costs than Original Medicare, and some have a $0 monthly premium. Here are a few questions to consider before purchasing a plan.

- Does the plan have a monthly premium?

- Many have a $0 premium.

- Some pay your Part B premium.

- If you choose a plan with a premium, it will be paid separately from your Part B premium of $148.50 .

Once youre enrolled in a Medicare Advantage plan, it becomes your primary insurance. The company handles paying all your claims. And every year, the cost of your plan will probably change. The plan provider sets the amounts charged for premiums, deductibles and services. An Annual Notice of Change is mailed to you each September to be effective Jan. 1.

Factors like location play a major role in determining the cost of a Medicare Advantage plan. Costs are typically lower when you use providers in your plans network and service area. To find the specific cost of a Medicare Advantage plan in your zip code, visit Medicare.gov.

Medigap F Cost Example

Gracie applies for a Plan F Medigap and the insurance company approves her. The following year she sees an orthopedic specialist about problems with her knee. Medicare pays 80% of the cost of this visit to her specialist. Plan F covers the other 20% owed under Part B. Gracie owes nothing.

The specialist sends her to an imaging facility to have an MRI done on her knee. Medicare pays 80% of the cost of her MRI. Medicare F pays the other 20%. Gracie pays absolutely nothing.

The results of the MRI show serious problems. Her orthopedic specialist tells Gracie that she is a candidate for a total knee replacement. She undergoes surgery at her local hospital and is in the hospital a couple of days. Gracie also has a home health care nurse come out to her home several times in the weeks following her surgery.

The total cost for Gracies surgery, hospital stay and follow-up care is $70,000. Medicare pays its share of the bills and sends the remainder of about $14,000 to Gracies Supplemental insurance carrier. The carrier pays the entire bill, and Gracie owes absolutely nothing for any of these Part A and Part B services. Her only out-of-pocket spending would be for medications.

That means the cost of Medicare Supplement Plan F is really only the premiums that you pay for the plan itself. Medicare Supplement Plan F rates will vary by insurance company, but you can rest assured there is no back-end spending.

Also Check: How Do I Know What Medicare Coverage I Have

Medicare Advantage Plans Coordinate Care Among Your Health Care Providers

Typically Medicare Advantage plans are managed care and have networks of contracted health care providers. Example would be Health Maintenance Organization Medicare Advantage plans. These HMO plans require you to select a Primary Care Physician who helps to coordinate your care.

Medicare Advantage plans that include prescription drug coverage may also have medication therapy management. This care coordination can be a convenience and a valuable aid to your health.

Consider Whether You Want Some Specific Coverage

You May Like: How Much Does Medicare Pay For Funeral Expenses

Report: Medicare Advantage Plans Can Be Too Good To Be True

- May 10th, 2007

Medicare Advantage plans have serious disadvantages over original Medicare, according to a new report by the Medicare Rights Center, Too Good To Be True: The Fine Print in Medicare Private Health Care Benefits. Medicare Advantage plans are provided by private insurers, unlike original Medicare, which is provided by the government. The government pays Medicare Advantage plans a fixed monthly fee to provide services to each Medicare beneficiary under their care. The plans often look attractive because they the offer the same basic coverage as original Medicare plus some additional benefits and services that original Medicare doesnt offer.

The idea behind the plans is to provide better services and lower out-of-pocket costs. However, it doesnt always work that way, according to the Medicare Rights Center. While the plans must provide a benefit package that is at least as good as original Medicares and cover everything Medicare covers, the plans do not have to cover every benefit in the same way. For example, plans may pay less for some benefits, like skilled nursing facility care, and offset this by offering lower copayments for doctor visits.

Local Elder Law Attorneys in Your City

City, State

The report, based on thousands of beneficiary calls to the Medicare Rights Center, lists nine common problems with Medicare Advantage plans. The problems include the following:

To read the full report, .

Dont Miss: How To Become A Medicare Provider In Florida

Best Medicare Advantage Providers Ratings

| Provider |

|---|

- Over-the-counter drug coverage

- Other services that promote health and wellness

You cant be enrolled in a Medicare Advantage plan and Original Medicare at the same time. To obtain Medicare benefits youve earned through payroll deductions before retirement, you must choose one of these plans.

During the open enrollment period, which runs from Oct.15 to Dec. 7 each year, you can join, switch or drop a plan for your coverage to begin on Jan. 1. If youre already enrolled in a Medicare Advantage plan, you can switch to a different Medicare Advantage plan or Original Medicare during the Medicare Advantage open enrollment period, which starts on Jan. 1 and ends on March 31 annually. You can only make one switch during that time period.

If youre already enrolled in Original Medicare , you may be eligible to switch to a Medicare Advantage plan . You must be at least 65 years old or have certain disabilities, such as permanent kidney failure or amyotrophic lateral sclerosis . If the Medicare Advantage plan you choose doesnt already have prescription drug coverage, you will have the option to enroll in Part D.

Read Also: How Do You Qualify For Medicare In Texas

Advantages Of Original Medicare

- Cost-effective. Most Americans dont have to pay a monthly premium for Part A. In addition, the monthly premium for Medicare Part B starts as low as $148.50 in 2021. If you receive Social Security payments, your monthly Medicare costs can be automatically deducted.

- Provider freedom. With original Medicare, you can visit any provider that accepts Medicare, including specialists. This means that you may be able to continue seeing your favorite healthcare providers after enrollment.

- Nationwide coverage. Original Medicare is accepted all over the United States. This can be especially beneficial for people who travel frequently.

Best Medicare Supplement Companies

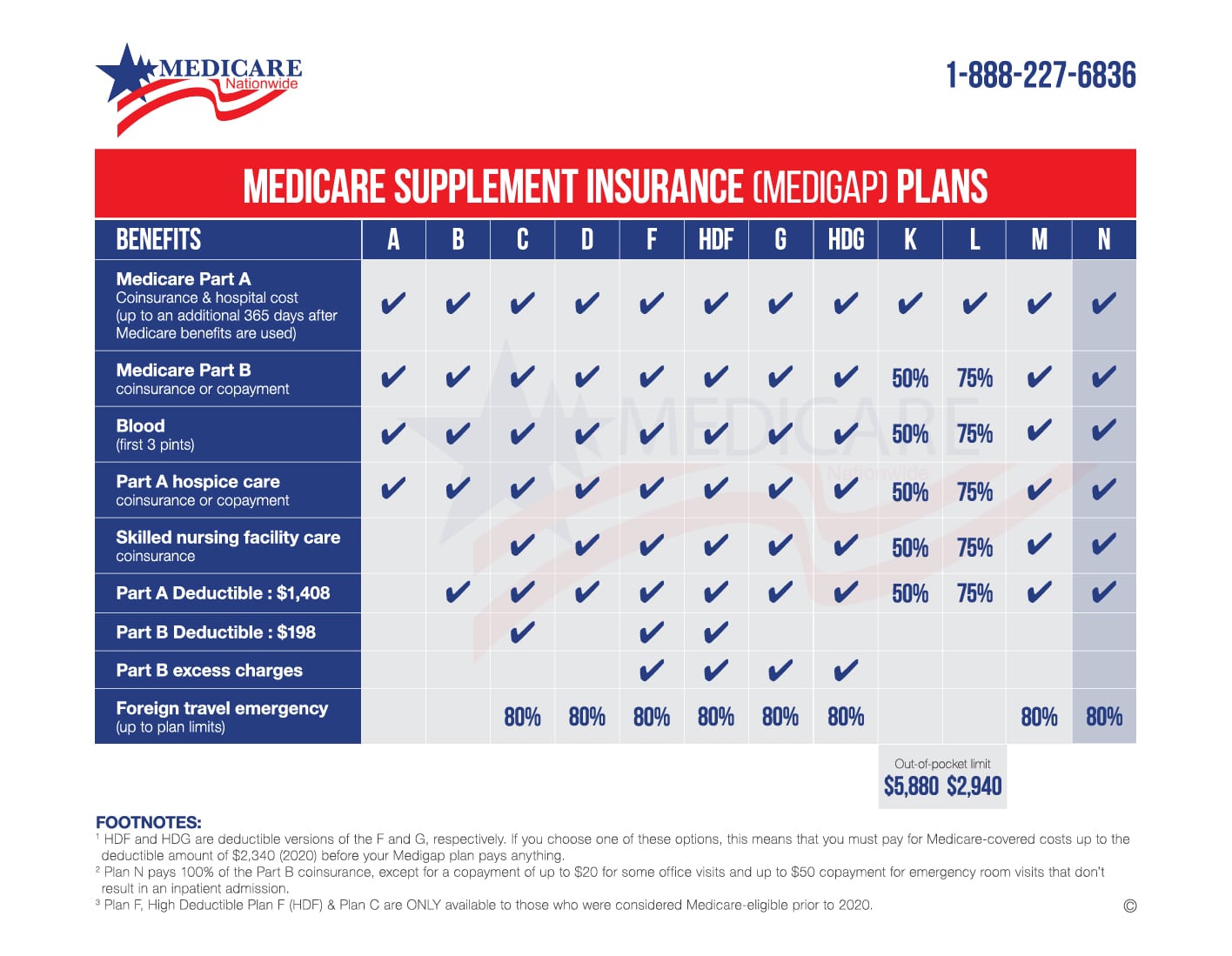

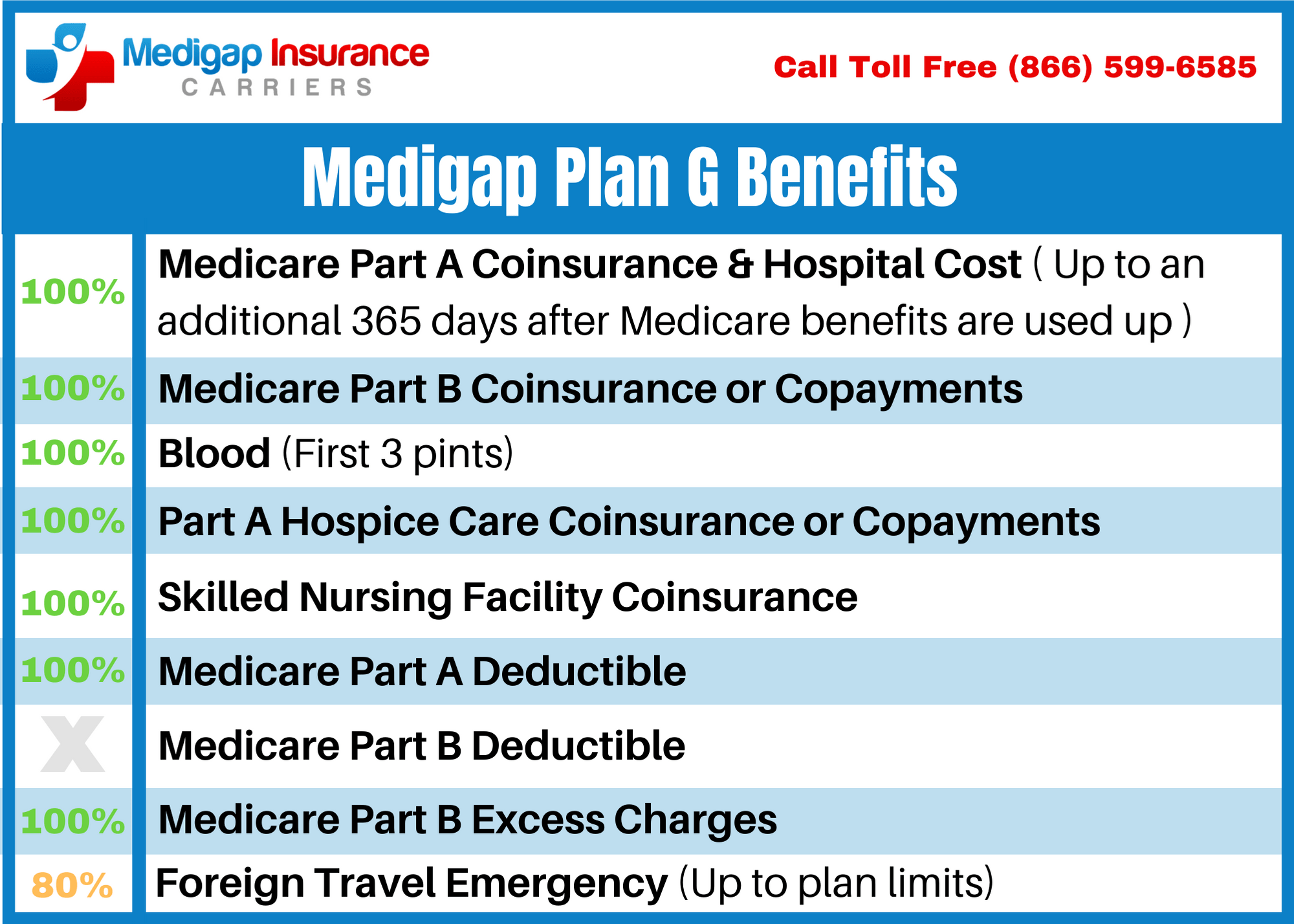

Unlike with traditional health insurance, where policies differ among providers, Medicare Supplement plans are standardized so that the benefits for each plan letter are the same for each company. This means that Medicare Supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna.

However, rates will change from company to company since each provider will choose a different pricing structure for its Medicare Supplement plans. It’s important that you take this into account along with each providerâs financial strength and history of rate increases. Some companies may offer cheap rates but will increase your rates more quickly as you age.

- Medigap plans offered: A, F, G, N and high-deductible F

- Average cost of Plan G: $179

Cigna, like UHC and Aetna, currently has an AM Best rating of A, meaning that it has the financial strength to continue to pay health insurance claims in the future. Cigna plans are widely available, and Cigna stands out for its high-deductible Plan F, which is an affordable way to protect yourself if you need expensive medical care. Cigna’s Medicare Supplement plans are generally priced higher than plans from some other companies, but using the company’s household premium discount can help you to get a better deal. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

You May Like: Does Medicare Cover Memory Care Units

Medicare Supplement Plan N: The Pay

Medicare Supplement Plan N is the most budget-friendly plan on our list. With this, however, comes more out-of-pocket costs. Medicare Supplement Plan N covers the full Medicare Part A deductible and Medicare Part B 20% coinsurance.

Thus, Medigap Plan N leaves you responsible for the Medicare Part B deductible, $20-$50 copays when visiting the doctor or hospital, and excess charges, if applicable in the state where you receive care.

Medicare Supplement Plan N is a fantastic option for those who do not regularly go to the doctor or hospital but still seek emergency coverage.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Medicare Supplement Plan N may be the best choice for those who:

- Seek a relatively low monthly premium

- Do not mind small copayments

- Are not concerned about excess charges

Medigap Plan N requires small copayments for certain services, such as $20 at the doctor and $50 for an emergency visit. However, you will not have copays if you visit one of your local urgent care facilities.

Also, Medigap Plan N does not cover Medicare Part B excess charges. However, not every state or doctor allows excess charges. The best way to avoid excess charges is to speak with your doctor.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Advantages Of Medicare Advantage

- Research suggests that those enrolled in Advantage plans can save more money on certain healthcare services. In addition, all Part C plans have an out-of-pocket maximum.

- Plan variety. There are roughly five types of Advantage plan structures to choose from, including HMO, PPO, PFFS, SNP, and MSA. Each of these has its own advantages and disadvantages.

- Coordinated care. If youre enrolled in a Medicare Advantage plan, youll likely have the benefit of coordinated care from in-network providers.

Read Also: How Much Is Part B Deductible For Medicare

Bottom Line For Medicare Advantage

It is very affordable, usually includes Rx coverage and caps your total annual risk to as high as $7,550. Just know that you will be limited to a smaller network and you will still usually have to pay deductible and copay fees that can add up . The biggest complant from our clients about Medicare Advantage is its smaller network and needing referals to see specialist. Those who do want a larger network of doctors should check out Medigap Pros and Cons.

If you are still not sure about Medicare Advantage, there are 3 hints that Medicare Advantage is right for you.

This is definitely a lot to take in. Your next step is to see which MA plans are available in your area and how much they cost. Then give us a call at 800-930-7956 and we can help you understand your options and enroll over the phone. There is no cost for our services.

A Review Of Medicare Advantage Vs Original Medicare And Medigap

One of the best ways weve discovered to figure out if a Medicare Advantage plan is right for you is to compare them directly with Original Medicare and a Medigap plan. So, lets do that by digging into the pros and cons of Medicare Advantage plans so we can figure out what is real and what isnt, and help you find the best Medicare plan for your personal situation.

Only then can you understand if Medicare Advantage plans are good for you. Well also answer these popular questions:

There is no debate when it comes to which plan offers better coverage. Original Medicare and a supplement plan offer the best coverage, but it costs more up-front. For a complete breakdown of the differences between Medicare Advantage plans and Medigap plans, read: Medicare Advantage vs Medigap: Which is Best for You?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death. To discover all of the pros and cons of Medicare Advantage, read: What are the Advantages and Disadvantages of Medicare Advantage Plans?

Don’t Miss: How Do I Apply For Medicare Part A Online